Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Spouses Bacolor Vs Banco Filipino

Caricato da

iwanttoeat0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

288 visualizzazioni1 paginaspcl

Titolo originale

Spouses Bacolor vs Banco Filipino

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentospcl

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

288 visualizzazioni1 paginaSpouses Bacolor Vs Banco Filipino

Caricato da

iwanttoeatspcl

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

SPOUSES BACOLOR vs.

BANCO FILIPINO SAVINGS

AND MORTGAGE BANK, DAGUPAN CITY BRANCH

(GR No. 148491; Feb. 8, 2007)

FACTS: On February 1982, spouses Zacarias and

Catherine Bacolor obtained a loan of P244,000.00 from

Banco Filipino Savings and Mortgage Bank. They

executed a promissory note providing that the amount

shall be payable within a period of ten 10 years with a

monthly amortization of P5,380.00 beginning March 11,

1982 and every 11th day of the month thereafter; that

the interest rate shall be 24% per annum, with a penalty

of 3% on any unpaid monthly amortization; that there

shall be a service charge of 3% per annum on the loan;

and that in case bank seeks the assistance of counsel to

enforce the collection of the loan, petitioners shall be

liable for 10% of the amount due as attorneys fees and

15% of the amount due as liquidated damages.

As security for the loan, petitioners mortgaged with

respondent bank their parcel of land located in Dagupan

City, Pangasinan.

From March 1982 to July 1991, petitioners paid

respondent bank P412,199.36. Thereafter, they failed to

pay the remaining balance of the loan. On August 1992,

petitioners received from respondent bank a statement of

account stating that their indebtedness as of July 1992

amounts to P840,845.61. In its letter dated January

1993, respondent informed petitioners that should they

fail to pay their loan within 15 days from notice,

appropriate action shall be taken against them. Due to

petitioners failure to settle their obligation, respondent

instituted, on March 1993, an action for extra-judicial

foreclosure of mortgage.

Prior thereto, or on February 1993, petitioners filed with

RTC, a complaint for violation of the Usury Law against

respondent. They alleged that the provisions of the

promissory note constitute a usurious transaction

considering the (1) rate of interest, (2) the rate of

penalties, service charge, attorneys fees and liquidated

damages, and (3) deductions for surcharges and

insurance premium. In their amended complaint,

petitioners further alleged that, during the closure of

respondent bank, it ceased to be a banking institution

and, therefore, could not charge interests and institute

foreclosure proceeding.

RTC rendered its decision dismissing petitioners

complaint and the interest rate of 24% per annum is not

usurious. CA rendered its Decision affirming the

Decision of the trial court.

ISSUE: WON the interest rate is "excessive and

unconscionable."

WON the bank lost its function as a banking institution

during its closure and therefore could no longer charge

interest and institute foreclosure proceedings.

HELD:

The petition lacks merit.

Article 1956 of the Civil Code provides that no interest

shall be due unless it has been expressly stipulated in

writing. Here, the parties agreed in writing on February

11, 1982 that the rate of interest on the petitioners loan

shall be 24% per annum.

With the suspension of the Usury Law and the removal

of interest ceiling, the parties are free to stipulate the

interest to be imposed on monetary obligations. Absent

any evidence of fraud, undue influence, or any vice of

consent exercised by one party against the other, the

interest rate agreed upon is binding upon them.

Petitioners cannot now renege on their obligation to

comply with what is incumbent upon them under the

loan agreement. A contract is the law between the

parties and they are bound by its stipulations.

Petitioners further contend that during the closure of

respondent bank (from January 1985 to July 1994), it

lost its function as a banking institution and, therefore,

could no longer charge interests and institute foreclosure

proceedings.

