Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

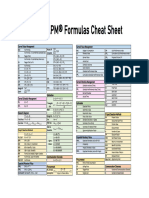

17 PMP Formulas Mentioned in The PMBOK Guide

Caricato da

Stéphane SmetsTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

17 PMP Formulas Mentioned in The PMBOK Guide

Caricato da

Stéphane SmetsCopyright:

Formati disponibili

17 PMP Formulas mentioned in the PMBOK Guide

BAC

Budgeted at

completion

PV c

Planned Value (

Costs )

PV = Planned %

complete x BAC (

Project budget )

EV

Earned Value

EV = Actual % complete

x BAC ( Project budget )

------

EV = Total months

completed / Total

months project x Total

cost

--------------

Actual % complete =

EV / BAC

AC

Actual Cost

CV

Cost Variance

CV = EV AC

EV = Earned Value

AC = Actual Cost

< 0 Over budget

= 0 On budget

> 0 Budget budget

SV SV = EV PV

< 0 Behind schedule

= 0 On schedule

Schedule Variance EV = Earned Value

PV = Planned Value

> 0 Ahead of schedule

SPI

Schedule

Performance Index

SPI = EV/PV

EV = Earned Value

PV = Planned Value

< 1 behind schedule

= 1 on schedule

> 1 ahead of schedule

CPI

Cost Performance

Index

CPI = EV/AC

EV = Earned Value

AC = Actual Cost

< 1 Over budget

= 1 On budget

> 1 Under budget

sometimes the term cumulative CPI would be

shown, which actually is the CPI up to that

moment

CPI

c

Cost Performance

Index

CPIc = EV

c

/AC

c

EV = Earned Value

AC = Actual Cost

< 1 Over budget

= 1 On budget

> 1 Under budget

sometimes the term cumulative CPI would be

shown, which actually is the CPI up to that

moment

TCPI

To-Complete

Performance Index

TCPI = (BAC EV)/

(BAC AC)

Or

TCPI = Remaining Work

Remaining Funds

BAC = Budget at

completion

EV = Earned value

AC = Actual Cost

TCPI = Remaining Work

< 1 Under budget

= 1 On budget

> 1 Over budget

/Remaining Funds

BAC = Budget at

completion

EV = Earned value

CPI = Cost performance

index

TCPI

c

To-Complete

Performance Index

TCPI

c

= (BAC EV)/

(BAC AC) ?????

BAC = Budget at

completion

EV = Earned value

CPI = Cost performance

index

< 1 Under budget

= 1 On budget

> 1 Over budget

TCPI

s

To-Complete

Performance Index

TCPI

s

= (BAC EV)/

(BAC AC) ?????

BAC = Budget at

completion

EV = Earned value

CPI = Cost performance

index

< 1 Under budget

= 1 On budget

> 1 Over budget

EAC no variance

Estimate at

Completion

if CPI remains the

same

EAC = BAC/CPI

BAC = Budget at

completion

CPI = Cost performance

index

if the CPI would remain the same till end of

project, i.e. the original estimation is not accurate

EAC typical

Estimate at

Completion

if substandard

EAC = AC + (BAC -

EV)/(CPI*SPI)

AC = Actual Cost

BAC = Budget at

completion

use when the question gives all the values (AC,

BAC, EV, CPI and SPI), otherwise, this formula is

not likely to be used

performance

continues

EV = Earned Value

CPI = Cost Performance

Index

SPI = Schedule

Performance Index

EAC atypical

Estimate at

Completion

if BAC remains the

same

EAC = AC + BAC EV

AC = Actual Cost

BAC = Budget at

completion

EV = Earned Value

the variance is caused by a one-time event and is

not likely to happen again

EAC flawed

Estimate at

Completion

if original is flawed

( fr: est dfectueux

)

EAC = AC + New ETC

AC = Actual Cost

New ETC = New

Estimate to Completion

if the original estimate is based on wrong

data/assumptions or circumstances have changed

ETC

Estimate to

Completion

ETC = EAC -AC

EAC = Estimate at

Completion

AC = Actual Cost

ETC flawed

Estimate to

Completion

reestimate

VAC

Variance at

Completion

VAC = BAC EAC

BAC = Budget at

completion

EAC = Estimate at

Completion

< 0 Under budget

= 0 On budget

> 0 Over budget

(Valid) ETC = EAC-AC

(atypical) ETC = BAC-EV

(typical) ETC = (BAC-EV) / CPI

Formulas / Math for PMP

If you think a formula is missing here but required in PMP exam. Post a comment and we will

add to this table.

