Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Lecture 2.2: Characteristics of Portfolios: Investment Analysis Fall, 2012

Caricato da

Hugo PagolaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Lecture 2.2: Characteristics of Portfolios: Investment Analysis Fall, 2012

Caricato da

Hugo PagolaCopyright:

Formati disponibili

CMU-logo

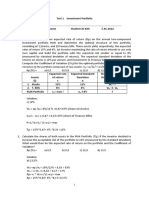

Today Portfolios Return on a Portfolio

Lecture 2.2: Characteristics of Portfolios

Investment Analysis

Fall, 2012

Anisha Ghosh

Tepper School of Business

Carnegie Mellon University

November 8, 2012

CMU-logo

Today Portfolios Return on a Portfolio

Readings and Assignments

Chapter 3 of the course textbook (EGBG) covers related

material.

Homework 2 is available on the Courses Wall for Week 2.

CMU-logo

Today Portfolios Return on a Portfolio

Characteristics of Portfolios

Most investors hold portfolios of a large number of assets rather than

individual assets.

The risk on a portfolio is more complex than a simple average of the risk

of individual assets - it depends on whether the returns on individual

assets tend to move together or whether some assets give good returns

when others give bad returns.

Benets of Diversication

There is risk reduction from holding a portfolio of assets if the assets do

not move in perfect unison.

CMU-logo

Today Portfolios Return on a Portfolio

Characteristics of Portfolios

Most investors hold portfolios of a large number of assets rather than

individual assets.

The risk on a portfolio is more complex than a simple average of the risk

of individual assets - it depends on whether the returns on individual

assets tend to move together or whether some assets give good returns

when others give bad returns.

Benets of Diversication

There is risk reduction from holding a portfolio of assets if the assets do

not move in perfect unison.

CMU-logo

Today Portfolios Return on a Portfolio

Characteristics of Portfolios

Most investors hold portfolios of a large number of assets rather than

individual assets.

The risk on a portfolio is more complex than a simple average of the risk

of individual assets - it depends on whether the returns on individual

assets tend to move together or whether some assets give good returns

when others give bad returns.

Benets of Diversication

There is risk reduction from holding a portfolio of assets if the assets do

not move in perfect unison.

CMU-logo

Today Portfolios Return on a Portfolio

Return on a portfolio

Denition

The return on a portfolio of assets is a weighted average of the return on the

individual assets where the weight applied to each return is the fraction of the

portfolio invested in the asset

R

pj

=

N

i =1

X

i

R

ij

, where

N

i =1

X

i

= 1

X

i

> 0 long position in asset i

X

i

< 0 short position in (short sale of) asset i

CMU-logo

Today Portfolios Return on a Portfolio

Return on a portfolio

Denition

The return on a portfolio of assets is a weighted average of the return on the

individual assets where the weight applied to each return is the fraction of the

portfolio invested in the asset

R

pj

=

N

i =1

X

i

R

ij

, where

N

i =1

X

i

= 1

X

i

> 0 long position in asset i

X

i

< 0 short position in (short sale of) asset i

CMU-logo

Today Portfolios Return on a Portfolio

Return on a portfolio

Denition

The return on a portfolio of assets is a weighted average of the return on the

individual assets where the weight applied to each return is the fraction of the

portfolio invested in the asset

R

pj

=

N

i =1

X

i

R

ij

, where

N

i =1

X

i

= 1

X

i

> 0 long position in asset i

X

i

< 0 short position in (short sale of) asset i

CMU-logo

Today Portfolios Return on a Portfolio

Expected Return on a portfolio

Properties of Expected Return:

1

The expected value of the sum of two returns is equal to the sum

of the expected value of each return:

E (R

1

+R

2

) = E (R

1

) +E (R

2

)

2

The expected value of a constant C times a return is the constant

times the expected return:

E (CR

i

) = CE (R

i

)

Expected Return on a Portfolio

The expected return on a portfolio is:

