Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Sss V de Los Santos G.R. No. 170195, March 28, 2011

Caricato da

mercy rodriguez0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

73 visualizzazioni2 paginePERSONS AND FAMILY RELATIONS

RIGHTS AND OBLIGATION OF SPOUSES – Joint Obligation to Support

Art. 70 Family Code

Titolo originale

sss v de los santos G.R. No. 170195, March 28, 2011

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoPERSONS AND FAMILY RELATIONS

RIGHTS AND OBLIGATION OF SPOUSES – Joint Obligation to Support

Art. 70 Family Code

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

73 visualizzazioni2 pagineSss V de Los Santos G.R. No. 170195, March 28, 2011

Caricato da

mercy rodriguezPERSONS AND FAMILY RELATIONS

RIGHTS AND OBLIGATION OF SPOUSES – Joint Obligation to Support

Art. 70 Family Code

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

PERSONS AND FAMILY RELATIONS

RIGHTS AND OBLIGATION OF SPOUSES Joint Obligation to Support

Art. 70 Family Code

SSS V DE LOS SANTOS

G.R. No. 170195, March 28, 2011

Doctrine:

An estranged wife who was not dependent upon her deceased husband for support is not qualified to be his beneficiary.

FACTS:

Antonio de los Santos and respondent Gloria de los Santos, both Filipinos, were married on April 29, 1964 in Manila. Less than one

year after, Gloria left Antonio and contracted another marriage with a certain Domingo Talens in Nueva Ecija. Sometime in 1969,

Gloria went back to Antonio and lived with him until 1983. They had three children.

In 1983, Gloria left Antonio and went to the United States. Later on, she filed for divorce against Antonio in California and executed

a document waiving all her rights to their conjugal properties and other matters. The divorce was granted on November 5, 1986.

In 1987, Antonio married Cirila de los Santos in Camalig, Albay. Their union produced one child, May-Ann N. de los Santos. On the

other hand, Gloria married Larry Thomas Constant, an American citizen, on July 11, 1987, in the US.

In 1989, Antonio amended his records at SSS and changed his beneficiaries from Mrs. Margarita de los Santos to Cirila de los Santos;

from Gloria de los Santos to May-Ann de los Santos; and from Erlinda de los Santos to Armine de los Santos. Antonio retired from

his employment in 1996, and from then on began receiving monthly pension.

Antoio died of respiratory failure on May 15, 1999. Upon his death, Cirila applied for and began receiving his SSS pension benefit,

beginning December 1999. On December 21, 1999, Gloria filed a claim for Antonios death benefits with the SSS. Her claim was

denied because she was not a qualified beneficiary of Antonio.

ISSUE:

Whether or not the respondent is still qualified as a primary beneficiary of the deceased SSS member Antonio?

HELD:

As found by both the SSC and the CA, the divorce obtained by respondent against the deceased Antonio was not binding in this

jurisdiction. Under Philippine law, only aliens may obtain divorces abroad, provided they are valid according to their national law.

The divorce was obtained by respondent Gloria while she was still a Filipino citizen and thus covered by the policy against absolute

divorces. It did not sever her marriage ties with Antonio.

However, although respondent was the legal spouse of the deceased, We find that she is still disqualified to be his primary

beneficiary under the SS Law. She fails to fulfill the requirement of dependency upon her deceased husband Antonio.

Social Security System v. Aguas

is instructive in determining the extent of the required dependency under the SS Law. In Aguas,

the Court ruled that although a husband and wife are obliged to support each other, whether one is actually dependent for support

upon the other cannot be presumed from the fact of marriage alone.

Further, Aguas pointed out that a wife who left her family until her husband died and lived with other men, was not dependent

upon her husband for support, financial or otherwise, during the entire period.

The obvious conclusion then is that a wife who is already separated de facto from her husband cannot be said to be dependent for

support upon the husband, absent any showing to the contrary. Conversely, if it is proved that the husband and wife were still

living together at the time of his death, it would be safe to presume that she was dependent on the husband for support, unless it is

shown that she is capable of providing for herself.

