Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

PTBC - Product Feature v.1.0

Caricato da

palmkodokCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

PTBC - Product Feature v.1.0

Caricato da

palmkodokCopyright:

Formati disponibili

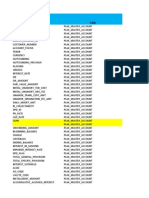

P

Supported

O

Not Supported

Portfolio Product Features Column1

Loan Data Mart Data Mart Creation

Extraction from Data Mart

Initial Process Pre-check Data Master

EIR Payment Generator

EIR Computation

Amortization Process

Specific Product Workaround

Fee/Cost Allocation and PRK Product

Fee/ Cost Materiality Check

Different currency for drawdown and Fee/cost

Adjustment Fee/cost

Exception handling

Fully amortize txn cost/fee when impaired

Individual Impairment Individual Grouping

Customer Grading Process

Threshold Limit for customer

Automatic Trigger

Checklist Trigger (Objective Evidence)

Estimated future cashflow

Unwinding Interest Income - Individual

Document attachment

IA Provision Movement

Collective Impairment - Automation Flexible Segmentation (collective group)

PD Methodology

LGD Methodology

LIP

Override PD/LGD/LIP

CA Provision Movement (Charge, Write Back)

PD Product Hierarchy

LGD Product Hierarchy

Unwinding Intrerest Income - Collective

Collective Impairment - Manual Fixed Segmentation

Manual PD & LGD

Manual PD

Manual LGD

Special Bucket Provision

PD Rating base on customer grading

LGD Parameter base on collateral code

Wholesale banking process

Recovery Data For LGD

GL Module & Accounting Setup GL Post Grouping

GL file download from Application

Branch reclassification

Reconciliation of unamortized amount

Journal parameter for Each transaction cost/fee

Liabilities Saving

Deposito

Regulatory Reporting

PSAK - PTBC

Column2 Current Condition

Providing Data Mart O

Reconciling Data Before Batch (Providing Report) O

Extraction from Data Mart O

P

Annuity P

Baloon Payment P

Multi Tier Rate O

Simple Interest O

Fixed Principal O

Fixed Interest O

Progressive Disbursement O

Irregular Payment O

IRR O

XIRR O

GoalSeek P

EIR Amortization P

SOD Amortization O

SL Amortization P

Exclusion for specific Product (Government Product) O

Loan with interest below market P

Reversal Annual Fee Credit Card O

Prorate From GL to Account

Prorate from facility to account O

Allocate to account and SL amortization until Full Disbursement

from transaction parameter P

Facility Level amortization ( SL ) till the drawdown and allocate to account based on

percentage of drawdown to limit. Continue SL amortization for the remaining fee at facility

level

O

Facility Fee amortization ( base on parameter ) P

User Defined in Transaction parameter P

Special FEE/Cost amortized using SL for specific period base on parameter P

base on currency & amount P

P

Additional / Reversal will be effective on next payment date P

Additional / Reversal will be effective on transaction date P

Exception EIR Engine P

Fully amortize txn cost/fee when impaired P

Customer Number grouping P

O

O

Bankcruptcy Flag O

Individual Significant P

MIA > 3 P

O

Customer level P

Account level P

Facility Level O

Unwinding Interest Interest - Individual P

Upload future cashflow per customer level P

Upload future cashflow per account level P

Assessment Level O

Amount Provision Movement Month to Month (Beg. Balance, Charge/Writeback and End.

Balance)

O

Specific PD Segmentation across portfolios O

Specific PD Sub Segmentation for certain PD Segment O

Specific LGD Segmentation across portfolios O

Specific LGD Sub Segmentation for certain LGD Segment O

Roll Rate / Net Flow Rate P

Migration Analysis P

Vintage Analysis O

Cash/Expected Recoveries O

Collateral Shortfall O

Loss on disposal O

LIP O

Override PD/LGD/LIP O

Amount Provision Movement Month to Month (Beg. Balance, Charge/Writeback and End.