E (R

p

) = E

i =1

X

i

R

ij

=

N

i =1

E (X

i

R

ij

)

=

N

i =1

X

i

E (R

i

)

CMU-logo

Today Portfolios Return on a Portfolio

Expected Return on a portfolio

Properties of Expected Return:

1

The expected value of the sum of two returns is equal to the sum

of the expected value of each return:

E (R

1

+R

2

) = E (R

1

) +E (R

2

)

2

The expected value of a constant C times a return is the constant

times the expected return:

E (CR

i

) = CE (R

i

)

Expected Return on a Portfolio

The expected return on a portfolio is:

E (R

p

) = E

i =1

X

i

R

ij

=

N

i =1

E (X

i

R

ij

)

=

N

i =1

X

i

E (R

i

)

CMU-logo

Today Portfolios Return on a Portfolio

Expected Return on a portfolio

Properties of Expected Return:

1

The expected value of the sum of two returns is equal to the sum

of the expected value of each return:

E (R

1

+R

2

) = E (R

1

) +E (R

2

)

2

The expected value of a constant C times a return is the constant

times the expected return:

E (CR

i

) = CE (R

i

)

Expected Return on a Portfolio

The expected return on a portfolio is:

E (R

p

) = E

i =1

X

i

R

ij

=

N

i =1

E (X

i

R

ij

)

=

N

i =1

X

i

E (R

i

)

CMU-logo

Today Portfolios Return on a Portfolio

Expected Return on a portfolio

Properties of Expected Return:

1

The expected value of the sum of two returns is equal to the sum

of the expected value of each return:

E (R

1

+R

2

) = E (R

1

) +E (R

2

)

2

The expected value of a constant C times a return is the constant

times the expected return:

E (CR

i

) = CE (R

i

)

Expected Return on a Portfolio

The expected return on a portfolio is:

E (R

p

) = E

i =1

X

i

R

ij

=

N

i =1

E (X

i

R

ij

)

=

N

i =1

X

i

E (R

i

)

CMU-logo

Today Portfolios Return on a Portfolio

Variance of Return on a portfolio

Variance of Return on a portfolio

The variance of a portfolio is the expected value of the squared

deviations of the returns on the portfolio from its mean return:

2

p

= E (R

p

E (R

p

))

2

= E (X

1

R

1j

+X

2

R

2j

[X

1

E (R

1

) +X

2

E (R

2

)])

2

= E (X

1

[R

1j

E (R

1

)] +X

2

[R

2j

E (R

2

)])

2

= E

X

2

1

[R

1j

E (R

1

)]

2

+X

2

2

[R

2j

E (R

2

)]

2

+2X

1

X

2

[R

1j

E (R

1

)] [R

2j

E (R

2

)]

= X

2

1

E [R

1j

E (R

1

)]

2

+X

2

2

E [R

2j

E (R

2

)]

2

+2X

1

X

2

E [R

1j

E (R

1

)] [R

2j

E (R

2

)]

= X

2

1

2

1

+X

2

2

2

2

+ 2X

1

X

2

E [R

1j

E (R

1

)] [R

2j

E (R

2

)]

CMU-logo

Today Portfolios Return on a Portfolio

Variance of Return on a portfolio

Variance of Return on a portfolio

The variance of a portfolio is the expected value of the squared

deviations of the returns on the portfolio from its mean return:

2

p

= E (R

p

E (R

p

))

2

= E (X

1

R

1j

+X

2

R

2j

[X

1

E (R

1

) +X

2

E (R

2

)])

2

= E (X

1

[R

1j

E (R

1

)] +X

2

[R

2j

E (R

2

)])

2

= E

X

2

1

[R

1j

E (R

1

)]

2

+X

2

2

[R

2j

E (R

2

)]

2

+2X

1

X

2

[R

1j

E (R

1

)] [R

2j

E (R

2

)]

= X

2

1

E [R

1j

E (R

1

)]

2

+X

2

2

E [R

2j

E (R

2

)]