Respondent herself admits that she left the conjugal abode on two (2) separate occasions, to live with two different men. The first

was in 1965, less than one year after their marriage, when she contracted a second marriage to Domingo Talens. The second time

she left Antonio was in 1983 when she went to the US, obtained a divorce, and later married an American citizen.

In fine, these uncontroverted facts remove her from qualifying as a primary beneficiary of her deceased husband.

Potrebbero piacerti anche

- BPI Leasing Corp V CA Admin Digest G R No 127624 November 18 2003Documento2 pagineBPI Leasing Corp V CA Admin Digest G R No 127624 November 18 2003Samiha TorrecampoNessuna valutazione finora

- People v. Mendez (2023)Documento43 paginePeople v. Mendez (2023)Avocado DreamsNessuna valutazione finora

- Criminal Procedure - 27 July 2017.list of CasesDocumento9 pagineCriminal Procedure - 27 July 2017.list of CasesJana GreenNessuna valutazione finora

- Retroactive Effect of Penal LawsDocumento4 pagineRetroactive Effect of Penal LawsHazel Reyes-AlcantaraNessuna valutazione finora

- Consti DigestDocumento10 pagineConsti DigestKate AlagaoNessuna valutazione finora

- Board of Trustees v. VelascoDocumento1 paginaBoard of Trustees v. VelascoRAINBOW AVALANCHENessuna valutazione finora

- Case Digest - Imbong Vs OchoaDocumento2 pagineCase Digest - Imbong Vs OchoaArvin MacedaNessuna valutazione finora

- PIL - Supplementary CasesDocumento9 paginePIL - Supplementary CasesGem AusteroNessuna valutazione finora

- Quinagoran V CA. GR 155179. Aug 24 2007Documento2 pagineQuinagoran V CA. GR 155179. Aug 24 2007Raymond Adrian Padilla ParanNessuna valutazione finora

- II.2. Cayetano vs. MonsodDocumento20 pagineII.2. Cayetano vs. MonsodKanglawNessuna valutazione finora

- Union of Filipino Employees Vs VivarDocumento2 pagineUnion of Filipino Employees Vs VivarIda ChuaNessuna valutazione finora

- Course Outline Final Admin Public Officers ElecDocumento17 pagineCourse Outline Final Admin Public Officers ElecQueenVictoriaAshleyPrietoNessuna valutazione finora

- Gallego Vs VeraDocumento7 pagineGallego Vs VeraCarl Vincent QuitorianoNessuna valutazione finora

- Admin Law & Law On Public Officers Bedan Red Book 2022Documento21 pagineAdmin Law & Law On Public Officers Bedan Red Book 2022Angelica Czarina DENSINGNessuna valutazione finora

- Abella v. CSCDocumento2 pagineAbella v. CSCuranusneptune20Nessuna valutazione finora

- Hallasgo v. COA, G.R. No. 171340, 11 September 2009Documento1 paginaHallasgo v. COA, G.R. No. 171340, 11 September 2009qwertyNessuna valutazione finora

- Agency and Partnership CasesDocumento7 pagineAgency and Partnership CasesGeanelleRicanorEsperonNessuna valutazione finora

- Vano v. GSIS GR 81327, Dec. 4, 1989Documento2 pagineVano v. GSIS GR 81327, Dec. 4, 1989Learsi AfableNessuna valutazione finora

- Legislative Concurrence On TreatiesDocumento19 pagineLegislative Concurrence On TreatiesCristinaNessuna valutazione finora

- Consti Cases ComelecDocumento28 pagineConsti Cases ComelecWTI billingNessuna valutazione finora

- Course Outline in Administrative Law, Law On Public Officers & Election LawDocumento5 pagineCourse Outline in Administrative Law, Law On Public Officers & Election LawyanieggNessuna valutazione finora

- Datu Kida V SenateDocumento4 pagineDatu Kida V SenateKathryn Claire BullecerNessuna valutazione finora

- U.S v. Ang Tang Ho 43 Phil. 1 - Political Law - Delegation of Power - Administrative BodiesDocumento1 paginaU.S v. Ang Tang Ho 43 Phil. 1 - Political Law - Delegation of Power - Administrative BodiesBenz Clyde Bordeos TolosaNessuna valutazione finora

