Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

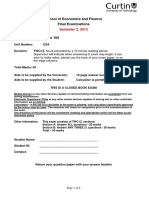

ECON 105 Midterm2 2013S

Caricato da

examkiller0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

454 visualizzazioni10 pagineMC P1 P2 Total Midterm Exam #2 ECON 105-D200: Principles of Macroeconomics. Communication with classmates for any purpose is forbidden. You can lose up to 5 points on this exam for failure to follow instructions.

Descrizione originale:

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoMC P1 P2 Total Midterm Exam #2 ECON 105-D200: Principles of Macroeconomics. Communication with classmates for any purpose is forbidden. You can lose up to 5 points on this exam for failure to follow instructions.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

454 visualizzazioni10 pagineECON 105 Midterm2 2013S

Caricato da

examkillerMC P1 P2 Total Midterm Exam #2 ECON 105-D200: Principles of Macroeconomics. Communication with classmates for any purpose is forbidden. You can lose up to 5 points on this exam for failure to follow instructions.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 10

Last Name: ____________________

First Name: ____________________

Student ID #: ___________________

MC

P1

P2

Total

Midterm Exam #2

ECON 105-D200: Principles of Macroeconomics

Prof. Krauth, Spring 2013

Please put away all materials except for pens or pencils and a non-programmable, non-

graphing, non-communicating calculator. Communication with classmates for any purpose is

forbidden. You can lose up to 5 points on this exam for failure to follow instructions, including

failure to put your name and student number on your exam and bubble sheets. Raise your hand

if you have any questions or needs. You do not need to show your work; all I care about is

your answer to the question. Good luck!

Multiple choice (40 questions - 2 points each)

1. Suppose that a lobster in Nova Scotia costs $10 and the same type of lobster in New Brunswick

costs $30. How could people make a profit in the situation?

a. by buying lobsters in Nova Scotia and selling them in New Brunswick, which

would increase the price of lobster in New Brunswick

b. by buying lobsters in Nova Scotia and selling them in New Brunswick, which

would decrease the price of lobster in New Brunswick

c. by buying lobsters in New Brunswick and selling them in Nova Scotia, which

would increase the price of lobster in New Brunswick

d. by buying lobsters in New Brunswick and selling them in Nova Scotia, which

would decrease the price of lobster in New Brunswick

2. In 2007 Freedonia had a population of 2,700 and real GDP of about $1,080,000. In 2006 it had a

population of 2,500 and real GDP of about $1,000,000. What was the approximate growth rate

of real GDP per person in Freedonia between 2006 and 2007?

a. 0 percent

b. 2.5 percent

c. 5 percent

d. 7.5 percent

3. In a market economy, when do we know that a resource has become scarcer?

a. when its price rises relative to other prices

b. when it is nonrenewable and some of it is used

c. when substitutes exist

d. when there are no substitutes

G

r

a

d

e

Last Name: _________________ First Name: _________________ Student ID #: ____________

2

4. Which of the following would NOT be considered physical capital?

a. a new factory building

b. a computer used to help Mercury Delivery Service keep track of their orders

c. on-the-job training

d. a desk used in an accountant's office

5. Which of the following is an important fact about population growth?

a. There are no substantial differences between rates of growth in population

among countries.

b. In developed countries, population tends to grow slower than in developing

countries.

c. Higher rate of growth in population implies higher productivity.

d. Economists generally believe that a country that increases its population growth

rate will increase its economic growth rate.

6. Real GDP per person is $25,000 in Aquilonia, $10,000 in Nemedia, $15,000 in Shem, and

$20,000 in Zexa. Saving per person is $2,000 in all three countries. Other things equal, what

would we expect?

a. All four countries will grow at the same rate.

b. Aquilonia will grow the fastest.

c. Nemedia will grow the fastest.

d. Shem will grow the fastest.

