Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financing Structure Solar

Caricato da

sandeepvempatiCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Financing Structure Solar

Caricato da

sandeepvempatiCopyright:

Formati disponibili

Here are some of the more common structures of financing renewable energy project.

They vary in

the type of participants, source of financing and allocation of benefits.

Corporate Financing

One corporation develops the project and finances all costs. There are no other investors or

lenders involved. The project may be set up as a subsidiary of the corporate parent. However, with

100% ownership, the subsidiary would have to be consolidated into the parent's financial accounts.

Naturally, the corporation reaps all the benefits of the project.

The corporate parent must have sufficient capacity for tax credits and benefits to be of use.

In the renewable energy sector, this is structure is rare and only used by utility companies

themselves.

Sale before Construction

The developer acquires lease and land rights, permits, interconnection agreements, power

purchase agreements and any renewable certificates or feed-in-tariffs.

The developer sells the developed project to a strategic investor and receives a development fee

from the investor.

The strategic investor (possibly a utility company) constructs the project on its balance sheet or

arranges bridge finance for the construction. The strategic investor owns and operates the plant.

The developer's risk is limited to the development capital.

Sale after Construction

The developer seeks bridge financing from lenders:

Construction Loan: Bank is repaid in full at completion of construction. Alternatively, bridge is

converted into long-term loan.

Cash Equity Bridge: Bank is repaid at completion of construction with funds from sponsor.

Developer may provide limited guarantee for cash equity.

Tax Equity Bridge: Bank is repaid at completion of construction with funds from tax investor, who

will only come in once the plant produces tax credits.

Investor Ownership Flip

The investor contributes almost all of the equity and receives a pro-rata percentage of the cash

and tax benefits prior to a flip in allocation.

At a given level of IRR (internal rate of return), the ownership flips back to the developer, after

which most of the cash and tax benefits are allocated to the developer.

Only the production tax credits will continue to go to the tax investor even after the "flip".

If the investor is a tax investor rather than a strategic investor, the pre-flip allocation may not

be pro-rata, and all tax benefits may go to the investor instead.

Leveraged Ownership Flip and Pay-As-You-Go ("PAYGO")

This is the most common project finance structure.

The tax investor makes contributions before production begins, though a portion may be deferred

until the project receives production tax credits, which are initially allocated to the tax investor,

though a high percentage is paid to the developer as an equity contribution. This serves as a claw-

back should the project not perform.

The leverage is at project level with long-term debt of up to 18 years, based on the PPA (Power

Purchase Agreement).

This structure also includes a return-based flip in the allocations.

As the term for the production tax credits is usually, an additional loan may be secured against

those flows.

Back Leveraged Structure

Similar to the Investor-Ownerhip-Flipstructure. However, the developer is leveraging its equity

stake in the project using debt financing.

The tax investor commits equity upfront.

Pre-Flip: Initially, 100% of cash goes to the developer until return of investment (similar to a

development fee). Then 100% goes to the investor.

Post-Flip: After the investor's pre-agreed IRR (typically 7% - 10% depending on project risks) is

reached ownership and cash flow allocations go back to the developer, including most of the tax

benefits.

Leveraged Lease

Construction is funded by sponsor equity and a construction loan. Once constructed, the sponsor

sells the project to the investors that have formed a trust and immediately leases it back.

The develpoper repays the construction loan from the sale proceeds. The trust is financed with

cash equity and a non-recourse term debt. Lease payments are likely to be assigned to a lender.

For tax purposes, a minimum of 20% equity is usually required.

Leasing generates a "time value of money" cost saving achieved by deferring tax payments. It also

improves cash flow.

If set up as Operating Lease, the lease may only be for 5 years with the option to re-lease.

Homeowner Model

When homeowners invest in renewable energy generators, they will own 100%. However, quite

frequently, they can get bank finance, in some cases up to 100% of the capital costs!

Depending on the jurisdiction, homeowners may have to set up a company to run the generator, in

whcih case they will also be able to profit from tax benefits.

However, unless they can offset the investment against profits elsewhere, the overall tax benefits

are not significant. The lack of tax benefits, however, is often compensated for by higher feed-in

tariffs for small installations..

The Optimum Financing Structure

With so many different financing structures to choose from, which one is the optimum? That very

much depends on the project itself as well as the participants. As with other infrastructure projects,

capital intensive energy projects are often financed as stand-alone entities (Project Finance) rather

than as part of a corporate balance sheet (Corporate Finance). The main advantages of project

finance are:

Non-recourse/limited recourse financing: There is no or only limited recourse to the project

sponsor's assets for the liabilities of the project. Thus, the project preserves the sponsor's debt

capacity.. Also, lenders will be more keen to participate in a workout.

Risk Sharing: By setting up a separate legal entity, the project risk is isloated and can be allocated

to the parties that can best control, understand and mitigate the risks involved. Consequently,

incentives for all involved are optimized. This includes political or country risk.

Favourable Tax Treatment: Project Finance structures allow tax benefits to be allocated to entities

that can make use of them.

Improved Financing Terms: The project may obtain more favourable finnacing term than it would

based on the sponsor's credit profile alone. This way projects can be carried out that would be too

big for one sponsor.

However, all of these benefits come at a high transaction cost, higher interest rates and insurance

coverage.

How to choose the Financing Structure?

