Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Funds Flow Statement

Caricato da

Sakhamuri Ram'sCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Funds Flow Statement

Caricato da

Sakhamuri Ram'sCopyright:

Formati disponibili

58

INTRODUCTION

Firms create manufacturing capacities for production of goods: some

provide services to consumers. They sell their goods or services to earn profit. They raise

funds to acquire manufacturing and other facilities. Thus, the three most important activities

of a business firm are; finance, production and marketing. firm secures !hatever capital it

needs and employees it "finance activity# in activities !hich generate returns on invested

capital and marketing activities.

Functions of Financial Management:-

The financial functions can be divided into four broad categories:

$nvestment decisions.

Financing decisions.

%ividend decisions.

&iquidity decisions.

1. Investment Decision:-

$nvestment decision or capital budgeting involves the decision of

allocation of capital or commitment of funds to long'term assets, !hich !ould yield, benefits

in future. $t(s one very significant aspect is the task of measuring the prospective profitability

of ne! investments. Future benefits are difficult to measure and cannot be predicted !ith

certainty.

2. Financing Decision:-

Financing decision is the second important function to be performed by

the financial manager. )roadly, he must decide !hen, !here and ho! to acquire funds to

58

meet the firm(s investment needs. The central issue before him is to determine the proportion

of equity and debt. The mi* of debt and equity is kno!n as the firm(s capital structure. The

firm(s capital structure is considered to be optimum !hen the market value of shares is

ma*imi+ed.

3. Divien Decision:-

%ividend decision is the third ma,or financial decision. The financial

manager must decide !hether the firm should distribute a portion and retain the balance.

&ike the debt policy, the dividend policy should be determined in terms of impact on the

shareholder(s value. The optimum dividend policy is one, !hich ma*imi+es the market value

of the firm(s shares.

!. "i#uiit$ Decision:-

-urrent assets management, !hich affects a firm(s liquidity, is an

important finance function. -urrent assets should be managed efficiently for safe guarding

the firm against the dangers of liquidity and insolvency. $nvestment in current assets affects

firm(s profitability, liquidity and insolvency. $nvestment in current assets affects firm(s

profitability, liquidity and risk. conflict e*ists bet!een profitability and liquidity !hile

managing current assets.

Financial analysis is the process of identifying the financial strengths and

!eaknesses of the firm. $t is done by establishing relationships bet!een the items of financial

statements vi+., balance sheet and profit and loss account. Financial analysis can be

undertaken by management of the firm or by parties outside the firm vi+., o!ner(s creditors,

investors and others.

58

Financial %tatement &nal$sis:-

Financial statements are prepared primarily for decision making. They

play a dominant role in setting the frame !ork of managerial decision. )ut the information

provided in the financial statements is not an end in itself as no meaningful conclusions can

be dra!n from these statements alone. .o!ever, the information provided in the financial

statements is of immense use in making decisions through analysis and interpretation of

financial statements.

Financial analysis is /the process of identifying the financial strengths

and !eakness of the firm by properly establishing relationship bet!een the items of the

balance sheet and the profit and loss amount. There are various methods or techniques used

in analy+ing financial statements, such as comparative statements, trend analysis, common'

si+e statements, schedule of changes in !orking capital, funds flo! and analysis, cost volume

profit analysis and ratio analysis.

Meaning of Financial %tatement &nal$sis:-

T$'es of &nal$sis

(e)tical &nal$sis *o)i+ontal &nal$sis

58

The term financial analysis also kno!n as analysis and interpretation of

financial statements, refers to the process of determine financial strength and !eakness of the

firm by establishing strategic relationship bet!een the items of the balance sheet, profit and

loss account and oilier operative data.

$n the !ords of /0yers(,1 financial statements analysis is largely study of

relationship among the various financial factors in a business as disclosed by a single' set of

statements and study of the trend of these factors as sho!n in a series of statements1.

The analysis and interpretation of financial statements is essential to bring out

the mystery behind the figures in financial statements.

Definition of Financial %tatement &nal$sis:-

&cco)ing to M$e)s:-

2Financial 3tatements nalysis is largely a study of relationship among

the various financial factors in a business as disclosed by a single set of the trend of these

factors as sho!n in a series of statements1.

&cco)ing to ,enne$ an Mulle):-

2The analysis and interpretations of financial statements reveal each and

every aspect regarding the !ell'being financial soundness, operational efficiency and

credit!orthiness of the concerned1

Met-os of Financial %tatement &nal$sis:-

58

The analysis and interpretation of financial statement is used to determine

the financial position and results of operations as !ell. number of methods or devices are

used to study the relationship bet!een different statements. n effort is made to use those

devices, !hich clearly analy+e the position of the enterprise. The follo!ing methods of

analysis are generally used:

Com'a)ative %tatements.

T)en &nal$sis.

Common si+e statements.

Funs flo. statements.

Cas- flo. statement.

Ratio &nal$sis.

Com'a)ative %tatements:-

The comparative financial statements are statements of the financial

position at different periods of time. The elements of financial position are sho!n in a

comparative form so as to give an idea of financial position at t!o or more periods. ny

statements prepared in a comparative term !ill be covered in comparative statements. From

practical point of vie!, generally t!o financial statements "balance sheet and income

statement# are prepared in comparative form for financial analysis purposes.

4ot only the comparison of the figures of t!o periods but also be

relationship bet!een balance sheet and income statement enables an in'depth study of

financial position a cooperative results. The comparative statement may sho!:

bsolute Figures "5upee mounts#

-hanges in absolute figures i.e., increase "or# decrease in absolute figures.

bsolute data in terms of percentages.

58

Com'a)ative Income %tatement:-

The income statement gives the results of the operation of a business.

The comparative income statement gives an idea of the progress of a business over a period

of time. The changes in absolute data in money values and percentages can be determined to

analy+e the profitability of the business. &ike comparative balance sheet, income statement

also has four columns. First t!o columns give figures of various items for t!o years. Third

and fourth columns are used to sho! increase is decrease in figures in absolute amounts and

percentages respectively.

Com'a)ative /alance %-eet:-

The comparative balance sheet analysis is the study of the trend of the

same items, group of items and computed items in t!o or more balance sheet of the same

business enterprise on different dates. The changes in periodic balance sheet items reflect the

conduct of a business. The changes can be observed by comparison of the balance sheet at

the beginning and at the end of a period and these changes can help in forming an opinion

about the progress of an enterprise. The comparative balance sheet has t!o columns for the

data of original valance sheets. third column is used it sho! increases in figures. The fourth

column may be added for giving percentages of increases or decreases. The balance sheet

sho!s the financial condition of a business at a given point of time.

Com'a)ative %tatements

-omparative $ncome 3tatement -omparative )alance 3heet

58

Common- %i+e %tatement:-

The common si+e statements, balance sheet and income statement are

sho!n in analytical percentages. The figures are sho!n as percentages of total assets, total

liabilities and total sales. The total assets ate taken as 677 and different assets are e*pressed

as a percentage of the total. 3imilarly various liabilities are taken as a part of total liabilities.

These statements are also kno!n as component percentage or 677 percent statement because

every individual item is stand as a percentage of the total 677. The short'comings in

comparative statements and tend percentages !here changes in items could not be compared

!ith the totals have been covered up. The analyst is able to assess the figures in relation lo

total values.

Common %i+e Income %tatement:-

n income statement in !hich each account is e*pressed as a

percentages of the value of sales. This type of financial statement can be used to allo! for

easy analysis bet!een companies or bet!een time periods of a company.

Common %i+e %tatements

-ommon si+e $ncome

3tatement

-ommon si+e )alance 3heet

58

Common %i+e /alance %-eet:-

company balance sheet that displays all items as percentages of a

common base figure. This type of financial statement can be used to allo! for easy analysis

bet!een companies or bet!een time periods of a company.

Cas- Flo. %tatement:-

-ash flo! is of vital importance to the financial management. $t is an

essential tool of financial analysis for short'term planning. The chief advantages of cash flo!

statement are as follo!s:'

3ince cash flo! statement is based on the cash basis of accounting, it is very useful

in the evaluation of cash position of a firm.

pro,ected cash flo! statement can be prepared in order to kno! the future cash

position of a concern so as to enable a firm to plan and coordinate its financial

operations properly. )y preparing this statement, a firm can come to kno! as to ho!

much cash !ill be generated into the firm and ho! much cash !ill be needed to

make various payments and hence the firm can !ell plan to arrange for the future

requirements of cash.