1. PERT (P + 4M + O )/ 6 Pessimistic, Most Likely,

Optimistic

2. Standard Deviation (P - O) / 6

3. Variance [(P - O)/6 ]squared

4. Float or Slack LS-ES and LF-EF

5. Cost Variance EV - AC

6. Schedule Variance EV - PV

7. Cost Perf. Index EV / AC

8. Sched. Perf. Index EV / PV

9. Est. At Completion (EAC) BAC / CPI,

AC + ETC -- Initial Estimates are flawed

AC + BAC - EV -- Future variance are Atypical

AC + (BAC - EV) / CPI -- Future Variance would

be typical

10. Est. To Complete

Percentage complete

EAC - AC

EV/ BAC

11. Var. At Completion BAC - EAC

12. To Complete Performance

Index TCPI

Values for the TCPI index of less then 1.0 is good

because it indicates the efficiency to complete is

less than planned. How efficient must the project

team be to complete the remaining work with the

remaining money?

( BAC - EV ) / ( BAC - AC )

13. Net Present Value Bigger is better (NPV)

14. Present Value PV FV / (1 + r)^n

15. Internal Rate of Return Bigger is better (IRR)

16. Benefit Cost Ratio Bigger is better ((BCR or Benefit / Cost) revenue

or payback VS. cost)

Or PV or Revenue / PV of Cost

17. Payback Period Less is better

Net Investment / Avg. Annual cash flow.

18. BCWS PV

19. BCWP EV

20. ACWP AC

21. Order of Magnitude Estimate -25% - +75% (-50 to +100% PMBOK)

22. Budget Estimate -10% - +25%

23. Definitive Estimate -5% - +10%

24. Comm. Channels N(N -1)/2

25. Expected Monetary Value Probability * Impact

26. Point of Total Assumption

(PTA)

((Ceiling Price - Target Price)/buyer's Share Ratio)

+ Target Cost

Sigma

1 = 68.27%

2 = 95.45%

3 = 99.73%

6 = 99.99985%

Return on Sales ( ROS )

Net Income Before Taxes (NEBT) / Total Sales OR

Net Income After Taxes ( NEAT ) / Total Sales

Return on Assets( ROA )

NEBT / Total Assets OR

NEAT / Total Assets

Return on Investment ( ROI ) NEBT / Total Investment OR

NEAT / Total Investment

Working Capital

Current Assets - Current Liabilities

Discounted Cash Flow

Cash Flow X Discount Factor

Contract related formulas

Savings = Target Cost Actual Cost

Bonus = Savings x Percentage

Contract Cost = Bonus + Fees

Total Cost = Actual Cost + Contract Cost

Critical Path formulas

Forward Pass: (Add 1 day to Early Start) EF = (ES + Duration - 1)

Backward Pass: (Minus 1 day to Late Finish)

LS = (LF - Duration + 1)

ES = Early Start; EF = Early Finish;

LS = Late Start; LF = Late Finish

EVA = Net Operating Profit After Tax - Cost of Capital (Revenue - Op. Exp - Taxes) -

(Investment Capital X % Cost of Capital) EVA - Economic Value Add Benefit Measurement -

Bigger is better

Source Selection = (Weightage X Price) + (Weightage X Quality)

EVM Formulas, How to Understand?

The following are EVM formulas. For EVM formulas description, read the article Definition of

EVM formulas.