The developer who initiates the project decides which finnancing structure best meets their needs for

a project based on multiple considerations.

Consideration /

Motivation

Context

Most

suitable

structure

Project Size

If the project's value is less than $50m, the transaction costs of

Project Finance will outweigh the benefits.

Corporate

Developer can

use tax benefits

If the developer wants to use tax benefits, the project needs to be

on its balance sheet. However, often, developers are much smaller

than the projects they develop and have no capacity to use all the

tax benefits.

Corporate

Developer can

fund project

costs

If the developer can fund project costs

Corporate

PAYGO

Low Project IRR

If the project's projected internal rate of return (IRR) is low,

increasing debt levels will help increase the equity holder's rate of

return.

Leveraged

Structure

Developer

wants early

cash

distribution

Due to the large capital expenditure there are no early cash

distributions available if developed on own balance sheet. The

developer either needs to sell early, or device a structure

wehereby the developer receives a large proportion of cash.

Project

Sale

Back-

leveraged

PAYGO

Re-financing

If the projeect already exists, but just needs re-financing, possibly

after construction, options include a pay-as-you-go structure or

leasing.

PAYGO

Leveraged

Lease

Impact of financing structure on returns and the cost of energy

The

investor's internal return and the plant's levelised cost of energy vary with the choice of financial

structure.

We have calculated the weighted average cost of capital, investor's internal rate of return and the

levelised cost of energy for investment in a 1MW solar park for different financing structures.

The levered structure yields the highest return and lowest cost of ownership because of the lower

cost of debt and the tax shield provided by the debt. Also, the debt lowers the average cost of capital,

though increases the expected return for the investor.

The cost of ownership is highest in the "sales after construction" scenario, as the interest for

financing the construction before the sale has been added to the capital cost of the whole plant.

Contract Framework

Constructing and operating a power plant or any other infrastructure facility requires a number of

contracts with all participants. They don't just document the legal structure. Contracts are also an

essential part of a risk mitigation strategy. The diagram below provides an overview of the contract

framework.

Financial & Control

Site Survey: A survey carried out by an independent experton feasibility of the project and

expected annual energy supply.

Security: Any loan agreements that are secured with lien on the land or other assets

Shareholder Agreement: Includes the capital structure and governance of the project company.

Management Contract: specifying management incentives.

Project Documents

Supply Agreement: Fixed price & date models may not be available due to the fact that

preparation of foundation (for instance for off-shore farms), turbine or panel sale and the balance of

plant are governed under separate contracts.

Balance of Plant Contracts: As most BOP contractors lack credit ratings, lenders will require

holdback of some payment until completion.

Land Agreements: The term needs to be similar to the useful life of the plant (20 - 25 years).

Contract includes definition of payments (usually based on gross revenues), audit rights of

landowner, exclusivity, non-disturbance provisions and scope of indemnities.

Planning Permissions

Environmental Consent: For most projects, consent will only be given by local authorities if certain

conditions are met with respect to safeguarding the environment. This contract may impose

restrictions on the operations times or demand additional investments.

Insurance: Risks that the sponsors and lenders cannot allocate may have to be insured against, for

instance political risk.

Operations Documents

Interconnection Agreement: Construction of grid connectivity, long-term feed-in agreement,

completion schedule

Turbine / Panel Service Agreement: Provided by the supplier with term duration of the warranty -

needs to correlate to other O & M work. Compensation usually based on a fixed fee.

O & M Contract: Includes the scope of work, compensation and separate fees, liability,

compliance, remedies and dispute resolution

Operating Licenses: If using patented technology, the project company may have to pay for

operating the technology under license. Length must aligh with useful life of plant.

Marketing Documents

Power Purchase Agreement: The Power Purchase Agreement (mostly with a utility company)

includes details on what is being sold (i.e. power, credits, certificates), peak or off-peak tariff. It also

specifies if the electricity has to be purchased if not taken or what happens if electricity is not

produced.

Renewable Energy Certificate Qualification: (or similar) - a certificate from government agency

that project qualifies for feed-in tariffs or production tax credits.

Instruments & Sources for Renewable Energy Projects

Instrument Sub Category Function Source

Equity Ordinary Shares

Rsik capital from

Sponsor

developer or sponsor

Preference Shares

Senior to ordinary

shares, typically from

tax investor;

sometimes proviiding a

cumulative dividend.

Institutional Investors

Investment Funds

Tax Investors

Debt

Subordinated Loan /

Mezzanine

Usually fixed rate,

long-term and

unsecured. May be

considered as equity.

Can be used to cover

construction overruns

or other guaranteed

payments

Lenders specialising in

mezzaninen debt

Syndicated Loans

Loan provided by two

or more lenders,

governed by a single

loan agreement. May

have different

agreements for

construction and

operating phase of

project. Provide long-

term finance

Banks

Senior Debt -

unsecured / secured

Large unsecured loans

are only available to

creditworthy

corporations. Banks

tend to limit their risk

to 5 - 10 years.

Commercial banks

Development Loan

Financing provided

during development of

project to a sponsor

with insuffiicient

resources.

Lender with project

experience

World Bank (only if

project can not

secure borrowing at

reasonable rates

from any other

sources)

Vendor

Intermediary Loan

Export-Import bank

lends to a financial

intermediary

(commercial bank),

which in turns lends to

the project.

