Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

RAP Schwartz RPSpresentationOSU 2010-2-22

Caricato da

Florabel Tolentino Sera Josef0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

20 visualizzazioni25 pagineEE

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoEE

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

20 visualizzazioni25 pagineRAP Schwartz RPSpresentationOSU 2010-2-22

Caricato da

Florabel Tolentino Sera JosefEE

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 25

The Regulatory Assistance Project

China EU India United States

Renewable Portfolio Standards

Lisa Schwartz

Presentation to Oregon State University Energy Economics Class

Feb. 22, 2010

About the

Regulatory Assistance Project

RAP is a nonprofit organization providing technical and

educational assistance to government officials on energy

and environmental issues. Senior RAP staff all have

extensive utility regulatory experience.

Funded by foundations and the US Department of Energy.

We have worked in nearly every state and many nations

throughout the world.

RAP also provides educational assistance to stakeholders,

utilities and advocates.

RAP is committed to fostering regulatory policies for the

electric industry that encourage economic efficiency,

protect environmental quality, assure system reliability,

and allocate system benefits fairly to all customers.

2

Outline

What is a Renewable Portfolio Standard?

RPS as public policy

RPS parts and variations

Oregons requirements

Federal proposals

United Kingdom and China

Feed-in tariffs, PURPA and net metering

3

What Are Renewable

Portfolio Standards?

Require retail electricity providers to generate or purchase

a portion of their power from renewable sources

Energy-based (percentage of retail sales) or capacity-based (megawatt

targets)

Typically backed with penalties

Most implemented through legislation; some through voter initiative or

regulatory action

In place in 29 states in US and District of Columbia, plus

other countries

More than 60% of non-hydro renewable additions since

1998 (16,500 MW) have been in states with active/

impending compliance obligations.

(Source: Ryan Wiser, Lawrence Berkeley National Laboratory, November 2009)

4

RPS as Public Policy

Reduce dependence on fossil fuels

National security, economic stability, sustainability

Diversify electricity supply

Boost economic development

In-state projects (jobs)

Manufacturing/assembly of components Because RPS

requirements drive projects, they are a factor in locating

manufacturing facilities (as are labor costs, tax

incentives, resource availability, etc.).

Reduce emissions of greenhouse gases

But put energy efficiency first on your list

5

Sources of US Energy-Related

CO

2

Emissions: 2004

6

Transportation

33.1%

Industrial

15.4%

Residential

6.6%

Commercial

4.0%

Other Electricity

Generation

7.0%

Electricity Generation

From Coal

33.8%

Source: EPA 2006

Power

sector

accounts

for 40%

Western RPS and Carbon

Policies

Nine Western states with an RPS

Carbon limits in three states

Emission performance standards in CA, OR and WA

Carbon cap and trade law in CA

Seven states and four Canadian provinces

engaged in Western Climate Initiative

By 2015, program expected to apply to 90% of their GHG emissions

But AZ just backed out of cap and trade portion

GHG emissions reductions: 15% below 2005 levels by 2020 and, over

long term, significantly lower risk of dangerous threats to climate

7

Eligible Fuels

Wind is dominating Focus is on improving flexibility in the

electric system to accommodate its variable generating output

(e.g., gas generators, virtual consolidation of Balancing Areas)

Biomass Exceptions may include incinerated waste (e.g.,

municipal solid waste), spent (black) pulping liquor, some types

of forestry waste

Geothermal Good baseload resource, but dry hole risk during

development

Ocean sources Making headway mostly abroad

Solar Trend toward RPS carve-outs, feed-in tariffs

Hydro Large hydro often excluded from eligibility

8

Tradable Renewable Energy

Certificates

To facilitate compliance, most states allow

renewable energy certificates (RECs) procured

separately (unbundled) from the associated

electricity to satisfy at least a portion of the

renewable resource obligation

9

One megawatt-hour

of electricity from

a renewable resource

Commodity Electricity

One Renewable Energy

Certificate

Tradable Renewable Energy

Certificates (cont.)

