Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Reading Price & Volume Across Multiple Timeframes - Dr. Gary Dayton

Caricato da

mr12323Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Reading Price & Volume Across Multiple Timeframes - Dr. Gary Dayton

Caricato da

mr12323Copyright:

Formati disponibili

APRIL2013 ATMASPHERE|5

READING PRICE & VOLUME ACROSS

MULTIPLE TIME FRAMES: APPLICATION

OFTHEWYCKOFFMETHOD

BYDR.GARYDAYTON

In this article, I highlight how reading price bars and volume across multiple

time frames can give both the swing trader and the day trader a substantial

edge in their trading. This approach was first described by Richard D.

WyckoffearlyintheTwentiethCentury.

Considered the father of technical analysis, Wyckoff distinguished market

phenomena like support and resistance, climactic action, and testing.

Despite the many changes since Wyckoffs time, understanding how supply

and demand is revealed through price action and volume can be of high

valuetothetechnicalanalystinassessingtodaysmarkets.

BeginWiththeBackground:WeeklyChart

Chart1:WeeklyChart

Beginning with the weekly chart, we use recent trading activity in the

Canadian Dollar (CD) currency futures (Chicago Mercantile Exchange) to

illustrate some of the skills of chart reading. The weekly has been trading

withinthehighandlowofJulyandOctober2011,respectively.AlthoughCD

held two higher lows at A and C, the market failed to follow through to the

upside at D. Instead, a Wyckoff Upthrust (UT) occurred when price closed

below the resistance level at B. This UT was tested at F on comparatively

6|ATMASPHERE APRIL2013

lightervolumeindicatingalackofbuyingjustundertheoldresistancelevel,

B.ThetestatFwasalsoanUT,moreclearlydefinedonadailychart,anda

choicelocationfortheswingtradertoinitiateasellshorttrade.

From the test at F, the market moved lower on increasing volume and wide

range, indicating active selling. The selling stopped just below the support

level at E with the next week closing above that support. The failure to

followthroughtothedownsideatasupportlevelistheoppositesituationof

a Wyckoff Upthrust. When price closes above support after dipping

underneathit,itisknownasaWyckoffSpring.

The swing trader is now presented with a dilemma. Having sold short, a

bullish spring begins to unfold. Should the short be covered, and perhaps a

long position initiated? The answer may be found in the lower time frame

charts.

GoingDeeper:DailyChart

Chart2:DailyChart

The daily chart shows the Wyckoff UT at F viewed as a test on the weekly

chart. The price bars at 1 and 2 show buyers unable to hold price above

recent resistance. Instead, sellers entered and closed these days in the

middle of their ranges and underneath resistance. The elevated volume

reinforcestheweaknessseeninthepricebars.Subsequentdayspaintlower

highs, lower lows, and all but one lower closesindicative of a market

unable to rally. Sellers aggressively drive price down beginning at 3 with

APRIL2013 ATMASPHERE|7

wide ranges, poor closes and increased volume to the low at G, indicating

heavyliquidation.

Andthenthedowndraftstops.Itisnormalforadescendingmarkettopause

and rally at support. The key question for the swing trader is whether the

rallyissimplyatechnicalpullbackoffofsupportorthestartofabullishmove

up.Thereareafewthingstoconsider.

Traders tend to rivet their eyes on the last few barsat the right edge of the

chart.Toreadachartcorrectly,itisimportanttogodeeperthanafewbars

and, instead, take in a more holistic view. Thus, the first consideration is

seenontheweeklychart.AtB,D,andF,buyershadthreeopportunitiesto

take this market higher, but failed. Although possible, it is less likely that a

strong rally would begin with this background. On the daily chart, we see a

swift fall from F to G. Volume expands on this large move down. Selling is

clearlydominant,asitshouldbewhenignitedbyaweeklyupthrust;thisisa

strongsignofweakness.ComparethisdownmovetotheupmovefromGto

H. Although there two or three strong days on the rally from G to H, the

dailyrangesandoverallvolumeiscomparativelyweakerthantherangesand

volume from F to G. Buyers will have to mount a much greater effort to

overcometherecentsupply.

We also see the rally from G to H stop around the lows of midDecember

where the market found support at that time. Because this support was

knifedthroughsoeasilybybar4,wewouldnowanticipateittoberesistance

as the market returns to that level at Markets frequently return to areas of

accelerated movement on high volume, such as bar 4. Although supply

dominated, the high volume also indicates the presence of buying. The

market may test these areas to assure itself that buyers have indeed been

removedandavoidoppositiontolowerprices.Thus,wewanttolookatthis

areacarefully.Abarbybarassessmentcanrevealmuchaboutthemarkets

strengthhere.