- Election DigestsDocumento48 pagineElection DigestsLarissaNessuna valutazione finora

- Divinagracia V Sto. TomasDocumento2 pagineDivinagracia V Sto. TomasChelle BelenzoNessuna valutazione finora

- Public Officers - Assigned CasesDocumento13 paginePublic Officers - Assigned CasesFrances Abigail BubanNessuna valutazione finora

- Case Digest - Belgica v. Executive SecretaryDocumento2 pagineCase Digest - Belgica v. Executive SecretaryJay BustaliñoNessuna valutazione finora

- 17navaroo v. CSC 226 Scra 522Documento1 pagina17navaroo v. CSC 226 Scra 522Deanne Mitzi SomolloNessuna valutazione finora

- 56 Commissioner of Customs V HypermixDocumento5 pagine56 Commissioner of Customs V Hypermix01123813Nessuna valutazione finora

- 2 Navarosa v. Comelec (Bries) PDFDocumento2 pagine2 Navarosa v. Comelec (Bries) PDFJoshua AbadNessuna valutazione finora

- Aquino v. Comelec (1975)Documento12 pagineAquino v. Comelec (1975)RenChaNessuna valutazione finora

- G.R. No. 195649 Maquiling Vs ComelecDocumento12 pagineG.R. No. 195649 Maquiling Vs ComelecAnonymous suicwlwNessuna valutazione finora

- Venue Effects of Stipulations On Venue Briones vs. Court of Appeals G.R. No. 204444 January 14, 2015 FactsDocumento7 pagineVenue Effects of Stipulations On Venue Briones vs. Court of Appeals G.R. No. 204444 January 14, 2015 FactscyhaaangelaaaNessuna valutazione finora

- Chiongbian V OrbosDocumento2 pagineChiongbian V OrbosAlexandrea CornejoNessuna valutazione finora

- Admin ElectDocumento27 pagineAdmin ElectMiji HarunoNessuna valutazione finora

- Abella Jr. vs. Civil Service Commission (G.R. No. 152574, 442 SCRA 507)Documento14 pagineAbella Jr. vs. Civil Service Commission (G.R. No. 152574, 442 SCRA 507)Narciso Javelosa IIINessuna valutazione finora

- 14Documento1 pagina14GoodyNessuna valutazione finora

- Lledo Vs Lledo Case Digest A.M. No. P-95-1167Documento14 pagineLledo Vs Lledo Case Digest A.M. No. P-95-1167Case Digest CompilationNessuna valutazione finora

- Admin Villegas V SubidoDocumento1 paginaAdmin Villegas V SubidoloricaloNessuna valutazione finora

- 01 Purisima Vs SalangaDocumento2 pagine01 Purisima Vs SalangaPiaNessuna valutazione finora

- 032 Maceda v. ERBDocumento10 pagine032 Maceda v. ERBTon RiveraNessuna valutazione finora

- National Amnesty Commission vs. COA - 156982 - September 8, 2004 - JDocumento10 pagineNational Amnesty Commission vs. COA - 156982 - September 8, 2004 - Jbuena brentNessuna valutazione finora

- Jurisprudence (The Spring Cannot Be Higher Than The Source)Documento17 pagineJurisprudence (The Spring Cannot Be Higher Than The Source)chichigau100% (1)

- Administrative Law Reviewer Ton PDFDocumento8 pagineAdministrative Law Reviewer Ton PDFAlvin Ryan KipliNessuna valutazione finora

- Judge Shall Be Separated or Removed From Office " Nowhere Does It Mention TheDocumento1 paginaJudge Shall Be Separated or Removed From Office " Nowhere Does It Mention TheKatrina Janine Cabanos-ArceloNessuna valutazione finora

- Biraogo Vs PTCDocumento5 pagineBiraogo Vs PTCSean ArcillaNessuna valutazione finora

- Abakada Guro Party List v. ErmitaDocumento3 pagineAbakada Guro Party List v. ErmitaMikee MacalaladNessuna valutazione finora