Enable more efficient markets greater liquidity and reduced

transaction costs

A study for the Western Electric Industry Leaders Group on

transmission needed to meet RPS and carbon requirements in

the Western Interconnection estimated that procuring west-wide

resources through certificate trading instead of building

transmission to remote resources could save $351 million in

2020.

See http://weilgroup.org/E3_WEIL_Complete_Study_2008_082508.pdf

But tradable RECs raise concerns about dump energy

What if California utilities use RECs from Oregon wind projects to

comply with their RPS obligations, but dont buy underlying energy

which is then sold as undifferentiated energy at market prices?

Could leave integration issues here

10

Tracking Certificates

Western Renewable Energy

Generation Information System

database is designed to issue, register and track all

RECs in the Western Interconnection

Protects against multiple-counting and selling

Provides infrastructure for REC trading*

Verifies compliance with renewable portfolio

standards and green power claims

Uses independent, verifiable and reliable data

11

*WREGIS is not a trading platform.

Comparing Standards

in the US

Requirements differ from state to state

Targets and timeframes

Capacity (MW) or energy (MWh, % of sales) based

Eligible fuels and technologies

Date generator (or incremental generation) began operation

Required levels or credit multipliers for certain resources such as solar

Whether customer-sited (distributed) resources are eligible

Whether generation must be generated within or delivered to the state

Whether the obligation is imposed (and imposed equally) on all suppliers

Banking of RECs for future year compliance

Penalties and flexibility mechanisms

Cost caps

Funding support

Whether energy efficiency can be used to meet part of requirement

12

Oregons Renewable

Portfolio Standard (HB 838, 2007)

13

Oregons Renewable

Portfolio Standard (cont.)

14

Small utilities can trigger application of targets that

otherwise apply only to large utilities

Buy into new coal plant or sign new contract for coal plant

Annex investor-owned utility territory without utilitys

permission

HB 3039 (2009) added a solar tier

At least 20 MW of solar photovoltaics in state by 1/1/20

Installations must be between 500 kW and 5 MW

2-to-1 REC multiplier for these systems before 1/1/16

Oregons Renewable

Portfolio Standard (cont.)

Eligible resources are wind, geothermal,

biomass, solar, wave, tidal, ocean thermal,

some hydro, and hydrogen from any of

these sources.

Hydro is limited to efficiency improvements at existing

facilities and a limited amount of low-impact facilities.

Generating plants that began operation after 1/1/95 are

eligible. Exceptions apply for hydro efficiency

improvements, low-impact hydro, and incremental

efficiency or capacity upgrades for other eligible

facilities.

15

Oregons Renewable

Portfolio Standard (cont.)

Flexible compliance mechanisms

Build or buy power from an eligible facility (or

continue generating at facility with an eligible on-

line date) and retire associated RECs. Facility must

be in U.S. portion of Western Interconnection.

Buy unbundled (tradable) RECs for up to 20% of

obligation from anywhere in Western

Interconnection, not just US portion

Make alternative compliance payment for

shortfall, to be used for future renewable resource

projects, conservation or power plant upgrades

Unlimited banking of RECs (early actions count)

16

Oregons Renewable

Portfolio Standard (cont.)

Cost cap Cant increase utilitys annual revenue

requirement by more than 4%, compared to case

without qualifying renewable resources

Incremental costs = Levelized cost of qualifying

electricity - Levelized cost of an equivalent amount

of electricity that is not qualifying electricity

Short-term renewable resource contracts (<5 years)

- Compare with published wholesale power prices

Long-term renewable resource contracts or owned-

facilities - Compare with proxy plant a natural

gas-fired, combined-cycle combustion turbine

17

Federal RPS

Two main RPS bills in Congress

House: HR 2454 (Waxman-Markey)

20% by 2020 renewable energy target (25% to 40% energy efficiency

compliance option)

Alternative compliance payment: $25/MWh + inflation

Senate: S 1462 (Bingaman)

15% by 2021 renewable energy target (26.67% energy efficiency

compliance option)

Alternative compliance payment: 2.1/kWh + inflation

4% cap on rate impact

Both exclude from the baseline large-scale hydro, new nuclear,

and generating plants with carbon capture and sequestration

Both exempt small utilities

18

Federal RPS (cont.)