The rally from the lows at G shows a good move up with firm and rising

closes. At bar 5, volume increases. This is not alarming as good progress is

made on this day, and the range is wide, proportionate to the volume. The

nextday,bar6,tellsadifferentstory.Onnearlythesameamountofvolume

as5,therangeonthisdaynarrows.Itisabouthalftherangeofbar5,andits

rangeremainsinsidetherangeofbar5.Althoughtherewascertainlybuying

onbar6,sellingkeptthebuyersfrommakingthekindofprogresstheymade

thepreviousday.IntheWyckoffMethod,thisisknownaseffortvs.result.

Volume represents effort and price is the result. Here we see large effort

with little result, a strong indication that sellers have again become active.

Thenextday,bar7,triestorallyabovethehighsof5and6,butfailsonlight

volume,indicatingbuyersarebecomingexhausted.Thesuddenhighvolume

andsubsequentlackofprogressdisplayedbybars5,6and7,suggestaminor

buyingclimaxhasoccurred.Thelasttwodaysonthechartbars8and9do

showthatbuyerswereabletoclosethesedaysontheirhighs,sothemarket

canbe expected topushalittlehigher. Volumeon bothdaysis thelightest

of the last three weeks. This adds to the developing story of weakness.

Thus, we want to be alert to any weak rally up to, just above, or just below

thehighofbar7.

DayTrading

8|ATMASPHERE APRIL2013

We will next take on the perspective of the day trader. For intraday

assessment,Iuseatickbarchart.Manyperiodsinthenear24hourmarkets

are lightly traded, making timebased charts more difficult to understand.

Tick charts compress this data into a more readerfriendly format while at

the same time retaining price bar characteristics that show demand and

supply. We also use an analytic tool developed by David Weis based on

WyckoffsoriginalwaveandtapereadingchartscalledtheWeisWave.This

tool plots the swingswhat Wyckoff called wavesas an overlay onto the

price bars. It also plots the volume of each wave along the bottom

histogram.Inhisday,Wyckoffplottedhischartsbyhandfromdatareadoff

the ticker tape. This is no longer practical in todays markets. The Weis

Wavedoesthisusefuljobforus.

Chart3:IntradayChart#1

IntradayChart1includesdatashowingthedailyhighsofbars7,8,and9and

their associated resistance line. The next day, the market rallies above the

highofbar7.Weimmediatelynotethattheupmoveissuspectbecausethe

volume on wave B is comparatively light. We note the up waves two days

ago (A) showed greater demand than we are now seeing on the break out.

We also see the market reverse and push easily down through and

underneath the resistance line along the daily highs. Just like D on the

weekly chart and F on the daily chart, this, too, is a Wyckoff Upthrust,

indicatingthepresenceofsignificantsellingashigherpricesabovetherecent

dailyhighsarerejected.

APRIL2013 ATMASPHERE|9

HighdownsidevolumecomesinonwaveCshowingstrongselling.Wenote

that wave C is also larger than recent down waves and up waves; another

indication supply has entered the market. The weak rally on wave D stops

justbelowresistance.Thisupwaveanditsassociatedvolumearesmall.Itis

atestoftheupthrust.Asthemarketturnsbackdownattheredarrow,the

daytradercaninitiateashorttrade.

Price moves through the intraday support level that caused wave C to stop.

Both waves and volume remain stronger to the downside than the upside.

Thus, the very weak rally to the underside of the intraday support line at E

offersanotheropportunityforashorttrade.

Ingeneral,theminimumprofittargetforanupthrustistheoppositesideof

thetradingrange.PricetravelstothislevelonwaveF,comingtothemulti

day low, which is a good location to cover shorts for the day trader who

wants to go home flat. In reviewing the days trading, we note that supply

has been stronger than demand, as seen by both the length of the waves

(down compared to up waves) and the down volume. We anticipate lower

pricesinthenearfuture.

Chart4:IntradayChart#2

TurningtoIntradayChart2,weseethatthenextdaybeginswithaweakrally

thatisunabletopushabovetheintradaysupportlinefromyesterday(atC),

which has now become resistance, just as we saw on the daily chart at H.

