Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Thesis

Caricato da

abrarbd2004Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Thesis

Caricato da

abrarbd2004Copyright:

Formati disponibili

International Journal of Business and Social Science Vol. 1 No.

2; November 2010

255

The Effect of Microfinance Factors on Women Entrepreneurs Performance in

Nigeria: A Conceptual Framework

Isidore Ekpe

1

Norsiah Binti Mat

2

Razli Che Razak

3

College of Business, Universiti Utara Malaysia,

06010 Sintok, Darul Aman, Malaysia

E-mail:

ekpe60@yahoo.com

1

,

norsiah@uum.edu.my

2

,

raz1152@uum.edu.my

3

Abstract

Women play a crucial role in the economic development of their families and communities but certain

obstacles such as poverty, unemployment, low household income and societal discriminations mostly in

developing countries have hindered their effective performance of that role. As such, most of them embark on

entrepreneurial activities to support their families. It is discovered that women entrepreneurship could be an

effective strategy for poverty reduction in a country; since women are the worst hit in such situation.

However, it is discovered that women entrepreneurs, especially in developing countries, do not have easy

access to microfinance factors for their entrepreneurial activity and as such have low business performance

than their men counterparts, whereas the rate of their participation in the informal sector of the economy is

higher than males, and microfinance factors could have positive effect on enterprise performance. The

objective of this study is to examine the effect of credit, savings, training and social capital on women

entrepreneurs performance in Nigeria. The study involves a survey using structured questionnaire and an in-

depth interview to solicit responses from women entrepreneurs, and secondary data from microfinance

institutions. Data analysis involves the use of Structural Equation Modelling.

Keywords: Microfinance, women entrepreneurs performance, Nigeria.

Introduction

Despite the crucial role of women entrepreneurs in the economic development of their families and countries;

it is, however, discovered that women entrepreneurs have low business performance compared to their male

counterparts (Akanji, 2006); and this is caused by factors which normally affect entrepreneurial performance.

Such factors include lack of credit, saving, education or training, and social capital (Shane, 2003).

Literature supports the fact that women entrepreneurs, mostly in developing countries, do not have easy access

to credit for their entrepreneurial activity (Ibru, 2009; Iganiga, 2008; Iheduru, 2002; Kuzilwa, 2005; Lakwo,

2007; May, 2007; Okpukpara, 2009), whereas the rate of women participation in the informal sector of the

economy is higher than males (Akanji, 2006; Akinyi, 2009). Lack of capital to start or run business led them

to request for credits from micro-finance institutions (Ibru, 2009; Kuzilwa, 2005). This is due to poverty,

unemployment, low household and business income and inability to save (May, 2009; Otero, 1999; Porter &

Nagarajan, 2005; Roomi & Parrot, 2008). Women entrepreneurs, mostly in developing countries, lack the

ability to save (Akanji, 2006; Mkpado & Arene, 2007), yet savings are needed to protect income, act as a

security for loan and could be re-invested in the business (Akanji, 2006).

Centre for Promoting Ideas, USA www.ijbssnet.com

256

Savings as a micro-finance factor enable people with few assets to save, since they could make weekly

savings as well as contribute to group savings, and such savings are mobilized by the micro-finance

institutions for further lending to other clients (Mkpado & Arene, 2007).

Women entrepreneurs, especially in developing countries lack training (IFC, 2007) and entrepreneurial

process is a vital source of developing human capital as well as plays a crucial role in providing learning

opportunity for individuals to improve their skills, attitudes and abilities (Brana, 2008; Cheston & Kuhn,

2002; Shane, 2003). Again, the effect of training on women entrepreneurs performance, especially in

developing countries, has not been adequately addressed in the literature. Taking cognizance of the peculiar

situations of most women in developing countries in terms of poverty, low educational levels and other

societal discriminations (Porter & Nagarajan, 2005; Roomi & Parrot, 2008); training is a very important

micro-finance factor for women entrepreneurs as it would provide the skills and experience needed for

business (Akanji, 2006, Cheston & Kuhn, 2002; Kuzilwa, 2005).

Literature supports the fact that majority of micro-finance institutions clients do not have specialized skills,

and so cannot make good use of micro-finance factors (Karnani, 2007), hence they need training. Paid

employment provides prior business experience that is vital for enterprise success, yet women entrepreneurs

mostly in developing countries lack this (Brana, 2008). This further strengthens the need for training as a

micro-finance factor for the women entrepreneurs. Again, there are suggestions from literature of the need to

study credit jointly with training on entrepreneurship performance in developing countries because of low

educational levels of women entrepreneurs in low-income countries (Harrison & Mason, 2007; Ibru, 2009;

Kuzilwa, 2005; Peter, 2001; Tazul, 2007). Education is related to training, and women entrepreneurs in high-

income countries are better educated than those in low income countries (Ibru, 2009).