Federal/state RPS interactions

Neither federal bill would diminish the authority of a state to adopt or

enforce any law or regulation regarding renewable energy

Waxman-Markey specifically allows states to adopt requirements that

are more stringent than federal requirements

Federal RECs would be entirely separate from state RECs. Federal

RECs would have no purpose other than compliance with the federal

requirement. Federal RECs would have liquid markets because they

can be used nationwide, but state RECs would still be bound by

individual state definitions and eligibility.

To avoid double counting, one federal certificate should be retired for

each non-federal certificate used to comply with a state RPS.

REC tracking systems New federal system or use existing regional

systems?

Alternative compliance payments Will states be able to direct funds to

encourage renewable energy development?

19

United Kingdom

Liberalized market Renewables Obligation

is on licensed electricity suppliers

Renewables obligation is 9.7% for 2009/10

Rises to 15.4% by 2015/16

Suppliers meet the obligation by acquiring

Renewables Obligation Certificates or paying a

buy-out price equivalent to 37.19/MWh* in

2009/10 (rising each year with the retail price

index), or a combination of the two

20

*2/22/10: 1 = 1.5491 US$

China

Established renewable energy goal & mandatory market share policy

2005 Renewable Energy Law required grid companies to buy all

certified renewable energy within their service areas

In September 2007, the government announced a 15% by 2020 target.

By 2008, China was on track to surpass that goal.

Goal is now a floor, establishing the minimum amount of renewable

resources in the planning process, which in turn drives investment

approval and the licensing process

In June 2009, the vice chairman of the National Development and

Reform Commission , the nations central policy-making body,

suggested that 20% by 2020 may be a reasonable target.

In 2009, China installed about 13,000 MW of wind, compared with

just under 10,000 MW in US (Source: AWEA, Wind Energy Weekly, 2/3/10)

21

Feed-in Tariffs

Also called Advanced Renewable Tariffs, theyre designed to

encourage small, diverse renewable resources by a variety of entities

Guarantee the right to interconnect and a buyer for the electricity

Rates based on renewable project costs, not utilitys avoided resource

Return on investment typically included in rates

Rates may vary by technology, geographic location and project size

Feed-in laws in Vermont (H.446) and Oregon (HB 3039)

Oregon tariffs in place April 1

st

for solar PV for PGE and Pacific Power

Offered by a few utilities elsewhere in the US

Also in Spain, Ontario, Italy, Germany, China and many other places

US Federal Power Act poses legal issues Net metering and RFP

solutions for now

Market-based pricing an auction or RFP targeting small-scale

renewable resources may provide similar benefits at lower cost to

ratepayers

22

PURPA and Net Metering

Federal PURPA requires (non-exempt) utilities to buy all

energy and capacity offered by Qualifying Facilities

renewable resources up to 80 MW and cogenerators of any size

States have broad discretion to set facility size eligible for standard avoided-

cost rates and standard contract terms

Oregon revamped its policies to provide Qualifying Facilities up to 20 MW

with fixed pricing for 15 years, plus an additional 5 years with some portion of

pricing based on then-current market conditions.

Net metering allows customers to generate power on-site from

eligible resources (solar, wind, etc.) and run their meter

backwards.

In Oregon, PGE and Pacific Power customers can install systems up to 2 MW

and get kilowatt-hour credits against their utility bills. Excess energy credits

can be carried forward to future months until the end of the billing year.

23

Parting Thoughts

RPSs are a major driver in renewable resource

development in US

Trend is toward increasing standards already in place

Tax incentives, siting and transmission also important

Federal production tax credit is 2.1 cents/kWh; alternative

30% investment tax credit

2009 Recovery Act provides funding for Interconnection-

wide transmission planning, including significant state and

stakeholder participation

Designed to support multi-state transmission lines to bring needed

renewable and other energy sources to loads

But will not solve issues related to facility and transmission siting

or cost allocation for interstate transmission lines

24

Lisa Schwartz

Senior Associate

541-990-9526

lschwartz@raponline.org

www.raponline.org

Potrebbero piacerti anche

- Designing A National Renewable Electricity StandardDocumento16 pagineDesigning A National Renewable Electricity StandardCarnegie Endowment for International PeaceNessuna valutazione finora