Export Credit Agency

Private Placement Direct sale of long-

term debt / equity

Sophisticated investors

including insurance

companies, pension

funds, trading

companies

Eurobond

Issued in amounts

averaging $100m

without prior

registration or

approval by any

particular government.

Terms usually range

from 10 - 15 years.

Loans may be made in

any currency, fewer

covenant than

syndicated bank loans,

and accessible through

a large and liquid

market. However, a

credit rating for the

project entity is

required which could

be both costly and

time-consuming to

obtain. Also, bond

issues tend not to

allow changes to the

underlying project.

Capital Markets

Guarantee Exchange Rate Risk

A commercial lender

provides a loan to the

project entity (the

Export Credit Agency

importing entity), at

below market interest

rates. The Export-

Import bank provides

compensation for the

difference between

commerical rate and

below-market rate

Political Risk

Limited protection

against risks of

sovereign non-

performance and

against certain Force

Majeure risks.

Word Bank

Tax Relief

Tax Credits

Tax Holidays

Duty exemption

Individual

governments may

offer tax incentives

Host governments

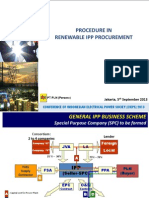

PROJECT FINANCE

Renewable Energy project financing is a relatively young industry, where

transaction structures continue to evolve.

Due to the unique nature of risks in most renewable energy financings,

transactions need to be constructed with a fine balance of risk allocation.

GLOBAL SOLARIS GROUP offers meaningful insight on maintaining this fine

balance and works with the most reputed and experienced Renewable Energy

investment firms.

OVERVIEW

Project finance is a structure employed to finance capital-intensive projects that

are either difficult to support on a corporate balance sheet or that have become

more attractive when financed on their own. Renewable energy projects in the

United States are typically financed using project finance and generally include a

mix of project equity investors, tax equity investors and project-level loans

provided by a syndicate of banks. Terms set forth by both lenders and equity

investors are based on the projects perceived riskiness and its expected future

cash flows.

The project finance structure revolves around the creation of a project

company. The project company holds all of the projects assets, including its

contractual rights and obligations. The project company is typically a limited-

liability company (LLC) or, in some cases, a limited partnership (LLP). Project-

level loans are usually non-recourse, meaning that they are secured by the

projects assets and paid off by the projects cash flow: the investors assets are

shielded should the project be unable to meet loan repayment terms.

Most renewable energy projects require a signed power purchase agreement

(PPA) in order to reach financial close and commence construction. The

commercial terms of the PPA and the engineering, procurement and construction

(EPC) contract, together with the projects associated market and technology

risks, will largely determine whether lenders consider the project financeable.

The maturing of the wind power market in recent years has allowed some major

wind parks to receive project financing in the absence of a long-term PPA

(known as merchant projects), but solar projects rarely receive financing in

advance of a PPA being signed.

I - Direct Equity

Project equity (aka cash equity orprivate equity) is supplied by private equity

firms or the developers themselves. Direct equity investors invest a specified

amount in a project in return for a certain stake in the projects future cash

flows.

II - Tax Equity

Renewable energy project developers typically do not have tax liabilities large

enough to efficiently capture the full amount of tax credits available for large

projects. To circumvent this issue, project developers can pair with a tax equity

partner that is better able to utilize a projects tax benefits. Traditionally, tax

equity investors have been large investment banks, commercial banks and

insurance companies with a high tax burden that seek to offset some portion of

their expected tax liability. In some cases, large equipment manufacturers are

able to provide tax equity.

The two primary tax equity financing structures of renewable energy projects in

the U.S. are the sale-leaseback model and the partnership flip model.

1 - Sale-Leaseback Model

The sale-leaseback model allows a project developer to recoup its entire

investment in a project, eliminating the need to invest directly. In this model,

the developer finances and installs a project and then immediately sells it to a

tax equity investor at full value. The tax equity investor then leases the project

back to the developer at a fixed rate for a period exceeding the PPA schedule.

The developer uses PPA revenue to fund rent payments to the tax equity

investor, who also claims all tax benefits associated with the project. At the end

of the lease term, the tax equity investor either remains the owner of the project

or the developer can buy the project back at its residual value.

The benefit of the sale-leaseback model is that the tax equity investor is able to

pass tax savings on to the project developer in the form of lower rent payments.

In turn, lower rent payments result in a lower PPA price and lower rates charged

to end customers.

2 - Partnership Flip Model

A partnership-flip model is structurally more complex than a sale-leaseback

model, but gives more freedom to the project developer within the partnership.

The project developer and tax equity investor form a partnership company

(typically a limited-liability company), through which they co-own a project. The

partnership becomes the formal owner of the project, receiving all associated

revenue and tax credit. Once formed, the partnership will negotiate over the

distribution of revenues and tax credits, which is done on a project-by project

basis. In all cases, the tax equity investor requires a certain rate of return within

a certain time frame (typically six to ten years). For example, during this time

frame the tax equity investor may claim 99 percent of revenue and tax

incentives within the partnership and the developer just one percent. Once the

tax equity investor achieves its required return, the partnership structure flips

and the developer may receive 95 percent of revenue and the tax equity

investor receives five percent.