ThepoorrallyendsinanintradayupthrustatthetopofwaveG,whereaday

trader can enter short as the market starts down. Note that volume

increases on wave G without much advance in price. The effort made by

buyersonwaveGwasmetbyasuperiorforceofsellinglimitingupsideprice

progressandaddingtotheconvictionofashortsaleontheupthrust.

The market makes good progress down on good downside volume through

thesupportlevelofFdowntoH.Whydoesthemarketstophere?Thelow

10|ATMASPHERE APRIL2013

ofwaveHisatthesamelevelastheweeklysupportatE.Itisanobviousand

logical location for the intraday market to at least pause. The minor down

wave between wave H and wave I shows that selling has abated. A rally

wouldnowbeexpected.

The market pulls back on wave I. A standard trend channel highlights an

overbought condition at the top of wave I. We also see the characteristic

effort vs. result in the high volume, little price progress of wave I. As the

marketturnsbackdowntoandunderthesupplylineofthetrendchannel,a

shorttradecanbeentered.

Shorts can be covered as the market is unable to fall below the days low if

thetraderpreferstoflattenattheendoftheday.Thereis,however,strong

evidence for further follow through to the downside for the next day. This

daysactionclearlyshowssellersincontrol.Downwavesremainlargerthan

up waves and downside volume predominates. The day began on its highs;

brokeyesterdayslow,andclosednearonitslows.Thetwoattemptstorally

(waves G and I) were both feeble. These are all characteristics of a weak

market.

The market does follow through to the downside the next trading day. We

notice, however, that price has reached an oversold position in the down

trendchannel,thesupplylineofwhichwasdrawnfromthetopsofwavesB

andG.AparallellinewouldthenhavebeendrawnfromthelowatwaveF,

butthemarketwassoweakthatitexceededthatline(notshown)rendering

ituseless.Inthiscase,aparalleldemandlineisdrawnfromthelowofwave

H. Wave J reaches the bottom of the trend channel. The astute Wyckoff

analyst would recognize that the volume at J has lessened (compared to

waves F, H and the wave after I). As the market turns up from wave K, the

signaltocovershortsandprepareforarallyisclear.

The rally ends at the top of wave L. An uptrend channel highlights the

oversoldpositionofprice.Pricehasrisenclosetothetopofthedowntrend

channelandjustbelowresistancethathasformedfromthelowsofwaveH.

Giventhedowntrendingconditionsofthismarket,itisunlikelypricewillrise

throughthiscombinationofresistance.Ashortmaybetakenhere,andprice

movesdownreturningtoyesterdayslowsatthebottomofwavesJandK.

Note carefully the rally from the lows at JK to the high at L. Although this

rally did not break the supply line, it is the largest up move since the down

trend began at B. We also note that more upside volume came in on this

move than we have seen in this downtrend. These two conditions indicate

that demand is beginning to enter the market. On the subsequent down

wave M, we see large downside wave volume, but price is unable to push

through yesterdays lows. This is an effort to go lower without a

proportionate result, indicating the buyers are absorbing selling. The time

periodisalsoimportant.Wehavenotseensuchhighintradayvolumeduring

thisperiod.Theseconditionsalertustoachangeinmarketbehavior.Atthe

bottomofwaveM,pricedipsunderneaththesupportofyesterdayslowand

closesbackaboveit.Withthestrengthseenintheimmediatebackground,a

longtrademaybeinitiatedatthisWyckoffSpring(greenarrow).

Conclusion

APRIL2013 ATMASPHERE|11

This article highlights the application of the Wyckoff Method in the modern

CanadianDollarcurrencyfuturesmarket.Althoughtheprinciplesofreading

supply and demand highlighted here were first described over 80 years ago

by Richard Wyckoff, they continue to serve the technical analyst and trader

well. In this modern era of advanced technologies where we tend to

emphasize indicators, statistical models and other derivatives, is easy to

overlook the straightforward behavioral principles of buying and selling

underlyingallfreelytradedmarkets.Readingsupplyanddemandcontinues

tobeavaluableguidetothemarketsnextlikelyactionandshouldbeapart

ofeveryanalystsskillset.

