Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Investigating International Causal Linkages Between Latin European Stock Markets in Terms of Global Financial Crisis A Case Study For Romania Spain and Italy

Caricato da

IjbemrJournalDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Investigating International Causal Linkages Between Latin European Stock Markets in Terms of Global Financial Crisis A Case Study For Romania Spain and Italy

Caricato da

IjbemrJournalCopyright:

Formati disponibili

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

12

Investigating International Causal Linkages Between Latin

European Stock Markets In Terms Of Global Financial Crisis : A

Case Study For Romania, Spain And Italy

Marian Siminic, Ph.D

University of Craiova, Faculty of Economics and Business Administration

Craiova, Romania

msiminica@yahoo.com

Ramona Biru, Ph.D

Regional Public Finances General Directorate of Craiova

Craiova, Romania

birauramona@yahoo.com

Abstract

The aim of this research paper is to investigate international causal linkages between Latin

European stock markets, such as Romania, Spain and Italy in terms of global financial crises.

Moreover, the structure of this research paper includes both theoretical developments and new

empirical findings. In recent past, the global phenomenon of increasing co-integration, co-

movement and financial contagion between developed and emerging stock markets have

significantly influenced foreign investment behavior. The global financial crisis has seriously

affected the international financial architecture and global economic stability due to

unprecedented dynamic financial contractions. In addition, as strictly economic approach,

Romanian labor migration generates a very high level in Italy and Spain as main destination

countries. On the other hand, financial integration and international causal linkages suggest a

certain behavioral pattern between receiving societies. The financial econometrics approach

includes various tools such as Unit Root Test, Hodrick-Prescott (HP) filter, Augmented Dickey-

Fuller stationary test, BDS test and Granger causality test. The final results provides a

comprehensive framework regarding international portfolio diversification, risk management and

strategic investment decision making process.

Key words : stock market linkages, cointegration, volatility, spillover effects, investment

process, financial integration, Granger causality, risk management, time-varying processes

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

13

Introduction

Causality and international linkage between emerging and developed stock markets

highlight the significant influence of dynamic transmission patterns focused on financial shocks

propagation. Beyond the effects of globalization, financial markets are influenced by certain

issues such as : cross-border transactions, investment policy reforms and liberalization of

financial operations. The liberalization and integration process of financial markets emphasizes

various opportunities based on reduction of capital transaction cost and foreign capital inflows.

Moreover, international investors are focused on the potential correlation among returns of

different national stock markets in order to diversify the investment risk based on international

diversification of portfolios. The multidimensional implications of financial integration generate

the possibility of identifying investment strategies in order to optimize the structure of risk

management. Technically, financial time series, such as daily stock market returns are defined on

the basis of certain stylized facts, namely : volatility clustering, high-frequency, non-stationarity

of price levels, leverage effect, heteroskedastic log returns, extreme variations in time,

deterministic chaos, fat-tailed distribution (leptokurtosis), nonlinearity, asymmetry.

The formal regulatory regarding the latest official assessment raport of FTSE Country

Classification issued on September 2013 provides the following classification of countries :

developed, advanced emerging, secondary emerging and frontier. According to the previous

classification, Romania is included in the frontier market category on the basis of significant

selection criteria. Moreover, it is characterized by negative features such as : illiquidity,

insufficient transparency, financial regulation issues, underdeveloped trading mechanisms. Thus,

Bucharest Stock Exchange is assimilated as a relatively young, fragmented and not very stable

stock market. However, the assumption of frontier market can be very attractive considering the

fact that it generates rapid growth and various opportunities for international investors. On the

other hand, Spain and Italy are included in the category developed countries. In other words,

Milan Stock Exchange (Milano Italia Borsa) and Madrid Stock Exchange (Bolsa de Madrid)

represent more stable and efficient stock markets.

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

14

Literature review

The global financial crisis that erupted in mid-2007 in U.S.A. triggered dramatic

consequences for most of stock markets across the world. An extreme financial phenomena does

not follow a historical pattern so it is very difficult to predict with high accuracy. According to

Biru (2014a) various stock crashes followed by severe financial crisis occurred rather frequently

in the last century and sometimes reaching global magnitude, such as : the Great Depression

between the years 1929-1933, Latin American financial debt crisis of the 1980s, Black Monday

(Black Monday) in 1987, the Asian financial crisis of 1997 1998, Russian financial crisis or

Ruble crisis in 1998, DOTCOM bubble during 2000 and 2002 and the Subprime crisis that

erupted in August 2007 in U.S.A.

Eun and Shim (1989) empirically analyzed the interdependence structure of major

national stock markets. Moreover, the authors suggested that innovations in U.S. market are

suddenly transmitted to other stock markets despite the fact that none of these markets can

adequately justify its movements. They investigated the existence of international transmission

of stock market movements among several mature markets, such as : Australia, Japan, Hong

Kong, U.K, Switzerland, France, Germany, Canada and U.S.A. Moreover, Abimanyu et. all

(2008) investigated the international linkages of the Indonesian capital market using

cointegration tests to examine the long-run equilibrium relationship between the stock markets of

Indonesia with China, France, Germany, Hong Kong, Japan, Korea, Malaysia, Netherlands,

Philippine, Singapore, Thailand, Taiwan, the United Kingdom and the United States.