In the case of Banco Filipino Savings & Mortgage Bank

vs. Monetary Board, Central Bank of the Philippines,

this Court ruled that the banks closure did not diminish

the authority and powers of the designated liquidator to

effectuate and carry on the administration of the bank,

thus:

x x x. We did not prohibit however acts such as receiving

collectibles and receivables or paying off creditors claims

and other transactions pertaining to the normal

operations of a bank. There is no doubt that that the

prosecution of suits for collection and the foreclosure of

mortgages against debtors of the bank by the liquidator

are among the usual and ordinary transactions

pertaining to the administration of a bank. x x x.

Likewise, in Banco Filipino Savings and Mortgage Bank

vs. Ybaez, where one of the issues was whether

respondent bank can collect interest on its loans during

its period of liquidation and closure, this Court held:

In Banco Filipino Savings and Mortgage Bank v.

Monetary Board, the validity of the closure and

receivership of Banco Filipino was put in issue. But the

pendency of the case did not diminish the authority of

the designated liquidator to administer and continue the

banks transactions. The Court allowed the bank

liquidator to continue receiving collectibles and

receivables or paying off creditors claims and other

transactions pertaining to normal operations of a bank.

Among these transactions were the prosecution of suits

against debtors for collection and for foreclosure of

mortgages. The bank was allowed to collect interests on

its loans while under liquidation, provided that the

interests were legal.

In fine, we hold that the interest rate on the loan agreed

upon between the parties is not excessive or

unconscionable; and that during the closure of

respondent bank, it could still function as a bonding

institution, hence, could continue collecting interests

from petitioners.

Potrebbero piacerti anche

- G.R. No. 148163 - Banco Filipino Savings and Mortgage Bank v. YbañezDocumento6 pagineG.R. No. 148163 - Banco Filipino Savings and Mortgage Bank v. YbañezlckdsclNessuna valutazione finora

- Bacolor vs. Banco Filipino Saving and Mortgage BankDocumento1 paginaBacolor vs. Banco Filipino Saving and Mortgage BankMarianne AndresNessuna valutazione finora

- Bacolor Banking Bank in DistressDocumento3 pagineBacolor Banking Bank in DistressJai Rel RadlynNessuna valutazione finora

- Barredo Vs GarciaDocumento2 pagineBarredo Vs GarciaDan Anthony BarrigaNessuna valutazione finora

- University of The East v. JaderDocumento1 paginaUniversity of The East v. JaderShari Realce AndeNessuna valutazione finora

- Jarco Marketing v. CAdocxDocumento2 pagineJarco Marketing v. CAdocxTerence Mark Arthur FerrerNessuna valutazione finora

- Santos v. PizardoDocumento5 pagineSantos v. PizardoPVallNessuna valutazione finora

- Floreindo v. MetrobankDocumento1 paginaFloreindo v. MetrobankSarah Jane UsopNessuna valutazione finora

- People vs. Suedad (Case Digest)Documento2 paginePeople vs. Suedad (Case Digest)FbarrsNessuna valutazione finora

- Amadora vs. CADocumento1 paginaAmadora vs. CAVanya Klarika NuqueNessuna valutazione finora

- Case Digest - Ruks Konsult Construction Vs Adworld Sign and Advertising CorpDocumento2 pagineCase Digest - Ruks Konsult Construction Vs Adworld Sign and Advertising CorpMaricris GalingganaNessuna valutazione finora

- P.L. Uy Realty Corporation vs. Als Management & DevelopmentDocumento3 pagineP.L. Uy Realty Corporation vs. Als Management & Developmentmiles1280100% (2)

- Napocor Vs PhibroDocumento2 pagineNapocor Vs PhibroTogz MapeNessuna valutazione finora

- #38. Allan Vs PNBDocumento37 pagine#38. Allan Vs PNBeizNessuna valutazione finora

- 12 Gutierrez-v-GutierrezDocumento1 pagina12 Gutierrez-v-GutierrezluigimanzanaresNessuna valutazione finora

- Vicarious LiabilityDocumento11 pagineVicarious LiabilityNeil Sandrei BayanganNessuna valutazione finora

- Spouses Batal vs. Spouses San PedroDocumento12 pagineSpouses Batal vs. Spouses San PedroShela L LobasNessuna valutazione finora

