Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Seaport: Sector Reviews

Caricato da

aighaaaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Seaport: Sector Reviews

Caricato da

aighaaaCopyright:

Formati disponibili

Sector Reviews : Seaport

Presented by

Directorate General of Sea Transportation

Ministry of Transportation

Republic of Indonesia

Korea-Indonesia PPP Fair 2007

1

Overview

Archipelagic shape of Indonesia needs reliable sea transportation

system to move people and goods between thousands of islands.

Indonesian international trade: 99.4 % (volume) and 95.2 % (value) of

export-import cargo are transported by sea.

As the 4

th

most populated country, Indonesia has been a big market

for imported products. Being rich of natural resources, it has been

among top exporters of oil and other commodities. This creates a

balance of trade volume from and to Indonesia.

Seaports are vital points of interface between sea and land transport

that determine efficient distribution of goods. The role of ports has

also been evolving into logistics center.

Some seaport infrastructures have been approaching their maximum

operating capacity while some greenfield projects are needed to

cope with highly increasing demand.

2

NO PORT 2003 2004 2005

1 TANJ UNG PRIOK 4,329,251 5,675,937

752,694

40,891

5,623,436

1,241,077

387,995

669,102

1,551,303

4,048,853

261,837,164

TOTAL 315,018,546 281,828,452 301,556,444

7,622,715

2 TANJ UNG PERAK 490,141 873,123

3 TANJ UNG EMAS 14,637 120,198

4 BELAWAN 3,828,293 5,525,676

5 MAKASSAR 1,138,219 1,036,423

6 BITUNG 388,676 521,041

10 OTHERS 299,772,091 278,959,438

7 PONTIANAK 735,792 589,164

8 PALEMBANG 1,232,884 2,391,269

9 PANJ ANG 3,088,562 3,917,397

Source : Directorate General of Sea Transportation

(Tons)

Export volume through ports in Indonesia

3

NO PORT

2003 2004 2005

1 TANJ UNG PRIOK 11,327,570 12,161,217

3,784,135

567,225

1,846,463

708,689

10,615

90,351

141,344

678,622

163,249,776

TOTAL 254,344,147 183,238,437 81,711,467

11,738,888

2 TANJ UNG PERAK 3,684,249 3,560,909

3 TANJ UNG EMAS 606,997 454,248

4 BELAWAN 1,548,607 2,759,676

5 MAKASSAR 637,017 690,222

6 BITUNG 92,491 20,451

10 OTHERS 235,510,699 61,438,929

7 PONTIANAK 222,923 117,097

8 PALEMBANG 197,525 205,571

9 PANJ ANG 516,069 725,476

Source : Directorate General of Sea Transportation

Note : 8 Main Exporters to Indonesia : Singapore, J apan, China, USA, Australia, South Korea, Germany, Malaysia

(Tons)

Import volume through ports in Indonesia

4

Owned by National

Sea Transportation

Company = 5,649

units / 6,493,771 GT

4,120 Units Vessel

(6,282,174 GT)

1,529 Units Vessel

(1,610,358 HP =

211,597 GT)

Owned by Special

Sea Transportation

Company = 1,488

units / 541,433 GT

1,306 Units Vessel

(515,754 GT)

182 Units Vessel

(119,160 HP =

25,679 GT)

TOTAL FLEET :

7,137 Units

(7,035,204 GT)

5,426 Units

(6,797,928 GT)

1,711 Units

(1,728,314 HP

= 237,276 GT)

March 2005 March 2007 March 2005 March 2007

Fishing Vessel 874 930 62,99 62,50

Tug Boat 169 180 12,26 12,10

Excursion Ship 57 65 4,16 4,37

Bulk Carrier 24 24 1,76 1,61

Tanker 9 9 0,66 0,60

Landing Craft 9 9 0,66 0,60

Barge 212 218 15,47 14,65

Others (Dredger,

Motor Boat, Carg

Supply Vessel)

TOTAL 1382 1488 100 100

3,56

Vessel Amount Percentage

Vessel Type

28 53 2,04

March 2005 March 2007 March 2005 March 2007

General Cargo 1388 1524 30,05 26,98

Container 107 118 2,32 2,07

Ferry / Crossing 0 59 1,3 1,05

Ro Ro 60 34 0 0,6

Bulk Carrier 22 23 0,48 0,41

Tanker 224 331 4,85 5,87

Barge 1236 1507 25,89 26,89

Passenger 229 253 4,96 4,48

Tug Boat 1188 1528 25,72 27,06

Landing Craft 205 272 4,43 4,82

TOTAL 4659 5649 100 100

Vessel Type

Vessel Amount Percentage

Indonesian merchant fleet

(as of March 2007)

5

Existing seaports networking

6

Panjang :

2004 : 85,130

2005 : 93,164

2006 : 81,545

Tanjung Perak :

2004 : 1,717,578

2005 : 1,775,862

2006 : 1,852,703

Tanjung Emas :

2004 : 355,009

2005 : 353,675

2006 : 370,108

Makassar :

2004 : 249,844

2005 : 244,199

2006 : 256,071

Pontianak :

