Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Summary Results Bangladesh

Caricato da

Anendya Chakma0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

13 visualizzazioni17 paginegatt

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentogatt

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

13 visualizzazioni17 pagineSummary Results Bangladesh

Caricato da

Anendya Chakmagatt

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 17

1

J. Agreement on Trade-Related Aspects of

Intellectual Property Rights (TRIPS) ........ 10

K. Dispute Settlement ................................... 11

L. Trade Policy Reviews ................................ 11

M. Enhanced Integrated Framework (EIF) ..... 12

N. General recommendations to improve

efectiveness of WTO Special Support

Measures .................................................. 12

SECTION II. SPECIAL SUPPORT MEASURES RELATED TO

PREFERENTIAL MARKET ACCESS

A. Non-reciprocal preference arrangements of

developed countries .................................. 13

B. Non-reciprocal preference arrangements of

developing countries ................................. 14

C. Reciprocal trade arrangements .................. 15

D. Recommendations to improve international

support measures related to preferential

market access ............................................ 16

Survey on International Support Measures specifc to the

Least Developed Countries (LDCs)

related to WTO Provisions and Preferential Market Access

Bangladesh

SUMMARY RESULTS

prepared by the United Nations Department of Economic and Social Afairs (DESA)

and the Committee for Development Policy (CDP) Secretariat*

TABLE OF CONTENTS

SECTION I. SPECIAL SUPPORT MEASURES UNDER THE WTO

A. Compliance with the WTO Agreements ... 2

B. Agreement on Agriculture (AoA) .............. 3

C. Agreement on the Application of Sanitary

and Phytosanitary Measures (SPS) ............ 4

D. Agreement on Technical Barriers to

Trade (TBT)............................................. 6

E. Agreement on Trade-Related Investment

Measures (TRIMs) ................................... 7

F. Agreement on Implementation of

Article VII of the GATT 1994

(Customs Valuation) ................................. 8

G. Agreement on Import Licensing Procedures 9

H. Agreement on Subsidies and Countervailing

Measures (ASCM) .................................... 9

I. General Agreement on Trade in Services

(GATS) .................................................... 9

* This summary was prepared by the DESA/CDP Secretariat, based on the survey response submitted by a consultant from

Bangladesh. The content, fndings, interpretations, and conclusions as expressed in this summary refect the views of its authors,

and do not necessarily represent the views of the United Nations or Bangladesh. The views presented in this document should not

be considered as the ofcial position of Bangladesh.

March 2012

2

SECTION I.

SPECIAL SUPPORT MEASURES UNDER THE WTO

A. Compliance with the WTO Agreements

Country response

Bangladesh had to undertake various obligations under

the Uruguay Round Agreements, covering commitments

on market access, subsidies, and the enactment of na-

tional rules and regulations, or the modifcation of exist-

ing national rules and regulations as per provisions of the

various WTO Agreements.

Market-access commitments were aimed at tarif

bindings at the ceiling level of 200% on agricultural

products, and of 50% on 13 other agriculture products

and 31 industrial products. Besides, Bangladesh also

bound other duties and charges (Article II.2b GATT)

at 2.5% for all products and undertook the commitment

to withdraw all quantitative restrictions by 2005.

In the area of subsidies, the obligations included (a)

keeping all domestic support in favour of agricultural

production below 10% of the value of total agriculture

production, (b) prohibiting the introduction of any

export subsidies in agriculture; and (c) withdrawal of

subsidies or support mesaures contingent upon the use of

domestic over imported goods by 2003.

Other requirements included obligations relating to

introducing the GATT valuation system, national anti-

dumping laws and regulations, and countervailing and

safeguard measures.

Bangladesh reported that it was in a position to com-

ply with market-access committments in most of the

cases, but faced great difculties in terms of complying

with some other obligations. For example, despite hav-

ing enacted laws and regulations in accordance with the

WTO agreements, the implementation of such rules was

challenging, owing to the lack of information required

to take action under these rules.

Pursuant to the Understanding on the Balance-of-

payments Provisions of the GATT 1994, Bangladesh

was scheduled to withdraw quantitative restrictions on

imports for 17 categories of products that were being

maintained on balance of payments grounds, by 2005.

However, as a WTO Member, Bangladesh resorted to

GATT Article XVIII:C as a reason to enforce import

restrictions on 5 of these categories beyond 2005, due

to their importance in terms of employment generation.

Te country was not allowed to invoke Article XVIII:C,

but Members agreed that Bangladesh maintained restric-

tions, until 2009, on the 4 following products: carton,

poultry, eggs, and salt. Bangladesh has already withdrawn

the quantitative restrictions as per its commitment.

In addition, Bangladesh, along with other LDCs, re-

quested an extension of the time frame for complying with

TRIPS and TRIMs obligations. An extension of the tran-

sitional period for implementing the TRIPS Agreement

until 2016 for pharmaceutical products and July 1 2013

for other products was granted to LDCs as a group of

members. LDCs have also been allowed to maintain exist-

ing TRIMs and introduce new measures until 2020.

Bangladesh anticipated difculties in ensuring compli-

ance with the WTO obligations, such as provisions related

to subsidies, compliance with SPS and TBT Agreements,

TRIMS, TRIPS etc. Bangladesh has put in place various

rules and regulations pertaining to SPS and TBT mea-

sures. However, faced with complaints over compliance,

Bangladesh may be unable to justify its scientifc ratio-

nale, due to inadequate human resources and skills.

Tere are some instances and indications of products

beings dumped into Bangladesh market. But the private

sectors lack of capacity to furnish evidence on the exist-

ence of such dumping practices, and on the alleged in-

jury caused to the domestic industry by such dumping,

which are two prerequisites for initiating any investiga-

tion, does not permit any investigation with respect to

antidumping and countervailing procedures.

Recognizing that the LDCs may face difculty in meeting

the rules set out by the WTO, the Decision on Measures

in Favour of Least-developed Countries

a

had foreseen the

need to ensure their efective participation in the world

trading system and to improve their trading opportuni-

ties. A great number of Multilateral Trade Agreements

(MTAs) provide Special and Diferential Treatment (SDT) to

LDCs in terms of longer transitional periods or, in some

cases, permanent exemptions, for so long as they remain

in that category. Many WTO Agreements commit WTO

Members, primarily among developed countries, to take

special measures in favour of LDCs, such as technical and

fnancial assistance, which ought to be implemented

expeditiously and subject to regular reviews.

a Annexed to the Final Act of the Uruguay Round.

3

B. Agreement on Agriculture (AoA)

..

The Agreement on Agriculture (AoA) initiates a reform

process aimed at establishing a fair and market-oriented

agricultural trading system through negotiations (Article 20)

on domestic support, market access, and export subsidies,

known as the three central concepts or pillars of the AoA.

WTO Members agreed to continue the reform process

through negotiations taking into account special and

diferential treatment to developing countries, including

concerns such as food security, and the possible negative

efects of reform implementation on LDCs and Net Food-

Importing Developing Countries (NFIDCs).

Article 15.2 of the AoA provides LDCs with an overall ex-

emption from undertaking reduction commitments, and

a more specifc exemption from bound agricultural tarif

reduction as far as the market access pillar is concerned.

Since none of the LDCs scheduled commitments with

respect to domestic support and export subsidies when

they became WTO Members, this provision does not rep-

resent an additional fexibility for LDCs under both pillars.

b

Although they have not scheduled commitments related

to trade distorting domestic support, LDCs are allowed to

maintain domestic support measures that fall under the

categories exempt from reduction commitments, such as

green box subsidies, developmental measures (Article 6.2)

and de minimis levels of support (for developing countries,

this is equal to 10% of the value of agricultural production

during the relevant year).

