Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Gann

Caricato da

Agus Empu RanubayanCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Gann

Caricato da

Agus Empu RanubayanCopyright:

Formati disponibili

Gann's Pyramid Trading Method

You are here : Forex Learning Center > Level EXPERT > Gann's Pyramid

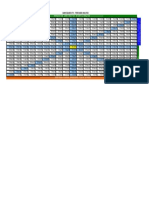

Red color shows the most important points.

When a red point is broken, the currency pair makes a complet turn of

the pyramid.

Example : If 81 is broken up, it goes to 121..

Yellow color shows very important points.

When a yellow point is broken, the currency pair goes to the next

corner.

Example: If 101 is broken up, it goes to 111.

Blue color shows very important points.

When a blue point is broken, the currency pair goes to the next corner.

Example : If 116 is broken up, it goes to 121.

Green color shows important points, but not very important

points.

There are resistances which can stop and reverse the direction. When a

green point is broken, the currency pair goes to the next point.

Example : If 154 is broken, It goes to 157.

To confirm a broken point signal, The two next sessions need to be

closed 50 pips over up (over down)

The ganns pyramid is a basic of the trading, invented at the start of the last century. We

could compare it to the Elliot waves or to the Fibonacci retracement (Gann also worked on

others types of retracements). The Gann's pyramid doesnt allow making day trading. Its

more a medium and long term analyzing tool. She allowed mostly seeing where the price is

going, where it will face zone of resistances and supports.

You can find a test of the Gann's pyramid at the bottom of this page that shows that the

pyramid is working!

To position your price in the pyramid, the principle is very simple : 1.50 correspond at 150.

At the contrary, for parity quoted in hundreds, the price doesnt change. (if a parity quote 98,

we will place 98 on the pyramid)

Here is an example for EUR/USD in 2008:

From 1.60 to 1.39 directly. Then rebond till 1.48. We went down till 1.24 and we go back to

1.45.

Take another historical daily chart and watch movements that have been done with the

pyramid.

Original of the pyramid:

The Ganns pyramid introduced above is very important. She gives vital information, some

points are suggested. Indeed, the pyramid is mostly introduced with round numbers. That's

why we had on our pyramid such levels as 108.5 or 113.5, to sum up, every green lines

between 81 and 121 of the Gann's pyramid. The practice showed us that these points are

sometimes key reversal trend points.

How it works?

A journey is considered as validated if the closing price is above (or below) 50 pips of the

line considered. To enter in position, two journeys must be validated. Some people will tell

you that one day is enough. Its your choice but note that the validation by 2 journeys allow

to eliminate a high number of false signals. According to various comments that I could

picked up, I advise you to adopt this last method.

Here now is how the pyramid is updated every evening: at the close of 11.00 pm, the close

price of each parity is picked up. Then, we postpone this level in the pyramid of Gann on the

corresponding parity. Take the example of EUR / USD which is between 139 and 142. If at

the close of Monday, the price is higher than 142 (1.42), then we put an arrow up and an

arrow down if the close is below 139 (1.39). Then, we choose the type of arrow and you just

need to see the legend. A blue arrow means for example that the close was less than 50 pips

and therefore the journey cannot be validated. Returning to our example of the EUR / USD,

we assume now a close price at 1.4210. Then i put a blue arrow because between 142 and

142.10 there are only 10 pips. Thejourney is not validated. However, if the close is at 1.4260,

I would put the white arrow with a 1 into it because we are in the case of a validated journey.

To validate the 2nd day, it is also necessary that the close on Tuesday is + - 50 pips above

1.42. Once the two days validated, the ganns pyramid indicates the next target of the parity.

In our example this would be 1.45 because 1.45 is the upper limit between 142 and 145 in the

pyramid.

Last important point: you updated each evening the Ganns pyramid table, on which we

indicate broken points, validated and others. This table is post on the Forum or in the section

technical analysis.

Trading strategies

The Ganns pyramid must be used in a MT or LT timescale. Indeed, objectives are around

several hundred of pips, it is therefore unusual that this one was reached during the day.