Balios and Xanthakis (2003) investigated international interdependence and dinamic

linkages between developed stock markets, namely U.K, Germany, France, Italy, Spain, U.S. and

Japan. They concluded that U.S. stock market is the leading stock market in the world and U.K

stock market is the leading stock market in Europe. On the other hand, Singh (2010) investigated

Chinese and Indian stock market linkages with several developed stock markets, such as U.S.,

U.K., Japan and Hong Kong. The empirical results revealed that both Chinese and Indian market

are correlated with all the selected developed markets based on the analysis of Granger causality.

Pretorious (2002) suggested that it is very important for international investors to understand the

forces behind the interdependence of emerging stock markets in order to be informed about the

potential occurrence of systemic risks and their global implications.

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

15

According to Khan (2011) an increasing number of investors are interested to invest in

developing countries so it is very important to answer the following rhetorical question Does

sensitivity to the world economy explain country performance over the great recession? The

author investigated the existence of cointegration between stock markets of US and 22 other

major economies.

Biru and Trivedi (2013) empirically analyzed the existence of cointegration and

international linkage between Bucharest stock exchange and certain European developed stock

markets, ie France, Germany and Greece. The empirical research covered the sample period from

January 2003 until December 2012 which were divided into two sub-periods in order to examine

both pre-crisis and post-crisis effects. Regarding the first period of analysis, ie January 2003

December 2007, it appears that there is no particular causality between Greek and Romanian,

German and Romanian, respectively French and Romanian stock markets. The second period of

analysis, ie January 2008 December 2012 suggested that Granger causality runs one way, from

Greece to Romania, but not the other way and there is no particular causality between German

and Romanian, respectively French and Romanian stock markets. Biru (2014b) investigated the

existence of dynamic causal linkages between international developed stock markets of Spain

and Canada. The empirical results of Granger causality tests among developed stock markets of

Spain and Canada highlighted significant investment opportunities based on international

portfolio diversification and risk management strategies. Granger causality runs simultaneously

in both directions for Spain and Canada based on a feedback relationship.

A macroeconomic approach based on statistical surveys

Basically, this research paper provides additional empirical evidence and a consistent

theoretical approach. Currently, Romania (2007), Spain (1986) and Italy (1952) are member

states in the European Union (EU28), but are characterized by rather different development

levels. Beyond the common Latin roots, the national languages of Romania, Spain and Italy are

closely related to each other based on linguistic similarities. Moreover, Romanian labor

migration revealed a very high level in Italy and Spain as main destination countries.

The World Bank provides a wide range of information on GNI per capita, ie formerly

GNP per capita, which is basically the gross national income converted to U.S. dollar, based on

the Atlas method, divided by the midyear population. According to the official presentation

based on World Bank national accounts data and OECD National Accounts data files, GNI

represents the sum of value added by all resident producers including any product taxes (less

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

16

subsidies) not included in the valuation of output plus net receipts of primary income

(compensation of employees and property income) from abroad.

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

17

Fig.1 GNI per capita based on World Bank Atlas method of conversion

(U.S. dollars)

Source : The World Bank computation based on World Bank national accounts data and

OECD National Accounts data files

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

18

Considering the world development indicators highlighted by the World Bank, Italy is a

high income country with a total population of 59.54 million (2012) and a Gross Domestic

Product (GDP) (current US$) of $2.013 trillion (2012). However The GDP growth in Italy was

negative, ie -2.5% per 2012 and the inflation was 1.2% per 2013. Moreover, Spain is also a high

income country with a total population of 46.76 million (2012) and a GDP (current US$) of

$1.322 trillion (2012). In addition, the GDP growth in Spain was negative, ie -1.6% per 2012 and

the inflation was 1.4% per 2013. On the other hand, Romania is a upper middle income country

with a total population of 20.08 million (2012) and a relatively low GDP (current US$) of $169.4

billion (2012). Nevertheless, the GDP growth in Romania was positive, ie 0.4% per 2012 and the

inflation was 4.0% per 2013.

Methodological approach and empirical results

The empirical analysis is based on the daily returns of the major stock indices during the

sample period between January 2007 and April 2013.

The continuously-compounded daily returns are calculated using the log-difference of the

closing prices of stock markets selected indices, ie BET-C Index (Romania), IBEX 35 Index

(Spain) and FTSE MIB Index (Italy), as follows :

1

1

ln ln ln

t t

t

t

t

p p

p

p

r

where p is the daily closing price. Data series consists of the daily closing prices for each sample

stock index during the period between January 2007 and April 2013 with the exception of legal

holidays or other events when stock markets havent performed transactions.