7. Which of the following is generally an opportunity cost of investment in human capital?

a. future job security

b. forgone wages during the years of school

c. increased earning potential

d. the costs of living during the years of school

8. Drug companies can usually obtain patents on new drugs. Patents turn new ideas into which of

the following goods?

a. private goods, which increase the incentive to engage in research

b. private goods, which decrease the incentive to engage in research

c. public goods, which increase the incentive to engage in research

d. public goods, which decrease the incentive to engage in research

9. Lucy wants to start her own psychiatric practice, but her expenditures exceed her income.

Which of the following best describes Lucy?

a. She is a saver who demands money from the financial system.

b. She is a saver who supplies money to the financial system.

c. She is a borrower who demands money from the financial system.

d. She is a borrower who supplies money to the financial system.

Last Name: _________________ First Name: _________________ Student ID #: ____________

3

10. Suppose Microsoft sells a bond. What is the company doing?

a. borrowing directly from the public

b. borrowing indirectly from the public

c. lending directly to the public

d. lending indirectly to the public

11. If Huedepool Beer runs into financial difficulty, how are bondholders and shareholders paid?

a. Shareholders are paid before bondholders.

b. Shareholders are paid after bondholders.

c. Shareholders and bondholders are paid proportional shares of the companys

assets.

d. Shareholders receive all the companys assets.

12. Suppose that the government finds a major defect in one of a company's products and

demands that it be taken off the market. Which of the following would we expect?

a. The supply of the stock and the price will both rise.

b. The supply of the stock and the price will both fall.

c. The demand for the stock and the price will both rise.

d. The demand for the stock and the price will both fall.

13. In a closed economy, how does national saving compare with investment?

a. National saving is usually greater than investment.

b. National saving is equal to investment.

c. National saving is usually less than investment because of the leakage of taxes.

d. National saving is usually less than investment.

14. Suppose that in a closed economy GDP is equal to 15,000, taxes are equal to 2500,

consumption equals 7500, and government expenditures equal 3000. What is public saving?

a. 600

b. 500

c. 500

d. 600

15. The country of Aquilonia does not trade with any other country. Its GDP is $30 billion. Its

government purchases $5 billion worth of goods and services each year, collects $7 billion in

taxes, and provides $3 billion in transfer payments to households. Private saving in Aquilonia is

$5 billion. What is consumption?

a. $18 billion

b. $21 billion

c. $13 billion

d. There is not enough information to answer the question.

Last Name: _________________ First Name: _________________ Student ID #: ____________

4

16. The Eye of Horus Incense Company has $10 million in cash, which it has accumulated from

retained earnings. It was planning to use the money to build a new factory. Recently, the rate of

interest has increased. How does this fact influence the companys decision?

a. The increase in the rate of interest should not influence the decision to build the

factory because the Eye of Horus doesn't have to borrow any money.

b. The increase in the rate of interest should not influence the decision to build the

factory because its shareholders are expecting a new factory.

c. The increase in the rate of interest should make it more likely that the Eye of

Horus will build the factory because a higher interest rate will make the factory

more valuable.

d. The increase in the rate of interest should make it less likely that the Eye of Horus

will build the factory because the opportunity cost of the $10 million is now

higher.

17. Suppose the market for loanable funds is in equilibrium. Using the table below, what is the

quantity of funds demanded?

GDP $100 billion

Consumption $65 billion

Taxes minus Transfers $15 billion

Government Purchases $20 billion

a. $25 billion

b. $20 billion

c. $15 billion

d. $10 billion

18. Suppose that the government were to replace the income tax with a consumption tax. What

would happen to the interest rate and investment, respectively?

a. increase and increase

b. decrease and decrease

c. increase and decrease

d. decrease and increase

19. What does the labour-force participation rate measure?

a. the percentage of the total adult population that is in the labour force

b. the percentage of the total adult population that is employed

c. the percentage of the labour force that is employed

d. the percentage of the labour force that is either employed or unemployed

Last Name: _________________ First Name: _________________ Student ID #: ____________

5

20. In 2000 in Japan, based on concepts similar to those used to compute Canadian employment

statistics, the unemployment rate was about 4.8 percent, the labour force participation rate

was about 62 percent, and the adult population was about 108 million. How many people were

employed?

a. about 52 million

b. about 64 million

c. about 67 million

d. about 103 million

21. Since World War II, which of the following has happened to the labour-force participation rate?

a. It has increased for both men and women.

b. It increased for women and decreased for men.

c. It has decreased for both men and women.

d. It decreased for women and increased for men.