-ash flo! statement helps in planning the repayment of loans, replacement of fi*ed

assets and other similar long'term planning of cash. $t is also significant of capital

budgeting decisions.

58

T)en &nal$sis:-

The financial statements may be analy+ed by computing trends of

series of information; this method determines the direction up!ards of do!n!ards and

involves the computation of the percentage relationship that each statement item bears to the

same item in base year. The information for a number of years is taken rp and one year,

generally the first year, is taken as a bade year. The figures of the base year are taken as 677

and trend ratios for other years are calculated on the bases of base year. The analyst is able to

see the trend of figures, !hether up!ard or do!n!ard.

Ratio &nal$sis:-

8ne of the techniques of analysis of financial statements is to calculate

ratios. 5atio is the numerical or an arithmetical relationship bet!een t!o figures. $t is

e*pressed !hen one figure is divided by another. $f 9777 is divided by 67,777 the ration can

be e*pressed as 9 or ::5 or 97;.

bsolute figures are valuable but they standing alone convey no

meaning unless compared !ith another. ccounting ration inter'relationships, !hich e*ist

among various accounting data< =hen relationships among various accounting data supplied

by financial statements are !orked out, they are kno!n as accounting ratios.

Classification of Ratios:-

5atios may be classified in a number of !ays keeping in vie! the

particular purpose. 5atios indicating profitability are calculated on the basis of the profit and

loss account, those indicating financial position are computed on the basis of the balance

sheet and those !hich operating efficiency or productivity or effective use of resources are

calculate on the basis of figures in the profit and loss account and the balance sheet.

58

This classification is rather crude and unsuitable to determine the

profitability and financial position of the business. To achiever this purpose effectively ratios

may be classified as:

0)ofita1ilit$ Ratios:-

>rofitability 5atios are of outmost importance for a concern; these ratios are

calculated to enlighten the end results of business activities, !hich is the sole criterion of the

overall efficiency of a business concern.

?ross profit margin ratio.

4et profit margin ratio

Tu)nove) 20e)fo)mance o) &ctivit$3 Ratios:-

These ratios are very important for a concern to ,udge ho! !ell facilities at the

disposal of the concern are being used or to ratios are usually calculated on the basis of sales

or cost of sales and are e*pressed in integers rather than as percentage. 3uch ratios should be

calculated separately for each type of asset. .igher the turnover ratio, the profitability and

use of capital or resources !ill be. The follo!ing are the important turnover ratios usually

calculated by a concern

5atios

>rofitability

5atio

&iquidity

5atio

&everage

5atio

ctivity

5atios

58

$nventory turn over ratio.

$nventory holding period.

"i#uiit$ Ratios:-

These ratios are calculated to ,udge the financial position of the concern from

long'term as !ell as short'term solvency point of vie!. The follo!ing are the ratios, !hich

are calculated in the respect.

-urrent ratio.

@uick ratio.

"eve)age Ratios:-

&everage 5atios to an increased means of accomplishing some purpose. $n

financial management it refers to employment of funds to accelerate rate of return to o!ners.

$t may be favorable or unfavorable. n unfavorable leverage e*ists if the rate of return

remains to ho!ever. $t can be used as a tool of financial planning by the finance manager.

%ebt ratio.

%ebt equity ratio.

58

Funs Flo. &nal$sis

3ignificant technique of financial analysis is /Funds Flo! nalysis(. $t

is designed to highlight changes in the financial conditions of a business concern bet!een

t!o points of time !hich generally conform to beginning and ending financial statement

dates. Funds flo! statement is also termed as a statement of sources and applications of

Funds(, /statement of changes in !orking capital, /statement of changes in Financial

>osition(, /statement of Funds supplied and pplied(, /statement of Funds ?enerated and

A*pended(, /!here got and !here gone statement(, funds statement.

lthough financial statements supply useful information to the

management and describe the nature of changes o!nership as a result of the period(s

productive and commercial activities, these statements fail to mirror the funds changes that

have taken place over a given time span. They do not spell out the movements of funds. $t is

more important to describe the sources from !hich additional funds sere derived and the uses

to !hich these funds !ere put, because the ultimate success of a business enterprise depends

on !here got and !here gone situations. The funds flo! statement is, therefore, prepared to

uncover the information !hich the financial statements fail to describe clearly.

Meaning an Conce't of 4Flo. of Funs5:-

The term /flo!( means movement and includes both /inflo!( and

/outflo!(. The term Flo! of funds( means transfer of economic valued from one asset of

equity to another. Flo! of funds is said to have taken placed !hen any transaction makes

changes in the amount of funds available before happening of the transaction. $f the effect of

transaction results in the increase of funds, it is called sources of funds and if it results in the

decrease of funds, it if kno!n as application of funds, further, in case the transaction does not

change funds it is said to have not resulted in the flo! of funds. ccording to the !orking

58

capital concept of funds, the term /flo! of funds( refers to the movement of funds in the

!orking capital. $f any transaction results in the increase in !orking capital, it is said lo be a

source or inflo! of funds and if it results in the decrease if !orking capital, it is said to be an

application or out'flo! of funds.

Funs Flo. %tatement:-

The follo!ing are the definitions of funds flo! statement.

&cco)ing to R.N. &nt-on$:-

BThe funds flo! statement describes the sources from !hich additional

funds !ere derived and the uses to !hich these funds !ere put1.

&cco)ing to R.&. Foul6:-

2 statement of sources and applications of funds is a technical devise

designed to analysis the changes in the financial conditions of a business bet!een t!o dates1.

&cco)ing to /ig man:-

2$t is a statement !hich highlights the underlying financial movements

and e*plains the changes of !orking capital from one point of time to another1.

Thus funds flo! statement is a report !hich summari+es the events

taking place bet!een the t!o accounting periods. $t spells out the sources from !hich funds

!ere derived and the uses to !hich these funds !ere put. This statement is essentially

derived from an analysis of the changes that have occurred in assets and liabilities items

bet!een t!o balances sheet dates. $n this statements only the net changes are sho!s that the

outcome of a transaction as of a series of transactions upon the financial condition of a

business enterprise is reflected more sharply.

58

%ignificance 2o)3 Im'o)tance of Funs Flo. %tatement:-

The funds flo! statement is an important tool of financial analysis. The

utility of the funds flo! statement items from the fact that it enables management,

shareholders, investors, creditors and other interested in the enterprise to evaluate the uses of

financial policies of the management.

Decisions Relating To Financing:-

=ith the people of the funds flo! statement the analyst can evaluate the

financing patterns of the enterprise. n analysis of the ma,or sources of funds in the past

reveals !hat portion of the gro!th !as financed internally and !hat portion e*ternally. The

statement is also meaningful in ,udging !hether the company has gro!n at too fast a rate,

credit has increased at relatively higher rate, one !ould !ish to evaluate the consequences of

slo!ness in the trade payments on the credit standing of the company and its ability to

finance in future.

Decision On Ca'itali+ation:-

The funds flo! statement serves as handmaid to the finance manager in

deciding the make up of capitali+ations. Astimated uses of funds for ne! fi*ed assets

!orking capital, dividend, and repayment of debt are made for each of several future years.

Astimates are made of the funds to be provided by operations, and the balance must be

obtained by borro!ing or issuance of ne! securities, if the indicated amount of ne! funds

required is greater than !hat the finance manager thinks possible to raise, then plans for ne!

fi*ed assets acquisition and the dividend policies are re'e*amined so that the uses of funds

can be brought into balance !ith the anticipated sources of financing them. $n particular

funds statements are very useful in planning intermediate and long term financing.

58

Reveals T-e Reasons Fo) Financial Difficulties:-

The funds flo! statement reveals clearly the cause for the financial

difficulties of the company. The difficulties may be due to improper mi* of short and

long term sources, un necessary accumulation of inventory of fi*ed assets etc., These

can be found out by a careful study of the funds flo! statement.

Useful To t-e 78te)nal 0a)ties:-

The outside parties can have a clear kno!ledge about the financial

policies that the company has persuade. $n the light of the information so supplied by the

statement the outsiders can decide !hether or not to invest in the enterprise and on !hat

terms funds have to be invested. The funds statement provides an insight into the financial

operations of a business enterprise an insight immensely valuable to the finance manager in

analy+ing the past and future e*pansion plans of the enterprise and the import of these plans

an its liquidity. .e can detect imbalances in the issue of funds and undertake remedial

actions.