Literature confirms that skill training and tertiary education have positive effect on enterprise performance

(Akanji, 2006; Cheston & Kuhn, 2002; Kuzilwa, 2005). Many women lack this, especially in developing

countries (Ibru, 2009), whereas the exploitation of entrepreneurial opportunity depends on the entrepreneurs

level of education, skills or knowledge acquired through work experience, social network and credit (Shane,

2003); hence the need for training as a micro-finance factor especially in developing economies is highlighted.

Social capital is vital for start-ups and growing firms and women entrepreneurs, especially in developing

countries, lack social connections that are a source of information for access to micro-finance factors

(Olomola, 2002). Again, social capital has been widely measured and found to have positive impact on the

performance of women enterprises in developing countries (e.g Brata, 2004; Lawal et al., 2009; Mkpado &

Arene, 2007; Olomola, 2002). Many studies abound on the relationship between one or a combination of

credit, savings, training and social capital, and women entrepreneurs performance (e.g Akanji, 2006; Cheston

& Kuhn, 2002; Kuzilwa, 2005; Lawal et al., 2009; Olomola, 2002; Reavley & Lituchy, 2008; Wycklam &

Wedley, 2003) but there is scarcity of research that jointly links credit, savings, training and social capital to

women entrepreneurs performance especially in developing countries, Nigeria inclusive.

Also, limited studies are available on the mediating relationship between opportunity and women

entrepreneurs performance (Tata & Prasad, 2008; Shane, 2003) and the moderating relationship between

attitude to risk and women entrepreneurs performance (Crisp & Turner, 2007; Vob & Muller, 2009). Women

entrepreneurs in this context lack credit, savings, training and social capital for entrepreneurial activity and

subsequent business performance (Akanji, 2006; Cheston & Kuhn, 2002; Ibru, 2009; Kuzilwa, 2005; Peter,

2001; Olomola, 2002). Whereas the Entrepreneurship Theory (Shane, 2003) postulates that business

environment provides opportunity for entrepreneurial activities to those entrepreneurs who could identify

them, and their decision to exploit such opportunities leads to the demand for micro-finance in terms of

resource acquisition. Acquisition of micro-finance could also lead to opportunity for entrepreneurial activity.

Appropriate use of acquired resources through good business strategy and organizational design could lead to

business performance (Brana, 2008; Koontz & Weihrich, 2006; Salman, 2009; Shane, 2003).

International Journal of Business and Social Science Vol. 1 No. 2; November 2010

257

Again, micro-finance factors could not lead to business performance without opportunity for entrepreneurial

activity. Financial management theorists believe that funds could only be sourced to finance a predetermined

project, business or contract (Van Horne, 1980).

As such, micro-finance could only lead to business performance when there is the tendency to engage in new

business or business expansion (Antoncic, 2006; Shane, 2003). Limited studies are also available on attitude

towards risk-taking moderating the relationship between micro-finance factors, opportunity for entrepreneurial

activity, and women entrepreneurs performance (Crisp & Turner, 2007; Vob & Muller, 2009).

Entrepreneurship theory (Shane, 2003) stated that entrepreneurs ability to discover and exploit opportunity

for entrepreneurial activity differs between individuals and depends on individuals attitude towards risk-

taking. For instance, a risk-averse individual is less likely to exploit entrepreneurial opportunity (Shane,

2003). As such, a person may not search for or discover entrepreneurial opportunity if he/she has a negative

attitude towards risk-taking. In the same vein, an individual may have an innovation business or service idea,

and great likelihood to access micro-finance but may not utilize the opportunity if he/she fears risk.

Behavioral theories such as the Theory of Planned Behavior, specifically the Intention Theory (Ajzen, 1991)

concluded that attitude towards behavior leads to intention which eventually leads to actual behavior. Other

supporting behavioral theorists (e.g Crisp & Turner, 2007) found that attitude and behavioral intention are

positively related.

Nigerias inability to develop her financial sector led to occasional banks distress which necessitated the

financial sector reforms in 1987, 1991 and 2000 (Ikhide & Alawode, 2001) leading to the licensing of 793

micro-finance banks in 2006. Such distresses often hinder economic development and increases poverty level

in a country; and studies worldwide have shown that low economic development and high poverty in a

country is due to that countrys inability to develop her financial sector (Chakraborty, 2008; Iganiga, 2008;

Stephen & Wilton, 2006; William & Thawatchai, 2008). Other studies base their arguments on a countrys

inability to develop her entrepreneurships (John, 2008; Kuzilwa, 2005; Mohd & Hassan, 2008; Roomi &

Parrot, 2008; Rushad, 2004; Srinivasan & Sriram, 2003).

