Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

BSE Shariah

Caricato da

activedeenCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

BSE Shariah

Caricato da

activedeenCopyright:

Formati disponibili

Research Article

December

2012

Mohd.Rizwan Page 5

I nternational J ournal of

Emerging Research in Management &Technology

I SSN: 2278-9359

A Study of the Movement of BSE-TASIS Shariah 50 Index in

accordance with Sensex

Dr.Anuj Kumar Tyagi, Mohd.Rizwan

SSIM,Moradabad,India,

MTU Noida, India

Abstract:

Shariah (I slamic Law) does not permit Muslims to invest in companies that derive significant benefits from interest

since usury is considered sinful under I slamic faith. Companies should not derive benefits from sale of products

deemed harmful like alcohol, tobacco and weapons. This is the underlying principle why a separate index of equities

called the Shariah I ndex was formed to tap the ever increasing I slamic investors in businesses across the world. The

aim is to enable the I slamic financial world to invest in Shariah-friendly businesses across the world. The authors

have reviewed the set norms. Historical data of the Bombay Stock Exchange is used to compare the movement of

Shariah I ndex with Sensex. Based on the empirical results and analytical arguments the study suggests the ethical

investor to invest in the companies of Shariah I ndex to earn the equivalent gain like others.

Keywords: Sensex; Shariah I ndex; I nvestor; Closing of I ndex; Opening of I ndex

I Introduction

The preferred Islamic investment format is equity. However equity comes along with ownership. Hence Islamic investors

have to ensure that the selected companys business and financial activities are not repugnant to Shariah norms. Due to

the exigencies of modern business and particularly the pervasiveness of interest based transactions, Shariah scholars have

arrived at minimum compliance criteria which, while excluding companies in gross violation, also provide investors with

a reasonably wide choice of Shariah-compliant equities. These minimum guidelines, however, are not uniformly applied

by all Shariah advisors. Investors seeking strict adherence to Islamic canonical law should therefore seek to use financial

products that utilize an advisor with as thorough and conservative an approach as possible. Owing to the strong economic

growth achieved by India in recent years there is an increasing interest from investors, especially those from countries

with large Islamic population, in Shariah compliant investment options in India. To help such investors track listed

Shariah compliant companies and their performance, BSE & TASIS have joined hands to launch BSE-TASIS Shariah 50

Index on Dec 27, 2010. The Bombay Stock Exchange has launched Indias first index of companies compliant with

Islamic law, or shariah, in an effort to bring more of the countrys 175millions Muslims into mainstream finance, and to

attract investment from foreign shariah-abiding funds.

I I TASI S (Taqwaa Advisory and Shariah I nvestment Solutions)

TASIS is Indias premier Shariah Advisory institution associated with the vast majority of Shariah compliant products

available in the country today. It was founded by a group of finance and investment professionals who realized the need

for a credible organization for providing guidance and support to individuals and corporations having an interest in the

nascent but rapidly growing Islamic finance industry in India. TASIS specializes in Shariah advisory, product structuring,

monitoring and Shariah certification. Currently it advises Indian companies, including government owned enterprises and

those from the private corporate sector, in matters related to the application of Shariah law in business matters. Scholars

on TASISs Shariah Board are based in North America, Europe and India, and are public figures who are highly reputed

in their respective fields of specialization. The criteria employed by TASIS, in most cases, is more conservative than

other Shariah advisory bodies.

I I I Description of I ndex

The BSE-TASIS Shariah 50 Index (Index) includes the top 50 companies in India that have passed TASISs stringent

Shariah compliance norms. The Index is a Cap Weighted Free Float Market Capitalization weighted Index comprised of

BSE listed Shariah compliant Companies which are part of the BSE-500 Index. The Index has been back-tested from 1st

January 2008 (Base Date) with the base index value of 1000. The Index is rebalanced on a quarterly basis i.e. end of

March, June, September and December quarters. There shall not be any intra-review inclusion to the Index. However, if

an existing constituent becomes non-Shariah compliant due to changes in financials or any corporate action, it may

trigger exclusion of the constituent from the Index immediately. Companies are reviewed for Shariah compliance by

TASIS on a monthly basis.

Research Article

December

2012

Mohd.Rizwan Page 6

I nternational J ournal of

Emerging Research in Management &Technology

I SSN: 2278-9359

I V BSE SENSEX

The BSE SENSEX (Bombay Stock Exchange Sensitive Index), also called the BSE 30 (BOMBAY STOCK

EXCHANGE)or simply the SENSEX, is a free-float market capitalization-weighted stock market index of 30 well-

established and financially sound companies listed on Bombay Stock Exchange (BSE). The 30 component companies

which are some of the largest and most actively traded stocks, are representative of various industrial sectors of the

Indian economy. Published since January 1, 1986, the SENSEX is regarded as the pulse of the domestic stock markets in

India.

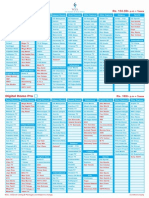

BSE listed Shariah Compliant Companies

1 A B B Ltd. 26 Hindustan Copper Ltd.

2 A C C Ltd. 27 Hindustan Unilever Ltd.

3 Alstom Projects India Ltd. 28 Indraprashtha Gas Ltd.

4 Ambuja Cements Ltd. 29 Jindal Saw Ltd.

5 Apollo Hospitals Enterprises Ltd., 30 Lupin Ltd.

6 Areva T & D India Ltd. 31 M R F Ltd.

7 Asian Paints Ltd. 32

Mangalore Refinery & Petrochemicals

Ltd.

