Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Gold and Crude Oil Corelation

Caricato da

9987303726Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Gold and Crude Oil Corelation

Caricato da

9987303726Copyright:

Formati disponibili

Where the Relationship between Gold and Oil Works and Where It Does Not

In the financial markets, gold is usually ascribed to the commodities category. In this group of assets you

will find silver, along with several others metals like platinum, palladium, copper etc. Apart from that,

commodities encompass a broad range of other products in the like of corn, but also crude oil, gas,

minerals and other. Such groups of assets are usually traded on commodity exchanges specialized in this

kind of products, for instance on the Chicago Mercantile Exchange or the London Metal Exchange.

Commodities differ from stocks or bonds in the fact that, usually they have significant importance for

some industry. For example, silver is used in the production of electrical conductors and oil is used as

fuel for various kinds of machines. The main difference from a financial point of view is that, other than

bonds and stocks, commodities do not give you cash flows in the like of dividends, coupons or the

principal. The only way in which commodities generate returns (excluding industrial applications) is

when their price changes in the direction you bet on.

Since price changes are of crucial importance for commodities investors, relationships between these

commodities are often examined in detail to establish if prices of one commodity can fuel prices of

another. It is, for instance, almost universally acknowledged that there is a strong relationship between

prices of gold and silver, where the price of silver strongly depends on the price of gold.

Most precious metals investors have probably analyzed the gold to silver ratio more than once in their

investment career, but such relationships can be found not only between metals. It is argued that prices

of gold and oil are also related. Higher price of oil would translate in higher prices of gold.

The main idea behind the gold-oil relation is the one which suggests that prices of crude oil partly

account for inflation. Increases in the price of oil result in increased prices of gasoline which is derived

from oil. If gasoline is more expensive, than its more costly to transport goods and their prices go up.

The final result is an increased price level in other words, inflation. The second part of the causal link is

the fact that precious metals tend to appreciate with inflation rising (in the current fiat monetary

environment). So, an increase in the price of crude oil can, eventually, translate into higher precious

metals prices.

To see if this is actually the case, lets take a look at the chart below. It presents prices of gold and Brent

crude oil in the 1987-2012 period.

As it turns out, both commodities tend to trade in the same direction. The relationship is far from

perfect but it seems to be there. We have measured this relationship by calculating the R-squared for

gold and crude oil in the above-mentioned period. R-squared is a statistical measure, but you dont need

to be a rocket scientist or have a Ph.D. in Mathematics to understand it. The basic idea is simply that if

you have two quantities (e.g. price paths), R-squared shows you how much of the changes in one of

those quantities can be explained by the other quantity. To put it simple, in our case R-squared shows

you how much of the changes in the price of gold can be explained by changes in the price of crude oil.

The result is 78.7% which, quite intuitively, tells you that, in fact, price levels of gold and crude oil are

strongly related. This is further confirmed by another chart.

On this chart, we have plotted prices of gold in relation to prices of Brent crude oil. This chart can be

interpreted in the following way: the horizontal axis shows you the price of oil on a given day and the

vertical axis shows the price of gold on the same day. So, if you look at the horizontal axis and find oil at,

say, $70, looking up in a straight line will tell you what gold cost when oil was at $70. We see that the

cloud of points is generally rising in the price of oil. This suggests, just as the previous chart did, that

there is a relation between the two price levels: higher prices of oil coincide with higher prices of gold.

One puzzle here is that it usually takes some time for higher oil prices to materialize as higher prices in

goods and services. But it does not seem to take too long for gold you have in your portfolio to trade in

line with oil. One explanation can be that, once oil appreciates, precious metals investors discount the

expected future higher prices o goods in the price of gold and gold goes up.

With such results on the table, it would be tempting to proclaim that you can trade this relationship. But

to see if this is really the case, well turn to a different chart.

This chart is similar to the previous one but it differs from it in two ways: we plot weekly gold and oil

returns instead of prices and we shorten the analyzed period to start with the year 2002. The results

here are completely different than before. The cloud of points does not seem to reveal any coincidence

or relationship it does not follow any visible trend and the points look like plotted randomly in the

middle of the chart, around 0% returns for both gold and oil. R-squared suggests that 7.2% of the

changes in gold returns can be explained by changes in oil returns. The conclusion might be thathigher

weekly oil returns dont necessarily imply anything meaningful for weekly returns of gold as far as long-

term analysis is concerned. We have obtained similar results for daily, monthly and quarterly returns.

