Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Notification of An Option To Tax Opting To Tax Land

Caricato da

Kimberly LewisDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Notification of An Option To Tax Opting To Tax Land

Caricato da

Kimberly LewisCopyright:

Formati disponibili

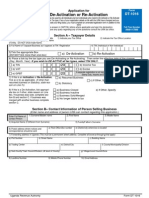

Notification of an option to tax

Opting to tax land and buildings

Attention – complete this form only to notify your decision to A paper copy and general guidance are available from our

opt to tax land and/or buildings. Before you complete this advice service on 0845 010 9000.

form, it is strongly recommended that you read Notice 742A Please complete this form in black ink and use capital letters.

Opting to tax land and buildings available from our website,

Send the completed form and supporting documents to the

go to www.hmrc.gov.uk

appropriate address as indicated overleaf.

Details of opter

Full name Phone number

Address Fax number

VAT number if applicable

Postcode

About the land and/or building(s) to be opted

(Please attach a list if more than one parcel of land and/or Has a plan been submitted?

building(s) is to be opted, with effective dates for each.)

Address. If it is bare land, provide its specific location or No Yes

attach a plan showing its location. Please state the effective date of this option to tax.

DD MM YYYY

The effective date should be the date you made your decision

to opt, or any future date from which you want your option to

Postcode take effect.

Notification must be made within 30 days of the effective date,

Land Registry title number this box is optional

or such longer period HMRC may allow in a particular case.

Previous exempt supplies

Have you made any exempt supplies of the land or buildings As you have made previous exempt supplies, prior written

you want to opt within the period of 10 years ending with the permission from HM Revenue & Customs will be required

date from which you want your option to be effective? For before you can opt to tax unless you meet one of the

example, you may have granted an interest in the land or conditions for automatic permission set out in Notice 742A,

building such as a lease. Section 5, ‘Permission to opt to tax’.

I confirm that I meet one or more of the conditions for

No Yes automatic permission.

If ‘No’, please complete the declaration and submit the form.

If ‘Yes’, please specify below, the exempt supplies of the land No Yes

or building you have made. If ‘Yes’, please state which specific condition is met.

1 2 3 4

If you do not meet the conditions for automatic permission,

please apply for permission to opt to tax by submitting

form VAT1614H to the appropriate address overleaf.

VAT1614A Page 1 HMRC 02/09

Declaration

I declare that the information provided on this form is true to the best of my knowledge and belief.

Signature Print name

Date of notification Status Director, Company Secretary, Sole Proprietor

DD MM YYYY Partner, Trustee*

Please note:

*If this notification is signed by anyone other than these persons then a signed letter of authority authorising the signatory to act

on their behalf must be submitted to HM Revenue & Customs. You should attach a letter of authority to this form if you have not

previously submitted one. Please note that form 64-8 Authorising your Agent does not allow you to sign on behalf of your client.

A letter of authority is attached

No Yes

A letter of authority has already been submitted

No Yes

Are you based outside the UK?

No Yes

If the answer is 'Yes', have you appointed a UK representative?

No Yes

In normal circumstances an option to tax cannot be revoked for at least 20 years from the effective date. We recommend you

retain records relating to your option to tax for the period that the option is effective.

Where do I send this form?

Send this form to: Unless

HM Revenue & Customs • you are registering for VAT and also want to opt to tax.

Option to Tax National Unit In this case, please send both forms to the appropriate

Cotton House VAT Registration Unit (VRU). For the address of the VRU

7 Cochrane Street covering your postcode, phone our advice service on

Glasgow 0845 010 9000 or go to www.hmrc.gov.uk or

G1 1GY • you are based outside the UK and are registered at the

Non-Established Taxable Persons Unit (NETPU). In this case,

Phone 0141 285 4174 / 4175

please send this form to:

Fax 0141 285 4423 / 4454

NETPU

Ruby House

8 Ruby Place

Aberdeen

AB10 1ZP

Phone 01224 404818

Fax 01224 401879

Page 2

Potrebbero piacerti anche

- How To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreDa EverandHow To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreNessuna valutazione finora

- Downloadable Rental Ledger TemplateDocumento4 pagineDownloadable Rental Ledger TemplatemaroNessuna valutazione finora

- RUN Property Application FormOccupationRelationshipPhoneNotesDocumento4 pagineRUN Property Application FormOccupationRelationshipPhoneNotesJerry LauNessuna valutazione finora

