Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

4

Caricato da

Felipe Andres Soto Zavala100%(1)Il 100% ha trovato utile questo documento (1 voto)

20 visualizzazioni30 pagineProf. Dr. Thomas Wrona - TUHH - isim - Internationalization Strategies - SS 2014 CONTENTS 1. Foundations of International Management 2. Strategies of international firms 3. Market entry strategies and foreign operation modes 4. Timing strategies 5. Non-market strategies 6. Internationalization processes 7. Managing HQ-subsidiary relationships 8.

Descrizione originale:

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoProf. Dr. Thomas Wrona - TUHH - isim - Internationalization Strategies - SS 2014 CONTENTS 1. Foundations of International Management 2. Strategies of international firms 3. Market entry strategies and foreign operation modes 4. Timing strategies 5. Non-market strategies 6. Internationalization processes 7. Managing HQ-subsidiary relationships 8.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

100%(1)Il 100% ha trovato utile questo documento (1 voto)

20 visualizzazioni30 pagine4

Caricato da

Felipe Andres Soto ZavalaProf. Dr. Thomas Wrona - TUHH - isim - Internationalization Strategies - SS 2014 CONTENTS 1. Foundations of International Management 2. Strategies of international firms 3. Market entry strategies and foreign operation modes 4. Timing strategies 5. Non-market strategies 6. Internationalization processes 7. Managing HQ-subsidiary relationships 8.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 30

Prof. Dr.

Thomas Wrona TUHH isim Internationalization Strategies SS 2014

CONTENTS

1. Foundations of International Management

1.1 Internationalization and International Management

1.2 What is an international firm?

1.3 Objectives of international firms

2. Strategies of international firms

2.1 Introduction

2.2 Target market strategies

2.3 Market entry strategies and foreign operation modes

2.4 Timing strategies

2.5 Allocation strategies

2.6 Non-market strategies

3. Internationalization processes

4. Managing HQ-Subsidiary relationships

91

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

MARKET ENTRY STRATEGIES AND FOREIGN OPERATION

MODES

Several possibilities to describe entries

Frequently used criterion: resource intensity

- intensity of international resource transfer

Here: different, ideal-typical market entry strategies

92

Market entry: initial entry of a market

Foreign operation modes: current operations in markets

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

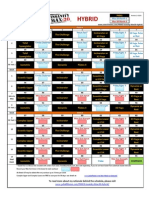

ENTRY MODES DEPENDING ON RESOURCE INTENSITY

100%

100%

Exporting

Licensing

Franchising

Wholly Owned

Subsidiary

Production

Subsidiary

Sales

Subsidiary

International

Alliances

Capital and

management

degree at

home

country

Capital and management

degree at host country

Source: adapted from Kutschker/Schmid (2004): p. 823

93

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

EXPORTING

2 types are possible:

! indirect export:

Foreign trade activities take place with partnership with local distributors

! direct export:

Foreign trade activities take place without partnership with local distributors;

There is a direct relationship between local and foreign business partners

Exporting is typically one of the first steps of internationalization

Sale of goods or services abroad

EXPORTING

94

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

INDIRECT VS. DIRECT EXPORT

Source: adapted from Welge/Holtbrgge (2006): Internationales Management, Schffer-Poeschel Verlag, Stuttgart, 2006, p. 110

95

Domestic

market

Foreign

market

Border

Indirect

export

Direct

export

Producer

Producer

Domestic

exporter

Foreign

customer

Foreign

importer

(foreign branch)