22. Suppose that some people are counted as unemployed when, to maintain unemployment

compensation, they search for work only at places where they are unlikely to be hired. If these

individuals were counted as out of the labour force instead of as unemployed, how would the

labour statistics change?

a. The unemployment rate and the labour-force participation rate would be higher.

b. The unemployment rate and the labour-force participation rate would be lower.

c. The unemployment rate would be lower and the labour-force participation rate

would be higher.

d. The unemployment rate would be higher and the labour-force participation rate

would be lower.

23. Suppose that consumers decide to buy more computers and fewer typewriters. As a result,

computer companies expand production while typewriter companies lay off workers. What is

this an example of?

a. structural unemployment created by efficiency wages

b. cyclical unemployment created by a recession

c. frictional unemployment created by a sectoral shift in demand

d. frictional unemployment created by a sectoral shift in supply

Last Name: _________________ First Name: _________________ Student ID #: ____________

6

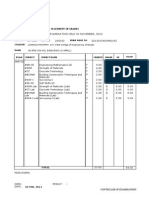

Use the graph below to answer the following questions.

Figure 1

24. Refer to Figure 1. If the minimum wage is $5 or $6, what is the number of people unemployed,

respectively?

a. 40 and 0

b. 20 and 20

c. 40 and 20

d. 0 and 0

25. Refer to Figure 1. If the minimum wage rose from $6 to $7, what would happen to

unemployment?

a. It would rise by 40.

b. It would rise by 20.

c. It would fall by 20.

d. It would fall by 40.

26. When Arnold uses dollars to record his income and expenses, how is he using money?

a. as a unit of account

b. as a means of payment

c. as a store of value

d. as a medium of exchange

27. Who owns the Bank of Canada?

a. private individuals

b. the Queen

c. the commercial banks

d. the federal government of Canada

Last Name: _________________ First Name: _________________ Student ID #: ____________

7

28. If the reserve ratio is 15 percent and currency holdings are zero, by how much will an additional

$1000 of reserves increase the money supply?

a. $1176

b. $1275

c. $5667

d. $6667

29. Which of the following lists contains only actions that increase the money supply?

a. raise the bank rate; make open market purchases

b. raise the bank rate; make open market sales

c. lower the bank rate; make open market purchases

d. lower the bank rate; make open market sales

30. Suppose the reserve ratio is 10 percent, and currency holdings are zero. Suppose the Bank of

Canada sells $10 million of bonds to the public. Which of the following best describes the

effects of this open market operation?

a. Bank reserves increase by $1 million, and the money supply eventually increases

by $10 million.

b. Bank reserves increase by $10 million, and the money supply eventually increases

by $100 million.

c. Bank reserves decrease by $1 million, and the money supply eventually increases

by $10 million.

d. Bank reserves decrease by $10 million, and the money supply eventually

decreases by $100 million.

31. How can the Bank of Canada directly protect a bank during a bank run?

a. by increasing reserve requirements

b. by selling government bonds to the bank

c. by lending reserves to the bank

d. by penalizing the bank in trouble

32. When does the supply of money increase?

a. when the value of money increases

b. when the price level decreases

c. when the Bank of Canada makes open-market purchases

d. when the Bank of Canada increases the bank rate

33. What does the principle of monetary neutrality imply?

a. An increase in the money supply will increase real GDP and the price level.

b. An increase in the money supply will increase real GDP, but not the price level.

c. An increase in the money supply will increase the price level, but not real GDP.

d. An increase in the money supply will increase neither the price level nor real GDP.

Last Name: _________________ First Name: _________________ Student ID #: ____________

8

34. According to the quantity equation, if P = 15, Y = 10, and M = 20, what is V?

a. 30

b. 15

c. 7.5

d. 7

35. Suppose that the Government of Canada unexpectedly decided to pay off its debt by printing

new money. Which of the following would happen?

a. People who held money would feel richer.

b. Prices would fall.

c. People who lent money at a fixed interest rate would feel richer.

d. People who borrowed money at a fixed interest rate would feel richer.