A benefit of the partnership-flip model is that the project developer receives

assistance in financing the construction of the project from the tax-equity

investor; financing is often difficult to source for large-scale projects.

III - Debt

Project debt is supplied by a bank or a syndicate of banks, which lend against

the expected future cash flow of a project. Debt packages inevitably vary by

project size and technology, but most solar, wind and geothermal projects

incorporate one or more of the following:

1 - Term Loans

Term loans are a basic vanilla commercial loan. Term loans typically have fixed

interest rates with monthly or quarterly repayments.

Term loans for renewable energy projects are typically long term, with

maturity dates generally between 10 and 20 years (though tenors dropped

significantly directly following the financial crisis). The collateral for term-loans is

typically the project itself.

2 - Construction Loans

The potential risks and returns to an investor during the construction period

differ from those expected once a project has reached commercial operation. As

such, most large renewable energy projects have a construction loan component

in the overall project-financing package. Construction loans are generally

distributed in several installments. After the first installment , and through the

term of the construction loan, the borrower makes interest only payments on the

installments received to date. When construction is complete, payment is due for

the entire amount. In some cases, construction loans will automatically convert

to term loans once commercial operation is reached. The interest rate on

construction loans is generally higher than on term loans.

3 - Equity Bridge Loan

Equity bridge loans have grown in popularity since the introduction of the ITC

cash grant in 2009. Because cash grants (which cover 30 percent of a projects

installed cost) are made 60 days after the project commences operation,

developers still need bridge financing to get through the projects construction

phase. Equity bridge financing is often furnished by equity investors until the

grant comes through, at which time the investor is typically repaid. Cash grant

bridge loan spreads are similar to term debt spreads, if not somewhat lower.

IV - Other

There are several additional financing instruments available: 144A bonds, Clean

Energy Renewable Bonds (CREBs), which are available to co-ops and

municipalities, Class B memberships, and prepaid service contracts.

POWER PURCHASE AGREEMENT (PPA)

The Solar Power Purchase Agreement (SPPA) is an alternative to financing and owning the system.

It offers you an opportunity to install solar or wind power at your facility without paying upfront

costs or worrying about system operation and maintenance. Sometimes referred to as a third

party ownership model, this approach lets you focus on your core mission, while solar experts

manage your energy system. For 15 to 20 years, you enjoy predictable, pre-set electricity prices,

and power from a solar system that is a source of pride for your organization.

PPA TERMS

Disclaimer: this document is only intended to illustrate a possible scenario. A wide range

of variables can and will alter the possible outcomes. All terms are fully negotiable.

The Parties

Buyer is the purchaser of electricity

Seller is the seller of electricity, i.e. a limited partnership owned by GLOBAL SOLARIS

GROUP

1- Term

A base term is established with one or more extensions options.The term

may vary from 15 to 20 years.

2- Effective Date

The PPA becomes binding from the date it is signed.

3- Commercial Operation Date

The PPA term starts from the commercial operation date also called

placed in service date.

4- Installation, Testing, Start-up

The PPA will include an obligation from the project owner to install and

test the system. It will also set a placed in service date that relates to

when the sale of electricity becomes active.

5- Contract Rate

The rate is fixed for the duration of the agreement with an escalation

clause reflecting inflation. The rate is designed to create lifecycle savings

for the consumer by targeting an increase rate that is less than from

utilities.The PPA starting rate is usually set at a discount from the rate

paid to the electric utility company.The contract price is based on the

amount of electricity generated by the project.

6- Environmental Attributes

The environmental attributes will attach and be available to the seller

during the term of the PPA.The PPA states the energy is sold without the

environmental attributes. The sale of Renewable Energy Certificates is the

prerogative of the owner of the system.

7- Interconnection

The PPA requires the seller to bear the cost of interconnection.

8- Operation & Maintenance

The PPA outlines the sellers responsibility to operate and maintain the

project in accordance with prudent operating practices. Such duties

include regular inspection and repair, as well as completion of scheduled

maintenance.The PPA also provides for access to the project.

9- Net Metering

Metering is most important as it determines the quantity of output for

which the seller is paid.Under Arizona law, net metering allows the

consumer to receive credits for excess electricity produced.The PPA

assigns those credits to the buyer.

10-Purchase Options

Timing: During the PPA purchase options can be exercised only from 6

years after commercial operation date up to the end of the term.

Pricing: Pricing is established at fair market value and a discounted

present value of the electricity produced by the system for the remainder

of its useful life.

11-Billing & Payment

The PPA determines how invoices are prepared, when they are issued, and how quickly

they are paid.The PPA sets forth procedures for raising and resolving billing disputes,

and the interest rate and penalties that apply to late payments.

REITs & Securitization

SOLAR REITS

Real Estate Investment Trusts are a financing method in which individual

investors invest in a fund that buys property or makes loans for real estate

assets or invests in other good assets applicable to real estate. As long as the

REIT annually pay its investors at least 90% of the REITs profits, the REIT itself

isnt taxed. Instead, only the individual investors are taxed on their REIT

dividends, thus avoiding double taxation.

Recently, the IRS made a so-called private letter ruling thatunder certain

conditionsallows solar equipment to be a good asset as part of a REIT.