LDCs as Net food Importers

The Committee on Agriculture monitors the follow-up

to the Decision on Measures Concerning the Possible

Negative Efects of the Reform Programme on Least-

Developed and Net Food-Importing Developing Countries

(Article 16.2 AoA). In this decision, trade ministers agreed,

inter alia, (i) to adopt guidelines to ensure that an increas-

ing proportion of basic foodstufs is provided to LDCs and

NFIDCs in fully grant form and (ii) to give full consideration

to requests for the provision of technical and fnancial as-

sistance to LDCs and NFIDCs to improve their agricultural

productivity and infrastructure. In 1995, the Committee

established notifcation requirements under which donor

Members are required to submit data on quantity of food

aid and technical and fnancial assistance to improve agri-

cultural productivity provided to LDCs and NFIDCs.

b Twenty-ve WTO Members can subsidize exports, but only for products on which

they have commitments to reduce subsidies. 34 WTO Members have commitments

to reduce their trade-distorting domestic supports in the amber box (i.e to reduce the

total aggregate measurement of support or AMS).

www.wto.org/english/tratop_e/agric_e/negs_bkgrnd08_export_e.htm

www.wto.org/english/tratop_e/agric_e/negs_bkgrnd08_domestic_e.htm

Country response

Domestic support

Bangladesh is not required to undertake any reduc-

tion commitment; when the country became a WTO

Member, its Aggregate Measurement of Support

(AMS) was at about 2-3% of agricultural GDP, way

below the permissible threshold of 10% of agricultural

production (de minimis). Te country has not so far

provided any agricultural export subsidies.

Bangladesh ofers domestic support in the form of

subsidies (input and output subsidies, for example, sub-

sidized fertilizer and seed procurement).

LDCs as Net food Importers

1

Food aid. After 1995, Bangladesh continued to receive

food aid and project aid in agriculture, but the country

reported that infows in food aids have gradually de-

creased in volume in recent years (see Annex Table 1).

All food aid received by Bangladesh has been in

grant form since 1985. Major donors include Australia,

Canada, Germany, Japan, the United States and

Saudi Arabia. (Source: External Resources Division of

Bangladesh).

Technical assistance. Various bilateral and multilateral

organizations have provided technical and fnancial as-

sistance to enhance agricultural output, productivity,

crop diversifcation and strengthening of Research and

Development (R&D) capacity.

Additional comments

Bangladesh mentioned that SDT provisions available to

agriculture have been of very limited use. Te country

gave examples in the following areas:

Market access. In the Uruguay Round, all countries,

including LDCs, had to withdraw all quantitative re-

strictions and bind duties on all agricultural products.

No SDT provision was available with this respect. While

Bangladesh, as an LDC, was not required to make any

1 See also WTO document G/AG/W/42/Rev.13,

Implementation of the Decision on Measures Concerning

The Possible Negative Efects of the Reform Programme

on Least-Developed and Net Food-Importing Developing

Countries, 15 October 2010.

4

reduction commitments, this fexibility was ofset by the

tarif liberalization process initiated by Bangladesh un-

der structural adjustment programmes, as part of World

Bank aid conditionalities in the early 1990s.

Domestic support. Bangladesh provided amber box

support to agriculture at the WTOs establishment.

However, the amount allocated for this support was

below 10% of the total value of agriculture produc-

tion; hence, Bangladesh was not required to make any

reduction commitment through taking advantage of

the relevant SDT provision. Terefore, the SDT provi-

sion relating to exemption from reducing amber box

subsidies has not been of any beneft to Bangladesh. As

a matter of fact, 34 countries had to make reduction

commitments, their trade-distorting domestic supports

exceeding 5% (for developed countries) and 10% (in the

case of developing countries) of the total value of their

agricultural production.

Export subsidies. At the WTOs creation, only 25 coun-

tries provided exports subsidies, and were required, as

such, to undertake reduction commitment. No LDC

was included in this list. Since Bangladesh did not pro-

vide any agricultural export subsidies, it could not use

SDT in export subsidies.

Food aid and technical assistance in agriculture. As

indicated earlier, food aid and agricultural project loan

infow have been on the decline over the past years.

Bangladesh indicated that one of the reasons for this

could be that its agriculture has been performing re-

markably well in recent times, with the country gradu-

ally moving towards food self-sufciency.

C. Agreement on the Application of Sanitary

and Phytosanitary Measures (SPS)

The SPS Agreement has several SDT provisions for LDCs:

When preparing or applying sanitary or phytosanitary

(SPS) measures, Members shall take account of the special

needs of developing country Members, and in particular of

the least-developed country Members (Article 10.1). In or-

der to operationalize Article 10.1, the SPS Committee set

out a Procedure to Enhance Transparency of Special and

Diferential Treatment in Favour of Developing Country

Members.

c

If a developing country identifes signifcant

difculties with the proposed or fnal measure, the im-

porting Member would examine whether and how the

identifed problem could best be addressed: (1) revision

of the SPS measure; (2) provision of technical assistance

to the exporting Member; or (3) provision of special and

diferential treatment. Such a decision has to be notifed

to the SPS Committee. As of 2012, no country has utilized

this procedure.

Under Article 10.4, Members should encourage and facil-

itate the active participation of developing country Members

in the relevant international organizations, that is the

FAO/WHO Codex Alimentarius, the World Organization for

Animal Health (OIE) and the International Plant Protection

Convention (IPPC). The 2001 Doha Ministerial Decision

on Implementation-related Issues and Concerns urges

the Director-General to continue his cooperative eforts with

these organizations and institutions in this regard, including

with a view to according priority to the efective participation

of least-developed countries and facilitating the provision of

technical and fnancial assistance for this purpose (par. 3.5).

As a result, trust funds have been established to increase

participation of developing countries in the three stand-

ard-setting bodies.

d

Under Article 9, Members agree to facilitate the provision

of technical assistance to other Members [...] inter alia, in the

areas of processing technologies, research and infrastructure,

including in the establishment of national regulatory bodies

[...] to allow such countries to adjust to, and comply with, sani-

tary or phytosanitary measures necessary to achieve the ap-

propriate level of sanitary or phytosanitary protection in their

export markets. The 2001 Doha Ministerial Decision on

Implementation-related Issues and Concerns urges mem-

bers to ensure that technical assistance is provided to least-

developed countries with a view to responding to the special

problems faced by them in implementing the Agreement

on the Application of Sanitary and Phytosanitary Measures

(par. 3.6). In 2002, the Standards and Trade Development

Facility (STDF) was established to assist developing coun-

tries to enhance their expertise and capacity to analyze

and implement international SPS standards, and thus their

ability to gain and maintain market access.

e

c See WTO documents G/SPS/33 and Add.1, Decision of the SPS Committee,

27 October 2004 and WTO document G/SPS/33/Rev.1,

18 December 2009.

d See WTO document G/SPS/GEN/510/Rev.1, 23 Feb 2005, Review of the

operation and implementation of the SPS Agreement Background

document, par. 26.

e http://www.standardsfacility.org/

5

Country response

Participation in standard-setting organizations

2

Bangladesh indicated that it did not have any representa-

tive in meetings of the World Organization for Animal

Health (OIE) or the International Plant Protection

Convention (IPPC), but that national delegations were

present at meetings of the Codex Alimentarius. Te coun-

try is a member of these three standard-setting bodies.