Mostly, the trade is done in a week. Of course, there are no prcised rules, movements of the

market could be violent and your stop loss or your target reache rapidly. Three strategies are

possible to trade with the Gann's pyramid. Obviously, each one can be modified according to

your profile. Here are these methods:

- The first one consists to place a stop above or below the line that has just given the signal to

buy or sell. The objective is the following line of the pyramid. This line is mostly at 250 or

300 pips, you can place your stop depending on the risk / return ratio (see money

management). For example, if you impose you a ratio of 3 (risk 1 to win 3), your stop will be

located approximately 250 / 3 = 83.3 pips below your entry point. The risk may be important

(and controlled) but the expectation of profit is also big.

This method can be improved as follows: Your stop is placed not on the basis of a ratio, but

according to a key level of support or resistance. So if a buy signal is given by the pyramid,

you place your stop under the nearest major support. The objective is unchanged, that is to

day the next line. However, although the lines of different colors can be viewed as goals, set

your goal a few pips below (or above depending on the side) is appropriate.

The important thing is to be disciplined. We must stick to your objectives and not take fright

at every market movement. There will be days the market will not stop going to the wrong

side for you. It is perfectly normal because there are corrective movements constantly. The

market never make a right line toward your goal. Like for the method of Dow, Gann's

pyramid allows you to play the trend.

- The second method consists to trade Gann's pyramid by color. The operation is the same for

each color. If a color is broken down or up, then the objective will be to the next line with the

same color. Afterwards, according to each color, the goal will be more or less distant. Green

are the most closed one and red the most distant. Thus, the objectives can be achieved only

after many years or simply never be achieved. That is why we must work with moving stops.

The position taken and the set up of the stop is done identically as the first method. However,

once the next line is reached,we target the next line until you reach the line of the same color

that is the goal. Thus, each new low and support that will form (in case you're bullish), the

stop will be moved to reduce gradually the risk or to ensure your profits. After the stop can

also be positioned below the last lowest, that 's up to you. Gann's pyramid then only give buy

or sell signals , the objectives is almost never reached (because too far).

You will find on the Forum members who are studying the best way to trade with the Gann's

pyramid. Join us now!

Study on the Gann's pyramid (realized by Forextribe)

To perform this study, we calculated the percentage of time that a high point or low point of

the range was reached when a change of range occurred. Consider an example. The EUR /

USD cross on the rise the level of 130. It is therefore in the range 130-133. 133 is its

objective. If it is reached at more or less 10 pips, I count 1 in the table. If not, I put 0. The

target can be reached at any time of the day. It may happen that there is only one day of

validation and in this case I will put the sign "-" for the second day. The percentage

represents the probability that the target is reached.

It is currently impossible to perform deep analysis given the limited data we have. The study

began in early 2009 until Friday 27 March 2009. The best study would be to calculate the

number of times that the line of the same color as the previous one has been reached when a

buy or sell signal is given.

It is important to remember that the pyramid of Gann is not very suitable for day trading.

Indeed, stop loss should be placed well below the range to avoid being stopped due to

volatility in the day. However, it can be use with other indicators to determine stop loss much

less distant. The super Trend for example, can be a useful tool to link with the pyramid Gann.

Thus, the super trend determines your stop and the pyramid of Gann your objective.

In the medium and long term, the pyramid can be used with no other indicator by placing

your stop well below the range. One hundred pips below seems appropriate. Concerning the

objective, its up to you, but the importance of lines plays a big part. Going beyond a red line,

for example, is an excellent point entry point, followed by yellow, the blue and green. The

target can be for example set to the next line of the same color. Beautiful performances were

achieved by using this method. These people will recognize and Im greeting them.

Here are the results of the study:

A summarization table of the performance:

As you can see, the Ganns pyramid offer interesting results and is a very good

indicator to enter or exit the market.

Study on the Gann's pyramid (realized by our members)

One of our members (Huralp) is trading for more than four months with the Gann's pyramid.

Here is his trading strategy: "I take two positions:

- A position with the next line as objective with a risk of 2% of my capital. No trailing stop

used.

- A second position with the next same color line as objective with a risk of 1% + Trailing

Stop corresponding to the difference between my opening price and my stop loss.

Here is his review of four months of trading with Gann's pyramid using this method: 17

traded pairs, capital of $ 1,000 on September 1st. The 1st of May : $ 1,283.37. So it's a profit

of 28.37%. 251 trades were made with 182 = 71.9% winning traders and 71 = 29.10% losing

trades."

