Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Gulf&Careers

Caricato da

JackHawk57Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Gulf&Careers

Caricato da

JackHawk57Copyright:

Formati disponibili

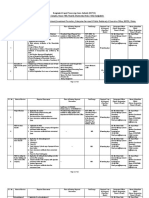

Employment & NRI Times

5

FRIDAY

August 29 - September 4, 2014

E

M

P

L

O

Y

M

E

N

T

&

N

R

I

T

I

M

E

S

EMPLOYMENT & NRI TIMES

E

M

P

L

O

Y

M

E

N

T

&

N

R

I

T

I

M

E

S

Read

Employment & NRI Times

WANT

ABROAD

NEW JOB

PUBLISHED EVERY FRIDAY

www.enritimes.com

E

mployees with a monthly salary

of over Rs 15,000 in their first

jobs would no longer be able to

contribute to the Employees Pension

Scheme (EPS) run by the provident

fund department.

The step is triggered by fears that

the hike in the salary ceiling for stat-

utory PF contributions to Rs 15,000

per month from Rs 6,500 per month,

would have a major adverse impact on

the Pension schemes financial viabil-

ity. According to the pension schemes

latest valuation, its unfunded liabil-

ity or deficit has shrunk by around Rs

51,000 crore from around Rs 62,000

crore in 2009 to around Rs 10,900 crore

in 2012. The schemes entry norms are

being tweaked to ensure that high-in-

come workers do not abuse the benefits

of a deficit-ridden scheme that enjoys a

subsidy from the central government.

The finance ministry has called for a

fresh valuation to assess the impact of

Union Minister for Food Processing Harsimrat Kaur Badal with CEO of

PepsiCo Indra Nooyi in New Delhi.

First salary cap of Rs 15,000 for EPS

the hike in the salary ceiling on PF con-

tributions and calibrating the schemes

benefits on the basis of a fresh valua-

tion. The last time the salary ceiling

was hiked, in 2001, from Rs 5,000 per

month to the present Rs 6,500 cap, the

pension schemes liabilities had jumped

by Rs 10,000 crore. Over 8.5 crore for-

mal sector employees have a Provident

Fund account, where 24pc of their sala-

ries is diverted to guarantee a lump

sum retirement nest-egg and a monthly

pension through the EPS. A little over

a third of this contribution (8.33pc of

salary) is parked in the EPS that was

launched in 1995 and is the only pen-

sion scheme in the world that defines

both contributions and benefits.

The government currently brings in

around Rs 1,200 crore a year into the

nearly Rs 2 lakh crore pension scheme,

contributing 1.16pc of every scheme

members salary up to the salary ceil-

ing. Less than 21pc of the schemes

beneficiaries get a monthly pension of

Rs 1,000 or more, with over a third get-

ting less than Rs 500. The government

has okayed a minimum pension under

the scheme to Rs 1,000 along with the

hike in the salary ceiling for statutory

PF contributions, but the finance min-

istry has set some stiff riders and con-

ditions before concurring.

The major changes being simultane-

ously introduced are designed to keep

out high income workers from availing

the pension scheme that currently of-

fers a pension linked to the salary paid

in their last 12 months in service.

Most importantly, the membership

of EPS is being restricted to persons

whose salary at the time of joining ser-

vice was less than Rs 15,000, the PF de-

partment has informed its board mem-

bers. If someones salary moves beyond

Rs 15,000 a month during the course of

their career, EPS contributions would

still be restricted to 8.33pc of Rs 15,000.

F

or all the premia one pays

throughout the term of a life in-

surance policy, the most crucial

responsibility is to ensure who will be

the beneficiary of the monetary relief

upon the death of the policyholder.

Considering that the purpose of

life insurance is primarily to provide

the benefit to the family of the policy-

holder after his death, it is crucial that

the details regarding the nominee are

clearly stated in the proposal form.

Serving as an instruction for the

insurer, a nomination simply clarifies

who the claim amount should be paid

to, in the unfortunate event of the poli-

cyholders death. In select cases, there

may be a possibility that in the absence

of a nomination, the policyholders fam-

ily members have to go through a lot

of hassles. Usually, the insurer would

call for a succession certificate or title-

holder from the claimant, which is is-

sued by the court of law. In most cases,

getting this certificate is a cumbersome

procedure, which can be avoided sim-

ply by taking care of it during the pro-

posal stage.

In the simplest of terms, a nominee

is the person proposed by the policy-

holder for receiving the claim amount

of the life insurance policy, upon his/

her death. It is important that the nom-

inee should have an insurable interest

in the life of the insured. Thus, insur-

ers insist on full details of the nominee

Significance of nomination

in life insurance cover

and relationship with the policyholder,

which needs to be mentioned clearly in

the proposal form.

