Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Oil Prices Are High and Stable For Now, OPEC Is Complacent AP June 11, 2014

Caricato da

Elias GarciaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Oil Prices Are High and Stable For Now, OPEC Is Complacent AP June 11, 2014

Caricato da

Elias GarciaCopyright:

Formati disponibili

Oil prices are high and stable for now, OPEC is complacent

AP June 11, 2014 (By PABLO GORONDI, Associated Press, Oil prices higher above $104 as OPEC seen holding production steady,

militants take Iraq city, http://www.usnews.com/news/business/articles/2014/06/11/oil-prices-rise-on-opec-expectations-iraq-jitters DOA:

6.11.2014 EJMG)

The price of oil edged higher above $104 on Wednesday, ahead of an OPEC meeting in Europe that is expected to

keep production levels steady for the year even as demand looks set to grow. By early afternoon in Europe, benchmark U.S. oil for July

delivery was up 11 cents to $104.46 a barrel in electronic trading on the New York Mercantile Exchange. On Tuesday, the contract fell 6 cents.

Brent crude, a benchmark for international oils, was up 42 cents to $109.94 a barrel on the ICE Futures exchange in London. Wednesday's OPEC

meeting is largely expected to keep the cartel's output target of 30 million barrels a day unchanged. "For months now, the OPEC basket

price has been moving within a comfortable range of between $100 and $110 per barrel," said analysts at

Commerzbank in a note to clients. "There is no reason for the OPEC members to take any sort of surprising decision that would disturb this

equilibrium, as this is the status quo that is preferred by all parties."

Economic cooperation and growth in Mexico will bolster its oil industry.

RICHARD G. LUGAR, 2012 (Senator from Indiana, OIL, MEXICO, AND THE TRANSBOUNDARY AGREEMENT Dec. 21, 2012. Retrieved

Apr. 21, 2013 from http://www.gpo.gov/fdsys/, rwg)

Congressional attention to the Mexican energy situation is critical for understanding bilateral issues between our countries and for

consideration of U.S. energy security. The United States has a profound interest in economic prosperity and

political stability in Mexico, and energy is foundational to both interests. Oil is vital for the Mexican

federal budget, underwriting both social programs and law and order, and the oil industry is an

important aspect of broader economic activity. Stability and growth, or lack thereof, in Mexicos oil

and gas sector can directly impact issues of bilateral concern.

Saudi would flood the market in response to the plan and crash oil prices

HULBERT 12 - Lead Analyst at European Energy Review; Senior Research Fellow, Netherlands Institute for International Relations;

Senior Research Fellow at the Center for Security Studies (Hulbert, Matthew. OPEC's Pending Bloodbath. June 10, 2012.

http://www.forbes.com/sites/matthewhulbert/2012/06/10/opecs-pending-bloodbath/)

Thats unlikely to happen, precisely because Riyadh can bring further pricing pressures to bear if it wants to get its

way in the cartel. The Kingdoms policy space has admittedly tightened over the past couple of years, but they remain the only

producer capable of significantly increasing or reducing production at will. Initial tanker data from Europe

suggests Riyadh may have started reigning in production that was running around 6% over OPEC quota. Its also raised July benchmarks for

Arab Light grades in Asia. But Iran, Venezuela, Nigeria, Angola and Algeria will want restraint to come far faster and far deeper to firm prices.

The line being spun from the free lunch brigade is that storage should easily cover any Iranian spikes when EU sanctions come into full effect

1st July, while OPEC quotas should be pared down to 29.5mb/d (or less). Cheap words from petro-hawks, not least because theyll all continue

to cheat on quotas to squeeze out every last drop they have. Riyadh knows that of course; hawks want a price floor to be set at $100/b to

sustain political regimes, but to do so entirely at Saudi expense. Russia is no different outside the cartel: free riding 101. Saudi Arabia (and

its GCC partners) might be willing to play ball given ongoing concerns from the Arab Awakening, but with some budgetary

tweaks and counter-cyclical cash to burn, they could all easily survive at $85/b making Iran et al sweat. Tehran

might decide to rip up formal quotas as it did in June 2011, but that would be a costly mistake. If the Saudis let prices fall, political outages

across smaller producer states could help to set a floor for them anyway. Iran would have no say in the matter. Given such pricing

perils, Saudi Arabia holds all the aces to settle institutional issues, not to mention giving the global economy more breathing

space (and Washington greater leeway over Iranian sanctions). But the real reason to let prices fall a little further isnt just

to make very clear to OPEC states where the ultimate volume and pricing power rests, but to fight Riyadhs

bigger battle over the next decade: Retaining 40% of OPEC market share in the midst of supposedly

huge non-OPEC supply growth. It didnt go unnoticed that despite Saudi production averaging 31 year highs and prices hitting