2004 : 139,456

2005 : 132,273

2006 : 138,991

Palembang :

2004 : 58,737

2005 : 65,879

2006 : 70,336

Belawan :

2004 : 571,048

2005 : 617,897

2006 : 662,115

Tanjung Priok :

2004 : 2,462,451

2005 : 2,339,354

2006 : 2,455,360

Bitung :

2004 : 102,648

2005 : 103,265

2006 : 100,933

(TEUs)

Container throughput in 9 major ports

7

Seaports networking in the future

8

1. Increasing national sea transportation services

a. Increase service quality;

b. Increase the role of sea transportation in stimulating other sectors competitiveness;

c. The development of transportation as major channel for national logistic system

implementation;

d. Balance the role of State Owned Enterprise (BUMN), Provincial State Owned Enterprise

(BUMD), private sector and cooperative;

e. Optimize the utilization of facilities available;

f. The development of sea transportation capacity;

g. Increase services at underdeveloped regions;

h. Increase services for certain community group; and

i. Increase services during the emergency situation.

2. Increase the establishment of sea transportation provision

a. Increase efficiency and competitiveness;

b. Simplify the licensing procedure and deregulation;

c. Increase services and technology standard;

d. Increase revenue and decrease subsidy;

e. Increase national transportation companys accessibility to do international transportation

services;

f. Increase the sea transportation service companies productivity and efficiency; and

g. Assist the State owned-enterprise/regional state enterprises.

3. Increase efficiency of energy utilization on sea transportation sector

a. Coordinating policies of both energy and sea transportation sector; and

b. Continuously develop energy saving sea transportation facilities by doing these following

activities.

National strategy of sea transportation development

9

1. Increase service quality;

2. Balance the role of State Owned Enterprise (BUMN), Provincial State

Owned Enterprise (BUMD), private sector and cooperative;

3. Optimize the utilization of available sea transportation capacity and

facilities;

4. Ports as center of intermodal integrity;

5. Increase services for underdeveloped regions, remote area and during

emergency situation;

6. Increase port enterpreneur guidance;

7. Increase efficiency and competitiveness of international hub/

international and national port;

8. Simplify the licensing procedure and deregulation;

9. Increase standardization on services and technology; and

10. Decentralize regional and local ports to provincial government or

residence/city government.

National strategy of seaport development

10

Strategy on port development is implemented through two approaches:

1. The Micro Approach is a strategy with individual

characteristic (individual port). This model of approach is

articulated by optimizing the port without neglecting the

continuity of supply-demand balance, so the port affairs could

support other sectors activity especially trading and industry.

At the end the port expected could give a safe, pleasant,

smooth, fast, effective and efficient services.

2. The Macro Approach is an approach that put more focus on

network burden which then reflected on market potential by

considering strategic environment factor that in the end will

create National Port Hierarchy pattern.

Implementation of national strategy

11

The macro approach is articulated through national development strategy as

follow :

Secondly, for Borneo Island (Kalimantan), the Pontianak Harbor can be develop

through increasing its service capacity, with the position as international port the

Pontianak Harbor is also expected to be feeder for Batam Harbor. Pontianak

Harbor development is anticipation to the effect of BIMP-EAGA.

Meanwhile, on the Eastern part of Borneo Island the Tarakan Harbor is chosen to

be developed along with its service capacity, and other harbor that will be

developed into international port are Samarinda Harbor and Balikpapan Harbor.

Firstly, define Sumatera Island and Batamas hub international port since the two

areas are geographically close to Singapore, thus in the strategy, Batam is

defined as complimentary harbor to Singapore Harbor and it will be gradually

advanced into hub international port.

Other harbors that projected to be hub international port are Belawan or

Lhokseumawe; especially to service liquid/bulk cargo. Moreover, other harbor at

Sumatera Island will take the role as feeder for BatamHarbor.

Continued

Implementation of national strategy

12

Fourthly, the harbor development in J ava Island is based on its demand increase;

especially for new harbor such as Bojonegara, the development has to be

integrated to processing/industrial zone activities in its neighborhood.

Fifthly, the Island of Lesser Sundas (Nusa Tenggara) and its neighborhood. The

development on this island is focused on the development of Southern part of

the Island by projecting Kupang Harbor to anticipate Australias trading

activities.

Thirdly, for Celebes Island (Sulawesi), Moluccas (Maluku) and Papua the harbor

that is chosen to be developed into hub international port is Bitung Harbor.

Meanwhile, Ternate Harbor in North Moluccas or J ayapura Harbor in Papua is

projected to be feeder harbor for Bitung Harbor .

Other consideration that was used in choosing Bitung Harbor to be developed

as hub international port is its proximity to international market watercourse,

which is Asia Pacific. It is also an anticipation taken towards BIMP-EAGA.