- Solar Parameter SummaryDocumento5 pagineSolar Parameter Summarysrivastava_yugankNessuna valutazione finora

- DownloadDocumento14 pagineDownloadGaurav SushrutNessuna valutazione finora

- RAP Cowart NEDRIOverview 2004-07-12Documento17 pagineRAP Cowart NEDRIOverview 2004-07-12raul_bsuNessuna valutazione finora

- FPL Proposal For A Florida Renewable Portfolio Standard: FPSC Staff Workshop December 6, 2007Documento16 pagineFPL Proposal For A Florida Renewable Portfolio Standard: FPSC Staff Workshop December 6, 2007Daniel Jesus Hernandez BallenaNessuna valutazione finora

- Performance analysis of US coal-fired power plantsDocumento29 paginePerformance analysis of US coal-fired power plantsharshNessuna valutazione finora

- GPS Generation Partners Questions & AnswersDocumento5 pagineGPS Generation Partners Questions & Answerslucylou8854Nessuna valutazione finora

- WND Enegry in IndiaDocumento20 pagineWND Enegry in IndiaManohara Reddy PittuNessuna valutazione finora

- Net Metering: Chandra Shah, NRELDocumento19 pagineNet Metering: Chandra Shah, NRELChetan GaonkarNessuna valutazione finora

- Funding EnergyDocumento3 pagineFunding EnergyjohnribarNessuna valutazione finora

- Mgerken Eblf Presentation 2009Documento28 pagineMgerken Eblf Presentation 2009suetierneyNessuna valutazione finora

- Regulating Carbon BrochureDocumento8 pagineRegulating Carbon BrochureHarshit MahajanNessuna valutazione finora

- Solar PV Project Financing: Regulatory and Legislative Challenges For Third-Party PPA System OwnersDocumento56 pagineSolar PV Project Financing: Regulatory and Legislative Challenges For Third-Party PPA System OwnersLiew Yee WienNessuna valutazione finora

- Grid of The Future: Are We Ready To Transition To A Smart Grid?Documento11 pagineGrid of The Future: Are We Ready To Transition To A Smart Grid?XavimVXSNessuna valutazione finora

- Solar ProjectDocumento7 pagineSolar ProjectPriyanka MishraNessuna valutazione finora

- Green Build DistributedGenerationDocumento16 pagineGreen Build DistributedGenerationsabnascimentoNessuna valutazione finora

- Energy StorageDocumento146 pagineEnergy StorageGuillermo Lopez-FloresNessuna valutazione finora

- MEPS three phase electric motorsDocumento2 pagineMEPS three phase electric motorsAnonymous DJrec2Nessuna valutazione finora

- IREC NM Model October 2009-1-51Documento7 pagineIREC NM Model October 2009-1-51OnwuntaNessuna valutazione finora

- ALEC Clean Power Plan Public CommentDocumento6 pagineALEC Clean Power Plan Public CommentALECNessuna valutazione finora

- Summary of Issues For The Fifth Northwest Power PlanDocumento5 pagineSummary of Issues For The Fifth Northwest Power PlanSaumya GuptaNessuna valutazione finora

- PCCI Energy Committee - TWG On PowerDocumento21 paginePCCI Energy Committee - TWG On PowerArangkada PhilippinesNessuna valutazione finora

- Caribbean Policy Research Institute (CaPRI), Renewable Energy: Ushering in The New Caribbean Economy, 12-2009Documento9 pagineCaribbean Policy Research Institute (CaPRI), Renewable Energy: Ushering in The New Caribbean Economy, 12-2009Detlef LoyNessuna valutazione finora

- ESN Elec Storage in The National Interest Report Final Web PDFDocumento8 pagineESN Elec Storage in The National Interest Report Final Web PDFroyclhorNessuna valutazione finora

- TET 407 - Energy Planning, Regulation & Investment PlanningDocumento69 pagineTET 407 - Energy Planning, Regulation & Investment PlanningMonterez SalvanoNessuna valutazione finora