The main point is that, even though the general price level of gold evolves in a similar direction to oil,

the relationship may not be tradable based on data for the long term. Over longer periods of time and

on average, opening long speculative positions in gold based on expected appreciation of oil may simply

not be profitable.

Having said that, its still possible for short-term patterns to emerge occasionally. So, even though there

seems to be no relationship between gold and oil returns over the long term, it may happen that a

relationship unveils itself in a short period of time offering trading opportunities.

A popular way to analyze gold in terms of crude oil is the gold:oil ratio in which the price of gold is

divided by the price of oil. We present historical levels of the ratio along with prices of gold on the chart

below.

Peaks in the ratio signalize periods when gold was expensive relative to oil. Troughs point out periods

when gold was relatively cheap compared with oil. The ratio does not reveal any striking patterns or

relationships. As is with charts, it can be interpreted differently by different persons. Quick calculations

yield an R-squared of 3.4%, which suggests that the ratio on its own may not have any particular impact

on gold prices at the same point in time.

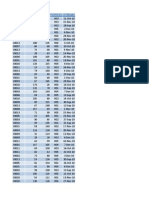

In light of the mixed results obtained so far, we have checked the relationship between gold and oil

price levels for stability. We have calculated R-squared values for gold and oil prices in a one-year

window for each day in the 1987-2012 period (subject to data availability). The results are presented on

the chart below.

The red line shows the R-squared values calculated in a one-year window ending on the day for which

the value is shown. The changes in the R-squared can be perceived as the stability of the gold-oil

relationship. High values indicate that for a one-year period prior to the day for which the value is

reported the link between gold and oil was relatively strong and they traded in the same directions. Low

values indicate that for one year the relationship was questionable and gold and oil traded

independently. We can see that the stability of the relation has been fluctuating dramatically for the last

25 years.

It is considerably difficult to find any apparent relationship between the behavior of R-squared values

and the price of gold. To check for any such link, we have applied two thresholds to the R-squared

values. The first threshold would be one that was broken when R-squared went up. The other one was

one that was broken when R-squared was declining. We have checked for different values of the

thresholds, values that would coincide with highest or lowest past returns of gold. Altogether, we have

answered four questions:

If the R-squared was going down, what threshold would have coincided with highest returns?

If the R-squared was going down, what threshold would have coincided with lowest returns?

If the R-squared was going up, what threshold would have coincided with highest returns?

If the R-squared was going up, what threshold would have coincided with lowest returns?

The answers:

For R-squared going down, a threshold of 63.8% would have coincided with monthly returns of

5.4%.

For R-squared going down, a threshold of 80.8% would have coincided with monthly returns of -

7.2%.

For R-squared going up, a threshold of 81.1% would have coincided with monthly returns of

10.8%.

For R-squared going up, a threshold of 86.2% would have coincided with monthly returns of -

11.0%.

Even if the above might seem slightly complicated, they imply two straightforward points:

When the relationship between gold and oil was strong but deteriorating, gold returns tended

to be considerably low.

When such a relationship was significant and strengthening, gold returns tended to be extreme

either considerably high or considerably low.

The above results do not imply that such relationships were tradable. But they point out that the degree

to which gold and oil traded in the same direction could have had influence on gold returns.

To sum up, there seems to be a relatively strong relationship between gold and oil prices but not

between gold and oil returns. The strength of the relationship between gold and oil coincides with high

or low gold returns. This relationship may not be useful for speculation over the long term but its

possible that patterns emerge locally, in short time spans. Results of our analysis of the relationship

between gold and oil show that if you are considering entering the gold market and the relationship

between gold and oil is strong but deteriorating, you may want to double check the current situation on

the market. Additionally, if you are to enter the market and the above-mentioned relationship is

strengthening, this could coincide with considerable movements in gold to either side. You might want

to check additional factors to confirm which side it might be.

If you would like to get more information on how oil can be related to precious metals, please read our

gold, silver and oil trio report. If you want to get to know more about other topics connected to gold and

silver, try our series of reports on gold and silver.