SV = EV PV + ve good

CV = EV AC + ve good

SPI = EV/PV greater than 1 is good

CPI = EV/AC greater than 1 is good

EAC = AC + BAC EV budgeted, atypical, no variation in future

EAC = BAC/CCPI no variation in BAC, same rate spending

EAC = AC + (BAC-EV)/CCPI typical, same variation in future

TCPI = (BAC EV)/(BAC-AC) must meet BAC

TCP I = (BAC EV)/(EAC-AC) not meet BAC, CPI decreased

VAC = BAC - EAC

ETC = EAC AC

% Complete = EV/BAC

EV = Total months completed / Total months project x Total cost

PV = Planned % complete x Project budget

EV = Actual % complete x Project budget

- See more at: http://innovativeprojectguide.com/pmp-exam/6-PMP%20EXAM/3-what-is-evm-whatis-

earned-value-management-and-evm-formulas.html#sthash.nzxXKGx1.dpuf

No. of Communication

Channels

n (n-1)/2

n = number of

members in the team

n should include the project manager

e.g. if the no. of team members increase from 4 to

5, the increase in communication channels:

5(5-1)/2 4(4-1)/2 = 4

PERT Estimation (O + 4M + P)/6

O= Optimistic

estimate

M= Most Likely

estimate

P= Pessimistic

estimate

Standard Deviation

(P O)/6

O= Optimistic

estimate

P= Pessimistic

estimate

this is a rough estimate for the standard

deviation

Float/Slack

LS ES

LS = Late start

ES = Early start

LF EF

LF = Late finish

EF = Early finish

= 0 On critical path

< 0 Behind schedule

Project Selection >

Future Value

Present Value

NPV Net Present Value

ROI Rate of Interest

IRR Internal Rate of Return

Payback Period

BCR Benefit Cost Ratio

CBR Cost Benefit Ratio

Communications > Communication Channels

Procurement > PTA Point of Total Assumption

Risk > EMV Expected Monetary Value

Cost & Schedule > EVM Earned Value

Management

CV Cost Variance

SV Schedule Variance

AC Actual Cost

PV Present Value

CPI Cost Performance Index

SPI Schedule Performance Index

EAC Estimate at Completion

BAC Budget at Completion

TCPI To Complete Performance Index

PERT(Program Evaluation and Review Technique)

>

EAD Expected Activity Duration

Standard Deviation

Variance of an activity

Network Diagram > Activity Duration

Total Float

Free Float

Miscellaneous > Average(Mean)

Median

Mode

Sigma Values

Rough Order of Magnitude(ROM)

estimate

Preliminary estimate

Budget estimate

Definitive estimate

Final estimate

Potrebbero piacerti anche

- PMP FormulaDocumento3 paginePMP FormulaCarmen SalazarNessuna valutazione finora

- Formulas To Pass CAPM ExamDocumento3 pagineFormulas To Pass CAPM ExamPhu Anh Nguyen75% (4)

- PMP Quick Reference GuideDocumento20 paginePMP Quick Reference Guidevivek100% (2)

- PMP Exam Cheat SheetDocumento10 paginePMP Exam Cheat SheetVimalkumar Nair100% (3)

- Postal Services HistoryDocumento13 paginePostal Services HistoryAnonymous Ndp7rXNessuna valutazione finora

- The PMP® Exam - Master and Leverage the ITTOsDa EverandThe PMP® Exam - Master and Leverage the ITTOsValutazione: 1 su 5 stelle1/5 (2)

- VI VI - PMP Formula Pocket GuideDocumento1 paginaVI VI - PMP Formula Pocket GuideSMAKNessuna valutazione finora

- PMP Formulas: 1. Number of Communication ChannelsDocumento5 paginePMP Formulas: 1. Number of Communication ChannelsramaiahNessuna valutazione finora

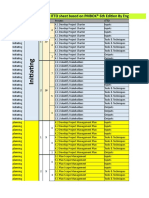

- ITTO Based On 6th Edition. SHERIFPMP - 1Documento36 pagineITTO Based On 6th Edition. SHERIFPMP - 1Hassan Mody Tota60% (10)

- Critical Path Method FormularsDocumento2 pagineCritical Path Method FormularsGimKonsultNessuna valutazione finora