8 B E M L Ltd. 33 Maruti Suzuki India Ltd.

9 Bajaj Auto Ltd. 34 Mcleod Russel India Ltd.

10 Bharat Heavy Electricals Ltd. 35 Motherson Sumi Systems Ltd.,

11 Bharti Airtel Ltd. 36 Mphasis Ltd.

12 Cadila Healthcare Ltd. 37 Nestle India Ltd.

13 Castrol India Ltd. 38 Oil & Natural Gas Corpn. Ltd.

14 Cipla Ltd. 39 Opto Circuits (India) Ltd.

15 Colgate-Palmolive (India) Ltd. 40 Reliance Industries Ltd.

16 Crompton Greaves Ltd. 41 Siemens Ltd.

17 Cummins India Ltd. 42 Sterling International Enterprises Ltd.

18 Dabur India Ltd. 43 Tata Consultancy Services Ltd.

19 Dr. Reddy'S Laboratories Ltd. 44 Tata Global Beverages Ltd.

20 G A I L (India) Ltd. 45 Tech Mahindra Ltd.

21

Glaxosmithkline Consumer

Healthcare Ltd. 46 Thermax Ltd.

22 Godrej Consumer Products Ltd. 47 Titan Industries Ltd.

23 Grasim Industries Ltd. 48 Ultratech Cement Ltd.

24 Hero Honda Motors Ltd. 49 Voltas Ltd.

25 Hindalco Industries Ltd. 50 Wipro Ltd.

List of BSE SENSEX Companies

1 Bajaj Auto 16 Jindal Steel

2 Bharti Airtel 17 Larsen

Research Article

December

2012

Mohd.Rizwan Page 7

I nternational J ournal of

Emerging Research in Management &Technology

I SSN: 2278-9359

3 BHEL 18 Mah and Mah

4 Cipla 19 Maruti Suzuki

5 Coal India 20 NTPC

6 Dr Reddys Labs 21 ONGC

7 GAIL 22 Reliance

8 HDFC 23 SBI

9 HDFC Bank 24 Sterlite Ind

10 Hero Motocorp 25 Sun Pharma

11 Hindalco 26 Tata Motors

12 HUL 27 Tata Power

13 ICICI Bank 28 Tata Steel

14 Infosys 29 TCS

15 ITC 30 Wipro

V Review Of Earlier Studies

The research studies on Islamic investment are minimum. Mostly, they may be the carried out in developed country like

UK, USA. The studies such as Abdullah and Bacha (2001) examined the impact of inclusion and detection of the stocks

in the Shariah index on return and trading volume of the Shariah stocks in Malaysia. They employed event study

methodology for daily closing prices and trading volume of the Shariah stocks during 1997 to 1999. The study found that

inclusion of the stocks in the Shariah index increased the returns and trading volume and exclusion of the stocks reduced

the returns and trading volume of the Shariah stocks in the Malaysia.

Ahamad and Ibrahim (2002) compared the risk and return performance of Kuala Lumpur Shariah Index (KLSI) with

Kuala Lumpur Composite index (KLCI) during the period 1999 to 2002. The sample period of the study is divided into

growing period, decline period and overall period. They have employed relative return technique, Standard deviation,

risk adjusted performance measurement and two sample t - test to measure the performance of both indices. The study

found that KLSI underperforms during overall period and decline period but it overperform in growing period. Finally

they find that there is no significant difference in performance of both indices during three sample period.

Hakim and Rashidian (2004a) investigated the risk and return of Dow Jones Islamic Stock Market Indices (DJIM) from

1999 to 2002. The study found that the three month T bill returns dominate both the Islamic Index and the Wilshire 5000

stock market index. However, return and risk of the Islamic index is less than the Wilshire 5000. The study also

examined the long run and short run relationship existing among the variables using unit root test, co integration and

causality test. The study found that T bill returns, Islamic index returns and Wilshire 5000 returns are not co- integrated.

Hakim and Rashidian (2004b) analysis the risk and return of the Dow Jones Islamic World Index, Dow Jones World

index and Dow Jones Sustainability (DJS) World index by using weekly closing value of the indices and LIBOR, a proxy

of the risk-free rate during period January 5, 2000 to August 30, 2004. By employing CAPM, the results of the study

reveals that the most popular index is market competitive but has underperformed in relation to another morally restricted

but non-Islamic index.The study concludes that investors in the Muslim index are not suffering a discernible cost for

complying with the Shariah restriction.

Hussein (2004) evaluated the performance of ethical investment with their unscreened benchmarks. The study

empirically tested whether returns of FTSE Global Islamic Index are significantly different from their index counterpart

(FTSE All- World Index). The sample period has been divided into two sub-periods, bull period (July 1996 March

2000) and bear period (April 2000 - August 2003). Both indices were performed in similar manner during entire sample

period. On the other hand, the Islamic index yields statistically significant positive abnormal returns in the bull market

period, whereas it underperformed in the bear market period. In general, the results show that the application of ethical

screening does not have an adverse effect on the FTSE Global Islamic Index performance.

Research Article

December

2012

Mohd.Rizwan Page 8

I nternational J ournal of

Emerging Research in Management &Technology

I SSN: 2278-9359

Hussein (2005) made an effort to test whether monthly returns of Financial Time Stock

Exchange (FTSE) Global Islamic index and Dow Jone Islamic Market Index are significantly different from their

common index for the period January 1996 to December 2004. The sample period is divided into bull market and bear

market. The study employs Capital Asset pricing model, Risk adjusted performance measurement, ttest, Wilcoxon

Signed test, buy and hold return method and cumulative return method for examining long run and short run relationship

between indices. In short run period, Islamic indices statistically overperfom during whole period and second bull market

period. In long run, Islamic indices overperfomed during entire period and second bull market period. Finally the study

finds that there is a similar performance between indices.