An important rule of nomination is

that your nominee has to be a legal heir

or the nomination will not be valid.

This implies that the proceeds from the

insurance policy do not belong to the

nominee and he/she is only a custo-

dian of the same. The family members

who are eligible for nomination, as per

Indian Personal Law are ones parents,

spouse and children. While filling in

the nomination, you must give specific

names and particulars of your wife/

children/parents and refrain from men-

tioning them only as a category.

Minor nominee

In case the nominee is a minor, the

insured is required to appoint a custo-

dian to whom the claim amount would

be given till the appointed nominee

turns 18. You would need to mention

your childs date of birth; the name of

his/her natural guardian and the nature

of the relationship with the guardian

will also have to be specified. In some

cases, there can be a variance between

the nomination and will. In case you

have a will in which you have specified

the beneficiary of your insurance pro-

ceeds, the will takes precedence over

any nomination that might have been

made. A nomination is not a mode of

making an inheritance.

For better understanding, a nomina-

tion is like telling the company When

I die, please call person X and tell him

to collect the policy money from you.

Creating a will, on the other hand, is

saying that This asset should finally go

to person Y. Here person X and Y can

be same or different, as you choose.

If the nominee dies?

* Inform the nominee or any other

member of your family about the poli-

cy and the nomination so that they can

make the best use of the sum assured

in your absence. * In the unfortunate

event of the nominees death during

the term of the policy, it is important

that a new nominee is appointed. This

needs to be done by informing the in-

surer of the alternate/new nominee.

* A situation of multiple nominees is

normally a complicated one and could

end up as a legal dispute too. Since the

insurer would prefer to hand over the

entire claim amount to only one of the

nominees on getting consent from oth-

er nominees for doing so, the dispute

could come in terms of submission of

such consent among the various nomi-

nees. *n In case there is more than

one legal heir, the insurer will call for

a joint discharge statement, waiver of

legal evidence and an indemnity bond.

These documents safeguard the insur-

ers interest, in case of any dispute on

settlement of the claim.

Is NRO account taxable ?

What are the tax implications of open-

ing and maintaining a non-resident

ordinary (NRO) account?

Interest earned from deposits in

NRO account is taxable in India. Fur-

ther, such an amount would be subject

to tax deduction at source in India.

Nevertheless, you may be eligible to

claim any benefits that may be avail-

able under the Double Taxation Avoid-

ance Agreement (DTAA) which India

might have entered into with the coun-

try of which you are a tax resident. You

may consult your tax adviser for fur-

ther guidance.

What are the consequences of an NRI

not filing return of income?

Any person who is required to file

return of income but has not done so

would be subject to the following con-

sequences: -Pay interest at the rate of

one per cent for every month or part

of a month starting from the date im-

mediately following the due date and

ending on the date of filing the return

of income or where the return is not

furnished, ending on the date of com-

pletion of assessment. Interest would

be payable on the amount of tax on the

total income that is due after giving

credit to advance tax, tax deducted at

source, relief (if any) under the appli-

cable DTAA and so on, losses (if any)

will cease and the NRI will not be able

to carry forward and set-off such losses;

Penalty for concealment of particulars

of ones income which may extend up

to three times the tax sought to be evad-

ed; Penalty of Rs.5,000 for not filing the

return of income by end of the relevant

assessment year and if the failure to file

the return of income is willful, then the

assessee could be punished in the fol-

lowing ways: a) In case the tax sought

to be evaded exceeds Rs.25,000, with

rigorous imprisonment for a term not

less than six months but which may

extend to seven years and with fine; b)

In any other case, with imprisonment

N

ew Zealand has emerged as a popular destination for Indian students.

There was an increase of 83 pc in the number of student visas issued to

Indians between January and July this year compared with the same pe-

riod last year, New Zealand High Commissioner to India Grahame Morton said.

According to latest figures released by the state-run Education New Zealand

(ENZ) department, first-time student visas issued to Indians for studying in that

country shot up by a staggering 123pc in 2014. New Zealands economic future

is very much linked to our key relationships. India is a major export market for

New Zealand and is one of the fastest growing large economies in the world,

Morton remarked. In 2013, about 11,984 Indian students were studying in New

Zealand, representing a 12pc chunk of the international student population in

that country. This year, the first-time student visas shot up by 123pc or 4,195 be-

tween January and July while the total student visas (first timers and renewals)

increased by 83pc compared with the same period last year. In the past 10 years,

there has been a 700pc increase in Indian students preferring to pursue academ-

ics in New Zealand. Management and commerce (38pc ) were the top favourites

among Indian students, followed by IT (15pc), engineering and health (10pc).