Foreign

customer

Foreign

customer

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

EXPORT - EVALUATION

Advantages

low resource commitment

low risk, especially using indirect

export with local distributors who sell

the goods at their own risk

low organizational complexity

experience of the distributor with the

local market/customer proximity

a possibility to get to know foreign

markets gradually

inexpensive form of

internationalization

high strategic flexibility

risk of trade barriers

problems with currency exchange

rates using direct export

Low acceptance in the host country,

because of no local presence of the

firm

indirect export is profit-reducing in

the long term

sales potential is not optimally used

no foreign experience and direct

customer relations / lack of loyalty

Disadvantages

96

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

ENTRY MODES DEPENDING ON RESOURCE INTENSITY

97

Source: adapted from Kutschker/Schmid (2004): p. 823

100%

100%

Exporting

Licensing

Franchising

Wholly Owned

Subsidiary

Production

Subsidiary

Sales

Subsidiary

Capital and

management

degree at

home

country

Capital and management

degree at host country

International

Alliances

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

LICENSING

Intellectual property rights licenses

Patents

Design (aesthetic pattern, e.g. fabric or models)

Trademark (Brand)

Copyrights (e.g. Word, Music, Art etc.)

Know-how licenses

Technical know-how

Commercial know-how

Granting of permission to use intellectual property rights or not

protected practical knowledge under defined conditions.

LICENSING AGREEMENT

98

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

EXAMPLES OF LICENSES OF SANOFI-AVENTIS AND GENTA

R&D license Production license Sales license

Aventis received a co-

exclusive right to use the

technology associated with

Genta for own research

purposes, to reproduce and

modify it

Aventis received the

worldwide exclusive right of

Genasense production

(Genasense is an innovative

substance for supporting tumor

therapies, currently not approved

by FDA)

Exclusive distribution right,

trademark rights & copyright

(outside of the USA) for

Aventis

Genta retains only the

approval right in case

foreign operations are

carried out by third parties

99

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

INTL LICENSING EVALUATION

Advantages

lower resource commitment

stable (regular) returns at low capital

risk

use of market know-how of the

licensee

entry strategy in case of trade

barriers

faster market entry, while there is

access to the resources of the

partner

no (very low) transport costs

lack of control

choosing a suboptimal partner !

quality and image problems

lower influence on the business

policy of the licensee

disclosure of sensitive know-hows

Disadvantages

100

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

ENTRY MODES DEPENDING ON RESOURCE INTENSITY

101

Source: adapted from Kutschker/Schmid (2004): p. 823

100%

100%

Exporting

Licensing

Franchising

Wholly Owned

Subsidiary

Production

Subsidiary

Sales

Subsidiary

Capital and

management

degree at

home

country

Capital and management

degree at host country

International

Alliances

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

Source: adapted from Holtbrgge/Welge (2010): p. 106

FRANCHISING

= a franchisor from the home country grants a so called business

format to a franchisee in a foreign country

FRANCHISING

102

Fig. 4-5

Franchising

Franchise agreement

" Business concept

(name, brand, equipment)

" Services

" Education and training

Franchisor Franchisee

Franchising fees

business format

= a time-proven procurement, sales and management concept

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

FRANCHISING

A franchisor grants a franchisee the right and obligation to sell specific

goods or services for their own account using the trade name, trade mark,

equipment and following the marketing concept of the franchisor

Franchisor has an obligation

- to train the franchisee

- to continuously inform him

- to support him at setting up his business

- to provide consulting

- to prepare advertising activities

- and he has the right to control the business activities

Franchisee has an obligation

- to make investments

- to follow the rules and instructions

- to secure the image

- to pay franchising fees (franchising fees depend on the industry and there is an

initial fee and/or continuing fees)

103

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

INTL FRANCHISING EXAMPLE

104

McDonalds

On a worldwide scale, about 70% of McDonalds restaurants are franchised. In Europe, getting a franchise

is a two-year process of screening and selection. Franchisee candidates must work at a store for two

years and undergo mandatory training. Those individuals selected pay US$ 45,000 for a 20-year contract.

Typically, start-up costs range from US$ 455,000 to US$ 768,500. An individual is expected to contribute

between US$ 100,000 and US$ 175,000 of his or her own money to start the restaurant.

In return, McDonalds gets a base royalty of 5% of sales, another approximately 8.5% of sales for rent of

the company-owned store, and an additional 3.75% of sales for the franchisees contribution to advertising.

All these percentages come from gross sales and not profit. However, despite McDonalds seemingly heavy

take, the average European store has a profit of US$ 200,000 per year. Large, high-volume stores in major

cities can even triple that sum.

