Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Fin 1 Valix Chap 6

Caricato da

Christian Sampaga0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

2K visualizzazioni24 pagineThis document contains multiple accounting problems involving receivables. It provides information on various receivable accounts, cash receipts, allowances, and journal entries. It tests the ability to classify accounts as current or non-current, calculate expense or allowance amounts, and prepare relevant journal entries. The problems cover the full accounting cycle for receivables, from initial recording to collection or write-off.

Descrizione originale:

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis document contains multiple accounting problems involving receivables. It provides information on various receivable accounts, cash receipts, allowances, and journal entries. It tests the ability to classify accounts as current or non-current, calculate expense or allowance amounts, and prepare relevant journal entries. The problems cover the full accounting cycle for receivables, from initial recording to collection or write-off.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

2K visualizzazioni24 pagineFin 1 Valix Chap 6

Caricato da

Christian SampagaThis document contains multiple accounting problems involving receivables. It provides information on various receivable accounts, cash receipts, allowances, and journal entries. It tests the ability to classify accounts as current or non-current, calculate expense or allowance amounts, and prepare relevant journal entries. The problems cover the full accounting cycle for receivables, from initial recording to collection or write-off.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 24

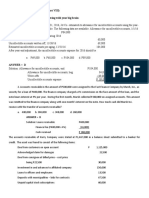

Problem 6-5

a. Accounts receivable 775,000

Notes receivable 100,000

Installments receivable 300,000

Advances to suppliers 150,000

Advances to subsidiary 400,000

Claim receivable 15,000

Subscriptions receivable 300,000

Accrued interest receivable 10,000

Customer's credit balances 30,000

Advances from customers 20,000

Receivables 2,000,000

b. Accounts receivable 775,000

Allowance for doubtful accounts (50,000)

Notes receivable 100,000

Installments receivable 300,000

Advances to suppliers 150,000

Claim receivable 15,000

Subscriptions receivable 300,000

Accrued interest receivable 10,000

Total trade and other receivables 1,600,000

c. The advances to subsidiary should be classified as noncurrent and

presented as long-term investment.

The customers' credit balances and advances from customers should

be classified as current liabilities and included as part of

"trade and other payables".

Problem 6-6

a. Accounts receivable - January 1 600,000

Charge sales 6,000,000

Total 6,600,000

Less: Collections from customers 5,300,000

Writeoff 35,000

Merchandise returns 40,000

Allowances to customers 25,000 5,400,000

Accounts receivable - December 31 1,200,000

b. Subscriptions receivable 150,000

Deposit on contract 120,000

Claim receivable 60,000

Advances to employees 10,000

Advances to affiliates 100,000

Advances to supplier 50,000

Accounts receivable 490,000

c. Accounts receivable 1,200,000

Claim receivable 60,000

Advances to employees 10,000

Advances to supplier 50,000

Total trade and other receivables 1,320,000

d. The subscriptions receivable should be deducted from subscribed share capital

The deposit on contract should be classified as noncurrent and presented non-current asset.

The advances to affiliates should be classified as noncurrent and presented as long-term investment.

The deposit on contract should be classified as noncurrent and presented non-current asset.

The advances to affiliates should be classified as noncurrent and presented as long-term investment.

Problem 6-7

Requirement 1

1. Accounts receivable 3,600,000

Sales 3,600,000

2. Notes receivable 400,000

Accounts receivable 400,000

3. Doubtful accounts 90,000

Allowance for doubtful accounts 90,000

4. Allowance for doubtful accounts 20,000

Accounts receivable 20,000

5. Sales return 15,000

Accounts receivable 15,000

6. Cash 2,450,000

Accounts receivable 2,450,000

7. Sales discount 45,000

Accounts receivable 45,000

8. Cash 150,000

Notes receivable 150,000

Requirement 2

Notes receivable 250,000

Requirement 3

Accounts receivable 670,000

Less: Allowance for doubtful accounts (70,000)