- Amador Vs CA, Et - Al., GR No. L-47745, April 15, 1988 DoctrineDocumento4 pagineAmador Vs CA, Et - Al., GR No. L-47745, April 15, 1988 DoctrineBleizel TeodosioNessuna valutazione finora

- Rakes vs. AGPDocumento20 pagineRakes vs. AGPJesha GCNessuna valutazione finora

- AdminLaw - Guevarra v. Commission On Elections, G.R. No. 12596Documento3 pagineAdminLaw - Guevarra v. Commission On Elections, G.R. No. 12596Lei BlancoNessuna valutazione finora

- Tankeh vs. Development Bank of The PhilippinesDocumento2 pagineTankeh vs. Development Bank of The PhilippinesHyacinth Salig-BathanNessuna valutazione finora

- Batarra V MarcosDocumento1 paginaBatarra V MarcosBGodNessuna valutazione finora

- Allen MC Conn Vs Paul Haragan Et Al.Documento2 pagineAllen MC Conn Vs Paul Haragan Et Al.Jillian AsdalaNessuna valutazione finora

- Rakes Vs AtlanticDocumento2 pagineRakes Vs AtlanticJames Evan I. ObnamiaNessuna valutazione finora

- Wright V Manila Electric RR & Light CoDocumento2 pagineWright V Manila Electric RR & Light CoJaz SumalinogNessuna valutazione finora

- Yobido Vs CADocumento2 pagineYobido Vs CAAiWeiNessuna valutazione finora

- Mariveles Vs CA 415Documento15 pagineMariveles Vs CA 415Joel G. AyonNessuna valutazione finora

- Andamo vs. Intermediate Appellate Court, 191 SCRA 195, November 06, 1990Documento1 paginaAndamo vs. Intermediate Appellate Court, 191 SCRA 195, November 06, 1990Rizchelle Sampang-ManaogNessuna valutazione finora

- 119 - Manila Railroad Co v. La CompaniaDocumento2 pagine119 - Manila Railroad Co v. La CompaniajrvyeeNessuna valutazione finora

- Estores Vs Spouses SupanganDocumento3 pagineEstores Vs Spouses SupanganAnne MiguelNessuna valutazione finora

- 17 Chiongvian-V - OrbosDocumento2 pagine17 Chiongvian-V - OrbosLuna BaciNessuna valutazione finora

- Marites - Cases Credit DigestedDocumento58 pagineMarites - Cases Credit DigestedMaritesCatayongNessuna valutazione finora

- Stronghold Insurance Company vs. Republic - Asahi Glass Corp.Documento1 paginaStronghold Insurance Company vs. Republic - Asahi Glass Corp.Juan Carlos Brillantes100% (1)

- Republic V Luzon StevedoringDocumento1 paginaRepublic V Luzon StevedoringSuiNessuna valutazione finora

- N-10-01 Jimenez v. BucoyDocumento1 paginaN-10-01 Jimenez v. Bucoy刘王钟Nessuna valutazione finora

- Loadmasters Customs Services, Inc. v. Glodel Brokerage Corporation, G.R. No. 179446, 10 January 2011, (639 SCRA 69)Documento3 pagineLoadmasters Customs Services, Inc. v. Glodel Brokerage Corporation, G.R. No. 179446, 10 January 2011, (639 SCRA 69)Christian Talisay100% (1)

- Rural Bank of San Miguel vs. MB DigestDocumento1 paginaRural Bank of San Miguel vs. MB DigestMae NavarraNessuna valutazione finora

- CIR V SM PRIMEDocumento2 pagineCIR V SM PRIMEPopeye100% (1)

- Victory Liner Vs Heirs of Malecdan Case DigestDocumento1 paginaVictory Liner Vs Heirs of Malecdan Case DigestSheena JuarezNessuna valutazione finora