Micro-finance factors and enterprise performance is vital to Nigeria due to her poor economic indices

portrayed by low GDP growth rate, high population, high birth rate and low death rate, high poverty and high

unemployment

1

(I.L.O, 2009);

2

(N.B.S, 2007);

3

(C.I.A, 2009). In the light of this, the Nigerian government

has encouraged vulnerable women to form Women Cooperatives Societies, as groups, so as to access micro-

finance factors for business activities or improvements. Such enterprises would serve as a tool for improving

their quality of life in particular and economy of the country in general.

Based on the discussions above, this study examines the relationship between micro-finance factors (credit,

savings, training and social capital) and women entrepreneurs performance in Nigeria.

Literature Review

Evidences from literature show that adequate credit aids entrepreneurship performance (Gatewood et al.,

2004; Kuzilwa, 2005; Lakwo, 2007; Martin, 1999; Ojo, 2009; Peter, 2001). The result of such credit

assistance to entrepreneurs, especially women, is often seen in improved income, output, investment,

employment and welfare of the entrepreneurs (Kuzilwa, 2005; Lakwo, 2007; Martin, 1999; Peter, 2001).

Credit had positive impact on business performance of entrepreneurs in Kenya (Peter, 2001), income and

wellbeing of women in Uganda (Lakwo, 2007). Credit and savings had positive impact on performance in

Nigeria (Ojo, 2009). Credit and training had positive impact on women entrepreneurs performance in

Tanzania (Kuzilwa, 2005). Savings acts as insurance for credit since women entrepreneurs lack physical

collaterals (Akanji, 2006; Mkpado & Arene, 2007; Versluysen, 1999). Savings has been found to have

positive effect on enterprise productivity in Nigeria (Ojo, 2009).

1

International Labor Organization

2

National Bureau of Statistics of Nigeria

3

Central Intelligence Agency-The World Factbook-Nigeria

Centre for Promoting Ideas, USA www.ijbssnet.com

258

Credit, savings and training were found to have positive impact on women entrepreneurs income and

wellbeing in Haiti, Kenya, Malawi and Nigeria (UNCDF/UNDP, 2003).

Savings and credit was also found to have positive effect on women entrepreneurs wellbeing in Bangladesh,

Indonesia, Ghana and Mexico (Vonderlack & Schreiner, 2001). Equally suggested by literature is the fact that

credit and training should go together, however little the training may be (Ibru, 2009; Kuzilwa, 2005). Skill

training is necessary to provide the needed entrepreneurial skill for small business start-up while business or

management training provides the needed managerial competence for routine and corporate decisions (Cunha,

2007; Jill et al., 2007; Robinson & Malach, 2004; Ying, 2008).

As such, training had positive impact on women entrepreneurship performance in Nigeria, Ghana, USA,

Tanzania and Canada respectively (Ibru, 2009; Cheston & Kuhn, 2002; Jill et al., 2007; Kuzilwa, 2005;

Reavley & Lituchy, 2008). Women entrepreneurs, especially in developing countries, lacked social

connections that are a source of credit and market information (Olomola, 2002), whereas social capital has

been found to have positive impact on the performance of women entrepreneurs (Brata, 2004; Lawal et al.,

2009; Mkpado & Arene, 2007; Olomola, 2002). Therefore we hypothesize that:

H1: Credit, savings, training and social capital are positively related to women entrepreneurs

performance in Nigeria.

Micro-finance provide the needed opportunity for entrepreneurs to start or improve business in order to make

profit and improve their lives (Allen et al., 2008; Brana, 2008; Lans et al., 2008; Majumdar, 2008; Roslan &

Mohd, 2009; Salman, 2009; Shane, 2003; Tata & Prasad, 2008). The ability of women entrepreneurs to make

use of the opportunity provided by micro-finance factors to ensure enterprise performance depends on their

attitude to risk; that is their ability to access information and willingness to act on the information (Shane,

2003). Thus, credit, savings, training and social capital could have positive impact on opportunity for

entrepreneurial activity of women entrepreneurs which could lead to business performance; depending on the

entrepreneurs attitude to risk (Crisp & Turner, 2007; Shane, 2003; Vob & Muller, 2009).

Micro-finance factors create opportunity for entrepreneurial activity (Shane, 2003); as such there is a positive

relationship between micro-finance factors and opportunity for entrepreneurial activity. Credit and savings

were found to have positive effect on opportunity for entrepreneurial activity in Nigeria (Akanji, 2006).

