Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

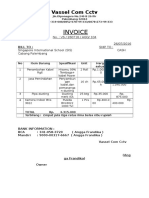

Definition of Invoice: Invoices

Caricato da

একজন নিশাচরTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Definition of Invoice: Invoices

Caricato da

একজন নিশাচরCopyright:

Formati disponibili

INVOICES

Definition of Invoice

57. A credit requiring an invoice without further definition will be satisfied by any type of invoice presented

(commercial invoice, customs invoice, tax invoice, final invoice, consular invoice, etc.). However, invoices

identified as provisional, pro-forma or the like are not acceptable. When a credit requires presentation of a

commercial invoice, a document titled invoice will be acceptable.

Description of the Goods, Services or Performance and other General Issues Related to Invoices

58. The description of the goods, services or performance in the invoice must correspond with the description in the

credit. There is no requirement for a mirror image. For example, details of the goods may be stated in a number

of areas within the invoice which, when collated together, represent a description of the goods corresponding to

that in the credit.

59. The description of goods, services or performance in an invoice must reflect what has actually been shipped or

provided. For example, where there are two types of goods shown in the credit, such as 10 trucks and 5 tractors,

an invoice that reflects only shipment of 4 trucks would be acceptable provided the credit does not prohibit

partial shipment. An invoice showing the entire goods description as stated in the credit, then stating what has

actually been shipped, is also acceptable.

60. An invoice must evidence the value of the goods shipped or services or performance provided. Unit price(s), if

any, and currency shown in the invoice must agree with that shown in the credit. The invoice must show any

discounts or deductions required in the credit. The invoice may also show a deduction covering advance

payment, discount, etc., not stated in the credit.

61. If a trade term is part of the goods description in the credit, or stated in connection with the amount, the invoice

must state the trade term specified, and if the description provides the source of the trade term, the same source

must be identified (e.g., a credit term CIF Singapore Incoterms 2000 would not be satisfied by CIF Singapore

Incoterms). Charges and costs must be included within the value shown against the stated trade term in the

credit and invoice. Any charges and costs shown beyond this value are not allowed.

62. Unless required by the credit, an invoice need not be signed or dated.

63. The quantity of merchandise, weights and measurements shown on the invoice must not conflict with the same

quantities appearing on other documents.

64. An invoice must not show:

a. over-shipment (except as provided in UCP 600 sub-article 30(b)), or

b. merchandise not called for in the credit (including samples, advertising materials, etc.) even if stated to

be free of charge.

65. The quantity of the goods required in the credit may vary within a tolerance of +/- 5%. This does not apply if a

credit states that the quantity must not be exceeded or reduced, or if a credit states the quantity in terms of a

stipulated number of packing units or individual items. A variance of up to +5% in the goods quantity does not

allow the amount of the drawing to exceed the amount of the credit.

66. Even when partial shipments are prohibited, a tolerance of 5% less in the credit amount is acceptable, provided

that the quantity is shipped in full and that any unit price, if stated in the credit, has not been reduced. If no

quantity is stated in the credit, the invoice will be considered to cover the full quantity.

67. If a credit calls for instalment shipments, each shipment must be in accordance with the instalment schedule.

Potrebbero piacerti anche

- Draft Invoice: My Company, Doctor Ashish KumarDocumento1 paginaDraft Invoice: My Company, Doctor Ashish Kumarashish patelNessuna valutazione finora

- InvoiceDocumento1 paginaInvoiceChintan ParmarNessuna valutazione finora

- Invoice summary for Futurex Trade Fair and Events Pvt LtdDocumento1 paginaInvoice summary for Futurex Trade Fair and Events Pvt Ltdhydb doeNessuna valutazione finora

- Invoice INV/2019/0001: Invoice Date: Due Date: SourceDocumento1 paginaInvoice INV/2019/0001: Invoice Date: Due Date: SourcevinaysgvNessuna valutazione finora

- Nairendrapal Sharma GST InvoiceDocumento1 paginaNairendrapal Sharma GST InvoiceDrv LimtedNessuna valutazione finora

- Invoice: Course Invoice Description Due Date Net Vat % Vat GrossDocumento2 pagineInvoice: Course Invoice Description Due Date Net Vat % Vat Grossmanu madhavNessuna valutazione finora