Net realizable value 600,000

Problem 6-8

FOB destination and freight collect FOB shipping point and freight collect

1. Accounts receivable 500,000 1. Accounts receivable

Freight out 10,000

Sales 500,000

Allowance for freight charge 10,000 2. Cash

Sales discount

2. Cash 475,000

Sales discount 15,000

Allowance for freight charge 10,000

Accounts receivable 500,000

FOB destination and freight prepaid FOB shipping point and freight prepaid

1. Accounts receivable 500,000 1. Accounts receivable

Freight out 10,000

Sales 500,000

Cash 10,000

2. Cash

2. Cash 485,000 Sales discount

Sales discount 15,000

Accounts receivable 500,000

FOB shipping point and freight collect

Accounts receivable 500,000

Sales 500,000

485,000

Sales discount 15,000

Accounts receivable 500,000

FOB shipping point and freight prepaid

Accounts receivable 510,000

Sales 500,000

Cash 10,000

495,000

Sales discount 15,000

Accounts receivable 510,000

Problem 6-9

1. Accounts receivable 4,000,000

Sales 4,000,000

2. Cash 1,470,000

Sales discount 30,000

Accounts receivable 1,500,000

3. Cash 1,000,000

Accounts receivable 1,000,000

4. Sales return 100,000

Accounts receivable 100,000

5. Sales return 20,000

Allowance for sales return 20,000

Problem 6-10

July 1 Accounts receivable 50,000 July 1 Accounts receivable

Sales 50,000 Sales

2 Accounts receivable 200,000 2 Accounts receivable

Sales 200,000 Sales

12 Cash 196,000 12 Cash

Sales discount 4,000 Accounts receivable

Accounts receivable 200,000

30 Cash 50,000 30 Cash

Accounts receivable 50,000 Accounts receivable

Sales discount forfeited

Net method Gross method

Accounts receivable 49,000

49,000

Accounts receivable 196,000

196,000

196,000

Accounts receivable 196,000

50,000

Accounts receivable 49,000

Sales discount forfeited 1,000

Net method

Problem 6-11

a. Credit sales (75% x 5M) 3,750,000

Doubtful accounts (2% x 3.75M) 75,000

Doubtful accounts expense 75,000

Allowance for doubtful accounts 75,000

b. Doubtful accounts expense (1% x 5M) 50,000

Allowance for doubtful accounts 50,000

c. Required allowance 80,000

Less: Credit balance of allowance (20,000)

Doubtful accounts expense 60,000

Doubtful accounts expense 60,000

Allowance for doubtful accounts 60,000

d. Required allowance (10% x 500,000) 50,000

Less: Credit balance of allowance (20,000)

Doubtful accounts expense 30,000

Doubtful accounts expense 30,000

Allowance for doubtful accounts 30,000

Problem 6-12

a. Required allowance (5% x 600,000) 30,000

Add: Debit balance in allowance account 10,000

Doubtful accounts expense 40,000

Doubtful accounts 40,000

Allowance for doubtful accounts 40,000

b. Required allowance 50,000

Add: Debit balance in allowance account 10,000

Doubtful accounts expense 60,000

Doubtful accounts 60,000

Allowance for doubtful accounts 60,000

c. Doubtful accounts (2% x 1.9M) 38,000

Allowance for doubtful accounts 38,000

Problem 6-13

a. Doubtful accounts (3% x 8M) 240,000

Allowance for doubtful accounts 240,000

b. Doubtful accounts 170,000

Allowance for doubtful accounts 170,000

Allowance - January 1 100,000

Doubtful accounts (squeeze) 170,000

Recovery 20,000

Total 290,000

Accounts written off (130,000)

Allowance - December 31 (8% x 2M) 160,000

c. Doubtful accounts 210,000

Allowance for doubtful accounts 210,000

Allowance - January 1 100,000

Doubtful accounts (squeeze) 210,000

Recovery 20,000

Total 330,000

Accounts written off (130,000)