Participation in the SPS Committee

Capital-based ofcials have had the opportunity to at-

tend some of the regular meetings of the SPS Committee.

Non-compliance with SPS measures of importing Members

Bangladesh experienced difculties in meeting the SPS

requirements of importing countries for some of its ex-

ports (see Annex Table 2):

Government action. Generally, exporters facing prob-

lems in meeting SPS requirements applied by import-

ing countries bring their case to the attention of the

Government. Te Government then takes the initiative

to resolve the problem through bilateral discussions with

the government of the country concerned, and under-

takes corrective measures.

In the case of shrimps, the European Union (EU)

imposed an import ban in 1997, which was later lifted

by the EU authorities. In 2009, the EU rejected entry for

at least 50 container loads of shrimps in which the pres-

ence of the banned antibiotic nitrofuran was detected.

Tese incidents led Bangladeshi exporters to maintain

an eight month voluntary export restraint on fresh

water shrimps as of May 2009. On 12 July 2010, the EU

adopted a decision aimed at testing 20% of all shrimps

consignments exported by Bangladesh into the Union,

and introduced a new mandatory testing requirement,

with a view to detecting the presence of oxytetracycline

and chlortetracycline.

2 See WTO document G/SPS/GEN/49/Rev.10, 4 March 2010,

on Membership in WTO and international standard-setting

bodies.

Notifying diculties with proposed SPS measures of

other WTO Members

Bangladesh does not have a regular system to monitor

SPS measures notifed to the WTO and evaluate their

impact on trade. For this reason, Bangladesh does not

notify the WTO when it faces potential difculties with

proposed SPS regulations by importing Members.

Technical assistance

In 1997, the EU provided fnancial and technical assis-

tance to help Bangladesh comply with Hazard Analysis

Critical Control Point (HACCP) requirements, a

food safety management system. In the last fve years,

Bangladesh has received technical and fnancial as-

sistance from the EU and UNIDO under the project

titled Bangladesh Quality Support programme. Te

program has focused on raising awareness and building

capacity within the private sector to meet the standards,

conformity assessment, and packaging requirements of

export markets in a competitive manner.

Bangladesh has also received some assistance from the

Indian Government to strengthen the capacity of the

Bangladesh Standards and Technical Institute (BSTI).

STDF Assistance

3

Te Government of Bangladesh is yet to receive any sup-

port from the STDF, which will be considered after the

completion of the Diagnostic Trade Integration Study

(DTIS) under the Enhanced Integrated Framework

(EIF). Te World Bank has been entrusted with the

DTIS and is currently engaged in the study.

Additional comments

Te main reasons for not appropriately taking advantage

of the SDT provisions under the SPS Agreement are re-

lated to inadequate human resources within the govern-

ment dealing with WTO issues, and the lack of proper

coordination among the various ministries monitoring

the WTO Agreements and implementing SPS measures.

3 See WTO document G/SPS/GEN/1029, 23 June 2010, for an

overview of STDF projects.

6

Country response

Participation in the TBT Committee

Representatives of Bangladesh rarely participate in meet-

ings of the TBT Committee. Between 1995 and 2010,

the country did not make any notifcation to the TBT

Committee.

4

Tere is lack of capacity to regularly examine TBT-

related notifcations both within the government and in

the private sector. As a result, Bangladesh has not been

able to assess trade impact of the TBT measures and put

on record its Specifc Trade Concerns regarding techni-

cal regulations and standards.

Non-compliance with technical regulations or standards

of importing Members

Some consignments of Bangladesh major export prod-

ucts, such as leather, knitwear, woven garments and

pharmaceuticals were rejected for lack of compliance

with technical regulation and packaging requirements

in importing countries.

4 See WTO document G/TBT/29, 8 March 2011.

D. Agreement on Technical Barriers

to Trade (TBT)

The TBT Agreement recognizes that developing countries are

not able to fully implement the Agreement because of their

special development and trade needs, as well as their stage

of technological development. The TBT Committee can

grant, upon requests specifed, time-limited exceptions in

whole or in part from obligations under the TBT Agreement.

When considering such requests, the Committee shall, in

particular, take into account the special problems of the least-

developed country Members (Article 12.8).

When providing advice and technical assistance to

other WTO Members, Members shall give priority to the

needs of the least-developed country Members. (Article 11.8).

Also, in determining the terms and conditions of the techni-

cal assistance, account shall be taken of the stage of devel-

opment of the requesting Members and in particular of the

least-developed country Members. (Article 12.7).

Technical assistance may include: advice on the prepara-

tion of technical regulations (Article 11.1); the establishment

of national standardizing bodies, and participation in the

international standardizing bodies (Article 11.2); the estab-

lishment of conformity assessment bodies (Article 11.3 and

11.4); advise regarding the steps that should be taken by

producers from developing countries if they wish to have

access to systems for conformity assessment operating

within the territory of the importing Member (Article 11.5);

advice regarding the establishment of the institutions and

legal framework which would enable them to fulfl the ob-

ligations of membership or participation in international

or regional conformity assessment systems (Article 11.6

and 11.7).

The 2001 Doha Ministerial Decision on Implementation-

related Issues and Concerns (i) urges members to provide,

to the extent possible, the fnancial and technical assistance

necessary to enable least-developed countries to respond

adequately to the introduction of any new TBT measures

which may have signifcant negative efects on their trade;

and (ii) urges members to ensure that technical assistance is

provided to least-developed countries with a view to respond-

ing to the special problems faced by them in implementing

the Agreement on Technical Barriers to Trade (par 5.4). In

2002, the WTO Secretariat submitted a questionnaire for

a survey to assist developing country Members to identify

and prioritise their specifc needs in the TBT feld.

f

In 2000, the TBT Committee decided that tangible

ways of facilitating developing countries participation in

international standards development should be sought. The

impartiality and openness of any international standard-

ization process requires that developing countries are not

excluded de facto from the process. With respect to improv-

ing participation by developing countries, it may be ap-

propriate to use technical assistance, in line with Article 11 of

the TBT Agreement.

g

The 2001 Doha Ministerial Decision

on Implementation-related Issues and Concerns urges

the Director-General to continue his cooperative eforts with

these organizations and institutions, including with a view to

according priority to the efective participation of least-devel-

oped countries and facilitating the provision of technical and

fnancial assistance for this purpose. (par 5.3). International

standard-setting organisations such as the ISO, ITU and IEC

have launched initiatives to enhance developing country

and LDC participation.

f See WTO document G/TBT/W/178, 18 July 2002.

The compilation of responses by the WTO Secretariat is contained in

WTO document G/TBT/W/193, 10 February 2003.

g See Development Dimension of the Decision of the Committee on Principles

for the Development of International Standards, Guides and Recommendations

with relation to Articles 2, 5 and Annex 3 of the Agreement, Annex 4 of

WTO document G/TBT/9, 13 November 2000.

7

Bangladesh has also faced TBT measures with regard

to export of shrimps to the United States due to lack

of compliance with the use of Turtle Excluder Devices

(TED) in open water fshing.

Government action. In the event of a non-compliance

issue, the Government of Bangladesh takes up the dis-

pute with the importing country to resolve the dispute

through mutual discussion and also by taking corrective

measures.

Identication of technical assistance needs

5

In 2002, Bangladesh responded to a survey by the WTO

Secretariat which aimed at assisting developing country

Members to identify and prioritise their technical as-

sistance needs.

