Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Application Level Corporate Laws Practices Nov Dec 2013

Caricato da

Timothy GillespieDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Application Level Corporate Laws Practices Nov Dec 2013

Caricato da

Timothy GillespieCopyright:

Formati disponibili

Page1of3

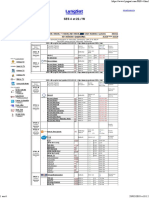

TAXATION-II

Time allowed 2 hours

Total marks 100

[N.B. The figures in the margin indicate full marks. Questions must be answered in English. Examiner will take account

of the quality of language and the manner in which the answers are presented. Different parts, if any, of the same

question must be answered in one place in order of sequence.]

Marks

01. Discuss the changes made by Finance Act 2013 with its effect on the following items. 10

a. Charge of Minimum Tax U/S. 16 CCC.

b. Change of Investment Rebate U/S. 44.

C. Deduction at source from salaries : newly added sub-section (2A) of section 50.

d. Additional powers to enquire and production of documents by the assessee sec.-116(1).

e. Requirements of certificate or acknowledgement receipts of return of income in certain cases Sec. 184A.

02. a. Who is liable to pay advance tax? 02

b. How advance tax is computed and payable? 04

c. B Ltd. computed its advance tax payable for income year 2012-2013 based on latest assessed

income of Tk. 500,000 for the income year 2009-2010. Assessment for the income year 2010-2011

was completed on 15 April 2013 at a loss of Tk. 600,000.

Calculate the amount of advance tax to be paid by B Ltd. in each quarter for the assessment year

2013-2014.

04

03. The following particulars of income of Mr. Ali Ahmed are available for the assessment year 2013-

2014 :

5

Income from house property Taka 100,000

Business income (after allowing for current years

depreciation of Tk. 20,000)

Taka 70,000

The following sums have been brought forward from the preceding year :

Unabsorbed depreciation Taka 80,000

Business loss Taka 50,000

Deputy Commissioner of Taxes is proposing to assess him on a total income of Tk. 100,000 by setting off only the

business loss of Tk. 50,000 and part of the unabsorbed depreciation of Tk. 20,000 against the business income of Tk.

70,000. Is he right in his action? Explain.

04. The following are the income of Mr. Azad for the year ended J une 30, 2013. Compute his total income

and tax liability.

20

a. Salary Income

Basic Salary 4,20,864

Festival Bonus 70,144

House Rent Allowance 3,75,735

Entertainment Allowance 4,173

Conveyance Allowance 35,072

Other Allowance 16,262

Employees Contribution to Provident Fund 42,086

Tax Deducted from Salary 12,000

b. House Property Income

House Rent 2,97,600

City Corporation Tax 9,000

Salary of Security Guard 48,000

Salary of Sweeper 12,000

c. Income from Business 3,78,975

d. Income from partnership (A Real estate business)

(Tax deducted at source Tk. 65,280)

5,96,400

e. Income from land sale (Capital gain)

(TDS Tk. 40,000)

1,60,000

f. Income from share business U/S. 32(7) 89,74,071

g. Dividend Income (Gross) 12,04,374

Page2of3

h. Interest from SB A/C (Gross) 966

i. Income from Fisheries Business 4,03,000

j. Income from poultry firm 2,05,000

(investment in Govt. Bond)

Notes :

1. Purchase of 5 years Bangladesh Sanchaya Patra 2,00,000

2. Investment in DPS 1,20,000

3. Advance tax for car registration 15,000

4. The assessee has a flat in Bashundhara R/A but was vacant

due to non-connection of Electricity and GAS.