Allowance - December 31 200,000

Problem 6-14

Requirement a

1. Accounts receivable 7,000,000

Sales 7,000,000

2. Cash 2,450,000

Sales discount 50,000

Accounts receivable (2.45M / 98%) 2,500,000

3. Cash 3,900,000

Accounts receivable 3,900,000

4. Allowance for doubtful accounts 30,000

Accounts receivable 30,000

5. Accounts receivable 10,000

Allowance for doubtful accounts 10,000

Cash 10,000

Accounts receivable 10,000

6. Sales return 70,000

Accounts receivable 70,000

Requirement b

Doubtful accounts 40,000

Allowance for doubtful accounts 40,000

Rate = 40,000 /1M =4%

Allowance for doubtful accounts - December 31 (4% x 1.5M) 60,000

Less: Allowance before adjustment (20,000)

Doubtful accounts expense 40,000

Requirement c

Accounts receivable - December 31 1,500,000

Allowance for doubtful accounts (60,000)

Net realizable value 1,440,000

Problem 6-15

Requirement a

1. Cash 800,000

Accounts receivable 7,200,000

Sales (800,000 / 10%) 8,000,000

2. Cash 684,000

Sales discount (5% x 720,000) 36,000

Accounts receivable (10% x 7.2M) 720,000

3. Cash 5,940,000

Accounts receivable 5,940,000

4. Sales discount 10,000

Allowance for sales discount 10,000

5. Sales return 80,000

Accounts receivable 80,000

6. Allowance for doubtful accounts 60,000

Accounts receivable 60,000

Accounts receivable 10,000

Allowance for doubtful accounts 10,000

Cash 10,000

Accounts receivable 10,000

7. Doubtful accounts 70,000

Allowance for doubtful accounts 70,000

Required Allowance - December 31 (5% x 2.4M) 120,000

Less: Allowance before adjustment (50,000)

Doubtful accounts expense 70,000

Rate = 100,000 /2M = 5%

Requirement b

Accounts receivable 2,400,000

Less: Allowance for doubtful accounts 120,000

Allowance for sales discount 10,000 (130,000)

Net realizable value 2,270,000

Problem 6-16

Requirement a

1. Accounts receivable 2,600,000

Sales (3,070,000 - 470,000) 2,600,000

2. Cash (2,455,000 - 1,455,000) 1,000,000

Accounts receivable 1,000,000

3. Cash 1,455,000

Sales discount 45,000

Accounts receivable (1,455,000 / 97%) 1,500,000

4. Allowance for doubtful accounts 20,000

Accounts receivable 20,000

5. Cash 470,000

Sales 470,000

6. Sales returns and allowances 55,000

Accounts receivable 55,000

7. Sales returns and allowances 10,000

Cash 10,000

8. Accounts receivable 5,000

Allowance for doubtful accounts 5,000

Cash 5,000

Accounts receivable 5,000

9. Doubtful accounts expense 50,000

Allowance for doubtful accounts 50,000

Credit Sales 2,600,000

Less: Sales discount 45,000

Sales returns and allowances 55,000 (100,000)

Net credit sales 2,500,000

Doubtful accounts (2.5M x 2%) 50,000

Requirement b

Accounts receivable 625,000

Less: Allowance for doubtful accounts (60,000)

Net realizable value 565,000

Problem 6-17

A.

1. Accounts Receivable 7,935,000

Sales 7,935,000

2. Cash 4,410,000

Sales Discount 90,000

Accounts Receivable 4,500,000

3. Cash 2,475,000

Sales Discount 25,000

Accounts Receivable 2,500,000

4. Accounts Receivable 15,000

Allowance for Doubtful Accounts 15,000

Cash 15,000

Accounts Receivaable 15,000

5. Cash 900,000

Accounts Receivable 900,000

6. Allowance for Doubtful Accounts 55,000

Accounts Receivable 55,000

7. Sales Return 30,000

Accounts Receivable 30,000

B.

Accounts Rec. Jan 1 1,500,000

Sales 7,935,000

Recovery 15,000

Collections (8,000,000)

Sales discount (115,000)

Writeoff (55,000)

Sales return (30,000)

Accounts Rec. Dec 1 1,250,000

Rate: 60,000/1,500,000= 0.004

Allowance for Doubtful Accounts 50,000

1,250,000 x 0.004

Less: Allowance before adjustment (20,000)

Doubful accounts expense 30,000

C.