To comply with IRS regulations, NREL has outlined three strategic options:

I - Utilize a taxable REIT subsidiary (TRS) to own PV projects

REITs can create a TRS that can develop, finance, and own rooftop solar PV

systems. The TRS can then receive the benefits of the 30% Investment Tax

Credit and also make income by selling the power generated to the building

tenants. The TRS then returns this after-tax income to the main REIT fund.

II - Utilize a TRS to develop and construct PV projects

A REIT can utilize a TRS to develop and construct PV projects, but instead of

owning the project after construction, the TRS can sell its ownership interest to

an investor or utility. Electricity generated by the project is retained by the

utility or is sold to an offtaker under the conditions of a long-term power

purchase agreement (PPA). In this case, the TRS only acts as a construction

contractor, and the parent REIT collects rent for leasing the rooftop space to the

project owner, which is considered good income by the IRS

III - Lease space to solar developers and project owners

In this case, a REIT owns rooftop space or land but does not form a TRS to

construct or develop the PV project. Instead, the REIT will lease the rooftop or

land to a PV project developer, which will pay the REIT monthly rent. This rental

income is considered good income by the IRS

SECURITIZATION

The introduction of solar asset-backed securities, commonly referred to as solar

securitization, has been the next big thing in energy finance for the past three

to four years. Whether the first real solar securitization happens this year or in

the near future, securitization is coming to solar finance.

As state and federal support for renewables shrinks, the industry must find ways

to continue to reduce costs, and access to less expensive capital will be a vital

piece of this process. Securitization will enable the solar industry to access a

much larger and more diverse investor base, which will eventually help to reduce

the long-term cost of capital to a likely range of 3% to 7%, compared with the

8% to 20% rate required by some project finance equity and tax equity

investors in the current market.

In the most basic form of a solar securitization, the holder, or originator, of a

portfolio of solar assets identifies and isolates contracted revenues from a series

of solar projects. The originator then bundles the contracted revenues into a

reference portfolio, and sells the revenue stream (but not the physical solar

asset itself) to an issuer, typically a special purpose vehicle. The SPV then issues

a tradable, interest-bearing security to investors in the capital markets. The

revenues generated by the reference portfolio fund a trustee account that passes

through payments, either fixed or floating, to the investors in the new security.

These investors are senior to equity investments and for stable income

producing assets like solar projects represent a relatively low risk investment.

Sources: NREL & Power Intelligence

Potrebbero piacerti anche

- Global Currency Reset - Revaluation of Currencies - Historical OverviewDocumento20 pagineGlobal Currency Reset - Revaluation of Currencies - Historical Overviewenerchi111196% (28)

- Solar Project CalculatorDocumento2 pagineSolar Project CalculatorAnonymous s8uhVJTNessuna valutazione finora

- ACCA AAA MJ19 Notes PDFDocumento156 pagineACCA AAA MJ19 Notes PDFOmer ZaheerNessuna valutazione finora

- PowerPurchaseAgreement WindindustryDocumento6 paginePowerPurchaseAgreement WindindustryztowerNessuna valutazione finora

- Commercial SolarDocumento12 pagineCommercial SolarMarian Veronica Sevilla100% (2)

- Project Finance Renewable Energy Projects Risk AnalysisDocumento10 pagineProject Finance Renewable Energy Projects Risk AnalysisAshutosh Agrawal100% (3)

- Exhibits To Full Deposition of Patricia Arango of Marshall C WatsonDocumento25 pagineExhibits To Full Deposition of Patricia Arango of Marshall C WatsonForeclosure FraudNessuna valutazione finora

- 100 MW Solar Farm Pre-Feasibility Study For Investment PDFDocumento11 pagine100 MW Solar Farm Pre-Feasibility Study For Investment PDFmirali74Nessuna valutazione finora

- Why The Excess VolatilityDocumento4 pagineWhy The Excess VolatilitysandeepvempatiNessuna valutazione finora

- Solar ProjectDocumento7 pagineSolar ProjectPriyanka MishraNessuna valutazione finora

- Setup 1MW Solar Plant GuideDocumento7 pagineSetup 1MW Solar Plant GuideJithesh Kumar KNessuna valutazione finora

- Feasibility Study For The Use of Solar Energy in Bijeljina and BogaticDocumento254 pagineFeasibility Study For The Use of Solar Energy in Bijeljina and BogaticNemanja NesicNessuna valutazione finora

- Solar Power PPA Toolkit FINAL 041015Documento232 pagineSolar Power PPA Toolkit FINAL 041015Emmanuel BouendeuNessuna valutazione finora

- PLN Invitation For Pre Qualification of EPC Contractors For Coal Fired Power PlantDocumento1 paginaPLN Invitation For Pre Qualification of EPC Contractors For Coal Fired Power PlantBudget GamingNessuna valutazione finora

- Feasibility Study of Developing Large Scale Solar PV Project in Ghana: An Economical AnalysisDocumento65 pagineFeasibility Study of Developing Large Scale Solar PV Project in Ghana: An Economical AnalysisFocus ArthamediaNessuna valutazione finora

- Business Plan Solar Factory Florida PDFDocumento60 pagineBusiness Plan Solar Factory Florida PDFmohammedNessuna valutazione finora

- Solar Project Finance GuidelinesDocumento4 pagineSolar Project Finance GuidelinesricardofranciscoNessuna valutazione finora

- First Solar CDM DocumentsDocumento115 pagineFirst Solar CDM DocumentsM Qamar Nazeer100% (1)