Useful &s Cont)ol Device:-

The funds flo! statement also serves as a control device in that the

statement compared !ith the budgeted figures !ill sho! to !hat e*tent the funds !ere put to

use according to plan. This enables the finance managers to find out deviation from the

planned course of action and take remedial steps to correct the deviations.

Thus, the funds statement dra!s the attention of finance manager to

problems !hich call for detailed analysis and immediate action. $n vie! of these funds flo!

statement is becoming more popular !ith management. Aven some bank managers make it

obligatory for the borro!ers to furnish a funds statement along !ith their annual balance

58

sheet no! a days many $ndian companies are publishing this statement in their annual reports

although they are not obliged to do so under the companies ct.

It *el's In T-e &nal$sis of Financial O'e)ations:-

The financial statements reveal the net effect of various transactions on

the operational and financial position of a concern. The balance sheet gives a static vie! of

the resources or a business and the uses to !hich these resources have been put at a certain

point of time. )ut it does not disclose the causes for changes in the assets and liabilities

bet!een t!o different points of time.

The funds flo! statement e*plains causes for such changes and also

the effect of these changes on the liquidity position of the company. 3ometimes a concern

may operate profitably and yet its cost position may become more and !orse. The funds flo!

statement gives a clear ans!er to such a situation e*plains !hat has happened to the profit of

the firm.

$t sho!s light on many perple*ing question of general interest !hich other!ise may

be difficult to be ans!ered, such as:

6. =hy !ere the net current assets lesser in spite of higher profits and vice'

versa<

:. =hy more dividends could not be declared in spite of available profits<

C. .o! !as it possible to distribute more dividends than the present earnings<

9. =hat happened to the net profit< =here did they go<

5. =hat happened to the proceeds of sale of fi*ed assets or issue of shares<

%ebentures etc.<

D. =hat are the sources of the repayment of debt<

E. .o! !as the increase in !orking capital financial and ho! !ill it be financed

in future<

58

$t helps the formation of a realistic dividend policy, sometimes a firm has sufficient

profits available for distribution as dividend but yet it may not be advisable to

distribute divided for lack of liquid of cash resources. $n such cases, a funds flo!

statement helps in the formation of a realistic dividend policy.

It *el's In T-e 0)o'e) &llocation of Resou)ces: -

The resources of a concern are al!ays limited and it !ants to make the

best use of these resources managerial decisions. The firm can plan the deployment of its

resources and allocate them among various applications.

It &cts &s & Futu)e 9uie: '

pro,ected funds flo! statement also acts as a guide for future to the

management. The management can come to kno! the various problems it is going to lace in

near future for !ant of funds. The firm(s future needs of funds can be pro,ected !ell in

advance and also the timing of these needs. The firm can arrange to finance these needs more

effectively and avoid future problems.

It *el's In &'')aising T-e Use of :o)6ing Ca'ital: '

funds flo! statement helps in e*plaining ho! efficiently the

management has used is !orking capital and also suggests !ays to improve !orking capital

position of the firm.

It *el's ,no.ing T-e Ove)all C)eit :o)t-iness of & Fi)m: '

58

The financial institutions and banks such as state financial institutions,

industrial %evelopment -orporation, industrial financial corporation of $ndia, industrial

development bank of $ndia etc., all ask for funds flo! statement constructed for a number of

years before granting loans to kno! the credit !orthiness and paying capacity of the firm.

.ence a firm seeking financial assistance from these institutions has no alternative but to

prepare funds flo! statements.

"imitations of Funs Flo. %tatement:-

The funds flo! statement has a number of uses; ho!ever it has certain

limitations also, !hich are listed belo!:

$t should be remembered that a funds ho! statement is not a substitute of an income

statement or a balance sheet. $t provides only some additional information as regards

changes in !orking capital.

$t cannot reveal continuous changes.

$t is not an original statement but simply is arrangement of data given in the financial

statements.

$t is essentially historic in nature and pro,ected funs flo! statement cannot be

prepared !ith much accuracy.

-hanges in cash are more important and relevant for financial management than the

!orking capital.

58

-ash flo! statement: a statement of changes in the financial position of firm on cash

basis is called a cash flo! statement.

Rules fo) Funs Flo. &nal$sis:-

The flo! of funds occurs !hen a transaction changes on the one hand a non current

account and on the other current account and vice'versa.

=hen a change in a non current account e.g., fi*ed assets, long term liabilities

reserves and surplus fictitious assets etc, is follo!ed by a change in another non'

current account, it does not amount to flo! of funds.

This is because of the fact that in such cases neither the !orking capital increases nor

decreases. 3imilarly, !hen a change in one current account results in a change in

anther current account it does not affect funds. Funds move from non current to

current transactions or vice'versa only.

$n simple language funds move !hen a transaction affects "i# a current assets and a

fi*ed assets or "ii# a fi*ed and a current liability or "iii# a current asset and a fi*ed

liability of "iv# a fi*ed liability and current liability, and funds so not move !hen the

transaction affects fi*ed assets and fi*ed liability or current assets and current

liability.

58

Financial %tatements an Funs Flo. %tatement:-

Financial statement means the profit and loss account and the balance

sheet. ll the organi+ations more particularly, the company from of organi+ations is required

to present the annual financial statements every year. The financial statements differ !ith the

funds flo! statement in many !ays.

Funds Flo! 3tatement is a statement measuring the inflo!s the

inflo!s and outflo!s of net !orking capital that result from any type of business activity

bet!een t!o dates. n $ncome statement in a statement measuring the inflo!s and outflo!s

of net assets of revenue nature that result form rendering goods on services to customers

bet!een t!o dates.

Funds Flo! 3tatements has become a useful tool in the hands of

financial analyst. That is being caused the financial statements i.e., $ncome statement

measures the flo!s restricted to transaction relating to rendering of goods and services to

customers. $t is not capable of any accurate information of the resources from operating

unless the income data is converted into funds data. $t does not depict the ma,or financial

transactions !hich have resulted in changes in )alance 3heet.

Com'a)ison 1et.een Funs Flo. %tatement an Cas- Flo. %tatement:-

The term /Funds( has a variety of meanings. $n a narro! sense it means

cash and the statement of changes in the financial position prepared on cash basis is called a

cash flo! statement. $n the most popular sense, the term /funds( refers to !orking capital and

58

a statement of changes in the financial position prepared on tills basis is called a funds flo!

statement. cash flo! statement is much similar to a funds flo! statement as both are

prepared to summaries the causes of changes in the financial position of a business.

.o!ever, follo!ing are the main differences bet!een funds and a cash flo! statement.

Funds flo! statement is based on a !ider concept of funds $.e., !orking capital !hile

cash flo! statement is based in the narro!er concept of funds, i.e., cash only, !hich

is only one element of !orking capital, the other being debtors stock, temporary

investment, bills receivable etc.

Funds flo! statement is based on accrual basis of accounting !hile cash flo!

statements are based on cash basis of accounting. $n cash flo! statement !hile

calculating operating profits, ad,ustments for prepaid and outstanding e*penses and

income are made to convert the data from accrual basis to cash basis, but no such

ad,ustments are required to be made !hile preparing a funds flo! statements.

Funds flo! statement does not reveal changes in current assets and current liabilities,

rather these appear separately in a schedule of changes in !orking capital. 4o such

schedule of change in !orking capital is prepared for a cash flo! statement and

changes in all assets and liabilities fi*ed as !ell as current, are summari+ed in the

cash flo! statement.

-ash flo! statement is prepared by taking the opening balance of cash, adding to this

all the inflo! of cash and deducting the outflo!s of cash from the total. The balance,

i.e., opening balance of cash and inflo!s of cash minus outflo!s of cash, is

reconciled !ith closing balance of cash. 4o such opening or closing balance appears

in a funds flo! statement. The net difference bet!een sources and applications of

funds does not represent cash rather it reveals the net increase or decrease in !orking

capital.

58

Funds flo! statement is useful in planning intermediate and long'term financing

!hile as cash flo! statement is more useful for short'term analysis and cash planning

of the business.

0)e'a)ation of Funs Flo. %tatement:-

$n order to prepare funds flo! statement, it is necessary to find out the

23ources and pplications1 of funds.

%ou)ces of Funs:-

Funs f)om O'e)ations:-

fund from operations is the only internal sources of funds. 3ome

ad,ustments are to be made in calculating funds from operations to the net profit given in the

financial statement.

