Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Afm Case 2

Caricato da

Vatsal MagajwalaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Afm Case 2

Caricato da

Vatsal MagajwalaCopyright:

Formati disponibili

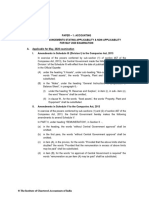

CASH FLOW STATEMENT OF ASHOK LEYLAND

PARTICULARS 2010

Profit before Tax 6045.06

ADJUSTMENTS FOR:

Depreciation 1505.74

Other Amortizations 164.76

Unrealized foreign exchange gains / losses (65.30)

Interest expense 196.46

Interest income (160.94)

Income from Investments (98.85)

Provision for diminution in value of Investments / Advances (168.13)

(Profit)/Loss on disposal of Fixed Assets / Long Term

Investments (323.15)

Transfer from General Reserve - Employee benefits (781.54)

Profit on sale of undertaking 0.00

OPERATING PROFIT BEFORE WORKING CAPITAL

CHANGES

6314.11

ADJUSTMENTS FOR CHANGES IN:

Inventories (1677.60)

Debtors (1005.76)

Advances (1047.41)

Current Liabilities and Provisions 4102.54

CASH GENERATED FROM OPERATIONS 6685.88

Income Tax (Paid) / Refund (1356.00)

NET CASH FLOW FROM OPERATING ACTIVITIES

BEFORE EXTRAORDINARY ITEM

5329.88

Payments under Voluntary Retirement Scheme (330.37)

NET CASH FLOW FROM OPERATING ACTIVITIES

AFTER EXTRAORDINARY ITEM (A)

4999.51

CASH FLOWS FROM INVESTING ACTIVITIES

Payments for assets acquisition (6812.87)

Proceeds on sale of Fixed Assets 108.49

Proceeds on sale of undertaking 0.00

Purchase of Long Term Investments (50.64)

Sale/Redemption of Long Term Investments 557.64

Income from Investments - Interest 44.78

- Dividend 129.39

Changes in Advances (1473.70)

NET CASH FLOW FROM INVESTING ACTIVITIES (B) (7496.91)

CASH FLOWS FROM FINANCING ACTIVITIES

Long term Borrowings - Raised 2162.35

- Repaid (829.95)

Changes in Short term borrowings 0.00

Debenture issue and Loan raising expenses paid (2.47)

Premium paid on Prepayment of Loan 0.00

Interest paid - net (167.02)

Dividend Paid and tax thereon (1792.34)

Interim dividend and tax thereon (2264.32)

NET CASH FLOW FROM FINANCING ACTIVITIES (C) (2893.75)

NET CASH INFLOW / (OUTFLOW) (A+B+C) (5391.15)

OPENING CASH AND CASH EQUIVALENTS (D) 8503.22

CLOSING CASH AND CASH EQUIVALENTS (E) 3112.07

NET INCREASE IN CASH AND CASH EQUIVALENTS (E-D) (5391.15)

Interpretation:

Operating activities:

The Ashok Leyland Ltds net cash flow from operations of 4999.51 (Rs in Millions) is less than

the sum of accrual based profit & depreciation that equals Rs. 5918.60, showing that the profit

has not been fully realized in cash. From the cash flow statements, the main positive item is the

depreciation charge of Rs. 1505.74 Thus the companys earning cannot be said to be of high

quality. Increase in Inventories was Rs. 1677.60 and increase in debtors is Rs. 1005.76 resulted

in strain on the cash generated from generation.

Investing Activities:

Form the Investing Activities section; Ashok Leyland Ltd has payments for assets acquisition of

Rs. 1824.56. The expenditure financed partly by:

a) Realizing Rs. 48.56 from the Sales of Plant.

b) Realizing Rs. 61.56 from the Sale Of Investments, Net OF Purchase.

c) Interest Revenue Rs. 42.70. This has left a gap of Rs. 1554.47 to be financed from

other sources.

Financing Activities:

It is seen from the Financing Activities section that the Ashok Leyland Ltd raised long-term

borrowing Rs. 6812.87& repaid long term borrowing Rs. 829.95. In effect, the net realization

from long-term sources was Rs. 507. Further, the company paid dividend Rs. 1792.34and interest

of Rs. 167.02 has been left, with net cash of Rs. 2893.75 from financing activities.

Net Cash Flow:

It is clear that the expansion in the plant & machinery during the period was major drain on cash.

The net cash out flow from investing activities of Rs. 5391.15 was met from three sources:

I. Cash Flow from Operations, Rs. 4999.51

II. Proceeds from Issuance of Share Capital, Rs. 7496.91 (after repaying loans &

disturbing interest and dividend).

III. Withdrawal from Cash Balance, Rs. 5391.15

That is Cash in Flow, which is good sign for company.

