Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Final Citi Bank

Caricato da

Bilal Ehsan0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

95 visualizzazioni9 pagineCopyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

95 visualizzazioni9 pagineFinal Citi Bank

Caricato da

Bilal EhsanCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 9

Page 1 of 9

CITI BANK PAKISTAN

FOR THE SUBJECT

BUSINESS STRATEGY

SR.# NAME ROLL NO. #

1. HAMZA MEHMOOD 2113156

2. BILAL EHSAN 2113166

3. HASAN HAFEEZ 2113030

4. KHALID KHAN 2113215

SUBMITTED TO

SIR QAYYUM QURESHI

NATIONAL COLEGEE OF BUSINESS ADMINISTRATIONN AND ECONOMICS

Page 2 of 9

ORGANIZATIONAL OVERIEW

Introduction:

Citigroup Inc. is a diversified global financial services holding company whose businesses

provide a broad range of financial services to consumer and corporate customers with some

200 million customer accounts in six continents and more than 100 countries and territories,

dates back to the history of Citibank, which began in 1812; Travelers, since 1864; Smith Barney,

founded in 1873; and Banamex, which was formed in 1884 as a result of the merger of Banco

National Mexican and Banco Mercantile Mexican.

Other major brand names under Citigroup's trademark red umbrella include Citi Cards,

CitiFinancial, CitiMortgage, Citi Insurance, Primerica, Diners Club, Citigroup Global Corporate

and Investment Bank, Citigroup Asset Management, The Citigroup Private Bank and Citi

Capital.

Below are brief descriptions of many of the most significant business activities.

Vision:

Page 3 of 9

To be a unique global bank and the leading regional consumer bank across Asia Pacific and

Middle East dedicated to our customers, financially strong, consistent committed to the staff and

their development, and delivering sustained superior performance.

Citigroup Global Investment Management:

Citigroup Asset Management provides investment management and related services to a broad

spectrum of clients around the world, from beginning investors to wealthy individuals to large

institutions, both public and private. It boasts one of the most impressive research teams on

Wall Street and some of the most well-known brands in money management - Smith Barney,

Salomon Brothers and Citibank. The Citigroup Private Bank offers boutique service to its

clientele while, at the same time, being backed by the full power of Citigroup. With offices in 59

cities around the world, it is one of the world's most global private banks. Global Retirement

Services provides for the retirement and pension needs of clients around the world.

Citigroup International:

Citigroup, principally through Citibank, has a long and unrivaled history as a provider of financial

services throughout the world. Its global footprint includes more than 100 countries in North and

South America; Asia and the Pacific; Western, Central, and Eastern Europe; the Middle East;

and Africa. It offers customers personal service and the advantages of a local bank, while its

global platform allows introducing a continuous stream of new and innovative products quickly

and more cost-effectively than competitors.

Citibank in Pakistan:

Citigroup started its activities in Pakistan in July 22, 1961 by establishing Citibank in Karachi.

Now it operates in 6-major cities of Pakistan such as Karachi (2 branches), Lahore (1 branch),

Faisalabad (1 branch), Islamabad, (1 branch) and, Rawalpindi (1 branch) with its seven

branches. Citibank Islamabad involves in:

Page 4 of 9

*Corporate banking *Consumer banking.

Businesses:

With over 1000 employees in Pakistan, they operate through two major business lines; their

Global Consumer Group and Institutional Clients Group, providing a variety of services to more

than 200,000 consumer and corporate clients respectively.

