Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Dispensers of California

Caricato da

Shweta GautamDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Dispensers of California

Caricato da

Shweta GautamCopyright:

Formati disponibili

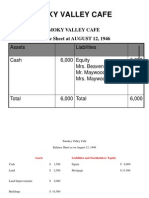

Dispensers of California, Inc

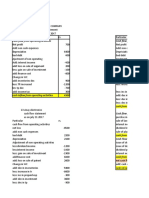

Balance Sheet Transaction Analysis

Transactions

Assets = Liabilities Equity

1a

1b

Hynes investment

Other investors

+ Patent $120,000

+ Cash 80,000

+ Common Stock $120,000

+ Common Stock 80,000

2 Incorporation costs - Cash $2,500 - Retained earnings $2,500

3 Equipment purchase -Cash $85,000

+ Equipment 85,000

4 Redesign costs - Cash $25,000 - Retained earnings $25,000

5 Component parts purchase + Inventory $212,100

- Cash 212,100

6 Bank loan

Bank loan repaid

Loan interest

+ Cash $30,000

- Cash 30,000

- Cash 500

+Bank loan $30,000

- Bank loan 30, 000

- Retained earnings $500

7 Manufacturing payroll - Cash $145,000 - Retained earnings $145,000

8 Other manufacturing costs - Cash 62,000 - Retained earnings $62,000

9 Selling general and administration - Cash $63,000 - Retained earnings $63,000

10 Ending inventory (cost of goods sold) * - Inventory $197,000 - Retained earnings $197,000

11 Sales + Cash $598,500 + Retained earnings $598,500

12 Incorporation and redesign costs (expenses as

incurred)

See 2 and 4

13 Depreciation - Equipment $8,500 - Retained earnings $8,500

14 Patent amortization - Patent $20,000 - Retained earnings $20,000

15 Ending work-in-progress and completed

inventory (none) (cost of goods sold)**

See 5, 7, 8, 10 and 13

16 Dividends - Cash $5,000 - Retained earnings $5,000

17 Income Taxes +Taxes payable $22,500 - Retained earnings $22,500

* Beginning component parts inventory $0 **Component parts used $197,000

Purchases 212,100 Manufacturing payroll 145,000

Total available 212,100 Other manufacturing costs 62,000

Ending component parts inventory 15,100 Depreciation 8,500

Components parts used 197,000 Cost of goods sold 412,500

Dispensers of California, Inc.

12-month Profit Plan

Sales $598,500

Cost of goods sold

Components $197,000

Mfg payroll 145,000

Other Mfg. 62,000

Depreciation 8,500 412,500

Gross margin $186,000

Selling, general and

Administration 63,000

Patent 20,000

Redesign costs 25,000

Incorporation costs 2,500

Operating profit $75,500

Interest 500

Profit before taxes $75,000

Tax expense 22,500

Net Income $52,500

Dispensers of California, Inc.

Projected Year-end Balance Sheet

Assets Liabilities

Cash $78,400 Taxes payable $22,500

Components inventory 15,100 Current liabilities $22,500

Current assets $93,500

Equipment (net) 76,500 Owners Equity

Patent (net) 100,000 Capital stock $200,000

___ Retained earnings 47,500

$270,000 $270,000

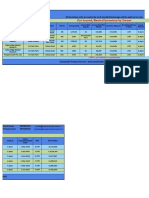

Dispensers of California, Inc.

Change in Retained Earnings

Beginning retained earnings $0

Net income 52,500

Dividends (5,000)

Ending retained earnings $47,500

Dispensers of California, Inc.

Cash Reconciliation

Receipts Disbursements

New equity capital $80,000

Incorporation $2,500

Equipment 85,000

Redesign 25,000

Component parts 212,100

Bank loan 30,000

Bank loan 30,000

Loan interest 500

Manufacturing payroll 145,000

Other manufacturing 62,000

S G & A 63,000

Sales 598,500

Dividend 5,000

Total $708,500 $630,100

Cash Reconciliation

Receipts $708,500

Disbursements 630,100

Ending Balance $78,400

Dispensers of California, Inc.