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

ENTRY MODES DEPENDING ON RESOURCE INTENSITY

105

Source: adapted from Kutschker/Schmid (2004): p. 823

100%

100%

Exporting

Licensing

Franchising

Wholly Owned

Subsidiary

Production

Subsidiary

Sales

Subsidiary

Capital and

management

degree at

home

country

Capital and management

degree at host country

International

Alliances

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

INTL ALLIANCES

Formalized and long-term cooperation between at least two legally

independent firms from different countries for joint implementation of

tasks whereby the goals can be better achieved jointly

INTERNATIONAL ALLIANCES

106

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

Joint Venture

long-term business

agreement between two

or more parties in the

form of a new firm

based on equity

contribution and joint

management

Strategic Alliances

Strategic partnership of

at least two, often

however more firms in

strategic important

area like R&D or

production

Consortiums

project-oriented

cooperation between

firms

107

KINDS OF INTL ALLIANCES

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

INTL JOINT VENTURE EXAMPLE

108

General Mills & Nestl

When the CEO of General Mills decided to enter the European market, where a very tough rival, Kellogg, was

entrenched, he knew it would be very expensive to set up manufacturing facilities and a huge marketing force.

However, he knew that another food giant, Nestl, the worlds largest food company, has a famous name in

Europe, a number of manufacturing plants, and a strong distribution system. On the other hand, Nestl lacked

strong cereal brand names, something that General Mills, the no. 2 American cereal company, had. Just two

weeks after the initial discussions, General Mills and Nestl formed a joint venture: Cereal Partners Worldwide.

General Mills provided the cereal technology, brand names, and cereal marketing expertise. Nestl supplied its

name, distribution channels, and production capacity. Cereal Partners Worldwide distributes cereals everywhere

in the world except the U.S. Within two years, the new company had already passed Quaker Oats, the long-

time number two in Europe after Kellogg. According to General Millss vice chairman, building factories and

distribution channels from scratch would have taken years.

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

INTL JOINT VENTURES EVALUATION

109

Advantages Disadvantages

sharing of risk

JV with a local partner allow to

circumvent local content rules or

import restrictions or local knowledge

deficits

accelerated market entry (vs. Subs.)

reduced capital need

Learning advantages (from local

partner)

Easier management compared to other

forms of alliances due to separate

legal form

high coordination costs compared to

an autonomous market entry

undesirable knowledge diffusion

problems to follow a cross-country

strategy when there are JV with

different partners

JV tend to instability (partners

cancelled agreement/divest company)

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

ENTRY MODES DEPENDING ON RESOURCE INTENSITY

110

Source: adapted from Kutschker/Schmid (2004): p. 823

100%

100%

Exporting

Licensing

Franchising

Wholly Owned

Subsidiary

Production

Subsidiary

Sales

Subsidiary

Capital and

management

degree at

home

country

Capital and management

degree at host country

International

Alliances

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

SALES AND PRODUCTION SUBSIDIARIES

Synonymous to:

- Production sites (mostly production entity factories or

plants)

- Branch offices (mostly sales)

- Representative offices (initiation of contacts)

= legally dependent foreign subsidiaries

111

SALES AND PRODUCTION SUBSIDIARIES

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

SALES AND PRODUCTION SUBSIDIARIES EXAMPLE

112

The banking sector and the manufacturing industry

A bank that wants to initiate business with clients in other countries but does not want to open a

banking operation in that country can do so through foreign representative offices. A foreign

representative office of a bank is basically a legally dependent sales office that provides information

regarding the financial services of the bank, but cannot deliver the services itself. It cannot accept

deposits or make loans. The foreign representative office of a U.S. bank will typically sell the banks

services to local firms that may need banking services for trade or other transactions in the U.S.

In the manufacturing industry, many firms establish foreign plants or foreign affiliates. Similar to a foreign

representative office, foreign plants and foreign affiliates are legally dependent corporate units of an

international firm. But in contrast to a foreign representative office that is established to initiate business

contacts, foreign plants usually are production-oriented, and foreign affiliates are sales-oriented. For

instance, many car manufacturers have their cars produced at legally dependent foreign production

plants, and many firms in the fashion industry sell their apparel abroad at the stores of legally dependent

foreign affiliates.