Dr. Gary Dayton is an active trader and a

psychologist.Hecreatedatrainingprogramcalled

Deep Practice based on psychological research in

expert performance to help traders acquire the

skillsoftheWyckoffMethod.Dr.Garyiscurrently

writingabookontradingpsychologytobepublishedbyJohnWiley&Sons.

www.TradingPsychologyEdge.com

Potrebbero piacerti anche

- Summary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthDa EverandSummary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthNessuna valutazione finora

- VSA - Cheat SheetDocumento18 pagineVSA - Cheat SheetAriel Devulsky90% (20)

- Summary of James F. Dalton, Eric T. Jones & Robert B. Dalton's Mind Over MarketsDa EverandSummary of James F. Dalton, Eric T. Jones & Robert B. Dalton's Mind Over MarketsNessuna valutazione finora

- Wyckoff Bar by Bar AnalysisDocumento4 pagineWyckoff Bar by Bar AnalysisIgor Shishkin91% (11)

- Wyckoff MethodsDocumento5 pagineWyckoff Methodsanalyst_anil1485% (13)

- Summary of Anna Coulling's A Complete Guide To Volume Price AnalysisDa EverandSummary of Anna Coulling's A Complete Guide To Volume Price AnalysisValutazione: 5 su 5 stelle5/5 (1)

- Vsa Basics From MTMDocumento32 pagineVsa Basics From MTMHafeezah Ausar100% (3)

- The New High: New Low Index: Stock Market’s Best Leading IndicatorDa EverandThe New High: New Low Index: Stock Market’s Best Leading IndicatorValutazione: 4 su 5 stelle4/5 (5)

- VSA Bar Definitions V 2Documento1 paginaVSA Bar Definitions V 2No Name89% (9)

- Mind Over Markets: Power Trading with Market Generated Information, Updated EditionDa EverandMind Over Markets: Power Trading with Market Generated Information, Updated EditionValutazione: 4 su 5 stelle4/5 (6)

- VSA Trade Set UpsDocumento28 pagineVSA Trade Set Upspirriper100% (14)

- The ABC's of VSADocumento21 pagineThe ABC's of VSAcarmenyeo80% (5)

- The Trader's Book of Volume: The Definitive Guide to Volume Trading: The Definitive Guide to Volume TradingDa EverandThe Trader's Book of Volume: The Definitive Guide to Volume Trading: The Definitive Guide to Volume TradingValutazione: 4.5 su 5 stelle4.5/5 (20)

- Volume Spread Analysis Improved With Wyckoff 2Documento3 pagineVolume Spread Analysis Improved With Wyckoff 2ngocleasing86% (7)

- Wouldn't You Like to Know Where the Stock Market is Heading?Da EverandWouldn't You Like to Know Where the Stock Market is Heading?Nessuna valutazione finora

- Richard Wyckoff False BreakoutsDocumento4 pagineRichard Wyckoff False Breakoutsdaviduk95% (20)

- VSA PrinciplesDocumento4 pagineVSA PrinciplesCryptoFX82% (11)

- Wyckoff e BookDocumento43 pagineWyckoff e BookIan Moncrieffe95% (22)

- How Charts Can Make You Money: An Investor’s Guide to Technical AnalysisDa EverandHow Charts Can Make You Money: An Investor’s Guide to Technical AnalysisNessuna valutazione finora

- Price VolumeDocumento3 paginePrice VolumeCryptoFX96% (24)

- Market Profile Basics: What is the Market Worth?Da EverandMarket Profile Basics: What is the Market Worth?Valutazione: 4.5 su 5 stelle4.5/5 (12)

- Wyckoff Terms and Their DefinitionsDocumento3 pagineWyckoff Terms and Their Definitionsbestnifty100% (7)

- Volume Spread Analysis Karthik MararDocumento34 pagineVolume Spread Analysis Karthik Mararku43to95% (19)

- How I Trade and Invest in Stocks and Bonds: Being Some Methods Evolved and Adopted During My Thirty-Three Years Experience in Wall StreetDa EverandHow I Trade and Invest in Stocks and Bonds: Being Some Methods Evolved and Adopted During My Thirty-Three Years Experience in Wall StreetValutazione: 5 su 5 stelle5/5 (3)

- Wyckoff Method - Law+TestDocumento6 pagineWyckoff Method - Law+Testallegre100% (3)

- The ABC's of VSADocumento20 pagineThe ABC's of VSAcarmenyeo100% (9)

- Three Books of Market Wisdom. Illustrated: Edwin LeFevre: Reminiscences of a Stock Operator Nicolas Darvas: How I Made 2,000,000 in the Stock Market Richard D. Wyckoff: How I Trade and Invest In Stocks and BondsDa EverandThree Books of Market Wisdom. Illustrated: Edwin LeFevre: Reminiscences of a Stock Operator Nicolas Darvas: How I Made 2,000,000 in the Stock Market Richard D. Wyckoff: How I Trade and Invest In Stocks and BondsNessuna valutazione finora