0e)fo)ma of Calculation of funs fo)ms o'e)ations

Ta1le 1.1

0a)ticula)s &mount 0a)ticula)s &mount

To %epreciation 888

)y 8pening )alance of >F&

Gc

888

To ?eneral 5eserve ccount 888 )y >rofit on fi*ed ssets 888

To &oss on fi*ed asset 888

To >rovision for Ta*ation 888

58

To -losing )alance of >F&

Gc

888 )y Funds from operations 888

888 888

The follo!ing procedure is to be follo!ed in the calculation of funds from operations.

6. 3tart !ith the 4et >rofit given in the profit and loss account.

:. dd the follo!ing items to the net profit as they do not result in outflo! of funds.

%epreciation on fi*ed assets.

>reliminary e*penses or good !ill etc., !ritten off.

-ontribution to debenture redemption funds, transfer to general reserve

etc., if they have been deducted before arriving at the figure of net profit.

>rovision for ta*ation and proposed dividend. These may be taken as

appropriations of profits or current liabilities for the purposes of Funds

Flo! 3tatement. Ta* or dividends actually paid are taken as applications to

funds. 3imilarly interim dividend paid is kno!n as an application of funds.

ll these items !ill be added back to net profit if already deducted, to find

funds from operations.

&oss on sale of fi*ed assets.

C. %educt the follo!ing items from net profit as they do not increase the funds:

>rofit on sale of fi*ed assets, since the full sale proceeds are taken as a

separate source of funds and conclusion here !ill result in duplication.

>rofit on revaluation of fi*ed assets.

58

4on'operating incomes such as dividend received or accrued rent. These

items increase funds but they are not operating incomes. They !ill be

sho!n under separate heads as 2sources1 of funds1 in the Funds Flo!

3tatement.

$n case the profit and loss account sho!s net loss this should be taken as

an items !hich decrease the finds.

%tatement of C-anges in :o)6ing Ca'ital:-

The increase or decrease in !orking capital can be calculated by

preparing the schedule of changes in !orking capital.

=orking capital represents the e*cess of current assets over current

liabilities. 3everal items of all current assets and current liabilities are the components of

!orking capital. $n order to ascertain the !orking capital at the beginning and at the end of

the period and to measure the increase or decrease therein it is necessary to prepare a

statement or schedule of changes in !orking capital

58

%c-eule of C-anges in :o)6ing Ca'ital of t-e Com'an$ fo) t-e ;ea) 7ne

Ta1le 1.2

>articulars >revious

Hear"5s.#

-urrent

Hear"5s.#

Affect on !orking capital

$ncrease "5s.# %ecrease"5s.#

2&3 Cu))ent &ssets:-

3tock

%ebtors

-ash I )ank

)ills receivable

>repaid e*penses

Total 2&3

2/3 Cu))ent lia1ilities:-

-reditors

)ills payable

8utstanding e*penses

Total 2/3

JJJ

JJJ

JJJ

JJJ

JJJ

JJJ

JJJ

JJJ

JJJ

JJJ

<<< <<<

JJJ

JJJ

JJJ

JJJ

JJJ

JJJ

<<< <<<

58

=orking changes:"')#

Inc)ease=ec)ease in

:o)6ing ca'ital

Total

JJJ

<<<

JJJ

<<<< <<<< <<<< <<<<

=hile preparing a schedule of changes in !orking capital it should be noted that.

1.

n increase in current assets increases !orking capital;

decrease in current assets decrease !orking capital;

n increase in current liabilities decreases !orking capital;

decrease in current liabilities increase !orking capital;

$ncreases in current asset and increase in current liabilities does not affect !orking

capital.

decrease in fi*ed assets and fi*ed liabilities affects !orking capital.

2. The changes in all currents assets and current liabilities are merged into one figure only

either an increase or decrease in !orking capital over the period for !hich funds statements

has been prepared. $f the !orking capital at the end of the difference e*pressed as /increase in

!orking capital(. 8n the other hand, if the !orking capital at the end of the period is less than

that at the commencement, the difference is called decrease in !orking capital.

Cu))ent &ssets:-

58

The e*pression /current assets( denotes those assets !hich are

continually on the move since they are constantly in motion, they are also kno!n as the

circulating capital of the business. These assets can or !ill be converted into cash during a

complete operating cycle of the business. -urrent assets include;

stock'in'trade or inventories

debtors

payments in advance or prepaid e*penses

stores

)ills receivables

-ash at bank

-ash in hand

=ork in progress

Cu))ent "ia1ilities:-

-urrent liabilities are those liabilities !hich are to be paid in the near future, i.e.,

during a complete operating cycle of the business. 3uch liabilities include;

Trade creditors

ccrued or outstanding e*penses.

)ills payable.

$ncome ta* payable

%ividends declared;

58

)ank overdraft

Note:-

3ome e*perts are of the opinion that as bank over draft has a tendency to

become more or less a permanent source of financing and hence it need not be included

among current liabilities.

%tatement of %ou)ces an &''lication of Funs:-

Funs F)om O'e)ation:-

$t is an internal source of funds. Funds from operations are to be

calculated as per the method stated above.

Funs F)om "ong Te)m "oans:-

&ong term loans such of debentures, borro!ing from financial

institutions !ill increase the !orking capital and therefore, there !ill be inflo! of funds.

.o!ever, if the debentures have been issued in consideration of some fi*ed assets, there

!ill be no inflo! of funds.

%ale Of Fi8e &ssets:-

3ale of land, buildings, and long'term investments !ill result in

generation of funds.

Funs F)om Inc)ease In %-a)e Ca'ital:-

$ssue of shares for cash or for any other current asset or in discharge of

current liability is another source of funds. .o!ever, shares allotted in consideration of

58

some fi*ed assets !ill not result in funds. .o!ever, it is recommended that such

purchase of fi*ed assets as !ell as issue of securities to pay for them be revealed in

funds flo! statement.

Dec)ease In :o)6ing Ca'ital:-

%ecrease in !orking capital is the result of decrease in current asset or

increase in current liabilities. $n both the cases inflo! of funds takes place. 3uppose

stock, a current asset reduce from 5s.65,777 to 5s.6:,777 the decrease of 5s.C,777 is

assumed to be due to the disposal of stock !hich undoubtedly brings funds into the

business. $n the fame !ay, increase in current liabilities means lesser payment, so

retaining funds is also a source.

0e)fo)ma of Funs flo. %tatements

Ta1le 1.3

0a)ticula)s &mount 2Rs.3

%ou)ces Of Funs:-

$ssue of shares

$ssue of debentures

&ong term borro!ings

3ale of fi*ed assets

K Dec)ease in .o)6ing ca'ital

Total sou)ces

&''lication Of Funs:-

5edemption of redeemable

>reference shares

5edemption of debentures

>urchase of fi*ed assets

>ayment of other long term loans

>ayment of dividends, ta*es, etc

>Inc)ease In :o)6ing Ca'ital

JJJ

JJJ

JJJ

JJJ

<<<

<<<

JJJ

JJJ

JJJ

JJJ

JJJ

JJJ

<<<

<<<

58

Total uses

4ote: K only one !ill be there.

T)eatment of &?ustments:-

3ome times the factors affecting the funds from operations may not be

given in the problems directly and there may be some hidden information. s such, some of

the transactions have to digger out using the additional information provided as ad,ustments

to the balance sheet. These items include: a# provision for ta* "b# proposed dividends "c# sale

purchase of fi*ed assets.

0)ovision Fo) Ta8:-

$t is current liability !hile preparing a funds flo! statement, these are

t!o options available.

>rovision for ta* may be taken as a current liability in such a case, !hen

provision for ta* is made the transaction involves profit and loss appropriation

account !hich is a fi*ed liability and provision for ta* account !hich is a

current liability. $t !ill thus decrease the !orking capital. 8n payment of ta*

these !ill be no change in !orking capital because it !ill in'values one current

liability "i.e., provision for ta*# and the other a current assets "i.e., bank or cash

balance#.

>rovision for ta* may be taken only as an appropriation of profit. $t means that,

there !ill no! change in !orking capital position !hen provision for ta* is

58

made since it !ill involve t!o fi*ed liabilities, i.e., profit and loss appropriation

account and provision for ta* account. .o!ever, !hen ta* is paid, it !ill be

taken as application of funds, because it !ill !hen involve />rovision for ta*

account( !hich has been taken as a fi*ed liability and /bank( !hich is current

assets.