5. Assessees total wealth 12,50,90,210

5. ABC Telecom Ltd. is a listed telecom company Enjoying Tax holiday since 1

st

September 2010 declared dividend 10% for the

year and no dividend was paid last year. Statement of Financial position of the company as at J une 30, 2013 is given below:

Particulars 2012-2013 2011-2012

Non Current assets

Property, Plant and Equipment (net of accumulated depreciation) 1,469,055,265 1,745,945,621

License fees 433,333,333 466,666,667

Investment 45,000,000 -

1,947,388,598 2,212,612,288

Current Assets

Receivables 56,734,179 54,512,957

Advances, Deposits ad Prepayments 12,364,972 12,543,768

69,099,151 67,056,725

Total assets

2,016,487,749 2,279,669,013

Equity and Capital

Paid up Capital 500,000,000 500,000,000

Tax Holiday Reserve 424,409,174 137,061,174

Retained Earnings 636,613,761 205,591,761

Total Equity and Capital 1,561,022,935 842,652,935

Non Current liability

Loan (net of current maturity) 102,632,982 442,632,982

Current liability

Loan current portion 340,000,000 978,390,964

Payables, accruals and provisions

12,831,832 15,992,132

Total Current liability

352,831,832 994,383,096

Total Liability

2,016,487,749 2,279,669,013

Month wise income before tax is given below:

Figures in million

Month International

Gate way (IGW)

Access Network

Services (ANS)

Dividend income

J uly '12 30,250,000 11,340,000

August '12 44,190,000 14,510,000

September '12 34,820,000 15,930,000 3,950,000

October '12 47,000,000 18,100,000

November '12 48,250,000 19,360,000

December '12 44,090,000 14,100,000 3,870,000

J anuary '13 41,020,000 12,130,000

February '13 44,890,000 14,900,000

March '13 45,670,000 15,780,000 3,800,000

April '13 49,440,000 19,550,000

May '13 41,110,000 17,230,000

J une '13 40,210,000 19,320,000 3,560,000

Total 510,940,000 192,250,000 15,180,000

Page3of3

Other information:

1. tax deducted at source Tk. 81,236,721 which includes Tk. 1,518,000 deducted from Dividend income and the

balance from IGW bill;

2. excess perquisite given by the company Tk. 3,782,925;

3. entertainment expenses Tk. 24,572,890;

4. depreciation charged Tk. 231,890,356 but as per third schedule depreciation is BDT 312,098,563;

5. amortization of license fees Tk. 33,333,333;

6. provision for gratuity Tk. 1,000,000;

7. provision for bad debts Tk. 5,000,000;

8. business promotion expenses Tk. 1,345,308; and

9. advertisement Tk. 650,000

10. Directors Remuneration Tk. 25,000,000.

The company has deducted tax and VAT except on Business promotion expenses of Tk. 1,345,308, advertisement Tk.

150,000 and Directors remuneration of Tk. 25,000,000. The company paid withhold tax and VAT with penalty against

directors remuneration before submission of return.

Requirements 25

1. Compute total taxable income and net tax payable.

6. Write your arguments against the following grounds of appeal.

a. Sale proceeds of a land Tk. 79,000,000 deposited in the bank account of a company. The land was in the

name of the Chairman of the company but the land was not shown in the wealth statement of the Chairmans

personal tax file. The company claimed the amount as loan from chairman but the DCT added as income of

the company and upheld by CT(A).

04

b. The DCT estimates Gross profit 36% of last year instead of shown GP 25% because the company failed to

produce all the vouchers of raw materials, factory overhead and added Tk. 40,500,000 with total income.

03

c. The DCT computed tax liability TK. 230,000,000 and advance tax deposited by the company Tk. 7,800,000

against income tax provision of Tk. 10,000,000. The DCT charged interest because Tk. 7,800,000 is less

than 75% of the claimed tax.

03

07. State the provision of section 17 of Value Added Tax, 1991 regarding self registration. What are the

procedures of registration under Rule 9?

5

08. What are the offences and penalties under section 37 (i) and Rule 35 of VAT Rules, 1991? 4

09. Mention the rate of VAT based on value additions fixed by NBR applicable to the following service

providers :

i) Carrying contractor.

ii) Advertising firm.

iii) Printing press.

iv) Information Technology Enabled Services.

v) Sponsorship Services.

Vi) Human Resource Suppliers.

Vii) Building floor Cleaning and maintenance firm.

viii) Event management firm.

ix) Chartered Plane or Helicopter.

x) Other Miscellaneous Services.

5

10. Writes short notes on following item relating to VAT :

i) Current Account.

ii) Penalty for False declaration of input tax.

iii) Retail trade service.