- Financial Analysis of 1 MW Solar PV PlantDocumento2 pagineFinancial Analysis of 1 MW Solar PV PlantEka BNessuna valutazione finora

- 9 Factors To Consider When Comparing McKinsey - Bain - BCG - Management ConsultedDocumento7 pagine9 Factors To Consider When Comparing McKinsey - Bain - BCG - Management ConsultedTarekNessuna valutazione finora

- Solar Power Generation PlantDocumento37 pagineSolar Power Generation Plantshani27100% (8)

- Economic Analyisi of 10 MW Solar PV in QuettaDocumento6 pagineEconomic Analyisi of 10 MW Solar PV in QuettaImran ShahzadNessuna valutazione finora

- Chapter 14Documento43 pagineChapter 14Dominic RomeroNessuna valutazione finora

- Detailed Project Reports, Feasibility Studies, Financial Modelling, Setting Up of Power PlantDocumento11 pagineDetailed Project Reports, Feasibility Studies, Financial Modelling, Setting Up of Power PlantiData InsightsNessuna valutazione finora

- Cornell CEA Lettuce HandbookDocumento48 pagineCornell CEA Lettuce HandbookChris Sealey100% (1)

- Renewable Energy FinanceDocumento9 pagineRenewable Energy FinanceCapital Line Energy FinancingNessuna valutazione finora

- Tracy Solar Energy Center Project, Towns of Orleans and Clayton, Jefferson County NYDocumento87 pagineTracy Solar Energy Center Project, Towns of Orleans and Clayton, Jefferson County NYpandorasboxofrocks100% (1)

- EPC Contract Best Practice ChecklistDocumento19 pagineEPC Contract Best Practice ChecklistAnonymous DFbSHXr0100% (1)

- Evaluate economic feasibility of power plant projectsDocumento7 pagineEvaluate economic feasibility of power plant projectsfundu123Nessuna valutazione finora

- Ghana 100mw Plant - 1.4Documento16 pagineGhana 100mw Plant - 1.4Mohd NB MultiSolarNessuna valutazione finora

- Sample Report - Project AppraisalDocumento26 pagineSample Report - Project Appraisalram_babu_590% (1)

- G5 Project NewFinal - TeamDocumento21 pagineG5 Project NewFinal - Teamrahul shuklaNessuna valutazione finora

- Solar Advisory & Project ExecutionDocumento8 pagineSolar Advisory & Project ExecutionPuneet Singh JaggiNessuna valutazione finora

- Sample Power Purchase AgreementDocumento49 pagineSample Power Purchase Agreementsjay210% (1)

- Solar PPA - Cover LetterDocumento2 pagineSolar PPA - Cover LetterHelen BennettNessuna valutazione finora

- Aarone Group 10MW Solar DPRDocumento35 pagineAarone Group 10MW Solar DPRSonu Khan100% (3)

- Solar Power Project FinancingDocumento19 pagineSolar Power Project Financingfundu567Nessuna valutazione finora

- Project Proposal Solar Photovoltaic Power Plants: Proposed byDocumento107 pagineProject Proposal Solar Photovoltaic Power Plants: Proposed byNimesh Ishanka100% (1)

- Bankability of Solar PV Projects v1Documento9 pagineBankability of Solar PV Projects v1MudasarSNessuna valutazione finora

- Tender SPV Rooftop 45 MWDocumento106 pagineTender SPV Rooftop 45 MWVikas JainNessuna valutazione finora

- Deployment of Hybrid Renewable Energy Systems in MinigridsDa EverandDeployment of Hybrid Renewable Energy Systems in MinigridsNessuna valutazione finora

- Renewable Power Generation Costs in 2019Da EverandRenewable Power Generation Costs in 2019Nessuna valutazione finora

- IPP Procedure ConferenceDocumento10 pagineIPP Procedure ConferencekongbengNessuna valutazione finora

- Renewable Energy Investor Guidbook - USAID ENERGY PROGRAMDocumento41 pagineRenewable Energy Investor Guidbook - USAID ENERGY PROGRAMGEDFNessuna valutazione finora

- PPA for Procurement of Solar PowerDocumento54 paginePPA for Procurement of Solar Powersamik_sarkar7041Nessuna valutazione finora

- Financing Renewable Energy in Sub Saharan AfricaDocumento56 pagineFinancing Renewable Energy in Sub Saharan AfricaUnited Nations Environment ProgrammeNessuna valutazione finora

- Private Ppa Term Sheet SOLAR PV Rooftop: Version 1.3 As of October 31st, 2017Documento4 paginePrivate Ppa Term Sheet SOLAR PV Rooftop: Version 1.3 As of October 31st, 2017Emeka S. OkekeNessuna valutazione finora

- Solar Opex and PpaDocumento2 pagineSolar Opex and PpaRakesh SharmaNessuna valutazione finora

- Overview of PPA FinancingDocumento9 pagineOverview of PPA FinancingMohit AgarwalNessuna valutazione finora

- Financial Feasibility Study of Solar PV ProjectDocumento15 pagineFinancial Feasibility Study of Solar PV ProjectVishal GargNessuna valutazione finora

- Project Report On Solar Power Plant PDFDocumento10 pagineProject Report On Solar Power Plant PDFDev Ananth50% (2)

