Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Rakesh Jhunjhunwala: 5 July 1960 (Age 54)

Caricato da

Chidam Baram0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

30 visualizzazioni6 pagineRakesh Jhunjhunwala is a renowned Indian investor and trader with a net worth over $1 billion. He started his career in 1985 with $100 and is now one of India's most famous equity investors. He manages his own portfolio through his asset management firm Rare Enterprises. Some of his major stock holdings include Titan Company, Lupin, CRISIL, and Rallis India.

Descrizione originale:

efoiesp

Titolo originale

warr way

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoRakesh Jhunjhunwala is a renowned Indian investor and trader with a net worth over $1 billion. He started his career in 1985 with $100 and is now one of India's most famous equity investors. He manages his own portfolio through his asset management firm Rare Enterprises. Some of his major stock holdings include Titan Company, Lupin, CRISIL, and Rallis India.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

30 visualizzazioni6 pagineRakesh Jhunjhunwala: 5 July 1960 (Age 54)

Caricato da

Chidam BaramRakesh Jhunjhunwala is a renowned Indian investor and trader with a net worth over $1 billion. He started his career in 1985 with $100 and is now one of India's most famous equity investors. He manages his own portfolio through his asset management firm Rare Enterprises. Some of his major stock holdings include Titan Company, Lupin, CRISIL, and Rallis India.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 6

Rakesh Jhunjhunwala

Born 5 July 1960 (age 54)

Pakistan, Pakistan

Education Chartered accountant

Alma mater Bombay University

Occupation Owner of Rare Enterprises,Investor & trader

Net worth USD 1.25 billion (2011)

[1]

Spouse(s) Rekhaa Jhunjunwala

Children 3

Rakesh Jhunjhunwala (born 5 July 1960) is an Indian investor and trader. He is a

qualified Chartered accountan. He manages his own portfolio as a partner in his asset

management firm, Rare Enterprises. Jhunjhunwala was described by India Today magazine as the

"pin-up boy of the current bull run "and by Economic Times as "Pied Piper of Indian bourses".

His investment philosophy says "Buy right and hold tight".

Rakesh Jhunjhunwala, 53, Indias most distinctive investor with a net worth of

more than USD 1 billion. He is one of the most famous and respected equity

investors in India and manages his own portfolio as a partner in his asset management

firm, Rare Enterprises.

Son of an income tax officer, he started trading in stocks while in Sydenham

College and plunged into investing as a full time profession soon after completing his

education.

He started his career with $100 in 1985 when the BSE Sensex was at 150. He

made his first big profit of Rs 0.5 million in 1986 when he sold 5,000 shares of Tata

Tea at a price of Rs 143 which he had purchased for Rs 43 a share just 3 months

ago. He made his first million in an iron ore mining company Sesa Goa whose shares

he bought at Rs 27 and sold at Rs 1,400.

His privately owned stock trading firm Rare Enterprises derives name from

first two initials of his name and wife Rekhas name.

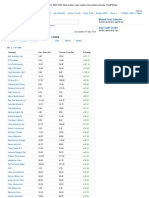

Below is the list of Stocks held till July 2014 by Rakesh JhunJhunwala, Rekha

JhunJhunwala or Rare Enterprises Equity:

Company %Holding No of

Shares

(in

Lakhs)

Rs

Crore

Titan Company 9.05 804.66 1,799

Lupin 1.76 78.83 737

CRISIL 5.67 40 444

Rallis India 10.03 195.08 349

Delta Corp 6.84 155 182

Aptech 41.57 170.56 124

Geometric 19.35 122.51 122

NCC 11.54 296.08 89

Praj Industries 8.45 150.02 70

Firstsource Solutions 3.8 250 61

Escorts 4.08 50 60

TV18 Broadcast 1.34 229.4 56

Kesoram Industries 6.83 75 55

Pipavav Defence and Offshore

1.43 105 48

Prime Focus 6.14 113.95 38

Geojit BNP Paribas Financial

7.88 180 36

Anant Raj 2.12 62.5 35

Sterling Holiday Resorts

3.67 25.05 20

SpiceJet 1.92 100 19

A2Z Maintenance and Engineering

16.7 123.88 16

DB Realty 1.03 25 15

Viceroy Hotels 14.64 62.08 12

Autoline Industries 10.18 12.51 10

Bilcare 8.51 20.03 10

Ion Exchange (India) 6.02 8.75 9

Hindustan Oil Exploration Company 1.5 19.61 8

Mcnally Bharat Engineering 3.21 9.98 6

Prozone Capital Shopping Centres 2.46 37.5 6

Adinath Exim Resources 4.05 1.66 0

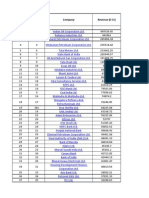

Company %Holding No of

Shares

(in

Lakhs)

