Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Stockholders Versus Managers

Caricato da

wildflower26040 valutazioniIl 0% ha trovato utile questo documento (0 voti)

66 visualizzazioni2 pagineagency problem between stockholder and management

Titolo originale

Agency Problem

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoagency problem between stockholder and management

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

66 visualizzazioni2 pagineStockholders Versus Managers

Caricato da

wildflower2604agency problem between stockholder and management

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

In agency relationship occurs when a principal hires an agent to perform

some duty. A conflict, known as an "agency problem," arises when there is a

conflict of interest between the needs of the principal and the needs of the

agent.

In finance, there are two primary agency relationships:

Managers and stockholders

Managers and creditors

1. Stockholders versus Managers

If the manager owns less than 100% of the firm's common stock, a

potential agency problem between mangers and stockholders exists.

Managers may make decisions that conflict with the best interests of

the shareholders. For example, managers may grow their firms to

escape a takeover attempt to increase their own job security.

However, a takeover may be in the shareholders' best interest.

2. Stockholders versus Creditors

Creditors decide to loan money to a corporation based on the riskiness

of the company, its capital structure and its potential capital structure.

All of these factors will affect the company's potential cash flow, which

is a creditors' main concern.

Stockholders, however, have control of such decisions through the

managers.

Since stockholders will make decisions based on their best interests, a

potential agency problem exists between the stockholders and

creditors. For example, managers could borrow money to repurchase

shares to lower the corporation's share base and increase shareholder

return. Stockholders will benefit; however, creditors will be concerned

given the increase in debt that would affect future cash flows.

Motivating Managers to Act in Shareholders' Best Interests

There are four primary mechanisms for motivating managers to act in

stockholders' best interests:

Managerial compensation

Direct intervention by stockholders

Threat of firing

Threat of takeovers

1. Managerial Compensation

Managerial compensation should be constructed not only to retain competent

managers, but to align managers' interests with those of stockholders as

much as possible.

This is typically done with an annual salary plus performance bonuses

and company shares.

Company shares are typically distributed to managers either as:

o Performance shares, where managers will receive a certain

number shares based on the company's performance

o Executive stock options, which allow the manager to purchase

shares at a future date and price. With the use of stock options,

managers are aligned closer to the interest of the stockholders

as they themselves will be stockholders.

2. Direct Intervention by Stockholders

Today, the majority of a company's stock is owned by large institutional

investors, such as mutual funds and pensions. As such, these large

institutional stockholders can exert influence on mangers and, as a result,

the firm's operations.

3. Threat of Firing

If stockholders are unhappy with current management, they can encourage

the existing board of directors to change the existing management, or

stockholders may re-elect a new board of directors that will accomplish the

task.

4. Threat of Takeovers

If a stock price deteriorates because of management's inability to run the

company effectively, competitors or stockholders may take a controlling

interest in the company and bring in their own managers.

In the next section, we'll examine the financial institutions and financial

markets that help companies finance their operations.

Potrebbero piacerti anche

- 0 Agency ProblemDocumento3 pagine0 Agency ProblemAnonymous KRQaT2PnYqNessuna valutazione finora

- The Principal-Agent ProblemDocumento9 pagineThe Principal-Agent ProblemAssignmentLab.comNessuna valutazione finora

- Agency Theory Suggests That The Firm Can Be Viewed As A Nexus of ContractsDocumento5 pagineAgency Theory Suggests That The Firm Can Be Viewed As A Nexus of ContractsMilan RathodNessuna valutazione finora

- Agency TheoryDocumento3 pagineAgency TheoryLynaNessuna valutazione finora

- Agency TheoryDocumento27 pagineAgency TheoryWilsonNessuna valutazione finora

- Role of Finance ManagerDocumento4 pagineRole of Finance ManagerDoreen AwuorNessuna valutazione finora

- The Agency Issue: Shareholders VS ManagersDocumento4 pagineThe Agency Issue: Shareholders VS ManagersSyed ZainulabideenNessuna valutazione finora

- Agency ProblemDocumento26 pagineAgency ProblemDauood MustafaNessuna valutazione finora