- Activation of Workflow For non-PO InvoicesDocumento3 pagineActivation of Workflow For non-PO InvoicesRajeev MenonNessuna valutazione finora

- Generate GST tax invoice for wood saleDocumento1 paginaGenerate GST tax invoice for wood saleAditya ShahNessuna valutazione finora

- AR Invoice - 13300310 PDFDocumento1 paginaAR Invoice - 13300310 PDFAli Ab AsNessuna valutazione finora

- Retail Invoice for Redmi 2 Prime Mobile PurchaseDocumento1 paginaRetail Invoice for Redmi 2 Prime Mobile PurchaseUmesh SiddarthNessuna valutazione finora

- Oct 20 2018 Ola Ride Receipt from Mumbai to Navi MumbaiDocumento3 pagineOct 20 2018 Ola Ride Receipt from Mumbai to Navi MumbaiMoham'medAlthafAs'lamNessuna valutazione finora

- Duplicate Receipts For Vehicle Number JH17B5978paid On 2015-06-1818-03-44.0 and Printed On 2015-06-18Documento1 paginaDuplicate Receipts For Vehicle Number JH17B5978paid On 2015-06-1818-03-44.0 and Printed On 2015-06-18Abhishek KumarNessuna valutazione finora

- Example: Cash Receipts Book: A B F G J L M ODocumento1 paginaExample: Cash Receipts Book: A B F G J L M Omiuchu73Nessuna valutazione finora

- Example - Partially Reduce Invoices - Logistics Invoice Verification (MM-IV-LIV) - SAP LibraryDocumento2 pagineExample - Partially Reduce Invoices - Logistics Invoice Verification (MM-IV-LIV) - SAP LibraryLokesh ModemzNessuna valutazione finora

- (615612035) ReceiptsDocumento2 pagine(615612035) ReceiptsShivam AtriNessuna valutazione finora

- B BIL PrintStatementDocumento1 paginaB BIL PrintStatementMandla RebirthNessuna valutazione finora

- Invoice Deletion Process Invoices in Tungsten Network For P&G Invoices RTV'edDocumento1 paginaInvoice Deletion Process Invoices in Tungsten Network For P&G Invoices RTV'edMari SolanoNessuna valutazione finora

- Unit M4 Expences ReceiptsDocumento6 pagineUnit M4 Expences ReceiptsEric Melchor RoyolNessuna valutazione finora

- Invoices 1Documento1 paginaInvoices 1api-351788692Nessuna valutazione finora

- Michael Nedd/ Theophilus Nedd 4 Bayleaf Court Santa Rosa ArimaDocumento2 pagineMichael Nedd/ Theophilus Nedd 4 Bayleaf Court Santa Rosa Arimamichael neddNessuna valutazione finora

- Invoice 19966341488Documento2 pagineInvoice 19966341488Shyam Goud TeegalaNessuna valutazione finora

- Receipts and Payments of Christ Nagar Residents' Association (CNRA), Christ Nagar, Neyyattinkara, Trivandrum, Kerala, India For The Year Ended 31st March, 2015Documento6 pagineReceipts and Payments of Christ Nagar Residents' Association (CNRA), Christ Nagar, Neyyattinkara, Trivandrum, Kerala, India For The Year Ended 31st March, 2015Jenipher Carlos HosannaNessuna valutazione finora

- Statement I Broad Details of Revenue ReceiptsDocumento1 paginaStatement I Broad Details of Revenue ReceiptsAtm AdnanNessuna valutazione finora

- SGHN2456014QLD Logistics Invoice 1560316148514Documento1 paginaSGHN2456014QLD Logistics Invoice 1560316148514MananNessuna valutazione finora

- June 2019Documento55 pagineJune 2019manju enterprisesNessuna valutazione finora

- Invoice 191Documento1 paginaInvoice 191Ayan SinhaNessuna valutazione finora

- Training invoice for Adobe Photoshop Course Level 1Documento1 paginaTraining invoice for Adobe Photoshop Course Level 1Abdul MNessuna valutazione finora

- ACT Invoice Summary and Charges for February 2022Documento1 paginaACT Invoice Summary and Charges for February 2022VinuNessuna valutazione finora