- TEC Directors Conference - EnerVision The New World of Power Supply TEC 01 09 2024Documento29 pagineTEC Directors Conference - EnerVision The New World of Power Supply TEC 01 09 2024Linda ReevesNessuna valutazione finora

- Captive Power PlantDocumento21 pagineCaptive Power PlantRohan Swamy100% (2)

- "Single Buyer" and Ontario S Electricity Supply StructureDocumento16 pagine"Single Buyer" and Ontario S Electricity Supply StructuremshalfanNessuna valutazione finora

- Alternative Energy ClarkeDocumento85 pagineAlternative Energy ClarkeEnergy dealersNessuna valutazione finora

- Economic AppraisalDocumento3 pagineEconomic AppraisalShubham patilNessuna valutazione finora

- Faq EnergyDocumento2 pagineFaq Energyandrea_e_vedderNessuna valutazione finora

- REC Mechanism in India For Solar Power Development: 16th March 2012Documento18 pagineREC Mechanism in India For Solar Power Development: 16th March 2012bijayabcNessuna valutazione finora

- Energy Strategies Study Analyzing The Cost of Small Modular Reactors and Alternative Power PortfoliosDocumento33 pagineEnergy Strategies Study Analyzing The Cost of Small Modular Reactors and Alternative Power PortfoliosThe Salt Lake TribuneNessuna valutazione finora

- Electric Power Grid ModernizationDocumento17 pagineElectric Power Grid ModernizationLeroy Lionel Sonfack100% (1)

- Net Energy Metering: Growth and Accountability in The Distributed Solar MarketDocumento12 pagineNet Energy Metering: Growth and Accountability in The Distributed Solar MarketCenter for American ProgressNessuna valutazione finora

- Reliability Metrics and Best Practices for Improving Electric Grid PerformanceDocumento35 pagineReliability Metrics and Best Practices for Improving Electric Grid PerformanceNishith ShettyNessuna valutazione finora

- Solargen Exec Summary 2-12-09 (Investor)Documento2 pagineSolargen Exec Summary 2-12-09 (Investor)klepalo123Nessuna valutazione finora

- Deployment of Grid-Scale Batteries in The United StatesDocumento30 pagineDeployment of Grid-Scale Batteries in The United StatesKirn ZafarNessuna valutazione finora

- Ashwin Gambhir - Setting The Right FiT Rates Challenges in IndiaDocumento16 pagineAshwin Gambhir - Setting The Right FiT Rates Challenges in IndiaAsia Clean Energy ForumNessuna valutazione finora

- EnerVision The New World of Power Supply TEC Managers Conference 12 07 2023Documento35 pagineEnerVision The New World of Power Supply TEC Managers Conference 12 07 2023Linda ReevesNessuna valutazione finora

- C 4: P F P C: Hapter Olicy Ramework For Romoting OgenerationDocumento10 pagineC 4: P F P C: Hapter Olicy Ramework For Romoting OgenerationbarmarwanNessuna valutazione finora

- Landfill Gas Energy Project Contracts and Permitting GuideDocumento20 pagineLandfill Gas Energy Project Contracts and Permitting GuidetotongopNessuna valutazione finora

- Suzlon AnalysisDocumento41 pagineSuzlon AnalysiskapilhrcNessuna valutazione finora

- Power Plan: Rethinking Policy To Deliver ADocumento32 paginePower Plan: Rethinking Policy To Deliver Ashadydogv5Nessuna valutazione finora

- Distributed Resource Electric Power Systems Offer Significant Advantages Over Central Station Generation and T&D Power SystemsDocumento8 pagineDistributed Resource Electric Power Systems Offer Significant Advantages Over Central Station Generation and T&D Power SystemsAbdulrahmanNessuna valutazione finora

- Addressing Solar Photovoltaic Operations and Maintenance ChallengesDocumento22 pagineAddressing Solar Photovoltaic Operations and Maintenance Challengesathanasios_ghikasNessuna valutazione finora

- Canada Electricity GuideDocumento26 pagineCanada Electricity Guidekkapoor03Nessuna valutazione finora