Training was found to have positive effect on entrepreneurial activity in Nigeria and Germany respectively

(Ibru, 2009; Stohmeyer, 2007). Credit and training were found to have positive effect on entrepreneurial

activity in France (Brana, 2008). Credit, training and social capital were found to have positive effect on

entrepreneurial activity in UK and USA respectively (Carter & Shaw, 2006; Shane, 2003). We therefore

hypothesize that:

H2: Credit, savings, training and social capital are positively related to opportunity for entrepreneurial

activity of women entrepreneurs in Nigeria.

Opportunity for entrepreneurial activity, in terms of new business or business expansion, acts as a link

between micro-finance factors and women entrepreneurs performance. It is reported that micro-finance

factors create opportunity for entrepreneurs to generate income (Brana, 2008). The discovery of business

opportunity and the decision to exploit the opportunity leads to a search for external funds, and the acquisition

of such funds again creates opportunity for entrepreneurial income-generating activity (Shane, 2003). Proper

application of the resources could lead to business performance (Koontz & Weihrich, 2006; Shane, 2003).

Social capital (networks) creates opportunity for entrepreneurial activity which leads to performance (Allen et

al., 2008). Yet still, opportunity in the market, identified through innovation, creates the need for micro-

finance factors which in turn creates opportunity for entrepreneurial profits (Salman, 2009). Social capital

provides opportunity for women entrepreneurs to network so as to access information and resources for

business (Tata & Prasad, 2008). Therefore we hypothesize that:

H3: Opportunity mediates the relationship between credit, savings, training and social capital; and

women entrepreneurs performance in Nigeria.

International Journal of Business and Social Science Vol. 1 No. 2; November 2010

259

H4: Opportunity of women entrepreneurs is positively related to women entrepreneurs performance in

Nigeria.

Entrepreneurship Theory of Shane (2003) states that an entrepreneurs ability to identify and tap the

opportunity provided by the external business environment to start or improve his/her business differs

between individuals and depends on individuals ability to access information and willingness to act upon the

information in terms of risk. Ability to access information and willingness to act upon the information in

terms of risk could be inferred to represent attitude to risk. Studies have found that attitude and behavioural

intention are positively related (Crisp & Turner, 2007) and that attitude towards behaviour leads to intention

which eventually leads to actual behaviour (Ajzen, 1991).

We therefore hypothesize that:

H5: Attitude to risk moderates the relationship between credit, savings, training, social capital, and

opportunity; and women entrepreneurs performance in Nigeria.

H6: Attitude to risk has positive effect on women entrepreneurs performance in Nigeria.

Taking a clue from previous studies that have earlier measured the variables, and in determining the

composite effect of micro-finance factors on women entrepreneurs performance, we could hypothesize that:

H7: Credit, savings, training, social capital, opportunity and attitude to risk are positively related to

women entrepreneurs performance in Nigeria.

Underpinning Theory

This research is underpinned on the Entrepreneurship Theory of Shane (2003). The theory consists of

opportunity discovery, evaluation of the opportunity and the decision to exploit the opportunity. Others

elements of the theory include self-employment, business operation and performance. The theory highlighted

four operational measures of performance which are survival, growth, profitability/income, and experiencing

initial public offering. Survival refers to continuation of entrepreneurial activity while growth refers to

increase in the ventures sales and employment. Profitability refers to new surplus of revenue over cost while

experiencing initial public offer refers to the sale of stock to the public (Shane, 2003).

Opportunities are created by the institutional or external environment for those entrepreneurs who could

identify them to start or improve their businesses and subsequently, their welfare (North, 1990; Shane, 2003).

Entrepreneurs ability to identify and tap such opportunities differs between entrepreneurs. It also depends on

their ability to access information and willingness to act upon the information in terms of risk; that is their

attitude (Shane, 2003). Individual attributes affect discovery of entrepreneurial opportunity. It is made up of

psychological and demographic factors such as motives, attitude to risk, education and training, career

experience, age and social status.

Changes in business environment such as economic, financial, political, legal, and socio-cultural factors also

affect discovery of opportunity. For example, income level of the entrepreneur, capital availability, political

stability, laws concerning private enterprise and property rights, and desire for enhanced social status by the

entrepreneur could affect discovery of entrepreneurial opportunity. Type of industry also affect opportunity

discovery. Industrial sectors such as distribution, manufacturing, agriculture, catering, and business services

are more attractive to entrepreneurs (Brana, 2008; Carter & Shaw, 2006; Gatewood et al., 2004; Riding, 2006;

Shane, 2003; Stohmeyer, 2007). The concentration of industries in a particular location could also influence

discovery of entrepreneurial opportunity by those in that location (Shane, 2003). Evaluation of the identified

opportunity is another stage in the entrepreneurial process, and appropriate decision at this stage leads to the

decision to exploit the opportunity (Shane, 2003). The decision to exploit the opportunity depends on the

intention of the entrepreneur, and the appropriate measure of entrepreneurial decision-making is intention

which leads to recognition of entrepreneurial opportunities (Shane, 2003). Exploitation of the opportunity

depends on the entrepreneurs level of education, skills or knowledge acquired through work experience,

social networks, credit, and cost-benefit analysis of the business (Shane, 2003).