- View Tax Return PDFDocumento14 pagineView Tax Return PDFEmil AndriesNessuna valutazione finora

- Coke Defends Parliamentary PrivilegesDocumento291 pagineCoke Defends Parliamentary PrivilegestomsobNessuna valutazione finora

- Mrs M Altman 2019-20 Tax ReturnDocumento22 pagineMrs M Altman 2019-20 Tax Returnyochanan altman100% (1)

- C Ujeniuc 2Documento17 pagineC Ujeniuc 2cujeniucYAHOO.COMNessuna valutazione finora

- Tax Return 2018Documento15 pagineTax Return 2018Arnaud CalisteNessuna valutazione finora

- View Tax Tax Return From 06:04:2020 To 5:04:2021Documento16 pagineView Tax Tax Return From 06:04:2020 To 5:04:2021raj6912377Nessuna valutazione finora

- Judicial Affidavit OngpinDocumento3 pagineJudicial Affidavit OngpinRhobee JynNessuna valutazione finora

- CSI Form 4 SOCO Report FormsDocumento4 pagineCSI Form 4 SOCO Report FormsMary Jane Porras0% (1)

- BoothPeterDarren 2022 1Documento14 pagineBoothPeterDarren 2022 1Αριστείδης ΜέγαςNessuna valutazione finora

- Tax Return 2018Documento16 pagineTax Return 2018Robert GyetwayNessuna valutazione finora

- Non-Resident Landlord Tax FormDocumento3 pagineNon-Resident Landlord Tax FormtinyharbsNessuna valutazione finora

- Rupert Lewis Biography Highlights Life and Achievements of Marcus GarveyDocumento6 pagineRupert Lewis Biography Highlights Life and Achievements of Marcus GarveyMikhaili Rvp Toney25% (4)

- Claim FormsDocumento4 pagineClaim FormsThaworn ThaweeaphiradeemaitreeNessuna valutazione finora

- Manuel V Cruz PanoDocumento3 pagineManuel V Cruz PanoCocoyPangilinan100% (1)

- Transfer of Reg PDFDocumento4 pagineTransfer of Reg PDFDanielWildSheepZaninNessuna valutazione finora

- CPPREP4124 - Notice To Vacate - VIC.v1.2Documento11 pagineCPPREP4124 - Notice To Vacate - VIC.v1.2ad78il1Nessuna valutazione finora

- Form AP1 - Registration of An EasementDocumento6 pagineForm AP1 - Registration of An EasementmartinNessuna valutazione finora

- SA105 English Notes-2021Documento12 pagineSA105 English Notes-2021Dominic NooneyNessuna valutazione finora

- SA105 Notes 2023Documento12 pagineSA105 Notes 2023ellylid73Nessuna valutazione finora

- Taxi and Private Hire Booking Office Licence Renewal Application ChecklistDocumento8 pagineTaxi and Private Hire Booking Office Licence Renewal Application ChecklistAr. RajaNessuna valutazione finora

- Application For RegistrationDocumento4 pagineApplication For RegistrationCris KadusaleNessuna valutazione finora

- BJ005 Self Assessment Tax Return 05.04.2023 - For ApprovalDocumento23 pagineBJ005 Self Assessment Tax Return 05.04.2023 - For ApprovalT5.COMNessuna valutazione finora

- Residents Discount Registration FormDocumento9 pagineResidents Discount Registration FormtuyreNessuna valutazione finora

- Lodge Home Building ComplaintDocumento5 pagineLodge Home Building ComplaintJacky HuangNessuna valutazione finora

- DVLA Refund ApplicationDocumento2 pagineDVLA Refund ApplicationWan Ahmad Hilfi JunaidiNessuna valutazione finora

- Ap1 2022-08-01Documento7 pagineAp1 2022-08-01ÖzlemNessuna valutazione finora

- File 2018 Tax Return ElectronicallyDocumento3 pagineFile 2018 Tax Return Electronicallymuhammad afiqNessuna valutazione finora

- Rms Form 45070107 Transfer of RegDocumento4 pagineRms Form 45070107 Transfer of Regkkarth47Nessuna valutazione finora

- Tradewise Insurance Commercial Vehicle Accident Report FormDocumento12 pagineTradewise Insurance Commercial Vehicle Accident Report FormNwachukwu ProsperNessuna valutazione finora

- Residential Tenancy Agreement GuideDocumento4 pagineResidential Tenancy Agreement GuideDaniel WhiteNessuna valutazione finora