- 09 Banda vs. ErmitaDocumento2 pagine09 Banda vs. ErmitaDemi PigNessuna valutazione finora

- ADMINISTRATIVE LAW OutlineDocumento3 pagineADMINISTRATIVE LAW OutlineMugiwara LuffyNessuna valutazione finora

- Rodrigo Vs SandiganbayanDocumento2 pagineRodrigo Vs SandiganbayanJc Araojo0% (1)

- 11 R. Marino Corpus Vs Miguel Cuaderno, Sr. 13 SCRA 591 (Case Digest)Documento1 pagina11 R. Marino Corpus Vs Miguel Cuaderno, Sr. 13 SCRA 591 (Case Digest)Deanne Mitzi SomolloNessuna valutazione finora

- Geronga v. VarelaDocumento15 pagineGeronga v. VarelagoyrexNessuna valutazione finora

- (CONSTI) Pamantasan NG Lungsod NG Maynila Vs IACDocumento2 pagine(CONSTI) Pamantasan NG Lungsod NG Maynila Vs IACMarc VirtucioNessuna valutazione finora

- Corona vs. CADocumento18 pagineCorona vs. CAErin GamerNessuna valutazione finora

- NHA vs. BaellosDocumento2 pagineNHA vs. BaellosMARRYROSE LASHERASNessuna valutazione finora

- SSS v. de Los SantosDocumento3 pagineSSS v. de Los SantosespressoblueNessuna valutazione finora

- V. SOCIAL SECURITY SYSTEM v. GLORIA DE LOS SANTOSDocumento1 paginaV. SOCIAL SECURITY SYSTEM v. GLORIA DE LOS SANTOSReynier Molintas ClemensNessuna valutazione finora

- Social Security System Gloria de Los Santos FactsDocumento3 pagineSocial Security System Gloria de Los Santos FactsKaren Ryl Lozada BritoNessuna valutazione finora

- Labiste - PFR 1Documento3 pagineLabiste - PFR 1Chardane LabisteNessuna valutazione finora

- Agra 7Documento5 pagineAgra 7Shally Lao-unNessuna valutazione finora

- ARELLANO Rem PW PDFDocumento102 pagineARELLANO Rem PW PDFmercy rodriguezNessuna valutazione finora

- 8 Motion To Admit CafsDocumento5 pagine8 Motion To Admit Cafsmercy rodriguezNessuna valutazione finora

- Remedial Law Review 1 - THURDAY 1pm-5pm Professor: Atty. Gabriel Dela Pena Legend: 1 Primary - 2 Back-UpDocumento3 pagineRemedial Law Review 1 - THURDAY 1pm-5pm Professor: Atty. Gabriel Dela Pena Legend: 1 Primary - 2 Back-Upmercy rodriguezNessuna valutazione finora

- Last Minute Tips For Remedial Law Review FinalsDocumento2 pagineLast Minute Tips For Remedial Law Review Finalsmercy rodriguezNessuna valutazione finora

- 2 Ejectment - Reply - DSG Vs REMDocumento6 pagine2 Ejectment - Reply - DSG Vs REMmercy rodriguezNessuna valutazione finora

- San Jose Owners V Atty. RamonillosDocumento7 pagineSan Jose Owners V Atty. Ramonillosmercy rodriguezNessuna valutazione finora

- En Banc: Respect To The Audit of The Boy Scouts of The Philippines." in Its Whereas Clauses, TheDocumento25 pagineEn Banc: Respect To The Audit of The Boy Scouts of The Philippines." in Its Whereas Clauses, Themercy rodriguezNessuna valutazione finora

- Persons and Family Relations LAW ON SEPARATION OF THE SPOUSES - Divorce Under Muslim Code Llave v. Republic (G.R. No. 169766, March 30, 2011)Documento1 paginaPersons and Family Relations LAW ON SEPARATION OF THE SPOUSES - Divorce Under Muslim Code Llave v. Republic (G.R. No. 169766, March 30, 2011)mercy rodriguezNessuna valutazione finora