Statement of Cash Flows (Direct Method)

Collections from customers $598,500

Payments to suppliers (212,100)

Payments to employees (295,000)

Legal payments (2,500)

Interest (500)

Operating cash flow $89,400

Equipment purchases (85,000)

Investing cash flow $(85,000)

Bank loan 30,000

Repayment of bank loan (30,000)

Capital 80,000

Dividends (5,000)

Financing cash flow $75,000

Change in cash $78,400

Beginning cash 0

Ending cash $78,400

Potrebbero piacerti anche

- Case Forest City Tennis ClubDocumento9 pagineCase Forest City Tennis ClubAhmedNiaz100% (1)

- HEWLETT PACKARD - Computer Systems Organization: Selling To Enterprise CustomersDocumento16 pagineHEWLETT PACKARD - Computer Systems Organization: Selling To Enterprise CustomersAbhishek GaikwadNessuna valutazione finora

- Northboro Machine Tools CorporationDocumento9 pagineNorthboro Machine Tools Corporationsheersha kkNessuna valutazione finora

- Lori Crump Accounting Case StudyDocumento1 paginaLori Crump Accounting Case StudyHarsh Anchalia100% (1)

- Dispensers of California Case AnalysisDocumento10 pagineDispensers of California Case AnalysisAvinash Singh100% (1)

- Maruti Manesar Lockout: The Flip Side of People Management: Case Study by Group 9Documento7 pagineMaruti Manesar Lockout: The Flip Side of People Management: Case Study by Group 9manik singh100% (1)

- Case Study 4 - 3 Copies ExpressDocumento8 pagineCase Study 4 - 3 Copies ExpressJZ0% (1)

- Case Problem 1 - Product MixDocumento7 pagineCase Problem 1 - Product Mixgorgory_30% (1)

- SecB Group7 ODD CaseDocumento2 pagineSecB Group7 ODD CaseKanuNessuna valutazione finora

- Making A Tough Personnel Decision at Nova Waterfront HotelDocumento11 pagineMaking A Tough Personnel Decision at Nova Waterfront HotelSiddharthNessuna valutazione finora

- TCS Case AnalysisDocumento3 pagineTCS Case AnalysisShubham PandeyNessuna valutazione finora

- Revenue Recognition at HBPDocumento2 pagineRevenue Recognition at HBPtechna8Nessuna valutazione finora

- Cavincare Case Study Decision SheetDocumento1 paginaCavincare Case Study Decision SheetNENCY PATELNessuna valutazione finora

- Music Mart SolutionDocumento6 pagineMusic Mart SolutionStranger Sinha50% (2)

- EcofDocumento6 pagineEcofAnish NarulaNessuna valutazione finora

- Smoky Valley CafeDocumento3 pagineSmoky Valley Cafemohit_namanNessuna valutazione finora

- 01 Ribbons N' Bows - SolutionDocumento4 pagine01 Ribbons N' Bows - SolutionShivam Kanojia100% (2)

- Marketing Management (Session 3) : Case: Reinventing Adobe. by Nilanjan Mukherjee (PGP13156) Section CDocumento2 pagineMarketing Management (Session 3) : Case: Reinventing Adobe. by Nilanjan Mukherjee (PGP13156) Section CNILANJAN MUKHERJEE100% (1)

- Case Analysis - Nitish@Solutions Unlimited 1Documento5 pagineCase Analysis - Nitish@Solutions Unlimited 1Piyush SahaNessuna valutazione finora

- End Point Model CaseDocumento8 pagineEnd Point Model CaseSAURAV KUMAR GUPTANessuna valutazione finora

- Solman 12 Second EdDocumento23 pagineSolman 12 Second Edferozesheriff50% (2)

- Case Music MartDocumento23 pagineCase Music MartDarwin Dionisio Clemente75% (4)

- Boardroom GameDocumento12 pagineBoardroom GameShivam SomaniNessuna valutazione finora

- Group11 Sharma IndustriesDocumento7 pagineGroup11 Sharma IndustriesRohanNessuna valutazione finora

- Pom Asychronous 2Documento1 paginaPom Asychronous 2B V Avinash Chowdary 2027931Nessuna valutazione finora

- Guesstimates Fact SheetDocumento2 pagineGuesstimates Fact SheetPhaneendra SaiNessuna valutazione finora

- Interest (1 - (1+r) - N/R) + PV of The Principal AmountDocumento2 pagineInterest (1 - (1+r) - N/R) + PV of The Principal AmountBellapu Durga vara prasadNessuna valutazione finora

- Cash Flow StatementDocumento4 pagineCash Flow StatementRavina Singh100% (1)

- Mphasis - ALP Case Study 2 PDFDocumento4 pagineMphasis - ALP Case Study 2 PDFshivamchughNessuna valutazione finora

- Maria Hernandez and AssociatesDocumento9 pagineMaria Hernandez and AssociatesMalik Fahad YounasNessuna valutazione finora