BET-C is the composite index of Bucharest stock exchange (BSE). It is a market

capitalization weighted index and reflects the price movement of all the companies listed on the

BSE regulated market, i.e Ist and IInd Category, excepting the SIFs. The FTSE MIB index

measures the performance of 40 of the most liquid and capitalised stocks listed on the Borsa

Italiana. Moreover, FTSE MIB index is the primary benchmark index for the Italian equity

markets capturing approximately 80% of the domestic market capitalization. On the other hand,

The IBEX 35 index is the benchmark stock market index of the Madrid Stock Exchange (Bolsa

de Madrid). The IBEX 35 index is a capitalization-weighted index comprising the 35 most liquid

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

19

Spanish stocks traded in the Madrid Stock Exchange.

The applied financial econometrics research methodology includes : descriptive statistics,

Unit Root Test, Augmented Dickey-Fuller stationary test, Hodrick-Prescott (HP) filter, BDS test

and Granger causality test.

Fig. 2 : The trend of BET-C Index (Romania), IBEX 35 Index (Spain) and FTSE MIB

Index (Italy) - individual graphics -

Source: Own computations based on selected financial data series

1000

2000

3000

4000

5000

6000

7000

8000

250 500 750 1000 1250 1500

BET-C CLOSING PRICE

10000

15000

20000

25000

30000

35000

40000

45000

250 500 750 1000 1250 1500

FTSE MIB CLOSING PRICE

4000

6000

8000

10000

12000

14000

16000

18000

250 500 750 1000 1250 1500

IBEX 35 CLOSING PRICE

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

20

Fig. 3 : The log-returns of BET-C Index (Romania), IBEX 35 Index (Spain) and FTSE MIB

Index (Italy) - joint graphic -

Source: Own computations based on selected financial data series

-.15

-.10

-.05

.00

.05

.10

.15

250 500 750 1000 1250 1500

BET-C LOG RETURN

FTSE MIB LOG RETURNS

IBEX 35 LOG RETURNS

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

21

Fig. 4 : The log-returns of BET-C Index (Romania), IBEX 35 Index (Spain) and FTSE MIB

Index (Italy) - individual graphics -

Source: Own computations based on selected financial data series

The fundamental characteristics of selected indices are represented by the following

issues : Jarque-Bera tests statistic which allows to eliminate the normality of distribution

-.15

-.10

-.05

.00

.05

.10

.15

250 500 750 1000 1250 1500

BET-C LOG RETURN

-.12

-.08

-.04

.00

.04

.08

.12

250 500 750 1000 1250 1500

FTSE MIB LOG RETURNS

-.10

-.05

.00

.05

.10

.15

250 500 750 1000 1250 1500

IBEX 35 LOG RETURNS

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

22

hypothesis, parameter of asymmetry distribution or Skewness and Kurtosis parameter which

measures the peakedness or flatness of the distribution (leptokurtic distribution). The test

Jarque-Bera is based on the following mathematical expressions :

)

4

) 3 (

(

6 24

) 3 (

6

2

2

2 2

k

s

n k s

n JB , considering :

2

3

1

2

1

3

3

3

] ) (

1

[

) (

1

n

i

i

n

i

i

x x

n

x x

n

s

2

1

2

1

4

4

4

1

) (

1

n

i

i

n

i

i

x x

n

x x

n

k

0

100

200

300

400

500

-0.10 -0.05 -0.00 0.05 0.10

Series: BET_C_LOG_RETURN

Sample 1 1538

Observations 1537

Mean -0.000393

Median 0.000197

Maximum 0.108906

Minimum -0.121184

Std. Dev. 0.017836

Skewness -0.685424

Kurtosis 10.16679

Jarque-Bera 3409.716

Probability 0.000000

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

23

Fig. 5 : Basic statistical characteristics of selected stock indices

Source: Own computations based on selected financial data series

Augmented Dickey-Fuller (ADF) test is used in order to determine the non-stationarity or

the integration order of a financial time series. A series noted

t

y is integrated of order one, ie

t

y

~ 1 I and contains a unit root if

t

y is non-stationary, but on the other hand

t

y is stationary, ie

1 t t t

y y y . Moreover, extrapolating the previous expression, a series

t

y is integrated of

0

50

100

150

200

250

-0.05 0.00 0.05 0.10

Series: FTSE_MIB_LOG_RETURNS

Sample 1 1538

Observations 1536

Mean -0.000565

Median 0.000230

Maximum 0.108742

Minimum -0.085991

Std. Dev. 0.018504

Skewness 0.030021

Kurtosis 6.767386

Jarque-Bera 908.5954

Probability 0.000000

0

100

200

300

400

500

-0.10 -0.05 -0.00 0.05 0.10

Series: IBEX_35_LOG_RETURNS

Sample 1 1538

Observations 1536

Mean -0.000329

Median 0.000154

Maximum 0.134836

Minimum -0.095859

Std. Dev. 0.018043

Skewness 0.204707

Kurtosis 8.038991

Jarque-Bera 1635.779

Probability 0.000000

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

24

order d, ie

t

y ~ d I if

t

y is non-stationary, but

t

d

y is stationary. Practically, ADF diagnostic

test investigates the potential presence of unit roots divided into the following categories : unit

root with a constant and a trend, unit root with a constant, but without a time trend, and finally

unit root without constant and temporal trend. Theoretically, ADF test is focused on the

following regression model :

p

i

t i t i t t

y y t c y

1

1

where p represents the number of lags for which it was investigated whether fulfilling the

condition that residuals are white noise, c is a constant, t is the indicator for time trend and is

the symbol for differencing. In addition, it is important to emphasize the essence of a stochastic

trend that can not be predicted due to the time dependence of residuals variance. Strictly related

to the ADF test, if the coefficients to be estimated and have the null value then the analyzed

financial time series is characterized by a stochastic trend. The null hypothesis, ie the time series

has a unit root is rejected if t-statistics is lower than the critical value.