Symmetry between prices of gold and crude oil coming

apart

Suraj Sowkar & Ashutosh R Shyam, ET Bureau Jun 27, 2014, 04.00AM IST

Tags:

risk|

Insurability|

Gold|

Crude oil

(Investors are buying)

A five-year symmetry between international prices of goldand crude oil is coming apart with investors

drifting away from the yellow metal as their risk aversion diminishes. Historically, both these commodities

had positive correlation, with their prices moving in tandem in either direction. However, the 120-day

correlation between crude oil and gold turned negative for the first time in five years since March.

The average correlation in the past seven years between spot gold and the West Texas Intermediate

(WTI), one of the major benchmarks for crude oil, has been a positive 0.34, but this relation is drifting

towards the negative zone, as investors start to regain their confidence and move away from gold, which

is considered a safe haven. At the same time, they are buying crude oil as gradual economic recovery

globally is expected to boost energy consumption.

"Crude oil and gold prices are coming apart as investors perceive that the world is not likely to go in

doldrums in the near future," said the global head of commodity and structured trade finance at an MNC

brokerage. "The investment in gold increases with increased risk perception in the market as it is

considered a safe heaven. But, with risk easing across the asset class gold is losing momentum and

crude oil is perking up with pick up in GDP growth globally," he added.

The correlation measure shows how two variables are related and it ranges from plus one to minus one. If

the measure is plus one, it means both variables move in perfect symmetry while minus one shows a

complete lack of symmetry. The correlation between crude and gold peaked at 0.62 in July 2010.

Crude and gold have moved together for the past five year as investors sought to diversify into

commodities from equities and bonds. But now, globally, investors are buying crude oil and selling gold.

Gold holding of exchange-traded funds has reached 1,714 metric tonnes, its lowest since July 2009.

Meanwhile, the International Energy Agency (IEA) raised forecasts for global oil demand in 2014 by

65,000 barrels a day, following strongerthan-expected growth in the first quarter in developed countries.

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Operarting Cycle of A Company: MoneyDocumento4 pagineOperarting Cycle of A Company: Money9987303726Nessuna valutazione finora

- Generic Competitive StrategiesDocumento18 pagineGeneric Competitive Strategies9987303726Nessuna valutazione finora

- ING Vysya Bank ValuationDocumento32 pagineING Vysya Bank Valuation9987303726Nessuna valutazione finora

- Maintain NEUTRAL: Acem in CMP Rs 219 Target Rs 191 ( 13%)Documento7 pagineMaintain NEUTRAL: Acem in CMP Rs 219 Target Rs 191 ( 13%)9987303726Nessuna valutazione finora

- Presented By: Group 2Documento33 paginePresented By: Group 29987303726Nessuna valutazione finora

- What Is Banking? Basics of Banking. Present Status of Banking in India. Assets & Liability Products of BanksDocumento1 paginaWhat Is Banking? Basics of Banking. Present Status of Banking in India. Assets & Liability Products of Banks9987303726Nessuna valutazione finora

- Sample BV ReportDocumento53 pagineSample BV Report9987303726Nessuna valutazione finora

- AR 2013 14 FullDocumento164 pagineAR 2013 14 Full9987303726Nessuna valutazione finora

- Sample Valuation ReportDocumento17 pagineSample Valuation ReportabhidadNessuna valutazione finora

- Subjects Professor Projects Due CurrentDocumento2 pagineSubjects Professor Projects Due Current9987303726Nessuna valutazione finora

- What If Analysis ScenarioDocumento11 pagineWhat If Analysis Scenario9987303726Nessuna valutazione finora

- Blackbook Project On Derivatives in IndiaDocumento47 pagineBlackbook Project On Derivatives in India9987303726100% (2)

- Select A Program: Program Views East North South WestDocumento2 pagineSelect A Program: Program Views East North South West9987303726Nessuna valutazione finora

- Our Mission, Culture and PrioritiesDocumento1 paginaOur Mission, Culture and Priorities9987303726Nessuna valutazione finora

- Exercises 1Documento4 pagineExercises 19987303726Nessuna valutazione finora

- Indian Institute of Banking & FinanceDocumento90 pagineIndian Institute of Banking & Financegopalmeb67% (3)

- Car Tax - Vlookup: Taxtable Might Be A Sensible Name For The TableDocumento1 paginaCar Tax - Vlookup: Taxtable Might Be A Sensible Name For The Table9987303726Nessuna valutazione finora

- Customer Idduration Purchase Amount Representative Date of CallDocumento22 pagineCustomer Idduration Purchase Amount Representative Date of Call9987303726Nessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Transformer Design (Version 1)Documento19 pagineTransformer Design (Version 1)Divya AravindNessuna valutazione finora