Accounts Rec. Dec. 31 1,250,000

Allowance for Doubful Accounts (50,000)

Net Realizable value 1,200,000

Problem 6-18

Amount Percent of Required

Uncollectible Allowance

1. Not yet due 1,700,000 - -

1 - 30 days past due 1,200,000 5% 60,000

31 - 60 days past due 100,000 25% 25,000

61 - 90 days past due 150,000 50% 75,000

Over 90 days past due 120,000 100% 120,000

3,270,000 280,000

2. Allowances - January 1 170,000

Receivables 30,000

Doubtful accounts (squeeze) 345,000

Total 545,000

Less: writeoff (235,000 + 30,000) (265,000)

Required allowance - December 31 280,000

3. Accounts receivable 3,270,000

Less: Allowance for doubtful accounts (280,000)

Net realizable value 2,990,000

Problem 6-19

1. 1,000,000 1% = 10,000

400,000 5% = 20,000

300,000 10% = 30,000

200,000 25% = 50,000

60,000 100% = 60,000

1,960,000 170,000

2. Allowance - January 1 90,000

Recoveries 20,000

Doubtful accounts (unknown) 200,000

Total 310,000

Less: writeoff (100,000 + 40,000) 140,000

Allowance - December 31 170,000

3. Doubtful accounts 20,000

Allowance for doubtful accounts 20,000

Correct amount 200,000

Recorded (2% x 9M) 180,000

Understatement 20,000

4. Accounts receivable - December 31 1,960,000

Less: Allowance for doubtful accounts 170,000

Net realizable value 1,790,000

Problem 6-20

2011 2012 2013 Total

1. Writeoff 26,000 29,000 30,000 85,000

Less: Recoveries (2,000) (3,000) (4,000) (9,000)

Net writeoff 24,000 26,000 26,000 76,000

Percentage to be used in computing the allowance = 76,000 / 3.8M = 2%

2. Credit sales for 2013 3,000,000

Multiply by bad debt percentage 2%

Provision for doubtful accounts 60,000

3. Accounts receivable - January 1, 2013 250,000

Add: Credit sales for 2013 3,000,000

Recoveries 5,000 3,005,000

Total 3,255,000

Less: Collections in 2013 2,615,000

Writeoff 40,000 2,655,000

Accounts receivable - December 31, 2013 600,000

4. Allowance for doubtful - Jan.1 20,000

Add: Doubtful accounts 2013 60,000

Recoveries 5,000 65,000

Total 85,000

Less: Writeoff (40,000)

Allowance for doubtful - Dec.31 45,000

Requirement 1 Requirement 4

Accounts Receivable-Dec 31, 2012 600,000 Required Allowance- Dec. 31 2013

Add: Sales for 2013 5,000,000 Add: Debit Balance before adjustments

Recovery of written off accounts 10,000 5,010,000 Total Increase in Allowance

Total 5,610,000

Less: Collections from Customers 4,360,000 Requirement 5

Accounts written off 50,000

Accounts settled by note 200,000 4,610,000 Doubtful Accounts

Accounts Receivable-Dec 31, 2013 1,000,000 Allowance for doubtful accounts

Requirement 2

Allowance for doubtful accounts-Dec 31,2012 30,000

Add: Recovery of written off accounts 10,000

Total 40,000

Less: Accounts written off 50,000

Allowance before adjustment- Dec. 31, 2013 (10,000)

Requirement 3

Required Allowance for doubtful accounts-Dec 31,2013

On Current Account 35,000

(700000 x 5%)

On Past Due Accounts 60,000

(300000 x 20%)

Total Required Allowance 95,000

Required Allowance- Dec. 31 2013 95,000

Add: Debit Balance before adjustments 10,000

Total Increase in Allowance 105,000

105,000

Allowance for doubtful accounts 105,000

Problem 6-23

1. Allowance - January 1, 2013 500,000

Doubtful accounts recorded (2% x 20M) 400,000

Recovery 50,000

Total 950,000

Less: Writeoff (300,000 + 100,000) (400,000)