$128/b in March 2012, the forward curve for 2018 was trading at $30/b discounts relative to spot. Youd think with the cartel maxed out and

proximate demand side problems looking bleak, five year curves would be exactly the other way, in sharp contango (i.e. far above prompt

prices) once the global economy and demand side fundamentals were fixed. The fact they werent is principally because the market thinks vast

swathes of unconventional production will come online, not just in North America where production is back above 6mb/d, but in Canada, Brazil

and even Arctic extremes. At $100/b that was a fair bet to place, but once benchmark prices drop back to two figures, the 6.4 trillion barrels of

unconventional reserves sitting in the Americas look a far less certain prospect. Canadian tar distinctly sticky; Brazilian pre-salt horribly deep;

Russian Arctic plays simply impossible. So when OPEC meets in Vienna expect Saudi Arabia to call the shots. The new

Secretary General will either be a Saudi national, or a compromise candidate Riyadh can live with.

Quotas will stay close to 30mb/d with minor reductions possible. Thinly veiled threats of sustained (or increased) production will be made if

Iran doesnt play ball. Yet the long term price point to watch isnt just one that keeps OPEC in business and

Riyadh in control, but where the al-Saud can maintain secular market share. Letting prices informally

slide to $85-90/b might be the kind of warning shot Riyadh wants to send to scrub unconventional

plays off global balance sheets. Its OPEC colleagues will see that as sailing far too close to the political wind, but a Saudi

bloodbath now, might be just the medicine OPEC requires to sustain its long term health, not unless the cartel is

absolutely determined to keep pricing itself out of existence.

Prolonged dip in prices collapses all producer states, causes political repression and

state collapse, and unleashes wars across the world

Hulbert 12 Matthew Hulbert is an analyst at the Netherlands Institute for International Relations "The political perils of low oil prices"

July 9 2012 www.europeanenergyreview.eu/site/pagina.php?id=3796&id_mailing=295&toegang=49182f81e6a13cf5eaa496d51fea6406

As unedifying as all that might be, the bigger problem producer states have is that internal repression has no guarantee of

success these days. It didn't work for Gadhafi in Libya, and it's unlikely to work for Assad in Syria in the long term. As fierce as the rear-

guard battles have been, theyve not been militarily conclusive or conducive to on-going hydrocarbon

production. Follow that argument through and it is clear that if the bulk of producer regimes were struggling to hang on in a $125/b world, they stand little chance of pulling

through in an $80/b (or less) environment. So we reach the third step, and logical conclusion of our argument. The lower prices go, the more likely

political unrest creates serious supply disruptions affecting physical supplies, with concomitant

effects on paper markets. That obviously puts a radically new spin on what 'cyclical' means as far as

price and political instability is concerned, but when we look across producer states, its hard to find any major players not sitting

on a powder keg of political risk these days. More likely than not, it will be some of the smaller players that get

caught in the cross fire first. In the Gulf, Saudi Arabia is already deeply concerned about Bahrain relative to its Eastern Province. State

implosion in Yemen is seen as an internal issueof the al-Saud to deal with, while serious deterioration in Iraq is becoming

increasingly problematic in the North. Libya could see any post-war oil gains rapidly wiped out,

Sudanese production has already fallen prey to intractable internal disputes, Kazakhstan remains entirely

'dispensable' in Central Asia given a lack of external clout in the region, while Nigeria has new civil strife problems to confront with Boko Haram. Thats before

we consider intractable problems in Central Africa and the Horn of Africa . Any one of these

jurisdictions could end up with a scorched earth policy if financing gaps arent closed. Go further up the producer state 'food

chain', and some of the world's largest players all have the same structural political problems, be it in the Middle