Rs

Crore

Geometric 17.67 112.61 159

Rallis India 10.08 196.06 466

NCC 9.65 247.58 174

Geojit BNP Paribas Financial Services 7.90 180.38 68

Bilcare 7.37 17.35 15

Titan Company 6.81 604.93 2,198

VIP Industries 6.70 94.71 95

Kesoram Industries 6.38 70.00 74

Ion Exchange (India) 6.02 8.75 14

Autoline Industries 5.93 7.31 6

Escorts 5.47 67.00 76

Agro Tech Foods 4.73 11.54 65

Autoline Industries 4.22 5.20 4

A2Z Maintenance and Engineering

Services

4.04 30.00 9

Dewan Housing Finance Corporation 3.97 51.00 183

Karur Vysya Bank 3.92 42.07 202

Firstsource Solutions 3.78 250.00 94

Adinath Exim Resources 3.53 1.45 0

Delta Corp 3.49 80.00 72

Agro Tech Foods 3.49 8.50 48

Sterling Holiday Resorts (India) 3.48 31.30 50

Prime Focus 3.41 63.25 31

Delta Corp 3.27 75.00 67

Prakash Industries 2.97 40.00 32

Prime Focus 2.73 50.70 25

Anant Raj 2.54 75.00 43

Pipavav Defence and Offshore

Engineering Company

2.11 155.08 76

Prozone Capital Shopping Centres 2.06 31.50 6

Titan Company 1.97 174.92 636

NCC 1.95 50.00 35

Potrebbero piacerti anche

- BTMM Workbook PDFDocumento146 pagineBTMM Workbook PDFAKINREMI AYODEJI88% (8)

- Nike Case Study-ResponseDocumento8 pagineNike Case Study-ResponseAnurag Sukhija100% (5)

- Mini Case IIDocumento7 pagineMini Case IISusan LaskoNessuna valutazione finora

- Financial Analysis Coles GroupDocumento5 pagineFinancial Analysis Coles GroupAmmar HassanNessuna valutazione finora

- Bill-05 01Documento8 pagineBill-05 01Pallavi PatilNessuna valutazione finora

- Rakesh Jhunjhunwala PortfolioDocumento2 pagineRakesh Jhunjhunwala Portfolioneotroniks2853Nessuna valutazione finora

- Presentation On EquitiesDocumento25 paginePresentation On EquitiesSethu ShankarNessuna valutazione finora

- Stock Near One Year High in Indian Stock MarketDocumento15 pagineStock Near One Year High in Indian Stock MarketSagar DeshpandeNessuna valutazione finora

- Vatalya Ack Cer A 2018Documento17 pagineVatalya Ack Cer A 2018Aditya JainNessuna valutazione finora

- NSE CompaniesDocumento174 pagineNSE Companiesragh14.balaNessuna valutazione finora

- Secondary Market (Stock Market) :: MeaningDocumento9 pagineSecondary Market (Stock Market) :: MeaningARTI JAISWALNessuna valutazione finora

- Final Year Project NiftyDocumento16 pagineFinal Year Project NiftyManish BarnwalNessuna valutazione finora

- Acknowledgement: Mr. Anush Murotia Mrs. Alka ShrivastavaDocumento16 pagineAcknowledgement: Mr. Anush Murotia Mrs. Alka ShrivastavaAditya JainNessuna valutazione finora

- Madhuveer Com 18 NetDocumento9 pagineMadhuveer Com 18 NetBalaji KrishnanNessuna valutazione finora

- List of In-House R&D Units in Industry Reporting Annual Expenditure More Than Rs. 500 LakhsDocumento4 pagineList of In-House R&D Units in Industry Reporting Annual Expenditure More Than Rs. 500 LakhsVignesh SelvarajNessuna valutazione finora

- WWWWDocumento10 pagineWWWWBalaji KrishnanNessuna valutazione finora

- Mumbai ITDocumento6 pagineMumbai ITambika_nagarNessuna valutazione finora

- Vatalya Ack Cer 2017Documento16 pagineVatalya Ack Cer 2017Aditya JainNessuna valutazione finora

- 100 Large/Medium Cap and 50 Small Cap Companies Along With Their Market Cap.Documento14 pagine100 Large/Medium Cap and 50 Small Cap Companies Along With Their Market Cap.Abhishek PatilNessuna valutazione finora