PARTICULARS 2009

Profit before Tax 4523.00

ADJUSTMENTS FOR:

Depreciation 1260.06

Other Amortizations 132.84

Unrealized foreign exchange gains / losses 102.05

Interest expense 288.33

Interest income (193.87)

Income from Investments (87.47)

Provision for diminution in value of Investments /Advances 0.00

(Profit)/Loss on disposal of Fixed Assets / Long Term Investments (66.61)

Transfer from General Reserve - Employee benefits 0.00

Profit on sale of undertaking (301.66)

OPERATING PROFIT BEFORE WORKING CAPITAL CHANGES 5656.67

ADJUSTMENTS FOR CHANGES IN:

Inventories (3477.99)

Debtors (179.55)

Advances 314.73

Current Liabilities and Provisions 2051.52

CASH GENERATED FROM OPERATIONS 4365.38

Income Tax (Paid) / Refund (1135.68)

NET CASH FLOW FROM OPERATING ACTIVITIES BEFORE

EXTRAORDINARY ITEM

3229.70

Payments under Voluntary Retirement Scheme (9.53)

NET CASH FLOW FROM OPERATING ACTIVITIES AFTER

EXTRAORDINARY ITEM (A)

3220.17

CASH FLOWS FROM INVESTING ACTIVITIES

Payments for assets acquisition (2646.86)

Proceeds on sale of Fixed Assets 54.34

Proceeds on sale of undertaking 620.00

Purchase of Long Term Investments (138.66)

Sale/Redemption of Long Term Investments 479.68

Income from Investments - Interest 48.95

- Dividend 56.93

Changes in Advances 189.77

NET CASH FLOW FROM INVESTING ACTIVITIES (B) (1335.85)

CASH FLOWS FROM FINANCING ACTIVITIES

Long term Borrowings - Raised 186.69

- Repaid (1162.88)

Changes in Short term borrowings (76.79)

Debenture issue and Loan raising expenses paid 0.00

Premium paid on Prepayment of Loan 0.00

Interest paid - net (166.96)

Dividend Paid and tax thereon (1356.10)

Interim dividend and tax thereon 0.00

NET CASH FLOW FROM FINANCING ACTIVITIES (C) (2576.04)

NET CASH INFLOW / (OUTFLOW) (A+B+C) (691.72)

OPENING CASH AND CASH EQUIVALENTS (D) 9194.94

CLOSING CASH AND CASH EQUIVALENTS (E) 8503.22

NET INCREASE IN CASH AND CASH EQUIVALENTS (E-D) (691.72)

Interpretation:

Operating activities:

The Ashok Leyland Ltds net cash flow from operations of 3220.17 (Rs in Millions) is less than

the sum of accrual based profit & depreciation that equals Rs. 4533.26, showing that the profit

has not been fully realized in cash. From the cash flow statements, the main positive item is the

depreciation charge of Rs. 1260.06. Thus the companys earning cannot be said to be of high

quality. Increase in Inventories was Rs. 3477.99 and increase in debtors is Rs.179.55 resulted in

strain on the cash generated from generation.

Investing Activities:

Form the Investing Activities section; Ashok Leyland Ltd has payments for assets acquisition of

Rs. 2646.86. The expenditure financed partly by:

a) Realizing Rs. 54.34 from the Sales of Plant.

b) Realizing Rs. [479.68 + (138.66)] 341.02 from the Sale Of Investments, Net OF

Purchase.

c) Interest Revenue Rs. 48.95 & dividend 56.93. This has left a gap of Rs. 1335.85

to be financed from other sources.

Financing Activities:

It is seen from the Financing Activities section that the Ashok Leyland Ltd raised long-term

borrowing Rs. 186.69 & repaid long term borrowing Rs. 1162.88. Interest paid and dividend paid

166.96 & 1356.10 that carried out finance activities Rs. 2576.04.

Net Cash Flow:

It is clear that the expansion in the plant & machinery during the period was major drain on cash.

The net cash out flow from investing activities of Rs. 691.72 was met from three sources:

1. Cash Flow from Operations, Rs. 3220.17

2. Proceeds from Issuance of Share Capital, Rs. 1335.85 (after repaying loans &

disturbing interest and dividend).

3. Withdrawal from Cash Balance, Rs. 691.72.

That is Cash in Flow, which is good sign for company.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- CH 4 HW PDFDocumento26 pagineCH 4 HW PDFIbra TutorNessuna valutazione finora

- Ric Watering ProjectDocumento3 pagineRic Watering ProjectTakudzwa GwemeNessuna valutazione finora

- FAC1602 STUDY GUIDE 001 - 2019 - 4 - BDocumento224 pagineFAC1602 STUDY GUIDE 001 - 2019 - 4 - BandreqwNessuna valutazione finora

- Assignment 1 Treasury Management: Submitted by 314141vatsal MagajwalaDocumento6 pagineAssignment 1 Treasury Management: Submitted by 314141vatsal MagajwalaVatsal MagajwalaNessuna valutazione finora

- A Grand Project Report On Study of Some Specific Talent Classes in Ahmedabad CityDocumento69 pagineA Grand Project Report On Study of Some Specific Talent Classes in Ahmedabad CityVatsal MagajwalaNessuna valutazione finora