East, Eurasia or Latin America . Any sign that a bigger petro-beast is losing control, and prices would

rapidly lift. That might be welcome news for producer states lucky enough to ride the price wave and remain intact, but it's a very dangerous game to play . And that's the

whole problem here - the gap between geological costs of production and the geopolitical cost of

survival is simply too wide for producers to cover without falling back on draconian measures. If this 'self-

correcting' mechanism between price and political unrest starts supporting an informal price floor then so be it, but we shouldn't be fooled that this is serving anyone's interests - on either side of the consumer-producer ledger. Yes, it will help firmprices when certain producers struggle

to adapt to rapidly shifting economic conditions, but assuming that more and more producer states hit political problems as prices slip, we're merely cementing the 'too big to fail' status of the very largest oil producers. Seeing petro-states

dropping like political flies as prices correct isn't a proper 'solution' for a floor, not only because prices will rebound with a vengeance when markets tighten,

but because it will make us even more dependent on a handful of key suppliers. As we all know from previous problems in Iraq (2.9 mb/d), Iran (3 mb/d), Libya(1.48 m/bd),

Nigeria(2.4 mb/d) and even Venezuela (2.7 mb/d), once things go politically wrong , it takes a very long time, if ever,

to get back to optimal production levels. It's the antithesis of where consumers want to be in terms of sourcing plentiful and fungible supplies. Final scene: corpses all

over the stage By way of reminder, as much as petro-states currently face a systemic crisis trying to set a price floor, it was only in March that we saw how badly placed OPEC is to moderate the market at the top. Seeing petro-

states in a pickle might warm the hearts of many right now, but markets can turn, and turn fast. When

they do, the oil weapon will shift target as well. It will no longer be pointed at petro players heads,

but directly at consumer states. That's the consequence of a dysfunctional energy system - not just with a $50-$150/b outlook eminently possible, but swings well beyond that 'price band' all too likely. Splitting

this price directly in two and sticking close to $100/b might not be that bad an idea after all: Mopping

up the mess from producer state implosion would require an effort far beyond the international

systems capabilities and reach. Carefully agreed truces are always better than outright wars, particularly for those squeamish about collateral damage. Corpses would litter the

entire energy stage.

Potrebbero piacerti anche

- Economical Writing McCloskey Summaries 1-10Documento4 pagineEconomical Writing McCloskey Summaries 1-10Elias Garcia100% (1)

- Economical Writing McCloskey Summaries 11-20Documento4 pagineEconomical Writing McCloskey Summaries 11-20Elias Garcia100% (1)

- Dell Compellent Sc4020 Deploy GuideDocumento184 pagineDell Compellent Sc4020 Deploy Guidetar_py100% (1)

- The Oil Card: Global Economic Warfare in the 21st CenturyDa EverandThe Oil Card: Global Economic Warfare in the 21st CenturyNessuna valutazione finora

- 1nc Compiled MasterfileDocumento246 pagine1nc Compiled MasterfileYichen SunNessuna valutazione finora

- 2020 Global Finance Business Management Analyst Program - IIMDocumento4 pagine2020 Global Finance Business Management Analyst Program - IIMrishabhaaaNessuna valutazione finora

- Ups and downs of oil prices: Will prices continue to fallDocumento18 pagineUps and downs of oil prices: Will prices continue to fallmuki10Nessuna valutazione finora

- Geopolitics of Cheap OilDocumento5 pagineGeopolitics of Cheap OilNabeel SalimNessuna valutazione finora

- The Oil & Gas Industry Doesn't Have A Bright Future The Oil & Gas Industry Volatile FutureDocumento2 pagineThe Oil & Gas Industry Doesn't Have A Bright Future The Oil & Gas Industry Volatile FutureRG MoPNGNessuna valutazione finora

- La Fluctuación ..... en InglesDocumento18 pagineLa Fluctuación ..... en InglesMarcia Lizeth Valarezo YungaNessuna valutazione finora

- Oil Glut Illusion: Prices Likely to Rise Again Due to Supply and Demand FactorsDocumento9 pagineOil Glut Illusion: Prices Likely to Rise Again Due to Supply and Demand Factorssaisridhar99Nessuna valutazione finora

- Negative AssignmentDocumento6 pagineNegative Assignmentyoungmoney6996Nessuna valutazione finora

- Delloite Oil and Gas Reality Check 2015 PDFDocumento32 pagineDelloite Oil and Gas Reality Check 2015 PDFAzik KunouNessuna valutazione finora

- Dire StraitsDocumento5 pagineDire StraitsWill MarshNessuna valutazione finora

- Report On Decline in Oil Prices - Saudia vs. US ShaleDocumento4 pagineReport On Decline in Oil Prices - Saudia vs. US Shalesupplier13Nessuna valutazione finora