Centre for Promoting Ideas, USA www.ijbssnet.com

260

The decision to exploit the opportunity leads to the quest for micro-finance; that is acquisition of resources.

Acquisition of resources could also lead to opportunity for entrepreneurial activity; that is new business or

business expansion. The appropriate use of the acquired resources in terms of business strategy and

organizational design could lead to profit performance (Brana, 2008; Koontz & Weihrich, 2006; Salman,

2009; Shane, 2003). However, environment plays greater role in opportunity exploitation than individual

attributes (Kuzilwa, 2005).

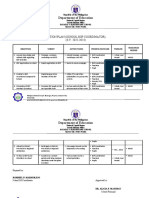

Conceptual Framework

The focus of this study is to examine the relationship between credit, savings, training and social capital; and

women entrepreneurs performance. The conceptual framework for this study is as shown below.

Figure 2.1

Research (Conceptual) Framework (Source: Authors compilation).

References

Ajzen, I. (1991). The Theory of Planned Behavior. The Organizational Behavior and Human Decision

Processes , 50, 179-211.

Akanji, O. O. (2006). Microfinance as a strategy for poverty reduction. Central Bank of Nigeria Economic

and Financial Review , 39 (4).

Akinyi, J. (2009). The role of microfinance in empowering women in Africa. Retrieved January 10, 2010, from

The African Executive Magazine: http://www.google.com

Allen, I. E., Elam, A., Langowitz, N. & Dean, M. (2008). 2007 Global Entrepreneurship Monitor report on

women and entrepreneurship. Babson College: The Center for Women's Leadership.

Antoncic, B. (2006). Impacts of diversification and corporate entrepreneurship strategy making on growth and

profitability: A normative model. Journal of Enterprising Culture , 14 (1), 49-63.

Brana, S. (2008). Microcredit in France: Does gender matter? 5th Annual Conference-Nice. European

Microfinance Network.

Credit

loan size

use of loan

Training

skill acquisition

general mgt

Opportunity

Social capital

network

diversity

network size

bonding

Attitude

to risk

Savings

Women

entrepreneurs

performance

net

profit

output

investm

ent

employ

ment

International Journal of Business and Social Science Vol. 1 No. 2; November 2010

261

Brata, A. G. (2004). Social capital and credit in a Javanese village. University of Atma Jaya, Yogyakarta,

Indonesia: Research Institute.

Carter, S. & Shaw, E. (2006). Women's business ownership: Recent research and policy developments. UK:

Small Business Service.

Central Intelligence Agency (CIA)-The World Factbook-Nigeria. (2009). Nigeria's Gross Domestic Product.

Retrieved January 26, 2009, from http://www.cia.gov/library/publication/the-world-

factbook/geos/ni.html#Econ

Chakraborty, I. (2008). Does financial development cause economic growth? The case of India. South Asia

Economic Journal , 9 (1), 109-139.

Cheston, S. & Kuhn, L. (2002). Empowering women through microfinance. A case study of Sinapi Aba Trust,

Ghana. USA: Opportunity International.

Crisp, R. J. & Turner, R. N. (2007). Essential Social Psychology. London: SAGE Publication.

Cunha, M. P. (2007). Entrepreneurship as decision-making: Rational, intuitive and improvisational

approaches. Journal of Enterprising Culture , 15 (1), 1-20.

Gatewood, E. J., Brush, C. G., Carter, N. M., Greene, P. G. & Hart, M. M. (2004). Women entrepreneurs,

growth and implications for the classroom. USA: Coleman Foundation whitepaper series for the USA

Association for Small Business and Entrepreneurship.

Harrison, R. T. & Mason, C. M. (2007). Does gender matter? Women business angels and the supply of

entrepreneurial finance. Entrepreneurship Theory and Practice , 31 (3), 445-472.

Ibru, C. (2009). Growing microfinance through new technologies. Federal University of Technology, Akure,

Nigeria.

Iganiga, B. O. (2008). Much ado about nothing: The case of the Nigerian microfinance policy measures,

institutions and operations. Journal of Social Sciences , 17 (2), 89-101.

Iheduru, N. G. (2002). Women entrepreneurship and development: The gendering of microfinance in Nigeria.

8th International Interdisplinary Congress on Women. Makerere University, Kampala, Uganda.

Ikhide, S. I. & Alawode, A. A. (2001). Financial sector reforms, macroeconomic instability and the order of

economic liberalization: The evidence from Nigeria. Nairobi, Kenya: African Economic Research

Consortium.