2

+2X

1

X

2

E [R

1j

E (R

1

)] [R

2j

E (R

2

)]

= X

2

1

2

1

+X

2

2

2

2

+ 2X

1

X

2

E [R

1j

E (R

1

)] [R

2j

E (R

2

)]

CMU-logo

Today Portfolios Return on a Portfolio

Covariance and Correlation

Covariance: The covariance of two assets is a measure of how returns

on the assets move together:

12

= E [R

1j

E (R

1

)] [R

2j

E (R

2

)]

Correlation: The correlation has the same properties as the covariance

but with a but with a range of 1 to 1:

12

=

12

2

CMU-logo

Today Portfolios Return on a Portfolio

Covariance and Correlation

Covariance: The covariance of two assets is a measure of how returns

on the assets move together:

12

= E [R

1j

E (R

1

)] [R

2j

E (R

2

)]

Correlation: The correlation has the same properties as the covariance

but with a but with a range of 1 to 1:

12

=

12

2

CMU-logo

Today Portfolios Return on a Portfolio

Benets of Diversication

The variance of a portfolio of N assets is

2

p

=

N

i =1

X

2

i

2

i

+

N

i =1

N

k=1

i =k

X

i

X

k

ik

In the case where all the assets are independent, the covariance

between them is zero, and the formula for the variance becomes

2

p

=

N

i =1

X

2

i

2

i

CMU-logo

Today Portfolios Return on a Portfolio

Benets of Diversication

The variance of a portfolio of N assets is

2

p

=

N

i =1

X

2

i

2

i

+

N

i =1

N

k=1

i =k

X

i

X

k

ik

In the case where all the assets are independent, the covariance

between them is zero, and the formula for the variance becomes

2

p

=

N

i =1

X

2

i

2

i

Potrebbero piacerti anche

- An Analysis of Stravinsky's Symphony of Psalms Focusing On Tonality and HarmonyDocumento68 pagineAn Analysis of Stravinsky's Symphony of Psalms Focusing On Tonality and Harmonyr-c-a-d100% (2)

- CFEA3230 Portfolio Theory Lecture 3Documento71 pagineCFEA3230 Portfolio Theory Lecture 3CEA130089 StudentNessuna valutazione finora

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- Risk and Return - Lu-6Documento54 pagineRisk and Return - Lu-6Mega capitalmarket100% (1)

- Portifolio Theory & Asset Pricing ModelsDocumento39 paginePortifolio Theory & Asset Pricing ModelszivainyaudeNessuna valutazione finora

- Phenomenology and Social Reality - Essays in Memory of Alfred Schutz (PDFDrive)Documento316 paginePhenomenology and Social Reality - Essays in Memory of Alfred Schutz (PDFDrive)Muhammad SyarofuddinNessuna valutazione finora

- Risk and ReturnDocumento46 pagineRisk and ReturnPavanNessuna valutazione finora

- Mach4 G and M Code Reference ManualDocumento81 pagineMach4 G and M Code Reference ManualMegi Setiawan SNessuna valutazione finora

- Mensuration & Calculation For Plumbing by Daleon PDFDocumento101 pagineMensuration & Calculation For Plumbing by Daleon PDFmanny daleon100% (1)

- BS en 10028-1Documento24 pagineBS en 10028-1Andrei Balázs100% (1)

- Theodore Sider - Logic For Philosophy PDFDocumento377 pagineTheodore Sider - Logic For Philosophy PDFAnonymous pYK2AqH100% (1)

- GCIF - Parte II IIIDocumento94 pagineGCIF - Parte II IIIJose Pinto de AbreuNessuna valutazione finora

- Money, Banking & Finance: Risk, Return and Portfolio TheoryDocumento39 pagineMoney, Banking & Finance: Risk, Return and Portfolio TheorysarahjohnsonNessuna valutazione finora