ENZ regional director Ziena Jalil said education fairs would be held in Indian cit-

ies. Immigration New Zealand area manager Nathanael Mackay said the country

has made changes to its work rights programme which permit more international

students to earn and learn. Besides, there are a range of scholarships for people

interested in studying there, including the recently-announced New Zealand-

India Sports Scholarships.

for a term which shall not be less than

three months but which may extend to

two years and with fine. However, if

the return is furnished before the ex-

piry of the assessment year or the tax

payable does not exceed Rs.3,000, then

the person will not be subject to the

prosecution provisions.

T

ata AIG General Insurance Com-

pany has launched three new

health insurance products--Me-

diPlus, MediSenior and MediRaksha.

While MediPlus is a smart and af-

fordable top-up health policy, MediS-

enior is a health cover for senior cus-

tomers ( above 60) and MediRaksha is

a basic medical insurance plan aimed

at residents in the semi-urban and ru-

ral locations and for the

economically backward sec-

tions. With the ever-rising

costs of healthcare services

and rising inflation, senior

citizens are grappling to

keep up with basic medical

expenses.

These new plans are

a comprehensive offering

with a unique set of features

that distinguishes itself from the exist-

ing gamut of health insurance products

currently available for all, Tata AIG

General Insurance CEO KK Mishra re-

vealed.

With empathy and trust being the

hallmark of the company, we will con-

tinue to provide world class services in

health and mediclaim space, he added.

Tata AIG launches unique health policies

The policy offers a waiver of deduct-

ible feature, which allows the customer

to migrate to the private sector general

insurers full-fledged indemnity-based

health insurance policy (without any

deductible) for an insured sum of Rs

5 lakh during his/her retirement years

between 58 and 60.

This feature is available to all cus-

tomers who hold/held a medical policy

from the company before

the age of 50. The entry age

for MediSenior is 61 years

and there is no restriction

on the maximum age at en-

try. MediSenior provides

comprehensive coverage

against in-patient hospitali-

sation, pre- and post- hos-

pitalisation, daycare pro-

cedures, domiciliary and

organ donor expenses, emergency am-

bulance.

Policy holders can use the cash-

less claim settlement across an exten-

sive network of hospitals, Mishra said.

MediRaksha, is a cover specifically de-

signed for tier two and three markets

or for those who fall under the lower

income class of society.

S

howering accolades on the tech-

nology prowess and start-up eco-

system prevalent in Bangalore,

British Deputy Prime Minister Nick

Clegg inaugurated the UK India Business

Councils (UKIBC) Bangalore centre.

This centre will be an invaluable

resource for any UK company looking

to realise their full potential in this in-

credible market. It will bring together

the very best expertise and business

support under one roof, he said. Clegg

praised the Indian voters who brought

about a regime change in the country

with their aspiration for change. It

is a recipe for change. Besides having

long historical ties, UK is currently the

largest investor among the G20 coun-

tries, he said. Joining hands of these

two great countries will bring out path-

breaking products and services for bil-

lions of people, he said.

The centre will deliver a range of ser-

vices and policy advice to build trade

and investment ties between the UK

UK Dy PM opens UKIBC centre

and South India. It will assist UK com-

panies to connect with local businesses

keen to work with British companies.

Besides providing support, advice and

networking for UK businesses across

sectors, UKIBCs Bangalore centre will

impart focus on tech-rich sectors.

The UKIBC Bangalore centre will

also host TechHub, the UK headquar-

tered international startup network,

which will give a unique co-working en-

vironment to catalyse technology start-

ups. Addressing the gathering, TechHub

Global Project Director Andrew Tibbitts

said: Our mission is to bridge the phys-

ical distance between each TechHub

and give our start-up members and cor-

porate partners access to the brightest

minds and ideas in the field.

If a company isnt taking advantage

of the Indian market, theyre missing

out on one of the largest emerging tech-

nology markets in the world and the

incredible R&D experience and innova-

tion possibilities it affords, he said.