Pairs Winning trades Losing trades Profit in dollar

AUD/USD 12 (85%) 2 (15%) 42.24 $

EUR/USD 12 (80%) 3 (20%) 32.26 $

NZD/USD 10 (83%) 2 (17%) 17.18 $

USD/CAD 10 (58%) 7 (42%) 9.43 $

GBP/USD 14 (73%) 5 (27%) 2.22 $

USD/JPY 7 (87%) 1 (13%) 40.11 $

CHF/JPY 8 (80%) 2 (20%) 6.06

EUR/JPY 10 (66%) 5 (34%) -11.20 $

GBP/JPY 9 (60%) 6 (40%) 4.04 $

EUR/GBP 6 (75%) 2 (25%) 66.00 $

EUR/CHF 13 (86%) 2 (14%) 61.19 $

AUD/JPY 9 (64%) 5 (36%) 3.67 $

CAD/JPY 13 (72%) 5 (28%) 1.01 $

EUR/AUD 9 (45%) 11 (55%) -110.29 $

EUR/CAD 14 (66%) 7 (34%) 54.77 $

GBP/CHF 14 (70%) 6 (30%) 0.45 $

USD/CHF 12 (100%) 0 (0%) 64.23 $

Total 182 (71.9%) 71 (29.1%) 283.37 $

Potrebbero piacerti anche

- ABC Trading Plan Pressure Points Road Map: Entry Stop Exit Stop 376.70Documento16 pagineABC Trading Plan Pressure Points Road Map: Entry Stop Exit Stop 376.70vasanth3675% (8)

- Gann Swing SystemDocumento17 pagineGann Swing Systembaraib7ty100% (1)

- Intraday Trade Using Gann Angle PDFDocumento19 pagineIntraday Trade Using Gann Angle PDFsriruban80% (5)

- William D. Gann's Simplified Stock Market TheoriesDa EverandWilliam D. Gann's Simplified Stock Market TheoriesValutazione: 4.5 su 5 stelle4.5/5 (12)

- 360 Gann Price ExcelDocumento2 pagine360 Gann Price Excelputih12163% (24)

- Gann Analysis Thru ExcelDocumento26 pagineGann Analysis Thru ExcelKaaran Thakker86% (14)

- Time and Price Squares PDFDocumento9 pagineTime and Price Squares PDFsurjansh50% (2)

- The Square of 9 Real TechniqueDocumento4 pagineThe Square of 9 Real Techniquekmrsg7100% (5)

- Gann Angle CalculatorDocumento3 pagineGann Angle Calculatorsathya44% (9)

- 45 Years In Wall Street (Rediscovered Books): A Review of the 1937 Panic and 1942 Panic, 1946 Bull Market with New Time Rules and Percentage Rules with Charts for Determining the Trend on StocksDa Everand45 Years In Wall Street (Rediscovered Books): A Review of the 1937 Panic and 1942 Panic, 1946 Bull Market with New Time Rules and Percentage Rules with Charts for Determining the Trend on StocksNessuna valutazione finora

- SQ of 9 FormulaDocumento8 pagineSQ of 9 FormulaJeff Greenblatt100% (2)

- Gann by MyselfDocumento20 pagineGann by MyselfMukesh Kumar100% (1)

- W.D. Gann - Angles CourseDocumento32 pagineW.D. Gann - Angles CourseVibhats Vibhor100% (6)

- Forex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders: A Technical Analysis for Spot and Futures Curency TradersDa EverandForex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders: A Technical Analysis for Spot and Futures Curency TradersNessuna valutazione finora

- Gann's Square of NineDocumento29 pagineGann's Square of NineindiaNessuna valutazione finora

- How To Calculate Square of Nine AnglesDocumento3 pagineHow To Calculate Square of Nine Anglesdockamag100% (5)

- How To Make Profits Trading in Commodities: A Study Of The Commodity Market, With Charts And Rules For Successful Trading And InvestingDa EverandHow To Make Profits Trading in Commodities: A Study Of The Commodity Market, With Charts And Rules For Successful Trading And InvestingValutazione: 5 su 5 stelle5/5 (1)

- Gann Calculator ExplainedDocumento5 pagineGann Calculator ExplainedKaaran Thakker100% (1)

- New Stock Trend Detector: A Review Of The 1929-1932 Panic And The 1932-1935 Bull MarketDa EverandNew Stock Trend Detector: A Review Of The 1929-1932 Panic And The 1932-1935 Bull MarketValutazione: 5 su 5 stelle5/5 (5)