- Snapshot of Rajesh ExportsDocumento4 pagineSnapshot of Rajesh ExportsYaseen ShaikhNessuna valutazione finora

- Study Of: Prof. Neeraj AmarnaniDocumento20 pagineStudy Of: Prof. Neeraj Amarnanipankil_dalalNessuna valutazione finora

- Monthly Gainers_ BSE, NSE, Stock Quotes, Share Market, Stock Market, Stock Tips_ Monthly Gainers_ BSE, NSE, Stock Quotes, Share Market, Stock Market, Stock Tips_ Rediff StocksMonthly Gainers_ BSE, NSE, Stock Quotes, Share Market, Stock Market, Stock Tips_ Rediff StocksMonthly Gainers_ BSE, NSE, Stock Quotes, Share Market, Stock Market, Stock Tips_ Rediff StocksRediff StocksDocumento16 pagineMonthly Gainers_ BSE, NSE, Stock Quotes, Share Market, Stock Market, Stock Tips_ Monthly Gainers_ BSE, NSE, Stock Quotes, Share Market, Stock Market, Stock Tips_ Rediff StocksMonthly Gainers_ BSE, NSE, Stock Quotes, Share Market, Stock Market, Stock Tips_ Rediff StocksMonthly Gainers_ BSE, NSE, Stock Quotes, Share Market, Stock Market, Stock Tips_ Rediff StocksRediff StocksChellakaruppasamyNessuna valutazione finora

- Dec 2011Documento4 pagineDec 2011Abdur Rafe Al-AwlakiNessuna valutazione finora

- BSE Top 100Documento49 pagineBSE Top 100George Khris DebbarmaNessuna valutazione finora

- The Rich ListDocumento7 pagineThe Rich Listgowtham.bNessuna valutazione finora

- 114 CCE2 Unit3Documento2 pagine114 CCE2 Unit3Prafull LokhandeNessuna valutazione finora

- Financial Instrument Symbol Name Last Change Previous CloseDocumento12 pagineFinancial Instrument Symbol Name Last Change Previous CloseSumeer BeriNessuna valutazione finora

- Saad Shaikh Aditiya Sir AssignmentDocumento4 pagineSaad Shaikh Aditiya Sir Assignment2224019.khan.miranNessuna valutazione finora

- 6 Confirmed Guest ListDocumento4 pagine6 Confirmed Guest ListvikasbrajeshshahNessuna valutazione finora

- Vatalya Ack Cer 2016Documento16 pagineVatalya Ack Cer 2016Aditya JainNessuna valutazione finora

- ! " +!, ,,) " +C - ., C 1 (1! 2 3#c! 45,) - !6+) ) 42 7 c,!2 (Documento11 pagine! " +!, ,,) " +C - ., C 1 (1! 2 3#c! 45,) - !6+) ) 42 7 c,!2 (Sakib ShaikhNessuna valutazione finora

- ET Top 500 Companies List India 2014Documento45 pagineET Top 500 Companies List India 2014Saakshi KaulNessuna valutazione finora

- Bombay Stock Exchange FinalDocumento49 pagineBombay Stock Exchange Finalchanky_kool8788% (8)

- QJy La Gyjedp Y1595606546808Documento5 pagineQJy La Gyjedp Y1595606546808debojyotiNessuna valutazione finora

- Stock ExchangeDocumento12 pagineStock ExchangeParidhi VarshneyNessuna valutazione finora

- Daily Equity Newsletter: Indian MarketDocumento4 pagineDaily Equity Newsletter: Indian Marketapi-196234891Nessuna valutazione finora

- Intraday - 26-7-18Documento270 pagineIntraday - 26-7-18ராபர்ட் ஆன்றோ ரெனிNessuna valutazione finora

- Intimation Anchor Letter-NSE and BSE - ExecutedDocumento2 pagineIntimation Anchor Letter-NSE and BSE - Executedhappycoollife7Nessuna valutazione finora

- Friday June 15, 2012Documento61 pagineFriday June 15, 2012colomboanalystNessuna valutazione finora

- Mini Project On NseDocumento19 pagineMini Project On Nsecharan tejaNessuna valutazione finora

- CompanyDocumento4 pagineCompanyPrembala SharmaNessuna valutazione finora

- IPO - Past Issues: Name Type Rate (RS.) Issue Value (RS.) Offered Equity Premium (RS.)Documento8 pagineIPO - Past Issues: Name Type Rate (RS.) Issue Value (RS.) Offered Equity Premium (RS.)vignesh87Nessuna valutazione finora

- Premarket MorningGlance SPA 17.11.16Documento3 paginePremarket MorningGlance SPA 17.11.16Rajasekhar Reddy AnekalluNessuna valutazione finora