- Requirements For Practice of Law 1Documento79 pagineRequirements For Practice of Law 1mercy rodriguezNessuna valutazione finora

- Vitriolo V DasigDocumento2 pagineVitriolo V Dasigmercy rodriguezNessuna valutazione finora

- Vitriolo V Dasig - Canon 6Documento2 pagineVitriolo V Dasig - Canon 6mercy rodriguez100% (3)

- Vitriolo V Dasig - Canon 6Documento2 pagineVitriolo V Dasig - Canon 6mercy rodriguez100% (3)

- Air France V CarrascosaDocumento2 pagineAir France V Carrascosamercy rodriguezNessuna valutazione finora

- Cayao V de Mundo 226 Scra 492Documento1 paginaCayao V de Mundo 226 Scra 492mercy rodriguezNessuna valutazione finora

- Constitutional Law 2 - Digest - 03 BINAY Vs DOMINGO, G.R. NO. 92389, September 11, 1991Documento1 paginaConstitutional Law 2 - Digest - 03 BINAY Vs DOMINGO, G.R. NO. 92389, September 11, 1991mercy rodriguez100% (1)

- Aurelio v. Aurelio, G.R. No. 175367, June 6, 2011Documento2 pagineAurelio v. Aurelio, G.R. No. 175367, June 6, 2011mercy rodriguezNessuna valutazione finora

- Lesaca v. LesacaDocumento2 pagineLesaca v. Lesacamercy rodriguezNessuna valutazione finora

- Lopez v. SenateDocumento1 paginaLopez v. Senatemercy rodriguez100% (1)

- Aklat v. ComelecDocumento1 paginaAklat v. Comelecmercy rodriguezNessuna valutazione finora

- XXX XXX XXX "XVIII. Urea Formaldehyde For The Manufacture of Plywood and Hardboard When Imported by and For The Exclusive Use of End-Users."Documento3 pagineXXX XXX XXX "XVIII. Urea Formaldehyde For The Manufacture of Plywood and Hardboard When Imported by and For The Exclusive Use of End-Users."mercy rodriguezNessuna valutazione finora

- Veterans Federation Party v. ComelecDocumento2 pagineVeterans Federation Party v. Comelecmercy rodriguezNessuna valutazione finora

- Accenture V Commission G.R. 190102 (Digest)Documento3 pagineAccenture V Commission G.R. 190102 (Digest)mercy rodriguezNessuna valutazione finora

- Veterans Federation Party v. ComelecDocumento2 pagineVeterans Federation Party v. Comelecmercy rodriguezNessuna valutazione finora

- Tanjanco v. CA - DigestDocumento1 paginaTanjanco v. CA - Digestmercy rodriguezNessuna valutazione finora

- Royal Lines Inc Vs CADocumento8 pagineRoyal Lines Inc Vs CAKathleen MaeNessuna valutazione finora

- Case Digest Yellow Pad 2Documento5 pagineCase Digest Yellow Pad 2Claire RoxasNessuna valutazione finora

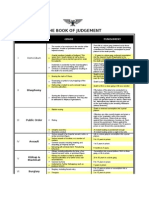

- Book of Judgement - SummaryDocumento3 pagineBook of Judgement - SummaryJon CokerNessuna valutazione finora

- Consti Mohit KumarDocumento3 pagineConsti Mohit KumarTushar GoyalNessuna valutazione finora

- 313.apo Cement Corporation, Petitioner, V. Mingson Mining Industries Corporation, RespondentDocumento3 pagine313.apo Cement Corporation, Petitioner, V. Mingson Mining Industries Corporation, RespondentJoanna Sarah T. DivaNessuna valutazione finora

- Govt V AburalDocumento5 pagineGovt V AburalJanelle Leano MarianoNessuna valutazione finora

- 2019 Ateneo Pre Week Commercial LawDocumento87 pagine2019 Ateneo Pre Week Commercial Lawfreegalado100% (5)

- Lumanog Vs PPDocumento163 pagineLumanog Vs PPJohnde MartinezNessuna valutazione finora