- Project Control Stages A Complete Guide - 2019 EditionDa EverandProject Control Stages A Complete Guide - 2019 EditionNessuna valutazione finora

- PMP Formulas Cheat SheetDocumento3 paginePMP Formulas Cheat SheetSudhir AcharyaNessuna valutazione finora

- Velopi PMP Cheat Sheet PDFDocumento1 paginaVelopi PMP Cheat Sheet PDFtrudiddleNessuna valutazione finora

- Gold-Satipatthana Sutta IntroductionDocumento52 pagineGold-Satipatthana Sutta IntroductionStéphane SmetsNessuna valutazione finora

- PMBOK Cheat SheetDocumento2 paginePMBOK Cheat SheetAhmed NasserNessuna valutazione finora

- PMP Formulas Cheat Sheet StatementDocumento1 paginaPMP Formulas Cheat Sheet StatementdercoconsultoresNessuna valutazione finora

- Formulas PMP V01Documento1 paginaFormulas PMP V01Eric AlvarezNessuna valutazione finora

- Formulas Math For PMPDocumento3 pagineFormulas Math For PMPramorclNessuna valutazione finora

- Drikung KagyuDocumento202 pagineDrikung KagyuStéphane Smets100% (2)

- Key Concept and Formulas For PMP ExamDocumento4 pagineKey Concept and Formulas For PMP ExamaaranganathNessuna valutazione finora

- Formulas To Pass PMP Exam PDFDocumento3 pagineFormulas To Pass PMP Exam PDFGalal MohamedNessuna valutazione finora

- The History of The Sixteen KarmapasDocumento187 pagineThe History of The Sixteen KarmapasStéphane Smets100% (2)

- PMP NotesDocumento49 paginePMP Notesgirishkris100% (1)

- Visit For Exam Resources For Disclaimer See PMP® Formula Study GuideDocumento2 pagineVisit For Exam Resources For Disclaimer See PMP® Formula Study GuideNeeraj ShuklaNessuna valutazione finora

- Project Management. Execution PlanningDocumento2 pagineProject Management. Execution PlanningAngelica DavalilloNessuna valutazione finora

- Formulas For PMP ExamDocumento5 pagineFormulas For PMP ExamppnaranattNessuna valutazione finora

- The Project Management Professional (PMP) Exam Cheat SheetDocumento2 pagineThe Project Management Professional (PMP) Exam Cheat Sheetadityavicky1100% (1)

- PMP Cheat SheetDocumento2 paginePMP Cheat SheetLukinho De SouzaNessuna valutazione finora

- PMP-ResourcesDocumento71 paginePMP-ResourcesmohamadNessuna valutazione finora

- Mahamudra Teaching - Garchen RinpocheDocumento88 pagineMahamudra Teaching - Garchen RinpocheStéphane SmetsNessuna valutazione finora

- PMP EVM Questions (20+ Practice Questions Included) EVM Graph QuestionsDocumento16 paginePMP EVM Questions (20+ Practice Questions Included) EVM Graph QuestionsJahidul Islam100% (1)

- Evm Quick GuideDocumento7 pagineEvm Quick GuideFarid FaridNessuna valutazione finora

- PMP Mock Exam 200 Q ADocumento31 paginePMP Mock Exam 200 Q ALuis Olavarrieta100% (5)

- Sale or Reproduction.: Figure 4-1. Project Integration Management OverviewDocumento14 pagineSale or Reproduction.: Figure 4-1. Project Integration Management OverviewHot SummerNessuna valutazione finora

- The Project Go No Go ChecklistDocumento2 pagineThe Project Go No Go ChecklistStéphane SmetsNessuna valutazione finora

- Project: PMP Certification Roadmap: Days Task StatusDocumento1 paginaProject: PMP Certification Roadmap: Days Task StatusQamar Shahzad SattiNessuna valutazione finora

- PMP Formulas Notes PDFDocumento2 paginePMP Formulas Notes PDFDildar SainiNessuna valutazione finora

- PMP FormulasDocumento2 paginePMP Formulasvnethi9317100% (2)