- Industrial Relations at Asian Paints - ePGPX03 - Group - 9Documento13 pagineIndustrial Relations at Asian Paints - ePGPX03 - Group - 9manik singh0% (2)

- Case1: Evie - Ai: The Rise of Artificial Intelligence and The Future of WorkDocumento4 pagineCase1: Evie - Ai: The Rise of Artificial Intelligence and The Future of WorkSoubhagya DashNessuna valutazione finora

- A5 - Indian ProductsDocumento18 pagineA5 - Indian ProductsVignesh nayakNessuna valutazione finora

- Sidhu'S Predicament: Case AnalysisDocumento5 pagineSidhu'S Predicament: Case AnalysisJithu JoseNessuna valutazione finora

- Hamilton - Case A - 5 PDFDocumento2 pagineHamilton - Case A - 5 PDFJayash Kaushal0% (1)

- Ramji Bai VasavaDocumento9 pagineRamji Bai Vasavaajatc6048100% (1)

- Sombrero - Proposed Fruit Juice Outlet PDFDocumento19 pagineSombrero - Proposed Fruit Juice Outlet PDFAngeli Aurelia100% (1)

- Maruti Case AnalysisDocumento2 pagineMaruti Case AnalysisJai SrivastavaNessuna valutazione finora

- Lava Case Study Decision Paper KaushalDocumento4 pagineLava Case Study Decision Paper Kaushalkaushal dhapareNessuna valutazione finora

- Silvia Caffe - SolutionDocumento1 paginaSilvia Caffe - SolutionMurtaza BadriNessuna valutazione finora

- Copy of Copy of Gentle Electric Part 2Documento3 pagineCopy of Copy of Gentle Electric Part 2inekelechi17% (6)

- Problems & Solutions - RNSDocumento28 pagineProblems & Solutions - RNSAyushi0% (1)

- Osd-10 Boldflash: Cross-Functional Challenges in The Mobile DivisionDocumento2 pagineOsd-10 Boldflash: Cross-Functional Challenges in The Mobile DivisionGaurav MadhwalNessuna valutazione finora

- Stafford Press SolvedDocumento2 pagineStafford Press SolvedMurali DharanNessuna valutazione finora

- NACCO Case PrepDocumento2 pagineNACCO Case Prepmiriel JonNessuna valutazione finora

- Case 2-2 Music Mart Balance Sheet 1 OctDocumento5 pagineCase 2-2 Music Mart Balance Sheet 1 OctAnubhav Jha100% (3)

- VNFPPDocumento1 paginaVNFPPSiddharth100% (1)

- New Year Eve CrisisDocumento6 pagineNew Year Eve CrisisManoj Kumar MishraNessuna valutazione finora

- Persuasive Essay Rocky Mountain Mutual CaseDocumento2 paginePersuasive Essay Rocky Mountain Mutual Casegoldust0100% (1)

- Davey Brothers Watch Co. SubmissionDocumento13 pagineDavey Brothers Watch Co. SubmissionEkta Derwal PGP 2022-24 BatchNessuna valutazione finora

- Cable Contractor - Aishwarya - Anand - SolankiDocumento1 paginaCable Contractor - Aishwarya - Anand - SolankiAishwarya SolankiNessuna valutazione finora

- Mid-Term Question Paper Set - 1Documento17 pagineMid-Term Question Paper Set - 1Archisha Srivastava0% (1)

- Hi-Ho, Yo-Yo, Inc. ReportDocumento4 pagineHi-Ho, Yo-Yo, Inc. ReportEdyta OdorowskaNessuna valutazione finora

- Coffee War Case AnalysisDocumento3 pagineCoffee War Case AnalysisSreeda PerikamanaNessuna valutazione finora

- Team9 - Crafting & Executing Offshore IT StrategyDocumento6 pagineTeam9 - Crafting & Executing Offshore IT StrategyAnkit SachdevaNessuna valutazione finora

- Stafford Press CaseDocumento4 pagineStafford Press CaseAmit Kumar AroraNessuna valutazione finora

- Dispensers of California, Inc.Documento7 pagineDispensers of California, Inc.Prashuk SethiNessuna valutazione finora

- Jawaban 11 - Statement of Cash FlowDocumento2 pagineJawaban 11 - Statement of Cash FlowBie SapuluhNessuna valutazione finora

- 2208 ch22Documento7 pagine2208 ch22Clyde Ian Brett PeñaNessuna valutazione finora