- Gordon Duff Interview, ShanaDocumento7 pagineGordon Duff Interview, ShanagpdufNessuna valutazione finora

- Steep Slide in Oil Prices Is Blessing For MostDocumento7 pagineSteep Slide in Oil Prices Is Blessing For MostAlvaro Villanueva CastroNessuna valutazione finora

- EN 2018 Q3 OilDocumento5 pagineEN 2018 Q3 Oiltanyan.huangNessuna valutazione finora

- Playing an oily gameDocumento2 paginePlaying an oily gameumerNessuna valutazione finora

- Venezuela Neg - SCDI 2013Documento37 pagineVenezuela Neg - SCDI 2013kellybye10Nessuna valutazione finora

- Oil Prices Term PaperDocumento5 pagineOil Prices Term Papereeyjzkwgf100% (1)

- Oil Price Fluctuations: Causes and Implications for IndiaDocumento4 pagineOil Price Fluctuations: Causes and Implications for IndiaUtpal Kumar DuttaNessuna valutazione finora

- Oilprice ArticleDocumento4 pagineOilprice ArticleGeorge OnyewuchiNessuna valutazione finora

- Oil's Collapse Is A Geopolitical Reset in DisguiseDocumento11 pagineOil's Collapse Is A Geopolitical Reset in DisguiseAndy YongNessuna valutazione finora

- DebateDocumento11 pagineDebateMustafa Mohammed ShammoutNessuna valutazione finora

- Running On Empty - HollandDocumento2 pagineRunning On Empty - HollandThe American Security ProjectNessuna valutazione finora

- Major Players Oil and Gas ArticleDocumento5 pagineMajor Players Oil and Gas ArticleArjit KumarNessuna valutazione finora

- Implications of The U.S. Energy Transition For The Transatlantic Partnership and The EU As A Strategic Actor in The MENA RegionDocumento3 pagineImplications of The U.S. Energy Transition For The Transatlantic Partnership and The EU As A Strategic Actor in The MENA RegionGerman Marshall Fund of the United StatesNessuna valutazione finora

- The future of the oil industry: Covid-19 crisis a glimpse of long-term challengesDocumento3 pagineThe future of the oil industry: Covid-19 crisis a glimpse of long-term challengesSumreenSattiNessuna valutazione finora

- The Future of Commodity Markets in IndiaDocumento11 pagineThe Future of Commodity Markets in Indiakumar vivekNessuna valutazione finora

- Price Dynamics of Crude OilDocumento3 paginePrice Dynamics of Crude OilnitroglyssNessuna valutazione finora

- Qatar Issue DiscussionDocumento25 pagineQatar Issue DiscussionAwais BhattiNessuna valutazione finora

- Overall, Canada Remained The Largest Buyer of US Oil in 2018, at 19% of All Oil Exports, According To EIA Data. During The First Half of 2018, The Largest Buyer of US Crude Oil WasDocumento9 pagineOverall, Canada Remained The Largest Buyer of US Oil in 2018, at 19% of All Oil Exports, According To EIA Data. During The First Half of 2018, The Largest Buyer of US Crude Oil WasCekinNessuna valutazione finora

- The Geopolitics of Inflation - ZeroHedgeDocumento4 pagineThe Geopolitics of Inflation - ZeroHedgePaola VerdiNessuna valutazione finora

- All You Need To Know About The Plummeting Oil PricesDocumento2 pagineAll You Need To Know About The Plummeting Oil PricesAditya BansalNessuna valutazione finora

- Harker AnCh Neg Apple Valley Minneapple Debate Tournament Round 5Documento5 pagineHarker AnCh Neg Apple Valley Minneapple Debate Tournament Round 5EmronNessuna valutazione finora

- Offshore Drilling Aff & Neg - CNDI Starter PackDocumento176 pagineOffshore Drilling Aff & Neg - CNDI Starter Packpacifist42Nessuna valutazione finora

- 2007 The Oil in The Middle EastDocumento6 pagine2007 The Oil in The Middle EastJames BradleyNessuna valutazione finora

- Why Oil Prices Keep FallingDocumento4 pagineWhy Oil Prices Keep FallingAarushiNessuna valutazione finora

- Weekly Market Commentary 3-5-2012Documento3 pagineWeekly Market Commentary 3-5-2012monarchadvisorygroupNessuna valutazione finora