Continued

Implementation of national strategy

13

Major Public-Private Partnership (PPP)

Projects

Bojonegara Port Development

Tanjung Perak Port Development at Lamong Bay

Belawan Port Development

Makassar Port Development

14

East Cilegon

Toll Gate

BOJONEGARA PORT DEVELOPMENT

TARGET

DESIGN : 2007

CONSTRUCTION : 2008-2009

OPERATION : 2009

COST : US $ 246 Million

FUNDING SOURCE : B to B / PPP

CAPACITY : 600.000 TEUs/Year

SECTION I FIRST STAGE

15

T E R M I N A L C U R A H B

T E R M I N A L C U R A H C

LAPANG

AN PENUM

PUKAN

U T I L I T AS

P A R K I R

100m

100m

S F B

ws

P E R K A M P U N G A N

D E S A S U M U R A N J A

R E N C A N A A R E A L

R E L O K A S I

E

LE

VA

SI 60 D

P

L

E

LE

V

A

S

I 100 D

P

L

300m

100m

100m

A R E A L C A D A N G A N P E N G E M B A N G A N

H O T E L , R E S T O R A N ,

R E K R E A S I D A N S A R A N A O L A H R A G A

A R E A P U S A T

P E R K A N T O R A N

L A P A N G A N

P A R K I R T R UC K

300m

600m

220m

200m

0 500 m

(- 16m)

(- 16m)

(-16m)

(- 16m)

(- 16m)

(-16m)

T E L U K B A N T E N

- 8M

-9m

-10m

-11m

-13m

- 14m

- 15m

-16m

- 17m

-18m

-19m

-21m

-20m

450m

- 7M

- 6M

- 5M

- 4M

-3M

80

C T 1

M P T 2

R o- R o

M P T 1

150m

220m

220m

C T 2

C T 3

C T 4

C T 5

C T 6

C T 7

C T 8

M P T 3

300m

300m

1000m

40m

450m

S kala :

200m

P E R K A N T O R A N P E ME R I NT AH

R E S T A R E A

K A N T O R T E R M I N A L G U D A N G L I N I 1 4 0X 6 0 m2

A P R O N

2 20X 5 0 m2

C F S D O M E S T K

15 X 20 M 2

G U D A N G L I NI 2

3 @ 4 0X 6 0 m2

G U D A N G L I N I 1

4 0X 6 0 m2

G U D A N G L I N I 1

4 0X 6 0 m2

G U D A N G L I N I 2 3 @ 4 0X 6 0 m2

G U D A N G L I N I 2

3 @ 4 0X 60 m2

C T D 1&2

R E E F E R

C O N T A IN E R

H A Z A R D

C O N T A I N E R

H A ZA R D

C O N T A I N E R

M A R I N E HO U S E

3 0X 25 M2

T E R M I N A L O F F I C E

3 0X 5 0 M 2 G A T E H O U S E 2 0X 20 M 2

M A I N T E N A N C E S HO P 30 X 50M 2

W A S HI N G S T A T I O N

15 X 20 M 2

P O W E R S T A T I O N

1 5X 2 0 M 2

F U E L S T A T I O N 1 5X 2 0 M2

W A T E R S U P P L Y

2 0X 20 M 2

D E R M A G A P E ME R I N T A H D A N R IS E T

P A R K I R P E R A L A T A N 14 7X 20 M 2

C F S I N T E R NS L 3 0X 3 0M 2

C T 9

C T 10

S P E C I A L W H AR F

T E R M I N A L C U R A H A

K A N T O R S E W A

U T I L IT A S

P A R K I R

P A M E R A N O U T D O O R

M E N A R A

P E L IN D O

R U M A H S A K I T /

P O L IK L I N IK

R E N C A N A P E N G E M B A N G A N IN D U S T R I

K S B

PERG

UDANG

AN

P A R K

C F B

R E N C A N A L A P A N G A N G O L F

D A N R E S O R T A R E A

300m

P E R U M A H A N K A R Y A W A N

S E R T A R E L O K A S I P E N D U D U K

BOJONEGARA PORT DEVELOPMENT PLAN

MASTER PLAN, INDUSTRIAL AND TRADING ZONE

BOJ ONEGARA PORT (2025)

DEVELOPMENT PLAN 2009

16

Assumption :

Interest Rate /DF

Adjustment Rate

Debt Equity Ratio

Total Investment

Container Capacity

Result :

NPV

IRR

Payback Period

15 %

10 % per 5 yr

70/30

USD 212,128,000

1,123,200 TEUs

USD 10,238,359

15.45 %

12 yr 3 mth

:

:

:

:

:

:

:

:

Financial Analysis

Bojonegara Port Development

Scope of Work1

st

STAGE

A. CIVIL WORK

1. PORT CHANNEL DIVERSION

2. DREDGING CHANNEL AND BASIN

3. BREAKWATER

4. CONTAINER WHARF

5. CONTAINER YARD

6. INTERNAL ACCESS ROAD

7. OFFICES

B. CARGO HANDLING EQUIPMENT

1. GANTRY CRANE

2. TRANSFER CRANE

3. MOBILE CRANE

4. REACH STACKER

5. HEAD TRUCK

6. CHASSIS

Total Cost : US $ 246,000,000

C. LAND AREA OF 120 HA HAS BEEN ACQUIRED

17

PHASE I (2004 - 2010)

