Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Gap Analysis Template

Caricato da

Ashutosh SinghCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Gap Analysis Template

Caricato da

Ashutosh SinghCopyright:

Formati disponibili

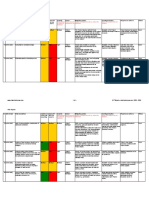

(1) Do

you understand

the requirement

sufficiently at

this stage

(2)

What further

work/help is

required to reach

an understanding

(3)

Do you

currently meet

this

requirement

(4)

Where are you

short on this

requirement

(5)

Action

required to

address any

shortfall/ gap

(6)

When do you

envisage you

will be able to

meet this

requirement

(7)

Who will be

responsible for

actions on this

requirement

(8)

Estimated time

required to

address gap

(9)

Level of resource

needed to

address gap

(10)

Current status

on requirement

R / A /G

l

l

l

key business and operational processes must be properly documented

directors and staff should understand all the operational and business processes relevant to their role

l

l

l

internal control

internal audit

outsourcing

l

l

l

l

l

l

l

l

risk policy setting out risk management strategy, covering each risk category

risk management process - risk identification and assessment, monitoring and reporting

l

l

l

l

l

design and implementation

testing and validation

documentation

informing the Board about the performance of the model

analysis of the performance of the model and production of summary reports

l

Governance Section

Existing

NEW

Fit & Proper Requirements (page 7)

Risk management standards - effective risk policy, subject to regular review

Governance standards

Existing

New

Risk Management (pages 8-9)

General governance requirements (pages 5-6)

Regular internal review of the system of governance

Written policies for:

Policies for risk management, internal control, internal audit and outsourcing reviewed at least annually

Processes for the identification and management of emerging risk issues

Risk management standards (risk governance) - structure for governance that supports risk management by providing clearly defined

accountabilities, expectations and reporting requirements for all parties

Operational processes minimum standards:

This template should be used in conjunction with Lloyd's "Guidance notes on gap analysis March 2009" and page

references are included below. Additional notes on completion of the relevant columns are included at the foot of

this document.

Risk management standards - governance structure to support the management of risk

Risk management standards:

Risk management standards - process to identify all significant risks

Underwriting Byelaw, para 42A, (appointments to senior positions) - fit and proper requirements for directors/partners/active underwriters/run-off

managers

Lloyds process for notification and amendment of appointments to all senior positions, including active underwriters and run-off managers

Risk management standards (risk governance) - structure of the risk management function

ICA guidance minimum standard: Mapping to the risk register

Existing

Governance standards

N/A (no significant changes to Lloyds requirements and processes anticipated at this stage)

Contingency plans operational processes minimum standards - appropriate business continuity plans

New

Risk management function will need to address the following tasks relating to the internal model:

Contingency planning (considered in a wider sense than operational business continuity)

(1) Do

you understand

the requirement

sufficiently at

this stage

(2)

What further

work/help is

required to reach

an understanding

(3)

Do you

currently meet

this

requirement

(4)

Where are you

short on this

requirement

(5)

Action

required to

address any

shortfall/ gap

(6)

When do you

envisage you

will be able to

meet this

requirement

(7)

Who will be

responsible for

actions on this

requirement

(8)

Estimated time

required to

address gap

(9)

Level of resource

needed to

address gap

(10)

Current status

on requirement

R / A /G

This template should be used in conjunction with Lloyd's "Guidance notes on gap analysis March 2009" and page

references are included below. Additional notes on completion of the relevant columns are included at the foot of

this document.

l

l

the assessment must be driven by risk appetite

consideration should be given to all risks that the business faces, including those that fall outside the SCR calculation (this applies whether

the standard formula or an internal model is used)

the ORSA should form an integral part of the business strategy and be taken into account on an ongoing basis in strategic decisions

l

assessment at different confidence levels eg as required for SCR, economic capital

longer term considerations ie assessment beyond the 12 month time horizon used for regulatory capital

l

agents will also need to revisit the ORSA in line with their own needs/material changes in the business

frequency of reassessment will be key in demonstrating use

agents will be required to inform Lloyds of the results of any reassessment of the ORSA

l

l

l

l

l

l

l

l

l

l

l

should be reported to the Audit Committee and/or Board on a timely basis

Audit Committee and/or Board will be responsible for ensuring compliance with findings

l

l

l

l

l

l

l

l

l

l

Existing

New

Internal control (page 12)

