Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chapter 4 Quiz

Caricato da

James Stallins Jr.0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

282 visualizzazioni4 pagineIntermediate Accounting by Spiceland Chapter 4 Quiz

Copyright

© © All Rights Reserved

Formati disponibili

DOC, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoIntermediate Accounting by Spiceland Chapter 4 Quiz

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

282 visualizzazioni4 pagineChapter 4 Quiz

Caricato da

James Stallins Jr.Intermediate Accounting by Spiceland Chapter 4 Quiz

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

Chapter 4 Quiz

(See related pages)

1

Enter the letter corresponding to the response that best completes each of the following statements or questions.

Which of the following captions would more likely be found in a multiple-step income statement?

A)

Total expenses.

B)

Total revenues and gains.

C)

Gross profit.

D)

None of the above.

2

n item t!picall! included in the income from continuing operations section of the income statement is"

A)

#iscontinued operations.

B)

Extraordinar! gain.

C)

$rior period ad%ustment.

D)

&estructuring costs.

3

The application of intraperiod income taxes requires that income taxes be apportioned to each of the following

items except"

A)

'ncome from continuing operations.

B)

(perating income.

C)

#iscontinued operations.

D)

Extraordinar! gains and losses.

4

)or a manufacturing compan!* each of the following items would be considered nonoperating income for income

statement purposes except"

A)

'ncome from investments.

B)

+ost of goods sold.

C)

'nterest expense.

D)

Gain on sale of investments.

5

(n ,a! -.* /0.-* the rlene +orporation adopted a plan to sell its cosmetics line of business* considered a component

of the entit!. The assets of the component were sold on (ctober .-* /0.-* for 1.*./0*000. The component generated

operating income from 2anuar! .* /0.-* through disposal of 1-00*000. 'n its income statement for the !ear ended

#ecember -.* /0.-* the compan! reported before-tax income from operations of a discontinued component of

13/0*000. What was the boo4 value of the assets of the cosmetics component?

A)

1500*000

B)

1.*6/0*000

C)

1-00*000

D)

None of the above.

6

The +ompton $ress +ompan! reported income before taxes of 1/70*000. This amount included a 170*000 extraordinar!

loss. The amount reported as income before extraordinar! items* assuming a tax rate of 608* is"

A)

1/70*000

B)

1.50*000

C)

1./0*000

D)

1.70*000

7

Which of the following material items would not be reported as an extraordinar! item?

A)

loss caused b! an unusual and infrequent hurricane.

B)

loss caused b! an unusual and infrequent volcano.

C)

loss caused b! obsolescence of inventor!.

D)

ll of the above would be reported as extraordinar! items.

8

The 9tibbe +onstruction +ompan! switched from the completed contract method to the percentage-of-completion

method of accounting for its long-term construction contracts. This is an example of"

A)

change in accounting principle.

B)

change in accounting estimate.

C)

n infrequent but not unusual item.

D)

n extraordinar! item.

9

Earnings per share should be reported for each of the following income statement captions except:

A)

'ncome from continuing operations.

B)

Extraordinar! gains and losses.

C)

(perating income.

D)

#iscontinued operations.

10

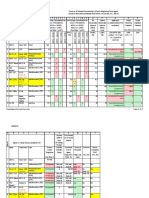

The following items appeared in the /0.- !ear-end trial balance for the :rown +offee +ompan!"

'ncome tax expense has not !et been accrued. The compan!;s income tax rate is 608. What amount should be

reported in the compan!;s !ear /0.- income statement as income before extraordinar! items?

A)

1<0*000

B)

133*000

C)

1-6*500

D)

176*000

11

9elected information from the /0.- accounting records of #unn;s uto #ealers is as follows"

'n its /0.- statement of cash flows* #unn;s should report net cash inflows from financing activities of"

A)

1/30*000

1/37*000

B)

C)

130*000

D)

1/73*000

12

=sing the information in question ..* #unn;s should report net cash outflows from investing activities of"

A)

1/>*000

B)

1-/*000

C)

1/5*000

D)

1/-*000

13

Which of the following items would not be included as a cash flow from operating activities in a statement of cash flows?

A)

+ollections from customers.

B)

'nterest on note pa!able.

C)

$urchase of equipment.

D)

$urchase of inventor!.

14

'n a statement of cash flows* 'nternational )inancial &eporting 9tandards allow companies to report interest paid as"

A)

Either an operating or investing cash flow.

B)

Either an investing or financing cash flow.

C)

n operating cash flow onl!.

D)

Either an operating or a financing cash flow.