6

Potrebbero piacerti anche

- 1P91+F2012+Midterm Final+Draft+SolutionsDocumento10 pagine1P91+F2012+Midterm Final+Draft+SolutionsJameasourous LyNessuna valutazione finora

- Mpu3123 Titas c2Documento36 pagineMpu3123 Titas c2Beatrice Tan100% (2)

- Tax Computations SampleDocumento5 pagineTax Computations Samplelcsme tubodaccountsNessuna valutazione finora

- Sample Past Exam Questions RevisedDocumento23 pagineSample Past Exam Questions RevisedAngie100% (2)

- Chapter 11 - Computation of Taxable Income and TaxDocumento22 pagineChapter 11 - Computation of Taxable Income and TaxMichelle Tan100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDa EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNessuna valutazione finora

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1Da EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Nessuna valutazione finora

- Order Confirmation 318155149Documento3 pagineOrder Confirmation 318155149charisse mae rillortaNessuna valutazione finora

- Affidavit of Consent To Travel A MinorDocumento3 pagineAffidavit of Consent To Travel A Minormagiting mabayogNessuna valutazione finora

- Blockchain in ConstructionDocumento4 pagineBlockchain in ConstructionHasibullah AhmadzaiNessuna valutazione finora

- Principles of Taxation ND2020Documento2 paginePrinciples of Taxation ND2020Sharif MahmudNessuna valutazione finora

- Accounts Assignment 2Documento12 pagineAccounts Assignment 2shoaiba167% (3)

- Instruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedDocumento6 pagineInstruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedmarygraceomacNessuna valutazione finora

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocumento4 pagineSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- Pe III Taxation II May Jun 2010Documento3 paginePe III Taxation II May Jun 2010swarna dasNessuna valutazione finora

- Use The Following Information To Answer Items 1 To 3:: FARQ 218 Page 1 of 3Documento3 pagineUse The Following Information To Answer Items 1 To 3:: FARQ 218 Page 1 of 3Irvin LevieNessuna valutazione finora

- Taxation Situational ProblemsDocumento32 pagineTaxation Situational ProblemsMilo MilkNessuna valutazione finora

- Requirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Documento5 pagineRequirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Srikrishna DharNessuna valutazione finora

- Accounting For Income Tax QuizDocumento5 pagineAccounting For Income Tax QuizTorico BryanNessuna valutazione finora

- Capii Income Tax and Vat July2015Documento15 pagineCapii Income Tax and Vat July2015casarokarNessuna valutazione finora

- Taxation Review Dec2017Documento7 pagineTaxation Review Dec2017Shaiful Alam FCANessuna valutazione finora

- Suggested Tax Paper May 2011Documento11 pagineSuggested Tax Paper May 2011Sudhir PanigrahiNessuna valutazione finora

- 35 Ipcc Accounting Practice ManualDocumento218 pagine35 Ipcc Accounting Practice ManualDeepal Dhameja100% (6)

- Management Control SystemDocumento11 pagineManagement Control SystemomkarsawantNessuna valutazione finora

- RTP Nov 15Documento46 pagineRTP Nov 15Aaquib ShahiNessuna valutazione finora

- 9mys 2010 Dec A PDFDocumento7 pagine9mys 2010 Dec A PDFGabriel SimNessuna valutazione finora

- Fianl AccountsDocumento10 pagineFianl AccountsVikram NaniNessuna valutazione finora

- AttDocumento8 pagineAttKath LeynesNessuna valutazione finora

- Taxation: MD Mashiur Rahaman Robin KPMG-RRHDocumento12 pagineTaxation: MD Mashiur Rahaman Robin KPMG-RRHZidan ZaifNessuna valutazione finora

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocumento25 pagineCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNessuna valutazione finora

- Taxation 2004 SolvedDocumento18 pagineTaxation 2004 Solvedapi-3832224100% (2)

- Scanner Ipcc Paper 4Documento34 pagineScanner Ipcc Paper 4Meet GargNessuna valutazione finora

- Classroom Exercise - Unit 1-1Documento2 pagineClassroom Exercise - Unit 1-1Hannah Jane ToribioNessuna valutazione finora