- CONSTRUCTION OF MULTIPURPOSE/CONTAINER TERMINAL

PHASE II (2010 - 2014)

- CONSTRUCTION OF CONTAINER TERMINAL

- CONSTRUCTION OF FERRY (RO-RO) TERMINAL

- CONSTRUCTION OF CONTAINER YARD

- EXTENSION OF CONTAINER YARD

PHASE III (2014 - 2025)

- EXTENSION OF CONTAINER TERMINAL

- CONSTRUCTION OF GENERAL CARGO TERMINAL

- CONSTRUCTION OF DEDICATED WHARVES

LONG TERM INFRASTRUCTURE NEEDS (2025)

Bojonegara

Bojonegara

Port Development

Port Development

18

FIRST STAGE (2004-2010)

Bojonegara Port Development

19

SECOND STAGE (2010-2014)

Bojonegara Port Development

20

THIRD STAGE (2014-2025)

Bojonegara Port Development

21

TANJUNG PERAK PORT DEVELOPMENT

AT LAMONG BAY

TARGET

DESIGN : 2007

CONSTRUCTION : 2008-2009

OPERATION : 2009

COST : US $ 268,5 Million

FUNDING SOURCE : B to B

CAPACITY : 1,7 Juta TEUs/Year

22

50 Ha Reclamation Area

51,200 m2 Container Berth

780 m Trestle (3 units @260 m)

9,600 GS (364,800 m2) Container Yard

1,138,800 TEUs Container Capacity

15,000 m2 Chassis Parking

2,500 m2 CFS

2,854 m Access Causeway

84 m Access Bridge

1 Ha Office Area

3 Ha Workshop Area

Port Facilities and Equipments

TOTAL COST :

US $ 268,500,000

SCOPE of WORKS

Tanjung

Tanjung

Perak Port Development at

Perak Port Development at

Lamong

Lamong

Bay

Bay

23

PROJECT LOCATION

PROJECT LOCATION

Tanjung

Tanjung

Perak Port Development at

Perak Port Development at

Lamong

Lamong

Bay

Bay

24

NO ACTIVITIES

I II III IV I II III IV I II III IV I II III IV

1 MASTER PLAN

2 DOCUMENT TENDER

3 PREPARATION FOR ACCESS ROAD

4 INFO MEMO

5 TENDER

6 REVIEW AMDAL (ANDAL,RKL/RPL) AND FS

7 SID / DED TELUK LAMONG

8 DEVELOPMENT LICENSE

9 ACCESS ROAD DEVELOPMENT

10 CONSTRUCTION DEVELOPMENT

11 OPERATION

Year 1 Year 2 Year 3 Year 4

SCHEDULE

Tanjung

Tanjung

Perak Port Development at

Perak Port Development at

Lamong

Lamong

Bay

Bay

25

Belawan Lama

- Wharf : 602 M

- Depth : - 5 M-LWS

Passenger Terminal

- Intl : 700 PAX

- Domestic : 2,450 PAX

Citra

- Wharf : 625 M + 150 M

- Depth : - 7 M-LWS

- Warehouse : 3 Unit

Container Terminal

- Wharf : 850 M

- Depth : - 10 M-LWS

- C Y : 98.000 M2

- Stacking : 73.000 M2

- C F S : 11.470 M2

- Warehouse : 11.470 M2

- Wharf : 1,670 M

- Depth : - 9 M-LWS

Ujung Baru

EXISTING CONDITION

EXISTING CONDITION

Belawan

Belawan

Port Development

Port Development

26

Terminal General Cargo

Area Industri

Terminal Sawit

Terminal Peti Kemas

Terminal General Cargo

T

W

O

L

I

N

E

A

P

R

O

A

C

H

C

H

A

N

N

E

L

DEVELOPMENT STAGES

DEVELOPMENT STAGES

Belawan

Belawan

Port Development

Port Development

27

SHORT TERM PROGRAM (2006-2010) :

A. CONVENTIONAL TERMINAL :

Review on Belawan Port Development Plan

Operational Re-arrangement and Rehabilitation of UJ UNG BARU &

CITRA Terminal

Relocation of Passenger Terminal (RoRo and Ferry)

Construction of Cargo Wharf

Capacity Enhancement of Access Channel

B. CONTAINER TERMINAL :

Development of Container Terminal

Procurement of Container Handling Equipment

Rp. 2.149.200.000.000,-

DEVELOPMENT PLAN

DEVELOPMENT PLAN

Belawan

Belawan

Port Development

Port Development

28

MEDIUM TERM PROGRAM (2011-2015) :

A. CONVENTIONAL TERMINAL :

Construction of Liquid Bulk Terminal

B. CONTAINER TERMINAL :

Construction of Container Wharf (300 m)

Procurement of Container Handling Equipment

Rp. 889.300.000.000,-

LONG TERM PROGRAM (2016-2020) :

A. CONVENTIONAL TERMINAL :

Construction of Cargo Terminal

B. CONTAINER TERMINAL :

Construction of Container Wharf

Procurement of Container handling Equipment

Rp.3.789.000.000.000,-

DEVELOPMENT PLAN

DEVELOPMENT PLAN

Belawan

Belawan

Port Development

Port Development

(continued)