- What Gann's Square-Of-9 Means For The Nasdaq 100Documento12 pagineWhat Gann's Square-Of-9 Means For The Nasdaq 100fsolomon100% (2)

- Pattern, Price and Time: Using Gann Theory in Technical AnalysisDa EverandPattern, Price and Time: Using Gann Theory in Technical AnalysisNessuna valutazione finora

- Gann StuffDocumento72 pagineGann StuffGABRIELE ROMEO75% (4)

- The Simplified Theory of The Time Factor in Forex TradingDa EverandThe Simplified Theory of The Time Factor in Forex TradingNessuna valutazione finora

- Gann AnglesDocumento3 pagineGann AnglesMohamed Wahid100% (1)

- The Law of Vibration: The revelation of William D. GannDa EverandThe Law of Vibration: The revelation of William D. GannValutazione: 4 su 5 stelle4/5 (33)

- Gann - List Download LinkDocumento4 pagineGann - List Download Linkscooex50% (2)

- 20 Years of Studying GannDocumento27 pagine20 Years of Studying GannNo Name100% (14)

- Trading World Markets Using Phi and the Fibonacci NumbersDa EverandTrading World Markets Using Phi and the Fibonacci NumbersValutazione: 4 su 5 stelle4/5 (4)

- Squaring Time and Price With PlanetsDocumento42 pagineSquaring Time and Price With PlanetsHitesh Patel86% (37)

- Gann Square of 9 - Time AnalysDocumento1 paginaGann Square of 9 - Time AnalysArpana Garg75% (4)

- Intraday Trade Gann AngleDocumento19 pagineIntraday Trade Gann AngleNandaKumarRathi100% (1)

- Gann Course in India - GannAndWavesDocumento9 pagineGann Course in India - GannAndWavesGann And Waves100% (1)

- Gann Time Price SquareDocumento5 pagineGann Time Price Squareanudora0% (1)

- Gann How To Trade Using The Methods of GannDocumento271 pagineGann How To Trade Using The Methods of GannRYvERbyaBYra94% (18)

- Gann's Scientific Methods Unveiled: Volume 2Documento194 pagineGann's Scientific Methods Unveiled: Volume 2dhamu020288% (8)

- Gann Cycles Introduction 182Documento5 pagineGann Cycles Introduction 182HazemSamir80% (5)

- Square of Nine WebinarsDocumento7 pagineSquare of Nine WebinarsPratik Rambhia100% (1)

- Kakasuleff, Chris - Predicting Market Trends Using The Square of 9Documento4 pagineKakasuleff, Chris - Predicting Market Trends Using The Square of 9Mohamed ElAgamy100% (4)

- William Gann Method PDFDocumento1 paginaWilliam Gann Method PDFchandra widjajaNessuna valutazione finora

- Overview of Auto GannDocumento4 pagineOverview of Auto GannLucky Chopra100% (1)

- Gann, WD Master Mathematical Price Time Trend CalculatorDocumento10 pagineGann, WD Master Mathematical Price Time Trend Calculatorsmashdwarf100% (3)

- Gann InSightsDocumento8 pagineGann InSightsAdam BorthwickNessuna valutazione finora

- Understanding Gann Price and Time CycleDocumento9 pagineUnderstanding Gann Price and Time CycleP Sahoo86% (7)

- Larry Jacobs - Gann Trade Real TimeDocumento203 pagineLarry Jacobs - Gann Trade Real TimeSoheil Engineer67% (3)

- W D Gann Course PathDocumento5 pagineW D Gann Course PathchirakiNessuna valutazione finora

- Intraday Trade Using Gann AngleDocumento19 pagineIntraday Trade Using Gann AngleGj Dharani100% (2)

- Gann CalculatorDocumento10 pagineGann Calculatorshephila567% (3)

- Dynamic Gann LevelsDocumento40 pagineDynamic Gann LevelsBalamurugan Natarajan100% (3)

- GannDocumento11 pagineGannrajivnk100% (1)

- Change in Teachers Ratings of AttentionDocumento9 pagineChange in Teachers Ratings of AttentionAgus Empu RanubayanNessuna valutazione finora

- Tabel R Product Moment Big SampleDocumento1 paginaTabel R Product Moment Big SampleAgus Empu RanubayanNessuna valutazione finora

- Trendlines and Channels-Draw A Manual Trend LineDocumento3 pagineTrendlines and Channels-Draw A Manual Trend LineAgus Empu Ranubayan100% (1)