Potrebbero piacerti anche

- Information Technology, Assoc PDFDocumento8 pagineInformation Technology, Assoc PDFJames Stallins Jr.Nessuna valutazione finora

- File System Forensics: Fat and NtfsDocumento74 pagineFile System Forensics: Fat and NtfsJames Stallins Jr.Nessuna valutazione finora

- Information Assurance PDFDocumento96 pagineInformation Assurance PDFJames Stallins Jr.Nessuna valutazione finora

- Guidetothestockmarket Doc BrownDocumento320 pagineGuidetothestockmarket Doc BrownJames Stallins Jr.Nessuna valutazione finora

- Spring 2017 IT Tutoring ScheduleDocumento1 paginaSpring 2017 IT Tutoring ScheduleJames Stallins Jr.Nessuna valutazione finora

- DOJ Digital Evidence HandlingDocumento91 pagineDOJ Digital Evidence HandlingTrus7ed100% (1)

- Electronic Evidence Handling Handbook - Uploaded by Ivneet SinghDocumento93 pagineElectronic Evidence Handling Handbook - Uploaded by Ivneet SinghivneetsinghanandNessuna valutazione finora

- Forensic Analysis PDFDocumento12 pagineForensic Analysis PDFJames Stallins Jr.Nessuna valutazione finora

- mr1 - Supplement 1-41 20190321 v5Documento106 paginemr1 - Supplement 1-41 20190321 v5James Stallins Jr.Nessuna valutazione finora

- Mr1 Offering Circular 40 0Documento274 pagineMr1 Offering Circular 40 0James Stallins Jr.Nessuna valutazione finora

- Conference Stock Course 2012 PDFDocumento351 pagineConference Stock Course 2012 PDFpaoloNessuna valutazione finora

- What To Expect With Net Asset Value (Nav) : Va Luation of Non-T Raded Reits Is ComplexDocumento5 pagineWhat To Expect With Net Asset Value (Nav) : Va Luation of Non-T Raded Reits Is ComplexJames Stallins Jr.Nessuna valutazione finora

- Mr1 Operating AgreementDocumento57 pagineMr1 Operating AgreementJames Stallins Jr.Nessuna valutazione finora

- Guidetothestockmarket Doc BrownDocumento320 pagineGuidetothestockmarket Doc BrownJames Stallins Jr.Nessuna valutazione finora

- Blueprint Income Personal Pension GuideDocumento44 pagineBlueprint Income Personal Pension GuideJames Stallins Jr.Nessuna valutazione finora

- Relativity - Processing User Guide - 9.5 PDFDocumento259 pagineRelativity - Processing User Guide - 9.5 PDFJames Stallins Jr.Nessuna valutazione finora

- Relativity - Upgrade Guide - 9.6 PDFDocumento199 pagineRelativity - Upgrade Guide - 9.6 PDFJames Stallins Jr.Nessuna valutazione finora

- 200 PMP Sample QuestionsDocumento122 pagine200 PMP Sample QuestionsKusum Bugalia100% (2)

- 2019 PMP Exam Questions - Sample PMP Exam Questions & RationalesDocumento12 pagine2019 PMP Exam Questions - Sample PMP Exam Questions & RationalesJames Stallins Jr.100% (3)

- RelativityOne - Admin Guide PDFDocumento562 pagineRelativityOne - Admin Guide PDFJames Stallins Jr.Nessuna valutazione finora

- 200 PMBOK 6th Edition Practice QuestionsDocumento86 pagine200 PMBOK 6th Edition Practice Questionsmichelle garcia80% (5)

- Relativity - Processing User Guide - 9.6 PDFDocumento280 pagineRelativity - Processing User Guide - 9.6 PDFJames Stallins Jr.Nessuna valutazione finora

- Investor Registration Agreement - ProsperDocumento14 pagineInvestor Registration Agreement - ProsperJames Stallins Jr.Nessuna valutazione finora

- 2019 FREE CAPM Questions and Answers - Assess Your Readiness!Documento33 pagine2019 FREE CAPM Questions and Answers - Assess Your Readiness!James Stallins Jr.100% (1)

- Relativity - Searching Guide - 9.6 PDFDocumento119 pagineRelativity - Searching Guide - 9.6 PDFJames Stallins Jr.Nessuna valutazione finora

- Relativity - Configuration Table Guide - 9.2Documento101 pagineRelativity - Configuration Table Guide - 9.2James Stallins Jr.Nessuna valutazione finora

- RelativityOne - Recipes PDFDocumento294 pagineRelativityOne - Recipes PDFJames Stallins Jr.100% (1)

- Relativity - User Guide - 9.6.50.31 PDFDocumento145 pagineRelativity - User Guide - 9.6.50.31 PDFJames Stallins Jr.Nessuna valutazione finora

- Relativity - Recipes - 9.2 PDFDocumento240 pagineRelativity - Recipes - 9.2 PDFJames Stallins Jr.Nessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Obligations and Contracts Bar Questions and Answers PhilippinesDocumento3 pagineObligations and Contracts Bar Questions and Answers PhilippinesPearl Aude33% (3)