- FIB3005Documento10 pagineFIB3005Nga nguyen thiNessuna valutazione finora

- ch07Documento53 paginech07ZoannNessuna valutazione finora

- Financial Economics Bocconi Lecture6Documento22 pagineFinancial Economics Bocconi Lecture6Elisa CarnevaleNessuna valutazione finora

- Chapter 7-Risk, Return, and The Capital Asset Pricing Model Percentage ReturnDocumento10 pagineChapter 7-Risk, Return, and The Capital Asset Pricing Model Percentage ReturnRabinNessuna valutazione finora

- Optimal Risky Portfolio (Bodie) PDFDocumento20 pagineOptimal Risky Portfolio (Bodie) PDFjoel_kifNessuna valutazione finora

- International Portfolio DiversificationDocumento34 pagineInternational Portfolio DiversificationGaurav KumarNessuna valutazione finora

- Chap 1 - Portfolio Risk and Return Part1Documento91 pagineChap 1 - Portfolio Risk and Return Part1eya feguiriNessuna valutazione finora

- Lecture 2.6: Implementing The Portfolio Problem: Investment Analysis Fall, 2012Documento42 pagineLecture 2.6: Implementing The Portfolio Problem: Investment Analysis Fall, 2012Hugo PagolaNessuna valutazione finora

- 5 Portfolio TheoryDocumento15 pagine5 Portfolio TheoryUtkarsh BhalodeNessuna valutazione finora

- S5 Risk Return Online VersionDocumento20 pagineS5 Risk Return Online Versionconstruction omanNessuna valutazione finora

- Lecture 2.5: Solution To The Portfolio Problem: Investment Analysis Fall, 2012Documento13 pagineLecture 2.5: Solution To The Portfolio Problem: Investment Analysis Fall, 2012Hugo PagolaNessuna valutazione finora

- FORMULA SHEET For Midterm ExamDocumento4 pagineFORMULA SHEET For Midterm Examakshitak.2021Nessuna valutazione finora

- Basics of Portfolio Theory: Goals: After Reading This Chapter, You WillDocumento13 pagineBasics of Portfolio Theory: Goals: After Reading This Chapter, You WillLalrohlui RalteNessuna valutazione finora

- Financial Economics Formulas 2014-10-19 11-33-13Documento4 pagineFinancial Economics Formulas 2014-10-19 11-33-13Romain FarsatNessuna valutazione finora

- R P - P - + C: Chapter Seven Basics of Risk and ReturnDocumento13 pagineR P - P - + C: Chapter Seven Basics of Risk and ReturntemedebereNessuna valutazione finora

- Markowitz Portfolio SelectionDocumento29 pagineMarkowitz Portfolio SelectionBirat SharmaNessuna valutazione finora

- Invt FM 1 Chapter-3Documento56 pagineInvt FM 1 Chapter-3Khalid Muhammad100% (1)

- #01 Session1Documento36 pagine#01 Session1YisraelaNessuna valutazione finora

- BM410-09 Theory 2 - MPT and Efficient Frontiers 28sep05Documento57 pagineBM410-09 Theory 2 - MPT and Efficient Frontiers 28sep05satishgwNessuna valutazione finora

- Chap 11 (PT 1) BBDocumento43 pagineChap 11 (PT 1) BBTaVuKieuNhiNessuna valutazione finora

- NPTEL Course: Course Title: Security Analysis and Portfolio Management Course Coordinator: Dr. Jitendra MahakudDocumento8 pagineNPTEL Course: Course Title: Security Analysis and Portfolio Management Course Coordinator: Dr. Jitendra MahakudAnkit ChawlaNessuna valutazione finora

- RWJ Chapter 11Documento17 pagineRWJ Chapter 11Ashish BhallaNessuna valutazione finora

- Lecture 10 - CAPMDocumento19 pagineLecture 10 - CAPMroBinNessuna valutazione finora

- Chapter 2Documento61 pagineChapter 2Meseret HailemichaelNessuna valutazione finora