Existing

N/A (this is a new requirement under Solvency II consistent with the principles of the ICAS regime)

Demonstrate the link between risk and capital management:

Set out the methods used to determine overall solvency needs, including:

Be updated annually as a minimum:

New

Internal audit will also need to assess whether the internal control system remains sufficient and appropriate for the business

Internal audit findings:

Internal audit reporting lines

New

Assess the possible impact of changes in the legal environment on operations and the identification and assessment of compliance risk

Risk management standards - assurance processes

Contribute to implementation of risk management system

Have relevant experience and expertise

Operational processes minimum standards - outsourced activities should be properly monitored and controlled

Existing

Internal audit function, independent from the operational functions of the business

Where outsourced, internal audit must remain subject to effective internal oversight

Internal audit should provide assurance over compliance with all internal strategies, processes and reporting procedures

Lloyds Valuation of Liabilities Rules (governing the production of Statements of Actuarial Opinion and technical provisions)

Outsourcing (page 16)

Each syndicate will need to ensure they have an actuarial function

GN20 Actuarial reporting under the Lloyds Valuation of Liabilities rules

Internal controls as covered by existing franchise standards (including underwriting, claims, and risk management)

Underwriting byelaw (paragraph 40) - compliance officer appointment

Compliance function to advise on laws, regulations etc relating to Solvency II

New

Express an opinion on the overall underwriting policy

Express an opinion on the adequacy of reinsurance arrangements

Internal Audit (page 13)

Existing

Risk management standards - ensuring independence between risk management and assurance processes

Actuarial function (page 14-15)

Existing

New

ORSA (pages 10-11)

Where functions are outsourced, agents will remain fully responsible for discharging all of their duties under the draft Directive

(1) Do

you understand

the requirement

sufficiently at

this stage

(2)

What further

work/help is

required to reach

an understanding

(3)

Do you

currently meet

this

requirement

(4)

Where are you

short on this

requirement

(5)

Action

required to

address any

shortfall/ gap

(6)

When do you

envisage you

will be able to

meet this

requirement

(7)

Who will be

responsible for

actions on this

requirement

(8)

Estimated time

required to

address gap

(9)

Level of resource

needed to

address gap

(10)

Current status

on requirement

R / A /G

This template should be used in conjunction with Lloyd's "Guidance notes on gap analysis March 2009" and page

references are included below. Additional notes on completion of the relevant columns are included at the foot of

this document.

l

l

l

l

l

l

l

definition of best estimate

cashflows

risk margin

premium provisions

l

l

l

the capital assessment should be driven by the key business risks

sound and appropriate capital assessment methodology

organisation understands key drivers of its capital requirements

l

the need to demonstrate clearly the link between the risk framework and the ICA calculation

consistency with the syndicate business plan (SBF)

embedding the ICA

the need to reflect the agents position against the franchise standards in the ICA

the importance of the involvement of senior management and the Board in deriving and challenging the capital assessment

the requirement for an amended ICA where the risk profile of the syndicate has changed materially or a new SBF is submitted during the

year

l

l

l

l

l

formal approval by Board/senior management

appropriate adjustments to be made when the risk profile changes

l

Technical Section

Report financial and solvency position to Lloyds on a quarterly basis

New

Existing

Valuation of Liabilities (page 19-20)

New

Calculate technical provisions as specified under QIS4:

Final requirements will not be clarified until Level 2 but it is envisaged that a new set of regulatory reporting forms will be developed

Use Test (pages 23-24)

Existing

Risk Management standards, capital allocation:

Lloyds ICA Guidance and Minimum Standards:

Lloyds Valuation of Liabilities Rules

GN20 Actuarial reporting under the Lloyds Valuation of Liabilities rules

Own Funds (page 21)

Existing

New

Use and approval of internal models

N/A (Lloyds do not anticipate applying any additional requirements for assets held at syndicate level over and above the draft Directive

requirements)