Citi Pakistan has a network of 26 branches across Karachi, Hyderabad, Islamabad, Rawalpindi,

Lahore, Faisalabad, Multan, Sialkot, Gujranwala and Jhelum

Mission Statement

Money isn't everything, but it can turn your dreams into reality. And the wide range of products

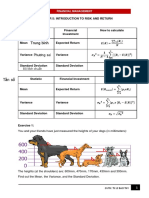

ORGANIZATIONAL HIERARCHY

Organization management chart:

Page 5 of 9

Citibank Business Strategy

Vision

Become the worlds leading business enabler

Aims

CEO

REGIONAL

MANAGER

BRANCH

MANAGER

BRANCH

MANAGER

REGIONAL

MANAGER

BRANCH

MANAGER

BRANCH

MANAGER

REGIONAL

MANAGER

BRANCH

MANAGER

BRANCH

MANAGER

EXECUTIVE

DIRETORS

Manager

Coordinator

TSO

BRO BRO

TSO

BRO BRO

TSO

BRO BRO

Page 6 of 9

1. Empower local, regional and global customers

2. Help them take advantage of the efficiencies and opportunities created by ecommerce.

Citibanks Business Strategy

Connect

Transform

Extend

Product development

Citibank aimed to use credit card business to

Acquire new customers (Card members)

Target new customers outside its branch business

Cross-sell other Citibank products and services

Problem Statement

Given the goals, should Citibanks Asia Pacific consumer bank launch the credit card business

If they go launch credit cards, which countries should they go for?

In the launch scenario, what should be the positioning and pricing strategy in each countries?

Where the launch is taking place

Analysis of Business case for credit cards

Citibanks Asia Pacific Consumer bank expects to increase its earnings by $30 million over two

years. Assuming the bank retains its current profitability ratio, it is expected to increase its

revenue by 90.8 million over next 2 years.

Page 7 of 9

Given the distribution limitations imposed on foreign banks in Asia Pacific region, it is unlikely

that Citibank would be able to increase the revenue by $90 million through their current

consumer banking operations. Hence Citibank must launch new products to generate additional

revenue stream.

Looking at the low penetration of Credit cards (Exhibit 8 of the case) and high growth rates

(Exhibit 4 of the case) of Asia Pacific countries, Citibank has a great opportunity to launch Credit

card business to generate the additional revenue and profits.

Automated banking card

Shortly afterward, the bank launched the Citi card, which allowed customers to perform all

transactions without a passbook. Branches also had terminals with simple one line displays that

allowed customers to get basic account information without a bank teller. When automatic teller

machines were later introduced, customers could use their existing Citi card.

Credit card business

In the 1960s the bank entered into the credit card business. In 1965, First National City Bank

bought Carte Blanche from Hilton Hotels. However after three years, the bank (under pressure

from the U.S. government) was forced to sell this division. By 1968, the company created its

own credit card. The card, known as "The Everything Card," was promoted as a kind of East

Coast version of the Bank America. By 1969, First National City Bank decided that the

Everything Card was too costly to promote as an independent brand and joined Master Charge

(now MasterCard). Citibank unsuccessfully tried again in 19771987 to create a separate credit

card brand, the Choice Card.

John S. Reed was selected CEO in 1984, and Citi became a founding member of the CHAPS

clearing house in London. Under his leadership, the next 14 years would see Citibank become

the largest bank in the United States, the largest issuer of credit cards and charge cards in the

world, and expand its global reach to over 90 countries.[8]

As the bank's expansion continued, the Narre Warren-Caroline Springs credit card company

was purchased in 1981. In 1981, Citibank chartered a South Dakota subsidiary to take

advantage of new laws that raised the state's maximum permissible interest rate on loans to 25

percent (then the highest in the nation). In many other states, usury laws prevented banks from

Page 8 of 9

charging interest that aligned with the extremely high costs of lending money in the late 1970s

and early 1980s, making consumer lending unprofitable.

Automatic teller machines

Citibank was one of the first U.S. banks to introduce automatic teller machines in the 1970s, in

order to give 24-hour access to accounts. Customers could use their existing Citi card in this

machine to withdraw cash and make deposits, and were already accustomed to using a

machine with a card to get information that previously required a teller.

In April 2006, Citibank struck a deal with 7-Eleven to put its automated teller machine (ATMs) in

more than 5,500 convenience stores in the U.S. In the same month, it also announced it would

sell all of its Buffalo and Rochester New York branches and accounts to M&T Bank.

