Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Boiler CFB

Caricato da

abdulrehman20100 valutazioniIl 0% ha trovato utile questo documento (0 voti)

90 visualizzazioni6 pagineboiler jinan

Titolo originale

boiler cfb

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoboiler jinan

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

90 visualizzazioni6 pagineBoiler CFB

Caricato da

abdulrehman2010boiler jinan

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 6

CFB Design Evolution of Chinese CFBs

Sean Li, Burns and Roe Enterprise Inc (BRE)

Tang Yong, Dongfang Boiler Corporation, China (DBC)

Zhang Yanjun, Harbin Boiler Company Ltd, China (HBC)

Gao Zhiyu, Shanghai Boilers Works Ltd, China (SBWL)

ABSTRACT: This paper presents the development, Chinese CFB market and design evolution

of the CFB boilers offered by the leading Chinese boiler manufacturers.

TECHNOLOGY AND CFB BOILER MANUFACTURERS.

China started CFB development in 1980s. R&D was mainly carried out by the universities and academics

who worked or cooperated with small boiler manufacturers to build some small CFB boilers (mainly less

than 30 MWe) for industrial users. Different types of designs had been tried and put into operation around

1990, utilizing zig-zag impact separators, horizontal cyclones, L-valves, etc.

From the early 1990s, some industrial users started to import 50 MWe CFB boilers from the US and Europe

with foreign financing; Some built the boiler by buying a design package and limited equipment from

US/European manufacturers, and subcontracting the boiler fabrication to the domestic manufacturers.

Ahlstrom Pyropower (now Foster Wheeler) was the leader in supplying imported CFB boilers in that period.

The Chinese utilities, which is the biggest boiler market in the country, were still cautious about CFB

technology. In 1994 they imported a 100 MWe boiler from Ahlstrom Pyropower and named it Neijiang 100

MWe CFB Demonstration Project, located at the Neijang Power Plant. The boiler burns local anthracite and

achieved moderate success: all performance guarantees were met. But the carbon loss was high and there

were some problems with the cooling capacity of the bottom ash coolers and the loopseal expansion joints.

Still unimpressed by the CFBs performance, the Chinese utilities did not start to build +135 MWe CFBs

until 2000 when the government approved few new PC power plant projects and it was easier for the utilities

to get CFBs approved. Around this time the Big Three Chinese boiler manufacturers (DBC, HBC, and

SBWL) were also ready to offer the 135 MWe CFB boilers, with HBC having technology transfer from

Alstom/EVT, SBWL having technology transfer from Alstom/CE (ABB-CE at that time), and DBC having

their own technology developed based on imported technology from Foster Wheeler for 50 to 100 MWe

CFBs. In a matter of seven years time, these suppliers have built over 100 units of +135 MWe CFBs.

In 2002, Alstom transferred the 300 MWe CFB technology to the three big Chinese boiler manufacturers and

got the boiler award for the Baima 1 x 300 MWe CFB demonstration project. The Baima unit is located not

far away from the Neijang Power Plant and also burns similar anthracite.

In 2006, FW transferred subcritical CFB technology to Wuxi Boiler Works.

EXPERIENCE LIST AND STATUS

One can use the word extra ordinary to describe the Chinese CFB market.

In the past decade, over 2,000 CFB units have been put into operation in China (Yue, etc, 2006). Most of the

units are in the Chinese standard turbine sizes (net MWe): 300 MWe (1025 t/h SH), 135 MWe (440 t/h SH),

50 MWe (220 t/h), 25 MWe (130 t/h), 12 MWe (75 t/h) and 5 MWe (35 t/h). The first tier boiler companies,

the Big Three, sell mostly 100 MWe and larger boilers, and are concentrating on the 300 MWe market now

as the second tier boiler manufacturers have entered the 100 to 200 MWe markets. The third tier companies

are dominating the small boiler market (< 50 MWe) and are moving up their boiler size too.