Allowance before adjustment 550,000

2. 5,000,000 x 5% 250,000

2,000,000 x 10% 200,000

1,000,000 x25% 250,000

500,000 -100,000 x 75% 300,000

Required allowance - December 31, 2013 1,000,000

3. Doubtful account 450,000

Allowance for doubtful accounts 450,000

(1M - 550,000)

Problem 6-24

1. Allowance - 1/1/2013 (1% x 2.8M) 28,000

2. Allowance - 1/1/2013 28,000

Doubtful accounts recorded in 2013 (1% x 3M) 30,000

Recovery 7,000

Total 65,000

Writeoff (27,000)

Allowance before adjustment 38,000

3. 300,000 x 1% 3,000

80,000 x 5% 4,000

60,000 x 20% 12,000

25,000 x80% 20,000

Required allowance - 12/31/2013 39,000

4. Doubtful account 1,000

Allowance for doubtful accounts 1,000

(39,000 - 38,000)

Potrebbero piacerti anche

- P. Lete ProblemsDocumento6 pagineP. Lete ProblemsPaul Andrei Lete33% (9)

- Acct. 162 - EPS, BVPS, DividendsDocumento5 pagineAcct. 162 - EPS, BVPS, DividendsAngelli LamiqueNessuna valutazione finora

- 3rd S.A QuestionsDocumento15 pagine3rd S.A QuestionsIsaiah John Domenic M. CantaneroNessuna valutazione finora

- Exercise - Part 2Documento5 pagineExercise - Part 2lois martinNessuna valutazione finora

- Intermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020Documento7 pagineIntermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020ohmyme sungjaeNessuna valutazione finora

- LeasesDocumento5 pagineLeasesCamille BacaresNessuna valutazione finora

- Global CompanyDocumento1 paginaGlobal Companydagohoy kennethNessuna valutazione finora

- Precious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan ReceivableDocumento6 paginePrecious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan Receivableprecious2lojaNessuna valutazione finora

- Inventory LatojaDocumento2 pagineInventory Latojalisa juganNessuna valutazione finora

- Loans and Receivables Sample Problems 2Documento2 pagineLoans and Receivables Sample Problems 2Bryce Bihag60% (5)

- Saint Joseph College of Sindangan Incorporated College of AccountancyDocumento18 pagineSaint Joseph College of Sindangan Incorporated College of AccountancyRendall Craig Refugio0% (1)

- Just-in-Time and Backflushing Costing TechniquesDocumento6 pagineJust-in-Time and Backflushing Costing TechniquesClaudette ClementeNessuna valutazione finora

- Universal Company mining journal entries 2020-2022Documento2 pagineUniversal Company mining journal entries 2020-2022Jerbert JesalvaNessuna valutazione finora

- Credo CompanyDocumento2 pagineCredo CompanyYan TagleNessuna valutazione finora

- AFARDocumento9 pagineAFARRed Christian PalustreNessuna valutazione finora

- Receivable Practice Problem 1Documento2 pagineReceivable Practice Problem 1ayeeeNessuna valutazione finora

- Cash and Cash Equivalents Audit of Papskie CompanyDocumento3 pagineCash and Cash Equivalents Audit of Papskie CompanyNicole ReyesNessuna valutazione finora

- Sarmiento, Shayne Angela - Exercises-Inventories P-1Documento4 pagineSarmiento, Shayne Angela - Exercises-Inventories P-1SHAYNE ANGELA SARMIENTONessuna valutazione finora

- Sabina Company Quiz #1 Questions and SolutionsDocumento6 pagineSabina Company Quiz #1 Questions and SolutionsJames Daniel SwintonNessuna valutazione finora

- Assessment Task 1-1Documento10 pagineAssessment Task 1-1hahahahaNessuna valutazione finora

- Problem 6-8 Answer A Savage CompanyDocumento6 pagineProblem 6-8 Answer A Savage CompanyJurie BalandacaNessuna valutazione finora