- Wave SetupsDocumento15 pagineWave SetupsRhino382100% (9)

- Two Roads Diverged: Trading DivergencesDa EverandTwo Roads Diverged: Trading DivergencesValutazione: 4 su 5 stelle4/5 (23)

- Volume Spread Analysis ExamplesDocumento55 pagineVolume Spread Analysis Examplesthinkscripter82% (11)

- Wyckoff 2.0: Structures, Volume Profile and Order FlowDa EverandWyckoff 2.0: Structures, Volume Profile and Order FlowValutazione: 4 su 5 stelle4/5 (28)

- The ABC's of VSA Accumulation Part IDocumento18 pagineThe ABC's of VSA Accumulation Part IThích Chánh Nghiệp100% (1)

- Wyckoff Price and Market StructuresDocumento2 pagineWyckoff Price and Market StructuresSeo Soon Yi100% (10)

- The Hidden Strengths of Volume AnalysisDocumento13 pagineThe Hidden Strengths of Volume AnalysisCryptoFX100% (8)

- Follow The Smart Money VSADocumento10 pagineFollow The Smart Money VSADavid Gordon100% (2)

- Volume Spread Analysis by Kartik MararDocumento47 pagineVolume Spread Analysis by Kartik MararNam Chun Tsang100% (3)

- Multiple Time Frame Analysis for Beginner TradersDa EverandMultiple Time Frame Analysis for Beginner TradersValutazione: 1 su 5 stelle1/5 (1)

- The ABC of VSA DistributionDocumento20 pagineThe ABC of VSA Distributionsliderboy100% (6)

- The ABC's of VSA: Stop ManagementDocumento22 pagineThe ABC's of VSA: Stop ManagementNo Name100% (1)

- Trade Secrets: Powerful Strategies for Volatile MarketsDa EverandTrade Secrets: Powerful Strategies for Volatile MarketsValutazione: 1.5 su 5 stelle1.5/5 (2)

- Price and Volume AnalystDocumento21 paginePrice and Volume Analystlaozi222100% (2)

- Wyckoff - 9 Classic Tests For Accumulation PDFDocumento16 pagineWyckoff - 9 Classic Tests For Accumulation PDFpt100% (5)

- Wyckoff VolumeDocumento6 pagineWyckoff VolumeMarcianopro183% (6)

- VSA Official Summary Part1Documento38 pagineVSA Official Summary Part1Otc Scan100% (2)

- Volume and Divergence by Gail MerceDocumento7 pagineVolume and Divergence by Gail MerceCryptoFX80% (5)

- Volume Spread Analysis RulesDocumento3 pagineVolume Spread Analysis RulesPRASADNessuna valutazione finora

- VSA Crib SheetDocumento9 pagineVSA Crib SheetSelwyn Lim100% (1)

- Introduction To Weis Waves PDFDocumento7 pagineIntroduction To Weis Waves PDFlequangtruong1602Nessuna valutazione finora

- Volume Secret MasterDocumento76 pagineVolume Secret MasterMARIANO736393% (27)

- Pro Finance Group Inc.: GraphDocumento1 paginaPro Finance Group Inc.: Graphmr12323Nessuna valutazione finora

- The Power of Habit - Charles DuhiggDocumento5 pagineThe Power of Habit - Charles DuhiggmanargyrNessuna valutazione finora

- HEAVEN AND THE ANGELS by H.A. BakerDocumento138 pagineHEAVEN AND THE ANGELS by H.A. Bakermannalinsky100% (3)

- Chifbaw Oscillator User GuideDocumento12 pagineChifbaw Oscillator User GuideHajar Aswad KassimNessuna valutazione finora

- The Revelation of HellDocumento18 pagineThe Revelation of HellEric Dacumi100% (12)

- Deepak Chopra The 7 Laws of SuccessDocumento6 pagineDeepak Chopra The 7 Laws of Successmr12323Nessuna valutazione finora

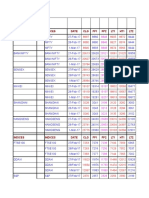

- Indices Indices Date CLG FP1 FP2 LT1 HT1 LT2Documento34 pagineIndices Indices Date CLG FP1 FP2 LT1 HT1 LT2mr12323Nessuna valutazione finora