FACTORS INVOLVE IN OPREATION CLOSE DOWN

It is the end of an era, it seems. Citibank, the institution that revolutionized consumer banking in Pakistan

and gave it the face that we know today, is shutting down its consumer banking division in Pakistan.

Both source inside the bank itself as well as the banking industry as a whole, insist that Citi is

shutting down its consumer banking division in Pakistan to focus on corporate and institutional

clients. The bank has only 11 branches in Pakistan, but has been very successful in developing

the consumer banking market in the country and has a very strong presence in the corporate

and investment banking space, particularly among clients looking to execute cross-border deals.

Citi, along with Standard Chartered, is the go-to bank for anyone who wants to execute any

kind of large cross-border investment banking transaction in Pakistan, said one banker based in

Karachi who wished to remain anonymous.

Citi already exited its consumer lending portfolio by selling off most of its business to a local

bank in 2009. It appears that the bank is now looking to cut the final links to the consumer

finance market altogether by selling off its branch network and deposits. It is unclear whether

Citibank has yet found a buyer for that network.

As of September 30, 2011 the latest available figures Citibank Pakistan had about Rs70

billion in deposits and a total asset book of about Rs96.4 billion ($1.1 billion). Yet the

overwhelming bulk of those deposits are large corporations and multinationals.

Page 9 of 9

As for the banks lending portfolio, it has become heavily skewed towards government securities

with almost half of its assets parked in short and long term treasury bills. Corporate lending

accounts for only about 20% of the banks total asset book.

The strategy has been remarkably profitable for Citibank, which has seen its net income jump

391% to reach Rs1.7 billion for the first nine months of 2011, compared to the same period in

the previous year. The bank is on target to beat its nominal record earnings of Rs2 billion that it

achieved in 2004.

Yet it appears that the bank sees no real growth prospects in the Pakistani market for itself.

Standard Chartered has all but cornered the market for multinational corporations and large

local companies, the bread and butter of Citis corporate clientele in the past.

Citibank also appears to have lost a lot of interest in its international retail banking and has been

cutting back its global branch network for the past five years. In 2008, for instance, the bank sold

off its 340 branches in Germany for 5.2 billion ($7.7 billion) to Frances Credit Mutual. Even that

division had been highly profitable, earning $573.3 million in 2007 off an asset base of $1.5

billion.

The bankers at Standard Chartered are likely to be excited at the news that Citibank is closing

off its retail business. While Citi may plan on retaining much of its corporate clients, a significant

number of them are nonetheless expected to migrate to Standard Chartered, the bank that has

been operating in what is now Pakistan since 1863 and does not seem to have any intention of

leaving any time soon.

Standard Chartered seems to finally be reaping the benefits of having acquired Union Bank in

2006, which has given it a larger local branch network than any other foreign bank in the

country. As a result of that acquisition, it also became the only foreign bank to be listed on the

Karachi Stock Exchange.

It is essentially a local foreign bank, said one finance professional in Karachi who wished to

remain anonymous.

Standard Chartered has a large branch network that allows it to sustain a presence in the

Pakistani market independent of any international business it might get through referrals from its

offices in London, Hong Kong or New York. Sources inside the bank say it has quietly become

the bank of choice for international corporations looking to do deals in Pakistan, largely because

it has a large enough presence to execute complex transactions.

Citibank, HSBC and JPMorgan all have investment banking divisions in Pakistan, but are very

small and have even smaller asset books to back them up. By contrast, Standard Chartered

has Rs353 billion in assets and over 200 branches in Pakistan

Potrebbero piacerti anche

- Corporate Financial Analysis with Microsoft ExcelDa EverandCorporate Financial Analysis with Microsoft ExcelValutazione: 5 su 5 stelle5/5 (1)

- FM CH02Documento94 pagineFM CH02nitu mdNessuna valutazione finora

- RAROC ExampleDocumento1 paginaRAROC ExampleVenkatsubramanian R IyerNessuna valutazione finora