36. Since 1992, which of the following has the Bank of Canada done?

a. It has announced that it was targeting the money supply growth of 2 percent.

b. It has announced a target rate of inflation of 2 percent.

c. It has announced an inflation target close to 4 percent.

d. It has announced its objective of maintaining a stable rate of economic growth of

2 percent.

37. Which of the following does net capital outflow measure?

a. an imbalance between a country's income and expenditure

b. an imbalance between a country's investment and saving

c. an imbalance between a country's sale of goods and services abroad and buying

of foreign goods and services

d. an imbalance between a country's sale of domestic assets abroad and domestic

purchase of foreign assets

38. Suppose Canada sells chocolate to the United States. Which of the following correctly identifies

the effects of this transaction?

a. U.S. net exports increase, and U.S. net capital outflow increases.

b. U.S. net exports increase, and U.S. net capital outflow decreases.

c. U.S. net exports decrease, and U.S. net capital outflow increases.

d. U.S. net exports decrease, and U.S. net capital outflow decreases.

39. A Canadian firm buys sardines from Morocco and pays for them with Canadian dollars. Which

of the following correctly identifies the effects of this transaction?

a. Canadian net exports increase, and Canadian net capital outflow increases.

b. Canadian net exports increase, and Canadian net capital outflow decreases.

c. Canadian net exports decrease, and Canadian net capital outflow increases.

d. Canadian net exports decrease, and Canadian net capital outflow decreases.

Last Name: _________________ First Name: _________________ Student ID #: ____________

9

40. A country has $60 million of domestic investment and net capital outflow of $20 million. What

is saving?

a. -$40 million

b. $40 million

c. $60 million

d. $80 million

Short Answer (2 questions 20 points total)

1. (15 points). Suppose the Canadian economy is accurately described by money

neutrality, the quantity theory of money, purchasing power parity, and interest rate

parity. You are an advisor to the Bank of Canada, and they are considering two

alternative policies: (a) manage the money supply to maintain a constant nominal

exchange rate with the U.S. dollar; or (b) maintain their current policy of managing the

money supply to maintain a stable inflation rate of 2%. Suppose the U.S. has an

inflation rate of 5%, a real GDP growth rate of 3% and a nominal interest rate of 0.5%,

and that Canadas real GDP growth rate is 4%.

a. Under policy (a) what will be the inflation rate in Canada?

b. Under policy (a) what will be the money growth rate in Canada?

c. Under policy (a) what will be the growth rate in Canadas nominal exchange rate,

(i.e., the value of the Canadian dollar in US dollars)?

d. Under policy (b) what will be the inflation rate in Canada?

Last Name: _________________ First Name: _________________ Student ID #: ____________

10

e. Under policy (b) what will be the money growth rate in Canada?

f. Under policy (b) what will be the growth rate in Canadas nominal exchange rate,

(i.e., the value of the Canadian dollar in US dollars)?

g. In the real world, inflation is never entirely stable, and purchasing power parity

does not exactly hold. Suppose that the U.S. inflation rate is actually highly

variable and unpredictable. Describe one advantage of policy (a) over policy (b)

given this situation.

h. Describe one advantage of policy (b) over policy (a) given the situation described

in part (g) of this question.

2. (5 points) Of the factors affecting long-run economic growth discussed in this course,

identify the one you think is the most important in explaining persistent income

differences between rich and poor countries? Explain (in no more than three sentences)

why you think it is the most important.

Potrebbero piacerti anche

- ECN204 Mid 2013WDocumento11 pagineECN204 Mid 2013WexamkillerNessuna valutazione finora

- ECN204 Midterm 2013W PracticeDocumento13 pagineECN204 Midterm 2013W PracticeexamkillerNessuna valutazione finora

- Macro Tut 2Documento7 pagineMacro Tut 2Hằng HàNessuna valutazione finora

- Group Assignment 2 (Chapter: 23, 24, 26, 28, 29)Documento4 pagineGroup Assignment 2 (Chapter: 23, 24, 26, 28, 29)karelimmanuelshangraihanNessuna valutazione finora