- UntitledDocumento90 pagineUntitledAnamNessuna valutazione finora

- Chapter 11Documento27 pagineChapter 11Sufyan KhanNessuna valutazione finora

- Test 1 INV Portfolio - 5 - May - 2022Documento2 pagineTest 1 INV Portfolio - 5 - May - 2022zakaria kerboubNessuna valutazione finora

- OptimalRiskyPortfolios (Chapter7)Documento35 pagineOptimalRiskyPortfolios (Chapter7)Joaquin DiazNessuna valutazione finora

- Topic - 4, Portfolio Expected ReturnDocumento29 pagineTopic - 4, Portfolio Expected Returnlinda zyongweNessuna valutazione finora

- Financial Economics Bocconi Lecture5Documento20 pagineFinancial Economics Bocconi Lecture5Elisa CarnevaleNessuna valutazione finora

- Ch11 - Latest VersionDocumento54 pagineCh11 - Latest VersionMhmood Al-saadNessuna valutazione finora

- Portfolio ManagementDocumento50 paginePortfolio ManagementmamunimamaNessuna valutazione finora

- Discussion 2Documento4 pagineDiscussion 2Anh Lê Thị LanNessuna valutazione finora

- Risk and ReturnDocumento38 pagineRisk and ReturnSunil Shaw0% (1)

- Chapter-10 Return & RiskDocumento19 pagineChapter-10 Return & Riskaparajita promaNessuna valutazione finora

- Risk & ReturnDocumento36 pagineRisk & ReturnNocturnal BeeNessuna valutazione finora

- FinanceDocumento3 pagineFinancemuneerppNessuna valutazione finora

- Introduction To Portfolio ManagementDocumento2 pagineIntroduction To Portfolio ManagementKatieYoungNessuna valutazione finora

- Lecture 4 Risk Aversion and Capital Allocation To Risky AssetsDocumento20 pagineLecture 4 Risk Aversion and Capital Allocation To Risky AssetsLuisLoNessuna valutazione finora

- Chapter 8Documento37 pagineChapter 8AparnaPriomNessuna valutazione finora

- CH 5th Risk and ReturnDocumento18 pagineCH 5th Risk and ReturnSADIA JAMEELNessuna valutazione finora

- Essentials of Corporate Finance 7th Edition Ross Solutions ManualDocumento16 pagineEssentials of Corporate Finance 7th Edition Ross Solutions Manualtannagemesodermh4ge100% (16)

- Portfolio Math CFA ReviewDocumento3 paginePortfolio Math CFA ReviewDionizioNessuna valutazione finora

- Lect5-2023Documento40 pagineLect5-2023vitordias347Nessuna valutazione finora

- CH 7 Efficient Diversification (Part 1) (W2024)Documento38 pagineCH 7 Efficient Diversification (Part 1) (W2024)Graeme WilhelmNessuna valutazione finora

- FM Ch5 Risk & ReturnDocumento75 pagineFM Ch5 Risk & Returntemesgen yohannesNessuna valutazione finora

- Portfolio AnalysisDocumento18 paginePortfolio Analysisveggi expressNessuna valutazione finora

- Introduction To Investments AND The Measurement of Investment Returns and RiskDocumento13 pagineIntroduction To Investments AND The Measurement of Investment Returns and RiskAaron PhamNessuna valutazione finora

- Week 4 Lecture PDFDocumento69 pagineWeek 4 Lecture PDFAkshat TiwariNessuna valutazione finora

- Unit - Iv: After Reading This Chapter, Students ShouldDocumento37 pagineUnit - Iv: After Reading This Chapter, Students ShouldJayash KaushalNessuna valutazione finora

- Investment Risk and Return-1Documento20 pagineInvestment Risk and Return-1kelvinyessa906Nessuna valutazione finora

- Principles of Finance Risk and Return: Instructor: Xiaomeng LuDocumento78 paginePrinciples of Finance Risk and Return: Instructor: Xiaomeng LuLinaceroNessuna valutazione finora