0)o'ose iviens:-

=hatever has been said about the 2provision for ta* is also applicable to

2proposed dividends1. >roposed dividends can also be dealt !ith in t!o !ays;

>roposed dividends may be taken current liability since declaration of

dividends by the share holders is simply a formality. 8nce the dividends are

declared in the general meeting, they !ill have to be paid !ithin 9: days of

theirs declaration. $n case proposed dividends is taken as a current liability it,

!ill appear as one of the items decreasing !orking capital in the schedule of

changes in !orking capital. $t !ill not be sho!n as an application of funds

!hen dividend is paid later on.

>roposed dividends may simply be taken as an appropriation of profits. $n

such a case proposed dividend for the current year !ill be added back to

current year(s profit in order to find out funds from operations if such amount

of dividend has already been charged to profits. >ayment of dividend !ill be

sho!n an 2application of funds1.

%ale O) 0u)c-ase Of Fi8e &ssets:-

For arriving at the final figure !e have to prepare the asset account,

depreciation account, assets sold as purchased account. This can be illustrated !ell !ith the

follo!ing e*tracts of the balance sheet.

58

&sset &ccount 20lant &n Mac-ine)$ &ccount3:-

This is maintained at the cost price. The accounts is debited !ith the

cost of the machinery as at the beginning of the year "i.e., balance in the machinery

account at the beginning# and !ith purchases during the year. $t is credited !ith the

cost price of the machinery sold and !ith cost of the machinery as at the close of the

year "i.e., balance in the machinery account at the end#. $n the problems either the

total value of purchases during the year may be missing or the cost of the machinery

sold may be missing. The missing figure can be found out by feeding the account

!ith the available information and balancing it.

De')eciation &ccount:-

%epreciation is not source of funds. 3ource of funds is constituted by

those transactions, !here one account belongs to current category and the other is longs

to non'current category. $n case of depreciation both items belong to non'current

category, as such it does not make any change in the funds and is not a source of funds. $n

support of the ans!er ,ournal entry regarding depreciation is presented here!ith.

>rofit and loss account is a non'current liability and fi*ed assets are

non'current asset. s both of them belong to non'current category, so depreciation is not a

source of funds.

&sset %ol &ccount:-

The purpose of preparing this account is to ascertain the profit or loss

made on sale of the asset. The account is debited !ith the cost of the assets sold "transferred

from the asset account#. $t is credited !ith the accumulated depreciation on the asset sold

"transferred from depreciation account#. $t is also credited !ith the money received on sale of

the machinery. The difference bet!een the t!o sides !ould be profit "if credit balance or loss

"if debit balance#.

58

O/@7CTI(7% OF T*7 %TUD;

To present a theoretical frame!ork relating to funds flo! analysis.

The main ob,ective of the study is to analy+e the financial information of

the Tirumala milk products private limited.

To evaluate the liquidity position of Tirumala milk products private

limited

To understand the operating efficiency of Tirumala milk products private

limited.

To determine the financial status of the company and analy+e them.

58

To make pertinent suggestions for the effective management of funds

flo! analysis of Tirumala milk products private limited.

M7T*ODO"O9; OF T*7 %TUD;

0ethodology is a systematic process of collecting information in order

to analy+e and verifies a phenomenon. The collection of data is t!o principle sources. They

are discussed as

>rimary data

3econdary data

0)ima)$ Data:-

The primary data needed for the study is gathered through intervie!

!ith concerned officers and staff, either individually or collectively, sum of the information

has been verified or supplemented !ith personal observation conducting personal intervie!s

!ith concerned officers of finance department of ATIRUM&"& MI", 0RODUCT%

0RI(&T7 "TDB.

%econa)$ Data:-

58

The secondary data needed for the study !as collected from published

sources such as, pamphlets of annual reports, returns and internal records, reference from te*t

books and ,ournal management.

Fu)t-e) ata neee fo) t-e stu$ .as collecte f)om:'

-ollection of required data from annual records of the company.

5eference from te*t books and ,ournals relating to financial management.

Diag)ammatic Re')esentation of Resea)c- Met-oolog$

Diag)am 2.1

D&T&

%OURC7

%

>rimary

3ources

3econdary

sources

0anagement 5espondents

>ersonal

8bservance

$nside The

-ompany

8ut 3ide the

-ompany

nnual

5eports

Te*t books

Lournals

58

N77D OF T*7 %TUD;

The main need of the study is to analyses the financial information of the

Tirumala 0ilk products private limited.

To find out the liquidity or short term solvency of the Tirumala milk

products private limited.

To kno! the different types of funds flo! analysis and ho! it sho!s

impact on different organi+ations.

To allo! the relationship among various aspects in such a !ay that it

allo!s dra!ing conclusion about the performance, strengths and

!eaknesses of the company.

58

To kno! the short term servicing ability of the company.

%I9NIFIC&NC7 OF T*7 %TUD;

This study is useful to the management, o!ners, investors, government,

employees, suppliers and society.

This study is useful to the research scholars !ho conduct in depth

research.

This study is useful to the similar organi+ation in assessing their financial

performance.

This study provides on insight into the various aspects financial statement

analysis ..ence the company can make the necessary changes in the

policy relating to it.

This study is also useful to competitors to make necessary. 3teps to

improved financial statement analysis.

58

"IMIT&TION% OF T*7 %TUD;

s the time spent on pro,ect is only D !eeks, it is not possible to go into

detail study.

3ince the current year !as not completed it !as not possible to compare

the current year information !ith the previous information.

3ome of the information !as !ith registered office of the company due

to some statutory requirements so it became difficult to get the overall

information of the company.

3ince !e are ne! to the company, company refused to provide its

financial information.

58

The funds flo! contains historical information. This in formation is

useful; but an investor should be concerned more about the present and

future.

The collected information is mainly through secondary data.

INDU%TR; 0ROFI"7

%airying has been of life in $ndia since the ancient times. The modern

diary $ndustry took roots in 6M57 !ith the sale of bottled milk in )ombay from rray milk

colony. The first large scale milk products factory !as started in 6M95 at nand a -o'

operative venture, !ith the assistance of N4$-AF, for the production of milk po!der, table

butter and ghee. These products !ere making from the buffalo milk.

The !orld(s largest development program over undertaken, the

operation flood undertook and gigantic task of upgrading and moderni+ing !ith production,

procurement, processing and marketing !ith the assistance provided by the =orld )ank and

other e*ternal agencies, designed and implemented by the 4ational %iary %evelopment

)oard "4%%)# and the $ndian %iary -orporation. The pro,ect !as launched in Luly, 6ME7. $ts

basic concept compromises the establishment of co'operative structure on nand pattern.

The popular adage 2nothing succeeds like success1 is applicable to the

dairy development in $ndia. $f the country !itnessed the 2green revolution1 leading to self'

reliance in food grains in the si*ties and the seventies, the decades of the eighties and the

nineties !itnessed the 2!hite revolution1. $ndian total milk production is ranked first in the

58

!orld follo!ed by the Nnited 3tates. $nitially dairying !as largely an unorgani+ed activity.

)y and large land holding farmers kept cattle mainly for bullock production. 0ilk !as

essentially a byproduct. The surplus after domestic consumption !as either converted into

conventional products mainly ghee and sold to middle men !ho cater to the needs of the

market.

s $ndia enters an era of economic reforms, agriculture, particularly the

livestock sector, is positioned to be a ma,or gro!th area. The fact that dairying could play a

more constructive role in promoting rural !elfare and reducing poverty is increasingly being

recogni+ed. For e*ample, milk production alone involves more than E7 million producers,

each raising one or t!o co!sGbuffaloes. -o! dung is an important input as organic fertili+er

for crop production and is also !idely used as fuel inn rural areas. -attle also serve as an

insurance cover for the poor households, being sold during times of distress

There !as an increasing demand for milk from the urban areas. There

arose a need for the farmers to increase the production of milk. 3ince the demand in the

urban scenario is rapidly increasing so do the farmers generate the supply< Further the ne!

dairy plant capacity approved under the 0ilk and 0ilk products order "00>8# has

e*ceeded 677 million lGpGd. The ne! capacity !ould surpass the pro,ected rural marketable

surplus of milk by about 97 percent by :775.

*I%TOR;

The origin of dairy farms under public management dates back to 688D

!hen the department of %efense established a fe! dairy farms in that year to supply milk and

milk products to the )ritish troops. The ne*t step !as initiated during the First =orld =ar.