- 1 EC 102, Spring 2019, Practice FinalDocumento16 pagine1 EC 102, Spring 2019, Practice FinalKrishna ArjunNessuna valutazione finora

- Economics Ansswers/solutionsDocumento11 pagineEconomics Ansswers/solutionsPramod kNessuna valutazione finora

- AP Macroecnomics Practice Exam 1Documento20 pagineAP Macroecnomics Practice Exam 1KayNessuna valutazione finora

- AP Macroecnomics Practice Exam 1Documento20 pagineAP Macroecnomics Practice Exam 1KayNessuna valutazione finora

- Economic Questions PDFDocumento8 pagineEconomic Questions PDFAurovind LeonNessuna valutazione finora

- Mac - Tut 3 Production and GrowthDocumento4 pagineMac - Tut 3 Production and GrowthHiền NguyễnNessuna valutazione finora

- Macro CHPT 13 Savings and InvestmentDocumento8 pagineMacro CHPT 13 Savings and InvestmentStephen RinikerNessuna valutazione finora

- Exercise - C9Documento4 pagineExercise - C9Kayden ĐỗNessuna valutazione finora

- B. Demand Loanable Funds by Selling BondsDocumento7 pagineB. Demand Loanable Funds by Selling Bondsdinhbinhan19052005Nessuna valutazione finora

- Topic 3Documento2 pagineTopic 3Lion JimNessuna valutazione finora

- Exam A SolutionsDocumento8 pagineExam A SolutionsEugene HwangNessuna valutazione finora

- Seminar 3: QuestionDocumento9 pagineSeminar 3: QuestionHong NguyenNessuna valutazione finora

- Macro Midterm 2018 Code ADocumento11 pagineMacro Midterm 2018 Code Anoi baNessuna valutazione finora

- AP 9 3rd QEDocumento5 pagineAP 9 3rd QEAira FactorNessuna valutazione finora

- 101 Old FinalDocumento13 pagine101 Old Finalntc7035Nessuna valutazione finora

- Macroeconomics 1Documento25 pagineMacroeconomics 1Bảo Châu VươngNessuna valutazione finora

- ECON 1000 - Final - 2012WDocumento8 pagineECON 1000 - Final - 2012WexamkillerNessuna valutazione finora

- Macro Tut 2Documento6 pagineMacro Tut 2TACN-2M-19ACN Luu Khanh LinhNessuna valutazione finora

- E202 S10 H01 Exam 1Documento8 pagineE202 S10 H01 Exam 1Okan ÜlgenNessuna valutazione finora

- Sample Paper MCQ Micro EconomicsDocumento8 pagineSample Paper MCQ Micro EconomicsbineshwarNessuna valutazione finora

- AP Macroeconomics Practice Exam 1Documento12 pagineAP Macroeconomics Practice Exam 1Nguyễn Phương LiênNessuna valutazione finora

- Chap 27Documento8 pagineChap 27Phuong Vy PhamNessuna valutazione finora

- MCQs - Chapters 25 - 28Documento10 pagineMCQs - Chapters 25 - 28Lâm Tú HânNessuna valutazione finora

- TQ in AP 9Documento4 pagineTQ in AP 9razel.dingalNessuna valutazione finora

- Practice Questions - RevisionDocumento8 paginePractice Questions - RevisionGbamara RichardNessuna valutazione finora

- Midterm 2 Practice TestDocumento5 pagineMidterm 2 Practice TestKrishnaNessuna valutazione finora

- Ten Principles of Economics, Thinking Like An EconomistDocumento7 pagineTen Principles of Economics, Thinking Like An EconomistTook Shir LiNessuna valutazione finora

- Tutorial QuestionsDocumento66 pagineTutorial QuestionsKim Chi100% (1)

- Exam 1 Practice ProblemsDocumento6 pagineExam 1 Practice ProblemsAnonymous VTbxBSoqWzNessuna valutazione finora

- AP Macro Economics Practice Exam 2Documento18 pagineAP Macro Economics Practice Exam 2KayNessuna valutazione finora

- Econ 102 Midterm A Spring 2016-17Documento8 pagineEcon 102 Midterm A Spring 2016-17e110807Nessuna valutazione finora