- Invoices 2393974Documento1 paginaInvoices 2393974KkNessuna valutazione finora

- Original Receipts For Vehicle Number JH17H1266 Paid On 21-05-201511-50-16Documento1 paginaOriginal Receipts For Vehicle Number JH17H1266 Paid On 21-05-201511-50-16Abhishek KumarNessuna valutazione finora

- Generate Rent Receipts Easily with ClearSave by ClearTaxDocumento2 pagineGenerate Rent Receipts Easily with ClearSave by ClearTaxAmit KumarNessuna valutazione finora

- Morning ride receipt HarshDocumento2 pagineMorning ride receipt Harshharsh kanojiaNessuna valutazione finora

- Invoice: Institute of Advanced Engineering and ScienceDocumento1 paginaInvoice: Institute of Advanced Engineering and ScienceMuhammad Zaki MustapaNessuna valutazione finora

- Federal Polytechnic Ado: Payment ReceiptsDocumento1 paginaFederal Polytechnic Ado: Payment ReceiptsAjewole Eben TopeNessuna valutazione finora

- Indoor Furniture Export InvoiceDocumento1 paginaIndoor Furniture Export Invoiceterlarang fileNessuna valutazione finora

- Statement of Cash Receipts and Disbursement - MargaDocumento16 pagineStatement of Cash Receipts and Disbursement - Margakarenmae intangNessuna valutazione finora

- Receipt 1469385 for travel purchaseDocumento1 paginaReceipt 1469385 for travel purchaseAtish ModiNessuna valutazione finora

- Cash Receipts MDocumento8 pagineCash Receipts MAveryl Lei Sta.AnaNessuna valutazione finora

- Sample Invoice A PDFDocumento1 paginaSample Invoice A PDFSirliindaNessuna valutazione finora

- Goh Joo Tiang: Billing AdviceDocumento2 pagineGoh Joo Tiang: Billing AdviceKezer GohNessuna valutazione finora

- Invoice # 0547 PDFDocumento1 paginaInvoice # 0547 PDFshafiqrehman7Nessuna valutazione finora

- Description: Lusaka Water & Sewerage Company LimitedDocumento1 paginaDescription: Lusaka Water & Sewerage Company Limitedpasyani nyirendaNessuna valutazione finora

- Print - Invoices - PDF ROLEA LAURA PDFDocumento1 paginaPrint - Invoices - PDF ROLEA LAURA PDFrolea catalinNessuna valutazione finora

- Renovation/Improvement ContractDocumento2 pagineRenovation/Improvement ContractPao BrillsNessuna valutazione finora

- Cash Receipts 2015Documento2 pagineCash Receipts 2015ProtozoaNessuna valutazione finora

- Invoice 282012Documento1 paginaInvoice 282012Shah Fakhrul Islam AlokNessuna valutazione finora

- Description Amount: Parts, and Then Click Receipt Slips (3 Per Page) in The Quick Parts Drop Down MenuDocumento2 pagineDescription Amount: Parts, and Then Click Receipt Slips (3 Per Page) in The Quick Parts Drop Down MenuUsman QurayshiNessuna valutazione finora

- InvoicesDocumento1 paginaInvoicesMounir MikhaelNessuna valutazione finora

- Sergiu Stoica Invoice 22326-1Documento1 paginaSergiu Stoica Invoice 22326-1Sergiu StoicaNessuna valutazione finora

- InvoiceDocumento2 pagineInvoicedebanwitaNessuna valutazione finora

- Invoice Sis PalembangDocumento1 paginaInvoice Sis PalembangSilvika PatrinNessuna valutazione finora

- Tax Invoice: Bill To Delivery atDocumento1 paginaTax Invoice: Bill To Delivery atSwaroop SinghNessuna valutazione finora

- Invoice Gu 035 JD PDFDocumento2 pagineInvoice Gu 035 JD PDFViktorNessuna valutazione finora

- How To Import Intransit ReceiptsDocumento2 pagineHow To Import Intransit ReceiptsPeter MakramNessuna valutazione finora

- View InvoicesDocumento2 pagineView InvoicesscnropNessuna valutazione finora

- Cw-Invoices Invoice 6730051 CWI1903736 Gif4us PDFDocumento1 paginaCw-Invoices Invoice 6730051 CWI1903736 Gif4us PDFManav SpoliaNessuna valutazione finora