Hussein and Omran (2005) examine the impact of ethical screening on the performance of the Dow- Jones Islamic

indexes during December 1995 to June 2003 by using monthly closing value of the DJIWI and its 13 sub indexes. The

sample period is divided into two sub periods, January 1996-March2000 and April 2000-July 2003, in order to track the

behavior of Islamic indexes under bull and bear market conditions. By employing CAPM, Sharpe ratio, treynor ratio, the

study finds that Islamic indexes provide positive abnormal returns over the entire period and the bull market period, but

they underperform their index counterparts over the bear market period.

Ahmad (2005) made an attempt to examine the relationship among the daily closing price of the

Bursa Malaysia Shariah index, EMAS index and the daily Malaysian three months T-bills rate during the period April

1999 to December 2004 in Malaysia. The study employs the unit root test, Johansen- Juselius cointegration test, Granger

Causality test and Vector Error Correction Model (VECM) to find the relationship among the variables. The results of

the study reveal that the Bursa Malaysia Shariah index, EMAS index and three months T-bills share a long run

relationship. In the short run, only changes in EMAS index tent to raise the value of BMSI and t-bills do not significantly

affect both indices in Malaysia.

Albaity and Ahamad (2008) investigated the performance and relationship between KLSI and KLCE over the period of

April 1999 to December 2005 in Malaysia. The study applied risk adjusted performance measurement, causality and

Johansen co integration test. They found that there is an insignificant return difference and long run bidirectional

relationship between both indices.

Sadegi (2008) investigated the impact of the introduction of Bursa Malaysia Islamic index on the financial performance

and liquidity of the screening securities involved in the Islamic index in Malaysia. The study employed event study

methodology to estimate mean cumulative returns of the Shariah compliant stocks in the days surrounding the event and

also investigate the changes in liquidity using trade volume and bid ask spread surrounding the event days as liquidity

proxies. The study found that the introduction of the Shariah index has positive and strong impact on the financial

performance of the Shariah compliant stocks.

Dharani and Natarajan (2011a) compared the risk and return of the S&P CNX Nifty Shariah index and S&P CNX

Nifty index at day wise, moth wise and quarter wise during 2nd January 2007 to 31

st

December 2010. The study finds

that there is a significance return difference between both indices during third quarter in India. Finally, the study found

that Ramalan effect prevailed in the Shariah index during third quarter of the study period.

Dharani and Natarajan (2011b) empirically examined the risk and return of the Nifty Shariah index and Nifty index

during the period 2nd January 2007 to 31st December 2010. The sample period is further divided into bull market period

and bear market period based on the movement of the both indices during the study period. The objective of the study is

to analyse the performance of the Islamic index and common index and to test whether any significant difference

between both indices in India.They employ Risk adjusted measurement such as Sharpe index, Treynor Index and Jensen

alpha. The t- test is used to test the mean returns difference between both indices. The study concluded that Nifty Shariah

and Nifty indices in India are performing in a similar manner.

Dharani and Natarajan (2012) empirically examined the risk and return behavior of the Shariah Compliant Stocks and

benchmark indices during the period from 2nd January 2007 to 29th July 2011. The study reveals that the average returns

of the Shariah Compliant Stocks and benchmark indices were almost similar. In the same line, average return of the

Shariah index and Common index in India during the study period were also highly resembled each other. With all

Shariah principles, the Shariah index provides same return as common index provide. Hence, the study reveals that the

equity based Shariah Compliant investment is a viable and ethical investment avenue.

VI Objectives Of The Study

The specific objectives of the study are:

1. To review the Shariah norms for Investment.

2. To estimate the existence of association among the selected Shariah Index and Sensex.

3. To study the relationship between Shariah and benchmark index.

Research Article

December

2012

Mohd.Rizwan Page 9

I nternational J ournal of

Emerging Research in Management &Technology

I SSN: 2278-9359

VII Research Methodology

The study exclusively based on secondary data. The data set comprises of monthly Closing Prices, high and low of the

selected Shariah Index and the Sensex.The data of the Shariah Index and Sensex were collected from the historical data

base available at BSE official website from January 2011 to June 2012.

Direct statistical analysis of financial data is difficult, because consecutive figures are highly correlated and the variances

of figures increase with time. Financial figures are not stationary. Consequently, it is more convenient to analyzing the

pattern of the collected information by using the graphs.

The concern data of both the superset data is converted into percentage change by using the following formula:

Percentage Change = (Figure of current month Figure of previous month) / Figure of current month * 100

VIII The Basic Conditions For Investment In Securities

The main principles of Islamic Finance include:

1. The prohibition or taking or receiving interest at exorbitant rates ( Riba ), but this does not preclude a rate of

return on investment.

2. Risk in any transaction must be shared between at least two parties so that the provider of capital and the

entrepreneur share the business risk in return for a share in profit.

3. The Prohibition of speculative behavior ( Gharar ) is not allowed, meaning that gambling ( Maysir ) and extreme

uncertainty or risk prohibited and thus contractual obligations and disclosure of information are a sacred duty.

This also restricts traditional derivatives.

4. Money is seen as potential capital and thus only takes the form of actual capital when it is used in a productive

capacity. Other investment guidelines restrict the following.

a) Investment in companies whose total debt divided by trailing 12 month average market capital is greater than

33%.

b) Investment in the companies whose sum of cash and interest bearing activities divided by trailing 12 month

average market capital is greater than 33%.

c) Investment in companies whose account receivables divided by total assets are greater than 33% (sometimes

45%).

d) Investments that violate the rules of Shariah, advised against by Shariah boards, and are generally non ethical

meaning that investment in businesses related to alcohol, pork related products, conventional financial service,

entertainment (gambling and casinos, hotels, cinema, pornography, music).