- UK Home Office: Set (O) FormDocumento15 pagineUK Home Office: Set (O) FormUK_HomeOfficeNessuna valutazione finora

- Booking Office 3124Documento8 pagineBooking Office 3124m227765hNessuna valutazione finora

- SAE Claim FormDocumento5 pagineSAE Claim FormNovaPNessuna valutazione finora

- Application For A Licence To Decommission A Bore(s) : Privacy Collection StatementDocumento6 pagineApplication For A Licence To Decommission A Bore(s) : Privacy Collection StatementKai FrankNessuna valutazione finora

- Application Form FA10C New Custom Food Control Plan Under Food Act 2014Documento7 pagineApplication Form FA10C New Custom Food Control Plan Under Food Act 2014Fatemeh ArefianNessuna valutazione finora

- Knife Dealer'S Renewal Application Checklist: /conversion/tmp/activity - Task - Scratch/598658976Documento8 pagineKnife Dealer'S Renewal Application Checklist: /conversion/tmp/activity - Task - Scratch/598658976Ar. RajaNessuna valutazione finora

- Knife Dealers 15451Documento8 pagineKnife Dealers 15451m227765hNessuna valutazione finora

- Landlord Legal Info SheetDocumento1 paginaLandlord Legal Info Sheetjames.armstrong35Nessuna valutazione finora

- Bond Refund FormDocumento2 pagineBond Refund FormJofamu100% (1)

- Use One Form Per Title. Any Parts of The Form That Are Not Typed Should Be Completed in Black Ink and in Block CapitalsDocumento3 pagineUse One Form Per Title. Any Parts of The Form That Are Not Typed Should Be Completed in Black Ink and in Block CapitalsSofia marisa fernandesNessuna valutazione finora

- Form 4 Joint Application Disposal Security BondDocumento2 pagineForm 4 Joint Application Disposal Security BondEduardomelloNessuna valutazione finora

- Regulated Agreement ESigned 2021-07-06Documento10 pagineRegulated Agreement ESigned 2021-07-06kaznic123Nessuna valutazione finora

- Change of Details FormDocumento4 pagineChange of Details FormJonathan EvansNessuna valutazione finora

- US Internal Revenue Service: f2350 - 1992Documento2 pagineUS Internal Revenue Service: f2350 - 1992IRSNessuna valutazione finora

- v34 Ni - 80809Documento2 paginev34 Ni - 80809William McCullaNessuna valutazione finora

- US Internal Revenue Service: f2350 - 2005Documento3 pagineUS Internal Revenue Service: f2350 - 2005IRSNessuna valutazione finora

- Resident Parking Permit ApplicationDocumento4 pagineResident Parking Permit ApplicationIondontuNessuna valutazione finora

- ATO Tax CompensationDocumento3 pagineATO Tax CompensationJohnNessuna valutazione finora

- US Internal Revenue Service: f2350 - 1999Documento2 pagineUS Internal Revenue Service: f2350 - 1999IRSNessuna valutazione finora

- Apss146e 1217Documento2 pagineApss146e 1217Saad AlenziNessuna valutazione finora

- Ir 1241Documento1 paginaIr 1241Kit ChuNessuna valutazione finora

- Resident Parking Permit - Guidance NotesDocumento4 pagineResident Parking Permit - Guidance NotesEnglandKorfballNessuna valutazione finora

- Tenancy Application Form: Property AddressDocumento2 pagineTenancy Application Form: Property AddressJerry LauNessuna valutazione finora

- Application For Enrollment To Practice Before The Internal Revenue Service 23Documento4 pagineApplication For Enrollment To Practice Before The Internal Revenue Service 23IRSNessuna valutazione finora

- VAT+7+ +Application+to+Cancel+Your+VAT+RegistrationDocumento6 pagineVAT+7+ +Application+to+Cancel+Your+VAT+Registrationtcosgrove3579Nessuna valutazione finora

- 4 - Irs 8822Documento1 pagina4 - Irs 8822Hï FrequencyNessuna valutazione finora

- Excise Licence Application PDFDocumento2 pagineExcise Licence Application PDFdebashishota4417Nessuna valutazione finora

- Notice of Renewal / Restoration of A Licence: Edmond Dinkha Esho 37 Greenhaven DR Pennant Hills NSW 2120Documento4 pagineNotice of Renewal / Restoration of A Licence: Edmond Dinkha Esho 37 Greenhaven DR Pennant Hills NSW 2120Edmond EshoNessuna valutazione finora