- Top 30 KSE 100 Index CompaniesDocumento2 pagineTop 30 KSE 100 Index CompanieslatifnomiNessuna valutazione finora

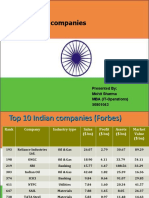

- Top 5 Indian Companies: Presented By: Mohit Sharma MBA (IT-Operations) 50801043Documento18 pagineTop 5 Indian Companies: Presented By: Mohit Sharma MBA (IT-Operations) 50801043Manu SharmaNessuna valutazione finora

- Karachi Stock ExchangeDocumento13 pagineKarachi Stock Exchangesehrish tahir100% (2)

- Bill06 01Documento6 pagineBill06 01Deepak AgarwalNessuna valutazione finora

- Presented By: Bhawna Rajora Sarita Singh Tanuja KumariDocumento45 paginePresented By: Bhawna Rajora Sarita Singh Tanuja KumariPriya SharmaNessuna valutazione finora

- QMDocumento29 pagineQMhimanshubahmaniNessuna valutazione finora

- The Super Rich List2Documento9 pagineThe Super Rich List2Nisha BhatiaNessuna valutazione finora

- Company - Jain Irrigation System LTDDocumento31 pagineCompany - Jain Irrigation System LTDNoor_DawoodaniNessuna valutazione finora

- Premarket MorningGlance SPA 15.12.16Documento3 paginePremarket MorningGlance SPA 15.12.16Rajasekhar Reddy AnekalluNessuna valutazione finora

- Phase 1 ResultsDocumento39 paginePhase 1 Resultsn.verdhan3264Nessuna valutazione finora

- Mutual Fund Portfolio and ReturnsDocumento3 pagineMutual Fund Portfolio and ReturnsVishwa Prasanna KumarNessuna valutazione finora

- Alcoholic Beverages-CH1Documento5 pagineAlcoholic Beverages-CH1Prateek KhardNessuna valutazione finora

- List of Companies of IndiaDocumento18 pagineList of Companies of IndiaKiran SonarNessuna valutazione finora

- Group Members: Ajinkya Lavate Chanky Jain Neeraj Inglekar James Fernandes Pritam GavliDocumento49 pagineGroup Members: Ajinkya Lavate Chanky Jain Neeraj Inglekar James Fernandes Pritam GavliArnima JainNessuna valutazione finora

- Before You Start The Exam, Please Fill The Following Details Below: Name: Roll Number: CompanyDocumento12 pagineBefore You Start The Exam, Please Fill The Following Details Below: Name: Roll Number: CompanyKamisetty SudhamshNessuna valutazione finora

- DSP Blackrock Top 100 Equity Fund: International School of Management ExcellenceDocumento17 pagineDSP Blackrock Top 100 Equity Fund: International School of Management ExcellencePreeti SinghNessuna valutazione finora

- IPOSDocumento18 pagineIPOSAamir MansuriNessuna valutazione finora

- Group Members: Manjunath Ronald Jacinta Carl JaqulineDocumento49 pagineGroup Members: Manjunath Ronald Jacinta Carl Jaqulinemanjunath2772Nessuna valutazione finora

- Gurus of Chaos: Modern India's Money MastersDa EverandGurus of Chaos: Modern India's Money MastersValutazione: 3.5 su 5 stelle3.5/5 (4)

- About Leather IndustryDocumento10 pagineAbout Leather IndustryChidam BaramNessuna valutazione finora

- Business Process Integrated Back Office: Enterprise Resource Planning (ERP) IsDocumento2 pagineBusiness Process Integrated Back Office: Enterprise Resource Planning (ERP) IsChidam BaramNessuna valutazione finora

- Manager of FinanceDocumento5 pagineManager of FinanceChidam BaramNessuna valutazione finora

- Kay Jay Forgings Pvt. LTD and Hr. Roll in Payroll, Hosur".The Main Objective Is To KnowDocumento1 paginaKay Jay Forgings Pvt. LTD and Hr. Roll in Payroll, Hosur".The Main Objective Is To KnowChidam BaramNessuna valutazione finora

- Rizwan.I: Education QualificationDocumento3 pagineRizwan.I: Education QualificationChidam BaramNessuna valutazione finora

- Role EXIM BankDocumento5 pagineRole EXIM BankChidam BaramNessuna valutazione finora

- Steel Authority of India: by C.Arun Kumar BeDocumento5 pagineSteel Authority of India: by C.Arun Kumar BeChidam BaramNessuna valutazione finora