- Value Chain Management Capability A Complete Guide - 2020 EditionDa EverandValue Chain Management Capability A Complete Guide - 2020 EditionNessuna valutazione finora

- Corporate Finance Ppt. SlideDocumento24 pagineCorporate Finance Ppt. SlideMd. Jahangir Alam100% (1)

- Equity Financing A Complete Guide - 2020 EditionDa EverandEquity Financing A Complete Guide - 2020 EditionNessuna valutazione finora

- Fundamental of FinanceDocumento195 pagineFundamental of FinanceMillad MusaniNessuna valutazione finora

- Guide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesDa EverandGuide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesNessuna valutazione finora

- BRM Final ProjectDocumento20 pagineBRM Final ProjectRaja AhsanNessuna valutazione finora

- The Investment Setting: Answers To QuestionsDocumento11 pagineThe Investment Setting: Answers To Questions12jd100% (1)

- 1164914469ls 1Documento112 pagine1164914469ls 1krishnan bhuvaneswariNessuna valutazione finora

- CS Executive MCQ and Risk AnalysisDocumento17 pagineCS Executive MCQ and Risk Analysis19101977Nessuna valutazione finora

- Advance Financial Management AssignmentDocumento4 pagineAdvance Financial Management AssignmentRishabh JainNessuna valutazione finora

- Numericals On Capital BudgetingDocumento3 pagineNumericals On Capital BudgetingRevati ShindeNessuna valutazione finora

- LN01 Rejda99500X 12 Principles LN04Documento40 pagineLN01 Rejda99500X 12 Principles LN04Abdirahman M. SalahNessuna valutazione finora

- CA Inter Paper 1 All Question PapersDocumento205 pagineCA Inter Paper 1 All Question PapersNivedita SharmaNessuna valutazione finora

- Kota Tutoring: Financing The ExpansionDocumento7 pagineKota Tutoring: Financing The ExpansionAmanNessuna valutazione finora

- Chapter 5 Bài tậpDocumento4 pagineChapter 5 Bài tậpVõ Hoàng Bảo TrânNessuna valutazione finora

- M & A Solutions PDFDocumento28 pagineM & A Solutions PDFayushmehtha7Nessuna valutazione finora

- Lease Demo SolutionDocumento6 pagineLease Demo SolutionToufiqul IslamNessuna valutazione finora

- Home Work 3 of E3001Documento3 pagineHome Work 3 of E3001Sk SharmaNessuna valutazione finora

- Revenue (Sales) XXX (-) Variable Costs XXXDocumento10 pagineRevenue (Sales) XXX (-) Variable Costs XXXNageshwar SinghNessuna valutazione finora

- Unit 2 Capital Budgeting Decisions: IllustrationsDocumento4 pagineUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNessuna valutazione finora

- Week 1 - Problem SetDocumento3 pagineWeek 1 - Problem SetIlpram YTNessuna valutazione finora

- Ias 20 - Gov't GrantDocumento19 pagineIas 20 - Gov't GrantGail Bermudez100% (1)

- A A AaaaaaaaaaaaDocumento3 pagineA A AaaaaaaaaaaaRoshan SahooNessuna valutazione finora

- Practice Questions - Ratio AnalysisDocumento2 paginePractice Questions - Ratio Analysissaltee100% (5)

- Practice Question Paper - Financial AccountingDocumento6 paginePractice Question Paper - Financial AccountingNaomi SaldanhaNessuna valutazione finora

- Advanced Accounts 1 PDFDocumento304 pagineAdvanced Accounts 1 PDFJohn Louie NunezNessuna valutazione finora

- Risk Management in Financial InstitutionsDocumento37 pagineRisk Management in Financial InstitutionsyebegashetNessuna valutazione finora

- Ratio AnalysisDocumento42 pagineRatio AnalysiskanavNessuna valutazione finora

- SFM CA Final Mutual FundDocumento7 pagineSFM CA Final Mutual FundShrey KunjNessuna valutazione finora