- Revenue Cycle Trade DiscountsDocumento50 pagineRevenue Cycle Trade DiscountsJean MaeNessuna valutazione finora

- Total Cash 8,050,000: Additional InformationDocumento10 pagineTotal Cash 8,050,000: Additional Informationeia aieNessuna valutazione finora

- MS03-03 - Activity-Based-Costing-Reviewees-EncryptedDocumento9 pagineMS03-03 - Activity-Based-Costing-Reviewees-EncryptedKaren MagsayoNessuna valutazione finora

- Quiz VIII - ARDocumento3 pagineQuiz VIII - ARBLACKPINKLisaRoseJisooJennieNessuna valutazione finora

- Arabian Company Reported The Following at YearDocumento1 paginaArabian Company Reported The Following at YearKatrina Dela CruzNessuna valutazione finora

- Cost AccountingDocumento12 pagineCost AccountingCamille G.Nessuna valutazione finora

- Chapter22 BuenaventuraDocumento4 pagineChapter22 BuenaventuraAnonnNessuna valutazione finora

- Asset 2Documento10 pagineAsset 2Samantha Ocampo100% (1)

- Intermacc Receivables Postlec WaDocumento3 pagineIntermacc Receivables Postlec WaClarice Awa-aoNessuna valutazione finora

- Seatwork 2B ASSIGNDocumento5 pagineSeatwork 2B ASSIGNYzzabel Denise L. Tolentino100% (1)

- Actg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizDocumento4 pagineActg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizMarilou Arcillas PanisalesNessuna valutazione finora

- LagunaDocumento8 pagineLagunarandom17341Nessuna valutazione finora

- Chapter 11 Answers RepportDocumento12 pagineChapter 11 Answers RepportJudy56% (16)

- LiabilitiesDocumento8 pagineLiabilitiesGerald F. SalasNessuna valutazione finora

- Auditibg Problems Purchase CommitmentDocumento1 paginaAuditibg Problems Purchase Commitmentnivea gumayagay0% (1)

- MGMT 134 CA KeyDocumento4 pagineMGMT 134 CA KeyAnand KL100% (1)

- Problem 7 - 22Documento3 pagineProblem 7 - 22Jao FloresNessuna valutazione finora

- ACC 123 Quiz 1Documento16 pagineACC 123 Quiz 1hwo50% (2)

- Cash and Cash EquivalentsDocumento33 pagineCash and Cash EquivalentsJohn kyle Abbago100% (2)

- ACCEPT OR REJECT A SPECIAL ORDERDocumento4 pagineACCEPT OR REJECT A SPECIAL ORDERKHAkadsbdhsgNessuna valutazione finora

- Cabael-Ae109-Proof of CashDocumento4 pagineCabael-Ae109-Proof of CashJanine MadriagaNessuna valutazione finora

- Financial Statement Elements and Accounting EquationDocumento12 pagineFinancial Statement Elements and Accounting EquationKaith Mendoza100% (1)

- GROUP WORK-Agriculture Biological Asset and Agricultural Produce13-FINALDocumento5 pagineGROUP WORK-Agriculture Biological Asset and Agricultural Produce13-FINALREMBRANDT KEN LEDESMANessuna valutazione finora

- Periodic or Perpetual (Same) : Specific IdentificationDocumento10 paginePeriodic or Perpetual (Same) : Specific Identificationhoneyjoy salapantanNessuna valutazione finora

- ACAE 22 Job Order Costing with SpoilageDocumento2 pagineACAE 22 Job Order Costing with SpoilageNick ivan AlvaresNessuna valutazione finora

- 1909 Gross Profit and Retail MethodDocumento3 pagine1909 Gross Profit and Retail MethodCykee Hanna Quizo Lumongsod50% (4)

- 1 LiabilitiesDocumento39 pagine1 LiabilitiesDiana Faith TaycoNessuna valutazione finora

- Intermediate Accounting Inventory ProblemsDocumento37 pagineIntermediate Accounting Inventory ProblemsMicko LagundinoNessuna valutazione finora