- 0-7803-7322-7/02/$17.00 (C) 2002 IeeeDocumento2 pagine0-7803-7322-7/02/$17.00 (C) 2002 IeeeArmaghan JamshaidNessuna valutazione finora

- Electricity in CanadaDocumento26 pagineElectricity in CanadarezurektNessuna valutazione finora

- REAP RESoverviewDocumento2 pagineREAP RESoverviewCam HamiltonNessuna valutazione finora

- Reduce Energy Use and Boost RenewablesDocumento4 pagineReduce Energy Use and Boost RenewablesLIYANA SAMSUDINNessuna valutazione finora

- Iso 9001:2008 CertifiedDocumento5 pagineIso 9001:2008 CertifiedAmol DeshmukhNessuna valutazione finora

- Hydropower Key Findings 1669753448Documento5 pagineHydropower Key Findings 1669753448Ian PillayNessuna valutazione finora

- AEE VA - Energy Transition Memo - 6.22.17Documento3 pagineAEE VA - Energy Transition Memo - 6.22.17Lowell FeldNessuna valutazione finora

- Electricity Market ReviewDocumento11 pagineElectricity Market ReviewHakob ManukianNessuna valutazione finora

- PPA Syndiacate Ppt FinalDocumento32 paginePPA Syndiacate Ppt Finalamer saeedNessuna valutazione finora

- Florida's Renewable Energy Future: Outlook For 2011Documento20 pagineFlorida's Renewable Energy Future: Outlook For 2011Southern Alliance for Clean EnergyNessuna valutazione finora

- Benchmarking: William Mccarty Chairman Indiana Utility Regulatory Commission September 9-10 Riga, LatviaDocumento15 pagineBenchmarking: William Mccarty Chairman Indiana Utility Regulatory Commission September 9-10 Riga, LatviatjukimaiNessuna valutazione finora

- Fueling Healthy Communities V1 Energy Storage Secure Supplies Whitepaper: POWER TO GAS ENERGY STORAGEDa EverandFueling Healthy Communities V1 Energy Storage Secure Supplies Whitepaper: POWER TO GAS ENERGY STORAGENessuna valutazione finora

- ModifiedNLC P343 Setting CalculationDocumento13 pagineModifiedNLC P343 Setting CalculationFlorabel Tolentino Sera Josef100% (1)

- CHN Lecture 082217Documento43 pagineCHN Lecture 082217Florabel Tolentino Sera JosefNessuna valutazione finora

- Book 1Documento8 pagineBook 1Florabel Tolentino Sera JosefNessuna valutazione finora

- NFPA Tamper Resistant Fact SheetDocumento1 paginaNFPA Tamper Resistant Fact SheetFlorabel Tolentino Sera JosefNessuna valutazione finora

- Transformer CalcDocumento1 paginaTransformer CalcFlorabel Tolentino Sera JosefNessuna valutazione finora

- Variable Speed Pumping, A Guide To Successful ApplicationDocumento6 pagineVariable Speed Pumping, A Guide To Successful Applicationongjoel0% (1)

- Earthing Substation Earthing Guide Central NetworksDocumento12 pagineEarthing Substation Earthing Guide Central Networksshahkhan552000100% (1)

- NFPA Home Electrical Fires Fact Sheet 2013Documento1 paginaNFPA Home Electrical Fires Fact Sheet 2013Florabel Tolentino Sera JosefNessuna valutazione finora

- Top 12 Changes 2014 NECDocumento2 pagineTop 12 Changes 2014 NECFlorabel Tolentino Sera JosefNessuna valutazione finora

- Introduction To Photovoltaic Systems - FLDocumento11 pagineIntroduction To Photovoltaic Systems - FLFlorabel Tolentino Sera JosefNessuna valutazione finora

- Variable Speed Pumping, A Guide To Successful ApplicationDocumento6 pagineVariable Speed Pumping, A Guide To Successful Applicationongjoel0% (1)

- Residential Electrical Inspections - FLDocumento12 pagineResidential Electrical Inspections - FLFlorabel Tolentino Sera JosefNessuna valutazione finora