- Oil Price Research PaperDocumento7 pagineOil Price Research Paperlrqylwznd100% (1)

- Adelman OilShortageReal 1972Documento40 pagineAdelman OilShortageReal 1972Israt Jahan DinaNessuna valutazione finora

- Index File FYI: Download The Original AttachmentDocumento57 pagineIndex File FYI: Download The Original AttachmentAffNeg.Com100% (1)

- In The National Interest, March 5, 2003Documento7 pagineIn The National Interest, March 5, 2003Sinéad ButlerNessuna valutazione finora

- Econ 1010 Research PaperDocumento7 pagineEcon 1010 Research Paperapi-324997839Nessuna valutazione finora

- Research Paper Oil PricesDocumento5 pagineResearch Paper Oil Pricesfvfr9cg8100% (1)

- DTT Oil Gas Reality Check 2012 12511Documento24 pagineDTT Oil Gas Reality Check 2012 12511Mariano OrtulanNessuna valutazione finora

- Essay: The Determinants of Oil PricesDocumento2 pagineEssay: The Determinants of Oil PricesJennyNessuna valutazione finora

- OPEC+ Production Cut Impact on Oil Prices & MarketDocumento6 pagineOPEC+ Production Cut Impact on Oil Prices & MarketRG MoPNGNessuna valutazione finora

- Venezuela Negative - UNT 2013Documento74 pagineVenezuela Negative - UNT 2013kellybye10Nessuna valutazione finora

- Connecting The Dots - The USA and Global RecessionsDocumento2 pagineConnecting The Dots - The USA and Global RecessionsChinmay PanhaleNessuna valutazione finora

- C C Is An IntergovernmentalDocumento5 pagineC C Is An IntergovernmentalSagar RachhNessuna valutazione finora

- A Primer at The PumpDocumento8 pagineA Primer at The PumpKumar Gaurab JhaNessuna valutazione finora

- Sprott On OilDocumento10 pagineSprott On OilMariusz Skonieczny100% (1)

- Cause and Effect - US Gasoline Prices 2013Documento7 pagineCause and Effect - US Gasoline Prices 2013The American Security ProjectNessuna valutazione finora

- Petroleum Economics Assignemnt No.1Documento3 paginePetroleum Economics Assignemnt No.1Saad FaheemNessuna valutazione finora

- Thesis About Oil Price HikeDocumento8 pagineThesis About Oil Price Hikepamelacalusonewark100% (1)

- Epochal Tectonic ShiftDocumento18 pagineEpochal Tectonic ShiftPeter G. SpenglerNessuna valutazione finora

- Review of LiteratureDocumento4 pagineReview of Literaturetabz ilog5Nessuna valutazione finora

- 2020 Oil, Gas, and Chemical Industry OutlookDocumento16 pagine2020 Oil, Gas, and Chemical Industry OutlookmapstonegardensNessuna valutazione finora

- Statistical Approach to Forecasting Crude Oil PricesDocumento19 pagineStatistical Approach to Forecasting Crude Oil PricesHarshit Shah100% (1)

- Emerging Threats - GartonDocumento17 pagineEmerging Threats - Gartonapi-231226562Nessuna valutazione finora

- This Is No Time For Celebration, The Oil Rally Is Just Getting Started (Commodity - CL1 - COM) - Seeking AlphaDocumento5 pagineThis Is No Time For Celebration, The Oil Rally Is Just Getting Started (Commodity - CL1 - COM) - Seeking AlphaMARIA BEATRIZ ABELENDANessuna valutazione finora

- Stratfor Worldview Forecast Q3-2021Documento6 pagineStratfor Worldview Forecast Q3-2021SamNessuna valutazione finora

- As Data Overflows Online, Researchers Grapple With EthicsDocumento5 pagineAs Data Overflows Online, Researchers Grapple With EthicsElias GarciaNessuna valutazione finora

- The Economic Analysis of Constitutions: Fatalism Versus VitalismDocumento15 pagineThe Economic Analysis of Constitutions: Fatalism Versus VitalismElias GarciaNessuna valutazione finora

- Calle Please Follow MeDocumento89 pagineCalle Please Follow MeElla TetraultNessuna valutazione finora

- Borges and The Reality of The WordDocumento12 pagineBorges and The Reality of The WordElias Garcia100% (1)