IX Observed Results

The final price at which a security is traded on a given trading day. The closing price represents the most up-to-date

valuation of a security until trading commences again on the next trading day.

Most financial instruments are traded after hours (although with markedly smaller volume and liquidity levels), so the

closing price of a security may not match its after-hours price. Still, closing prices provide a useful marker for investors

to assess changes in stock prices over time - the closing price of one day can be compared to the previous closing price

in order to measure market sentiment for a given security over a trading day.

The price at which a security first trades upon the opening of an exchange on a given trading day. A security's opening

price is an important marker for that day's trading activity, especially for those interested in measuring short-term results,

such as day traders. Additionally, securities, which experience very large intra-day gains and losses, will have those

swings measured relative to their opening price for the day.

Quite commonly, a security's opening price will not be identical to its closing price. This is due to after-hours trading and

to changes in investor valuations or expectations of the security occurring outside of trading hours.

Percentage Change From Opening to Closing of Sensex and Shariah

Months Sensex

Tasis

Shariah

Dec-11 -6.65 -5

Jan-12 10.67 6.11

Feb-12 3.33 4.44

Research Article

December

2012

Mohd.Rizwan Page 10

I nternational J ournal of

Emerging Research in Management &Technology

I SSN: 2278-9359

Mar-12 -1.75 -1.12

Apr-12 -0.63 -1.32

May-12 -6.63 -4.04

Jun-12 7.47 4.9

Jul-12 -1.16 -0.71

Aug-12 1.07 1.13

Sep-12 7.42 5.88

Oct-12 -1.48 -1

Nov-12 4.6 4.14

Dec-12 0.34 -0.13

I nterpretation: The above table and graph show the percentage change in the indices opening to their closing. In

December 2011 both the indices Sensex and Tasis Shariah shows the negative change in their closing from their opening,

i.e. -6.65 and -5 respectively. Then in first month of 2012 both the indices shows the remarkable positive change. From

the month of February 2012 the indices start going down slowing the trend is continue till May 2012. Again the positive

change can be notice in the month of June. In July 2012 there is negative change, but this change do not continue and the

indices take positive turn in August and September 2012 and the noticed change is Sensex: 1.07 in August and 7.42 in

September, Tasis Shariah: 1.13 in August and 5.88 in September. October 2012 shows the negative change and

November 2012 shows the change of 4.6 and 4.14 respectively.

Percentage Change in Closing Prices from last month (Sensex and Tasis Shariah)

-10

-5

0

5

10

15

P

e

r

c

e

n

t

a

g

e

C

h

a

n

g

e

Dec-

11

Jan-

12

Feb-

12

Mar-

12

Apr-

12

May-

12

Jun-

12

Jul-12

Aug-

12

Sep-

12

Oct-

12

Nov-

12

Dec-

12

Sensex -6.65 10.67 3.33 -1.75 -0.63 -6.63 7.47 -1.16 1.07 7.42 -1.48 4.6 0.34

Tasis Shariah -5 6.11 4.44 -1.12 -1.32 -4.04 4.9 -0.71 1.13 5.88 -1 4.14 -0.13

Percentage Change From Opening to Closing of

Sensex and Shariah

Research Article

December

2012

Mohd.Rizwan Page 11

I nternational J ournal of

Emerging Research in Management &Technology

I SSN: 2278-9359

Month Sensex

Tasis

Shariah

Dec-11 -5.61 -2.69

Jan-12 -6.16 -4.77

Feb-12 10.58 6.01

Mar-12 3.11 4.45

Apr-12 -1.6 -1.01

May-12 -0.33 -0.76

Jun-12 -6.64 -4.38

Jul-12 7.53 5.09

Aug-12 -1.11 -0.48

Sep-12 1.28 1.09

Oct-12 7.55 6.12

Nov-12 -1.57 -1.01

I nterpretation: The above table and the graph show the Percentage change in the monthly closing of indices from the

closing of last month. There is lots of ups and down can be notice. In December 2011 Sensex shows -5.61 as the

percentage change in its closing from its last month, on the other hand Tasis shariah depict -2.69. The down flow

increases in January 2012.But the following month shows the highest percentage change ie. 10.58 and 6.01 respectively

but again in the month of march both the indices go down slowly and the trend continue till june 2012. We shows -6.64

and -4.38 respectively. In the month of july indices goes up and the noticed percentage change is 7.53 and 5.09

respectively then in august 2012 sensex again shows the negative change ie. -1.11 and tasis shariah shows -0.48.

-10

-5

0

5

10

15

P

E

R

C

E

N

T

A

G

E

C

H

A

N

G

E

Dec-

11

Jan-12

Feb-

12

Mar-

12

Apr-

12

May-

12

Jun-12 Jul-12

Aug-

12

Sep-

12

Oct-12

Nov-

12

Sensex -5.61 -6.16 10.58 3.11 -1.6 -0.33 -6.64 7.53 -1.11 1.28 7.55 -1.57

Tasis Shariah -2.69 -4.77 6.01 4.45 -1.01 -0.76 -4.38 5.09 -0.48 1.09 6.12 -1.01

Percentage Change in Closing prices from last

month

Research Article

December

2012

Mohd.Rizwan Page 12

I nternational J ournal of

Emerging Research in Management &Technology

I SSN: 2278-9359

September and October 2012 shows the positive percentage change in both the indices. Again the negative change can be

noticed in both the indices .