NZ popular with Indian students

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- List of Pending Material RequestDocumento2 pagineList of Pending Material RequestJackHawk57Nessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Seder Group-Sk660 Skid Only-40Documento2 pagineSeder Group-Sk660 Skid Only-40JackHawk57Nessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Quotation - TyresDocumento1 paginaQuotation - TyresJackHawk57Nessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- c15 Tech Doc 06 PC Motherboard TechnologyDocumento0 paginec15 Tech Doc 06 PC Motherboard TechnologyJackHawk57Nessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Ubuntu Command Reference Cheat SheetDocumento1 paginaUbuntu Command Reference Cheat Sheetv155r100% (22)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- App3 Flexographic Ink Formulations and StructuresDocumento58 pagineApp3 Flexographic Ink Formulations and StructuresMilos Papic100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Multiculturalism, Crime, and Criminal Justice PDFDocumento449 pagineMulticulturalism, Crime, and Criminal Justice PDFJames Keyes Jr.100% (2)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Berlin Briefing 1 - Debating at The WUDC Berlin 2013 PDFDocumento9 pagineBerlin Briefing 1 - Debating at The WUDC Berlin 2013 PDFChaitanya PooniaNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Cda Change Name Locality enDocumento2 pagineCda Change Name Locality enBiñan Metropolitan ChorusNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- National Law Institute University, Bhopal: Enforceability of Share Transfer RestrictionsDocumento13 pagineNational Law Institute University, Bhopal: Enforceability of Share Transfer RestrictionsDeepak KaneriyaNessuna valutazione finora

- Letter From SMEIA To British PMDocumento4 pagineLetter From SMEIA To British PMpandersonpllcNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- RAILROAD Joint Petition For Rulemaking To Modernize Annual Revenue Adequacy DeterminationsDocumento182 pagineRAILROAD Joint Petition For Rulemaking To Modernize Annual Revenue Adequacy DeterminationsStar News Digital MediaNessuna valutazione finora

- Cbo Score of The Aca - FinalDocumento364 pagineCbo Score of The Aca - FinalruttegurNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Britannia: Business Conduct (COBC) For Its Employees. This Handbook Covers The CodeDocumento17 pagineBritannia: Business Conduct (COBC) For Its Employees. This Handbook Covers The CodevkvarshakNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Whole IBS ManualDocumento105 pagineWhole IBS ManualBenalin C R100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Napoleon The ManDocumento6 pagineNapoleon The Manlansmeys1498Nessuna valutazione finora

- ASME B16-48 - Edtn - 2005Documento50 pagineASME B16-48 - Edtn - 2005eceavcmNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Durkheim's Division of Labor in SocietyDocumento22 pagineDurkheim's Division of Labor in SocietyJeorge M. Dela CruzNessuna valutazione finora

- IPRA Case DigestDocumento14 pagineIPRA Case DigestElden ClaireNessuna valutazione finora

- Barangay ProfilesDocumento3 pagineBarangay ProfilesMello Jane Garcia DedosinNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Transaction Date Value Date Cheque Number/ Transaction Number Description Debit Credit Running BalanceDocumento2 pagineTransaction Date Value Date Cheque Number/ Transaction Number Description Debit Credit Running Balancesylvereye07Nessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Sermon Guide: Jesus: The Chief CupbearerDocumento16 pagineSermon Guide: Jesus: The Chief CupbearerRahul JOshiNessuna valutazione finora

- RAWLINGS (TRAWLING) LIMITED - Company Accounts From Level BusinessDocumento7 pagineRAWLINGS (TRAWLING) LIMITED - Company Accounts From Level BusinessLevel BusinessNessuna valutazione finora

- ObiascoDocumento6 pagineObiascoHoney BiNessuna valutazione finora

- Navarro v. SolidumDocumento6 pagineNavarro v. SolidumJackelyn GremioNessuna valutazione finora

- Core ScientificDocumento8 pagineCore ScientificRob PortNessuna valutazione finora

- ACCTG 1 Week 4 - Recording Business TransactionsDocumento17 pagineACCTG 1 Week 4 - Recording Business TransactionsReygie FabrigaNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Brokenshire College: Form C. Informed Consent Assessment FormDocumento2 pagineBrokenshire College: Form C. Informed Consent Assessment Formgeng gengNessuna valutazione finora

- 09 10 CalendarDocumento1 pagina09 10 CalendardhdyerNessuna valutazione finora

- Bangladesh Export Processing Zones AuthorityDocumento16 pagineBangladesh Export Processing Zones AuthoritySohel Rana SumonNessuna valutazione finora

- The Seven Ignored Messages of JesusDocumento4 pagineThe Seven Ignored Messages of JesusBarry OpsethNessuna valutazione finora

- Free Pattern Easy Animal CoasterDocumento4 pagineFree Pattern Easy Animal CoasterAdrielly Otto100% (2)

- PTC Mathcad Prime Installation and Administration GuideDocumento60 paginePTC Mathcad Prime Installation and Administration GuideHector Ariel HNNessuna valutazione finora

- TM ApplicationDocumento2 pagineTM Applicationlalitkaushik0317Nessuna valutazione finora

- Minimum Wages ActDocumento31 pagineMinimum Wages ActanithaNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)