Table 1: Augmented Dickey-Fuller (ADF) Test

Null Hypothesis: BET_C_LOG_RETURN has a unit root

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -6.649379 0.0000

Test critical values: 1% level -3.434459

5% level -2.863242

10% level -2.567724

Null Hypothesis: FTSE_MI B_LOG_RETURNS has a unit root

t-Statistic Prob.*

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

25

Augmented Dickey-Fuller test statistic -19.12321 0.0000

Test critical values: 1% level -3.434415

5% level -2.863222

10% level -2.567714

Null Hypothesis: I BEX_35_LOG_RETURNS has a unit root

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -19.70668 0.0000

Test critical values: 1% level -3.434415

5% level -2.863222

10% level -2.567714

Source: Own computations based on selected financial data series

The BDS test was used in order to determine whether the residuals are independent and

identically distributed. BDS test is a two-tailed test and is based on the following hypothesis :

H

0

: sample observations are independently and identically distributed (I.I.D.)

H

1

: sample observations are not I.I.D., aspect involving that the time series is non-

linearly dependent if first differences of the natural logarithm have been calculated.

The BDS methodology involves a time series x

t

for t=1, 2, 3T based on its m-history

1 1

,..., ,

m t t t

m

t

x x x x where m is the called embedding dimension. Implicitly, the correlation

integral (a measure of time patterns frequency) is estimated as follows :

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

26

s m T t

m

s

m

t

m m

m

x x I

T T

C , ,

1

2

,

and

n m

n

m

C C

,

lim

where T

m

= T-m+1 and , ,

m

s

m

t

x x I represents a binary function which has the following values

for i=0, 1, 2m-1:

otherwise

x x if

x x I

i s i t m

s

m

t

0

1

, ,

Table 2 : BDS Test

BDS Test for BET_C_LOG_RETURN

Dimensio

n BDS Statistic Std. Error z-Statistic Prob.

2 0.037404 0.002553 14.65042 0.0000

3 0.069451 0.004061 17.10348 0.0000

4 0.093462 0.004840 19.30854 0.0000

5 0.109259 0.005051 21.63141 0.0000

6 0.115585 0.004877 23.69986 0.0000

BDS Test for FTSE_MIB_LOG_RETURNS

Dimensio

BDS Statistic Std. Error z-Statistic Prob.

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

27

n

2 0.014375 0.002304 6.239415 0.0000

3 0.035941 0.003656 9.830998 0.0000

4 0.052971 0.004347 12.18478 0.0000

5 0.064634 0.004525 14.28432 0.0000

6 0.071673 0.004358 16.44745 0.0000

BDS Test for I BEX_35_LOG_RETURNS

Dimensio

n BDS Statistic Std. Error z-Statistic Prob.

2 0.013962 0.002266 6.162988 0.0000

3 0.030358 0.003602 8.428382 0.0000

4 0.041428 0.004291 9.654089 0.0000

5 0.051520 0.004475 11.51306 0.0000

6 0.057228 0.004318 13.25392 0.0000

Source: Own computations based on selected financial data series

According to Brock, Dechert, Scheinkman, LeBaron (1996), the BDS statistics is

calculated as follows :

,

, 1 ,

,

m

m

m

m

S

C C

T V

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

28

where S

m,

is defined as the standard deviation of

m

m

C C T

, 1 ,

. In addition, the BDS statistics

converges in distribution to N(0,1) thus the null hypothesis of independent and identically

distributed is rejected based on a result such as 96 , 1

, m

V in terms of a 5 % significance level.

The null hypothesis was rejected in all three sample cases based on selected stock

indices. The following outputs highlight the value of the standardised BDS statistics and the

corresponding two-sided probabilities.

The empirical analysis includes the use of Hodrick-Prescott (HP) filter which is a

specialized filter for trend and business cycle estimation. Hodrick-Prescott filter has a wide

applicability in economics. The basic idea suggests that in the center of the sample financial time

series the lter is symmetric and towards the end of the series is becoming increasingly

asymmetric. On the other hand, Hodrick-Prescott filter involves the decomposition of the sample

financial time series into a trend component and a residual component, which may or may not

include a cyclical component.