The following list some major CFB boiler players in China:

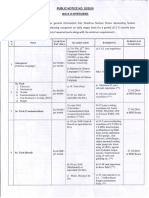

MWe 300 200 135-150 100 50 <50

DBC 25 4 56 14 21 Note 1

HBC 11 1 57 8 52 Note 1

SBWL 10 6 21 6 0 Note 1

Wuxi Boiler Works 0 3 18 2 98 715**

Jinan Boiler Works 0 5 7 14 122 1,150

Wuhan Boiler Works 0 0 5 3 7 12

*all Information came directly from the manufacturers as of October, 2007.

** Includes 24 units of municipal solid waste CFB boilers

CHINESE CFB BOILER DESIGN

The pragmatic Chinese boiler manufacturers have made many changes to imported CFB designs over the

years. Normally they would send their design team to the foreign company transferring the technology to

design the boiler(s) for a recent order. The first units look like a boiler from the foreign company, but there is

no guarantee after that. They can change the boiler design to make the boilers more suitable for the local fuel

and operation.

One good example is the first 300 MWe CFB project that DBC built is the 2 x 300 MWe Qinghuadao project

based on Alstom license (see Fig. 1). DBC started to offer a different boiler design (see Fig. 2) to all the

projects that followed. The other two boiler companies, SBWand HBC have done the same thing (see Fig. 3

and Fig. 4). The reason is that the revised design offers cost advantage and a simpler design for the local

market.

Compared with the US and European manufacturers, the Chinese manufacturers enjoy the advantage of a

huge market with standard steam conditions and easier clients who are much less likely to enter litigations

with the manufacturers should there be performance or schedule shortfalls. Therefore the Chinese

manufacturers are much more willing to test different boiler designs and configurations until they find the

best design. Information is also spread in the industry more rapidly than in the West. Gradually, the Chinese

CFB designs from all manufacturers are becoming similar.

Most Chinese CFB boilers operate in a tougher environment than the boilers in the West in that:

The fuels are of more varieties. One week the boiler can burn bituminous coal of 25% ash. The

next week it can change to gob or culm of 40% ash.

The fuel crushers are mostly from domestic suppliers and it is rare that the fuel size to the furnace

meets the manufacturers requirement. Very often the fuel is much coarser than design and large

rocks get into the furnace too.

Little or no limestone is fed to the furnace although this is changing now. This makes the boiler

more subjective to tube erosion.

The following gives an account of the Chinese CFB design features which are different from those offered

by Western CFB manufacturers

1. Rotating ash coolers (see Fig.5) for the bottom ash cooling.

This is a Chinese invention and is widely used in almost all the Chinese CFB boilers because of its

reliability and simplicity (Li, etc 2005). The imported CFB technology from Foster Wheeler and

Alstom all use the fluidized type of ash coolers, which became one of the major boiler operation

problems due to plugging and high ash outlet temperature because of the plants difficulty in

controlling the crushed fuel size and the fuel ash content.

When the rotary ash coolers came to the market, they were an instant success with the Chinese CFB

boilers. The ash cooler is like a reverse kilm. Solids enter the rotating barrel from one side, cooled

by spiral and longitudinal fins inside the barrel, and leave the barrel cool from the other side. The

spiral fins lift and convey the solids continuously to the barrel exit. There is no mechanical pushing

force on the solids and therefore there is little erosion on the fins and barrel. The solid flow increases

with the barrel rotating speed and decrease to zero when the barrel stops rotating.

The barrel is double layered with coolant, normally condensate or service water, spiraling from one

end to the other between the layers. The sensible heat of the ash is transferred to the fins, to the

barrel and then to the coolant.

Alstoms 1x300 MWe Baima boiler was retrofitted with this type of ash coolers (4 x 20 t/h capacity)

a few months after commercial operation due to plugging problem in the original fluidized ash

coolers.

Alstom is convinced the rotary cooler design is acceptable and is offering the rotary cooler on most

large CFB projects in all markets. Some other Western CFB manufacturers have shown interest in

the product and are doing the due diligence on it.