Syndicate assets comply with GENPRU

New

Demonstrate use of the model in the business

Process for review of the internal model

Board and senior management understanding and constructive challenge

Consider the impact on the SCR where the model is re-run to reflect changes in the business

Changes to the risk management framework, including the modelling process:

Clear link and consistency between the capital element of the internal model and other elements

Supervisory Reporting & Public Disclosure (pages 17-18)

Requirement to submit information to Lloyds for annual regulatory return to the FSA

Existing

Provide syndicate annual reports to Lloyds and the FSA

(1) Do

you understand

the requirement

sufficiently at

this stage

(2)

What further

work/help is

required to reach

an understanding

(3)

Do you

currently meet

this

requirement

(4)

Where are you

short on this

requirement

(5)

Action

required to

address any

shortfall/ gap

(6)

When do you

envisage you

will be able to

meet this

requirement

(7)

Who will be

responsible for

actions on this

requirement

(8)

Estimated time

required to

address gap

(9)

Level of resource

needed to

address gap

(10)

Current status

on requirement

R / A /G

This template should be used in conjunction with Lloyd's "Guidance notes on gap analysis March 2009" and page

references are included below. Additional notes on completion of the relevant columns are included at the foot of

this document.

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

non-claims experience that could affect the profit and capital position

new external quantitative information

qualitative information, both internal and external

l

l

l

Extent of reliance on syndicate data

Reference should be made to market data but needs to be adjusted to reflect syndicate characteristics

Data should not be excessively smoothed as this is likely to understate volatilities

Expect the person responsible for any analysis supported by data to sign off that data meets criterion allowing for proportionality

Statistical quality standards (pages 25-26)

Existing

New

The drivers of risk in each risk group should be identified and described

The model should allow sensitivity testing of the main parameters as requested

Prescribed sensitivity tests are required as part of ICA pro-forma

Calibration Standards (pages 27-28)

Existing

Model should be calibrated using a VaR measure with a 99.5% confidence level, over a one year period

Non modelled risks should be calibrated to the 99.5% confidence level and a suitable aggregation method should be used

The model must be able to calculate a separate ICA for each syndicate covering all years of account of the syndicate combined

The model should allow output into constituent risk groups and be capable of showing the result by risk group both pre and post diversification

New

Profit & loss attribution (page 29)

Existing

New

Provide analysis of model output against actual loss experience

Review validity of past data over time as trends emerge and experience changes

Model should be flexible enough to allow for outputs other than the 1:200 level result

Output must address Solvency II risk categorisations for comparison with standard formula SCR

Management and Board understanding of sensitivity testing

Validate ICA against ECR and explain differences

Explicit back testing of the model is required

Comparison of model output to emerging experience on a timely basis (expected to be at a class of business level)

Analysis of emerging experience versus model expectations may need to be regularly reported to Lloyds

Validation Standards (pages 30-31)

Existing

Stress tests are needed to validate the model output for reasonableness and to help with calibrating assumptions

Stress and scenario tests must be relevant to their business and sufficiently extreme to represent the 1:200 level

Sufficient data over and above a syndicates own data should be considered and additional stress tests performed on uncertain assumptions

All models must be subject to sensitivity analysis

New

Output of internal model will have to be compared against standard formula SCR for at least first two years of internal model use

Validation function should be independent of the person parameterising the model to allow objective and robust challenge

Board should have overall responsibility for validation - management information on validation should be presented to the board and challenged

by it

Validation of the model should be carried out at least annually (appropriate frequency should be assessed by materiality)

Goodness of fit of probability distributions should be tested where statistical techniques are used, including both the choice of distribution and

the parameters

Actual vs expected analysis should be part of the validation process (expected to be at a class of business level)

Validation should consider not only emerging claims experience but all new data including:

Validation should check that all risks in the risk register are modelled and if not modelled there should be written justification

Assessment of accuracy, completeness and appropriateness of data should form part of the validation process. Data quality and model

sensitivity should drive design of calibration

Documentation should be adequate enough to allow independent verification of the validation process

(1) Do

you understand

the requirement

sufficiently at

this stage

(2)