- Printable Travel Receipt Template PDFDocumento1 paginaPrintable Travel Receipt Template PDFTorque couplingNessuna valutazione finora

- Commercial in VoiceDocumento1 paginaCommercial in Voicegomez johnNessuna valutazione finora

- Statutory Updates CA Final IDT May 2020 - CA Ramesh Soni PDFDocumento42 pagineStatutory Updates CA Final IDT May 2020 - CA Ramesh Soni PDFJack JackuNessuna valutazione finora

- Valuation Under Central ExciseDocumento3 pagineValuation Under Central Exciseapi-3822396100% (1)

- Diversity ManagementDocumento10 pagineDiversity Managementএকজন নিশাচরNessuna valutazione finora

- OrganizingDocumento17 pagineOrganizingAsif Shah50% (2)

- Credit Risk Management of United Commercial BDocumento45 pagineCredit Risk Management of United Commercial Bএকজন নিশাচরNessuna valutazione finora

- Functions of The FamilyDocumento14 pagineFunctions of The Familyএকজন নিশাচরNessuna valutazione finora

- Planning Class 7,8Documento139 paginePlanning Class 7,8একজন নিশাচরNessuna valutazione finora

- Experience Through SensesDocumento29 pagineExperience Through Sensesএকজন নিশাচরNessuna valutazione finora

- A Personality TheoryDocumento7 pagineA Personality Theoryএকজন নিশাচরNessuna valutazione finora

- Political Environment of Bangladesh: Nataraj Pangal - Shreya RanaDocumento11 paginePolitical Environment of Bangladesh: Nataraj Pangal - Shreya Ranaএকজন নিশাচরNessuna valutazione finora

- Social ResponsibilityDocumento14 pagineSocial Responsibilityএকজন নিশাচরNessuna valutazione finora

- Relation Between Bangladesh and United Nations OrganizationDocumento16 pagineRelation Between Bangladesh and United Nations Organizationএকজন নিশাচরNessuna valutazione finora

- Characteristics of Service MarketingDocumento14 pagineCharacteristics of Service Marketingএকজন নিশাচরNessuna valutazione finora

- Chokkhe Amar Trishna by Humayun AhmedDocumento91 pagineChokkhe Amar Trishna by Humayun AhmedHabib Rahman100% (1)

- Balance of Payment of BangladeshDocumento9 pagineBalance of Payment of Bangladeshএকজন নিশাচরNessuna valutazione finora

- Calculation of Weight of Equity and Debt: 2012Documento13 pagineCalculation of Weight of Equity and Debt: 2012একজন নিশাচরNessuna valutazione finora

- A Questionnaire For Foreign Students.Documento2 pagineA Questionnaire For Foreign Students.একজন নিশাচরNessuna valutazione finora

- Flow Chart of Sales SystemDocumento2 pagineFlow Chart of Sales SystemleekosalNessuna valutazione finora

- Accounting Basics-Automatic Journal EntriesDocumento12 pagineAccounting Basics-Automatic Journal EntriesAdham AghaNessuna valutazione finora

- AUDITING (35 Items) : Problem No. 1Documento8 pagineAUDITING (35 Items) : Problem No. 1Angelica EstolatanNessuna valutazione finora

- InvoiceDocumento2 pagineInvoiceAvijitSinharoyNessuna valutazione finora

- Swiggy Order Details for Ajinkya PanchbudheDocumento2 pagineSwiggy Order Details for Ajinkya PanchbudheAjinkya PanchbudheNessuna valutazione finora

- SAP MM Erp GreatDocumento27 pagineSAP MM Erp GreatMADHU sudhanNessuna valutazione finora

- Show Cause Notice ResponseDocumento18 pagineShow Cause Notice ResponseMahi RaperiaNessuna valutazione finora

- InvertedDocumento2 pagineInvertedShrikant KeskarNessuna valutazione finora

- Raju Bhai PDFDocumento1 paginaRaju Bhai PDFbsnlquotesNessuna valutazione finora

- Invoice ProcessingOpentextDocumento97 pagineInvoice ProcessingOpentextudayan bhatacharyaNessuna valutazione finora