58

$n 6M69, the %epartment of %efense on the advice of the )oard of

griculture advised the ?overnment in 6M6D, to appoint imperial dairy e*pert. The ne*t

important step !as the decision to conduct a census of livestock. The )oard of griculture

carried out the livestock census in 6M6M as a preparatory action for planned dairy

development. $n 6M:7, the imperial e*pert recommended to the ?overnment for the

establishment of a training center to meet the manpo!er requirements for managing the

%efiance %airy Farms. )y this time there !ere three dairy farms and until 6M:C the )ritish

?overnment(s approach to!ards dairying !as confined to milk requirements of the military

only. fter 6M:C, diploma course in dairy !ere started at )angalore.

%r. 4.-. =right, %irector, %airy 5esearch institute, 3cotland !ho !as

invited to $ndia in 6MCD for revie!ing the progress of dairying in the country has made t!o

recommendations: '

$ndustry needs have to be solved by developing o!n technology and technologists in

the country.

$ndia is country of villages, of !hich most inhabitants are small, marginal farmers

and landless laborers. %evelopment should be promoted only on co'operative lines.

$n 6MCE, the &uck no! 0ilk producer(s co'operative Nnion limited !as

established paving the !ay for the organi+ation of such union in districts and state.

$n 6M95, the Famine enquiry commission in its report emphasi+ed the

need for developing fodder supply for increasing milk production and recommended the

adoption of mi*ed farming !ith a place for fodder and crop rotation. s a sequel to this,

under the ?reater )ombay 0ilk 3cheme, milk !as procured from kaira district, ?u,arat by

the private dairy. That gave !ay to the idea of creating an institutional structure for dairying

on co'operative lines.

58

Develo'ments of Inust)$:-

National Dai)$ Develo'ment /oa) 2NDD/3 :'

The ?overnment of $ndia had established the 4ational %airy

%evelopment )oard "4%%)#, an autonomous body headquartered at nand(s -o'operative

in $ndia. $n order to develop dairy in $ndia, 4%%4 dre! plans for /operation flood(.

O'e)ation Floo:-

$n the late si*ties, the board dre! up a pro,ect called 8peration

Flood "8F# I meant to crate a flood of milk in $ndia(s villages !ith funds mobili+ed from

foreign donations. >roducer(s co'operatives, !hich sought to link dairy development !ith

milk marketing, !ere central plank of this pro,ect. The 8peration Flood, !hich started in

6ME7, concludes its third phase in 6MMD and has to its credit these significant results:'

The enormous urban market stimulus has led to sustained.

>roduction increases, raising per capita availability of milk to early :77 grams per

day.

The dependence on commercial imports of milk solids are alone a!ay !ith.

0oderni+ation and e*pansion of the dairy industry and its infrastructure, activating

milk grid.

58

0arketing e*panded to supply hygienic and fair priced milk to some C77 million

consumers in 557 cities and to!ns.

nation!ide net!ork of multi'tier producer(s co'operative, democratic in structure

and professionally managed, has come into e*istence. 0illions of small producers

participate in an economic enterprise and improve the quality of their life and

environment.

%airy equipment manufacture has e*panded to meet most of the industry(s needs

T-)ee 0-ases of Develo'ment

The scheme sought to establish milk produces co'operatives in the

villages and make modern technology available to them. The broad ob,ectives are to increase

milk productions "2a flood of milk1# augment rural incomes and transfer to milk producers

the profits of milk producers the profits of milk, marketing !hich are hitherto en,oyed by

!ell'to'do'middlemen.

0*&%71:-

>hase 6 of 8peration Flood !as financed by the sale !ithin $ndia of skimmed

milk po!der and butter oil gifted by the A- countries via the !orld food program. s

founder'chairman of the 4ational %airy %evelopment )oard "4%%)# of $ndia %r.Ourien

finali+ed the plans and negotiated the details of AA- assistance. .e looked after the

administration of the scheme as found'chairman of the erst!hile $ndian %airy -o'operation,

the pro,ect authority for 8peration Flood. %uring its first phase, the pro,ect aimed at linking

$ndia(s 68 best milk sheds !ith the milk markets of the four metropolitan cities of %elhi,

0umbai, -alcutta and 0adras.

0*&%72:-

58

>hase : of the pro,ect, implemented during 6M86'85 raised this to some 6CD

milk sheds linked to over :M7 urban markets. The seed capital rose from the sale of

=F>GAA- gift products and =orld )ank loan had created, by end 6M85, a self'sustaining

system of 9C,777 village(s co'operatives covering 9.:5 million milk producers. 0ilk po!der

production !ent up from ::,777 tons in the pre pro,ect year to 6, 97,777 tons in 6M8M, thanks

to dairies set up und 8peration Flood. The AAP gifts thus helped to promote self'reliance.

%irect marketing of milk by producer(s co'operatives resulting inn the transfer of profits

from milk contracts increased by several million liters per day.

0*&%73:-

>hase C of 8peration Flood "6M85'6MMD# enabled dairy co'operatives to rapidly

build to the basic up the basic infrastructure required to procure and market more and more

milk daily. Facilities !ere created by the co'operatives to provide better veterinary first'aid

health care services to their producer(s members.

&nan 0atte)n Dia)$ Develo'ment

The information nand pattern of milk co'operative !as launched !ith the

organi+ation of Orishna %istrict -o'operative 0ilk producers Nnion &imited. $n this pattern

the function of diary is milk procurement, processing and marketing are controlled by the

milk producers themselves.

0lanning Investment:-

CC.9C -rores

58

:9E.5C -rores

68E.77 -rores

C9M.77 -rores

66D.77 -rores

D77.77 -rores

Dai)$ Inust)$ in &n-)a 0)aes-:-

The program %airy $ndustry !as mooted !ith commendable

help of the Nnited 4ational $nternational -hildren(s Amergency Fund, Food and griculture

8rgani+ation and Freedom from .unger -ompany campaign organi+ation of the N.O. These

organi+ation insisted a lot of the establishment of the dairy units at .ydria and Pi,aya!ada in

6MDE and 6MDM respectively, !hich lead to pioneer dairy development in ndhra >radesh later

to set cooling and chilling centers have been setup to feed these t!o gigantic units.

The ?overnment of ndhra >radesh started dairy development

corporation to interest of milk producers and ensuring adequate supply of fresh milk at

reasonable price to the urban consumers as .>.%.%.-., come in to the e*istence on :

nd

pril

6ME9. .>.%.%.-., providing employment to nearly :7 employees and organism easy many as

8E dairy units including seven milk factories, 6C district dairies, :: chilling centers, 68

cooling centre and 65 mini cooling centers.

$n addition to that the private units have been contributing their

little mite in the development of dairy industry 0Gs. .industan milk foods that has started a

malted milk product factory in 5a,ahmundry. Further to enhance !orking efficiency and to

58

increase the turnover, the ?overnment has constituted on autonomous dairy development.

-orporation on the recommendation measure the dairy industry improving to!ards massive

milk production and milk collections.

Dai)$ Develo'ment:-

$n 6MD7 pilot milk supply scheme !as started in the state for the dairy

development. $ts initial capacity !as 677 liters a day in the time of starting. 4o! its daily

collection increased to 66 lakhs liters per day. $t is also !orking as alien bet!een milk

producers of the to!ns by providing reasonable price to the producers to maintain stable

market.

&.0. Dia)$ Develo'ment Co-O'e)ative Fee)ation 2&.0.D.D.C.F3:-

.>.%.%.-.F. !as formed in 8ctober,6M86 to implement 8peration

Flood': program through active involvement of producers in organi+ation milk production,

procurements, processing and marketing on 2three'tier1. -o'operative structure as per the

4ational ?overnment of $ndia. The three'tier system consists of primary dairy co'operatives

societies( 6C village level, co'operative unions at district level and federation at state level.

O'e)ation Floo:-

58

$n our state operation flood !as divided in three types

2nand &evel1.

Pillage &evel ' %.-.3.

%istrict &evel ' 0.>.-.P.

3tate &evel ' .>.%.%.-.

O'e)ation Floo 0)og)amme):-

$ndian diary %evelopment -orporation o!n the responsibility of

implementation of operation flood programs, !hich provides money assistance, put E7 ;

to!ards loans and C7 ; as subsidy. 4ational %iary %evelopment -orporation selected

district of the 3tate for implementation of operation fold.