2. Grid nozzles

Different grid nozzle designs came to China together with the technology transfer. Many Chinese

boiler manufacturers have tried different designs and finally found the bell type of nozzle (see Fig.

6) is the most appropriate for their boilers.

3. Reheat Wingwalls

HBC and SBWL have the reheater wingwalls inside the furnace as their standard design. The

reheaters in the earlier units of one manufacture worked but suffered high pressure drop (compared

with reheattubes in the backpass) and warped panels. The manufacturer quickly updated the design

with revised top hangers to eliminate the panel distortion.

DBC uses parallel backpass for the reheat temperature control. HBC and SBW use water spray for

the reheat temperature control.

4. Cyclone Construction

Due to its low cost and low construction cost (normally only about 10% of the plant cost) most

Chinese boiler manufacturers offer casing cyclones in lieu of cooled cyclones.

5. Bed Temperature

Higher bed temperature for better carbon burnup and lower carbon content in fly ash. Having 6% or

higher carbon content in fly ash is a big issue in China. This problem gets even bigger when no or

little limestone is added to dilute the carbon content in the fly ash.

6. Front Wall Fuel Feed

Most boilers are front wall feed only. This may have some performance impact, such as higher Ca/S.

But adding rear wall feed increases cost and reduces boiler reliability.

7. Lighter Structure Steel.

The Chinese CFB boilers normally have much less steel and platforms than in the West. Part of the

reason is the difference in code requirement and the fact that they do more recalculations after the

auxiliary equipment information is known. It is not unusual to see some boilers do not have

platforms to the drum, downcomers, cyclones and J valves. Boiler penthouses are very rare.

8. Boiler layout.

The primary air ducts to the furnace, induct burners, etc are normally in the sub floor about 10 feed

below the ground floor. The furnace grid is only about 4-6 feed above the ground floor. The bottom

ash conveyer is normally in a pit. As a result, he boiler looks less crowded as one enters the boiler.

600 MWE SUPERCRTICAL CFB DEVELOPMENT IN CHINA

Following the success of 600 MWe and 1000 MWe supercritical PC boilers in China, the Chinese

government has organized the Big Three boiler manufacturers, universities and research institutes to develop

a 600MW supercritical CFB demonstration project. The research budget for the supercritical boiler is 5

MUSD. No technology transfer from the Western boiler companies is expected. Universities and research

institutes will be in a supporting role to the boiler manufacturers in the technology development.

CONCLUSION

Due to the market size, technology transfer and local characteristics of fuels, equipment selection and plant

operation, the Chinese CFB boiler manufacturers have made significant improvements to the imported CFB

boiler designs for the local market. Some of the improvements have been adopted by other world leading

CFB suppliers. It is expected that Chinas development of 600 MWe supercritical CFB boilers will

contribute significantly to the CFB industry.

RFERENCES

Li Sean, Guo Guanglong, Kang Shifu, Ling Rotating Ash Cooler - Solution for CFB Ash Cooling

presented at the CIBO conference, PA, USA, 2006.

Yue Guangxi, etc, Report of the 300MW CFB demonstration project in Baima Sichuan, Sino Power Press,

2007

Fig. 1. 2x300 MWe Qinghuangdao Power

Plant by DBC Commissioned in 2006

Fig. 2. 2x300 MWe Wangjaozhuang Power

Plant by DBC to be Operated in 2008

Fig. 3. Latest 300 MWe CFB Design by HBC

Fig. 4. Latest 300 MWe CFB Design by SBWL

Fig. 5. Rotating ash cooler by Songling

(diagram and photo (15/hr capacity)

provided by Songling)

Fig. 6. Bell Type Grid Nozzles

Potrebbero piacerti anche

- Welding ProcessessDocumento20 pagineWelding Processessabdulrehman2010Nessuna valutazione finora