6

Te country prioritised the following

TBT-related technical assistance, technical cooperation

and capacity building needs:

y Technical Mission by the WTO for raising aware-

ness about the TBT and providing training to con-

cerned ofcials with a view to enabling them to fulfl

the requirement of the TBT Agreement;

y Technical and fnancial assistance to upgrade the

Bangladesh Standards and Testing Institution (BSTI);

y Financial assistance to participate in international

standard-setting activities as well as in annual and

triennial reviews of the TBT Agreement;

y Technical assistance regarding access to systems for

conformity assessment operated by the developed

countries.

Technical assistance

Bangladesh has benefted from the technical and fnan-

cial support of the EU, the United Nations Industrial

Development Organization (UNIDO), and Japan Debt

Cancellation Fund (JDCF). Projects funded and imple-

mented included the following: Quality Management

System and Conformity Assessment Activity for

Bangladesh Quality Support Programme (Post MFA),

Market access and trade facilitation support for South

5 See WTO document G/TBT/W/178, Questionnaire for a

survey to assist developing country Members to identify and

prioritise their specifc needs in the TBT-feld,18 July 2002.

The compilation of responses by the WTO Secretariat is

contained in WTO document G/TBT/W/193, 10 February 2003.

6 The submission of Bangladesh is contained in WTO

document JOB(02)/99/Add.37, 2 October 2002.

Asian least-developed countries, through strengthening

institutional and national capacities related to standards,

metrology, testing and quality, Modernization of BSTI

through procurement of sophisticated equipment & infra-

structure, Development of Laboratories for accreditation.

Use of Article 12.8 TBT

Bangladesh did not make use of Article 12.8 TBT.

Additional comments

It was suggested that the country would be better pre-

pared to make use of the relevant SDT provisions, if

a particular institution, such as the Bangladesh Tarif

Commission (BTC), was entrusted with the responsi-

bility to regularly monitor the notifcations, and assess

human resource capacity and steps to be taken in view

of this. In this case, possible modalities could be to

strengthen and build up capacity of an appropriately

tasked and mandated institution to properly deal with

TBT-related issues.

E. Agreement on Trade-Related Investment

Measures (TRIMs)

LDCs were granted a seven-year transitional pe-

riod to phase out measures inconsistent with the TRIMs

Agreement, if they were notifed 90 days after the date

of the acceptance of the WTO Agreement (Article 5.1 and

Article 5.2).

h

The transition period could be extended, if an

LDC experienced particular difculties to bring these mea-

sures in conformity with the TRIMs Agreement (Article 5.3).

The 2001 Doha Ministerial Decision on Implementation-

related Issues and Concerns, urges the Council for Trade

in Goods to consider positively requests that may be made

by least-developed countries under Article 5.3 of the TRIMs

Agreement or Article IX.3 of the WTO Agreement, as well as to

take into consideration the particular circumstances of least-

developed countries when setting the terms and conditions

including time-frames (par. 6.2).

Annex F of the Hong Kong Ministerial Declaration

i

in-

troduced three SDT provisions which will expire by 2020:

First, LDCs were allowed to maintain TRIMs-inconsistent

measures for a (new) period of seven years, if notifed by

18 January 2008. Second, this transition period may be

8

Country response

Notication of TRIMs inconsistent with the

TRIMs Agreement

Bangladesh has never notifed the WTO of any TRIMs

inconsistent with the TRIMs Agreement.

Introduction of TRIMs inconsistent with the

TRIMs Agreement

Bangladesh did not introduce any new measure deviat-

ing from the obligations of the TRIMs Agreement.

F. Agreement on Implementation of Article VII

of the GATT 1994 (Customs Valuation)

Country response

Resort to SDT provisions

7

Bangladesh delayed the implementation of the Agreement

on Customs Valuation for fve years (Article 20.1)

since it was not party to the Tokyo Round Customs

Valuation Code, without notifying the WTO. Te

country did not request an extension of the fve-year

delay period (Annex III, paragraph 1).

Te country also delayed the application of the

computed value method (Article 20.2). Furthermore,

the country made reservations concerning: minimum

values (Annex III, paragraph 2), reversal of sequential

order of Articles 5 and 6 (Annex III, paragraph 3), and

application of Article 5.2 whether or not the importer so

requests (Annex III, paragraph 4).

8

7 See WTO document G/VAL/W/77/Rev.1, 15 October 2009,

p. 4-6, for an overview.

8 Bangladesh indicated in the survey that it made a reservation

concerning minimum values (Annex III, paragraph 2).

According to WTO document G/VAL/W/77/Rev.1 (see

previous footnote), Bangladesh has ofcially not resorted to

Annex III, paragraph 2.

The Agreement on Customs Valuation permitted devel-

oping country Members not party to the Tokyo Round

Customs Valuation Code to delay application of the provi-

sions of this Agreement an initial transitional period of fve

years (Article 20.1), which could be extended if requested

and justifed (Annex III.1).

Pursuant to Article 20.2, developing country Members

could delay application of the computed value method

for a period not exceeding three years following their

application of all other provisions of this Agreement.

Annex III.2 allowed developing countries which valued

goods on the basis of ofcially established minimum values

[...] to make a reservation to enable them to retain such values

extended by the Council for Trade in Goods under the

existing procedures set out in the TRIMs Agreement,

taking into account the individual fnancial, trade, and de-

velopment needs of the Member in question. Third, LDCs

were given the right to introduce new TRIMs-inconsistent

measures for fve years, if notifed within six months after

their adoption.

h Governments that accepted the WTO Agreement after 1 January 1995 had a

period of 90 days after the date of their acceptance of the WTO Agreement to make

the notications foreseen in Article 5.1, with the period for the elimination of TRIMs

notied under Article 5.1 being governed by reference to the date of entry into force

of the WTO Agreement itself (i.e. 1 January 1995). See WTO document WT/L/64,

10 April 1995 and G/L/860, 29 October 2008.

i www.wto.org/english/thewto_e/minist_e/min05_e/nal_annex_e.htm#annexf

on a limited and transitional basis under such terms and con-

ditions as may be agreed to by the Members.

Annex III.3 allowed developing countries to make a res-

ervation concerning the sequential order of Articles 5 and 6.

Members who made a reservation under Article III.4 are

allowed to use the prices applicable in the importing coun-

tries, whether or not the importer agrees to it.

These two provisions are permanent exceptions

if Members consented to the reservation, in contrast

with the special provisions under Articles 20.1 and 20.2,

Annex III.1 and Annex III.2.

j

The 2001 Doha Ministerial Decision on Implementation-

related Issues and Concerns urges the Council for Trade

in Goods to give positive consideration to requests that

may be made by least-developed country members under

paragraphs 1 and 2 of Annex III of the Customs Valuation

Agreement or under Article IX.3 of the WTO Agreement, as well

as to take into consideration the particular circumstances of

least-developed countries when setting the terms and condi-

tions including time-frames.

j As of 2009, there is no single Member to have beneted from these provisions.

9

Article 3:5 (j) of the Agreement on Import Licensing

Procedures provides that in allocating non-automatic

licences, consideration shall also be given to ensuring a

reasonable distribution of licences to new importers. [] In

this regard, special consideration should be given to those im-

porters importing products originating in developing country

Members and, in particular, the least-developed country

Members.

G. Agreement on Import Licensing Procedures

Country response

Participation in the Committee on Import Licensing

Representatives of Bangladesh have not attended the

regular meetings of the Committee on Import Licensing.