- Agency CostsDocumento14 pagineAgency Costsహరీష్ చింతలపూడిNessuna valutazione finora

- Corporate Governance, StakeholdersDocumento6 pagineCorporate Governance, StakeholdersIbra GrnNessuna valutazione finora

- Agency TheoryDocumento17 pagineAgency TheoryLegend GameNessuna valutazione finora

- Corporate Governance and Capital Structure DecisionDocumento41 pagineCorporate Governance and Capital Structure DecisionBabandi IbrahimNessuna valutazione finora

- Corporate Finance: A Beginner's Guide: Investment series, #1Da EverandCorporate Finance: A Beginner's Guide: Investment series, #1Nessuna valutazione finora

- Agency Problems and Control of The CorporationsDocumento2 pagineAgency Problems and Control of The CorporationsJain JacobNessuna valutazione finora

- Agency Problems and Accountability of Corporate Managers and ShareholdersDocumento8 pagineAgency Problems and Accountability of Corporate Managers and Shareholdersariolacm60% (5)

- Written Report by Group 2Documento9 pagineWritten Report by Group 2Jefferzon RavivNessuna valutazione finora

- Agency ProblemDocumento2 pagineAgency ProblemmudeyNessuna valutazione finora

- Module 6 Agency ProblemsDocumento6 pagineModule 6 Agency ProblemsRod Jessen A. VillamorNessuna valutazione finora

- BBPW3103 - Agency ProblemDocumento11 pagineBBPW3103 - Agency ProblemM AdiNessuna valutazione finora

- Corporate GovernanceDocumento47 pagineCorporate GovernanceShivaniNessuna valutazione finora

- Fnancial Management ReportDocumento5 pagineFnancial Management ReportPearl RagasajoNessuna valutazione finora

- Strategic Financial ManagementDocumento213 pagineStrategic Financial ManagementShubha Subramanian100% (5)

- Corporate Governance and ESG An IntroductionDocumento27 pagineCorporate Governance and ESG An IntroductionahmedNessuna valutazione finora

- 1.introduction To Finance Management - Jan 2012-1Documento9 pagine1.introduction To Finance Management - Jan 2012-1Moud KhalfaniNessuna valutazione finora

- Political Science Economics Asymmetric Information Principal AgentDocumento7 paginePolitical Science Economics Asymmetric Information Principal AgentPrashant RampuriaNessuna valutazione finora

- Agency TheoryDocumento5 pagineAgency TheoryalfritschavezNessuna valutazione finora

- Agency ConflictsDocumento5 pagineAgency ConflictsAnisha KhandelwalNessuna valutazione finora

- Answers To Review QuestionsDocumento5 pagineAnswers To Review QuestionsMaria ArshadNessuna valutazione finora

- Agency ProbDocumento2 pagineAgency ProbtuhangNessuna valutazione finora

- Group Coursework - MBA IDocumento11 pagineGroup Coursework - MBA IBuatienoNessuna valutazione finora

- Q1) Define The Meaning of Agency Theory?Documento8 pagineQ1) Define The Meaning of Agency Theory?vivek1119Nessuna valutazione finora

- Understanding Financial Management: A Practical Guide: Guideline Answers To The Concept Check QuestionsDocumento5 pagineUnderstanding Financial Management: A Practical Guide: Guideline Answers To The Concept Check QuestionsManuel BoahenNessuna valutazione finora

- Terricina Jackson Fundamentals of FinancialManagementAug31st2009Documento6 pagineTerricina Jackson Fundamentals of FinancialManagementAug31st2009terraj1979Nessuna valutazione finora

- Agency CostsDocumento27 pagineAgency CostsDepankan DasNessuna valutazione finora

- Manajemen Keuangan Lanjutan - Tugas Minggu 1Documento7 pagineManajemen Keuangan Lanjutan - Tugas Minggu 1NadiaNessuna valutazione finora

- Agency Theory AssignmentDocumento6 pagineAgency Theory AssignmentProcurement PractitionersNessuna valutazione finora

- Agency Problems and Their ConsequencesDocumento4 pagineAgency Problems and Their ConsequencesGreat ButaliNessuna valutazione finora