29

MAKASSAR PORT

30

Metric Ton Metric Ton

AUSTRALIA

FLOUR = [160.322 ]

MALAYSIA

SUGAR = [6.321]

EUROPE

FERTILIZATION = [14.745]

JAPAN

FERTILIZER = [6.315]

SPAREPARTS = [15]

INDIA

WHEAT = [294.176]

SUGAR = [21.670]

UNI SOVYET

WHEAT = [10.025]

ARAB SAUDI

HEAVY EQUIPMENT = [1.598]

THAILAND

SUGAR = [76.124]

COIL = [1.950]

GIPS = [41.500]

THAILAND

SUGAR = [76.124]

COIL = [1.950]

GIPS = [41.500]

SINGAPORE

ASPHALT = [3.176]

GENSET = [158]

STEEL = [91]

SPARE PART = [119]

MIX COMMOD = [33]

CHOCO GRAIN = [125]

SINGAPORE SINGAPORE

ASPHALT = [3.176]

GENSET = [158]

STEEL = [91]

SPARE PART = [119]

MIX COMMOD = [33]

CHOCO GRAIN = [125]

CANADA

FLOUR = [10.354]

SPAREPARTS = [7]

CANADA

FLOUR = [10.354]

SPAREPARTS = [7]

CHINA

UREA FERTILIZATION = [15.889]

CEMENT = [9.397]

FLOUR = [5.918]

CHINA

UREA FERTILIZATION = [15.889]

CEMENT = [9.397]

FLOUR = [5.918]

31

NEW ZEALAND

KLINKER = [24.200]

SINGAPORE

CHOCO GRAIN = [11.904]

KLINKER = [70.142]

CEMENT = [28.192]

BANGLADESH

KLINKER = [334.308]

MEXICO

CHOCO GRAIN = [2.032]

AFRICA

KLINKER = [27.001]

CEMENT = [76.512]

Metric Ton Metric Ton

NETHERLAND

WHEAT = [2.685]

SOUTH KOREA

WHEAT = [34.090]

SOUTH KOREA

WHEAT = [34.090]

TAIWAN

KLINKER = [76.503]

PLYWOOD = [1.131]

TAIWAN TAIWAN

KLINKER = [76.503]

PLYWOOD = [1.131]

BRAZIL

CHOCO GRAIN = [66.252]

BRAZIL

CHOCO GRAIN = [66.252]

JEPANG

PLYWOOD = [54.005]

GULA TETES = [12.068]

JEPANG

PLYWOOD = [54.005]

GULA TETES = [12.068]

U S A

CHOCO GRAIN = [75.507]

U S A

CHOCO GRAIN = [75.507]

CANADA

CHOCO GRAIN = [5.588 ]

COSTA RICA

KLINKER = [20.257]

CEMENT = [15.000]

COSTA RICA

KLINKER = [20.257]

CEMENT = [15.000]

MALAYSIA

CHOCO GRAIN = [67.893]

KLINKER = [48.500]

WHEAT = [27.334]

MARMER = [1.000]

32

TIME FRAME FOR REVITALISATION AND DEVELOPMENT

1 Pengadaan 2 (Dua) Unit TT

& Upgrade Cy Pangk. Soekarno

2 Pengadaan 1 (satu) Set ABMPK

3 Pengadaan 1 (satu) Set ABMPK

4 Tahap Awal MNP ->2 Tahun

5 Tahap I.A, MNP ->1,5 Tahun

6 Tahap I.B, MNP ->2 Tahun

Keterangan :

Proyeksi Traffik ( Rata-Rata =7,8% per tahun )

Kapasitas CY

Pengembangan MNP

200,000

250,000

300,000

350,000

400,000

450,000

500,000

550,000

600,000

650,000

700,000

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

TAHUN

TRAFFIK (TEUS)

33

34

KETERANGAN :

1. LUAS CY TPM = 7,5 HA

2. LUAS SERBAGUNA = 4 HA

35

MASTERPLAN MAKASSAR PORT (2025)

TAHAP II 2015 - 2025

TAHAPAN PENGEMBANGAN

TAHAP I 2007 - 2015

RESERVED AREA

36

MAKASSAR PORT DEVELOPMENT STAGE I

G

R

O

U

N

D

S

L

O

T

- 1

2

(6

x

3

2

T

E

U

)

G

R

O

U

N

D

S

L

O

T

- 1

0

(6

x

3

2

T

E

U

)

G

R

O

U

N

D

S

L

O

T

- 8

(6

x

3

2

T

E

U

)

G

R

O

U

N

D

S

L

O

T

- 6

(6

x

3

2

T

E

U

)

G

R

O

U

N

D

S

L

O

T

- 2

(6

x

3

2

T

E

U

)

G

R

O

U

N

D

S

L

O

T

- 4

(6

x

3

2

T

E

U

)

G

R

O

U

N

D

S

L

O

T

- 1

1

(6

x

3

2

T

E

U

)