Further, the country has not brought any issues regarding

the application of import licenses by another Member to

the attention of the Committee on Import Licensing.

H. Agreement on Subsidies and

Countervailing Measures (ASCM)

Country response

Export subsidies

Export subsidies are provided for 13 items, including

local yarn (5%), bicycles (15%), shrimps (12.5%), light

engineering products (10%), leather products (17.5%),

ship-building (5%) and jute products (7.5%).

Te exports benefting from such subsidies have

not been subject to countervailing measures. Further,

Bangladesh indicated that none of the products receiv-

ing export subsidies achieved export competitiveness

within the meaning of Article 27.6 of the Agreement.

I. General Agreement on Trade

in Services (GATS)

According to Annex VII to the Agreement on Subsidies

and Countervailing Measures, LDCs are not subject to the

prohibition on export subsidies as set out in Article 3.1(a) of

that Agreement (Article 27.2(a)). However, their subsidized

exports are potentially liable for countervailing duties (if the

subsidies exceed the de minimis requirements, Article 27.10).

An LDC loses its exemption on export subsidies for

a product in which it has reached export competitive-

ness, a share of at least 3.25 per cent in world trade for

that product for two consecutive calendar years. Legally,

export competitiveness only exists if the LDC notifes the

WTO or if the WTO Secretariat performs the calculation on

request of another Member (Article 27.6).

LDCs can beneft from a phase-out period of eight

years after reaching export competitiveness (Article 27.5).

In the 2001 Doha Ministerial Decision on Implementation-

related Issues and Concerns, it was decided that the eight-

year period in Article 27.5 within which a least-developed

country Member must phase out its export subsidies in respect

of a product in which it is export-competitive begins from the

date export competitiveness exists within the meaning of

Article 27.6.

The GATS provides that special priority shall be given to the

least-developed country Members in the implementation of

Article IV:1 and IV.2. (Article IV:3).

Article IV:1 states that the increasing participation of de-

veloping country Members in world trade shall be facilitated

through negotiated specifc commitments [...] relating to:

(a) the strengthening of their domestic services capacity and

its efciency and competitiveness, inter alia through access

to technology on a commercial basis; (b) the improvement

of their access to distribution channels and information net-

works; and (c) the liberalization of market access in sectors

and modes of supply of export interest to them.

In 2003, Members decided to develop appropriate

mechanisms with a view to achieving full implementation of

Article IV:3 of the GATS and facilitating efective access of LDCs

services and service suppliers to foreign markets. Members

also decided that targeted and coordinated technical assis-

tance and capacity building programmes shall continue to be

provided to LDCs in order to strengthen their domestic services

capacity, build institutional and human capacity, and enable

them to undertake appropriate regulatory reforms.

k

Telecommunications

In the GATS Annex on Telecommunications,

l

paragraph 6(d),

it is agreed that Members shall give special consideration to

opportunities for the least-developed countries to encourage

foreign suppliers of telecommunications services to assist in the

transfer of technology, training and other activities that support

the development of their telecommunications infrastructure

and expansion of their telecommunications services trade.

k See WTO document TN/S/13, 5 September 2003, Modalities for the special treat-

ment for Least-Developed Country Members in the negotiations on trade in services.

l http://www.wto.org/english/tratop_e/serv_e/12-tel_e.htm.

10

Country response

Extension of transition period

A request for further extension of the transition period

will perhaps be made in the future as the deadline looms.

Information on technical assistance needs to the WTO

Pursuant to paragraph 2 of the Decision of the Council

for TRIPS on the Extension of the transition period

under article 66.1 of the TRIPS Agreement for least-

developed country Members, Bangladesh provided in-

formation on its individual priority needs for technical

and fnancial cooperation.

9

9 WTO document IP/C/W/546, 23 March 2010.

Country response

Priority service sectors in national development policies

Bangladesh reported that no service sector has been pri-

oritized in its national development policies.

Technical assistance

Te country has not carried out any national assessment

of trade in services. In the last 5 years, Bangladesh did

not receive support from trading partners to increase its

participation in world services trade.

Technical assistance in telecommunications services

Since 1995, a number of telecommunication companies

providing mobile telephone services have been operating

in Bangladesh. In order to raise the efciency of their em-

ployees and provide quality service, they have provided

training programmes on a commercial basis. Tese pro-

grammes, along with telecom business operations run

in the country, have facilitated technology transfer. Te

programmes were not undertaken to meet any specifc

commitment under the WTO, but were part of normal

business practice, to cater for the human resources needs

of multinational companies.

J. Agreement on Trade-Related Aspects of

Intellectual Property Rights (TRIPS)

LDCs were not required to implement the pro-

visions of the TRIPS Agreement, other than

Articles 3, 4 and 5, for a period of 10 years from

1 January 1996 (Articles 65.1 and 66.1). An extension of the

transition period (par. 1) was granted for LCD members for

another 7.5 years, until 1 July 2013.

m

In addition, LDCs were

not obliged to provide or enforce patents or exclusive

marketing rights on pharmaceutical products until

1 January 2016.

n

Article 67 stipulates that developed country Members

shall provide, on request and on mutually agreed terms and

conditions, technical and fnancial cooperation in favour of de-

veloping and least-developed country Members. According

to paragraph 2 of the Decision on the Extension of the

Transition Period under Article 66.1 for LDCs, all the LDC

Members will provide to the Council for TRIPS as much in-

formation as possible on their individual priority needs for

technical and fnancial cooperation in order to get proper

assistance to implement the TRIPS Agreement, preferably

by 1 January 2008. Developed country Members were re-

quested to furnish technical and fnancial cooperation in

favour of LDCs in order to efectively address these needs.

Under Article 66.2 of the TRIPS Agreement, developed

country Members shall provide incentives to enterprises and

institutions in their territories for the purpose of promoting

and encouraging technology transfer to least-developed

country Members in order to enable them to create a sound

and viable technological base. A mechanism for ensuring

the monitoring and full implementation of the obligations

under Article 66.2 was established by the TRIPS Council.

o

Paragraph 6 of the Doha Ministerial Declaration on the

TRIPS Agreement and Public Health

p

recognized that

WTO Members with insufcient or no manufacturing ca-

pacities in the pharmaceutical sector could face difculties in

making efective use of compulsory licensing under the TRIPS

Agreement. A waiver of obligations under Article 31(f)

of the TRIPS Agreement permits such countries to issue

compulsory licences to suppliers in exporting countries

under specifc conditions. It is assumed that LDCs have

insufcient or no manufacturing capacities. Subsequently,

on 6 December 2005, a Protocol amending the TRIPS

Agreement from giving this provision a permanent legal

status was submitted for signature by Members.

q

m See WTO document IP/C/40, 30 November 2005.

n See WTO document IP/C/25, 1 July 2002.

See WTO document WT/L/478, 12 July 2002.

o See WTO document IP/C/28, 28 February 2003, Implementation of Article 66.2

of the TRIPS Agreement.

p See WTO document WT/MIN(01)/DEC/2, 20 November 2001.

q See WTO document WT/L/641, 8 December 2005.

11

Technical cooperation

Te country has received technical cooperation from

developed country Members to assist in the implemen-

tation of the TRIPS Agreement. Te European Union

has supported a project in the Department of Patents,

Designs and Trademarks, with the objective to intro-

duce new laws or modify existing laws in the area of

patent designing, trademarks and geographical indica-

tions. Te project also stipulated the training of police,

customs ofcials, lawyers and judges in areas of TRIPS

compliance.