- National Interest: Clause: 1Documento7 pagineNational Interest: Clause: 1Chidam BaramNessuna valutazione finora

- Adrsgdrsfdipptfinal 120827124149 Phpapp02Documento29 pagineAdrsgdrsfdipptfinal 120827124149 Phpapp02Chidam BaramNessuna valutazione finora

- Search EngineDocumento3 pagineSearch EngineChidam BaramNessuna valutazione finora

- Legal Aspect of BusinessDocumento198 pagineLegal Aspect of BusinessChidam BaramNessuna valutazione finora

- Content: Chapter - No Content Page - NoDocumento4 pagineContent: Chapter - No Content Page - NoChidam BaramNessuna valutazione finora

- Chidhambaram.C Objective: Graduated Institution University Year of Passing PercentageDocumento2 pagineChidhambaram.C Objective: Graduated Institution University Year of Passing PercentageChidam BaramNessuna valutazione finora

- TAIFEX Nifty 50 Futures Contract Specifications: Item Description Underlying Index Ticker SymbolDocumento2 pagineTAIFEX Nifty 50 Futures Contract Specifications: Item Description Underlying Index Ticker SymbolVenkataNessuna valutazione finora

- Chapter 17. Multinational Cost of Capital and Capital StructureDocumento26 pagineChapter 17. Multinational Cost of Capital and Capital StructureFaiz1000100% (11)

- 02 The Determination of Exchange RatesDocumento16 pagine02 The Determination of Exchange RatesAbdul MajeedNessuna valutazione finora

- CS Global Money Notes 4Documento17 pagineCS Global Money Notes 4rockstarliveNessuna valutazione finora

- P1 Part4.2Documento8 pagineP1 Part4.2Minie KimNessuna valutazione finora

- Debt A-BDocumento966 pagineDebt A-Bmerrylmorley100% (1)

- Hotel Room RekapDocumento9 pagineHotel Room RekapSoehermanto DodyNessuna valutazione finora

- JWCH 04Documento23 pagineJWCH 04007featherNessuna valutazione finora

- Star Net ClientDocumento8 pagineStar Net ClientXyz YxzNessuna valutazione finora

- ECM+Report Q3 +2023Documento8 pagineECM+Report Q3 +2023Jeffery AlvarezNessuna valutazione finora

- Financial EngineeringDocumento2 pagineFinancial EngineeringMeenakshi ParasharNessuna valutazione finora

- 1st American Bank CaseDocumento6 pagine1st American Bank CaseRenu EsraniNessuna valutazione finora

- Forex For CAIIBDocumento6 pagineForex For CAIIBkushalnadekarNessuna valutazione finora

- Kwacha PerformanceDocumento24 pagineKwacha PerformanceTimothy NshimbiNessuna valutazione finora

- Stocks and Their ValuationDocumento31 pagineStocks and Their ValuationShao BajamundeNessuna valutazione finora

- Tutorial 6: Chap 7 Efficient Diversification: The Following Data Apply To Problem 4 Through 10: A Pension Fund Manager IsDocumento4 pagineTutorial 6: Chap 7 Efficient Diversification: The Following Data Apply To Problem 4 Through 10: A Pension Fund Manager IsLim Xiaopei100% (1)

- Module - 4 Foreign Exchange Market: Market ParticipantsDocumento15 pagineModule - 4 Foreign Exchange Market: Market ParticipantsRahul R NaikNessuna valutazione finora

- Why Are Financial Institutions Special?: True / False QuestionsDocumento23 pagineWhy Are Financial Institutions Special?: True / False Questionslatifa hnNessuna valutazione finora

- Practicequestions Mt3a 625Documento25 paginePracticequestions Mt3a 625sonkhiemNessuna valutazione finora

- BuildersMart ContentDocumento4 pagineBuildersMart ContentMalikNisarAwanNessuna valutazione finora

- 2 SampleDocumento23 pagine2 Sampleaaaaammmmm8900% (1)

- DCF ModelingDocumento12 pagineDCF ModelingTabish JamalNessuna valutazione finora

- Interest Rates & HY Returns - JPM StudyDocumento12 pagineInterest Rates & HY Returns - JPM Studyvilnius00Nessuna valutazione finora

- Chong Hing Bank: Potential Privatization: U/G To BUYDocumento8 pagineChong Hing Bank: Potential Privatization: U/G To BUYsuksesNessuna valutazione finora

- Study Notes On DerivativesDocumento13 pagineStudy Notes On DerivativesAbrar Ahmed100% (2)

- Multiple-Choice MlearningDocumento29 pagineMultiple-Choice MlearningBích TiênNessuna valutazione finora