- Gas Turbine Lease Engine, Ruston TB5000, Ruston TB5400, Siemens SGT100, Siemens SGT200Documento3 pagineGas Turbine Lease Engine, Ruston TB5000, Ruston TB5400, Siemens SGT100, Siemens SGT200sink or swimNessuna valutazione finora

- Operations Manual 18WDocumento137 pagineOperations Manual 18Wto_john100% (1)

- Engg CW DetailsDocumento26 pagineEngg CW DetailsMuhammad Sohail TariqNessuna valutazione finora

- Cameco Investor Presentation 2019 Q3Documento28 pagineCameco Investor Presentation 2019 Q3jesusftNessuna valutazione finora

- SCERT Kerala State Syllabus 9th Standard Physics Textbooks English Medium Part 2Documento64 pagineSCERT Kerala State Syllabus 9th Standard Physics Textbooks English Medium Part 2SafarNessuna valutazione finora

- Capital Markets ProjectDocumento54 pagineCapital Markets Projectjaggis1313100% (4)

- EHVT Unit 1Documento19 pagineEHVT Unit 1SumanranuNessuna valutazione finora

- Design and Application of A Spreadsheet-Based ModelDocumento7 pagineDesign and Application of A Spreadsheet-Based ModelPassmore DubeNessuna valutazione finora

- Retigo Vision CatalogueDocumento32 pagineRetigo Vision Cataloguesuonodimusica0% (1)

- Sheet Metal Operation Figures and Q A For StudentsDocumento15 pagineSheet Metal Operation Figures and Q A For StudentsRavinder Antil75% (4)

- QP GuidlineDocumento282 pagineQP GuidlinerupeshNessuna valutazione finora

- ZPMC RTG DrawingDocumento444 pagineZPMC RTG DrawingBilal MakhdoomNessuna valutazione finora

- Bagi 'LKPD 2 Teks News ItemDocumento8 pagineBagi 'LKPD 2 Teks News ItemMuhammad IhsanNessuna valutazione finora

- Solar PV Power Plant Project (50MW) : RishehDocumento10 pagineSolar PV Power Plant Project (50MW) : RishehAzizul KhanNessuna valutazione finora

- BEE VivaDocumento8 pagineBEE VivaHimanshi100% (6)

- Aluminum 2 10 HP - EnpdfDocumento2 pagineAluminum 2 10 HP - EnpdfPriv Tinashe MatewaNessuna valutazione finora

- Indian Automobile Sector Analysis January 2023 1693838553Documento1 paginaIndian Automobile Sector Analysis January 2023 1693838553Rohit PareekNessuna valutazione finora

- VolvoDocumento38 pagineVolvoMarculescu Nicolae CatalinNessuna valutazione finora

- Nuclear Power PLantDocumento3 pagineNuclear Power PLantibong tiriritNessuna valutazione finora

- Sales Training Slides - NetSure 501 AC0 (Actura Flex 48420)Documento63 pagineSales Training Slides - NetSure 501 AC0 (Actura Flex 48420)chkimkimNessuna valutazione finora

- Static Electricity in Fuel Handling FacilitiesDocumento29 pagineStatic Electricity in Fuel Handling Facilitiesbiondimigu100% (1)

- Energy, Work and Power: PHY111: Mechanics and Thermo Properties of MatterDocumento71 pagineEnergy, Work and Power: PHY111: Mechanics and Thermo Properties of MatterStudent 365Nessuna valutazione finora

- Constant Hanger and SupportDocumento3 pagineConstant Hanger and Supportivan jhonatanNessuna valutazione finora

- 3.4 Burner Lance ManualDocumento3 pagine3.4 Burner Lance ManualANTONIO MEDINA RIOSNessuna valutazione finora

- Physics Volume 3B Work, P, Energy KeyDocumento15 paginePhysics Volume 3B Work, P, Energy KeySesha Sai KumarNessuna valutazione finora

- Test Procedure and Settings of RCCDocumento5 pagineTest Procedure and Settings of RCCkundan kunalNessuna valutazione finora

- Ques - 14 55 PDFDocumento15 pagineQues - 14 55 PDFVosuMittalNessuna valutazione finora

- Mohammad Shadab Khan - Field OperatorDocumento6 pagineMohammad Shadab Khan - Field OperatorDonNessuna valutazione finora