Develo'ment of Dai)$ in Nineties:-

The momentum gained in the dairy through co'operatives during the

last :7 years !ill no! take $ndia into nineties as ma,or dairying country of the !orld. The

country(s milk production in the early si*ties !hich !as about :7 million tons has touched a

record of 5D million tons. $t is likely to reach about 87 million tons by :777 %. $ndia !hich

one time !as dependant on other countries for products such as milk po!der, table butter and

cheese has no! become self sufficient. $t has even started e*porting some of them in small

quantities simultaneously efforts are made to e*pand milk procurement, processing and

marketing to meet the gro!ing demand for milk products.

58

9)o.t- of t-e Inust)$:-

)efore the independence of $ndia, in the first half of the :7

th

century

dairying in the country !as largely unorgani+ed. Fluid milk and its products !ere generally

not easily marketable commodities and there !as no transport of these products to far

distances. 8rgani+ed dairying, as !ell understood in the !est started in a small !ay !hen

military dairy farms and creameries !ere established to!ards the end of the :7th century to

meet the demands of the armed forces and their hospitals. 3ome private dairies, such as

Oaveters and poisonsQ !ith encouraged making pasteuri+ed butter, primarily for the use of the

)ritish army. s a result the imperial institute of animal .usbandry and dairying !as

established in 6M:C at )angalore. There has been another ma,or effort in the early 6M97Qs

!here milk produced in rural areas of kaira district !as collected in bulk >asteuri+ed and

transported by distributing in )ombay by B the )ombay milk schemeB operated by the

)ombay municipality. =hen $ndia become independent in 6M9E, one of the ma,or milk

schemes to be included the country !as Bthe ?reater )ombay milk scheme "?)03#B.

Mil6 %-es=Unions:-

8peration flood programmer has been identified into milk shedsGunions.

T&/"7 3.1

NO MI", %*7D% = UNION% DI%TRICT%

6 Pisakha 3rikakulam, Pi+ianagaram, Pi+ag

: ?odavari Aast and =est ?odavari

C T$5N0& T$5N0&

9 ?untur'>rakasam ?untur'>rakasam

5 -hittoor -hittoor

D -uddapha -uddapah

E Ournool Ournool

8 4algonda'5anga 5eddy 4algonda'5anga 5eddy

M 0edak'4i+amabad 0edak'4i+amabad

58

COM0&N; 0ROFI"7

T$5N0& 0$&O >58%N-T3 >rivate &imited is a professionally managed

company engaged in the manufacture of a !ide range of %airy >roducts !hich include 0ilk

in 3achets, 3!eets, Flavored 0ilk, -urd in -ups and 3achets, 0ilk >o!der, )utter, ?hee and

)utter 8il both in bulk as !ell as in consumer packs...

Astablished in 6MM8, T$5N0& 0$&O >58%N-T3 "># &td. is one of the

fastest gro!ing >rivate 3ector Anterprises in $ndia !ith a team of dedicated professionals.

The company has one of the most modern and versatile plants in the $ndian %airy $ndustry

!ith state'of'the'art technology. T$5N0& 0$&O >58%N-T3 "># &td. >roducts meet

stringent quality control tests and cater to the premium segment of the market for %airy

>roducts. T$5N0& 0$&O >58%N-T3 "># &td. is presently implementing an e*pansion

programme and proposes to launch ne! products in the near future.

>resently T$5N0& 0$&O >58%N-T3 market presence in ndhra

>radesh, Oarnataka and Tamil 4adu. $t handle 6C &akh liters of milk per day in packing

stations and dairy plant, !hich is the single largest plant in the state of ndhra >radesh. $ts

5egistered 8ffice is located at 4arasarao>et, ?utur %ist and -orporate 8ffice is located at

Oavurihills, .yderabad.

58

T$5N0& 0$&O >58%N-T3 "># &td. sells a rich, varied offering of

nutritious, tasty and healthy food products under !ell'kno!n brand. Taste, health,

convenience, reliability and vitality for consumers are key characteristics. 0ilk comes from

cattle herd that receive the best care along !ith healthy and nutritious diet in the form of

quality feed to ensure that they produce !holesome, high'quality milk. The ma,or

contributors to the success of T$5N0& 0$&O >58%N-T3 "># &td. are:'

Mil6 0)ocu)ement Net.o)6

%u'e)io) sales an ma)6eting ')o.ess

%t)ategic tec-nological C inf)ast)uctu)al avantage

7fficient -uman investments

/)ief Int)ouction a1out Com'an$:-

=e have established a dairy unit named Tirumala 0ilk products "># &imited, at

Oadivedu Pillage, -hillakur 0andal, 4ellore %istrict, ndhra >radesh and commissionered

for commercial production for mareting during sepetember 6MMM to handle :,:5,777 litres of

milk per day. The plant is located on -alcutta'-hennai 4ational .igh !ay, Mkms from ?udur

to!n to!ards -hennai, in an are of 6C.77 acres.

Ince'tion

(ision

Mission

0olicies

1. Ince'tion:-

The unit is registered under 3.3.$. The milk is bulk is being purchased from

other dairies processed, homogeni+ed, packed and marketed mainly in -hennai, )angalore

58

and 0ysore cites. The milk is being also sold in ?uduru, Tirupathi and 4ellore to!ns basing

on consumers( demand. )y marketing the milk in various to!ns, assured market. 8ut let is

provided to large number of village milk producers for their surplus are applied before

machinery is installed in the dairy. 3trict quality standards are applied before marketing the

milk for !hich !ell equipped laboratory is established. $n order to deliver quality milk to the

consumers insulted trucks are used to transport milk from the dairy to various destinations.

2. (ision:-

Tirumala 0ilk >roducts "># &imited is a dream come true to the dynamic

young entrepreneurs !ho have ,ointly effected to convert their skills, kno!ledge and

e*perience in the field of processing and producing milk and milk products.

5eali+ing the 0ilk >roduct >otentialities of the inversion track of the

?overnment of ndhra >radesh and ?overnment of $ndia, !ith self managed financial

resources and established the Tirumala %airy in the year 6MM5 at 4arasaraopet, ?untur

%istrict and erected ne! plant at Oadivedu in the year 6MMM. Today, the dairy has pods to

equate ma,or dairies into eh southern region !hich has not only captured the market but also

has mode 2Tirumala1 an accepted )rand and preference of the consumers.

3. Mission:-

Tirumala 0ilk >roduct "># &imited is a dream come true to the dynamic young

entrepreneurs !ho have ,ointly afforded to convert their skills, kno!ledge and e*perience in

the field of processing and producing milk products.

!. 0olicies:-

58

5eali+ing the milk product potentialities of the inversion track of the

?overnment of ndhra >radesh and ?overnment of $ndia, !ith self managed financial

resources and established the Tirumala %airy in the year 6MM5, at 4arasaraopet %istrict,

?untur and erected ne! plant at Oadivedu in the year 6MMM. Today, the dairy has posed to

equate ma,or dairies in the southern region !hich has not only captured the market but also

has mode 2T$5N0&1 an accepted )rand and preference of the consumers.

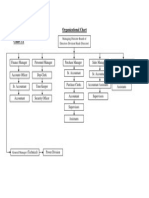

O)gani+ation C-a)t:-

T$5N0& 0$&O >58%N-T3 "># &td. has a seasoned )oard

of %irectors !ith a collective blend of visionary leadership, consumer marketing e*pertise

and technological pro!ess.

Diag)am 3.1

58

/./)a-ma Naiu - Managing Di)ecto)

D./)a-mananam - @oint Managing Di)ecto)

/.Nages.a)a Rao - Di)ecto)

D). N.(en6ata Rao - Di)ecto)

7.N.Rao - 78ecutive Di)ecto)

R. s)inivasa Rao - 9ene)al Manage)

C-. Malli6a)?una Rao - Financial Manage)

&)eas of O'e)ation:-

Tirumala distributes milk to various parts of Tamil 4adu, ndhra >radesh, and

Oarnataka. ?udur is the main source for delivering milk and milk products to -hennai and

other ma,or parts of Tamil 4adu. The procurement and processing section located at

>asupattur village of -hitoor district in ndhra >radesh is the source of milk, curd and

products !hich are supplied in )angalore and 0ysore 0arkets. The packing station located

at Pellacheruvu, :7 O0 a!ay from 5egistered 8ffice and plant at 3ingavaram =est

?odavari %istrict, =adiyaram in 0edak %istrict and ?unagal in 5angareddy %istrict supplie

milk curd and other products to ma,or markets of ndhara >radesh !hich includes

58

.yderabad, Pi,aya!ada, ?untur, 5a,amandry, Oakinada, Pisakhapatnam, 0ahabubnagar and

Oarim 4agar. 3kim 0ilk >o!der, )utter and )utter oil produced at ?udur plant are supplied

to ma,or $ndustrial and $nstitutional customers located across $ndia.