X Conclusion

The present study analyzed the movement of the selected Tasis Shariah and Sensex during the period from December

2011 to November 2012. The closing values of the selected Shariah and Sensex are collected from BSE websites. The

study employed table and graph analysis to examine the study objectives. It found that Tasis Shariah and sensex move

almost in the same direction in a particular month. Hence, the study infers that the equity based ethical investors can gain

more or less the same by investing in the Shariah companies shares as other are gaining from Sensex. To summarise, the

paper has shown that the screens commonly used to assess shariah compliance of companies for the purpose of including

them in the list of acceptablecompanies, need to be modified.

References:

[1]. AAOIFI (2003), Shariah Standards, The Accounting & Auditing Organization for Islamic Financial

Institutions: Manama, Bahrain.

[2]. Ali, Salman Syed (2005), Islamic Capital Market Products - Developments & Challenges, Islamic Research and

Training Institute, Islamic Development Bank, Jeddah, Saudi Arabia, pp.93.

[3]. Cox, Stella (2004), The Development of the Islamic Capital Market, 3rd Annual Finance Sumit, Euromoney

Seminar: London, UK.

[4]. DeLorenzo, Yusuf Talal (2000), Shari`ah Supervision of Islamic Mutual Funds, 4th Annual Harvard Forum on

Islamic Finance.

[5]. Hussein, Khalid (2004), Ethical Investment: Empirical Evidence from FTSE Islamic Index, Islamic Economic

Studies, Vol.12, no.1 (August), pp. 21-40.

[6]. Obaidullah, M. (2001), Regulation of Stock Market in an Islamic Economy in: Islamic Banking and Finance:

Current Developments in Theory and Practice, Munawar Iqbal (ed.) Leicester, UK: Islamic Foundation.

[7]. Obaidullah, M. (2005), Islamic Financial Services, Islamic Economics Research Centre, King Abdul Aziz

University, Jeddah, Saudi Arabia, Chapter 16.

[8]. OICU-IOSCO (2004), Islamic Capital Market Fact Finding Report, Report of the Islamic Capital Market Task

Force of the International Organization of Securities Commissions, July.

[9]. Securities Commission Malaysia (2003) Regulations of the Securities Commission Syariah Advisory Council,

Securities Commission: Kuala Lumpur, Malaysia.

[10]. Siddiqi, M.N. (2004), Riba, Bank Interest and the Rational of its Prohibition, Islamic Research and Training

Institute, Islamic Development Bank, Jeddah, Saudi Arabia, pp.164.

[11]. Siddiqui, Rushdi (2003) Rationale for Applying DJIMI Screens to KLSE: A Proposal, a presentation made in

the Conference on Future Trends in Islamic Equity Bond Market. Kuala Lumpur. June 25, 2003.

[12]. Tariq Al Rifai, (2000), Monitoring the Performance of Islamic Equity Funds, New Horizon, No. 103, October.

[13]. Usmani, Muhammad Imran Ashraf (2002), Meezan Bank's Guide to Islamic Banking, Meezan Bank,

Pakistan. Chapter 29.

[14]. Usmani, Taqi (), Principles of Shariah Governing Islamic Investment Fundsaccountancy.com.pk, also see,

http://www.islamic-finance.net/islamic-equity/taqi2.html

[15]. Wilson, Rodney (unpublished), Screening Criteria for Islamic Equity Funds. Received through mail to the

author.

[16]. www.http://islamic-finance.net/islamic-equity/screen.html

[17]. Yaquby, Nizam, Participation and Trading in Equities of Companies whose Main Business is Primarily Lawful

but Fraught with some Prohibited Transactions, Paper presented to the FourthHarvard Islamic Finance Forum,

October 2000.

[18]. Abdullah. M.H., and Bacha Halal. O.I. (2001). Stock Designation and Impact on Price and Trading Volume.

The Journal of Accounting, Commerce & Finance Islamic Perspective 1.5(2001): pp. 66-97.

[19]. Ahmad. S. A. (2005). Dynamic linkages among BMSI, EMAS Index and T bills. A

thesis submitted to the Faculty of Finance and Banking. Universiti Utara Malaysia.

[20]. Ahmad. Z and Ibrahlm H. (2002). A Study of Performance of the KLSE Syariah Index, Malaysian

Management Journal, 6 (1&2), 25-34.

[21]. Albaity. M., and Ahmad. R., (2008). Performance of Syariah and Composite Indices: Evidence from Bursa

Malayaia, Asian Academy of Management Journal of Accounting and Finance, Vol.4. No. 1, 23-43.

Research Article

December

2012

Mohd.Rizwan Page 13

I nternational J ournal of

Emerging Research in Management &Technology

I SSN: 2278-9359

[22]. Dharani. M and Natarajan. P. (2011a). Seasonal Anomalies between S&P CNX Nifty Shariah Index and S&P

CNX Nifty Index in India. Journal of Social and Development Sciences Vol. 1, No. 3, pp. 101-108, Apr 2011,

Dubai, UAE.

[23]. Dharani. M and Natarajan. P. (2011b). Equanimity of Risk and Return Relationship between Shariah Index and

General Index in India. Journal of Economics and Behavioral Studies. Vol. 2, No. 5, pp. 213-222, May 2011,

Dubai, UAE.

[24]. Hakim, S. and Rashidian, M. (2004). How costly is investors compliance to Shariah? Paper presented at the

11th Economic Research Forum Annual Conference in Sharjah, U.A.E. on December 14-16, Beirut, Lebanon.

www.erf.org.eg/CMS/getFile.php?id=543

[25]. Hakim. S and Rashidian. M, (2004), Risk & Return of Islamic Stock Market Indexes Paper presented at the

International Seminar of Non-bank Financial Institutions: Islamic Alternatives, Kuala Lumpur, Malaysia.