The following figures highlights the use of Hodrick Prescott Filter in the case selected

stock returns :

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

29

-.15

-.10

-.05

.00

.05

.10

.15

-.15

-.10

-.05

.00

.05

.10

.15

250 500 750 1000 1250 1500

BET-C LOG RETURN

Trend

Cycle

Hodrick-Prescott Filter (lambda=100)

-.10

-.05

.00

.05

.10

.15

-.10

-.05

.00

.05

.10

.15

250 500 750 1000 1250 1500

FTSE MIB LOG RETURNS

Trend

Cycle

Hodrick-Prescott Filter (lambda=100)

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

30

Fig. 6 : Hodrick Prescott Filter

Source: Own computations based on selected financial data series

-.10

-.05

.00

.05

.10

.15

-.10

-.05

.00

.05

.10

.15

250 500 750 1000 1250 1500

IBEX 35 LOG RETURNS

Trend

Cycle

Hodrick-Prescott Filter (lambda=100)

-.15

-.10

-.05

.00

.05

.10

.15

B

E

T

-

C

L

O

G

R

E

T

U

R

N

-.12

-.08

-.04

.00

.04

.08

.12

F

T

S

E

M

IB

L

O

G

R

E

T

U

R

N

S

-.10

-.05

.00

.05

.10

.15

-.15 -.10 -.05 .00 .05 .10 .15

BET-C LOG RETURN

IB

E

X

3

5

L

O

G

R

E

T

U

R

N

S

-.10 -.05 .00 .05 .10 .15

FTSE MIB LOG RETURNS

-.10 -.05 .00 .05 .10 .15

IBEX 35 LOG RETURNS

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

31

Fig.7 : Matrix of all pairs of selected stock market indices

Source: Own computations based on selected financial data series

Fig. 8 Distribution graphics CDF - SURVIVOR QUANTILE

Source: Own computations based on selected financial data series

0.0

0.2

0.4

0.6

0.8

1.0

-.12 -.08 -.04 .00 .04 .08 .12

BET-C LOG RETURN

P

r

o

b

a

b

ility

CDF

0.0

0.2

0.4

0.6

0.8

1.0

-.12 -.08 -.04 .00 .04 .08 .12

BET-C LOG RETURN

P

r

o

b

a

b

ility

Survivor

-.15

-.10

-.05

.00

.05

.10

.15

0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0

Probability

B

E

T

-

C

L

O

G

R

E

T

U

R

N

Quantile

0.0

0.2

0.4

0.6

0.8

1.0

-.08 -.04 .00 .04 .08 .12

FTSE MIB LOG RETURNS

P

r

o

b

a

b

ility

CDF

0.0

0.2

0.4

0.6

0.8

1.0

-.08 -.04 .00 .04 .08 .12

FTSE MIB LOG RETURNS

P

r

o

b

a

b

ility

Survivor

-.12

-.08

-.04

.00

.04

.08

.12

0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0

Probability

F

T

S

E

M

IB

L

O

G

R

E

T

U

R

N

S

Quantile

0.0

0.2

0.4

0.6

0.8

1.0

-.10 -.05 .00 .05 .10 .15

IBEX 35 LOG RETURNS

P

r

o

b

a

b

ility

CDF

0.0

0.2

0.4

0.6

0.8

1.0

-.10 -.05 .00 .05 .10 .15

IBEX 35 LOG RETURNS

P

r

o

b

a

b

ility

Survivor

-.10

-.05

.00

.05

.10

.15

0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0

Probability

IB

E

X

3

5

L

O

G

R

E

T

U

R

N

S

Quantile

Empirical Distribution

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

32

Fig.9 : Theoretical Quantile-Quantile Plots

(Extreme values)

Source: Own computations based on selected financial data series

-12

-8

-4

0

4

8

-.15 -.10 -.05 .00 .05 .10 .15

BET-C LOG RETURN

E

x

t

r

e

m

e

V

a

l

u

e

Q

u

a

n

t

i

l

e

-12

-8

-4

0

4

8

-.10 -.05 .00 .05 .10 .15

FTSE MIB LOG RETURNS

E

x

t

r

e

m

e

V

a

l

u

e

Q

u

a

n

t

i

l

e

-10

-5

0

5

10

-.10 -.05 .00 .05 .10 .15

IBEX 35 LOG RETURNS

E

x

t

r

e

m

e

V

a

l

u

e

Q

u

a

n

t

i

l

e

Theoretical Quantile-Quantiles

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

33

Table 3 : The correlation matrix

BET_C_LOG_

RETURNS

FTSE_MIB_LOG_

RETURNS

IBEX_35_LOG_

RETURNS

BET_C_LOG_

RETURNS 1 0.0548973773763317 0.0428710355864532

FTSE_MIB_

LOG_RETUR

NS 0.0548973773763317 1

-

0.0356442275665437

IBEX_35_LO

G

_RETURNS 0.0428710355864532 -0.0356442275665437 1

Source: Own computations based on selected financial data series

According to Granger (1969), if some other time series Yt contains informations

regarding the past periods which are useful in the prediction Xt and in addition this informations

are included in no other series used in the predictor, then this implies that Yt caused Xt.