- Yoga - Patanjali-YogaSutras-Sanskrit-English PDFDocumento86 pagineYoga - Patanjali-YogaSutras-Sanskrit-English PDFTantra Path100% (1)

- PMP Calculations ExplainedDocumento10 paginePMP Calculations ExplainedasimozmaNessuna valutazione finora

- PMP PreparationDocumento17 paginePMP Preparationsherifelshammaa100% (2)

- Thrangu Rinpoche - The Short Dorje Chang Lineage PrayerDocumento42 pagineThrangu Rinpoche - The Short Dorje Chang Lineage PrayerStéphane SmetsNessuna valutazione finora

- External Environmental AnalysisDocumento19 pagineExternal Environmental AnalysisHale Bulasan100% (1)

- Earned Value Analysis: Making It Work: Joe Lukas, PMP, PM, CCEDocumento60 pagineEarned Value Analysis: Making It Work: Joe Lukas, PMP, PM, CCERosely Gamboa SanchezNessuna valutazione finora

- Doha TreasuresDocumento62 pagineDoha TreasuresStéphane Smets100% (1)

- Basic PMP FormulasDocumento9 pagineBasic PMP Formulasgirishkris100% (2)

- My PMP NotesDocumento252 pagineMy PMP NotesRashmita Sahu100% (2)

- HE Garchen Rinpoche Wheel PrayersDocumento4 pagineHE Garchen Rinpoche Wheel PrayersStéphane SmetsNessuna valutazione finora

- Sample PMP Earned Value QuestionsDocumento9 pagineSample PMP Earned Value QuestionsSajid ZebNessuna valutazione finora

- PMP Question BankDocumento54 paginePMP Question BankAneesh Mohanan71% (7)

- PMP Question BankDocumento54 paginePMP Question BankAneesh Mohanan71% (7)

- 1 Pdfsam The Kagyu Monlam BookDocumento50 pagine1 Pdfsam The Kagyu Monlam BookStéphane SmetsNessuna valutazione finora

- Exam Questions PMPDocumento13 pagineExam Questions PMPSandeep MaheyNessuna valutazione finora

- Special Cases Linear ProgrammingDocumento14 pagineSpecial Cases Linear ProgrammingArchana KaruniNessuna valutazione finora

- Dll-4th-Week - EntrepreneurshipDocumento15 pagineDll-4th-Week - EntrepreneurshipJose A. Leuterio Jr.100% (2)

- P2MM Self Assess PRINCE2Project v012Documento22 pagineP2MM Self Assess PRINCE2Project v012Stéphane SmetsNessuna valutazione finora

- Final Report - CaterpillarDocumento17 pagineFinal Report - CaterpillarJainendra SinhaNessuna valutazione finora

- 26 Batangas-I Electric Cooperative Labor Union vs. YoungDocumento2 pagine26 Batangas-I Electric Cooperative Labor Union vs. YoungNinaNessuna valutazione finora

- 343.1 - PMP Full Sample Exam-Answers and RationalesDocumento200 pagine343.1 - PMP Full Sample Exam-Answers and RationalesSuhailshah1234Nessuna valutazione finora

- Formulas - Math For PMPDocumento2 pagineFormulas - Math For PMPabhi10augNessuna valutazione finora

- PMP Formulas 01234Documento12 paginePMP Formulas 01234Waqas AhmedNessuna valutazione finora

- PMP Itto MnemonicsDocumento3 paginePMP Itto Mnemonicsamitsingh5100% (2)

- Project Earned Value Analysis1Documento4 pagineProject Earned Value Analysis1Kocic BalicevacNessuna valutazione finora

- Award The Project To A Supplier Who Is Already On The Procuring Organization's Preferred Supplier ListDocumento16 pagineAward The Project To A Supplier Who Is Already On The Procuring Organization's Preferred Supplier ListRohit JhunjhunwalaNessuna valutazione finora

- IttoDocumento9 pagineIttoaaradhana345Nessuna valutazione finora

- PMP Exam Cheat SheetDocumento10 paginePMP Exam Cheat Sheethema_cse4Nessuna valutazione finora