International Finance Corporation (IFC). (2007). Gender entrepreneurship markets, GEM country brief.

Afghanistan: GEM.

International Labor Organization (ILO). (2009). Gender employment. Retrieved July 8, 2009, from

http://www.ilo.org

Jill, K. R., Thomas, P. C., Lisa, G. K. & Susan, S. D. (2007). Women entrepreneurs preparing for growth: The

influence of social capital and training on resource acquisition. Journal of Small Business and

Entrepreneurship , 20 (1), 169-181.

John, M. (2008). Evaluation of two approaches to organizational change for Small and Medium Sized

Businesses. Sunway Academic Journal , 5, 31-47.

Karnani, A. (2007). Microfinance misses its mark. Retrieved February 18, 2009, from Standford Social

Innovation Review:http://www.ssireview.org/articles.

Centre for Promoting Ideas, USA www.ijbssnet.com

262

Kuzilwa, J. (2005). The role of credit for small business success: A study of the National Entrepreneurship

Development Fund in Tanzania. The Journal of Entrepreneurship , 14 (2), 131-161.

Koontz, H. & Weihrich, H. (2006). Essentials of management (6

th

ed.). Tata McGraw-

Hill Publication Co.

Lakwo, A. (2007). Microfinance, rural livelihood, and women's empowerment in Uganda. Retrieved August

3, 2009, from African Studies Center Research Report 2006: http://www.google.com

Lans, T., Hulsink, W., Baert, H. & Mulder, M. (2008). Entrepreneurship education and training in a small

business context: Insights from the competence-based approach. Journal of Enterprising Culture , 16

(4), 363-383.

Lawal, J. O., Omonona, B. T., Ajani, O. I. Y., & Oni, O. A. (2009). Effects of social capital on credit access

among cocoa farming households in Osun State, Nigeria. Agricultural Journal , 4 (4), 184-191.

Majumdar, S. (2008). Modelling growth strategy in small entrepreneurial business organizations. The Journal

of Entrepreneurship , 17 (2), 157-168.

Martin, T. G. (1999). Socio-economic impact of microenterprise credit in the informal sector of Managua,

Nicaragua. Retrieved January 21, 2009, from http://scholar.lib.vt.edu/thesis/

May, N. (2007). Gender responsive entrepreneurial economy of Nigeria: Enabling women in a disabling

environment. Journal of International Women's Studies , 9 (1).

Mkpado, M. & Arene, C. J. (2007). Effects of democratization of group administration on the sustainability of

agricultural microcredit groups in Nigeria. International Journal of Rural Studies , 14 (2), 1-9.

Mohd, D. A. & Hassan, Z. (2008). Microfinance in Nigeria and the prospect of introducing its Islamic version

there in the light of selected Muslim countries' experience. Retrieved January 26, 2009, from

http://www.mpra.ub.uni-muenchen.de/8287/

National Bureau of Statistics (NBS). (2007). Annual abstracts of statistics: Nigeria's unemployment level.

Abuja, Nigeria: National Bureau of Statistics.

North, D. C. (1990). Institutions, institutional change and economic performance. Cambridge, UK:

Cambridge University Press.

Ojo, O. (2009). Impact of microfinance on entrepreneurial development: The case of Nigeria. Faculty of

Administration and Business, University of Bucharest, Romania.

Okpukpara, B. (2009). Microfinance paper wrap-up: Strategies for effective loan delivery to small scale

enterprises in rural Nigeria. Journal of Development and Agricultural Economics , 1 (2), 41-48.

Olomola, A. S. (2002). Social capital, microfinance group performance and poverty implications in Nigeria.

Ibadan, Nigeria: Nigerian Institute of Social and Economic Research.

Otero, M. (1999). Bringing development back into microfinance. Latin America: ACCION International.

Porter, E. G. & Nagarajan, K. V. (2005). Successful women entrepreneurs as pioneers: Results from a study

conducted in Karaikudi, Tamil Nadu, India. Journal of Small Business and Entrepreneurship , 18 (1),

39-52.

Reavley, M. A. & Lituchy, T. R. (2008). Successful women entrepreneurs: A six-country analysis of self-

reported determinants of success-more than just dollars and cents. International Journal of

Entrepreneurship and Small Business , 5 (3-4), 272-296.

International Journal of Business and Social Science Vol. 1 No. 2; November 2010

263

Riding, A. (2006). Small Business financing profiles. Canada: SME Financing Data Initiative.

Robinson, P. & Malach, S. (2004). Multi-disciplinary entrepreneurship clinic: Experiential education in theory

and practice. Journal of Small Business and Entrepreneurship , 17 (1), 317-331.