Moreover, Granger suggested that if X

t

and Y

t

are two different stationary time series variables

with zero means, then the canonical causal model

has the following form :

m

j

m

j

t j t j j t j t

Y b X a X

1 1

m

j

m

j

t j t j j t j t

Y d X c Y

1 1

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

34

where

t

and

t

play the role of two uncorrelated white-noise series, namely

s t s t

E E 0 for t s and on the other hand 0

s t

E for s t , . Practically, the

basic concept of causality requires that in the case when Y

t

is causing X

t

some b

j

is different from

zero and vice versa, ie in the case when X

t

is causing Y

t

some c

j

is different from zero. A

different situation implies that causality is valid simultaneously in both directions or simply a so-

called feedback relationship between X

t

and Y

t

. The F-distribution test is used to test the

Granger causality hypotheses based on the following formula :

k n RSS

m RSS RSS

F

UR

UR R

/

/

where RSS

R

is the residual sum of squares, RSS

UR

is the unrestricted residual sum of squares, m

is the number of lagged X

t

variables, K is the number of parameters in the restricted regression.

The null hypothesis Ho implies that lagged X

t

terms do not belong in the regression. The null

hypothesis is rejected if the F-value exceeds the critical F value at the selected level of

significance (5%) or if the P-value is lower than the level of significance.

Table 4 : Granger Causality tests

Pairwise Granger Causality Tests

Null Hypothesis: Obs F-Statistic Probability

FTSE_MIB_LOG_RETURNS does not

Granger Cause BET_C_LOG_RETURN 1534 0.63020 0.53262

BET_C_LOG_RETURN does not Granger Cause

FTSE_MIB_LOG_RETURNS 0.90168 0.40610

IBEX_35_LOG_RETURNS does not

Granger Cause BET_C_LOG_RETURN 1534 1.26421 0.28276

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

35

BET_C_LOG_RETURN does not Granger Cause

IBEX_35_LOG_RETURNS 1.01013 0.36441

IBEX_35_LOG_RETURNS does not

Granger Cause

FTSE_MIB_LOG_RETURNS 1534 0.13020 0.87793

FTSE_MIB_LOG_RETURNS does not Granger

Cause IBEX_35_LOG_RETURNS 1.02881 0.35768

Source: Own computations based on selected financial data series

Conclusions

The main aim of this paper is to investigate international causal linkages between Latin

European stock markets, such as Romania, Spain and Italy in the turbulent context of the global

financial crises. In recent past, the impact of the global financial crisis on economic migration

was extremely high as global implications. Theoretically, financial integration and international

causal linkages suggest a certain behavioral pattern between receiving societies. The empirical

results of Granger causality tests among Latin European stock markets of Romania, Spain and

Italy highlight significant investment opportunities based on international portfolio

diversification and risk management strategies. Technically, the null hypothesis is rejected if the

F-value exceeds the critical F value at the selected level of significance (5%) or if the P-value is

lower than the level of significance, so there is no particular causality between Italy and Spain,

Romania and Italy and not even between Romania and Spain in the sample period, ie the period

between January 2007 and April 2013. Consequently, it appears that the null hypothesis of no

Granger causality is not rejected, so there is no causal relationship between analyzed stock

markets. International portofolio diversification benefits in globalized stock markets highlight

the opportunity of investing in various categories of financial assets across national (local) stock

markets with lower correlations in order to achieve high returns.

ISSN: 2349-5677

Volume 1, Issue 1, June 2014

36

References

1. Abimanyu, Y., et. all, (2008) International Linkages to the Indonesian Capital Market:

Cointegration Test, Jakarta, Capital Market and Financial Institution Supervisory

Agency, Ministry of Finance of Indonesia

2. Balios, D., Xanthakis, M. (2003) International interdependence and dinamic linkages

between developed stock markets, South Eastern Journal of Economics, pp. 105-130

3. Biru, F.R (2014a) Investigating Long-Term Behavior Of Milan Stock Exchange: An

Empirical Analysis Journal of Management and Social Science (JOMASS), Volume 1,

Issue 2, Blue Square Publishing House, pp. 29-37, ISSN 2348-6317,

4. Biru, F.R (2014b) Analyzing Dynamic Causal Linkages Between Developed Stock

Markets Of Spain And Canada, International Journal Of Core Engineering &

Management (IJCEM), Volume 1, Issue 2, pp. 1-9, ISSN: 2348 9510

5. Biru, F.R, Trivedi, J. (2013) Analyzing cointegration and international linkage between

Bucharest stock exchange and European developed stock markets, NAUN International

Journal of Economics and Statistics, Issue 4, Volume 1, pg. 237-246, ISSN: 2309-0685