- At ActiveDocumento3 pagineAt Activemr12323Nessuna valutazione finora

- Details of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018Documento5 pagineDetails of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018mr12323Nessuna valutazione finora

- Deepak Chopra The 7 Laws of SuccessDocumento6 pagineDeepak Chopra The 7 Laws of Successmr12323Nessuna valutazione finora

- Tims Trading MaximsDocumento1 paginaTims Trading Maximsmr12323Nessuna valutazione finora

- Addition 03.2013. TS LSFA BS PDFDocumento1 paginaAddition 03.2013. TS LSFA BS PDFmr12323Nessuna valutazione finora

- Astro PreditDocumento1 paginaAstro Preditmr12323Nessuna valutazione finora

- ProFx 4 User Manual PDFDocumento20 pagineProFx 4 User Manual PDFMelque ResendeNessuna valutazione finora

- GN 5 41Documento1 paginaGN 5 41mr12323Nessuna valutazione finora

- Revision of Pension (c116063)Documento1 paginaRevision of Pension (c116063)mr12323Nessuna valutazione finora

- Nifty Super Trend Back Test Results 2008 To 2013Documento176 pagineNifty Super Trend Back Test Results 2008 To 2013mr12323Nessuna valutazione finora

- BitcoinsDocumento45 pagineBitcoinsSwadhin Sonowal100% (1)

- 0510 ColeDocumento21 pagine0510 Colemr12323Nessuna valutazione finora

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Documento4 pagineChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- Scope of AnatomyDocumento25 pagineScope of Anatomymr12323Nessuna valutazione finora

- GN 5 38Documento1 paginaGN 5 38mr12323Nessuna valutazione finora

- Cheatsheet Fib ElliottDocumento12 pagineCheatsheet Fib ElliottYano0% (1)

- Traders World 20101Documento10 pagineTraders World 20101satish sNessuna valutazione finora

- F9D1 ManualDocumento18 pagineF9D1 Manualmr12323Nessuna valutazione finora

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Documento4 pagineChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- Trading Manual PDFDocumento24 pagineTrading Manual PDFmr12323Nessuna valutazione finora

- Barclay and Hendershott-Price Discovery and Trading After HoursDocumento33 pagineBarclay and Hendershott-Price Discovery and Trading After HoursPulkit GoelNessuna valutazione finora

- WolfeWaveDashboard UserGuideDocumento4 pagineWolfeWaveDashboard UserGuidemr12323Nessuna valutazione finora

- Tradeonix 2.0: (An Updated Version of Tradeonix)Documento17 pagineTradeonix 2.0: (An Updated Version of Tradeonix)mr12323100% (1)

- Running Head: Integrated Marketing Plan of Oyo Rooms 1Documento14 pagineRunning Head: Integrated Marketing Plan of Oyo Rooms 1Duong Trinh MinhNessuna valutazione finora

- 7 understanding-market-capitalization-types-explanation-and-practical-applications-for-investors-20231007100811DiKLDocumento11 pagine7 understanding-market-capitalization-types-explanation-and-practical-applications-for-investors-20231007100811DiKLAani RashNessuna valutazione finora

- HSEDocumento308 pagineHSEAnonymous 2JNPJ2aXNessuna valutazione finora

- Business Case Biomass Fuel PelletDocumento18 pagineBusiness Case Biomass Fuel Pelletagbuc11100% (2)

- ArticleDocumento4 pagineArticleĐỗ Thị HuyềnNessuna valutazione finora

- Marketing Project: by Anu Thomas 11 ADocumento11 pagineMarketing Project: by Anu Thomas 11 AThomas AntoNessuna valutazione finora

- CPV by WeygandtDocumento50 pagineCPV by WeygandtJen NetteNessuna valutazione finora

- Bon Appetea Review On Related LiteratureDocumento6 pagineBon Appetea Review On Related LiteratureDessa VamentaNessuna valutazione finora

- Business Notes IB HLDocumento28 pagineBusiness Notes IB HLVicente DebhardNessuna valutazione finora

- Regulatory Functions & Processes: Cristina Lu E RanilloDocumento13 pagineRegulatory Functions & Processes: Cristina Lu E RanilloCristina Lu Elmundo RanilloNessuna valutazione finora

- CH 6 Fixed - Income QuestionsDocumento73 pagineCH 6 Fixed - Income QuestionsPunit SharmaNessuna valutazione finora