Use of the Paragraph 6 System

10

Te country has accepted the Protocol Amending the

TRIPS Agreement on 15 March 2011. Bangladesh has

not yet imported pharmaceutical products produced

under compulsory license.

New patents on pharmaceutical products

Although Bangladesh as an LDC is exempted from TRIPS

obligations for pharmaceutical products until 2016,

patents for pharmaceutical products had been granted

under Patents and Designs Act No. 11, 1911 until 2006.

According to available information, Bangladesh has

recently discontinued the practice to grant patent on

pharmaceutical products.

K. Dispute Settlement

10 http://www.wto.org/english/tratop_e/trips_e/amendment_e.htm

Country response

Participation in WTO dispute settlement

Bangladesh has been involved in two dispute settlement

cases, as follows (see Annex Table 3).

Bangladesh has never requested the good ofces of

the Director General or the Chairman of the DSB.

L. Trade Policy Reviews

Country response

Bangladesh underwent two Trade Policy Reviews since

the establishment of the WTO, respectively in 2000 and

2006. Its frst Trade Policy Review (under GATT) was

carried out in 1992.

Technical assistance from the WTO Secretariat

Bangladesh took appropriate preparations for the trade

policy reviews of 2000 and 2006 without having re-

quested technical assistance from the WTO.

Article 24 of the Dispute Settlement Understanding

sets out Special Procedures Involving Least-Developed

Country Members under which particular consideration

shall be given to the special situation of LDCs. At all stages

of the determination of the causes of a dispute and of dis-

pute settlement procedures, Members shall exercise due

restraint both in raising matters involving LDCs, and in ask-

ing for compensation or seeking authorization to suspend

concessions or other applicable obligations.

In dispute settlement cases involving an LDC, the

Director-General or the Chairman of the DSB shall, upon

request by a LDC ofer their good ofces, conciliation and me-

diation with a view to assisting the parties to settle the dispute,

before a request for a panel is made.

The Trade Policy Review Mechanism (TPRM) provides

that smaller trading countries will be reviewed every six

years, except that a longer interval may be fxed for LDCs.

Particular account shall be taken of difculties presented

to LDCs in compiling their reports. The Secretariat shall

make available technical assistance on request to devel-

oping country Members, and in particular to the least

developed country Members.

Trade Policy Review URL

2000

www.wto.org/english/tratop_e/tpr_e/tp132_e.htm

2006

www.wto.org/english/tratop_e/tpr_e/tp269_e.htm

12

Country response

Bangladesh has not yet submitted any proposal for

support under the Aid for Trade initiative. However,

eforts have been initiated to identify possible areas and

projects, through the DTIS process,

11

to be subsequently

submitted for support under Aid for Trade.

N. General recommendations to improve

eectiveness of WTO Special Support

Measures

In many LDCs, there is a lack of capacity to (a) absorb

the technical notifcations from the WTO, (b) assess

their implications on ofensive as well as defensive inter-

ests, (c) take follow-up actions to safeguard the countrys

ofensive and defensive interests, and (d) design propos-

als for concrete technical, advisory, and fnancial capac-

ity building support from the WTO or developmental

partners. In this regard, there is a need for (a) setting up

WTO focal points in key ministries, (b) greater inter-

ministerial coordination, and (c) building up greater

capacity to (i) articulate and (ii) prepare projects for sup-

port, in various agencies and ministries. Enhancing the

capacity of Chambers of Commerce in WTO-related

matters is also important.

11 A diagnostic trade integration study (DTIS) evaluates internal

and external constraints on a countrys integration into the

world economy. It is the frst step for funding under the

Enhanced Integrated Framework (EIF).

M. Enhanced Integrated Framework (EIF)

Bangladesh country profle is posted on the EIF website.

LDCs have highlighted the importance of their own contri-

bution to reducing their supply-side constraints. One of the

main components of the Enhanced Integrated Framework

(EIF) process includes the preparation of a Diagnostic Trade

Integration Study (DTIS) to recognize constraints to trad-

ers, distinguish sectors of greatest export potential, and

identify an action matrix, a plan of action that would allow

a better integration of LDCs into the international trading

system. This would enable LDCs to formulate trade-related

projects and to access Aid for Trade.

Aid for Trade is development assistance targeted at

helping developing countries to take advantage of trade

opportunities. In December 2005, the Sixth Ministerial

Conference in Hong Kong created a new WTO work

programme on Aid for Trade. Ministers directed the WTO

to coordinate its eforts with donors and relevant agencies

to signifcantly increase aid for trade-related technical assis-

tance and capacity building (Annex F of the Hong Kong

Ministerial Declaration).

r

r See Aid for Trade.

13

SECTION II.

SPECIAL SUPPORT MEASURES RELATED TO

PREFERENTIAL MARKET ACCESS

A. Non-reciprocal preference arrangements

of developed countries

Country response

Eligibility and product coverage

Bangladesh is eligible for all Generalised Systems of

Preferences (GSP) schemes maintained by developed

countries. In FY 2009-10, the top three export destina-

tions were the European Union (50.7%), the United States

(24.4%) and Canada (4.1%). Te Everything But Arms

(EBA) scheme of the EU and GSP schemes of a number

of other developed countries such as Canada, Australia,

and Japan cover most traded items of Bangladesh.

A major exception is the US GSP. Although the US

GSP scheme covers more than 85% of items exported

by LDCs, the scheme does not cover apparels, which are

Bangladeshs major products exported to the US. About

5% of Bangladeshs exports to the US market were Most

Favored Nation (MFN) zero-duty exports, whilst the

GSP scheme covered only about 2% of exports.

Main impediments to fully utilizing preferences

Bangladesh has listed the following constraints to fully

utilize preferences, ranked in descending importance,

ranging from the highest to the lowest inhibiting factors:

For non-tarif measures, please refer to Section I.C

on the SPS Agreement and Section I.D on the TBT

Agreement.

1. Rules of origin

Rules of origins present a signifcant impediment to the

full utilization of LDC preferences. Bangladeshs major

item of export is apparel. Bangladeshi apparel frms in

the woven-Ready Made Garment (RMG) segment have

to import a signifcant quantity of fabrics and are there-

fore unable to fully utilize preferences in woven apparel

due to two-stage transformation requirements.

For other products, rules of origin present a less sig-

nifcant barrier. Bangladesh could utilize preferences

in export of knitwear and shrimps to the EU market.

Also, among the countries which have been providing

duty free access to LDCs, Canada has the most gener-

ous rules of origin requirements; Bangladesh could take

advantage of these preferences.

Over the last 5 years, the country has not received

technical assistance regarding compliance with rules

of origin and related documentary requirements, either

through bilateral or multilateral programmes. However,

the EU has recently undertaken a project for introduc-

ing a GSP certifcation system in Bangladesh which

will improve Bangladeshs administrative capacity with

Non-reciprocal market access preferences entitle export-

ers from LDCs to pay lower tarifs or to have duty- and

quota-free access to third country markets. Many of these

trade preferences are granted under the Generalized

System of Preferences (GSP).

Developed Members, and developing country

Members declaring themselves in a position to do so,

agreed to provide duty-free and quota-free market access

on a lasting basis, for all products originating from all LDCs by

2008 or no later than the start of the implementation period

in a manner that ensures stability, security and predictability.

Members who face difculties to provide duty-free and

quota-free (DFQF) market access immediately commit

themselves to provide duty-free and quota-free market ac-

cess for at least 97 per cent of products originating from LDCs,

defned at the tarif line level, by 2008 or no later than the start

of the implementation period (Annex F of the 2005 Hong

Kong Ministerial Declaration).