Roomi, M. A. & Parrot, G. (2008). Barriers to development and progression of women entrepreneurs in

Pakistan. The Journal of Entrepreneurship , 17 (1), 59-72.

Roslan. A. H. & Mohd, Z. A. K. (2009). Determinants of microcredit repayment in Malaysia: The case of

Agrobank. Humanity and Social Sciences Journal , 4 (1), 45-52.

Rushad, F. (2004). Essays on microcredit programs and evaluation of women's success. Retrieved January 21,

2009, from htttp://www.scholar.lib.vt.edu/theses//

Salman, A. (2009). How to start a business: A guide for women. Pakistan: Center for International Private

Enterprise, Institute of National Endowment for Democracy, affiliate of the USA Chamber of

Commerce.

Shane, S. (2003). A general theory of entrepreneurship: The individual-opportunity nexus. UK: Edward Elgar.

Srinivasan, R. & Sriram, M. S. (2003). Microfinance: An introduction. Retrieved January 26, 2009, from

IIMB Management Review: http://www.iimahd.ernet

Stephen, C. & Wilton, W. (2006). Don't blame the entrepreneur, blame the government: The centrality of the

government in enterprise development. Journal of Enterprising Culture , 14 (1), 65-84.

Stohmeyer, R. (2007). Gender gap and segregation in self-employment: On the role of field of study and

apprenticeship training. Germany: German Council for Social and Economic Data (RatSWD).

Tata, J. & Prasad, S. (2008). Social capital, collaborative exchange and microenterprise performance: The role

of gender. International Journal of Entrepreneurship and Small Business , 5 (3/4), 373-385.

Tazul, I. (2007). Microcredit and poverty alleviation. Hampshire, England: Ashgate Publishing Limited.

UNCDF/UNDP. (2003). Microfinance Program: Impact assessment (2003) based on case studies in Haiti,

Kenya, Malawi and Nigeria. United Nations Capital Development Fund in conjunction with United

Nations Development Program.

VanHorne, J. C. (1980). Fundamentals of financial management (4th ed.). Englewood Cliffs, N.J: Prentice-

Hall Inc.

Versluysen, E. (1999). Defying the odds-Banking for the poor. USA: Kumerian Press.

Vob, R. & Muller, C. (2009). How are the conditions for high-tech start-ups in Germany. International

Journal of Entrepreneurship and Small Business , 7 (3), 285-311.

Vonderlack, R. M. & Schreiner, M. (2001). Women, microfinance and savings: Lessons and proposals.

Washington University, St. Louis, USA: Center for Social Development.

William, S. & Thawatchai, J. (2008). Impact of the lack of institutional development on the venture capital

industry in Thailand. Journal of Enterprising Culture , 16 (2), 189-204.

Ying, L. Y. (2008). How industry experience can help in the teaching of entrepreneurship in Universities in

Malaysia. Sunway Academic Journal , 5, 48-64.

Potrebbero piacerti anche

- Advantages and Disadvantages of Mergers and AcquisitionsDocumento3 pagineAdvantages and Disadvantages of Mergers and Acquisitionsabrarbd2004Nessuna valutazione finora

- Advantages and Disadvantages of Mergers and AcquisitionsDocumento3 pagineAdvantages and Disadvantages of Mergers and Acquisitionsabrarbd2004Nessuna valutazione finora

- New Microsoft Office Word DocumentDocumento1 paginaNew Microsoft Office Word Documentabrarbd2004Nessuna valutazione finora

- "Instituting New Training Programs": Report On CaseDocumento5 pagine"Instituting New Training Programs": Report On CaseMahbub IslamNessuna valutazione finora

- External Environment AnalysisDocumento14 pagineExternal Environment Analysisabrarbd2004Nessuna valutazione finora

- June28 5Documento2 pagineJune28 5abrarbd2004Nessuna valutazione finora

- June28 5Documento2 pagineJune28 5abrarbd2004Nessuna valutazione finora

- BFIDC and The Private Garden Owners Grow Rubber On Around 92Documento18 pagineBFIDC and The Private Garden Owners Grow Rubber On Around 92abrarbd2004100% (1)

- Higher Algebra - Hall & KnightDocumento593 pagineHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Higher Algebra - Hall & KnightDocumento593 pagineHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- BFIDC and The Private Garden Owners Grow Rubber On Around 92Documento7 pagineBFIDC and The Private Garden Owners Grow Rubber On Around 92abrarbd2004Nessuna valutazione finora

- Higher Algebra - Hall & KnightDocumento593 pagineHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- 5 Undiscovered Equity Funds With High Growth Potential June 2020 PDFDocumento34 pagine5 Undiscovered Equity Funds With High Growth Potential June 2020 PDFKOUSHIKNessuna valutazione finora