- Banco de Oro vs. Bayuga, 93 SCRA 443Documento18 pagineBanco de Oro vs. Bayuga, 93 SCRA 443Jillian Batac100% (1)

- Case Digest Asset Builders Vs StrongholdDocumento2 pagineCase Digest Asset Builders Vs StrongholdMirai Kuriyama0% (1)

- CANON7 9 AdditionalDocumento11 pagineCANON7 9 AdditionalJustine M.Nessuna valutazione finora

- R Transport Corporation v. Luisito G. YuDocumento3 pagineR Transport Corporation v. Luisito G. YuJoshua MaulaNessuna valutazione finora

- Fuellas Vs CadanoDocumento4 pagineFuellas Vs CadanoMutyaAlmodienteCocjinNessuna valutazione finora

- Philippine Hawk V LeeDocumento2 paginePhilippine Hawk V LeeJanine IsmaelNessuna valutazione finora

- Metro Manila Transit Corp v. CADocumento3 pagineMetro Manila Transit Corp v. CAEva TrinidadNessuna valutazione finora

- Tanpingco vs. IAC (1992)Documento5 pagineTanpingco vs. IAC (1992)Madelinia100% (1)

- Metrobank vs. CADocumento2 pagineMetrobank vs. CADongkaeNessuna valutazione finora

- CPG - 1. Metrobank Et Al Vs TanDocumento6 pagineCPG - 1. Metrobank Et Al Vs TanImma OlayanNessuna valutazione finora

- Manliclic V CalaunanDocumento2 pagineManliclic V CalaunanMillicent MatienzoNessuna valutazione finora

- Metro Concast v. Allied Banking - Case DigestDocumento2 pagineMetro Concast v. Allied Banking - Case DigestLulu RodriguezNessuna valutazione finora

- St. Francis High School vs. Court of AppealsDocumento3 pagineSt. Francis High School vs. Court of AppealsMandaluyong RtcNessuna valutazione finora

- (People vs. Ligon, 152 SCRA 419 (1987) ) PDFDocumento13 pagine(People vs. Ligon, 152 SCRA 419 (1987) ) PDFJillian BatacNessuna valutazione finora

- Petitioner vs. vs. Respondents: First DivisionDocumento12 paginePetitioner vs. vs. Respondents: First DivisionGael MoralesNessuna valutazione finora

- Carino v. CHR (Digest)Documento2 pagineCarino v. CHR (Digest)Homer SimpsonNessuna valutazione finora

- Durban Apartments v. Pioneer InsuranceDocumento2 pagineDurban Apartments v. Pioneer InsuranceNivra Lyn EmpialesNessuna valutazione finora

- DIGESTDocumento7 pagineDIGESTSometimes goodNessuna valutazione finora

- Pelayo vs. Lauron 12 Phil. 453Documento1 paginaPelayo vs. Lauron 12 Phil. 453Lu CasNessuna valutazione finora

- Case Digests For Banking LawsDocumento22 pagineCase Digests For Banking LawsJanine CastroNessuna valutazione finora

- Banco Filipino Vs YbanezDocumento3 pagineBanco Filipino Vs YbanezAllen Jeil GeronaNessuna valutazione finora

- Holophane Denver Elite Bollard - Spec Sheet - AUG2022Documento3 pagineHolophane Denver Elite Bollard - Spec Sheet - AUG2022anamarieNessuna valutazione finora

- BWTS Test HazırlıklarıDocumento1 paginaBWTS Test HazırlıklarısabeerNessuna valutazione finora

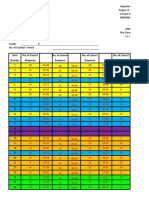

- Item AnalysisDocumento7 pagineItem AnalysisJeff LestinoNessuna valutazione finora

- Lifeline® Specialty: Fire Resistant QFCI Cable: Fire Resistant, Flame Retardant Halogen-Free Loose Tube - QFCI/O/RM-JMDocumento2 pagineLifeline® Specialty: Fire Resistant QFCI Cable: Fire Resistant, Flame Retardant Halogen-Free Loose Tube - QFCI/O/RM-JMkevinwz1989Nessuna valutazione finora