- PMP Exam Prep: (What It Really Takes To Prepare and Pass)Documento26 paginePMP Exam Prep: (What It Really Takes To Prepare and Pass)meetvisu118100% (1)

- 342.1 - PMP Full Sample Exam-NewDocumento200 pagine342.1 - PMP Full Sample Exam-NewSuhailshah1234Nessuna valutazione finora

- S No Knowledge Area Process Process Group: Planning Planning Planning PlanningDocumento21 pagineS No Knowledge Area Process Process Group: Planning Planning Planning PlanningRana Gaballah0% (1)

- PMP Sample Questions PDFDocumento106 paginePMP Sample Questions PDFmp272Nessuna valutazione finora

- PMP 2022Documento96 paginePMP 2022Kim Katey KanorNessuna valutazione finora

- Pre Construction Services A Complete Guide - 2020 EditionDa EverandPre Construction Services A Complete Guide - 2020 EditionNessuna valutazione finora

- PMP Formulas by EdwardDocumento3 paginePMP Formulas by Edwardmask81Nessuna valutazione finora

- Earn Value Management (Control Cost) : PercentDocumento1 paginaEarn Value Management (Control Cost) : PercentMaheswaren MahesNessuna valutazione finora

- Earned Value Management - Activity PDFDocumento2 pagineEarned Value Management - Activity PDFMark Genesis VelonzaNessuna valutazione finora

- KH-Formula-Sheet - PMP ExamDocumento1 paginaKH-Formula-Sheet - PMP Examjalejandropinedag100% (1)

- My Notes On PMP FormulasDocumento2 pagineMy Notes On PMP Formulasshakeelkhn18Nessuna valutazione finora

- The Value Proposition CanvasDocumento1 paginaThe Value Proposition CanvasStéphane SmetsNessuna valutazione finora

- NGÖNDRODocumento2 pagineNGÖNDROStéphane SmetsNessuna valutazione finora

- SSM-Implementing Scrum-Source Jeff Sutherland-How To BeginDocumento12 pagineSSM-Implementing Scrum-Source Jeff Sutherland-How To BeginStéphane Smets100% (1)

- EVA What Is Evm Whatis Earned Value Management Evm FormulasDocumento3 pagineEVA What Is Evm Whatis Earned Value Management Evm FormulasStéphane SmetsNessuna valutazione finora

- AIO CHAPTER00 IntroductionDocumento3 pagineAIO CHAPTER00 IntroductionStéphane SmetsNessuna valutazione finora

- Free SWOT Analysis TemplateDocumento1 paginaFree SWOT Analysis Templatereza tavayefNessuna valutazione finora

- 001 POTD Commentary IntroductionDocumento8 pagine001 POTD Commentary IntroductionStéphane SmetsNessuna valutazione finora

- English Alphabet PrononciationDocumento6 pagineEnglish Alphabet PrononciationStéphane SmetsNessuna valutazione finora

- Blueprinting Questionnaire InteractiveDocumento14 pagineBlueprinting Questionnaire InteractiveStéphane SmetsNessuna valutazione finora

- IXth Karmapa Foundational Practices Excerpts From The Chariot For Travelling The Supreme PathDocumento44 pagineIXth Karmapa Foundational Practices Excerpts From The Chariot For Travelling The Supreme PathStéphane SmetsNessuna valutazione finora

- Mpowerment: W N D T W Offered in Reply To Questions On The Key Points R E M P LDocumento8 pagineMpowerment: W N D T W Offered in Reply To Questions On The Key Points R E M P LStéphane SmetsNessuna valutazione finora

- 001 Empowerment Cover PageDocumento5 pagine001 Empowerment Cover PageStéphane SmetsNessuna valutazione finora

- III RD Karmapa A Treatise EntitledA Teaching On The Essence of The Tathagatas (The Tathagatagarbha)Documento60 pagineIII RD Karmapa A Treatise EntitledA Teaching On The Essence of The Tathagatas (The Tathagatagarbha)Stéphane SmetsNessuna valutazione finora

- 001 Empowerment Cover PageDocumento2 pagine001 Empowerment Cover PageStéphane SmetsNessuna valutazione finora