- Lecture 3.4: Empirical Evidence On The CAPM: Investment Analysis Fall, 2012Documento33 pagineLecture 3.4: Empirical Evidence On The CAPM: Investment Analysis Fall, 2012Hugo PagolaNessuna valutazione finora

- IEEE Xplore - Enterprise Information Security Architecture A Review of Frameworks, Methodology, and Case StudiesDocumento2 pagineIEEE Xplore - Enterprise Information Security Architecture A Review of Frameworks, Methodology, and Case StudiesHugo PagolaNessuna valutazione finora

- Lecture 3.3: The Capital Asset Pricing Model: Implications: Investment Analysis Fall, 2012Documento10 pagineLecture 3.3: The Capital Asset Pricing Model: Implications: Investment Analysis Fall, 2012Hugo PagolaNessuna valutazione finora

- Lecture 3.2: The Capital Asset Pricing Model: Assumptions and DerivationDocumento41 pagineLecture 3.2: The Capital Asset Pricing Model: Assumptions and DerivationHugo PagolaNessuna valutazione finora

- Lecture 2.6: Implementing The Portfolio Problem: Investment Analysis Fall, 2012Documento42 pagineLecture 2.6: Implementing The Portfolio Problem: Investment Analysis Fall, 2012Hugo PagolaNessuna valutazione finora

- Lecture 3.1: The Capital Asset Pricing Model (CAPM) : MotivationDocumento12 pagineLecture 3.1: The Capital Asset Pricing Model (CAPM) : MotivationHugo PagolaNessuna valutazione finora

- Lecture 2.5: Solution To The Portfolio Problem: Investment Analysis Fall, 2012Documento13 pagineLecture 2.5: Solution To The Portfolio Problem: Investment Analysis Fall, 2012Hugo PagolaNessuna valutazione finora

- Slides1 Lecture1 Subtopic6Documento11 pagineSlides1 Lecture1 Subtopic6Hugo PagolaNessuna valutazione finora

- Course Outline To Investment Analysis-Series 1Documento30 pagineCourse Outline To Investment Analysis-Series 1kanabaramitNessuna valutazione finora

- Lecture 2.4: Mean-Variance Efficient Frontier: Investment Analysis Fall, 2012Documento33 pagineLecture 2.4: Mean-Variance Efficient Frontier: Investment Analysis Fall, 2012Hugo PagolaNessuna valutazione finora

- Lecture 2.1: Mean Variance Portfolio Theory: Investment Analysis Fall, 2012Documento12 pagineLecture 2.1: Mean Variance Portfolio Theory: Investment Analysis Fall, 2012Hugo PagolaNessuna valutazione finora

- Slides1 Lecture2 Subtopic3Documento12 pagineSlides1 Lecture2 Subtopic3Hugo PagolaNessuna valutazione finora

- Lecture 1.4: Market Indexes: Investment Analysis Fall, 2012Documento15 pagineLecture 1.4: Market Indexes: Investment Analysis Fall, 2012Hugo PagolaNessuna valutazione finora

- Slides1 Lecture1 Subtopic5Documento25 pagineSlides1 Lecture1 Subtopic5Hugo PagolaNessuna valutazione finora

- Lecture 1.3: Risk-Return Characteristics of Securities: Investment Analysis Fall, 2012Documento24 pagineLecture 1.3: Risk-Return Characteristics of Securities: Investment Analysis Fall, 2012Hugo PagolaNessuna valutazione finora

- Lecture 1.2: Major Types of Publicly Traded Securities: Investment Analysis Fall, 2012Documento48 pagineLecture 1.2: Major Types of Publicly Traded Securities: Investment Analysis Fall, 2012Hugo PagolaNessuna valutazione finora

- IAS10gR2 Sles9 InstallDocumento17 pagineIAS10gR2 Sles9 InstallHugo PagolaNessuna valutazione finora

- OAS Manual b13995Documento632 pagineOAS Manual b13995Hugo PagolaNessuna valutazione finora