Balance)

O

O

O

O

Segment_Code and CA Segmentation P

Upload Manual Textfile P

Upload PD manual file P

Upload Recovery Matrix file P

Override PD LGD for specific Loan Account O

O

O

O

O

Per Product Group, Per GL Account P

Reverse Previous Month, Book Current Month P

Show the GL File posted through Web Application P

GL or Journal Parameter P

Reconcile between Journal Collective and Detail Transaction O

P

O

O

Payment Generator O

Payment Generator O

CKPN in account level O

Fair Value in account level O

Unamortized fee, Amortization of Fee in account level O

Unamortized cost, Amortization of cost in account level O

Unwinding Interest Income in account level O

Remarks

Currently all the loan will convert to IDR

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Different types of provisions and loan impairment assessmentsDocumento8 pagineDifferent types of provisions and loan impairment assessmentspalmkodokNessuna valutazione finora

- FIS Remote-Prophet-Training-SubscriptionDocumento15 pagineFIS Remote-Prophet-Training-Subscriptionpalmkodok0% (2)

- 9-204-066 Dividend Policy - 204702-XLS-ENGDocumento17 pagine9-204-066 Dividend Policy - 204702-XLS-ENGValant Rivas DerteNessuna valutazione finora

- Anaplan Leaders ProfileDocumento11 pagineAnaplan Leaders ProfilepalmkodokNessuna valutazione finora

- Insurance Business Analyst Job Desc - QualificationDocumento4 pagineInsurance Business Analyst Job Desc - QualificationpalmkodokNessuna valutazione finora

- Insurance Risk Suite Experience Rating ManagerDocumento3 pagineInsurance Risk Suite Experience Rating ManagerpalmkodokNessuna valutazione finora

- 09 FMF - SSA & DC ParticipantsDocumento67 pagine09 FMF - SSA & DC ParticipantspalmkodokNessuna valutazione finora

- FIS IFRS17-Group-Calculations-Training - 2Documento2 pagineFIS IFRS17-Group-Calculations-Training - 2palmkodokNessuna valutazione finora

- Excel Technique - ConsolidationDocumento16 pagineExcel Technique - ConsolidationpalmkodokNessuna valutazione finora

- FIS Insurance Accreditaiton-BrochureDocumento5 pagineFIS Insurance Accreditaiton-BrochurepalmkodokNessuna valutazione finora

- FIS Nested-Structures-AgendaDocumento3 pagineFIS Nested-Structures-AgendapalmkodokNessuna valutazione finora

- Insurance Risk Suite IFRS17 Group Calculations LibraryDocumento2 pagineInsurance Risk Suite IFRS17 Group Calculations LibrarypalmkodokNessuna valutazione finora

- 09 FMF - SSA & DC ParticipantsDocumento67 pagine09 FMF - SSA & DC ParticipantspalmkodokNessuna valutazione finora

- Insurance Risk Suite Data Conversion SystemDocumento3 pagineInsurance Risk Suite Data Conversion SystempalmkodokNessuna valutazione finora

- BCG-COVID-19-BCG Perspectives Version 6.1 19may2020Documento44 pagineBCG-COVID-19-BCG Perspectives Version 6.1 19may2020palmkodokNessuna valutazione finora

- Excel Technique - CameraDocumento4 pagineExcel Technique - CamerapalmkodokNessuna valutazione finora

- Report Design in CognosDocumento4 pagineReport Design in CognospalmkodokNessuna valutazione finora

- 1P Limit Management ICL-BMPK - V1.1 - For VendorDocumento8 pagine1P Limit Management ICL-BMPK - V1.1 - For VendorpalmkodokNessuna valutazione finora

- ETL FunctionalitiesDocumento17 pagineETL FunctionalitiespalmkodokNessuna valutazione finora

- ConsultativePaperBaselIII PDFDocumento116 pagineConsultativePaperBaselIII PDFpalmkodokNessuna valutazione finora

- ETL FunctionalitiesDocumento17 pagineETL FunctionalitiespalmkodokNessuna valutazione finora

- Report Design in CognosDocumento4 pagineReport Design in CognospalmkodokNessuna valutazione finora

- Accounting Setup HLBDocumento2 pagineAccounting Setup HLBpalmkodokNessuna valutazione finora

- Anti Money Laundry Project TimelineDocumento3 pagineAnti Money Laundry Project Timelinepalmkodok100% (1)

- Maybank Report MFRS 139 Project Loan AnalysisDocumento3 pagineMaybank Report MFRS 139 Project Loan AnalysispalmkodokNessuna valutazione finora

- Risk Management PricingDocumento1 paginaRisk Management PricingpalmkodokNessuna valutazione finora

- Test Cases For POC-HLBDocumento92 pagineTest Cases For POC-HLBpalmkodokNessuna valutazione finora

- Recon IT & Network - 2Documento23 pagineRecon IT & Network - 2palmkodokNessuna valutazione finora

- Accounting Setup HLBDocumento2 pagineAccounting Setup HLBpalmkodokNessuna valutazione finora

- Sample - Gap Analysis IndonesiaDocumento101 pagineSample - Gap Analysis IndonesiapalmkodokNessuna valutazione finora