G

R

O

U

N

D

S

L

O

T

- 9

(6

x

3

2

T

E

U

)

G

R

O

U

N

D

S

L

O

T

- 7

(6

x

3

2

T

E

U

)

G

R

O

U

N

D

S

L

O

T

- 5

(6

x

3

2

T

E

U

)

G

R

O

U

N

D

S

L

O

T

- 1

(6

x

3

2

T

E

U

)

G

R

O

U

N

D

S

L

O

T

- 3

(6

x

3

2

T

E

U

)

PAOTERE EXSISTING

CONTAINER

TERMINAL

INDUSTRIAL

AREA

PORT AREA

ACTIVITIES

RESIDENCES

MARINA

PAOTERE

HOTEL AND TRADE

AREA

BUSSINESS AREA

ACTIVITIES

PASSENGER

TERMINAL

WAREHOUSE

AND OFFICES

SHOPPING

AREA

TOL GATE TALLO LAMA

PUBLIC

UTILITY AREAS

37

SCOPE OF WORK FOR STAGE I

Consist of 2 parts : (I A and I B) such as :

I.A. LAND, consist of :

a. Retaining Wall + 5.600 M.

b. Reclamation 200 Ha.

c. Akses road + 2 KM.

Cost Rp. 800 Milyar , construction time 1,5 Year.

I.B. Port development stages 30 HA, consist of :

a. Container wharf 260 M

b. Container Yard 6 HA

c. Procurement of equipment .

Cost + Rp. 600 Milyar, construction time 2 Year

Potrebbero piacerti anche

- Marine Market in Southeast AsiaDocumento10 pagineMarine Market in Southeast AsiaLinda.man ChenNessuna valutazione finora

- Presentasi Maritime DARMADIDocumento11 paginePresentasi Maritime DARMADIashkisaragiNessuna valutazione finora

- SM Term Paper - WestportsDocumento29 pagineSM Term Paper - Westportskallis5Nessuna valutazione finora

- Min of Shipping Annual ReportDocumento103 pagineMin of Shipping Annual ReportAkhil UnnikrishnanNessuna valutazione finora

- Topic: Turn Around Time of Container Vessels at Chittagong Port: Review & Assesment Submitted ToDocumento11 pagineTopic: Turn Around Time of Container Vessels at Chittagong Port: Review & Assesment Submitted ToSHAH MOHAMMED KARIMNessuna valutazione finora

- Newsletter - June - July - For-WebsiteDocumento24 pagineNewsletter - June - July - For-WebsiteRakeshNessuna valutazione finora

- DP World Internship ReportDocumento40 pagineDP World Internship ReportSaurabh100% (1)

- Significance of World Shipping and Sea-Borne TradeDocumento26 pagineSignificance of World Shipping and Sea-Borne TradeIqtiran KhanNessuna valutazione finora

- Coastal ProtectionDocumento22 pagineCoastal ProtectionbkrNessuna valutazione finora

- Assigment 5 - Muh IkhsanDocumento3 pagineAssigment 5 - Muh IkhsanikhsanNessuna valutazione finora

- Paper by Lieutenant Commander (S) FHL Silva Sri Lanka A Future Logistic Hub of Asia'Documento14 paginePaper by Lieutenant Commander (S) FHL Silva Sri Lanka A Future Logistic Hub of Asia'Lalinda Silva100% (1)

- Corporatisation Turn Tide PortsDocumento2 pagineCorporatisation Turn Tide PortsGanesh KesavanNessuna valutazione finora

- Port Development: Port Policy and Trend of Maritime Logistics 2.1.1 Port Policy DirectionDocumento268 paginePort Development: Port Policy and Trend of Maritime Logistics 2.1.1 Port Policy Directionrk100% (1)

- Lecture 6 - Ports of MalaysiaDocumento68 pagineLecture 6 - Ports of Malaysiashuting2teoh100% (6)

- UntitledDocumento28 pagineUntitledVasim MemonNessuna valutazione finora

- Marine Terminal Synopsis PDFDocumento3 pagineMarine Terminal Synopsis PDFAr. RakeshNessuna valutazione finora

- Marine Terminal SynopsisDocumento3 pagineMarine Terminal SynopsisAr. RakeshNessuna valutazione finora

- Ministry of Transport: Vietnam Maritime AdministrationDocumento32 pagineMinistry of Transport: Vietnam Maritime AdministrationchienNessuna valutazione finora

- Cruise TerminalDocumento6 pagineCruise TerminalGokul Krishna100% (1)

- Lectura Gestion Logistica PortuariaDocumento12 pagineLectura Gestion Logistica PortuariaALI VIZONessuna valutazione finora

- 1 Maritime TransportDocumento413 pagine1 Maritime TransportWondwosen Tiruneh100% (1)

- PortCompetition - Competition Between The Ports of Singapore and MalaysiaDocumento11 paginePortCompetition - Competition Between The Ports of Singapore and MalaysiaNgurah Buana100% (2)

- Analysis of Pakistani Shipping IndustryDocumento73 pagineAnalysis of Pakistani Shipping IndustryAdil Yousuf50% (2)