Potrebbero piacerti anche

- S650 Service - 6987168 enUS SMDocumento1.311 pagineS650 Service - 6987168 enUS SMcarlos andres salazar sanchez75% (4)

- Ab Initio Interview Questions - HTML PDFDocumento131 pagineAb Initio Interview Questions - HTML PDFdigvijay singhNessuna valutazione finora

- Corporate Governance in India: From Policies to RealityDocumento200 pagineCorporate Governance in India: From Policies to Realitykmraoof0% (1)

- CIS2103-202220-Group Project - FinalDocumento13 pagineCIS2103-202220-Group Project - FinalMd. HedaitullahNessuna valutazione finora

- PROTON Preve 2012 On 4 DR Sal 1.6 Premium (CFE) AUTO 138Bhp (A) (04/12-)Documento12 paginePROTON Preve 2012 On 4 DR Sal 1.6 Premium (CFE) AUTO 138Bhp (A) (04/12-)bluhound1Nessuna valutazione finora

- Real Estate Developer Resume SampleDocumento1 paginaReal Estate Developer Resume Sampleresume7.com100% (2)

- Maintenance Form1 Contract#14496Documento2 pagineMaintenance Form1 Contract#14496activedeenNessuna valutazione finora

- Indian Capital MarketsDocumento122 pagineIndian Capital MarketsVivek100% (4)

- Back of The NapkinDocumento51 pagineBack of The Napkinibn_rawhi67% (3)

- Brain Rules PresentationDocumento131 pagineBrain Rules PresentationJon Phillips100% (6)

- Equity Research Fundamental and Technical Analysis and Its Impact On Stock Prices With Reliance MoneyDocumento81 pagineEquity Research Fundamental and Technical Analysis and Its Impact On Stock Prices With Reliance MoneyRs rs100% (2)

- Fundamental and Technical Analysis at Kotak Mahindra Mba Project ReportDocumento108 pagineFundamental and Technical Analysis at Kotak Mahindra Mba Project ReportBabasab Patil (Karrisatte)67% (6)

- Demystifying Venture Capital: How It Works and How to Get ItDa EverandDemystifying Venture Capital: How It Works and How to Get ItNessuna valutazione finora

- Building Manufacturing Competitiveness: The TOC WayDa EverandBuilding Manufacturing Competitiveness: The TOC WayValutazione: 3 su 5 stelle3/5 (1)

- Value Engineering VA - VEDocumento146 pagineValue Engineering VA - VEactivedeen100% (1)

- Indian Stock Market and Investors StrategyDa EverandIndian Stock Market and Investors StrategyValutazione: 3.5 su 5 stelle3.5/5 (3)

- Restructuring The Circular Economy Into The Resource Based Economy (Michaux, 2021)Documento126 pagineRestructuring The Circular Economy Into The Resource Based Economy (Michaux, 2021)CliffhangerNessuna valutazione finora

- BBA ProjectDocumento76 pagineBBA ProjectAbhijeet Kashyap100% (3)

- Shariah Compliant Stocks in India-A Viable and Ethical Investment VehicleDocumento13 pagineShariah Compliant Stocks in India-A Viable and Ethical Investment VehicleSyed AhmedNessuna valutazione finora

- Scope If If in IndiaDocumento3 pagineScope If If in Indiapurple0123Nessuna valutazione finora

- Method Nifty Shariah IndicesDocumento15 pagineMethod Nifty Shariah IndicesT BwrsxNessuna valutazione finora

- Dissertation, BBADocumento37 pagineDissertation, BBAGarvit AgarwalNessuna valutazione finora

- Dhaka Stock Exchange IndexDocumento10 pagineDhaka Stock Exchange IndexS.M Riaz NowshadNessuna valutazione finora

- IJCoMA 04 2013 0037Documento20 pagineIJCoMA 04 2013 0037Admir MeskovicNessuna valutazione finora

- Shariah Screening Methodology: Does ItDocumento29 pagineShariah Screening Methodology: Does ItabelNessuna valutazione finora

- Maximising wealth through non-SLR investmentsDocumento78 pagineMaximising wealth through non-SLR investmentsSanchita NaikNessuna valutazione finora

- Nothing Is Wrong With Undertaking Risky Investments As Long As The Investor Understands The Possible Consequences.Documento8 pagineNothing Is Wrong With Undertaking Risky Investments As Long As The Investor Understands The Possible Consequences.Richa GoenkaNessuna valutazione finora

- Corporate Governanceand Indian Stock Market Asian Journalof ManagementDocumento8 pagineCorporate Governanceand Indian Stock Market Asian Journalof ManagementAfnanParkerNessuna valutazione finora

- Shivam Kumar 1032 PDFDocumento8 pagineShivam Kumar 1032 PDFShivam KumarNessuna valutazione finora

- Proposal On Stock VolatilityDocumento12 pagineProposal On Stock VolatilityHeidi BellNessuna valutazione finora

- ProjectDocumento80 pagineProjectShameem AnwarNessuna valutazione finora

- Analyzing Top Indian Sectors: Banking and FMCGDocumento34 pagineAnalyzing Top Indian Sectors: Banking and FMCGPooja LilaniNessuna valutazione finora

- Economic Factors and Their Impact On Portfolio ManagmentDocumento28 pagineEconomic Factors and Their Impact On Portfolio ManagmentAmith SinghNessuna valutazione finora

- Portfolio Management-Unicon Investment SolutionsDocumento62 paginePortfolio Management-Unicon Investment SolutionsRamesh AnkithaNessuna valutazione finora

- PDF Investment PDFDocumento7 paginePDF Investment PDFFayeNessuna valutazione finora