- Pcib Vs Ca Case DigestDocumento8 paginePcib Vs Ca Case DigestJaimie Lyn TanNessuna valutazione finora

- CMC-498-Gaza-19 (1) 7 (K (9) - Jashim Miah-HabignajDocumento14 pagineCMC-498-Gaza-19 (1) 7 (K (9) - Jashim Miah-HabignajSmiler KhanNessuna valutazione finora

- Deed of Grant of Usufructuary Rights No ConsiderationDocumento3 pagineDeed of Grant of Usufructuary Rights No ConsiderationAngelica Marie100% (1)

- ACE Agreement 1: Design: 2009 EditionDocumento33 pagineACE Agreement 1: Design: 2009 Editionmohamed_gameel_3Nessuna valutazione finora

- MP Judiciary 2001 025a0eac8fc3aDocumento28 pagineMP Judiciary 2001 025a0eac8fc3aMohd SuhailNessuna valutazione finora

- Ordinance Kite FyingDocumento2 pagineOrdinance Kite FyingEi BinNessuna valutazione finora

- People vs. EnojasDocumento1 paginaPeople vs. EnojasShane Fernandez JardinicoNessuna valutazione finora

- Resident Marine Mammals of The Protected Seascape Tañon Strait vs. ReyesDocumento2 pagineResident Marine Mammals of The Protected Seascape Tañon Strait vs. ReyesElaine Honrade100% (3)

- J&K Services Selection Board: Applied Application Form For Appointment To Class-IvDocumento3 pagineJ&K Services Selection Board: Applied Application Form For Appointment To Class-IvVijay SarmalNessuna valutazione finora

- Investigation Data Form (IDF)Documento1 paginaInvestigation Data Form (IDF)NOEL CORALNessuna valutazione finora

- Wilson v. GirardDocumento1 paginaWilson v. GirardFatima Blanca SolisNessuna valutazione finora

- Ong Koh Hou at Wan Kok Fond V Da Land SDN BHD (2018) MYCA 207Documento15 pagineOng Koh Hou at Wan Kok Fond V Da Land SDN BHD (2018) MYCA 207Marco Isidor TanNessuna valutazione finora

- 01 Property - Concepts - Maneclang v. Intermediate Appellate Court #01Documento1 pagina01 Property - Concepts - Maneclang v. Intermediate Appellate Court #01Perkyme0% (1)

- G.R. No. 145226 February 06, 2004 LUCIO MORIGO y CACHO, Petitioner, vs. People of The Philippines, Respondent. Second Division DecisionDocumento3 pagineG.R. No. 145226 February 06, 2004 LUCIO MORIGO y CACHO, Petitioner, vs. People of The Philippines, Respondent. Second Division DecisionChielsea CruzNessuna valutazione finora

- Module 1Documento2 pagineModule 1Shaina Laguitan BaladadNessuna valutazione finora

- TAX REV 2 - CIR vs. ASALUS CORPORATIONDocumento5 pagineTAX REV 2 - CIR vs. ASALUS CORPORATIONCayen Cervancia CabiguenNessuna valutazione finora

- General Conditions of Contract Qatar May 2007Documento58 pagineGeneral Conditions of Contract Qatar May 2007Leonidas AnaxandridaNessuna valutazione finora

- Alternative Dispute ResolutionDocumento2 pagineAlternative Dispute ResolutionGi Em EyNessuna valutazione finora

- Piercing The Corporate Veil: - Non-Stock Corporation - Natural Person - Reverse PiercingDocumento2 paginePiercing The Corporate Veil: - Non-Stock Corporation - Natural Person - Reverse PiercingRvan Gui100% (2)

- Petitioner Vs Vs Respondent: First DivisionDocumento20 paginePetitioner Vs Vs Respondent: First DivisionNestor Pol RascoNessuna valutazione finora

- Garcia v. VillarDocumento3 pagineGarcia v. VillarKDNessuna valutazione finora

- Affidavit of Undertaking 2019 PatrolmanDocumento1 paginaAffidavit of Undertaking 2019 PatrolmanMarcliene May Ortiz Obial75% (12)