What further

work/help is

required to reach

an understanding

(3)

Do you

currently meet

this

requirement

(4)

Where are you

short on this

requirement

(5)

Action

required to

address any

shortfall/ gap

(6)

When do you

envisage you

will be able to

meet this

requirement

(7)

Who will be

responsible for

actions on this

requirement

(8)

Estimated time

required to

address gap

(9)

Level of resource

needed to

address gap

(10)

Current status

on requirement

R / A /G

This template should be used in conjunction with Lloyd's "Guidance notes on gap analysis March 2009" and page

references are included below. Additional notes on completion of the relevant columns are included at the foot of

this document.

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

l

Notes

1

2

3

4

5

6

7

8

9

10

Agents should state the name and job title of those individuals responsible for completing each specific action identified.

An indication of the time required to address this gap (e.g. in person months) should be provided.

Agents should estimate here the amount and level of resource necessary to become compliant with the requirements where these are not currently met. In particular, agents should highlight areas where they expect that additional resource will be required and what form this additional

resource will take.

Agents should select a status of red, amber or green to reflect the size and nature of the gap identified, and the level of risk associated with not complying with the requirement by the time of Solvency II implementation.

Agents should state whether they currently meet both the new and existing requirements.

Where the agent has identified a shortfall in meeting any of the expected requirements, they should provide detail as to where the gap arises.

For each identified gap, detail should be provided as to what actions are planned in order for the agent to address this gap and meet the requirement as it is currently envisaged.

For those requirements not currently met, agents should state the approximate date by which they expect to become compliant (in particular whether they expect to have addressed any gaps in time for the dry running process).

Documentation Standards (pages 32-33)

Existing

Existing

External models and data (page 34)

New

Cover the operational details of the internal model as well as the design

All changes should be documented on an ongoing basis (model to be revisited regularly and updated as necessary in line with risk profile of

business)

Outline the policy for changing the model

Be detailed and complete enough to allow a skilled and knowledgeable professional to replicate the model

Address articles 118-122 and 124

The overall ICA figure split by major risk category, before and after diversification

The allocation of capital across risk groups and the rationale and method used to derive the figures for each

Explain the approach to deriving the ICA and how it links together the business plan, key risks inherent in the business, related risk

management processes and practices and the capital required by the risks

Why the methodology chosen is appropriate to the syndicates business, taking account of its risk profile, risk appetite, track record with respect

to risk experience and exposure and the key principles upon which the ICA is based

The approach adopted towards the quantification of risk and the rationale for this approach

Highlight any areas where model is deemed not to perform effectively (model weaknesses) and detail how these are addressed

Detail the theory underlying the internal model and be relevant to complexity of model

The stress and scenario tests used and why they are appropriate for the business

The sensitivity of key assumptions

Clear strategy for regular review of any external models/data sources used

Document process undertaken to ensure external data/model chosen is appropriate to risk profile and should include sufficient sensitivity and

scenario testing to validate use

Able to demonstrate thorough understanding of use and limitations of any vendor software/products used

Any reliance on external supplier to be documented together with role of product(s) and extent to which they are used

Use of external cat models/ESG ICA must allow for possibility of model error or risks not captured in external models

Set out how Board/senior management are engaged in process particularly where outsourcing/consultants used

New

External loss databases, such as ORIC (operational risk consortium) for operational risk, to supplement own data when assessing 1:200 losses

Agents should detail whether they currently feel they have a sufficient understanding of the requirement and what it is trying to achieve, bearing in mind that further guidance and detail will be provided going forward as the Level 2 implementing measures are developed. Agents

should also consider the extent to which the understanding of the requirement is shared across the organisation.

Details should be provided as to what additional work the agent feels needs to be completed by them in order for the appropriate people at the agency to reach an adequate level of understanding of the requirement. Agents should also include here anything that Lloyds could do or

provide to assist in reaching this understanding.