- Problem Session-1 02.03.2012Documento12 pagineProblem Session-1 02.03.2012charlie simoNessuna valutazione finora

- 203 Final Winter 2009 Answers POSTDocumento15 pagine203 Final Winter 2009 Answers POSTJonathan RuizNessuna valutazione finora

- Macro Tut 2 With Ans 3Documento7 pagineMacro Tut 2 With Ans 3Van Anh LeNessuna valutazione finora

- Đề cương ôn tập MacroeconomicsDocumento6 pagineĐề cương ôn tập MacroeconomicsminhhquyetNessuna valutazione finora

- MC Exercise (Part 1)Documento6 pagineMC Exercise (Part 1)xdivanxd100% (1)

- Please Do Not Write On This Examination FormDocumento14 paginePlease Do Not Write On This Examination FormbopgalebelayNessuna valutazione finora

- Set 1Documento2 pagineSet 1ShuMuKong0% (1)

- TUTORIAL Questionslatest Partly Answered UpDocumento69 pagineTUTORIAL Questionslatest Partly Answered Upnguyenkyphong18Nessuna valutazione finora

- Answers To Second Midterm Summer 2012Documento13 pagineAnswers To Second Midterm Summer 2012Vishesh GuptaNessuna valutazione finora

- Econ Homework Due 13 PDFDocumento4 pagineEcon Homework Due 13 PDFVijay PalanivelNessuna valutazione finora

- Unit I: National Income and Related AggregatesDocumento31 pagineUnit I: National Income and Related AggregatesB. ABINESHNessuna valutazione finora

- Midterm Macro 2Documento22 pagineMidterm Macro 2chang vicNessuna valutazione finora

- S2 2013 Final Exam (+ MCQ Answers)Documento8 pagineS2 2013 Final Exam (+ MCQ Answers)shikha ramdanyNessuna valutazione finora

- Econ 102 Quiz 2 A Spring 2016-17Documento4 pagineEcon 102 Quiz 2 A Spring 2016-17e110807Nessuna valutazione finora

- Hird MacroDocumento6 pagineHird MacroNguyễn Phước Định TườngNessuna valutazione finora

- Pandemic MillionairesDocumento15 paginePandemic MillionairesSayuri GoyaNessuna valutazione finora

- Old Exam AEDocumento12 pagineOld Exam AEaaaaaNessuna valutazione finora

- Soal Uts Pe 2 Genap 2019 2020 EnglishDocumento6 pagineSoal Uts Pe 2 Genap 2019 2020 EnglishNur Fakhira AzizaNessuna valutazione finora

- Practice Quizzes Topic 4-C25Documento6 paginePractice Quizzes Topic 4-C25phươngNessuna valutazione finora

- TUT Macro Unit 1 (Sept 2016)Documento4 pagineTUT Macro Unit 1 (Sept 2016)Shuba ShiniNessuna valutazione finora

- Chap 1,2,3 (Ans)Documento5 pagineChap 1,2,3 (Ans)Julia Kently MiaNessuna valutazione finora

- Final 2016Documento15 pagineFinal 2016Ismail Zahid OzaslanNessuna valutazione finora

- Quiz 1Documento42 pagineQuiz 1Tuan NganNessuna valutazione finora

- Mgeb02 FinalDocumento4 pagineMgeb02 FinalexamkillerNessuna valutazione finora

- Eco100y1 Wolfson Tt2 2012fDocumento12 pagineEco100y1 Wolfson Tt2 2012fexamkillerNessuna valutazione finora

- Eco100 Furlong Tt3 2014sDocumento5 pagineEco100 Furlong Tt3 2014sexamkillerNessuna valutazione finora

- Eco100y1 Wolfson Tt3 2013wDocumento13 pagineEco100y1 Wolfson Tt3 2013wexamkillerNessuna valutazione finora

- Eco100 Furlong Tt2 2014sDocumento10 pagineEco100 Furlong Tt2 2014sexamkillerNessuna valutazione finora

- Eco100y1 Wolfson Tt4 2013wDocumento11 pagineEco100y1 Wolfson Tt4 2013wexamkillerNessuna valutazione finora