- Financial PlanDocumento20 pagineFinancial Planzhijaescosio25Nessuna valutazione finora

- Anfin208 Mid Term AssignmentDocumento6 pagineAnfin208 Mid Term Assignmentprince matamboNessuna valutazione finora

- INCOME TAX VALUE ADDED TAX ACTIVITY SolutionDocumento6 pagineINCOME TAX VALUE ADDED TAX ACTIVITY SolutionMarco Alejandro IbayNessuna valutazione finora

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocumento9 pagineIdentify The Choice That Best Completes The Statement or Answers The QuestionJay-L TanNessuna valutazione finora

- CORPORATE INCOME TAX (Answer Key)Documento5 pagineCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarNessuna valutazione finora

- Taxation MalawiDocumento15 pagineTaxation MalawiCean Mhango100% (1)

- Bcom TaxDocumento6 pagineBcom TaxAditya .cNessuna valutazione finora

- Taxation Management and PlanningDocumento10 pagineTaxation Management and PlanningJoel EdauNessuna valutazione finora

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocumento171 pagineIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionRengeline LucasNessuna valutazione finora

- 2012Documento21 pagine2012Mohammad Salim HossainNessuna valutazione finora

- INCOME TAXATION OF CORPORATION ExercisesDocumento3 pagineINCOME TAXATION OF CORPORATION ExercisesCheska DizonNessuna valutazione finora

- CTPMDocumento13 pagineCTPMYogeesh LNNessuna valutazione finora

- Practical Accounting Problems 1Documento4 paginePractical Accounting Problems 1Eleazer Ego-oganNessuna valutazione finora

- Taxation Review June2017Documento9 pagineTaxation Review June2017Shaiful Alam FCANessuna valutazione finora

- Exercise Questions On NT and MCITDocumento2 pagineExercise Questions On NT and MCITDamdam AlunanNessuna valutazione finora

- Accounting For Taxes 6Documento7 pagineAccounting For Taxes 6charlene kate bunaoNessuna valutazione finora

- IMT 57 Financial Accounting M1Documento4 pagineIMT 57 Financial Accounting M1solvedcareNessuna valutazione finora

- Deductions From Gross IncomeDocumento10 pagineDeductions From Gross IncomewezaNessuna valutazione finora

- Business & Profession Q - A 02.9.2020Documento42 pagineBusiness & Profession Q - A 02.9.2020shyamiliNessuna valutazione finora

- Income Tax - ExercisesDocumento2 pagineIncome Tax - ExercisesEnges FormulaNessuna valutazione finora

- 518 Reviewers 3Documento8 pagine518 Reviewers 3RALLISONNessuna valutazione finora

- ECO-2 - ENG-J18 - CompressedDocumento6 pagineECO-2 - ENG-J18 - CompressedAmit AdhikariNessuna valutazione finora

- F1 November 2010 AnswersDocumento11 pagineF1 November 2010 AnswersmavkaziNessuna valutazione finora

- CA Inter Mighty 50Documento47 pagineCA Inter Mighty 50INTER SMARTIANSNessuna valutazione finora

- FAR05 - Accounting For Income and Deferred TaxesDocumento4 pagineFAR05 - Accounting For Income and Deferred TaxesDisguised owlNessuna valutazione finora

- TaxDocumento3 pagineTaxLet it beNessuna valutazione finora

- DT - Test 2 - D23 - NSDocumento3 pagineDT - Test 2 - D23 - NSMadhav TailorNessuna valutazione finora

- MAS Compilation of QuestionsDocumento6 pagineMAS Compilation of Questionsgon_freecs_4Nessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNessuna valutazione finora

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- Role of Room RatesDocumento5 pagineRole of Room RatesJonathan JacquezNessuna valutazione finora

- Resort Operations ManagementDocumento15 pagineResort Operations Managementasif2022coursesNessuna valutazione finora

- SES 4 at 22. °W: Advertisements AdvertisementsDocumento6 pagineSES 4 at 22. °W: Advertisements Advertisementsemmanuel danra10Nessuna valutazione finora