- A Study On Investment in Shares, and Comparative Analysis of Broking FirmsDocumento18 pagineA Study On Investment in Shares, and Comparative Analysis of Broking FirmsAman GuptaNessuna valutazione finora

- Top 10 India Brokerage FirmsDocumento7 pagineTop 10 India Brokerage FirmsMàñú PhíłípNessuna valutazione finora

- A Study Stock Performance Select Ipos in India 1528 2635 25 6 852Documento12 pagineA Study Stock Performance Select Ipos in India 1528 2635 25 6 852Sukruth B SNessuna valutazione finora

- Shariah Governance Practices in Malaysian Islamic Financial InstitutionsDocumento16 pagineShariah Governance Practices in Malaysian Islamic Financial Institutionszabardast099Nessuna valutazione finora

- Research Methodology for Valuing Public Sector EnterprisesDocumento84 pagineResearch Methodology for Valuing Public Sector EnterprisesApoorv MudgilNessuna valutazione finora

- Internship ProjectDocumento60 pagineInternship ProjectdanishNessuna valutazione finora

- Stock Exchange-Adani Industries: Scanning of Business Environment MGMT102 (PSDA-1)Documento16 pagineStock Exchange-Adani Industries: Scanning of Business Environment MGMT102 (PSDA-1)Mayank JainNessuna valutazione finora

- Fundamental and Technical Analysis: Executive SummaryDocumento87 pagineFundamental and Technical Analysis: Executive SummaryMyrmidon_13Nessuna valutazione finora

- Stock Market in India - An IntroductionDocumento47 pagineStock Market in India - An IntroductionRajat JainNessuna valutazione finora

- Corporate Governance Disclosure Practices of Telecom Industry: Evidence From IndiaDocumento14 pagineCorporate Governance Disclosure Practices of Telecom Industry: Evidence From IndiaIJAR JOURNALNessuna valutazione finora

- FRA MidtermDocumento59 pagineFRA MidtermNadeem AkhterNessuna valutazione finora

- Marwadi Shares & Finance LTDDocumento110 pagineMarwadi Shares & Finance LTDhoneylangalia50% (2)

- Ecnomic Growth IndiaDocumento45 pagineEcnomic Growth IndiaChandan ParsadNessuna valutazione finora

- Pestle Analysis On Reliance Industries: MBA Student - DBS Module International ManagementDocumento15 paginePestle Analysis On Reliance Industries: MBA Student - DBS Module International ManagementshubhamNessuna valutazione finora

- Sajai Singh, Partner, J. Sagar Associates, Bangalore, India: Venture Capital Investment in The Indian MarketDocumento12 pagineSajai Singh, Partner, J. Sagar Associates, Bangalore, India: Venture Capital Investment in The Indian MarketVenkatakrishnan KrishnanNessuna valutazione finora

- 2018 Khairi Faiz Mazri IsrDocumento13 pagine2018 Khairi Faiz Mazri IsrRitaNessuna valutazione finora

- Corporate Governance in India & Sebi Regulations: Presented byDocumento15 pagineCorporate Governance in India & Sebi Regulations: Presented byMolu WaniNessuna valutazione finora

- Are Indian Businesses Serious About Corporate Governance?: Submitted byDocumento8 pagineAre Indian Businesses Serious About Corporate Governance?: Submitted byShaurya DeepNessuna valutazione finora

- Comparative Study of Capital MarketDocumento77 pagineComparative Study of Capital MarketZameer AhmedNessuna valutazione finora

- Analyzing Performance of IPOs in India and Factors Affecting Investor DecisionsDocumento15 pagineAnalyzing Performance of IPOs in India and Factors Affecting Investor DecisionsSingh GurpreetNessuna valutazione finora

- Risk and Return Analysis of Pharmaceutical Industry in Capital MarketsDocumento13 pagineRisk and Return Analysis of Pharmaceutical Industry in Capital MarketssoumithrasasiNessuna valutazione finora

- Test of Sharpe Ratio On Selected Mutual Fund SchemesDocumento10 pagineTest of Sharpe Ratio On Selected Mutual Fund SchemesPritam ChandaNessuna valutazione finora

- Taqwaa Advisory and Shariah Investment Solutions (P) LTDDocumento20 pagineTaqwaa Advisory and Shariah Investment Solutions (P) LTDyfarhana2002Nessuna valutazione finora

- IRDA Short NotesDocumento9 pagineIRDA Short NotesaswinecebeNessuna valutazione finora

- FYP-Equity Research Fundamental-Technical Analysis - Impact On Stock Prices-RelianceDocumento80 pagineFYP-Equity Research Fundamental-Technical Analysis - Impact On Stock Prices-RelianceNikhil AntoNessuna valutazione finora

- Comparing Stock Screening in Bangladesh and MalaysiaDocumento22 pagineComparing Stock Screening in Bangladesh and MalaysiashibluNessuna valutazione finora

- A Study of Financial Helth of Steel Authority of India Limited (Sail) by Using Ratio AnalysisDocumento8 pagineA Study of Financial Helth of Steel Authority of India Limited (Sail) by Using Ratio Analysiskanianbalayam1983Nessuna valutazione finora

- 19BAL045Documento7 pagine19BAL045Akshat KothariNessuna valutazione finora

- Vol 12-1..KHALED A. HUSSEIN..Ethical Investment.Documento20 pagineVol 12-1..KHALED A. HUSSEIN..Ethical Investment.Maj ImanNessuna valutazione finora

- VimsDocumento115 pagineVimsHamin LoteyNessuna valutazione finora

- 1.1 General Introduction: Security AssetsDocumento20 pagine1.1 General Introduction: Security AssetschenchukalNessuna valutazione finora