- Revised DMS ProposalDocumento17 pagineRevised DMS ProposalApril UyanNessuna valutazione finora

- 100 MW Solar Power MOUDocumento3 pagine100 MW Solar Power MOURakesh SinghNessuna valutazione finora

- Solar Power Project: Project Appraisal Prepared By-Ankit Khaitan Divesh Praladhka Paul Antony Tony ThattilDocumento15 pagineSolar Power Project: Project Appraisal Prepared By-Ankit Khaitan Divesh Praladhka Paul Antony Tony ThattilPaul Antony0% (1)

- Off-Site Renewables Ppa Pitch Deck Template: Last Updated February 2020Documento28 pagineOff-Site Renewables Ppa Pitch Deck Template: Last Updated February 2020samwel kariukiNessuna valutazione finora

- ALCO For A BankDocumento66 pagineALCO For A BankHarsh Monga100% (1)

- CrowdSolar - Draft Business PlanDocumento27 pagineCrowdSolar - Draft Business PlanDaniel HerrNessuna valutazione finora

- Feasibility Study of Solar Power in India 2014Documento3 pagineFeasibility Study of Solar Power in India 2014iData InsightsNessuna valutazione finora

- Accounting For Intercompany Transactions - FinalDocumento15 pagineAccounting For Intercompany Transactions - FinalEunice WongNessuna valutazione finora

- A13 - Power Purchase Agreement PPADocumento11 pagineA13 - Power Purchase Agreement PPAadnmaNessuna valutazione finora

- 1 RFP 2 X 75 MW Gipcl Gsecl at CharankaDocumento297 pagine1 RFP 2 X 75 MW Gipcl Gsecl at Charankaanoop13100% (1)

- Company and Our Latest Completed Projects.: (Please Indicate Other Contact)Documento1 paginaCompany and Our Latest Completed Projects.: (Please Indicate Other Contact)Darryl Annika Raine Ybañez0% (1)

- Final Report - HybridDocumento67 pagineFinal Report - HybridohiozuaNessuna valutazione finora

- Assessment 2 - Project Charter - Draft 1Documento10 pagineAssessment 2 - Project Charter - Draft 1AdreaNessuna valutazione finora

- Technical Proposal - Solar Water PumpDocumento13 pagineTechnical Proposal - Solar Water PumpTikendra Sirohi100% (1)

- SSFA Market UpdateDocumento34 pagineSSFA Market UpdatelawrgeoNessuna valutazione finora

- EU Solar PV Business ModelsDocumento78 pagineEU Solar PV Business ModelsAdrian Fratean100% (1)

- GTR 2020 PDFDocumento80 pagineGTR 2020 PDFZeghba TalalNessuna valutazione finora

- Wind Energy Potential for Remote IslandDocumento9 pagineWind Energy Potential for Remote IslandAhmad TamimiNessuna valutazione finora

- 044 Malkajgiri PDFDocumento19 pagine044 Malkajgiri PDFsandeepvempatiNessuna valutazione finora

- Ey The Insolvency and Bankruptcy Code 2016 An Overview PDFDocumento6 pagineEy The Insolvency and Bankruptcy Code 2016 An Overview PDFRaghav DhootNessuna valutazione finora

- Economy of Permanence PDFDocumento169 pagineEconomy of Permanence PDFVenNessuna valutazione finora

- Women EmpowermentDocumento84 pagineWomen EmpowermentsandeepvempatiNessuna valutazione finora

- Round The Year Vegetable Production Inside Low Cost PolyhouseDocumento4 pagineRound The Year Vegetable Production Inside Low Cost PolyhousesandeepvempatiNessuna valutazione finora

- L&T's Turnkey Wind Farm SolutionsDocumento4 pagineL&T's Turnkey Wind Farm SolutionssandeepvempatiNessuna valutazione finora

- Cornell CEA Baby Spinach HandbookDocumento26 pagineCornell CEA Baby Spinach HandbookRadu Boieru100% (1)

- Hidrolechuga HidroponiaDocumento4 pagineHidrolechuga HidroponianeodymioNessuna valutazione finora

- WPD New Map Feb 2010Documento1 paginaWPD New Map Feb 2010krupasvNessuna valutazione finora

- Economy of Permanence PDFDocumento169 pagineEconomy of Permanence PDFVenNessuna valutazione finora

- ABI BrochureDocumento6 pagineABI BrochuresandeepvempatiNessuna valutazione finora

- New Horizons in Solar FinancingDocumento5 pagineNew Horizons in Solar FinancingsandeepvempatiNessuna valutazione finora

- DocumentDocumento4 pagineDocumentsandeepvempatiNessuna valutazione finora

- 1112 Ias 21 Consolidation of Foreign Subsidiary Practice RevisionDocumento24 pagine1112 Ias 21 Consolidation of Foreign Subsidiary Practice RevisionsandeepvempatiNessuna valutazione finora

- Bfsi CoursesDocumento9 pagineBfsi CoursessandeepvempatiNessuna valutazione finora

- Absolute Return Strategies - A Useful Tool For Today's Plan SponsorsDocumento5 pagineAbsolute Return Strategies - A Useful Tool For Today's Plan SponsorssandeepvempatiNessuna valutazione finora