- Language Test 12ADocumento1 paginaLanguage Test 12ABurundukFeedNessuna valutazione finora

- Financial Justification of ProjectsDocumento5 pagineFinancial Justification of ProjectsDilippndtNessuna valutazione finora

- New Product Design, Concept, Measurement, and ConsequencesDocumento16 pagineNew Product Design, Concept, Measurement, and Consequences罗准恩 Loh Chun EnNessuna valutazione finora

- BIG Associate Partners ListDocumento2 pagineBIG Associate Partners ListasanyogNessuna valutazione finora

- IIE TransactionsDocumento19 pagineIIE TransactionsGerman TelloNessuna valutazione finora

- Understanding the Cradle-to-Grave Carbon Footprint of Structural Precast ConcreteDocumento4 pagineUnderstanding the Cradle-to-Grave Carbon Footprint of Structural Precast ConcretetdrnkNessuna valutazione finora

- Agile Development AssignmentDocumento12 pagineAgile Development AssignmentDavid IyodoNessuna valutazione finora

- Presentation On Olper'sDocumento43 paginePresentation On Olper'skashif8ansari3644100% (5)

- MOAC Setup R12Documento57 pagineMOAC Setup R12Naimish SolankiNessuna valutazione finora

- This Content Downloaded From 103.232.241.147 On Mon, 19 Sep 2022 16:51:43 UTCDocumento15 pagineThis Content Downloaded From 103.232.241.147 On Mon, 19 Sep 2022 16:51:43 UTCsayondeepNessuna valutazione finora

- A. Soriano Corporation 2009 Annual Stockholders Meeting Notice and AgendaDocumento47 pagineA. Soriano Corporation 2009 Annual Stockholders Meeting Notice and AgendaGabriel uyNessuna valutazione finora

- A Hybrid Approach To Assess Decommissioning Options For Offshore InstallationsDocumento6 pagineA Hybrid Approach To Assess Decommissioning Options For Offshore InstallationsDaniel DamboNessuna valutazione finora

- Indian Import Duty HS Code 4707 GuideDocumento4 pagineIndian Import Duty HS Code 4707 GuideTuna ManNessuna valutazione finora

- Sampling PDFDocumento30 pagineSampling PDFAbid RahimNessuna valutazione finora

- Democratic Leadership (Tim Cook)Documento2 pagineDemocratic Leadership (Tim Cook)Eaint Hmue Thet MonNessuna valutazione finora

- He Integration of Information and Information Technology in Accounting Education Effects On Student PerformanceDocumento17 pagineHe Integration of Information and Information Technology in Accounting Education Effects On Student PerformanceconnieNessuna valutazione finora

- Robert J. Foster-Coca-Globalization - Following Soft Drinks From New York To New Guinea (2008)Documento304 pagineRobert J. Foster-Coca-Globalization - Following Soft Drinks From New York To New Guinea (2008)Diego AlbertoNessuna valutazione finora

- Nepal REPORT FinalDocumento64 pagineNepal REPORT Finalravi474Nessuna valutazione finora

- Types of Electronic MediaDocumento5 pagineTypes of Electronic Mediaeeqanabeella0% (1)

- AWS Re:invent 2023 - Improve Operational Efficiency and Resilience With AWS SupportDocumento49 pagineAWS Re:invent 2023 - Improve Operational Efficiency and Resilience With AWS SupportNeelNessuna valutazione finora

- BSBTEC601 Task 1Documento3 pagineBSBTEC601 Task 1machuky jrNessuna valutazione finora

- Hilton Pharma Report on Pharmaceutical IndustryDocumento8 pagineHilton Pharma Report on Pharmaceutical IndustryFakhrunnisa khanNessuna valutazione finora

- Payatas C Elementary School BSP Action PlanDocumento2 paginePayatas C Elementary School BSP Action PlanRommel Marmolejo100% (2)

- Partnership FormationDocumento5 paginePartnership FormationMary Elisha PinedaNessuna valutazione finora

- Cash and Cash Equivalents FundamentalsDocumento10 pagineCash and Cash Equivalents FundamentalsGRACE ANN BERGONIONessuna valutazione finora

- Atul Sales & Distribution of Parag MilkDocumento111 pagineAtul Sales & Distribution of Parag MilkAbhishek SharmaNessuna valutazione finora

- 12023/janshatabdi Exp Chair Car (CC)Documento3 pagine12023/janshatabdi Exp Chair Car (CC)Nutan sinhaNessuna valutazione finora

- Volkswagen Case StudyDocumento7 pagineVolkswagen Case StudyMUHAMMAD ANS SHAMASNessuna valutazione finora

- Nailpro Abril 2023Documento55 pagineNailpro Abril 2023PCNessuna valutazione finora