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014 113

Advantages

Visible presence in the host country

enforcement of strategies without need

of coordination with third parties

uniformity of market appearance

Rep offices can provide additional

support for exporting firms

Production branches enhance flexibility

across countries

higher risks especially in politically

unstable countries due to high resource

transfer and lower reversibility of

investments

only few activities are internationalized

(e.g. sales) low possibilities to take

advantage of country differences

Disadvantages

SALES AND PRODUCTION SUBSIDIARIES - EVALUATION

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

ENTRY MODES DEPENDING ON RESOURCE INTENSITY

114

Source: adapted from Kutschker/Schmid (2004): p. 823

100%

100%

Exporting

Licensing

Franchising

Wholly Owned

Subsidiary

Production

Subsidiary

Sales

Subsidiary

Capital and

management

degree at

home

country

Capital and management

degree at host country

International

Alliances

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

WHOLLY OWNED SUBSIDIARIES

= legally independent foreign subsidiaries

WHOLLY OWNED SUBSIDIARIES

115

Greenfield Investments

Establishment of a new foreign

subsidiary. Resources needed for the

new business area are developed

internally

Mergers & Acquisitions

Acquisition: A firm from the home

country buys all or most of the

ownership stakes of a foreign firm.

Merger: Combining of two legally and

economically independent firms, one

domestic and one foreign, whereat at

least one firm loses its legal

autonomy.

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

GREENFIELD INVESTMENTS EXAMPLE OF LIDL

116

Lidl

With annual sales revenues of almost " 40 bn. per year, Germany-based Lidl is one of the leading food

discounters in the world. Lidl operates in 22 countries and has almost 8,000 stores worldwide. When entering

new foreign markets, Lidl usually establishes wholly-owned foreign subsidiaries in the form of greenfield

investments. Afterwards, Lidl builds logistics centres within the country for distributing the products to the

discount stores. As a next step, Lidl buys or rents property for building its stores usually 40 to 80 stores

within the first three years.

In Finland, for instance, Lidl established a wholly-owned foreign subsidiary in 2002, built several logistics

centres and opened ten discount stores in the country. Shortly after, Finland was the basis for further

expansion to the Scandinavian countries: Lidl opened its first stores in Sweden in 2003, it entered the

Norwegian market in 2004, and it broke into the Danish market in 2005.

In 2007, Lidls sales revenues in Denmark, Norway, Sweden, and Finland amounted to more than " 1 bn.

However, Lidl had to withdraw from the Norwegian market in 2008 due to bad economic performance.

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

GREENFIELD INVESTMENTS - EVALUATION

Advantages

lower risk of failure since internal

growth is usually affected with lower

problems

building on current strategies (no

historic heritage of acquired firm)

better fit to culture

application of the newest

technologies

time-consuming

problems of acquiring relevant local

resources (i.a. market know-how)

increased rivalry in the market (new

player)

Disadvantages

117

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

ADVANTAGES & DISADVANTAGES OF ENTRY MODES

118

Entry Mode Advantages Disadvantages

Exporting

Low commitment, low risk, low complexity

Strategy for gradually entering markets

Ability to realize location and experience curve

economies

High transport costs

Trade barriers

Low acceptance of goods abroad

No foreign experience/customer contact

Licensing

Low development costs and risks

Use of market know-how of the licensee

Faster market entry, while there is access to the

resources of the partner

Lack of control over technology

Inability to realize location and experience curve

economies

Lower influence on the business policy of the

licensee

Franchising

Low development costs and risks

Rapid internationalization is possible

Uniform public appearance worldwide

Lack of control over quality

Uniform practice worldwide requires a

standardized product

Development of complex management and

control mechanisms

Joint Ventures

Access to local partners knowledge

Sharing development costs and risks

JV with a local partner allow to circumvent local

content rules/import restrictions

Undesirable knowledge diffusion

No independent action

JV tend to instability (partners cancelled

agreement/divest company)