6. Brock, W.A., W.D. Dechert and J.A. Scheinkman (1987) A Test for Independence

Based on the Correlation Dimension, Department of Economics, University of

Wisconsin at Madison, University of Houston, and University of Chicago

7. Dickey, D.A., Fuller, W. A., (1981) Likelihood Ratio Statistics for Autoregressive Time

Series with a Unit Root, Econometrica, pp. 1057-1072

8. Engle R. F., Granger C. W. J., (1987) Cointegration and Error Correction:

Representation, Estimation and Testing, Econometrica, 55, pp. 251-76

9. Eun, C.S., Shim, S. (1989) International Transmission of Stock Market Movements,

Journal of Financial and Quantitative Analysis, pp. 241-256

10. Granger, C. W. J. (1969) Investigating Causal Relations by Econometric Models and

Cross-spectral Methods, Econometrica 37 (3): 424438

11. Khan, T.A (2011) Cointegration of International Stock Markets: An Investigation of

Diversification Opportunities, Undergraduate Economic Review, Volume 8, Issue 1,

12. Singh, G.S.P. (2010) Chinese and Indian Stock Market Linkages with Developed Stock

Markets, Asian Journal of Finance & Accounting, Vol. 2, No. 2: E2

13. *** - http://data.worldbank.org/

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- The Implications of Freudian Psychoanalytic Theory On Managerial Behavior A Critical StudyDocumento6 pagineThe Implications of Freudian Psychoanalytic Theory On Managerial Behavior A Critical StudyIjbemrJournalNessuna valutazione finora

- International Negotiation The Cuban Missile Crisis Template For Social ChangeDocumento10 pagineInternational Negotiation The Cuban Missile Crisis Template For Social ChangeIjbemrJournalNessuna valutazione finora

- An Analytical Study To Determine The Impact of CAD REPO WPI On The Benchmark G Sec of IndiaDocumento8 pagineAn Analytical Study To Determine The Impact of CAD REPO WPI On The Benchmark G Sec of IndiaIjbemrJournalNessuna valutazione finora

- Recruitment Strategies A Power of E Recruiting and Social MediaDocumento21 pagineRecruitment Strategies A Power of E Recruiting and Social MediaIjbemrJournalNessuna valutazione finora

- An Economic Analysis of Jammu and Kashmir Handicraft Exports and Its MarketingDocumento7 pagineAn Economic Analysis of Jammu and Kashmir Handicraft Exports and Its MarketingIjbemrJournal100% (1)

- A Study On The Problems Faced by The FMCG Distribution Channels in Rural Area of Bhopal Hoshangabad Districts of M.P.Documento9 pagineA Study On The Problems Faced by The FMCG Distribution Channels in Rural Area of Bhopal Hoshangabad Districts of M.P.IjbemrJournalNessuna valutazione finora

- Certification in Tourism As An Element of Quality Management - Theoretical Aspects and Entrepreneurs' AttitudesDocumento10 pagineCertification in Tourism As An Element of Quality Management - Theoretical Aspects and Entrepreneurs' AttitudesIjbemrJournalNessuna valutazione finora

- Volume 1, Issue 2, July 2014: ISSN: 2349-5677Documento16 pagineVolume 1, Issue 2, July 2014: ISSN: 2349-5677IjbemrJournalNessuna valutazione finora

- Volume 1, Issue 2, July 2014: ISSN: 2349-5677Documento16 pagineVolume 1, Issue 2, July 2014: ISSN: 2349-5677IjbemrJournalNessuna valutazione finora

- Financial Performance of Axis Bank and Kotak Mahindra Bank in The Post Reform Era Analysis On CAMEL ModelDocumento34 pagineFinancial Performance of Axis Bank and Kotak Mahindra Bank in The Post Reform Era Analysis On CAMEL ModelIjbemrJournalNessuna valutazione finora

- The Necessity of Ιnternal Audit as a Procedure of Effective Fiancial Management in a Public Organization of Healthcare Services Case Study in Hospitals of 3 4 Health Coynty OfDocumento14 pagineThe Necessity of Ιnternal Audit as a Procedure of Effective Fiancial Management in a Public Organization of Healthcare Services Case Study in Hospitals of 3 4 Health Coynty OfIjbemrJournalNessuna valutazione finora

- Examination of Social Cultural Impacts of Tourism in Chembe Mangochi MalawiDocumento32 pagineExamination of Social Cultural Impacts of Tourism in Chembe Mangochi MalawiIjbemrJournalNessuna valutazione finora

- Premature School Abandonment and Its Long Term Economic Consequences in Developing Countries A Case Study For RomaniaDocumento10 paginePremature School Abandonment and Its Long Term Economic Consequences in Developing Countries A Case Study For RomaniaIjbemrJournalNessuna valutazione finora

- Terrorism DiscourseDocumento10 pagineTerrorism DiscourseIjbemrJournalNessuna valutazione finora

- Price Sensitivity Decision Involvement of Online Shoppers An Empirical StudyDocumento9 paginePrice Sensitivity Decision Involvement of Online Shoppers An Empirical StudyIjbemrJournalNessuna valutazione finora

- The Role of Sub National Governments in Creating Frameworks For Growth Selfreliance and ProsperityDocumento21 pagineThe Role of Sub National Governments in Creating Frameworks For Growth Selfreliance and ProsperityIjbemrJournalNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Case LawsDocumento4 pagineCase LawsLalgin KurianNessuna valutazione finora

- Impact of Brexit On TataDocumento2 pagineImpact of Brexit On TataSaransh SethiNessuna valutazione finora