- The Essentials of Mahamudra PracticeDocumento8 pagineThe Essentials of Mahamudra PracticeStéphane Smets100% (1)

- Fundamental Abhidhamma - NandamalabhivamsaDocumento104 pagineFundamental Abhidhamma - NandamalabhivamsabalabeyeNessuna valutazione finora

- Spring 09 LawDocumento5 pagineSpring 09 Lawmarklaw1Nessuna valutazione finora

- Remedy ArchitectureDocumento177 pagineRemedy ArchitectureKatchy RockerNessuna valutazione finora

- What Is Social Capital PDFDocumento26 pagineWhat Is Social Capital PDFSelma KoundaNessuna valutazione finora

- E-Logistics and E-Supply Chain Management: Applications For Evolving BusinessDocumento21 pagineE-Logistics and E-Supply Chain Management: Applications For Evolving BusinessRUCHI RATANNessuna valutazione finora

- viewNitPdf 4432460Documento5 pagineviewNitPdf 4432460Sushant RathiNessuna valutazione finora

- Solution Manual For Mcgraw-Hill Connect Resources For Whittington, Principles of Auditing and Other Assurance Services, 19EDocumento36 pagineSolution Manual For Mcgraw-Hill Connect Resources For Whittington, Principles of Auditing and Other Assurance Services, 19Ebenjaminmckinney3l5cv100% (19)

- The Children's Investment Fund - TCI Pillar 3 Disclosure - 2017Documento7 pagineThe Children's Investment Fund - TCI Pillar 3 Disclosure - 2017Beverly TranNessuna valutazione finora

- ACCOUNTING REPORT PHD 803Documento45 pagineACCOUNTING REPORT PHD 803Meanne SolinapNessuna valutazione finora

- JJM StrategyDocumento3 pagineJJM Strategyvkisho5845Nessuna valutazione finora

- Notice Inviting Tender: Panipat Thermal Power StationDocumento3 pagineNotice Inviting Tender: Panipat Thermal Power StationMark KNessuna valutazione finora

- Kanchan YadavDocumento14 pagineKanchan YadavNandini JaganNessuna valutazione finora

- Chapter 5Documento11 pagineChapter 5lijijiw23Nessuna valutazione finora

- Practical Applications of The Petroleum Resources Management SystemDocumento1 paginaPractical Applications of The Petroleum Resources Management Systemabnou_223943920Nessuna valutazione finora

- FEIGENBAUM + Ishikawa + TaguchiDocumento7 pagineFEIGENBAUM + Ishikawa + Taguchiaulia rakhmawatiNessuna valutazione finora

- 07 - Crafting Business ModelsDocumento7 pagine07 - Crafting Business ModelsKamran MirzaNessuna valutazione finora

- Japheth Dillman ResumeDocumento2 pagineJapheth Dillman ResumeJapheth Honey Badger DillmanNessuna valutazione finora

- Chapter 6 Costing by Products and Joint ProductsDocumento2 pagineChapter 6 Costing by Products and Joint ProductsfahadNessuna valutazione finora

- Lean StartupDocumento19 pagineLean StartupVansh BuchaNessuna valutazione finora

- How To Become A For-Profit Social Enterprise (FOPSE)Documento12 pagineHow To Become A For-Profit Social Enterprise (FOPSE)FreeBalanceGRP100% (1)

- What Is Engineering InsuranceDocumento4 pagineWhat Is Engineering InsuranceParth Shastri100% (1)

- GL Bajaj FormateDocumento5 pagineGL Bajaj FormateFARMANNessuna valutazione finora

- Modern Chronological TemplateDocumento2 pagineModern Chronological TemplateMadanmohan RathaNessuna valutazione finora

- Gautam Resume PDFDocumento4 pagineGautam Resume PDFGautam BhallaNessuna valutazione finora

- tGr09TG ICTDocumento116 paginetGr09TG ICTRislan MohammedNessuna valutazione finora

- Tle 7Documento7 pagineTle 7Huricane SkyNessuna valutazione finora