- Electrical Safety Now (NFPA 70E 2012) - FLDocumento11 pagineElectrical Safety Now (NFPA 70E 2012) - FLFlorabel Tolentino Sera JosefNessuna valutazione finora

- NFPA AFCI Fact SheetDocumento1 paginaNFPA AFCI Fact SheetFlorabel Tolentino Sera JosefNessuna valutazione finora

- Introduction To Photovoltaic Systems - CADocumento10 pagineIntroduction To Photovoltaic Systems - CAFlorabel Tolentino Sera JosefNessuna valutazione finora

- 2007 Code Breakfast Q&ADocumento5 pagine2007 Code Breakfast Q&AFlorabel Tolentino Sera JosefNessuna valutazione finora

- Bibliography NewDocumento2 pagineBibliography NewFlorabel Tolentino Sera JosefNessuna valutazione finora

- RAP Neme EfficiencyasaTandDresource 2012 Feb 14Documento40 pagineRAP Neme EfficiencyasaTandDresource 2012 Feb 14Meral SüzerNessuna valutazione finora

- Out of StepDocumento15 pagineOut of StepFlorabel Tolentino Sera JosefNessuna valutazione finora

- OSHA Safety Rules - KYDocumento1 paginaOSHA Safety Rules - KYFlorabel Tolentino Sera JosefNessuna valutazione finora

- Key Lessons About Market-Based Mechanisms 市场机制的主要经验教训: David Crossley, Senior Advisor, RAP David Crossley,高级顾问,RAPDocumento23 pagineKey Lessons About Market-Based Mechanisms 市场机制的主要经验教训: David Crossley, Senior Advisor, RAP David Crossley,高级顾问,RAPFlorabel Tolentino Sera JosefNessuna valutazione finora

- DOE Strategic Plan - 2012 GPRA AddendumDocumento5 pagineDOE Strategic Plan - 2012 GPRA AddendumFlorabel Tolentino Sera JosefNessuna valutazione finora

- Short-Circuit Calculations AnswersDocumento2 pagineShort-Circuit Calculations AnswersadauNessuna valutazione finora

- 2005 Code BreakfastDocumento5 pagine2005 Code BreakfastFlorabel Tolentino Sera JosefNessuna valutazione finora

- OSHA Safety Rules - KYDocumento1 paginaOSHA Safety Rules - KYFlorabel Tolentino Sera JosefNessuna valutazione finora

- Module 9 Energy MGMT EconomicsDocumento31 pagineModule 9 Energy MGMT EconomicsFlorabel Tolentino Sera JosefNessuna valutazione finora

- RAP Swanson CEMRegulatoryMechanismsProviderDeliveredEE 2012 MarchDocumento72 pagineRAP Swanson CEMRegulatoryMechanismsProviderDeliveredEE 2012 MarchFlorabel Tolentino Sera JosefNessuna valutazione finora

- RAP Gottstein BCM EEM12 Florence 2012 May 10Documento41 pagineRAP Gottstein BCM EEM12 Florence 2012 May 10Florabel Tolentino Sera JosefNessuna valutazione finora

- Synapse Hurley DemandResponseAsAPowerSystemResource 2013 May 31Documento76 pagineSynapse Hurley DemandResponseAsAPowerSystemResource 2013 May 31raul_bsuNessuna valutazione finora

- Urban Planning Thesis Topics CeptDocumento7 pagineUrban Planning Thesis Topics Ceptmarianaarnoldmadison100% (1)

- Environmental Planning Quiz (35 Questions)Documento7 pagineEnvironmental Planning Quiz (35 Questions)DutchsMoin Mohammad100% (2)

- Yemane Berhe Concept Note For ECO Axum PDFDocumento96 pagineYemane Berhe Concept Note For ECO Axum PDFabel_kayel100% (1)

- EPB Lakeview Lodge FNDocumento50 pagineEPB Lakeview Lodge FNSimon Tembo100% (1)

- Environment: Definition Scope & ImportanceDocumento17 pagineEnvironment: Definition Scope & ImportanceNavjoshNessuna valutazione finora