- Emergency Room Delivery RecordDocumento7 pagineEmergency Room Delivery RecordMariel VillamorNessuna valutazione finora

- Advantages and Disadvantages of The DronesDocumento43 pagineAdvantages and Disadvantages of The DronesVysual ScapeNessuna valutazione finora

- SEMICONDUCTORS AssignmentDocumento8 pagineSEMICONDUCTORS AssignmentMaryam MuneebNessuna valutazione finora

- The Changing Face of War - Into The Fourth GenerationDocumento5 pagineThe Changing Face of War - Into The Fourth GenerationLuis Enrique Toledo MuñozNessuna valutazione finora

- 2002, Vol.86, Issues 4, Hospital MedicineDocumento221 pagine2002, Vol.86, Issues 4, Hospital MedicineFaisal H RanaNessuna valutazione finora

- Suband Coding in MatlabDocumento5 pagineSuband Coding in MatlabZoro Roronoa0% (1)

- Victron MultiPlus 48 1200-13-16 Datasheet enDocumento1 paginaVictron MultiPlus 48 1200-13-16 Datasheet enBAHJARI AMINENessuna valutazione finora

- DSE61xx Configuration Suite Software Manual PDFDocumento60 pagineDSE61xx Configuration Suite Software Manual PDFluisNessuna valutazione finora

- Product CycleDocumento2 pagineProduct CycleoldinaNessuna valutazione finora

- Investigatory Project Pesticide From RadishDocumento4 pagineInvestigatory Project Pesticide From Radishmax314100% (1)

- Equipment, Preparation and TerminologyDocumento4 pagineEquipment, Preparation and TerminologyHeidi SeversonNessuna valutazione finora

- Clean Agent ComparisonDocumento9 pagineClean Agent ComparisonJohn ANessuna valutazione finora

- Sieve Shaker: Instruction ManualDocumento4 pagineSieve Shaker: Instruction ManualinstrutechNessuna valutazione finora

- Human Resouse Accounting Nature and Its ApplicationsDocumento12 pagineHuman Resouse Accounting Nature and Its ApplicationsParas JainNessuna valutazione finora

- Assessing Gross Efficiency and Propelling Efficiency in Swimming Paola Zamparo Department of Neurological Sciences, Faculty of Exercise and Sport Sciences, University of Verona, Verona, ItalyDocumento4 pagineAssessing Gross Efficiency and Propelling Efficiency in Swimming Paola Zamparo Department of Neurological Sciences, Faculty of Exercise and Sport Sciences, University of Verona, Verona, ItalyVijay KumarNessuna valutazione finora

- Capacity PlanningDocumento19 pagineCapacity PlanningfarjadarshadNessuna valutazione finora

- sl2018 667 PDFDocumento8 paginesl2018 667 PDFGaurav MaithilNessuna valutazione finora

- Abinisio GDE HelpDocumento221 pagineAbinisio GDE HelpvenkatesanmuraliNessuna valutazione finora

- Application of ISO/IEC 17020:2012 For The Accreditation of Inspection BodiesDocumento14 pagineApplication of ISO/IEC 17020:2012 For The Accreditation of Inspection BodiesWilson VargasNessuna valutazione finora

- Understanding Oscilloscope BasicsDocumento29 pagineUnderstanding Oscilloscope BasicsRidima AhmedNessuna valutazione finora

- Obiafatimajane Chapter 3 Lesson 7Documento17 pagineObiafatimajane Chapter 3 Lesson 7Ayela Kim PiliNessuna valutazione finora

- Chapter 2Documento22 pagineChapter 2Okorie Chinedu PNessuna valutazione finora

- Injection Timing (5L) : InspectionDocumento2 pagineInjection Timing (5L) : InspectionaliNessuna valutazione finora

- Control SystemsDocumento269 pagineControl SystemsAntonis SiderisNessuna valutazione finora

- How To Check PC Full Specs Windows 10 in 5 Ways (Minitool News)Documento19 pagineHow To Check PC Full Specs Windows 10 in 5 Ways (Minitool News)hiwot kebedeNessuna valutazione finora

- Amar Sonar BanglaDocumento4 pagineAmar Sonar BanglaAliNessuna valutazione finora

- Deluxe Force Gauge: Instruction ManualDocumento12 pagineDeluxe Force Gauge: Instruction ManualThomas Ramirez CastilloNessuna valutazione finora

- Micropolar Fluid Flow Near The Stagnation On A Vertical Plate With Prescribed Wall Heat Flux in Presence of Magnetic FieldDocumento8 pagineMicropolar Fluid Flow Near The Stagnation On A Vertical Plate With Prescribed Wall Heat Flux in Presence of Magnetic FieldIJBSS,ISSN:2319-2968Nessuna valutazione finora

- Individual Assignment ScribdDocumento4 pagineIndividual Assignment ScribdDharna KachrooNessuna valutazione finora