- Spontaneous Orders and Game Theory: A Comparative Conceptual AnalysisDocumento37 pagineSpontaneous Orders and Game Theory: A Comparative Conceptual AnalysisAlejandra SalinasNessuna valutazione finora

- Democracy, Markets, and The Legal Order: Notes On The Nature of Politics in A Radically Liberal SocietyDocumento18 pagineDemocracy, Markets, and The Legal Order: Notes On The Nature of Politics in A Radically Liberal SocietyElias GarciaNessuna valutazione finora

- Foss GameDocumento24 pagineFoss GameCrosbby Buleje DiazNessuna valutazione finora

- Democracy, Markets, and The Legal Order: Notes On The Nature of Politics in A Radically Liberal SocietyDocumento18 pagineDemocracy, Markets, and The Legal Order: Notes On The Nature of Politics in A Radically Liberal SocietyElias GarciaNessuna valutazione finora

- Bitcoin Financial Regulation: Securities, Derivatives, Prediction Markets & GamblingDocumento78 pagineBitcoin Financial Regulation: Securities, Derivatives, Prediction Markets & GamblingCoin CenterNessuna valutazione finora

- Critical Literary Analysis of BorgesDocumento15 pagineCritical Literary Analysis of BorgesElias Garcia100% (1)

- Design and Shit: Reality, Materiality and Ideality in The Works of Jean Baudrillard and Slavoj ŽižekDocumento12 pagineDesign and Shit: Reality, Materiality and Ideality in The Works of Jean Baudrillard and Slavoj ŽižekjananiwimukthiNessuna valutazione finora

- Postmodern Condition of Borges FiccionesDocumento24 paginePostmodern Condition of Borges FiccionesElias Garcia100% (1)

- Obama's Executive Order On HackingDocumento2 pagineObama's Executive Order On HackingElias GarciaNessuna valutazione finora

- Rivalry and Central PlanningDocumento109 pagineRivalry and Central PlanningElias GarciaNessuna valutazione finora

- Economical Writing McCloskey Summaries 21-31Documento5 pagineEconomical Writing McCloskey Summaries 21-31Elias GarciaNessuna valutazione finora

- Snowden's QA On RedditDocumento2 pagineSnowden's QA On RedditElias GarciaNessuna valutazione finora

- The nine billion names of God by Arthur C. Clarke summarizedDocumento6 pagineThe nine billion names of God by Arthur C. Clarke summarizedPanini DubeyNessuna valutazione finora

- Native Americans and US Government AbuseDocumento2 pagineNative Americans and US Government AbuseElias GarciaNessuna valutazione finora

- China Da 1ncDocumento63 pagineChina Da 1ncElias GarciaNessuna valutazione finora

- Abominable Mirrors: On The 'Macabre' HyperFictions of Jorges Luis BorgesDocumento40 pagineAbominable Mirrors: On The 'Macabre' HyperFictions of Jorges Luis BorgesElias Garcia100% (1)

- China Disadvantage (Updated Core) - HSS 2013Documento274 pagineChina Disadvantage (Updated Core) - HSS 2013Elias GarciaNessuna valutazione finora

- Worms Da - Endi 2013 - Ed LeeDocumento19 pagineWorms Da - Endi 2013 - Ed LeeDustin PingNessuna valutazione finora

- US-China influence in Latin AmericaDocumento296 pagineUS-China influence in Latin AmericaElias GarciaNessuna valutazione finora

- FTAA Counterplan - Emory 2013Documento39 pagineFTAA Counterplan - Emory 2013Elias GarciaNessuna valutazione finora

- Dutch Disease Disadvantage - Gonzaga 2013Documento97 pagineDutch Disease Disadvantage - Gonzaga 2013Elias GarciaNessuna valutazione finora

- China Disadvantage Supplement - GMU 2013Documento30 pagineChina Disadvantage Supplement - GMU 2013Elias GarciaNessuna valutazione finora

- China Sphere of Influence DA - Berkeley 2013Documento77 pagineChina Sphere of Influence DA - Berkeley 2013Elias GarciaNessuna valutazione finora

- Mexico Labor-LGBTQ QPQ CPs - Michigan7 2013 BFJRDocumento102 pagineMexico Labor-LGBTQ QPQ CPs - Michigan7 2013 BFJRElias GarciaNessuna valutazione finora

- EA Linear RegressionDocumento3 pagineEA Linear RegressionJosh RamosNessuna valutazione finora