- Swot Analysis of Sustainable Goals in An Australian Context 3Documento2 pagineSwot Analysis of Sustainable Goals in An Australian Context 3api-658413408Nessuna valutazione finora

- Assignment Alternative Energy Technology 30-10 - 2019Documento2 pagineAssignment Alternative Energy Technology 30-10 - 2019joseph gikonyoNessuna valutazione finora

- ĐỀ 1Documento3 pagineĐỀ 1Nguyễn Tùng MinhNessuna valutazione finora

- Sustainable Design and Construction - Sustainability Checklist GuidanceDocumento2 pagineSustainable Design and Construction - Sustainability Checklist GuidanceescfanNessuna valutazione finora

- Biophotolysis-Based Hydrogen Production by CyanobaDocumento12 pagineBiophotolysis-Based Hydrogen Production by CyanobaAshwary Sheel Wali Research Scholar, Dept of Mech Engg., IIT (BHU)Nessuna valutazione finora

- Sample Proposal: Increasing Awareness of HIV / AIDS - UgandaDocumento9 pagineSample Proposal: Increasing Awareness of HIV / AIDS - UgandabelmondNessuna valutazione finora

- Presentation Green Jobs ENDocumento12 paginePresentation Green Jobs ENKlaudija LutovskaNessuna valutazione finora

- Sustainable Development Goals for CitiesDocumento35 pagineSustainable Development Goals for CitieshasnolNessuna valutazione finora

- Hexa Research IncDocumento4 pagineHexa Research Incapi-293819200Nessuna valutazione finora

- 1.8 SAK Conservations of Biodiversity EX-SITU in SITUDocumento7 pagine1.8 SAK Conservations of Biodiversity EX-SITU in SITUSandipNessuna valutazione finora

- Eight DimensionsDocumento1 paginaEight DimensionsAnonymous FfaqvAx45GNessuna valutazione finora

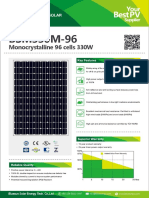

- BSM330M-96: Monocrystalline 96 Cells 330WDocumento2 pagineBSM330M-96: Monocrystalline 96 Cells 330WMostafaNessuna valutazione finora

- SBRDocumento18 pagineSBREco Green Sales & MarketingNessuna valutazione finora

- Adrianus Van Haandel (Author) Book List - IsBNDocumento2 pagineAdrianus Van Haandel (Author) Book List - IsBNksbbs100% (1)

- OneEco-AirportPlan en PDFDocumento8 pagineOneEco-AirportPlan en PDFgilang isyafiNessuna valutazione finora

- Class VIII - Interdisciplinary Holiday HomeworkDocumento8 pagineClass VIII - Interdisciplinary Holiday HomeworkDivya VatsaNessuna valutazione finora

- Environment EconomicsDocumento9 pagineEnvironment EconomicsUmar SaleemNessuna valutazione finora

- Bruce BremerDocumento21 pagineBruce BremerNutsdieyaa ErnieNessuna valutazione finora

- 1Malaysia Green Clean Campaign SpeechDocumento2 pagine1Malaysia Green Clean Campaign SpeechSilmi SubriNessuna valutazione finora

- Solar Thermal Power - 2.1 Introduction-HODocumento11 pagineSolar Thermal Power - 2.1 Introduction-HORado DetonaNessuna valutazione finora

- Wind Power Tech PaperDocumento28 pagineWind Power Tech PaperanandmaverickNessuna valutazione finora

- RemoDocumento8 pagineRemoJeseemNessuna valutazione finora

- RYA CHP (Göteborg Energi) : Case Study Factsheet Europe, SwedenDocumento1 paginaRYA CHP (Göteborg Energi) : Case Study Factsheet Europe, SwedenNander Acosta OyarceNessuna valutazione finora

- Mas Enry1Documento98 pagineMas Enry1Enry GunadiNessuna valutazione finora

- HSE Horizon Scanning Short Report Marine Renewable Energy: Status: Active MonitoringDocumento3 pagineHSE Horizon Scanning Short Report Marine Renewable Energy: Status: Active MonitoringRauf HuseynovNessuna valutazione finora