Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Accy200 Tutwk3

Caricato da

froza347Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Accy200 Tutwk3

Caricato da

froza347Copyright:

Formati disponibili

CHAPTER 1:

DISSCUSSION QUESTIONS

11)

Financial statements are prepared under the assumption that the entity will

continue to operate for the foreseeable future

Implications in accounting, for example:

Justification for use of historical costs for non-current assets and the

systematic allocation of depreciation

Supports inclusion of assets such as goodwill and prepaid expenses, even

if they dont have any sales value

12)

A resource controlled by the entity as a result of past events and from which

future economic benefits are expected to flow to the entity. Three

characteristics:

1. The resources must contain future economic benefits

2. The entity must have control over the resource in such a way that the

entity has the capacity to benefit economically from the asset in the

pursuit of their objectives.

3. The event or events giving rise to the entitys control over the resource

must have occurred.

13)

A present obligation of the entity arising from past events, the settlement of

which is expected to result in an outflow from the entity of resources embodying

economic benefits.Characteristics include:

1. Not just a legal debt, business policies for equity or fairness.

2. Not sufficient to result in future economic debts, i.e. decide to buy an asset

in the future.

3. Giving up of resources embodying economic benefit.

14)

The measurement of the receipt of the land is important because if it is classified

as a government grant, which in this case seems to be the case, then it can be

defined as income. To record government grants related to assets are to be

debited to assets but cannot be credited directly to income or to equity. Instead,

they must be credited to an account called deferred income.

Exercises:

12)

A)

An asset is something that is expected to bring future economic benefits to the

company. Thus, something that only has sentimental valuethat is, it is

incapable of having value to othersdoes not have economic value.

B)

Due to the legal case not yet being complete (no past transaction has occurred)

there is actually no obligation for the firm to make any payments therefore it

isnt classified as a liability and there is no decrease in an asset or increase in

liability so it is not an expense.

C)

The item is removed from the businesses financial statements as it is now retired

from work therefore it can no longer be referred to as a asset as no future

economic benefits are expected to flow to the entity.

D)

The donation will be recognised as income it is an increase in economic benefits

in the form of an increase of assets and the amount of income can be measured

reliably, thus it is income. It will also be recognised as an asset as it has become a

resource controlled by the business as a result of past events (donation) and

future economic benefits are expected to occur.

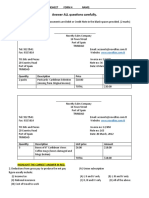

The donation will be recorded as:

Cash at bank

Income

$10000

$10000

13)

Glenelg should recognise this event as revenue as it is probable (indeed certain)

that the future benefits of the event will occur, and the amount of income can be

measured reliably.

If the $3600 is paid in advance, then the event will be recorded as a liability

because there is a future sacrifice of economic benefits (the required rendering

of the service) that the entity is presently obliged to make to the customer as a

result of a past event (the payment). It is probable (indeed certain) that the

future sacrifice will be required, and the amount of the liability can be measured

reliably.

14)

Future economic benefits arising from the development expenditure will not

qualify for recognition as an asset because it is not possible, at the date of the

expenditure, to establish that it is probable that future economic benefits will

eventuate.

CHPATER 3

DISCUSSION QUESTIONS

1)

Reserves arise as a result of increases in equity other than from contributions

from equity participants (share capital). They may arise from various actions:

1. earnings of profits [retained earnings]

2. increases in the fair value of assets [asset revaluation surplus].

The difference from the other equity accounts is that the amounts in these

accounts are earned through the course of the businesses activities, e.g. profits or

losses, and not contributed by the shareholders.

9)

Companies are governed by legislation, and there is normally a clear

distinction made between contributed capital and profits retained in the

entity. Separate accounts are required for a number of reasons, one is that

the accounts are funded by different sources.

More than one owner so in profit distribution (dividends) required

distributing

Increased activities, transferring between account increased required to

distinguish between owners capital and others.

10)

Appropriated retained earnings are retained earnings that have been set aside

by action of the board of directors for a specific use. An appropriation of retained

earnings may be for such purposes as:

Acquisitions

Debt reduction

Marketing campaign

New construction

New product development

Research and development

Reserve against expected insurance losses

Restriction imposed by a loan covenant

Stock buyback

EXERCISES:

6)

As a result of the company not having shareholder approval for the divided prior

to the ending of the reporting period, a liability should be recognized only once

the annual general meeting approves the dividends. This is because, before that

date, the entity does not have a present obligation. Therefore the accountant

doesnt need to report anything in relation to the dividend.