- Chromate Free CoatingsDocumento16 pagineChromate Free CoatingsbaanaadiNessuna valutazione finora

- Developing the cycle of maslahah based performance management system implementationDocumento27 pagineDeveloping the cycle of maslahah based performance management system implementationM Audito AlfansyahNessuna valutazione finora

- Bengali (Code No - 005) COURSE Structure Class - Ix (2020 - 21Documento11 pagineBengali (Code No - 005) COURSE Structure Class - Ix (2020 - 21Břîšťỹ ÃhmęđNessuna valutazione finora

- (123doc) - Chapter-24Documento6 pagine(123doc) - Chapter-24Pháp NguyễnNessuna valutazione finora

- SDS OU1060 IPeptideDocumento6 pagineSDS OU1060 IPeptideSaowalak PhonseeNessuna valutazione finora

- Seminar Course Report ON Food SafetyDocumento25 pagineSeminar Course Report ON Food SafetyYanNessuna valutazione finora

- ITP Exam SuggetionDocumento252 pagineITP Exam SuggetionNurul AminNessuna valutazione finora

- Kate Elizabeth Bokan-Smith ThesisDocumento262 pagineKate Elizabeth Bokan-Smith ThesisOlyaGumenNessuna valutazione finora

- Corporate Governance, Corporate Profitability Toward Corporate Social Responsibility Disclosure and Corporate Value (Comparative Study in Indonesia, China and India Stock Exchange in 2013-2016) .Documento18 pagineCorporate Governance, Corporate Profitability Toward Corporate Social Responsibility Disclosure and Corporate Value (Comparative Study in Indonesia, China and India Stock Exchange in 2013-2016) .Lia asnamNessuna valutazione finora

- Marshall Stability Test AnalysisDocumento5 pagineMarshall Stability Test AnalysisZick Zickry50% (2)

- HP HP3-X11 Exam: A Composite Solution With Just One ClickDocumento17 pagineHP HP3-X11 Exam: A Composite Solution With Just One ClicksunnyNessuna valutazione finora

- Factors of Active Citizenship EducationDocumento2 pagineFactors of Active Citizenship EducationmauïNessuna valutazione finora

- Link Ratio MethodDocumento18 pagineLink Ratio MethodLuis ChioNessuna valutazione finora

- 7 Aleksandar VladimirovDocumento6 pagine7 Aleksandar VladimirovDante FilhoNessuna valutazione finora

- Mounting InstructionDocumento1 paginaMounting InstructionAkshay GargNessuna valutazione finora

- NLP Business Practitioner Certification Course OutlineDocumento11 pagineNLP Business Practitioner Certification Course OutlineabobeedoNessuna valutazione finora

- Guidelines - MIDA (Haulage)Documento3 pagineGuidelines - MIDA (Haulage)Yasushi Charles TeoNessuna valutazione finora

- Prac Res Q2 Module 1Documento14 paginePrac Res Q2 Module 1oea aoueoNessuna valutazione finora

- Pasadena Nursery Roses Inventory ReportDocumento2 paginePasadena Nursery Roses Inventory ReportHeng SrunNessuna valutazione finora

- Bala Graha AfflictionDocumento2 pagineBala Graha AfflictionNeeraj VermaNessuna valutazione finora

- Dep 32.32.00.11-Custody Transfer Measurement Systems For LiquidDocumento69 pagineDep 32.32.00.11-Custody Transfer Measurement Systems For LiquidDAYONessuna valutazione finora

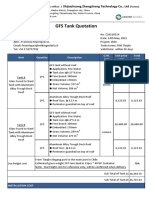

- GFS Tank Quotation C20210514Documento4 pagineGFS Tank Quotation C20210514Francisco ManriquezNessuna valutazione finora

- Felizardo C. Lipana National High SchoolDocumento3 pagineFelizardo C. Lipana National High SchoolMelody LanuzaNessuna valutazione finora

- CDI-AOS-CX 10.4 Switching Portfolio Launch - Lab V4.01Documento152 pagineCDI-AOS-CX 10.4 Switching Portfolio Launch - Lab V4.01Gilles DellaccioNessuna valutazione finora

- KPUPDocumento38 pagineKPUPRoda ES Jimbert50% (2)

- IQ CommandDocumento6 pagineIQ CommandkuoliusNessuna valutazione finora

- AtlasConcorde NashDocumento35 pagineAtlasConcorde NashMadalinaNessuna valutazione finora