Wholly owned

Subsidiaries

Building on existing business relations/image (M&A)

Acquisition and protection of knowledge

Ability to engage in global strategic coordination

Ability to realize location and experience economies

Highest costs and risks

May increase rivalry in the market (greenfield)

Management problems selection & integration

of firms is a complex task (M&A)

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014 119

Foreign Trade

Cross-national trade with goods or services in the form of export or import

International Transfer of Resources

International Licensing:

Transfer of intangible assets

(e.g. know-how) to a foreign firm

for a licence fee

International Franchising:

Transfer of a business format/

business package to a foreign firm

for a franchise fee

Internat. Management

Contracting:

Transfer of management

services to a foreign firm

for a management fee

International Cooperation

International Consortium:

Project-oriented cooperation

between firms from

different countries

International Strategic Alliance:

Strategy-oriented cooperation

between firms from

different countries

International Joint Venture:

Cooperation between firms from

different countries in the form of

creating an additional joint firm

Foreign Direct Investment

Foreign Branch:

Legally dependent foreign

corporate unit (plant, affi-

liate, representative office)

Foreign Minority Stake:

Stake of < 50% in a

legally independent foreign

corporate unit

Foreign Subsidiary:

Stake of 50% in a

legally independent foreign

corporate unit

International Merger:

Amalgamation of firms

from different countries

into a new firm

WRAP-UP: INTL ENTRY STRATEGIES & OPERATION MODES

Prof. Dr. Thomas Wrona TUHH isim Internationalization Strategies SS 2014

FACTORS INFLUENCING MARKET ENTRY STRATEGIES

What does the choice of a market entry strategy depend on? What

would you consider entering an international market?

Knowledge & experience of decision maker

Country risks (political, market) & potential

Objectives (e.g. efficiency seeking vs. market seeking)

Strategic considerations

(e.g. kind of competitive advantage, speed, flexibility, economies of scale,

use of synergies, control possibilities)

Product characteristics (e.g. transferability, relevance of reputation,

complexity)

Legal restrictions (e.g. local content)

(...)

120

Potrebbero piacerti anche

- P90X3 Workout - Get Ripped in 30 Minutes A Day - BeachbodyDocumento19 pagineP90X3 Workout - Get Ripped in 30 Minutes A Day - BeachbodyFelipe Andres Soto Zavala100% (1)

- RPHQ) Dqgrdshughushvrfrq3 HVWHGH (Qhur: 5Hylvhho3Odqghqxwulflrqgh3Documento2 pagineRPHQ) Dqgrdshughushvrfrq3 HVWHGH (Qhur: 5Hylvhho3Odqghqxwulflrqgh3Felipe Andres Soto ZavalaNessuna valutazione finora

- A Laravel Webshop - MurzeDocumento5 pagineA Laravel Webshop - MurzeFelipe Andres Soto ZavalaNessuna valutazione finora

- P90X3 Max30 Hybrid Rev1Documento1 paginaP90X3 Max30 Hybrid Rev1Felipe Andres Soto ZavalaNessuna valutazione finora

- Insanity Max 30 Ab MaximizerDocumento2 pagineInsanity Max 30 Ab MaximizerFelipe Andres Soto Zavala100% (1)

- Theory of International Trade DemoDocumento161 pagineTheory of International Trade DemoFelipe Andres Soto ZavalaNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Approaches To Industrial RelationsDocumento39 pagineApproaches To Industrial Relationslovebassi86% (14)

- Alcor's Impending Npo FailureDocumento11 pagineAlcor's Impending Npo FailureadvancedatheistNessuna valutazione finora

- PT Berau Coal: Head O CeDocumento4 paginePT Berau Coal: Head O CekresnakresnotNessuna valutazione finora

- Factors Affecting SME'sDocumento63 pagineFactors Affecting SME'sMubeen Shaikh50% (2)