All Lloyds minimum ICA standards must be addressed

Potrebbero piacerti anche

- Risk management plan A Clear and Concise ReferenceDa EverandRisk management plan A Clear and Concise ReferenceNessuna valutazione finora

- Business Continuity Plan 7JCMDocumento11 pagineBusiness Continuity Plan 7JCMNatELI' Mining Engineering ServicesNessuna valutazione finora

- Risk Register TemplateDocumento20 pagineRisk Register TemplatesavasgNessuna valutazione finora

- KPI For ProjectDocumento6 pagineKPI For ProjectAhmed Imtiaz Rao100% (1)

- Change Management FormDocumento2 pagineChange Management Formbhushan.katariyaNessuna valutazione finora

- KPI Sheet GADocumento47 pagineKPI Sheet GAYuvaraj MohanNessuna valutazione finora

- OHS Risk Register-OldDocumento24 pagineOHS Risk Register-OldMohamed Rizwan100% (1)

- Master Risk RegisterDocumento165 pagineMaster Risk RegisterriaNessuna valutazione finora

- Risk Register - OHS - Examples For The OfficeDocumento3 pagineRisk Register - OHS - Examples For The OfficeNick Hadley100% (2)

- Sample Risk Assessment FormDocumento11 pagineSample Risk Assessment FormkbonairNessuna valutazione finora

- Risk and Opportunities Register Bulacan State UniversityDocumento58 pagineRisk and Opportunities Register Bulacan State UniversityNiezel Sabrido100% (1)

- KPIDocumento7 pagineKPIMushfika MuniaNessuna valutazione finora

- Workers' Welfare StandardsDocumento111 pagineWorkers' Welfare StandardsM Ramadhan FarithNessuna valutazione finora

- Content Gap Analysis TemplateDocumento2 pagineContent Gap Analysis TemplateJOSE MAURICIO MAHECHA APONTENessuna valutazione finora

- Contractor Performance PracticeDocumento7 pagineContractor Performance PracticeJohn SambulaNessuna valutazione finora

- New Vendor Info FormDocumento11 pagineNew Vendor Info FormRoseNPrinceNessuna valutazione finora

- TD-HSE-FORM-003 Supplier Evaluation FormDocumento4 pagineTD-HSE-FORM-003 Supplier Evaluation FormDamalie100% (1)

- Service Level Agreement ManagementDocumento7 pagineService Level Agreement Managementnandy39Nessuna valutazione finora

- Business Continuity Plan TemplateDocumento25 pagineBusiness Continuity Plan TemplateNate Nyamasvisva100% (1)

- Risk Mitigation Action Plan TemplatesDocumento5 pagineRisk Mitigation Action Plan TemplatesHector Eduardo Ermacora100% (2)

- Tool Assessment Best Practice TemplateDocumento14 pagineTool Assessment Best Practice TemplateScott IsaacsNessuna valutazione finora

- Customer Satisfaction SurveyDocumento10 pagineCustomer Satisfaction SurveyIppi100% (1)

- LESSONS LEARNED FROM CO2 SYSTEM SHUTDOWNDocumento6 pagineLESSONS LEARNED FROM CO2 SYSTEM SHUTDOWNLuthius100% (2)

- Rating Criteria for Risk AssessmentsDocumento13 pagineRating Criteria for Risk AssessmentsDisha Shah100% (3)

- Risk Management Plan TemplateDocumento10 pagineRisk Management Plan TemplateNovita_100Nessuna valutazione finora

- Root Cause Analysis ReportDocumento3 pagineRoot Cause Analysis Reportnesmanila3219Nessuna valutazione finora

- Business Impact Analysis Template Castellan SolutionsDocumento9 pagineBusiness Impact Analysis Template Castellan Solutionsعبدالله المريتع100% (1)

- First Aid Box Treatment & Inspection Register TemplateDocumento1 paginaFirst Aid Box Treatment & Inspection Register TemplateSn Ahsan100% (1)

- RACI Matrix of PMVDocumento2 pagineRACI Matrix of PMVMuideen OyedeleNessuna valutazione finora

- Company Asset RegisterDocumento19 pagineCompany Asset Registerj_kalyanaramanNessuna valutazione finora

- Risk Register of Common Project RisksDocumento4 pagineRisk Register of Common Project Risksعمر El KheberyNessuna valutazione finora