- ECON 101 Final Practice1Documento32 pagineECON 101 Final Practice1examkillerNessuna valutazione finora

- MATH115 Exam1 2013W PracticeDocumento10 pagineMATH115 Exam1 2013W PracticeexamkillerNessuna valutazione finora

- MATH263 Mid 2009FDocumento4 pagineMATH263 Mid 2009FexamkillerNessuna valutazione finora

- STAT111 Exam1 PracticeDocumento5 pagineSTAT111 Exam1 PracticeexamkillerNessuna valutazione finora

- MATH150 Midterm1 2009springDocumento8 pagineMATH150 Midterm1 2009springexamkillerNessuna valutazione finora

- STAT111 Final PracticeDocumento3 pagineSTAT111 Final PracticeexamkillerNessuna valutazione finora

- STAT112 Midterm1 PracticeDocumento18 pagineSTAT112 Midterm1 PracticeexamkillerNessuna valutazione finora

- STAT220 Midterm PracticeDocumento13 pagineSTAT220 Midterm PracticeexamkillerNessuna valutazione finora

- STAT110 Exam2 2009F PracticeDocumento6 pagineSTAT110 Exam2 2009F PracticeexamkillerNessuna valutazione finora

- STAT111 Exam2 PracticeDocumento11 pagineSTAT111 Exam2 PracticeexamkillerNessuna valutazione finora

- STAT110 Exam1 Hendrix PracticeDocumento6 pagineSTAT110 Exam1 Hendrix PracticeexamkillerNessuna valutazione finora

- STAT110 Exam1 2009F Version BDocumento6 pagineSTAT110 Exam1 2009F Version BexamkillerNessuna valutazione finora

- STAT110 Exam3 2009F PracticeDocumento2 pagineSTAT110 Exam3 2009F PracticeexamkillerNessuna valutazione finora

- SSC302 Midterm 2010FDocumento3 pagineSSC302 Midterm 2010FexamkillerNessuna valutazione finora

- STAT110 Exam2 2009FDocumento6 pagineSTAT110 Exam2 2009FexamkillerNessuna valutazione finora

- STAT110 Final 2009spring PracticeDocumento5 pagineSTAT110 Final 2009spring PracticeexamkillerNessuna valutazione finora

- STAT110 Exam2 2013spring Edwards PracticeDocumento3 pagineSTAT110 Exam2 2013spring Edwards PracticeexamkillerNessuna valutazione finora

- STAT110 Exam3 2009F Version ADocumento4 pagineSTAT110 Exam3 2009F Version AexamkillerNessuna valutazione finora

- STAT1100 Final LaurelChiappetta PracticeDocumento10 pagineSTAT1100 Final LaurelChiappetta PracticeexamkillerNessuna valutazione finora

- STAT0200 Final 2009spring Pfenning PracticeDocumento13 pagineSTAT0200 Final 2009spring Pfenning PracticeexamkillerNessuna valutazione finora

- STAT1100 Exam3 LaurelChiappetta PracticeDocumento4 pagineSTAT1100 Exam3 LaurelChiappetta PracticeexamkillerNessuna valutazione finora

- STAT1100 Exam2 LaurelChiappetta PracitceDocumento4 pagineSTAT1100 Exam2 LaurelChiappetta PracitceexamkillerNessuna valutazione finora

- STAT1100 Exam1 LaurelChiappetta PracitceDocumento5 pagineSTAT1100 Exam1 LaurelChiappetta PracitceexamkillerNessuna valutazione finora

- STAT102 Midterm2 PracticeDocumento9 pagineSTAT102 Midterm2 PracticeexamkillerNessuna valutazione finora

- People Vs Felipe Santiago - FCDocumento2 paginePeople Vs Felipe Santiago - FCBryle DrioNessuna valutazione finora

- SANDHU - AUTOMOBILES - PRIVATE - LIMITED - 2019-20 - Financial StatementDocumento108 pagineSANDHU - AUTOMOBILES - PRIVATE - LIMITED - 2019-20 - Financial StatementHarsimranSinghNessuna valutazione finora