- BAE Systems PresentationDocumento19 pagineBAE Systems PresentationSuyash Thorat-GadgilNessuna valutazione finora

- Production Management Midterm ReviewDocumento21 pagineProduction Management Midterm Reviewielsiu21184Nessuna valutazione finora

- BSBA-CAP Program at Benilde Offers Business and IT EducationDocumento8 pagineBSBA-CAP Program at Benilde Offers Business and IT EducationMaria Jana Minela IlustreNessuna valutazione finora

- Cips November 2014 Examination TimetableDocumento1 paginaCips November 2014 Examination TimetableajayikayodeNessuna valutazione finora

- 01 Chapter 1 Joint Venture and Public EnterpriseDocumento11 pagine01 Chapter 1 Joint Venture and Public EnterpriseTemesgen LealemNessuna valutazione finora

- HR Pepsi CoDocumento3 pagineHR Pepsi CookingNessuna valutazione finora

- Syllabus PGDERPDocumento6 pagineSyllabus PGDERPAsif Ali H100% (1)

- Yawa Final Najud Ni Chap 1-8Documento76 pagineYawa Final Najud Ni Chap 1-8Karljefferson BalucanNessuna valutazione finora

- Ebook Sap OmDocumento39 pagineEbook Sap OmmarcosoliversilvaNessuna valutazione finora

- Evidencia 3 Curriculum - Vitae - FormatDocumento3 pagineEvidencia 3 Curriculum - Vitae - Formatana bautistaNessuna valutazione finora

- Group 3 Case STUDY 1Documento7 pagineGroup 3 Case STUDY 1Rhoel YadaoNessuna valutazione finora

- Cost and Management Accounting I For 3rd Year Business Education StudentsDocumento86 pagineCost and Management Accounting I For 3rd Year Business Education StudentsAmir Kan100% (2)

- Food and Beverage OperationsDocumento6 pagineFood and Beverage OperationsDessa F. GatilogoNessuna valutazione finora

- Gmail - Exciting Roles Available at One Finserv Careers!Documento8 pagineGmail - Exciting Roles Available at One Finserv Careers!Arif KhanNessuna valutazione finora

- AUC CHECK REFERENCE FORM - OriginalDocumento2 pagineAUC CHECK REFERENCE FORM - OriginalteshomeNessuna valutazione finora

- FABIZ I FA S2 Non Current Assets Part 4Documento18 pagineFABIZ I FA S2 Non Current Assets Part 4Andreea Cristina DiaconuNessuna valutazione finora

- SBM J22 Mark PlanDocumento38 pagineSBM J22 Mark PlanWongani KaundaNessuna valutazione finora

- Case Study 2 Part 1: The StoryDocumento5 pagineCase Study 2 Part 1: The StoryMary Jane InsigneNessuna valutazione finora

- Consumer Behavior of Parle - 'Documento19 pagineConsumer Behavior of Parle - 'anmolNessuna valutazione finora

- Coal India LimitedDocumento92 pagineCoal India LimitedChanchal K Kumar100% (3)

- MTO CSO Interview Customer Service TrendsDocumento4 pagineMTO CSO Interview Customer Service Trendsgl02ruNessuna valutazione finora

- 606 Assignment Naresh Quiz 3Documento3 pagine606 Assignment Naresh Quiz 3Naresh RaviNessuna valutazione finora

- Impact of Business Strategy, Financial Leverage on Earnings Management Moderated by Corporate GovernanceDocumento18 pagineImpact of Business Strategy, Financial Leverage on Earnings Management Moderated by Corporate GovernanceHusnaini Dwi WanriNessuna valutazione finora

- Cba 2008-2009 PDFDocumento10 pagineCba 2008-2009 PDFjeffdelacruzNessuna valutazione finora

- Statement of Cash FlowDocumento45 pagineStatement of Cash FlowJay Bianca Abera Alistado100% (1)

- Introduction To Digital MarketingDocumento16 pagineIntroduction To Digital Marketingareeza aijazNessuna valutazione finora

- Methods of Evaluating Capital InvestmentsDocumento5 pagineMethods of Evaluating Capital InvestmentsJake BundokNessuna valutazione finora

- Ch04 Environmental Scanning and Industry AnalysisDocumento38 pagineCh04 Environmental Scanning and Industry AnalysisMona LeeNessuna valutazione finora

- Cost Behavior 2nd Exam BSADocumento4 pagineCost Behavior 2nd Exam BSARica Jayne Gerona CuizonNessuna valutazione finora