Although LDCs may be granted duty-free treatment

for all or most of their exports to some of their trading

partners, these preferences are far from being fully uti-

lized, and many exports eligible for preferential treatment

do not actually receive it, and are eventually submitted to

duties.

1 Rules of origin

2 Supply-side problems

3 Non-tarif measures

4 Lack of awareness of eligibility to preferential treatment

5 Lack of awareness of preferences

6 Low preferential margins

14

regard to rules of origin.

2. Supply-side constraints

Bangladesh mentioned the following major supply con-

straints to the countrys exports:

3. Low-preference margins

Bangladeshs major export products are woven and knit

garments, shrimps, leather and leather products, jute

and jute products, and fertilizers, all of which constitute

about 95% of its global exports. Among those, woven

and knit garments are covered by GSP schemes of some

developed countries, but not by the US GSP scheme.

Woven and knit garments are subject to high duties

in all countries, an average MFN duty of 15%, and

tarif peaks pose formidable challenge to Bangladeshi

exporters.

Te following major export products have low-

preference margins:

4. Security of access

Te country considered that the lack of security of pref-

erential access acted as a deterrent to export-oriented

investment. A good example of that was the petition

fled by a sleeping bag manufacturer in the United States

requiring the withdrawal of GSP facilities on sleeping

bags. Te Government of Bangladesh as well as other

Bangladeshi stakeholders sent their written submissions

on the petition when the Ofce of United States Trade

Representative (USTR) initiated the review. Te request

was eventually denied by the USTR.

Duty-free and quota-free (DFQF) access granted

within the framework of the WTO seems to be more

predictable and secure. Te WTO DFQF market access

initiative stipulates DFQF treatment to all LDC items,

on a lasting basis. Other related provisions of the WTO

(on rules of origin) also mention LDC-friendly rules of

origin. Terefore, a universal and comprehensive DFQF

treatment, as stipulated in the Hong Kong Ministerial

Declaration, is a preferred option.

B. Non-reciprocal preference arrangements

of developing countries

Supply-side constraints

inhibiting exports

Products aected

Physical infrastructure All sectors

Human resources All sectors, particularly those

requiring skilled workers

High cost of capital All sectors

Capacity constraints in complying

with SPS and TBT standards of

importing countries

All sectors

Border infrastructure All sectors

Importing

market

Product Duty

United States Shrimps, jute and jute

products, fertilizers

MFN duty-free

European Union Jute and jute products,

leather, fertilizers

MFN duty-free

or low-duty

Canada Shrimps, fertilizers, leather,

jute and jute products

(excluding jute bags)

MFN duty-free

Japan Jute and jute products

(excluding jute fabrics)

MFN duty-free

Japan Shrimps Very low-duty

(lower than 5%)

Under Annex F of the Hong Kong Ministerial Declaration,

developing countries declaring themselves in a position

to do so, agreed to follow suit in providing duty-free and

quota-free (DFQF) treatment to LDC products.

s

The Global System of Trade Preferences among

Developing Countries (GSTP) is a preferential trade

agreement signed on 13 April 1988, aiming at increasing

trade between developing countries in the framework of

UNCTAD. Pursuant to Article 17.3 of the GSTP Agreement,

LDCs shall not be required to make concessions on a recip-

rocal basis, and such participating least-developed country

shall beneft from the extension of all tarif, para-tarif and

non-tarif concessions exchanged in the bilateral/plurilateral

negotiations which are multilateralized.

t

s Members who face diculties to provide DFQF market access immediately

commit themselves to provide duty-free and quota-free market access for at least

97 per cent of products originating from LDCs, dened at the tari line level, by

2008 or no later than the start of the implementation period

(Annex F of the 2005 Hong Kong Ministerial Declaration).

t http://www.unctadxi.org/gstp

15

Country response

Eligibility and product coverage

Bangladesh indicated eligibility for the preference

schemes of the following countries:

y Republic of Korea, with Rules of Origin requirement

of 50% value addition;

y China, with Rules of Origin requirement of 40%

value addition or Change of Tarif Heading (CTH);

y India, with Rules of Origin requirement of 30%

value addition, plus CTH (DFQF within fve years);

y Brazil has granted Bangladesh DFQF access cover-

ing 80% of all tarif lines, to be increased to 100%

by 2012 under the WTO DFQF treatment.

Major product exclusions reported by Bangladesh are

listed in Annex Table 4.

Main impediments to fully utilizing preferences

Te main impediments to utilizing preferences in

schemes made available by developing countries primar-

ily relate to product coverage and rules of origin:

y For Bangladesh, the Duty Free and Tarif Preference

scheme (DFTP) ofered by India in 2008 is less

attractive than tarif concessions granted by India

under the South Asian Free Trade Agreement

(SAFTA), both in terms of coverage and extension

of tarif concessions. While all products covered un-

der DFTP Scheme are duty-free since January 2008

under the SAFTA, these are yet to be made duty-free

under the DFTP scheme.

y Te Republic of Korea introduced the duty-free

scheme for LDCs on 1 January 2008 and product

coverage was further extended frst in January 2009,

then in January 2010. Te coverage of the duty-free

scheme accorded by the Republic of Korea to its

imports from Bangladesh is not signifcant. Rules

of origin require 50% value addition. Terefore, it

will not be easy for Bangladesh to beneft from this

particular scheme.

y Te duty-free scheme granted by China has come

into efect only on 1 July 2010. Terefore, it is too

early to make an assessment of its efectiveness.

Generalized System of Trade Preferences (GSTP)

Bangladesh enjoys tarif preferences granted for LDCs

under the Global System of Trade Preferences (GSTP).

However, Bangladesh is not participating in the on-

going third round of trade negotiations under the GSTP.

C. Reciprocal trade arrangements

Country response

Benets of Reciprocal trade agreements (RTAs)

Te government considered that being a party to recip-

rocal trade agreements has provided additional benefts

over those enjoyed from LDC status under the WTO

(see Annex Table 5).

y SAFTA: India is currently providing duty-free access

to a majority of export products from Bangladesh

under the South Asian Free Trade Agreement

(SAFTA), which do not beneft from such a treat-

ment under Indias DFTP scheme for LDCs.

y APTA: Te global initiative of the Republic of Korea

has been so far less lucrative than the preferences

Every LDC WTO Member is a party to at least one Free

Trade Agreement (FTA), customs union or limited prefer-

ential agreement. Such agreements, when entered into

with other developing countries, often provide LDCs with

preferential access to markets that they would otherwise

not receive.

In FTAs with developed countries, which are commit-

ted to grant DFQF treatment, additional benefts can be

provided by improvements in rules of origin or greater

access to fnancial and technical assistance to overcome

Non-Tarif Measures (NTMs) such as SPS. On the other hand,

membership in these Agreements may require LDCs to

make reciprocal concessions which they are not required

to make in the WTO or even accept more stringent disci-

plines on other trade issues (so-called WTO plus). LDCs

could also face higher duties than their competitors when

they do not sign FTAs with major export markets.

u

u See Strengthening International Support Measures for the Least Developed

Countries, Policy Note, Committee for Development Policy, p. 9.

16

granted under the Asia Pacifc Trade Agreement

(APTA), as APTA covers many items of export in-

terest to Bangladesh.

y BIMSTEC: Bangladesh also receives additional

market access under the BIMSTEC-FTA from

Tailand. BIMSTEC stands for Bay of Bengal

Initiative for Multi-Sectoral Technical and Economic

Cooperation.