- Chema LiteDocumento8 pagineChema LiteHàMềmNessuna valutazione finora

- 3 Sept 2018Documento50 pagine3 Sept 2018siva kNessuna valutazione finora

- Chapter 13Documento67 pagineChapter 13HugooNessuna valutazione finora

- Long-Term Funds:: Sources and CostsDocumento23 pagineLong-Term Funds:: Sources and CostsArmilyn Jean Castones0% (1)

- Blue Chip CompanyDocumento12 pagineBlue Chip CompanyMuralis MuralisNessuna valutazione finora

- Sustainable Pre Leased 06122019Documento2 pagineSustainable Pre Leased 06122019vaibhav vermaNessuna valutazione finora

- AgreementtoLease Commercial ShortForm 511 PDFDocumento3 pagineAgreementtoLease Commercial ShortForm 511 PDFtom75% (4)

- Atlantic Tours General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003Documento4 pagineAtlantic Tours General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003babe447Nessuna valutazione finora

- ACCO320Midterm Fall2013FNDocumento14 pagineACCO320Midterm Fall2013FNzzNessuna valutazione finora

- Federal RetirementDocumento50 pagineFederal RetirementFedSmith Inc.100% (1)

- Course Content and Objectives: ACCT 151 Introduction To Financial Accounting FALL 2014 Professor BrodishDocumento18 pagineCourse Content and Objectives: ACCT 151 Introduction To Financial Accounting FALL 2014 Professor BrodishzeroyopNessuna valutazione finora

- Comp Acct G 1 PrelimDocumento2 pagineComp Acct G 1 PrelimTiffanyNessuna valutazione finora

- Financial Statement AnalysisDocumento26 pagineFinancial Statement Analysissagar7Nessuna valutazione finora

- Irrevocable Master Fee Protection Agreement SampleDocumento3 pagineIrrevocable Master Fee Protection Agreement SampleFAHAMI HASHIMNessuna valutazione finora

- Rapport Startup 2023 PDFDocumento23 pagineRapport Startup 2023 PDFsalma hilaliNessuna valutazione finora

- Application Form For Clean LoansDocumento2 pagineApplication Form For Clean LoansmaheshNessuna valutazione finora

- White County Lilly Endowment Scholarship ApplicationDocumento11 pagineWhite County Lilly Endowment Scholarship ApplicationVoodooPandasNessuna valutazione finora

- Hire Purchase For Bcom and Nepal CADocumento14 pagineHire Purchase For Bcom and Nepal CANandani BurnwalNessuna valutazione finora

- Meredith WhitneyDocumento13 pagineMeredith WhitneyFortuneNessuna valutazione finora

- Cambridge IGCSE: Accounting For Examination From 2020Documento12 pagineCambridge IGCSE: Accounting For Examination From 2020Abdallah OmarNessuna valutazione finora

- Ch17 - Analysis of Bonds W Embedded Options.ADocumento25 pagineCh17 - Analysis of Bonds W Embedded Options.Akerenkang100% (1)

- Madhuban Bapudham SchemeDocumento3 pagineMadhuban Bapudham SchemerahulNessuna valutazione finora

- 24.4 SebiDocumento30 pagine24.4 SebijashuramuNessuna valutazione finora

- Money - MultiplierDocumento10 pagineMoney - MultiplierSparsh JainNessuna valutazione finora

- The Essential Guide To Systems Trading (For Non-Programmers)Documento29 pagineThe Essential Guide To Systems Trading (For Non-Programmers)Constantino L. Ramirez III100% (4)

- Cover Cek MaybankDocumento2 pagineCover Cek MaybankArifa HasnaNessuna valutazione finora

- Public Trust Registration Office: Trust Accounts Submission Verification FormDocumento1 paginaPublic Trust Registration Office: Trust Accounts Submission Verification FormHashtag ComputersNessuna valutazione finora

- Acc117 Group AssignmentDocumento15 pagineAcc117 Group AssignmentMUHAMMAD HIFZHANI AZMANNessuna valutazione finora

- UAE ConfDocumento20 pagineUAE ConfAkshata kaleNessuna valutazione finora

- USDA USFS Nursery Manual For Native Plants - A Guide For Tribal Nurseries - Nursery Management Nursery Manual For Native Plants by United States Department of Agriculture - U.S. Forest Service PDFDocumento309 pagineUSDA USFS Nursery Manual For Native Plants - A Guide For Tribal Nurseries - Nursery Management Nursery Manual For Native Plants by United States Department of Agriculture - U.S. Forest Service PDFGreg John Peterson100% (2)

- Project On Partnership Accounting PDFDocumento17 pagineProject On Partnership Accounting PDFManish ChouhanNessuna valutazione finora