11)

DEBIT CREDIT

Transfer to retained earnings

Retained earnings

General reserves

Transfer to retained earnings

$68000

$68000

$68000

$68000

Interim dividend paid

Cash

Retained earnings

Interim dividend paid

$60000

$60000

$60000

$60000

Asset revaluation surplus

Transfer from asset revaluation surplus

Transfer from asset revaluation surplus

General reserves

$104000

$104000

$104000

$104000

General reserve

Share capital

$960000

$960000

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Exchange RateDocumento5 pagineExchange Ratekim juhwiNessuna valutazione finora

- Euro Currency Market (Unit 1)Documento27 pagineEuro Currency Market (Unit 1)Manoj Bansiwal100% (1)

- Quiz 2Documento9 pagineQuiz 2yuvita prasadNessuna valutazione finora

- CLS 12Documento27 pagineCLS 12aarchi goyalNessuna valutazione finora

- MAINDocumento80 pagineMAINNagireddy KalluriNessuna valutazione finora

- Fundamental Analysis of Bandhan BankDocumento41 pagineFundamental Analysis of Bandhan BankAbhishekNessuna valutazione finora

- Huerta Alba Resort V CADocumento2 pagineHuerta Alba Resort V CAsinisteredgirl100% (1)

- Arsenal's Board Members and DirectorsDocumento11 pagineArsenal's Board Members and DirectorsMussa MlawaNessuna valutazione finora

- Lincoln Park Retiree LawsuitDocumento64 pagineLincoln Park Retiree LawsuitJessica StrachanNessuna valutazione finora

- Introduction of Aditya Birla GroupDocumento4 pagineIntroduction of Aditya Birla GroupdeshmonsterNessuna valutazione finora

- Introduction To Sustainability AccountingDocumento8 pagineIntroduction To Sustainability AccountingAnonymous UhgThoNessuna valutazione finora

- IBP - Lending-Products-Ops Risk Mgmnt-IBP Course-Day 4-2 4 12Documento19 pagineIBP - Lending-Products-Ops Risk Mgmnt-IBP Course-Day 4-2 4 12Zehra RizviNessuna valutazione finora

- DO - 163 - S2015 - DupaDocumento12 pagineDO - 163 - S2015 - DupaRay Ramilo100% (1)

- Financial News - FN 40 Under 40 Rising Stars in Investment Banking - 12 Dec 2011Documento14 pagineFinancial News - FN 40 Under 40 Rising Stars in Investment Banking - 12 Dec 2011Edna ConceiçãoNessuna valutazione finora

- Acc 411 Principles of AuditingDocumento95 pagineAcc 411 Principles of Auditingbenard kibet legotNessuna valutazione finora

- Basics of Engineering Economy, 1e: CHAPTER 12 Solutions ManualDocumento15 pagineBasics of Engineering Economy, 1e: CHAPTER 12 Solutions Manualttufan1Nessuna valutazione finora

- Evaluation of Investment Project Using IRR and NPVDocumento6 pagineEvaluation of Investment Project Using IRR and NPVchew97Nessuna valutazione finora

- A Practical Guide To GST (Chapter 15 - Transition To GST)Documento43 pagineA Practical Guide To GST (Chapter 15 - Transition To GST)Sanjay DwivediNessuna valutazione finora

- Lecture Notes MTH5124: Actuarial Mathematics IDocumento117 pagineLecture Notes MTH5124: Actuarial Mathematics IRishi KumarNessuna valutazione finora

- Affidavit of Loss - Lavina AksakjsDocumento1 paginaAffidavit of Loss - Lavina AksakjsAnjo AlbaNessuna valutazione finora

- Affidavit of Lara Ann Lavi - Dec 10 2009 - USA and Oppression - 2Documento32 pagineAffidavit of Lara Ann Lavi - Dec 10 2009 - USA and Oppression - 2asghar_786Nessuna valutazione finora

- "Impact of Digitalization in Cooprative Bank": A Project Report ONDocumento53 pagine"Impact of Digitalization in Cooprative Bank": A Project Report ONNamitaNessuna valutazione finora

- Pyq - Mat112 - Jun 2019Documento5 paginePyq - Mat112 - Jun 2019isya.ceknua05Nessuna valutazione finora

- DRM-CLASSWORK - 16th JuneDocumento3 pagineDRM-CLASSWORK - 16th JuneSaransh MishraNessuna valutazione finora

- Kausar AlamDocumento1 paginaKausar AlamVenu Gopal RaoNessuna valutazione finora

- Fundamentals of Marketing ManagementDocumento65 pagineFundamentals of Marketing ManagementPriaa100% (1)

- Change Your Life PDF FreeDocumento51 pagineChange Your Life PDF FreeJochebed MukandaNessuna valutazione finora

- Salas Vs CADocumento4 pagineSalas Vs CAHiroshi Carlos100% (1)

- Diagnostic Investments QuestionsDocumento5 pagineDiagnostic Investments Questionscourse heroNessuna valutazione finora

- Ta/Da Bill of Non-Official Member Invited To Attend The MeetingDocumento3 pagineTa/Da Bill of Non-Official Member Invited To Attend The MeetingVasoya ManojNessuna valutazione finora