- Agency Problem - Its Solution and Involvement in Financial ManagementDocumento10 pagineAgency Problem - Its Solution and Involvement in Financial ManagementSultana SultanaNessuna valutazione finora

- Solution: - : 2-Management, S PerspectiveDocumento14 pagineSolution: - : 2-Management, S PerspectiveFaiqa MughalNessuna valutazione finora

- Fin220 ch1Documento22 pagineFin220 ch1अंजनी श्रीवास्तवNessuna valutazione finora

- CG NotesDocumento10 pagineCG NotesPranay Singh RaghuvanshiNessuna valutazione finora

- 10-Corporate Governance and EthicsDocumento14 pagine10-Corporate Governance and EthicsIKLIMA PILA SOPIANessuna valutazione finora

- Theories in Financial Management - The Commerce PediaDocumento1 paginaTheories in Financial Management - The Commerce Pediahasan mdNessuna valutazione finora

- FM Unit 1Documento4 pagineFM Unit 1GordonNessuna valutazione finora

- Ge Entrep Activity 2 (Sayre)Documento4 pagineGe Entrep Activity 2 (Sayre)Cyrell Malmis SayreNessuna valutazione finora

- Topic 1 Corporate FinanceDocumento8 pagineTopic 1 Corporate FinanceAbdallah SadikiNessuna valutazione finora

- Case Study Special Topics in AccountingDocumento5 pagineCase Study Special Topics in AccountingSonia Dora DemoliaNessuna valutazione finora

- Corporate Finance - Ch-1Documento2 pagineCorporate Finance - Ch-1aryanigneousNessuna valutazione finora

- Tutorial 1 QuestionsDocumento4 pagineTutorial 1 QuestionshrfjbjrfrfNessuna valutazione finora

- Financial Management - Chapter 1 NotesDocumento2 pagineFinancial Management - Chapter 1 Notessjshubham2Nessuna valutazione finora

- Agency TheoryDocumento18 pagineAgency TheoryAakankshaVatsNessuna valutazione finora

- FM 101 SG 1Documento4 pagineFM 101 SG 1Kezia GwynethNessuna valutazione finora

- Copy of SS-BF-II-12 WEEK 5 Lecture NotesDocumento3 pagineCopy of SS-BF-II-12 WEEK 5 Lecture NotesSheanne GuerreroNessuna valutazione finora

- Questions Mba - MidtermDocumento6 pagineQuestions Mba - Midtermاماني محمدNessuna valutazione finora

- A Survey at Corporate GovernanceDocumento4 pagineA Survey at Corporate GovernancemahsanmukhtarNessuna valutazione finora

- Financial MGMTDocumento13 pagineFinancial MGMTBen AzarelNessuna valutazione finora

- Chapter 1 Lecture NoteDocumento9 pagineChapter 1 Lecture NoteLinh ChiNessuna valutazione finora

- Paper P1 Professional AccountantDocumento10 paginePaper P1 Professional AccountantbaqiralqamariNessuna valutazione finora

- AF301 Unit 7 Positive Accounting TheoryDocumento41 pagineAF301 Unit 7 Positive Accounting TheoryNarayan DiviyaNessuna valutazione finora

- Corporate Governance & Ethics Meghna Sharma 20020341208 HR 2020-22Documento18 pagineCorporate Governance & Ethics Meghna Sharma 20020341208 HR 2020-22Meghna SharmaNessuna valutazione finora

- 2020 Cma P1 B SCFDocumento37 pagine2020 Cma P1 B SCFThasveer AvNessuna valutazione finora

- 9-Public DebtDocumento19 pagine9-Public DebtUsama AdenwalaNessuna valutazione finora

- Learn The ABCs and Get Your CAP Rev 3Documento9 pagineLearn The ABCs and Get Your CAP Rev 3sc100% (22)

- Revision Plan Final Far 2 Sir Adnan RaufDocumento5 pagineRevision Plan Final Far 2 Sir Adnan RaufKh Tabish MajeedNessuna valutazione finora

- In Class Excel - 825 - WorkingDocumento98 pagineIn Class Excel - 825 - WorkingIanNessuna valutazione finora