- Educ 3 Prelim Act.1 AlidonDocumento2 pagineEduc 3 Prelim Act.1 AlidonJonash AlidonNessuna valutazione finora

- Jesus Chavez AffidavitDocumento21 pagineJesus Chavez AffidavitThe Dallas Morning NewsNessuna valutazione finora

- Semiotics Study of Movie ShrekDocumento15 pagineSemiotics Study of Movie Shreky2pinku100% (1)

- ACSRDocumento3 pagineACSRWeber HahnNessuna valutazione finora

- MagmatismDocumento12 pagineMagmatismVea Patricia Angelo100% (1)

- PUERPERAL SEPSIS CoverDocumento9 paginePUERPERAL SEPSIS CoverKerpersky LogNessuna valutazione finora

- CRM Final22222222222Documento26 pagineCRM Final22222222222Manraj SinghNessuna valutazione finora

- Hellwalker: "What Terrors Do You Think I Have Not Already Seen?"Documento2 pagineHellwalker: "What Terrors Do You Think I Have Not Already Seen?"mpotatoNessuna valutazione finora

- Group 2 Lesson 2 DramaDocumento38 pagineGroup 2 Lesson 2 DramaMar ClarkNessuna valutazione finora

- Cct4-1causal Learning PDFDocumento48 pagineCct4-1causal Learning PDFsgonzalez_638672wNessuna valutazione finora

- End of Semester Student SurveyDocumento2 pagineEnd of Semester Student SurveyJoaquinNessuna valutazione finora

- 6401 1 NewDocumento18 pagine6401 1 NewbeeshortNessuna valutazione finora

- Mohak Meaning in Urdu - Google SearchDocumento1 paginaMohak Meaning in Urdu - Google SearchShaheryar AsgharNessuna valutazione finora

- Amt 3103 - Prelim - Module 1Documento17 pagineAmt 3103 - Prelim - Module 1kim shinNessuna valutazione finora

- ANI Network - Quick Bill Pay PDFDocumento2 pagineANI Network - Quick Bill Pay PDFSandeep DwivediNessuna valutazione finora

- Iii. The Impact of Information Technology: Successful Communication - Key Points To RememberDocumento7 pagineIii. The Impact of Information Technology: Successful Communication - Key Points To Remembermariami bubuNessuna valutazione finora

- Digestive System LabsheetDocumento4 pagineDigestive System LabsheetKATHLEEN MAE HERMONessuna valutazione finora

- Karnataka BankDocumento6 pagineKarnataka BankS Vivek BhatNessuna valutazione finora

- Game Theory Presentation: Big BrotherDocumento11 pagineGame Theory Presentation: Big BrotherNitinNessuna valutazione finora

- Result 1st Entry Test Held On 22-08-2021Documento476 pagineResult 1st Entry Test Held On 22-08-2021AsifRiazNessuna valutazione finora

- Consortium of National Law Universities: Provisional 3rd List - CLAT 2020 - PGDocumento3 pagineConsortium of National Law Universities: Provisional 3rd List - CLAT 2020 - PGSom Dutt VyasNessuna valutazione finora

- 4Q 4 Embedded SystemsDocumento3 pagine4Q 4 Embedded SystemsJoyce HechanovaNessuna valutazione finora

- BCG-How To Address HR Challenges in Recession PDFDocumento16 pagineBCG-How To Address HR Challenges in Recession PDFAnkit SinghalNessuna valutazione finora

- Ikramul (Electrical)Documento3 pagineIkramul (Electrical)Ikramu HaqueNessuna valutazione finora

- Photo Essay (Lyka)Documento2 paginePhoto Essay (Lyka)Lyka LadonNessuna valutazione finora

- Dumont's Theory of Caste.Documento4 pagineDumont's Theory of Caste.Vikram Viner50% (2)