- Pre-Test 9Documento3 paginePre-Test 9BLACKPINKLisaRoseJisooJennieNessuna valutazione finora

- Calculate Basic and Diluted EPSDocumento12 pagineCalculate Basic and Diluted EPSJoey WassigNessuna valutazione finora

- Far 6660Documento2 pagineFar 6660Glessy Anne Marie FernandezNessuna valutazione finora

- Financial Reporting and Accounting Standards: Chapter Learning ObjectivesDocumento12 pagineFinancial Reporting and Accounting Standards: Chapter Learning ObjectivesMagdy KamelNessuna valutazione finora

- Jose A. Espiritu For Appellant. Cohn, Fisher and Dewitt For AppelleeDocumento16 pagineJose A. Espiritu For Appellant. Cohn, Fisher and Dewitt For AppelleeFebbie MarianoNessuna valutazione finora

- Backflush Costing Journal EntriesDocumento2 pagineBackflush Costing Journal EntriesKellyjean IntalNessuna valutazione finora

- Additional Problems DepnRevaluation and ImpairmentDocumento2 pagineAdditional Problems DepnRevaluation and Impairmentfinn heartNessuna valutazione finora

- Business Combination Q4Documento2 pagineBusiness Combination Q4Sweet EmmeNessuna valutazione finora

- RECEIVABLESDocumento23 pagineRECEIVABLESSaghielyn BicomongNessuna valutazione finora

- 5-1 Problem SolvingDocumento11 pagine5-1 Problem SolvingRianne GliocamNessuna valutazione finora

- IA Chapter-4-7Documento11 pagineIA Chapter-4-7Christine Joyce EnriquezNessuna valutazione finora

- G2 Leg Tech - RevDocumento45 pagineG2 Leg Tech - RevChristian SampagaNessuna valutazione finora

- G2 Leg Tech - RevDocumento45 pagineG2 Leg Tech - RevChristian SampagaNessuna valutazione finora

- Narratives: Constitutional Law IIDocumento7 pagineNarratives: Constitutional Law IILen Vicente - FerrerNessuna valutazione finora

- Regulation - Married NameDocumento1 paginaRegulation - Married NameChristian SampagaNessuna valutazione finora

- Abas Kida vs. SenateDocumento1 paginaAbas Kida vs. SenateChristian SampagaNessuna valutazione finora

- Regulatory Framework For Business Transactions Special Laws Q & A NotesDocumento54 pagineRegulatory Framework For Business Transactions Special Laws Q & A Noteschristine elaineNessuna valutazione finora

- Regulation - Married NameDocumento1 paginaRegulation - Married NameChristian SampagaNessuna valutazione finora

- Agpalo Notes 2003Documento84 pagineAgpalo Notes 2003ducati99d395% (19)

- Lawyers League For A Better Philippines Vs Aquino DIGESTDocumento1 paginaLawyers League For A Better Philippines Vs Aquino DIGESTChristian Sampaga100% (1)

- BackgroundDocumento16 pagineBackgroundChristian SampagaNessuna valutazione finora

- MBA II Semester Short Question & Answers BA 7021 - SECURITY ANALYSIS & PORTFOLIO MANAGEMENTDocumento23 pagineMBA II Semester Short Question & Answers BA 7021 - SECURITY ANALYSIS & PORTFOLIO MANAGEMENTPalani Arunachalam100% (1)

- Time Value of Money: Brooks, (2013) Chapters 3, 4Documento49 pagineTime Value of Money: Brooks, (2013) Chapters 3, 4DiannaNessuna valutazione finora

- The Moral Hazard Model: The Discrete and The Continuous CasesDocumento6 pagineThe Moral Hazard Model: The Discrete and The Continuous CasesJournal of ComputingNessuna valutazione finora

- Starbucks - Delivering Customer ValueDocumento6 pagineStarbucks - Delivering Customer Valuecloudyapple100% (1)

- N5 Financial Accounting November 2016Documento10 pagineN5 Financial Accounting November 2016TsholofeloNessuna valutazione finora