Ce)tificates an &.a)s:-

$n recognition of its efforts and achievements in the dairy foods industry, and in

ackno!ledgment of all the challenges surmounted, T$5N0& 0$&O >58%N-T3

"># &td. has !on many a!ards and certificates.

0ore enduring than any public recognition for our contributions is the satisfaction !e

en,oy by creating a superior product and giving back to our communities.

T$5N0& 0$&O >58%N-T3 "># &td. is an $38 M776::777 and an $38 :777:

:775 certified company. The dairy is follo!ing @uality 0anagement 3ystem and

Food 3afety 3tandards.

part from $38 certification, $t has -ertificate from 3?3 on 30> nalysis too.

T$5N0& 0$&O >58%N-T3 "># &td. has $3$ &icence, gmark &icence and

adheres to all other statutory standards as per requirements.

0)oucts:-

58

T$5N0& 0$&O >58%N-T3 "># &td. covers the entire spectrum of dairy

products sold in markets. The complete ranges of T$5N0& 0$&O >58%N-T3 "># &td.

are highly nutritious, healthy and bring you a !orld of goodness.

T$5N0& 0$&O >58%N-T3 "># &td. pasteuri+es and packages all fresh

dairy products in technologically superior and hygienic conditions to ensure pure natural

freshness.

T$5N0& 0$&O >58%N-T3 "># &td. .andles D.5 &akhs liters of milk per

day in all their packing 3tations and main dairy plant !hich is the highest in the state of

ndhra >radesh.

Ti)umala Mil6 0)oucts 203 "t. *anles Mil6 in t-e Follo.ing "ocations

Ta1le 3.2

0acing "ocations *anling Ca'acit$ 'e) a$

?udur

9.7 &akh litres

Pellala -heruvu

:.7 &akh litres

)himadolu

6.7 &akh litres

>alamaner

:.7 &akh litres

?ungal

9.7 &akh litres

0)ocu)ement of Mil6:-

58

T$5N0& 0$&O >58%N-T3 "># &td. established :5 -hilling centers in

ndhra >radesh and 8 chilling centers in Tamilnadu to procure both -o! F )uffalo milk.

)est quality milk is procured and chilled at chilling centers, to retain freshness of milk. The

strength of the T$5N0& 0$&O >58%N-T3 "># &td. is to procure more than D.7 lakh

liters of milk directly from agentsGfarmers using state'of'the'art machinery and professionally

trained staff.

0)ouction:-

T$5N0& 0$&O >58%N-T3 "># &td. has its main dairy plant at Oadivedu !ith

handling capacity of 9.7 lakhs lts of milk per day from various chilling centers and

local units.

0ain plant processes C.7 &akhs &ts of milk per day in automatic sachet filling

machines for supply and distribution to -hennai, Tirupati, 4ellore, etcR in insulated

puffs.

There is continuous gro!th in sale of milk from 57777 ltrs to C57777 ltr !ith in a

span of one'decade.

T$5N0& 0$&O >58%N-T3 "># &td. has its o!n supply chain management,

!hich is the key to timely distribution.

t >alamaner unit processes and supplies 6.77 lakh liters of milk and :7777 liters of

curd to )angalore city.

Pellalacheruvu F )himadolu packing stations processes and supplies :.7 lakh liters

of milk to Pi,aya!ada., ?untur , Aluru, Pisakhapatnam, Oakinada and 5a,ahmundry.

=adiyaram plant has capacity of 57777 &iters milk to cater to the markets of 0edak,

4i+ambad, dilabad and Oarim 4agar %istricts of .>

58

/utte): '

$s made from pure co! F )uffalo fat under hygienically processed through

continuous butter making machine.

9-ee :'

$s made from pure co! F )uffalo butter under supervision C7 years

granulation, colour and aroma of ghee !ith a capacity of 8 tonnes per day. ?hee is packed in

a !ide range of E ml to 65 Ogs.

Mil6 0o.e) :'

$s made from fresh co! F buffalo milk, plant is capable of marketing all type

of milk po!ders !ith a capacity of 65 tonnes per day.

/$-0)oucts :'

Flavored 0ilk,

&assi, Ohava,

0ilk -ake,

0ysore pak,

>anner,

58

$ce -ream,

-urd,

)uttermilk.

/alance %-eet:-

)alance sheet is the most significant financial statement. $t

indicates the financial condition or the state of affairs of a business at a

particular moment of time. 0ore specifically, /balance sheet contains

information about resources and obligations of a business entity and about its

o!ners( interests( in the business at a particular pint of time. Thus, the balance

sheet of a firm prepared on 0arch C6, :76C reveals the firm(s financial position

on this specific date. $n the language of accounting, balance sheet

communicates information about assets, liabilities and o!ner(s equity for a

business firm as on a specific date. $t provides a snapshot of the financial

position of the firm at the close of the firm(s accounting period.

58

%c-.no &s on 31-D3-2DDE

$.%OURC7 OF FUND%:-

6# 3hare holders fund

:#5eserves and surplus

C#3ecured loans

9#Nn'secured loans

$$. &00"IC&TION OF FUND%:-

13Fi8e assets:-

?ross block

&ess: deprecation

-apital !ork'in'progress

23Investments

33Cu))ent &ssets:-

$nventory

3undry debtors

%eposits

-ash and bank balances

&oans, advances and prepaid e*penses

6

:

C

9

5

D

E

8

M

67

:C757777.77

985EM68M.77

68CC:DD68.77

7.77

:59M5587E.77

6989DEDD7.77

D78CM978.77

8ED:8:5:.77

9CE568CC.77

6C6C87785.77

:D67777.77

67M7E569E.77

DC5866C.77

9C:6D57.77

:DCDE9CC.77

:5CDE99M.77

6E698MEM:.77

58

"ess: cu))ent lia1ilities an ')ovisions:

-urrent liabilities

>rovisions for e*penses

N7T CURR7NT &%%7T%

9# 0isc.A*pencess to the e*tent not !ritten off

66

6:

9C9M:::6.77

E78E69M.77

575EMCE7.77

6:7M679::.77

55C77.77

:59M5587E.77

/alance s-eet of Ti)umala Mil6 0)oucts 0)ivate "imite &s on

31-D3-2DDE

Ta1le !.1

%c-.no &s on 31-D3-2DDF

$.%OURC7 OF FUND%:-

6# 3hare holders fund

:#5eserves and surplus

C#3ecured loans

9#Nn'secured loans

$$. &00"IC&TION OF FUND%:-

13Fi8e assets:-

?ross block

&ess: deprecation

-apital !ork'in'progress

6

:

C

9

:C757777.77

D95658CM.M5

679:5D978.7D

8759CM99.77

:E:CDD6M:.76

:9C955589.8C

M75M88:8.6D

65:85DE5D.DE

M95C6CE.C7

6D:C7M8MC.ME

58

23Investments

33Cu))ent &ssets:-

$nventory

3undry debtors

%eposits

-ash and bank balances

&oans, advances and prepaid e*penses

"ess: cu))ent lia1ilities an ')ovisions:

-urrent liabilities

>rovisions for e*penses

N7T CURR7NT &%%7T%

9# 0isc.A*pencess to the e*tent not !ritten off

5

D

E

8

M

67

66

6:

:D67777.77

677ED785D.77

D8999C:.7:

EC9ED9C.77

C88C8976.MD

:::8965E.E8

6ED7E59M7.ED

D7:MM:89.ED

8C9MM7E.MD

D8D9M6M:.E:

67E9:D:M8.79

:7777.77

:E:CDD6M:.76

/alance s-eet of Ti)umala Mil6 0)oucts 0)ivate "imite &s on

31-D3-2DDF

Ta1le !.2

/alance s-eet of Ti)umala Mil6 0)oucts 0)ivate "imite &s on

31-D3-2D1D

%c-.no &s on 31-D3-2D1D

$.%OURC7 OF FUND%:-

6# 3hare holders fund

:#5eserves and surplus

C#3ecured loans

$$. &00"IC&TION OF FUND%:-

13Fi8e assets:-

?ross block

&ess: deprecation

6

:

C