- Guarantor Application FormDocumento3 pagineGuarantor Application FormObioha ClintonNessuna valutazione finora

- Advance RulingProcedureDocumento13 pagineAdvance RulingProcedureshubhamt25Nessuna valutazione finora

- DT-1016 De-Activation and Re-ActivationDocumento2 pagineDT-1016 De-Activation and Re-ActivationIsaka Isse100% (3)

- Surrender Form SummaryDocumento3 pagineSurrender Form SummaryDevendra RawoolNessuna valutazione finora

- Buenaventura V Ca PDFDocumento19 pagineBuenaventura V Ca PDFbrida athenaNessuna valutazione finora

- Robert Nozick - Jonathan WolffDocumento11 pagineRobert Nozick - Jonathan Wolffjose.zarate69100% (1)

- The John Joan CaseDocumento9 pagineThe John Joan CaseDiane DuranNessuna valutazione finora

- Property Ownership Dispute Case SummaryDocumento14 pagineProperty Ownership Dispute Case SummaryAditya SharmaNessuna valutazione finora

- Speaking Out On Human Rights: Debating Canada's Human Rights SystemDocumento10 pagineSpeaking Out On Human Rights: Debating Canada's Human Rights SystemPearl EliadisNessuna valutazione finora

- This Following Text Is For Number 1 To 5: Choose The Best Answer by Crossing A, B, C, D, or E!Documento7 pagineThis Following Text Is For Number 1 To 5: Choose The Best Answer by Crossing A, B, C, D, or E!Denok SasyaNessuna valutazione finora

- Agreement PreviewDocumento7 pagineAgreement PreviewKumar utsavNessuna valutazione finora

- Law On Negotiable Instruments Sections 1-10Documento3 pagineLaw On Negotiable Instruments Sections 1-10Santi ArroyoNessuna valutazione finora

- PrếntationDocumento12 paginePrếntationPXCRNessuna valutazione finora

- Ged109 Discoursepaper Gonzales Am2Documento12 pagineGed109 Discoursepaper Gonzales Am2ethanNessuna valutazione finora

- US Quest for EmpireDocumento5 pagineUS Quest for EmpireCarol LeeNessuna valutazione finora

- Present Simple Tense GuideDocumento9 paginePresent Simple Tense GuideGustavo PacompiaNessuna valutazione finora

- Tillie OlsenDocumento2 pagineTillie OlsenCarl RollysonNessuna valutazione finora

- Brothers, wives, fathers and leaders in the IliadDocumento2 pagineBrothers, wives, fathers and leaders in the IliadMary Ann Ponce Moncera0% (1)

- Tina Turner Biography - 154987Documento2 pagineTina Turner Biography - 154987Tatiana Melo ZacariasNessuna valutazione finora

- Heinrich Müller (Gestapo) : From Wikipedia, The Free EncyclopediaDocumento6 pagineHeinrich Müller (Gestapo) : From Wikipedia, The Free EncyclopediaMircea BlagaNessuna valutazione finora

- MANGILIMAN, Neil Francel Domingo (Sep 28)Documento8 pagineMANGILIMAN, Neil Francel Domingo (Sep 28)Neil Francel D. MangilimanNessuna valutazione finora

- Jacobs Ruling 2 0311Documento8 pagineJacobs Ruling 2 0311ray sternNessuna valutazione finora

- Redbucket Franchies ListDocumento18 pagineRedbucket Franchies ListMerchant Hussain aliNessuna valutazione finora

- Us Antitrust Law Policies and ProceduresDocumento33 pagineUs Antitrust Law Policies and ProceduresThalia SandersNessuna valutazione finora

- MarDocumento6 pagineMarNational CSR Hub100% (1)

- The Indian Tolls (Army and Air Force) Act, 1901-15 Sep2004Documento7 pagineThe Indian Tolls (Army and Air Force) Act, 1901-15 Sep2004Prr RaoNessuna valutazione finora

- Hungry Wolf: A Wise Old OwlDocumento2 pagineHungry Wolf: A Wise Old OwlAnnuar IsmailNessuna valutazione finora

- Politician WatchDocumento3 paginePolitician WatchRoya HerrleNessuna valutazione finora

- ObliconDocumento12 pagineObliconagent_rosNessuna valutazione finora