- Lazy Portfolios: Core and SatelliteDocumento2 pagineLazy Portfolios: Core and Satellitesan291076Nessuna valutazione finora

- WP SkuratDocumento16 pagineWP SkuratVeer GupteNessuna valutazione finora

- Intermediate Financial Management 11th Edition Brigham Test BankDocumento20 pagineIntermediate Financial Management 11th Edition Brigham Test Banknicholasyoungxqwsbcdogz100% (32)

- EHS301 ENGINEERING ECONOMICS AND MANAGEMENTDocumento48 pagineEHS301 ENGINEERING ECONOMICS AND MANAGEMENTVamshidhar ReddyNessuna valutazione finora

- Cost Accounting Level 3/series 2-2009Documento17 pagineCost Accounting Level 3/series 2-2009Hein Linn Kyaw100% (5)

- PERFORMANCE THE 8th' P' OF MARKETING - A PROPOSAL.Documento6 paginePERFORMANCE THE 8th' P' OF MARKETING - A PROPOSAL.prabal dasNessuna valutazione finora

- CRM Practices in Banking SectorDocumento14 pagineCRM Practices in Banking SectorParvathy AdamsNessuna valutazione finora

- Customer Loyalty and Patronage of Quick Service Restaurant in NigeriaDocumento23 pagineCustomer Loyalty and Patronage of Quick Service Restaurant in NigeriaMhiz AdesewaNessuna valutazione finora

- Group Sem2Documento9 pagineGroup Sem2swabhiNessuna valutazione finora

- Giridhar Case Study AshishDocumento9 pagineGiridhar Case Study AshishAshish SinghNessuna valutazione finora

- Test 5 BDocumento2 pagineTest 5 BOfentse RanalaNessuna valutazione finora

- Finace in Business ReDocumento20 pagineFinace in Business ReGauri SidharthNessuna valutazione finora

- Topic Name:-: Economic Order Quantity (Eoq)Documento9 pagineTopic Name:-: Economic Order Quantity (Eoq)Lokesh RajpurohitNessuna valutazione finora

- Business Market VS Consumer MarketDocumento3 pagineBusiness Market VS Consumer MarketDanielle TglgNessuna valutazione finora

- Acctg For LTCC - IllustrationsDocumento13 pagineAcctg For LTCC - IllustrationsGalang, Princess T.Nessuna valutazione finora

- WDB Member Directory July 1 2023Documento3 pagineWDB Member Directory July 1 2023api-408552833Nessuna valutazione finora

- CFA Econs R8Documento312 pagineCFA Econs R8Thanh NguyễnNessuna valutazione finora

- 2023 Nole-Torres-Dole-7-New-Idp-FormatDocumento2 pagine2023 Nole-Torres-Dole-7-New-Idp-FormatSphinx Calijancallaoregonasramones TorresNessuna valutazione finora

- MRP II (Manufacturing Resource Planning)Documento22 pagineMRP II (Manufacturing Resource Planning)Sankalp GuravNessuna valutazione finora

- Havells India LTDDocumento7 pagineHavells India LTDshalabhs4uNessuna valutazione finora

- Director Marketing in San Francisco Bay CA Resume Jeff BuchoffDocumento2 pagineDirector Marketing in San Francisco Bay CA Resume Jeff BuchoffJeffBuchoffNessuna valutazione finora

- Private Equity in AustraliaDocumento5 paginePrivate Equity in AustraliaWinnifred AntoinetteNessuna valutazione finora

- Prelim Departmental Exam Reviewer With Answer Key PDFDocumento11 paginePrelim Departmental Exam Reviewer With Answer Key PDFAndrea Marie CalmaNessuna valutazione finora

- 1 OM-IntroductionDocumento35 pagine1 OM-IntroductionA11Shridhar SuryawanshiNessuna valutazione finora

- FINANCIAL DERIVATIVES – AN INTRODocumento20 pagineFINANCIAL DERIVATIVES – AN INTRODavid Adeabah OsafoNessuna valutazione finora