- Siteminder Erp Config Agent Oracle enDocumento49 pagineSiteminder Erp Config Agent Oracle enHugo PagolaNessuna valutazione finora

- 01 - 6.2 Global Bike in SACDocumento34 pagine01 - 6.2 Global Bike in SACjroldan0313Nessuna valutazione finora

- High Performance Premium Tile AdhesivesDocumento6 pagineHigh Performance Premium Tile Adhesivesshreekumar_scdlNessuna valutazione finora

- SIMULATION of EMERGENCY ROOMS USING FLEXSIMDocumento10 pagineSIMULATION of EMERGENCY ROOMS USING FLEXSIMBrandon VarnadoreNessuna valutazione finora

- Ranjit Kumar-Research Methodology A Step-by-Step G-15-16Documento2 pagineRanjit Kumar-Research Methodology A Step-by-Step G-15-16Trendy NewsNessuna valutazione finora

- Fem PDFDocumento65 pagineFem PDFManda Ramesh BabuNessuna valutazione finora

- ABB Medium-Voltage Surge Arresters - Application Guidelines 1HC0075561 E2 AC (Read View) - 6edDocumento60 pagineABB Medium-Voltage Surge Arresters - Application Guidelines 1HC0075561 E2 AC (Read View) - 6edAndré LuizNessuna valutazione finora

- SANS5847 - Flakiness Index of Course AggregatesDocumento7 pagineSANS5847 - Flakiness Index of Course AggregatesAndrew MwindililaNessuna valutazione finora

- Atomic Absorption SpectrosDocumento2 pagineAtomic Absorption SpectrosSirTonz100% (1)

- XS4P08PC410TF: Product Data SheetDocumento5 pagineXS4P08PC410TF: Product Data SheetGonzalo GarciaNessuna valutazione finora

- Sci Problem SolutionsDocumento10 pagineSci Problem SolutionsVS PUBLIC SCHOOL BangaloreNessuna valutazione finora

- PartIII Semiconductor at Equilibrium PrintDocumento22 paginePartIII Semiconductor at Equilibrium PrintK.bhogendranathareddy KuppireddyNessuna valutazione finora

- Spring State Machine TransitionsDocumento6 pagineSpring State Machine TransitionsGroza CristiNessuna valutazione finora

- REvision Test - 1Documento2 pagineREvision Test - 1JagendraNessuna valutazione finora

- ReviewerDocumento6 pagineReviewerNeo GarceraNessuna valutazione finora

- Polymer-Plastics Technology and EngineeringDocumento6 paginePolymer-Plastics Technology and Engineeringsamuelben87Nessuna valutazione finora

- DSP Lab 6Documento7 pagineDSP Lab 6Ali MohsinNessuna valutazione finora

- Third Space Learning - Fluent in Five - Spring Term 2 Week 5Documento11 pagineThird Space Learning - Fluent in Five - Spring Term 2 Week 5ZoonieFRNessuna valutazione finora

- Skin and Its AppendagesDocumento3 pagineSkin and Its AppendagesMarchylle Faye JimenezNessuna valutazione finora

- Pay It ForwardDocumento4 paginePay It ForwardAndrew FarrellNessuna valutazione finora

- Math PerformanceDocumento2 pagineMath PerformanceMytz PalatinoNessuna valutazione finora

- Comentarios-103 - Parte I - English PDFDocumento89 pagineComentarios-103 - Parte I - English PDFSakthivel VNessuna valutazione finora

- Dwnload Full Physics 3rd Edition Giambattisata Solutions Manual PDFDocumento35 pagineDwnload Full Physics 3rd Edition Giambattisata Solutions Manual PDFmarcusquyepv100% (12)

- Airplane Wing Geometry and ConfigurationsDocumento7 pagineAirplane Wing Geometry and Configurationsh_mahdiNessuna valutazione finora

- Opsis Technique Eng 2007Documento4 pagineOpsis Technique Eng 2007sukumariicbNessuna valutazione finora