- Market Models For AggregatorsDocumento14 pagineMarket Models For AggregatorsJagälskar Den MaissaNordicNessuna valutazione finora

- Extended Essay - 1st Full DraftDocumento25 pagineExtended Essay - 1st Full DraftNasma MustafaNessuna valutazione finora

- Module 7 - Mini Marketing PlanDocumento13 pagineModule 7 - Mini Marketing PlanCESTINA, KIM LIANNE, B.Nessuna valutazione finora

- The Management of Society's Resources Is Important Because Resources Is ScarceDocumento1 paginaThe Management of Society's Resources Is Important Because Resources Is ScarceRodel Amante MedicoNessuna valutazione finora

- Mec-008 EngDocumento35 pagineMec-008 EngnitikanehiNessuna valutazione finora

- Task 1: FintechDocumento4 pagineTask 1: Fintechmango chaunsaNessuna valutazione finora

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento32 pagineStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceassasas asasNessuna valutazione finora

- Ipo RHP IrfcDocumento413 pagineIpo RHP IrfcNaresh GaurNessuna valutazione finora

- The Effects of Price Changes: Substitution and Income EffectsDocumento1 paginaThe Effects of Price Changes: Substitution and Income EffectspenelopegerhardNessuna valutazione finora

- In Problem 10 16 We Projected Financial Statements For Wal Mart Stores 126832Documento2 pagineIn Problem 10 16 We Projected Financial Statements For Wal Mart Stores 126832Amit PandeyNessuna valutazione finora

- CLO Primer PinebridgeDocumento16 pagineCLO Primer PinebridgeAditya DeshpandeNessuna valutazione finora

- Random Problem 2 Pinkypdf PDF FreeDocumento23 pagineRandom Problem 2 Pinkypdf PDF FreeTokis SabaNessuna valutazione finora

- Toyota Media PlanningDocumento10 pagineToyota Media PlanningAishwarya KengarNessuna valutazione finora

- Skechers U S A: PESTEL AnalysisDocumento7 pagineSkechers U S A: PESTEL AnalysisShruti JhunjhunwalaNessuna valutazione finora

- KFC Internationalization Process and StrategiesDocumento7 pagineKFC Internationalization Process and StrategiesAnkita I S 2027743100% (2)

- Book Review Why Smartnmess Will Not Save YouDocumento8 pagineBook Review Why Smartnmess Will Not Save YouMuhammad Bilal AfzalNessuna valutazione finora

- Organización de La ProducciónDocumento4 pagineOrganización de La ProducciónIrma JMNessuna valutazione finora

- ABSNet GlossaryDocumento37 pagineABSNet Glossaryapi-3778585Nessuna valutazione finora

- Special Edition of Our IAS Plus Newsletter: IAS Plus Guide To IFRS 2 Share-Based Payment 2007Documento9 pagineSpecial Edition of Our IAS Plus Newsletter: IAS Plus Guide To IFRS 2 Share-Based Payment 2007Divine Epie Ngol'esuehNessuna valutazione finora

- Molly's Game: The True Story of the 26-Year-Old Woman Behind the Most Exclusive, High-Stakes Underground Poker Game in the WorldDa EverandMolly's Game: The True Story of the 26-Year-Old Woman Behind the Most Exclusive, High-Stakes Underground Poker Game in the WorldValutazione: 3.5 su 5 stelle3.5/5 (129)

- The Habits of Winning Poker PlayersDa EverandThe Habits of Winning Poker PlayersValutazione: 4.5 su 5 stelle4.5/5 (10)

- Alchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningDa EverandAlchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningValutazione: 5 su 5 stelle5/5 (5)

- Basic Bridge: Learn to Play the World's Greatest Card Game in 15 Easy LessonsDa EverandBasic Bridge: Learn to Play the World's Greatest Card Game in 15 Easy LessonsNessuna valutazione finora

- Poker: A Beginners Guide To No Limit Texas Holdem and Understand Poker Strategies in Order to Win the Games of PokerDa EverandPoker: A Beginners Guide To No Limit Texas Holdem and Understand Poker Strategies in Order to Win the Games of PokerValutazione: 5 su 5 stelle5/5 (49)

- Magic The Gathering: Deck Building For BeginnersDa EverandMagic The Gathering: Deck Building For BeginnersNessuna valutazione finora

- The Book of Card Games: The Complete Rules to the Classics, Family Favorites, and Forgotten GamesDa EverandThe Book of Card Games: The Complete Rules to the Classics, Family Favorites, and Forgotten GamesNessuna valutazione finora