- Ichimoku WinnersDocumento40 pagineIchimoku WinnersIngemar FalkNessuna valutazione finora

- Es070617 1Documento3 pagineEs070617 1RICARDO100% (1)

- A Summer Internship Project On The Derivatives MarketDocumento20 pagineA Summer Internship Project On The Derivatives MarketSonu KumarNessuna valutazione finora

- 50h 50l 15c Rachit Jain Crossover StrategyDocumento5 pagine50h 50l 15c Rachit Jain Crossover StrategyKarthick AnnamalaiNessuna valutazione finora

- SSRN Id3596245 PDFDocumento64 pagineSSRN Id3596245 PDFAkil LawyerNessuna valutazione finora

- Whitepaper QuopiDocumento19 pagineWhitepaper Quopiliam veluNessuna valutazione finora

- TRADING PLAN by IntelligencefxDocumento9 pagineTRADING PLAN by IntelligencefxSanusi GarubaNessuna valutazione finora

- tmp5015 TMPDocumento208 paginetmp5015 TMPFrontiersNessuna valutazione finora

- TeleTrader - WebStation - en PDFDocumento2 pagineTeleTrader - WebStation - en PDFDragan MilicNessuna valutazione finora

- Iex Dam Tam Web 2017Documento65 pagineIex Dam Tam Web 2017Girish MehraNessuna valutazione finora

- 3 - Trading On IEX Mr. Sudhir BhartiDocumento50 pagine3 - Trading On IEX Mr. Sudhir Bhartiminushastri33Nessuna valutazione finora

- SSRN Id3890338Documento20 pagineSSRN Id3890338MiladEbrahimiNessuna valutazione finora

- Best Intraday TipsDocumento4 pagineBest Intraday TipsGururaj VNessuna valutazione finora

- 20 Advantages of Futures Over Forex, Stocks and ETFsDocumento4 pagine20 Advantages of Futures Over Forex, Stocks and ETFsFco Jav RamNessuna valutazione finora

- 110AB0064 李少珠 1.) Dark Pool 暗池Documento4 pagine110AB0064 李少珠 1.) Dark Pool 暗池李少珠 AnanchaNessuna valutazione finora

- Creating A Trading Plan EminiMindDocumento37 pagineCreating A Trading Plan EminiMindregddd50% (2)

- Mindfluential EbookDocumento95 pagineMindfluential EbookAkhil Kotian100% (4)

- Shahid's Mentorship ProgramDocumento12 pagineShahid's Mentorship Programahmad khuramNessuna valutazione finora

- Chapter 16, Online Banking and Investing: OutlineDocumento42 pagineChapter 16, Online Banking and Investing: Outlinemanojbhatia1220Nessuna valutazione finora

- Momentum Trend TraderDocumento121 pagineMomentum Trend Traderjordan881100% (1)

- Trading Questions AnsweredDocumento22 pagineTrading Questions AnsweredShagudi Gutti100% (1)

- Gary Smith - MomentumDocumento17 pagineGary Smith - MomentumbrentNessuna valutazione finora

- Trading With Pivot Points - Understanding The Ins, Outs and Formulas - VantagePointDocumento7 pagineTrading With Pivot Points - Understanding The Ins, Outs and Formulas - VantagePointluca pilottiNessuna valutazione finora

- Detailed Analysis of 920 Short Straddle Strategy. Is It Stopped Working?Documento4 pagineDetailed Analysis of 920 Short Straddle Strategy. Is It Stopped Working?Navin ChandarNessuna valutazione finora

- FX Starter Guide PD PDFDocumento17 pagineFX Starter Guide PD PDFВлад ИвановNessuna valutazione finora

- Momentum Investing - Ken WolffDocumento60 pagineMomentum Investing - Ken Wolffpprkut11Nessuna valutazione finora

- Inner CircleDocumento96 pagineInner Circlemr.ajeetsingh20% (5)

- Judas Swings and Market Protraction by Day Trading RaufDocumento6 pagineJudas Swings and Market Protraction by Day Trading Rauf350 DegreesNessuna valutazione finora

- ML CourseDocumento27 pagineML CourseOliver Bradley100% (5)

- 5 6078069466250346586Documento168 pagine5 6078069466250346586Achuthamohan100% (1)

- Swing Trade Pro 2.0 PDFDocumento135 pagineSwing Trade Pro 2.0 PDFSooraj Mittal91% (11)