- 81 Dhruvil Sy BDocumento61 pagine81 Dhruvil Sy BVatsal MagajwalaNessuna valutazione finora

- 81 Dhruvil Sy BDocumento61 pagine81 Dhruvil Sy BVatsal MagajwalaNessuna valutazione finora

- Business Law AssignmentDocumento9 pagineBusiness Law AssignmentVatsal MagajwalaNessuna valutazione finora

- Case 9 Uniform UniformsDocumento3 pagineCase 9 Uniform UniformsVatsal MagajwalaNessuna valutazione finora

- Accounts AssignmentDocumento5 pagineAccounts AssignmentVatsal MagajwalaNessuna valutazione finora

- Resettlement and Ethnic Development PlanDocumento147 pagineResettlement and Ethnic Development PlanDương Viết CươngNessuna valutazione finora

- Intermediate Accounting RTP May 20Documento44 pagineIntermediate Accounting RTP May 20Durgadevi BaskaranNessuna valutazione finora

- Tata Capital Housing Finance LimitedDocumento27 pagineTata Capital Housing Finance LimitedParth BhattNessuna valutazione finora

- FA Work BookDocumento59 pagineFA Work BookUnais AhmedNessuna valutazione finora

- Accounting 203 Chapter 12 TestDocumento3 pagineAccounting 203 Chapter 12 TestAnbang XiaoNessuna valutazione finora

- Answer Assignment 1 - V1-2 - Fall 2020Documento14 pagineAnswer Assignment 1 - V1-2 - Fall 2020JamNessuna valutazione finora

- IFRS 16 2022 ExamplesDocumento15 pagineIFRS 16 2022 ExamplesSergiu BoldurescuNessuna valutazione finora

- Adjusting Entries KaroleDocumento89 pagineAdjusting Entries Karole이시연Nessuna valutazione finora

- ch19 Accounting Income TaxesDocumento102 paginech19 Accounting Income TaxesIndah SariwatiNessuna valutazione finora

- Sekai WaDocumento2 pagineSekai WaMicaela EncinasNessuna valutazione finora

- Indian Accounting Standard 105: © The Institute of Chartered Accountants of IndiaDocumento17 pagineIndian Accounting Standard 105: © The Institute of Chartered Accountants of IndiaRITZ BROWNNessuna valutazione finora

- Asset Report: List of Tcodes: AR01 AR02 AR03 AR05 AW01N, S - ALR - 87011990Documento18 pagineAsset Report: List of Tcodes: AR01 AR02 AR03 AR05 AW01N, S - ALR - 87011990Abdulla Al mamunNessuna valutazione finora

- Engineering Economic Analysis Dr. Rakesh KumarDocumento38 pagineEngineering Economic Analysis Dr. Rakesh KumarDEV RAJNessuna valutazione finora

- Commonly Found Errors in Reporting Practices - ICAIDocumento166 pagineCommonly Found Errors in Reporting Practices - ICAIKANNAPPAN NAGARAJANNessuna valutazione finora

- Water Resources Systems Planning and Management - LectureDocumento30 pagineWater Resources Systems Planning and Management - LectureTejaswiniNessuna valutazione finora

- Advanced Financial Reporting Questions and AnswersDocumento3 pagineAdvanced Financial Reporting Questions and AnswersMEYVIELYKERNessuna valutazione finora

- BCT 2105 Accounting Software - Marking SchemeDocumento8 pagineBCT 2105 Accounting Software - Marking SchemeSylvia RatemoNessuna valutazione finora

- Aud ProbDocumento9 pagineAud ProbKulet AkoNessuna valutazione finora

- Vehicle Lifecycle Costs Analysis: Sponsored byDocumento32 pagineVehicle Lifecycle Costs Analysis: Sponsored byJairo Iván SánchezNessuna valutazione finora

- Adjustments To Final AccountsDocumento20 pagineAdjustments To Final AccountsSalamaNessuna valutazione finora

- F1 CIMA Workbook Q PDFDocumento169 pagineF1 CIMA Workbook Q PDFKhadija Rampurawala100% (1)

- Finance Interview Best Practices Be Prepared For Technical QuestionsDocumento14 pagineFinance Interview Best Practices Be Prepared For Technical Questionsmanish mishraNessuna valutazione finora

- Cfs Direct Method - IaDocumento35 pagineCfs Direct Method - IaCanny TrầnNessuna valutazione finora

- CAF-6 Mock Solution by SkansDocumento6 pagineCAF-6 Mock Solution by SkansMuhammad YahyaNessuna valutazione finora

- Chapter SixDocumento27 pagineChapter SixMisganaw WaleNessuna valutazione finora

- Acctg13 PPE ProblemsDocumento4 pagineAcctg13 PPE ProblemsKristel Keith NievaNessuna valutazione finora

- Twelve Cases of AccountingDocumento152 pagineTwelve Cases of AccountingregiscardosoNessuna valutazione finora