- Om Tables Invoiced2Documento5 pagineOm Tables Invoiced2KrishnaChaitanyaChalavadiNessuna valutazione finora

- MXA000015Documento68 pagineMXA000015Nancy ReyesNessuna valutazione finora

- Financial Modeling & Analysis Course, Ottawa - The Vair CompaniesDocumento4 pagineFinancial Modeling & Analysis Course, Ottawa - The Vair CompaniesThe Vair CompaniesNessuna valutazione finora

- Banker Blues WordDocumento2 pagineBanker Blues WordMary Anne BantogNessuna valutazione finora

- Exercise For Chapter 2Documento2 pagineExercise For Chapter 2Bui AnhNessuna valutazione finora

- TSPL GST Petition - AnnexuresDocumento407 pagineTSPL GST Petition - AnnexuresVIVEK anandNessuna valutazione finora

- ITC FundamentalsDocumento114 pagineITC FundamentalsRAUNAQ SHARMANessuna valutazione finora

- Customs clearance and documentation requirementsDocumento9 pagineCustoms clearance and documentation requirementsezrizalNessuna valutazione finora

- InvoiceDocumento1 paginaInvoiceTanmay SinghNessuna valutazione finora

- Oneplus 9 RDocumento1 paginaOneplus 9 R1CG20CS032 JAYANTH SHREE VISHNUNessuna valutazione finora

- InvoiceDocumento1 paginaInvoiceRaj mishraNessuna valutazione finora

- Everything about ABNs and ACNs in AustraliaDocumento2 pagineEverything about ABNs and ACNs in AustraliadelobdNessuna valutazione finora

- Kathiresan.M: Mob No: +91 8220460621 Email IDDocumento3 pagineKathiresan.M: Mob No: +91 8220460621 Email IDROYAL CUSTOMERSNessuna valutazione finora

- Freshwork InvoiceDocumento1 paginaFreshwork InvoiceSourajyoti GuptaNessuna valutazione finora

- Latihan Soal SAP Fundamental ModulDocumento10 pagineLatihan Soal SAP Fundamental ModulStella BenitaNessuna valutazione finora

- AmazonDocumento2 pagineAmazongoldmine20233Nessuna valutazione finora

- Period Close: R12 General Ledger Management FundamentalsDocumento41 paginePeriod Close: R12 General Ledger Management FundamentalsErshad RajaNessuna valutazione finora

- LawDocumento10 pagineLawTannaoNessuna valutazione finora

- M.thiruselvam BE Electrical CP ExperienceDocumento7 pagineM.thiruselvam BE Electrical CP ExperiencethiruNessuna valutazione finora

- Payment: Commercial CorrespondenceDocumento8 paginePayment: Commercial CorrespondencestrawberryktNessuna valutazione finora

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetDa EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNessuna valutazione finora

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- Profit First for Therapists: A Simple Framework for Financial FreedomDa EverandProfit First for Therapists: A Simple Framework for Financial FreedomNessuna valutazione finora

- Financial Accounting For Dummies: 2nd EditionDa EverandFinancial Accounting For Dummies: 2nd EditionValutazione: 5 su 5 stelle5/5 (10)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Da EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Valutazione: 4.5 su 5 stelle4.5/5 (14)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantDa EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantValutazione: 4.5 su 5 stelle4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyDa EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyValutazione: 5 su 5 stelle5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDa EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItValutazione: 5 su 5 stelle5/5 (13)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Da EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Valutazione: 5 su 5 stelle5/5 (1)

- Basic Accounting: Service Business Study GuideDa EverandBasic Accounting: Service Business Study GuideValutazione: 5 su 5 stelle5/5 (2)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesDa EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesValutazione: 4.5 su 5 stelle4.5/5 (30)

- Project Control Methods and Best Practices: Achieving Project SuccessDa EverandProject Control Methods and Best Practices: Achieving Project SuccessNessuna valutazione finora

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsDa EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsValutazione: 4 su 5 stelle4/5 (7)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Da EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Valutazione: 4 su 5 stelle4/5 (33)

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungDa EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungValutazione: 4 su 5 stelle4/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyDa EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyValutazione: 4 su 5 stelle4/5 (4)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsDa EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNessuna valutazione finora