12

Important export products from Bangladesh face

higher tarifs than those of competitors in main markets

due to FTAs, customs unions or other limited preferen-

tial schemes.

D. Recommendations to improve

international support measures related to

preferential market access

Te following suggestions were provided:

y Product coverage of DFQF. In order to improve

preferential market access, coverage of such access

should be widened by extending DFQF market

access to all products from all LDCs, on a lasting,

secured and predictable basis, in line with the Hong

Kong Ministerial Decision of the WTO.

12 http://www.bimstec.org/about_bimstec.html

y Rules of origin. Rules of origin should be formulated

in such a way so that countries eligible for preferen-

tial treatment can efectively take advantage of such

preferences.

y Supply-side constraints and export diversifcation.

One of the major concerns relate to supply-side con-

straints. Greater international support in building

supply-side capacities towards export diversifcation

is key to realising the potential benefts of preferential

market access. Besides, initiatives towards encourag-

ing Foreign Direct Investment (FDI) in LDCs from

developed and developing countries (through addi-

tional incentives for these countries), more energetic

support for capacity-building in SPS-TBT areas, and

technology transfer could enable LDCs to improve

their supply-side capacities. Te WTO Agreement

on Trade Facilitation also stipulates that necessary

support will be accorded to LDCs in identifed areas

of capacity needs. Te support envisaged under the

Aid for Trade initiative should also be expedited and

enhanced.

17

ANNEX

Table 1: Food aid and project aid in agriculture received by Bangladesh after 1995

US$ million

Period (FY = fnancial year) Food aid Project aid in agriculture Total

FY 1990/91 FY 1994/95 882.1 363.5 1 245.6

FY 1995/96 FY1999/00 304.1 651.1 955.2

FY 2000/01 FY 2004/05 198.6 278.1 476.7

Source: Bangladesh Ministry of Finance, External Relations Division

Table 2: Non-compliance with SPS measures of importing Members

Export product Importing partner Grounds for rejection

Shrimps European Union Import ban after EU inspections of Bangladeshs seafood processing plants which

found serious defciencies in infrastructure and hygiene conditions in processing

establishments and lax quality control by Bangladesh government inspectors

Hilsa fsh India Mandatory testing requirement of each and every consignment of all processed

food and sanitary permit requirement for import of hilsa fsh

Table 3: Bangladesh, participation in WTO dispute settlement

Case number Case name Capacity Initiation date

DS243 United States of America Rules of Origin for

Textiles and Apparel Products

third party 11 January 2002

DS306 India Anti-Dumping Measure on Batteries from

Bangladesh

complainant 28 January 2004

Table 4: Bangladesh major product exclusions

US$ million

Importing country Product excluded Value of exports

Value of exports as percentage of

total exports to country concerned

Republic of Korea Shrimps, leather, petroleum by-products 84.7 69.5

China No major export items 11.0 8.3

India Betel nuts, garments 22.7 8.0

Brazil Information not available

Table 5: Bangladesh Benets of RTAs

Beneft(s)

South Asian Free Trade Agreement

(SAFTA)

Asia Pacifc Trade Agreement

(APTA)

Greater security of access X X

Preferential treatment that would not otherwise be

available X X

Wider product coverage X

More fexible rules of origin X X

Provisions for dealing more efectively with NTMs

Additional technical and fnancial assistance X X

Potrebbero piacerti anche

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Report On Loan Disbursement and Recovery Status of Krishi BankDocumento66 pagineReport On Loan Disbursement and Recovery Status of Krishi BankAnendya Chakma100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Planning CommissionDocumento6 paginePlanning CommissionAnendya ChakmaNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Letter of Transmittal: Sincerely YoursDocumento2 pagineLetter of Transmittal: Sincerely YoursAnendya ChakmaNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Letter of Transmittal: Md. Nahin HossainDocumento2 pagineLetter of Transmittal: Md. Nahin HossainAnendya ChakmaNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- 20 480Documento8 pagine20 480Anendya ChakmaNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Engineering EthicsDocumento25 pagineEngineering EthicsAnendya ChakmaNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Introduction To Geotechnical Engineering: GroundDocumento23 pagineIntroduction To Geotechnical Engineering: GroundAnendya ChakmaNessuna valutazione finora

- Huram Resource ManagementDocumento21 pagineHuram Resource ManagementAnendya ChakmaNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- What Is Auditing ?Documento6 pagineWhat Is Auditing ?Anendya ChakmaNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Societal Influences: European Common MarketDocumento2 pagineSocietal Influences: European Common MarketAnendya ChakmaNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- A Report OnDocumento24 pagineA Report OnAnendya ChakmaNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- 20 480Documento8 pagine20 480Anendya ChakmaNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Management and Organizational Processes: An Underlying Rhetorical ModelDocumento19 pagineManagement and Organizational Processes: An Underlying Rhetorical ModelAnendya ChakmaNessuna valutazione finora

- Ratio ExplainDocumento4 pagineRatio ExplainAnendya ChakmaNessuna valutazione finora

- Forecasting of Wheat Production in Bangladesh: Ezaul Arim, Bdul WAL AND KterDocumento12 pagineForecasting of Wheat Production in Bangladesh: Ezaul Arim, Bdul WAL AND KterAnendya ChakmaNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Assignment No:: Prepared OnDocumento1 paginaAssignment No:: Prepared OnAnendya ChakmaNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Profiting With Ichimoku CloudsDocumento46 pagineProfiting With Ichimoku Cloudsram100% (2)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Short Note On LIC and Insurance SectorDocumento37 pagineShort Note On LIC and Insurance Sectorappliedjobz50% (2)

- ADVENT'19 Encipher: Case It To Ace It: The Commerce Society - Kirori Mal CollegeDocumento3 pagineADVENT'19 Encipher: Case It To Ace It: The Commerce Society - Kirori Mal CollegeParth ChawlaNessuna valutazione finora

- Welcome To Indian Railway Passenger Reservation EnquiryDocumento2 pagineWelcome To Indian Railway Passenger Reservation EnquiryChhaviNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The IMF Classification of Exchange Rate Regimes: Hard PegsDocumento4 pagineThe IMF Classification of Exchange Rate Regimes: Hard PegsAnmol GrewalNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- Contract & Accounts (CE6G) - TenderDocumento24 pagineContract & Accounts (CE6G) - TenderRamaiz DarNessuna valutazione finora

- Guide To Top 50 Consulting Firms (2006)Documento903 pagineGuide To Top 50 Consulting Firms (2006)Interrobang90Nessuna valutazione finora

- On The Legacy of TATA in IndiaDocumento18 pagineOn The Legacy of TATA in IndiaanupojhaNessuna valutazione finora

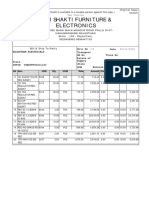

- Shri Shakti Furniture & Electronics: Credit OrginalDocumento1 paginaShri Shakti Furniture & Electronics: Credit OrginalRahul BansalNessuna valutazione finora

- Special Power of AttorneyDocumento2 pagineSpecial Power of AttorneyjustineNessuna valutazione finora

- Paper One Exam Practice Questions - Tragakes 1Documento12 paginePaper One Exam Practice Questions - Tragakes 1api-260512563100% (1)

- Isb540 - HiwalahDocumento16 pagineIsb540 - HiwalahMahyuddin Khalid100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Sale Deed EnglishDocumento4 pagineSale Deed Englishnavneet0% (1)