- 01 - Quality Improvement in The Modern Business Environment - Montgomery Ch01Documento75 pagine01 - Quality Improvement in The Modern Business Environment - Montgomery Ch01Ollyvia Faliani MuchlisNessuna valutazione finora

- Factors That Shape A Child's Self-ConceptDocumento17 pagineFactors That Shape A Child's Self-ConceptJaylou BernaldezNessuna valutazione finora

- POLS 1503 - Review QuizDocumento12 paginePOLS 1503 - Review QuizDanielle FavreauNessuna valutazione finora

- Torrens System: Principle of TsDocumento11 pagineTorrens System: Principle of TsSyasya FatehaNessuna valutazione finora

- Fearing GodDocumento5 pagineFearing GodAnonymous d79K7PobNessuna valutazione finora

- The Power of GodDocumento100 pagineThe Power of GodMathew CookNessuna valutazione finora

- Politics of BelgiumDocumento19 paginePolitics of BelgiumSaksham AroraNessuna valutazione finora

- Deanne Mazzochi Complaint Against DuPage County Clerk: Judge's OrderDocumento2 pagineDeanne Mazzochi Complaint Against DuPage County Clerk: Judge's OrderAdam HarringtonNessuna valutazione finora

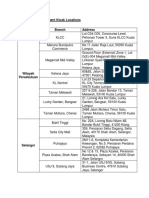

- Debit Card Replacement Kiosk Locations v2Documento3 pagineDebit Card Replacement Kiosk Locations v2aiaiyaya33% (3)

- Forn VännenDocumento14 pagineForn VännenDana KoopNessuna valutazione finora

- Career Oriented ProfileDocumento3 pagineCareer Oriented ProfileSami Ullah NisarNessuna valutazione finora

- Blue Umbrella: VALUABLE CODE FOR HUMAN GOODNESS AND KINDNESSDocumento6 pagineBlue Umbrella: VALUABLE CODE FOR HUMAN GOODNESS AND KINDNESSAvinash Kumar100% (1)

- The Kurdistan Worker's Party (PKK) in London-Countering Overseas Terrorist Financing andDocumento28 pagineThe Kurdistan Worker's Party (PKK) in London-Countering Overseas Terrorist Financing andrıdvan bahadırNessuna valutazione finora

- 2016-10-26 Memo Re Opposition To MTDDocumento64 pagine2016-10-26 Memo Re Opposition To MTDWNYT NewsChannel 13Nessuna valutazione finora

- ARI - Final 2Documento62 pagineARI - Final 2BinayaNessuna valutazione finora

- Abbreviations Related To Hotel Management 14.09.2018Documento5 pagineAbbreviations Related To Hotel Management 14.09.2018Anonymous BkRbHIeyqnNessuna valutazione finora

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 paginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Raj SakariaNessuna valutazione finora

- Public Administration and Governance: Esther RandallDocumento237 paginePublic Administration and Governance: Esther RandallShazaf KhanNessuna valutazione finora

- Zmaja Od Bosne BB, UN Common House, 71000 Sarajevo, Bosnia and Herzegovina Tel: +387 33 293 400 Fax: +387 33 293 726 E-Mail: Missionsarajevo@iom - Int - InternetDocumento5 pagineZmaja Od Bosne BB, UN Common House, 71000 Sarajevo, Bosnia and Herzegovina Tel: +387 33 293 400 Fax: +387 33 293 726 E-Mail: Missionsarajevo@iom - Int - InternetavatarpetrovicNessuna valutazione finora

- Who Am I NowDocumento7 pagineWho Am I Nowapi-300966994Nessuna valutazione finora

- A Term Paper On The Application of Tort Law in BangladeshDocumento7 pagineA Term Paper On The Application of Tort Law in BangladeshRakib UL IslamNessuna valutazione finora

- Military Aircraft SpecsDocumento9 pagineMilitary Aircraft Specszstratto100% (2)

- Local Labor Complaint FormDocumento1 paginaLocal Labor Complaint FormYVONNE PACETENessuna valutazione finora

- Manajemen Rantai Pasok Tugas Studi Kasus Seven-Eleven: OlehDocumento11 pagineManajemen Rantai Pasok Tugas Studi Kasus Seven-Eleven: OlehRane ArthurNessuna valutazione finora

- University of The Philippines Open University Faculty of Management and Development Studies Master of Management ProgramDocumento10 pagineUniversity of The Philippines Open University Faculty of Management and Development Studies Master of Management ProgramRoldan TalaugonNessuna valutazione finora

- Aquarium Aquarius Megalomania: Danish Norwegian Europop Barbie GirlDocumento2 pagineAquarium Aquarius Megalomania: Danish Norwegian Europop Barbie GirlTuan DaoNessuna valutazione finora

- Change Management and Configuration ManagementDocumento5 pagineChange Management and Configuration ManagementTống Phước HuyNessuna valutazione finora

- Bakst - Music and Soviet RealismDocumento9 pagineBakst - Music and Soviet RealismMaurício FunciaNessuna valutazione finora