- Rough Rule of Thumb For Saturation Temperature of SteamDocumento1 paginaRough Rule of Thumb For Saturation Temperature of SteamRiteshNessuna valutazione finora

- How To Size and Design DuctsDocumento91 pagineHow To Size and Design DuctsPrabir Bhowmik100% (1)

- TeachingComprehension PDFDocumento288 pagineTeachingComprehension PDFabdulrehman2010100% (1)

- Consensus On OperatingDocumento10 pagineConsensus On Operatingabdulrehman20100% (1)

- New Microsoft Office Excel WorksheetDocumento5 pagineNew Microsoft Office Excel Worksheetabdulrehman2010Nessuna valutazione finora

- 11 Chapter 3Documento22 pagine11 Chapter 3abdulrehman2010Nessuna valutazione finora

- New Microsoft Office Excel WorksheetDocumento5 pagineNew Microsoft Office Excel Worksheetabdulrehman2010Nessuna valutazione finora

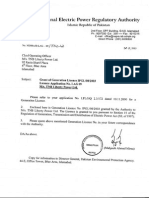

- Pub Not 22016Documento4 paginePub Not 22016abdulrehman2010Nessuna valutazione finora

- Tag DramaDocumento1 paginaTag Dramaabdulrehman2010Nessuna valutazione finora

- New Microsoft Office Excel WorksheetDocumento5 pagineNew Microsoft Office Excel Worksheetabdulrehman2010Nessuna valutazione finora

- ConfinedDocumento28 pagineConfineddgdhandeNessuna valutazione finora

- Rankine CycleDocumento20 pagineRankine Cycleabdulrehman2010100% (1)

- ALL Purpose Worksheet (Conversions)Documento20 pagineALL Purpose Worksheet (Conversions)bryandownNessuna valutazione finora

- Seattle Boiler and Pressure Vessel Code - 1999 Effective July 1, 1999Documento30 pagineSeattle Boiler and Pressure Vessel Code - 1999 Effective July 1, 1999abdulrehman2010Nessuna valutazione finora

- Boilers 1Documento29 pagineBoilers 1Thakur Kamal Prasad50% (2)

- Generation Licen TNB Liberty Power Ltd-Dated 30-08-2003Documento28 pagineGeneration Licen TNB Liberty Power Ltd-Dated 30-08-2003abdulrehman2010Nessuna valutazione finora

- Impedance Test Results On Conductive ConcreteDocumento1 paginaImpedance Test Results On Conductive Concreteabdulrehman2010Nessuna valutazione finora

- PIEAS Sample Test Paper For BS EngineeringDocumento12 paginePIEAS Sample Test Paper For BS EngineeringAitazaz Ahsan100% (4)

- Higher Algebra - Hall & KnightDocumento593 pagineHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Higher Algebra - Hall & KnightDocumento593 pagineHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Gujarat Ambuja: Redefining Operational EfficiencyDocumento23 pagineGujarat Ambuja: Redefining Operational Efficiencys_prashob8329Nessuna valutazione finora

- AddressDocumento2 pagineAddressDom LimbagaNessuna valutazione finora

- Ultima X Series EC Declaration of ConformityDocumento8 pagineUltima X Series EC Declaration of ConformityRahul DevaNessuna valutazione finora

- Lightolier Calculite CFL Downlighting Catalog 1999Documento38 pagineLightolier Calculite CFL Downlighting Catalog 1999Alan MastersNessuna valutazione finora

- Performance ReportDocumento17 paginePerformance ReportMuthu RamanNessuna valutazione finora

- Fundamentals of Gas Meter StationsDocumento6 pagineFundamentals of Gas Meter StationsRachel BaileyNessuna valutazione finora

- Business Plan For Enterprise Start-Up: The Association of Business Executives QCFDocumento8 pagineBusiness Plan For Enterprise Start-Up: The Association of Business Executives QCFDaleNessuna valutazione finora

- Rechargeable High Power Lithium BatteriesDocumento41 pagineRechargeable High Power Lithium BatteriesCreanga GabrielNessuna valutazione finora