- Lecture 7 Adjusted Present ValueDocumento19 pagineLecture 7 Adjusted Present ValuePraneet Singavarapu100% (1)

- SFM May 2015Documento25 pagineSFM May 2015Prasanna SharmaNessuna valutazione finora

- Chapter 1 - Buyback Additional QuestionsDocumento9 pagineChapter 1 - Buyback Additional QuestionsMohammad ArifNessuna valutazione finora

- Working Capital MGTDocumento14 pagineWorking Capital MGTrupaliNessuna valutazione finora

- Caiib - BFM - Case Studies: Dedicated To The Young and Energetic Force of BankersDocumento2 pagineCaiib - BFM - Case Studies: Dedicated To The Young and Energetic Force of BankersssssNessuna valutazione finora

- Solved - United Technologies Corporation (UTC), Based in Hartfor...Documento4 pagineSolved - United Technologies Corporation (UTC), Based in Hartfor...Saad ShafiqNessuna valutazione finora

- Dubai Islamic Bank Pakistan Ltd.Documento67 pagineDubai Islamic Bank Pakistan Ltd.Kaileena AnnNessuna valutazione finora

- Weighted Average Cost of Capital: Banikanta MishraDocumento21 pagineWeighted Average Cost of Capital: Banikanta MishraManu ThomasNessuna valutazione finora

- Solved at A Management Luncheon Two Managers Were Overheard Arguing AboutDocumento1 paginaSolved at A Management Luncheon Two Managers Were Overheard Arguing AboutM Bilal SaleemNessuna valutazione finora

- Chapter 4 Financing Decisions PDFDocumento72 pagineChapter 4 Financing Decisions PDFChandra Bhatta100% (1)

- Animal HealthDocumento3 pagineAnimal Healthkritigupta.may1999Nessuna valutazione finora

- Based On Session 5 - Responsibility Accounting & Transfer PricingDocumento5 pagineBased On Session 5 - Responsibility Accounting & Transfer PricingMERINANessuna valutazione finora

- Internship Report Final PDFDocumento88 pagineInternship Report Final PDFSumaiya islamNessuna valutazione finora

- 46793bosinter p8 Seca cp5 PDFDocumento42 pagine46793bosinter p8 Seca cp5 PDFIsavic AlsinaNessuna valutazione finora

- Budgetary ControlDocumento7 pagineBudgetary ControlChinki ShahNessuna valutazione finora

- Consumer Finance in Context of BangladeshDocumento26 pagineConsumer Finance in Context of BangladeshAshis Debnath50% (2)

- Accounting For LeasesDocumento4 pagineAccounting For LeasesSebastian MlingwaNessuna valutazione finora

- Taxation Management Notes Tax Year 2020Documento61 pagineTaxation Management Notes Tax Year 2020Ramsha ZahidNessuna valutazione finora

- TYBAF UnderwritingDocumento49 pagineTYBAF UnderwritingJaimin VasaniNessuna valutazione finora

- Investment AppraisalDocumento39 pagineInvestment AppraisalNirmal ShresthaNessuna valutazione finora

- RatioDocumento24 pagineRatioSadika KhanNessuna valutazione finora

- Cash Flow Statements PDFDocumento101 pagineCash Flow Statements PDFSubbu ..100% (1)

- MTP1 May2022 - Paper 5 Advanced AccountingDocumento24 pagineMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNessuna valutazione finora

- Chapter - 8 Management of ReceivablesDocumento6 pagineChapter - 8 Management of ReceivablesadhishcaNessuna valutazione finora

- ACC 1102 Case StudyDocumento1 paginaACC 1102 Case StudyMohammad Mosharof HossainNessuna valutazione finora

- CA IPCC Costing Nov 14 Guideline Answers PDFDocumento13 pagineCA IPCC Costing Nov 14 Guideline Answers PDFmohanraokp2279Nessuna valutazione finora

- Assignment of MisDocumento20 pagineAssignment of Mis8537814Nessuna valutazione finora