- Glossary of Solar EnergyDocumento21 pagineGlossary of Solar Energysandeepvempati100% (1)

- CCR Arbitrage Volatilité 150: Volatility StrategyDocumento3 pagineCCR Arbitrage Volatilité 150: Volatility StrategysandeepvempatiNessuna valutazione finora

- Bfsi CoursesDocumento9 pagineBfsi CoursessandeepvempatiNessuna valutazione finora

- Bfsi CoursesDocumento9 pagineBfsi CoursessandeepvempatiNessuna valutazione finora

- Hedge Funds: Overview/Applications For Insurance CompaniesDocumento9 pagineHedge Funds: Overview/Applications For Insurance CompaniessandeepvempatiNessuna valutazione finora

- Hedge Funds: Overview/Applications For Insurance CompaniesDocumento9 pagineHedge Funds: Overview/Applications For Insurance CompaniessandeepvempatiNessuna valutazione finora

- CBOE VARBX BenchmarkDocumento7 pagineCBOE VARBX BenchmarkBob YundtNessuna valutazione finora

- Bond Arbitrage FundDocumento2 pagineBond Arbitrage FundsandeepvempatiNessuna valutazione finora

- CBOE VARBX BenchmarkDocumento7 pagineCBOE VARBX BenchmarkBob YundtNessuna valutazione finora

- Adi Alternative InvestmentsDocumento6 pagineAdi Alternative InvestmentssandeepvempatiNessuna valutazione finora

- Risk Management Lessons From Knock-In Knock-Out Otion DisasterDocumento25 pagineRisk Management Lessons From Knock-In Knock-Out Otion DisastersandeepvempatiNessuna valutazione finora

- Banking Techniques ProjectDocumento10 pagineBanking Techniques ProjectOana PredaNessuna valutazione finora

- TAX of PinalizeDocumento19 pagineTAX of PinalizeDennis IsananNessuna valutazione finora

- Leveraging The Credit Shelter Trust W/Sun Protector VULDocumento4 pagineLeveraging The Credit Shelter Trust W/Sun Protector VULBill BlackNessuna valutazione finora

- Covid-19 and Its Impact On Indian EconomyDocumento8 pagineCovid-19 and Its Impact On Indian EconomyDr Shubhi AgarwalNessuna valutazione finora

- SEPCODocumento84 pagineSEPCOAvijoy GuptaNessuna valutazione finora

- A Study On Customer Satisfaction of Reliance Life InsuranceDocumento57 pagineA Study On Customer Satisfaction of Reliance Life InsuranceRishabh PandeNessuna valutazione finora

- Business Finance - Loan AmortizationDocumento30 pagineBusiness Finance - Loan AmortizationJo HarahNessuna valutazione finora

- Bonds - March 7 2018Documento6 pagineBonds - March 7 2018Tiso Blackstar GroupNessuna valutazione finora

- Madhya Pradesh Upkar Adhiniyam, 1981 PDFDocumento22 pagineMadhya Pradesh Upkar Adhiniyam, 1981 PDFLatest Laws TeamNessuna valutazione finora

- Prospects and Challenges of Agent Banking in BangladeshDocumento45 pagineProspects and Challenges of Agent Banking in BangladeshRahu Rayhan75% (8)

- COM203 AmalgamationDocumento10 pagineCOM203 AmalgamationLogeshNessuna valutazione finora

- Chapter 6 Partnership Formation Operation and LiquidationDocumento6 pagineChapter 6 Partnership Formation Operation and Liquidationanwaradem225Nessuna valutazione finora

- Offset Agreement - Wikipedia, The Free EncyclopediaDocumento20 pagineOffset Agreement - Wikipedia, The Free EncyclopedianeerajscribdNessuna valutazione finora

- MAS-06 Operational BudgetingDocumento7 pagineMAS-06 Operational BudgetingKrizza MaeNessuna valutazione finora

- Tax Sheltered SchemesDocumento13 pagineTax Sheltered SchemesVivek DwivediNessuna valutazione finora

- Full FM Module Final Draft 222Documento157 pagineFull FM Module Final Draft 222bikilahussenNessuna valutazione finora

- Contract to Sell LandDocumento3 pagineContract to Sell LandEppie SeverinoNessuna valutazione finora

- Epicor ERP 10 Malaysia Country Specific Functionality Guide 10.0.700Documento30 pagineEpicor ERP 10 Malaysia Country Specific Functionality Guide 10.0.700nerz8830Nessuna valutazione finora

- Alluvial Capital Management Q2 2021 Letter To PartnersDocumento8 pagineAlluvial Capital Management Q2 2021 Letter To Partnersl chanNessuna valutazione finora

- FORM 10-K: United States Securities and Exchange CommissionDocumento55 pagineFORM 10-K: United States Securities and Exchange CommissionJerome PadillaNessuna valutazione finora

- Part 1-Tax planning: What is it? Types, benefits, evasion & moreDocumento16 paginePart 1-Tax planning: What is it? Types, benefits, evasion & moreshujaNessuna valutazione finora

- 861 EvidenceDocumento5 pagine861 Evidencelegalmatters100% (1)

- Invoice Artech010723 Artech Alliance Owners Association Artech RealtorsDocumento2 pagineInvoice Artech010723 Artech Alliance Owners Association Artech RealtorsPrasad SNessuna valutazione finora