- 42407664Documento13 pagine42407664Ashish KapareNessuna valutazione finora

- Religare Mutual FundDocumento70 pagineReligare Mutual FundpopNessuna valutazione finora

- A Study On Role of SEBI As A Regulatory Authority in Indian Capital Market: An Empirical AnalysisDocumento2 pagineA Study On Role of SEBI As A Regulatory Authority in Indian Capital Market: An Empirical AnalysisIOSRjournalNessuna valutazione finora

- Role of SEBIDocumento18 pagineRole of SEBIRamesh Thangavel TNessuna valutazione finora

- SWOT Personal SWOT AnalysisDocumento2 pagineSWOT Personal SWOT Analysisactivedeen100% (1)

- Supplications /: Upon Breaking The FastDocumento1 paginaSupplications /: Upon Breaking The FastactivedeenNessuna valutazione finora

- 22 Package New Pre ProDocumento1 pagina22 Package New Pre ProactivedeenNessuna valutazione finora

- Iso 2867-1994Documento16 pagineIso 2867-1994activedeenNessuna valutazione finora

- Vehicle Damage or Theft-Contract# 14496Documento2 pagineVehicle Damage or Theft-Contract# 14496activedeenNessuna valutazione finora

- Isb Admission TrendsDocumento5 pagineIsb Admission TrendsactivedeenNessuna valutazione finora

- Ragas 355 Points On PMPDocumento10 pagineRagas 355 Points On PMPactivedeenNessuna valutazione finora

- Um RT SeriesDocumento20 pagineUm RT Seriesactivedeen100% (1)

- Um RT SeriesDocumento20 pagineUm RT Seriesactivedeen100% (1)

- Arabian HorseDocumento8 pagineArabian HorseactivedeenNessuna valutazione finora

- National Income Practice QuestionsDocumento29 pagineNational Income Practice QuestionsSujalNessuna valutazione finora

- PrefaceDocumento16 paginePrefaceNavaneeth RameshNessuna valutazione finora

- Claim Form - Group Health InsuranceDocumento5 pagineClaim Form - Group Health Insurancevizag mdindiaNessuna valutazione finora

- M88A2 Recovery VehicleDocumento2 pagineM88A2 Recovery VehicleJuan CNessuna valutazione finora

- Spec 2 - Activity 08Documento6 pagineSpec 2 - Activity 08AlvinTRectoNessuna valutazione finora

- Computer Application in Business NOTES PDFDocumento78 pagineComputer Application in Business NOTES PDFGhulam Sarwar SoomroNessuna valutazione finora

- IT ManagementDocumento7 pagineIT ManagementRebaz Raouf Salih MohammedNessuna valutazione finora

- Request For Information (Rfi) : Luxury Villa at Isola Dana-09 Island - Pearl QatarDocumento1 paginaRequest For Information (Rfi) : Luxury Villa at Isola Dana-09 Island - Pearl QatarRahmat KhanNessuna valutazione finora

- List of Registered Architects and Engineers As On 30-08-2010 PDFDocumento10 pagineList of Registered Architects and Engineers As On 30-08-2010 PDFSaidhu MuhammedNessuna valutazione finora

- November 2022 Examination: Indian Institution of Industrial Engineering Internal Assignment For IIIE StudentsDocumento19 pagineNovember 2022 Examination: Indian Institution of Industrial Engineering Internal Assignment For IIIE Studentssatish gordeNessuna valutazione finora

- Payment Solutions For Travel Platform: SabreDocumento2 paginePayment Solutions For Travel Platform: Sabrehell nahNessuna valutazione finora

- Expert Java Developer with 10+ years experienceDocumento3 pagineExpert Java Developer with 10+ years experienceHaythem MzoughiNessuna valutazione finora

- Application Tracking System: Mentor - Yamini Ma'AmDocumento10 pagineApplication Tracking System: Mentor - Yamini Ma'AmBHuwanNessuna valutazione finora

- MTD Microwave Techniques and Devices TEXTDocumento551 pagineMTD Microwave Techniques and Devices TEXTARAVINDNessuna valutazione finora

- AAFA Webinar Intertek Jan 2012 V5Documento29 pagineAAFA Webinar Intertek Jan 2012 V5rabiulfNessuna valutazione finora

- PhysRevResearch 4 043041Documento6 paginePhysRevResearch 4 043041marco juradoNessuna valutazione finora

- Kj1010-6804-Man604-Man205 - Chapter 7Documento16 pagineKj1010-6804-Man604-Man205 - Chapter 7ghalibNessuna valutazione finora

- Capital Asset Pricing ModelDocumento11 pagineCapital Asset Pricing ModelrichaNessuna valutazione finora

- Rubrics For Lab Report For PC1 Lab, PC2 Lab, CIC LabDocumento4 pagineRubrics For Lab Report For PC1 Lab, PC2 Lab, CIC LabHunie PopNessuna valutazione finora

- T. Herndon, M. Asch, R. Pollin - Does High Public Debt Consistently Stifle Economic Growth. A Critique of Reinhart and RogoffDocumento26 pagineT. Herndon, M. Asch, R. Pollin - Does High Public Debt Consistently Stifle Economic Growth. A Critique of Reinhart and RogoffDemocracia real YANessuna valutazione finora

- Examples 5 PDFDocumento2 pagineExamples 5 PDFskaderbe1Nessuna valutazione finora

- WebquestDocumento3 pagineWebquestapi-501133650Nessuna valutazione finora

- CXS 310-2013 - PomegranateDocumento5 pagineCXS 310-2013 - PomegranateFranz DiazNessuna valutazione finora

- My Con Pds Sikafloor 161 HCDocumento5 pagineMy Con Pds Sikafloor 161 HClaurenjiaNessuna valutazione finora