- The Little Book of Bridge: Learn How to Play, Score, and WinDa EverandThe Little Book of Bridge: Learn How to Play, Score, and WinNessuna valutazione finora

- Poker: How to Play Texas Hold'em Poker: A Beginner's Guide to Learn How to Play Poker, the Rules, Hands, Table, & ChipsDa EverandPoker: How to Play Texas Hold'em Poker: A Beginner's Guide to Learn How to Play Poker, the Rules, Hands, Table, & ChipsValutazione: 4.5 su 5 stelle4.5/5 (6)

- Mental Card Mysteries - Thirty-Five Weird And Psychic EffectsDa EverandMental Card Mysteries - Thirty-Five Weird And Psychic EffectsNessuna valutazione finora

- Earn $30,000 Per Month Playing Online Poker: A Step-By-Step Guide to Single Table TournamentsDa EverandEarn $30,000 Per Month Playing Online Poker: A Step-By-Step Guide to Single Table TournamentsValutazione: 2 su 5 stelle2/5 (6)

- Self-Working Close-Up Card Magic: 56 Foolproof TricksDa EverandSelf-Working Close-Up Card Magic: 56 Foolproof TricksValutazione: 4 su 5 stelle4/5 (7)

- Poker: The Best Techniques for Making You a Better PlayerDa EverandPoker: The Best Techniques for Making You a Better PlayerValutazione: 4.5 su 5 stelle4.5/5 (73)

- Phil Gordon's Little Green Book: Lessons and Teachings in No Limit Texas Hold'emDa EverandPhil Gordon's Little Green Book: Lessons and Teachings in No Limit Texas Hold'emValutazione: 4 su 5 stelle4/5 (64)

- The Only Poker Book You'll Ever Need: Bet, Play, And Bluff Like a Pro--from Five-card Draw to Texas Hold 'emDa EverandThe Only Poker Book You'll Ever Need: Bet, Play, And Bluff Like a Pro--from Five-card Draw to Texas Hold 'emValutazione: 2 su 5 stelle2/5 (1)

- How to Play Spades: A Beginner’s Guide to Learning the Spades Card Game, Rules, & Strategies to Win at Playing SpadesDa EverandHow to Play Spades: A Beginner’s Guide to Learning the Spades Card Game, Rules, & Strategies to Win at Playing SpadesNessuna valutazione finora

- Cards and Card Tricks, Containing a Brief History of Playing Cards: Full Instructions with Illustrated Hands, for Playing Nearly all Known Games of Chance or Skill; And Directions for Performing a Number of Amusing TricksDa EverandCards and Card Tricks, Containing a Brief History of Playing Cards: Full Instructions with Illustrated Hands, for Playing Nearly all Known Games of Chance or Skill; And Directions for Performing a Number of Amusing TricksNessuna valutazione finora

- Your Worst Poker Enemy: Master The Mental GameDa EverandYour Worst Poker Enemy: Master The Mental GameValutazione: 3.5 su 5 stelle3.5/5 (1)

- POKER MATH: Strategy and Tactics for Mastering Poker Mathematics and Improving Your Game (2022 Guide for Beginners)Da EverandPOKER MATH: Strategy and Tactics for Mastering Poker Mathematics and Improving Your Game (2022 Guide for Beginners)Nessuna valutazione finora

- The Everything Tabletop Games Book: From Settlers of Catan to Pandemic, Find Out Which Games to Choose, How to Play, and the Best Ways to Win!Da EverandThe Everything Tabletop Games Book: From Settlers of Catan to Pandemic, Find Out Which Games to Choose, How to Play, and the Best Ways to Win!Nessuna valutazione finora

- How to Play Rummy and Gin Rummy: A Beginners Guide to Learning Rummy and Gin Rummy Rules and Strategies to WinDa EverandHow to Play Rummy and Gin Rummy: A Beginners Guide to Learning Rummy and Gin Rummy Rules and Strategies to WinNessuna valutazione finora

- Straight Flush: The True Story of Six College Friends Who Dealt Their Way to a Billion-Dollar Online Poker Empire--and How it All Came Crashing Down…Da EverandStraight Flush: The True Story of Six College Friends Who Dealt Their Way to a Billion-Dollar Online Poker Empire--and How it All Came Crashing Down…Valutazione: 4 su 5 stelle4/5 (33)