- Bank Statement PDFDocumento2 pagineBank Statement PDFanon_97903622Nessuna valutazione finora

- Addams&Family Inc.Documento5 pagineAddams&Family Inc.Trisha Mae CorpuzNessuna valutazione finora

- Impact of Currency Fluctuations On Indian Stock MarketDocumento5 pagineImpact of Currency Fluctuations On Indian Stock MarketShreyas LavekarNessuna valutazione finora

- PDF DocumentDocumento2 paginePDF DocumentRanger SidahNessuna valutazione finora

- A Project Report On "Role of Financial Institution IN Industrial Development"Documento12 pagineA Project Report On "Role of Financial Institution IN Industrial Development"Sonali KaleNessuna valutazione finora

- S. P. Mandali'S Prin L. N. Welingkar Institute of Management Development & ResearchDocumento6 pagineS. P. Mandali'S Prin L. N. Welingkar Institute of Management Development & ResearchNavil BordiaNessuna valutazione finora

- Jio BillDocumento1 paginaJio BillEkant Das50% (2)

- Fainace ManagementDocumento30 pagineFainace ManagementSaudulla Jameel JameelNessuna valutazione finora

- RenewalPremium 35616458Documento1 paginaRenewalPremium 35616458Raghavendra ChinnuNessuna valutazione finora

- INV LiqDocumento2 pagineINV Liqblessing chembeziNessuna valutazione finora

- Assgmnt Nov 2016 QDocumento2 pagineAssgmnt Nov 2016 QNUR ATIQAH AB SHUKORNessuna valutazione finora

- 1 - 2018 Introduction To Banking Operations UBA-Day 1 PDFDocumento111 pagine1 - 2018 Introduction To Banking Operations UBA-Day 1 PDFAustinNessuna valutazione finora

- Partnership and Corporation - Accounting IiDocumento5 paginePartnership and Corporation - Accounting IiJeremie ArgoncilloNessuna valutazione finora

- CHAPTER 8 Caselette - Audit of LiabilitiesDocumento27 pagineCHAPTER 8 Caselette - Audit of LiabilitiesNovie Marie Balbin Anit100% (1)

- REVIEWERDocumento3 pagineREVIEWERWayne GodioNessuna valutazione finora

- Accountancy & Financial ManagementDocumento38 pagineAccountancy & Financial ManagementUsman AyyubNessuna valutazione finora

- Shariah-Compliant E-Wallet Prospects & Challenges (28 October 2020 ISRA Consulting)Documento51 pagineShariah-Compliant E-Wallet Prospects & Challenges (28 October 2020 ISRA Consulting)Abdul Aziz Mohd Nor100% (1)

- Quotation: Dahua Diamond PartnerDocumento1 paginaQuotation: Dahua Diamond PartnerNimesh AnuradhaNessuna valutazione finora

- RBI Vs SEBIDocumento5 pagineRBI Vs SEBIMANASI SHARMANessuna valutazione finora

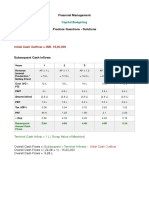

- Capital Budgeting - SolutionDocumento5 pagineCapital Budgeting - SolutionAnchit JassalNessuna valutazione finora

- 20161115-ARKInvest-Disruptive Innovation New Markets New MetricsDocumento17 pagine20161115-ARKInvest-Disruptive Innovation New Markets New MetricsBatiatus Spartacus CrixusNessuna valutazione finora

- Bergerac Case AnalysisDocumento12 pagineBergerac Case Analysissiddhartha tulsyan100% (1)

- Teodocio, Anne Pauline LDocumento6 pagineTeodocio, Anne Pauline LAnne TeodocioNessuna valutazione finora

- 2 Introduction To Accounting Sample ExercisesDocumento3 pagine2 Introduction To Accounting Sample ExercisesXia AlliaNessuna valutazione finora

- Intercorporate Acquisitions and Investments in Other EntitiesDocumento56 pagineIntercorporate Acquisitions and Investments in Other EntitiesErawati KhusnulNessuna valutazione finora