- Good Practices in City Energy Efficiency Bogota, Colombia - Bus Rapid Transit For Urban TransportDocumento10 pagineGood Practices in City Energy Efficiency Bogota, Colombia - Bus Rapid Transit For Urban TransportpraktekNessuna valutazione finora

- Switchgear Application Guide 12E3 PDFDocumento135 pagineSwitchgear Application Guide 12E3 PDFMohamad AbdulghaniNessuna valutazione finora

- Study of Piston Manufacturing and Completion of A Project On"Understandinng Piston Manufacturinng Process " in Piston PlantDocumento26 pagineStudy of Piston Manufacturing and Completion of A Project On"Understandinng Piston Manufacturinng Process " in Piston PlantSambhav Jain100% (1)

- Gujarat, SMEDocumento20 pagineGujarat, SMEDeepak Pareek100% (1)

- Scheuch Folder Ligno Impulsfilter E 20150522 02Documento6 pagineScheuch Folder Ligno Impulsfilter E 20150522 02MagdalenaNessuna valutazione finora

- 22nd NCE EA TopperList RevisedDocumento2 pagine22nd NCE EA TopperList RevisedKahkashanNessuna valutazione finora

- Honeywell Ad12612 Install GuideDocumento2 pagineHoneywell Ad12612 Install GuideAlarm Grid Home Security and Alarm MonitoringNessuna valutazione finora

- Master'S ThesisDocumento44 pagineMaster'S ThesisRawezh Muhtasim MustafaNessuna valutazione finora

- PF Ip55Documento7 paginePF Ip55Lương Văn TrungNessuna valutazione finora

- Rim Seal Pourer Data SheetDocumento3 pagineRim Seal Pourer Data Sheetadilmomin45Nessuna valutazione finora

- 4 Ps RahimafrozeDocumento6 pagine4 Ps RahimafrozeMahmuda SwarnaNessuna valutazione finora

- Captura de Pantalla 2019-11-13 A La(s) 4.58.49 P. M PDFDocumento1 paginaCaptura de Pantalla 2019-11-13 A La(s) 4.58.49 P. M PDFmaritza hernadezNessuna valutazione finora

- Choosing The Right PV VoltageDocumento1 paginaChoosing The Right PV Voltagedabs_orangejuiceNessuna valutazione finora

- 150-SMC50 Arrancadores Estáticos PDFDocumento58 pagine150-SMC50 Arrancadores Estáticos PDFcamel2003Nessuna valutazione finora

- Electric Vehicles Unplugged Global Marketing AnalysisDocumento36 pagineElectric Vehicles Unplugged Global Marketing AnalysisFater Saadat NiakiNessuna valutazione finora

- Ficha Tecnica Accesorios MechDocumento40 pagineFicha Tecnica Accesorios MechTommylee golden retriever100% (1)

- Company Compensation ($ Millions) Return in 2013 (%)Documento5 pagineCompany Compensation ($ Millions) Return in 2013 (%)JasonNessuna valutazione finora

- 2021 IIEE SMR Governor's Report 1Documento41 pagine2021 IIEE SMR Governor's Report 1Ralph VillaNessuna valutazione finora

- Mechanical Engineer Project Manager in Houston TX Resume Patrick OjoDocumento5 pagineMechanical Engineer Project Manager in Houston TX Resume Patrick OjoPatrickOjoNessuna valutazione finora

- 4.2. Description of Exemplary Flexibility MeasuresDocumento2 pagine4.2. Description of Exemplary Flexibility MeasuresSead RizvanovićNessuna valutazione finora

- Ferry Fuel Surcharge and Fuel Cost Mitigation ReportDocumento36 pagineFerry Fuel Surcharge and Fuel Cost Mitigation ReportCommunityNewsNessuna valutazione finora

- Saudi Arabia Position PaperDocumento2 pagineSaudi Arabia Position PaperShashank SrikanthNessuna valutazione finora