- Significant Risk RegisterDocumento8 pagineSignificant Risk RegisterswestyNessuna valutazione finora

- Key Performance Indicator KPI-PSDDocumento2 pagineKey Performance Indicator KPI-PSDtmj psd20% (1)

- GAP Analysis TableDocumento3 pagineGAP Analysis TableGianis Pap100% (1)

- Lecture 4 RISK EvaluationEstimation and Contol RMS 103Documento3 pagineLecture 4 RISK EvaluationEstimation and Contol RMS 103Grazel SagalesNessuna valutazione finora

- RR TemplateDocumento26 pagineRR TemplateburereyNessuna valutazione finora

- Project Management Plan - Template - HG-PMP-000 - Rev0Documento32 pagineProject Management Plan - Template - HG-PMP-000 - Rev0crazy ghostNessuna valutazione finora

- WDC 2013-14 Health & Safety ReportDocumento18 pagineWDC 2013-14 Health & Safety ReportSarah WalkerNessuna valutazione finora

- HSE-P-07 Work Permit Procedure Issue 2.1Documento30 pagineHSE-P-07 Work Permit Procedure Issue 2.1eng20072007100% (1)

- Risk and Opportunity Register: Director, Department of Administrative ServicesDocumento4 pagineRisk and Opportunity Register: Director, Department of Administrative ServicesroderickvicenteNessuna valutazione finora

- Skills Matrix TemplateDocumento3 pagineSkills Matrix TemplateMakeshNessuna valutazione finora

- KPI Template HSEDocumento3 pagineKPI Template HSEpyuditya75% (8)

- Use of Company Equipment (Voice Mail, E-Mail, Computers, Etc.)Documento3 pagineUse of Company Equipment (Voice Mail, E-Mail, Computers, Etc.)AyushiNessuna valutazione finora

- QMS - Risk Register SummaryDocumento26 pagineQMS - Risk Register SummaryTigor GurningNessuna valutazione finora

- Business Continuity ManagementDocumento3 pagineBusiness Continuity ManagementChandra RaoNessuna valutazione finora

- CONTRACTOR PERFORMANCE REVIEWDocumento2 pagineCONTRACTOR PERFORMANCE REVIEWAndi YanuarNessuna valutazione finora

- Corporate Risk ControlDocumento31 pagineCorporate Risk ControlRyan AdamsNessuna valutazione finora

- Health Safety and Environment Manual FSDocumento101 pagineHealth Safety and Environment Manual FSZulhilmi Zalizan100% (1)

- Client Feedback FormDocumento1 paginaClient Feedback FormMohamed YasirNessuna valutazione finora

- Environmental Aspects Register and EvaluationDocumento6 pagineEnvironmental Aspects Register and EvaluationShrikant UtekarNessuna valutazione finora

- D101: Demo of Iso 9001:2015 Document Kit (Manufacturing)Documento10 pagineD101: Demo of Iso 9001:2015 Document Kit (Manufacturing)Sayed DarwishNessuna valutazione finora

- AS 9100 Surveillance Audit ReportDocumento9 pagineAS 9100 Surveillance Audit ReportNestor CzerwackiNessuna valutazione finora

- Annual Safety Activity Plan of UAIL Site, Rev.-03Documento1 paginaAnnual Safety Activity Plan of UAIL Site, Rev.-03Sheikh AshfaqueNessuna valutazione finora

- Change Request Form TemplateDocumento4 pagineChange Request Form TemplateDonovan DenyssenNessuna valutazione finora

- Change Control Request Form Change Request Number:: General InformationDocumento2 pagineChange Control Request Form Change Request Number:: General Informationarunrpatil0465450% (1)

- Statement of Work TemplateDocumento13 pagineStatement of Work Templatedk24991Nessuna valutazione finora

- Vendor Assessment QuestionnaireDocumento12 pagineVendor Assessment QuestionnaireAxelrose04Nessuna valutazione finora

- Project Risk Register - FormatDocumento6 pagineProject Risk Register - FormatSameer MuntodeNessuna valutazione finora

- Gap Analysis TemplateDocumento7 pagineGap Analysis Templatejohn100% (1)

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19Da EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19Nessuna valutazione finora