- IBDocumento26 pagineIBKedar SonawaneNessuna valutazione finora

- Metropolitan Transport Corporation Guindy Estate JJ Nagar WestDocumento5 pagineMetropolitan Transport Corporation Guindy Estate JJ Nagar WestbiindduuNessuna valutazione finora

- Designing For Adaptation: Mia Lehrer + AssociatesDocumento55 pagineDesigning For Adaptation: Mia Lehrer + Associatesapi-145663568Nessuna valutazione finora

- Calander of Events 18 3 2020-21Documento67 pagineCalander of Events 18 3 2020-21Ekta Tractor Agency KhetasaraiNessuna valutazione finora

- Request BADACODocumento1 paginaRequest BADACOJoseph HernandezNessuna valutazione finora

- De Mgginimis Benefit in The PhilippinesDocumento3 pagineDe Mgginimis Benefit in The PhilippinesSlardarRadralsNessuna valutazione finora

- HPAS Prelims 2019 Test Series Free Mock Test PDFDocumento39 pagineHPAS Prelims 2019 Test Series Free Mock Test PDFAditya ThakurNessuna valutazione finora

- Fire Service Resource GuideDocumento45 pagineFire Service Resource GuidegarytxNessuna valutazione finora

- Final - APP Project Report Script 2017Documento9 pagineFinal - APP Project Report Script 2017Jhe LoNessuna valutazione finora

- KaleeswariDocumento14 pagineKaleeswariRocks KiranNessuna valutazione finora

- Company ProfileDocumento13 pagineCompany ProfileDauda AdijatNessuna valutazione finora

- Democratic Developmental StateDocumento4 pagineDemocratic Developmental StateAndres OlayaNessuna valutazione finora

- Change Control Procedure: Yogendra GhanwatkarDocumento19 pagineChange Control Procedure: Yogendra GhanwatkaryogendraNessuna valutazione finora

- MBBcurrent 564548147990 2022-12-31 PDFDocumento10 pagineMBBcurrent 564548147990 2022-12-31 PDFAdeela fazlinNessuna valutazione finora

- The Global Interstate System Pt. 3Documento4 pagineThe Global Interstate System Pt. 3Mia AstilloNessuna valutazione finora

- Basice Micro - AssignmentDocumento2 pagineBasice Micro - AssignmentRamiah Colene JaimeNessuna valutazione finora

- Quasha, Asperilla, Ancheta, Peña, Valmonte & Marcos For Respondent British AirwaysDocumento12 pagineQuasha, Asperilla, Ancheta, Peña, Valmonte & Marcos For Respondent British Airwaysbabyclaire17Nessuna valutazione finora

- Ifland Engineers, Inc.-Civil Engineers - RedactedDocumento18 pagineIfland Engineers, Inc.-Civil Engineers - RedactedL. A. PatersonNessuna valutazione finora

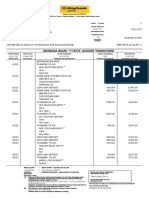

- InvoiceDocumento2 pagineInvoiceiworldvashicmNessuna valutazione finora

- India of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andDocumento2 pagineIndia of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andDITSANessuna valutazione finora

- The Possibility of Making An Umbrella and Raincoat in A Plastic WrapperDocumento15 pagineThe Possibility of Making An Umbrella and Raincoat in A Plastic WrapperMadelline B. TamayoNessuna valutazione finora

- Dog and Cat Food Packaging in ColombiaDocumento4 pagineDog and Cat Food Packaging in ColombiaCamilo CahuanaNessuna valutazione finora

- Is Enron OverpricedDocumento3 pagineIs Enron Overpricedgarimag2kNessuna valutazione finora

- Ape TermaleDocumento64 pagineApe TermaleTeodora NedelcuNessuna valutazione finora

- RMC 46-99Documento7 pagineRMC 46-99mnyng100% (1)

- 3D2N Bohol With Countryside & Island Hopping Tour Package PDFDocumento10 pagine3D2N Bohol With Countryside & Island Hopping Tour Package PDFAnonymous HgWGfjSlNessuna valutazione finora