- SEW Products OverviewDocumento24 pagineSEW Products OverviewSerdar Aksoy100% (1)

- 5e - Crafting - GM BinderDocumento37 pagine5e - Crafting - GM BinderadadaNessuna valutazione finora

- Sayyid DynastyDocumento19 pagineSayyid DynastyAdnanNessuna valutazione finora

- Project Report On ICICI BankDocumento106 pagineProject Report On ICICI BankRohan MishraNessuna valutazione finora

- TestDocumento56 pagineTestFajri Love PeaceNessuna valutazione finora

- Syllabus Biomekanika Kerja 2012 1Documento2 pagineSyllabus Biomekanika Kerja 2012 1Lukman HakimNessuna valutazione finora

- 1634313583!Documento24 pagine1634313583!Joseph Sanchez TalusigNessuna valutazione finora

- Steven SheaDocumento1 paginaSteven Sheaapi-345674935Nessuna valutazione finora

- Diane Mediano CareerinfographicDocumento1 paginaDiane Mediano Careerinfographicapi-344393975Nessuna valutazione finora

- Multi Grade-ReportDocumento19 pagineMulti Grade-Reportjoy pamorNessuna valutazione finora

- 2017 - The Science and Technology of Flexible PackagingDocumento1 pagina2017 - The Science and Technology of Flexible PackagingDaryl ChianNessuna valutazione finora

- 40+ Cool Good Vibes MessagesDocumento10 pagine40+ Cool Good Vibes MessagesRomeo Dela CruzNessuna valutazione finora

- Impact Grammar Book Foundation Unit 1Documento3 pagineImpact Grammar Book Foundation Unit 1Domingo Juan de LeónNessuna valutazione finora

- Laboratory Methodsin ImmnunologyDocumento58 pagineLaboratory Methodsin Immnunologyadi pNessuna valutazione finora

- Togaf Open Group Business ScenarioDocumento40 pagineTogaf Open Group Business Scenariohmh97Nessuna valutazione finora

- StatisticsAllTopicsDocumento315 pagineStatisticsAllTopicsHoda HosnyNessuna valutazione finora

- Reply To Pieta MR SinoDocumento9 pagineReply To Pieta MR SinoBZ RigerNessuna valutazione finora

- Narrative ReportDocumento6 pagineNarrative ReportAlyssa Marie AsuncionNessuna valutazione finora

- MSC in Healthcare Management (Top-Up) Degree From ARU - Delivered Online by LSBR, UKDocumento19 pagineMSC in Healthcare Management (Top-Up) Degree From ARU - Delivered Online by LSBR, UKLSBRNessuna valutazione finora

- Nikulin D. - Imagination and Mathematics in ProclusDocumento20 pagineNikulin D. - Imagination and Mathematics in ProclusannipNessuna valutazione finora

- Ollie Nathan Harris v. United States, 402 F.2d 464, 10th Cir. (1968)Documento2 pagineOllie Nathan Harris v. United States, 402 F.2d 464, 10th Cir. (1968)Scribd Government DocsNessuna valutazione finora

- LM213 First Exam Notes PDFDocumento7 pagineLM213 First Exam Notes PDFNikki KatesNessuna valutazione finora

- First Aid General PathologyDocumento8 pagineFirst Aid General PathologyHamza AshrafNessuna valutazione finora

- RSA ChangeMakers - Identifying The Key People Driving Positive Change in Local AreasDocumento29 pagineRSA ChangeMakers - Identifying The Key People Driving Positive Change in Local AreasThe RSANessuna valutazione finora

- Nandurbar District S.E. (CGPA) Nov 2013Documento336 pagineNandurbar District S.E. (CGPA) Nov 2013Digitaladda IndiaNessuna valutazione finora

- (s5.h) American Bible Society Vs City of ManilaDocumento2 pagine(s5.h) American Bible Society Vs City of Manilamj lopez100% (1)

- Information Security Policies & Procedures: Slide 4Documento33 pagineInformation Security Policies & Procedures: Slide 4jeypopNessuna valutazione finora

- InnovationDocumento19 pagineInnovationPamela PlamenovaNessuna valutazione finora