- STP and Marketing MixDocumento25 pagineSTP and Marketing MixKurt canonNessuna valutazione finora

- Module 1 - Basic Topology and Router Setup: The Following Will Be The Common Topology Used For The First Series of LabsDocumento9 pagineModule 1 - Basic Topology and Router Setup: The Following Will Be The Common Topology Used For The First Series of LabsHassan AwaisNessuna valutazione finora

- 1 Court Jurisdiction 1 Court JurisdictionDocumento19 pagine1 Court Jurisdiction 1 Court JurisdictionHermione Leong Yen KheeNessuna valutazione finora

- Mordheim - Cities of Gold Slann Warband: Tommy PunkDocumento5 pagineMordheim - Cities of Gold Slann Warband: Tommy PunkArgel_Tal100% (1)

- Freemason's MonitorDocumento143 pagineFreemason's Monitorpopecahbet100% (1)

- People vs. Nadera, JR.: 490 Supreme Court Reports AnnotatedDocumento11 paginePeople vs. Nadera, JR.: 490 Supreme Court Reports AnnotatedFatzie MendozaNessuna valutazione finora

- Louis Vuitton: by Kallika, Dipti, Anjali, Pranjal, Sachin, ShabnamDocumento39 pagineLouis Vuitton: by Kallika, Dipti, Anjali, Pranjal, Sachin, ShabnamkallikaNessuna valutazione finora

- Indira Gandhi BiographyDocumento4 pagineIndira Gandhi BiographySocial SinghNessuna valutazione finora

- Practical TaskDocumento3 paginePractical TaskAAAAAAANessuna valutazione finora

- English 6: Making A On An InformedDocumento30 pagineEnglish 6: Making A On An InformedEDNALYN TANNessuna valutazione finora

- Osayan - Argumentative Essay - PCDocumento2 pagineOsayan - Argumentative Essay - PCMichaela OsayanNessuna valutazione finora

- Business PlanDocumento36 pagineBusiness PlanArun NarayananNessuna valutazione finora

- Senate Bill No. 982Documento3 pagineSenate Bill No. 982Rappler100% (1)

- Charles Simics The World Doesnt End Prose PoemsDocumento12 pagineCharles Simics The World Doesnt End Prose PoemsCarlos Cesar ValleNessuna valutazione finora

- Universidad Abierta para Adultos (UAPA) : PresentadoDocumento6 pagineUniversidad Abierta para Adultos (UAPA) : PresentadoWinston CastilloNessuna valutazione finora

- Example Research Paper On Maya AngelouDocumento8 pagineExample Research Paper On Maya Angelougw2wr9ss100% (1)

- Accomplishment Report For The 2023 GSP Orientation and Update For Troop LeadersDocumento6 pagineAccomplishment Report For The 2023 GSP Orientation and Update For Troop LeadersMarianne Hilario100% (1)

- Strategic Management CompleteDocumento20 pagineStrategic Management Completeأبو ليلىNessuna valutazione finora

- RHP Final Reviewer Galing Sa PDF Ni SirDocumento37 pagineRHP Final Reviewer Galing Sa PDF Ni SirAilene PerezNessuna valutazione finora

- Digital Platforms Report 2015 v2 PDFDocumento23 pagineDigital Platforms Report 2015 v2 PDFВладимир КоровкинNessuna valutazione finora

- Advent of Dawn Raids in India - A Case of Aggressive Anti-Trust Regime - Anti-Trust - Competition Law - IndiaDocumento7 pagineAdvent of Dawn Raids in India - A Case of Aggressive Anti-Trust Regime - Anti-Trust - Competition Law - IndiaNitish GuptaNessuna valutazione finora

- MKT4220 JAN2021 Individual Assessment 30%Documento3 pagineMKT4220 JAN2021 Individual Assessment 30%suvendran MorganasundramNessuna valutazione finora

- 2022 Post Report - FinalDocumento11 pagine2022 Post Report - FinalAise TrigoNessuna valutazione finora

- The Harm Principle and The Tyranny of THDocumento4 pagineThe Harm Principle and The Tyranny of THCally doc100% (1)