- Issues and Challenges For Malaysia To Become Smart Port'Documento26 pagineIssues and Challenges For Malaysia To Become Smart Port'AmaLieya Are-MalynNessuna valutazione finora

- Green Shipping LineDocumento24 pagineGreen Shipping LineyashurockuNessuna valutazione finora

- Chapter - I: 1.1 Ministry of ShippingDocumento34 pagineChapter - I: 1.1 Ministry of ShippingsrinivasNessuna valutazione finora

- Maritime Agenda ArticleDocumento9 pagineMaritime Agenda ArticleDr. Bina Celine DorathyNessuna valutazione finora

- SMMC G6 Professor: Shihmin LoDocumento13 pagineSMMC G6 Professor: Shihmin Locaroline 1307Nessuna valutazione finora

- (Session 3) Bangladesh - Port DevelopmentDocumento25 pagine(Session 3) Bangladesh - Port DevelopmentShowkat AliNessuna valutazione finora

- Myanmar Maritime Quickscan Report March 2016Documento104 pagineMyanmar Maritime Quickscan Report March 2016Kaung Myat Hein100% (2)

- Blue Economy and ShipbreakingDocumento8 pagineBlue Economy and ShipbreakingAdeen TariqNessuna valutazione finora

- Cruise Ship Terminal ThesisDocumento6 pagineCruise Ship Terminal Thesissamantharandallomaha100% (2)

- Overview of STX Shipyard Facilities - Rev.1Documento25 pagineOverview of STX Shipyard Facilities - Rev.1emba2015Nessuna valutazione finora

- Jomo Kenyatta University of Agriculture and TechnologyDocumento6 pagineJomo Kenyatta University of Agriculture and TechnologyBruse OluochNessuna valutazione finora

- Singapore Martime HPODocumento13 pagineSingapore Martime HPOGilang HendraNessuna valutazione finora

- Coastal Shipping - DG SHIPPINGDocumento45 pagineCoastal Shipping - DG SHIPPINGMuthu Praveen Sarwan100% (1)

- Glendale PartnerDocumento94 pagineGlendale PartnerPutri Mulia SariNessuna valutazione finora

- Port Reform and Development in IndonesiaDocumento38 paginePort Reform and Development in IndonesiaMiftah KhoeruddinNessuna valutazione finora

- Performance of Major PortsDocumento5 paginePerformance of Major PortsrohityadavalldNessuna valutazione finora

- Singapore MagazineDocumento36 pagineSingapore MagazinerobinxsunNessuna valutazione finora

- 2019 Osj Conference Spore Capt Imran (Final)Documento24 pagine2019 Osj Conference Spore Capt Imran (Final)Ahmad ImranNessuna valutazione finora

- Managing The Sea Transportation BusinessDocumento17 pagineManaging The Sea Transportation Businessmayanti aritonangNessuna valutazione finora

- Domestic ToirismDocumento8 pagineDomestic ToirismSHARONNessuna valutazione finora

- ASSIGNMENT 1 FinalDocumento7 pagineASSIGNMENT 1 Finalmishal zikriaNessuna valutazione finora

- Uma - Ar PortDocumento46 pagineUma - Ar PortspergeonNessuna valutazione finora

- Thực tập đợt 1 - Cảng cá Hạ Long (Lê Thu Uyên) Cuối cùng rồi sẽ không sửa thêm gì nữaDocumento28 pagineThực tập đợt 1 - Cảng cá Hạ Long (Lê Thu Uyên) Cuối cùng rồi sẽ không sửa thêm gì nữaThùy Linh DươngNessuna valutazione finora

- Feasibility Study Review - Aceh International Fishing Port Development - Lampulo - Banda AcehDocumento44 pagineFeasibility Study Review - Aceh International Fishing Port Development - Lampulo - Banda AcehHilmy Bakar AlmascatyNessuna valutazione finora

- Pom FinalDocumento15 paginePom FinalDivya BajajNessuna valutazione finora

- PROJECT REPORT - International Container Transhipment TerminalDocumento83 paginePROJECT REPORT - International Container Transhipment TerminalBibin Babu50% (2)

- ProfileDocumento6 pagineProfileValerie Masita HariadiNessuna valutazione finora

- SM Report Vol 113022017Documento463 pagineSM Report Vol 113022017Avtansh GhaiNessuna valutazione finora

- Maritime India Vision 2030Documento300 pagineMaritime India Vision 2030Priyansh AggarwalNessuna valutazione finora

- Ghana Ports and Harbours Authority FullDocumento23 pagineGhana Ports and Harbours Authority FullKaren DavisNessuna valutazione finora

- Philippines 6.1 Manila Port (1) Outline of The Port Location and RolesDocumento55 paginePhilippines 6.1 Manila Port (1) Outline of The Port Location and RolesArch Chet AlabaNessuna valutazione finora

- BV MBR2011 Int-EXEDocumento20 pagineBV MBR2011 Int-EXEnikmatesaNessuna valutazione finora

- Thesis - Research WritingDocumento99 pagineThesis - Research WritingPankaj RaiNessuna valutazione finora

- Indian Port Association (IPA)Documento135 pagineIndian Port Association (IPA)RashidulNessuna valutazione finora

- Heui Catalog PDFDocumento6 pagineHeui Catalog PDFLuisYFer1Nessuna valutazione finora

- Source SCM Sieu To Khong LoDocumento284 pagineSource SCM Sieu To Khong LoQuảng KimNessuna valutazione finora

- Quote: Customer IDDocumento2 pagineQuote: Customer IDItalo GutierrezNessuna valutazione finora

- Loi - Harina - ModeloDocumento7 pagineLoi - Harina - ModeloDannd R VENessuna valutazione finora

- Notes in Insurance Law - 2Nd Semester Ay 2017-2018Documento22 pagineNotes in Insurance Law - 2Nd Semester Ay 2017-2018Kurt Paul Gacoscos BagayaoNessuna valutazione finora

- Docs AISDocumento17 pagineDocs AISCesar LegaspiNessuna valutazione finora

- Company Profile Bukit Asam MeratusDocumento3 pagineCompany Profile Bukit Asam MeratusWilly AriefNessuna valutazione finora

- TESC Lesson 1Documento14 pagineTESC Lesson 1amardonesNessuna valutazione finora

- MSA LAY OUT and Org ChartDocumento16 pagineMSA LAY OUT and Org ChartRaka NoorsyachNessuna valutazione finora

- Medusa430314 MBLDocumento1 paginaMedusa430314 MBLroddy2012Nessuna valutazione finora

- Foreign Trade Policy (2015-2020)Documento17 pagineForeign Trade Policy (2015-2020)Neha RawalNessuna valutazione finora

- Question 1. What Is CIF Contract? Judicial Definition of A CIF Contract. AnswerDocumento3 pagineQuestion 1. What Is CIF Contract? Judicial Definition of A CIF Contract. AnswerSubaNessuna valutazione finora

- Transportation Law SyllabusDocumento27 pagineTransportation Law SyllabusKAREENA AMEENAH ACRAMAN BASMANNessuna valutazione finora

- 05 - Overview of Demurrage and Despatch - NewDocumento4 pagine05 - Overview of Demurrage and Despatch - NewBiswajit Q MalakarNessuna valutazione finora

- Fab Plans CatDocumento18 pagineFab Plans CatawatereautoservicesNessuna valutazione finora

- Dciq-38af4-071287 Dfo 36Documento13 pagineDciq-38af4-071287 Dfo 36Wilkin Llanca BlasNessuna valutazione finora

- ADL 85 Export, Import Procedures and Documentation V2Documento5 pagineADL 85 Export, Import Procedures and Documentation V2solvedcare0% (1)

- PSWDocumento2 paginePSWLinda G. CordovaNessuna valutazione finora

- Practical Guide To INCOTERMS 2010Documento22 paginePractical Guide To INCOTERMS 2010Global Negotiator100% (13)

- Loading LPG CalculationsDocumento12 pagineLoading LPG CalculationsJohn Green67% (3)

- Marco Esposito CV ENGDocumento4 pagineMarco Esposito CV ENGMarco EspositoNessuna valutazione finora

- Mini-Test A. Emails and Letters Questions 1 and 2 Refer To The Following LetterDocumento3 pagineMini-Test A. Emails and Letters Questions 1 and 2 Refer To The Following LetterN Fittrii0% (1)

- Ra MarocDocumento39 pagineRa Marocamina beniazNessuna valutazione finora

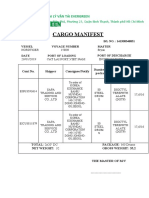

- Cargo Manifest: Công Ty Tnhh Đại Lý Vận Tải EvergreenDocumento2 pagineCargo Manifest: Công Ty Tnhh Đại Lý Vận Tải EvergreenFeng KrissNessuna valutazione finora

- Sales 402 FINALS Reviewer 2009Documento56 pagineSales 402 FINALS Reviewer 2009Juna May YanoyanNessuna valutazione finora

- Company Profile Poslog (Short)Documento18 pagineCompany Profile Poslog (Short)pwjemiNessuna valutazione finora

- Export Import Documentation and ProcessDocumento52 pagineExport Import Documentation and ProcessAltamish Ikram100% (1)

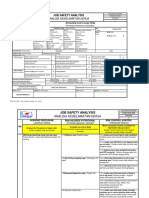

- 8.2 JSA OPR Working in Big VesselDocumento8 pagine8.2 JSA OPR Working in Big VesselHadiyan Yusra SulistyoNessuna valutazione finora

- Johnson Toy Company: Edwin White, Brad Carman Embry-Riddle Aeronautical UniversityDocumento15 pagineJohnson Toy Company: Edwin White, Brad Carman Embry-Riddle Aeronautical UniversityMuhammad TalhaNessuna valutazione finora

- Functions of Courier Services and How They're Various From Postal ServicesDocumento3 pagineFunctions of Courier Services and How They're Various From Postal Servicesmelune61ccNessuna valutazione finora