Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Capital Budgeting Karimulla

Caricato da

Sakhamuri Ram'sCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Capital Budgeting Karimulla

Caricato da

Sakhamuri Ram'sCopyright:

Formati disponibili

MBA Programme

INTRODUCTION

INTRODUCTION TO FINANCIAL MANAGEMENT

Finance in the modern business world is regarded as life blood of a business

enterprise; finance function has become so important that it has give birth to financial

management as a separate subject. So this subject is acquiring universal applicability.

Financial management is that managerial activity, which is concerned with the planning

and controlling of the firm's financial resources, as a separate activity of recent origin it

was a branch of its own, and it draws heavily on economics for its theoretical

concepts.

Financial management is broadly concerned with the acquisition and use of

funds by a business firm. It deals with

. !ow large should the firm be and how fast should it grow"

#. $hat should be the composition of the firm's avels"

%. $hat should be the mi& of the firm's financing"

'. !ow should the firm analysis, plan and control its financial

affairs"

$hile the first three questions e&press ()ra Solomon's conception of financial

management as discussed in his clerical wor*. +,he theory of financial

management+ the forth one represents an addition that is very relevant in the light of

the responsibilities shouldered by finance managers in practice.

1 ECE

MBA Programme

-ey activities of financial management

,he three broad activities of financial management

Financial analysis, planning and control.

.anagement of the firm's asset structure.

.anagement of the firm's financial structure

Financial /nalysis, 0lanning /nd 1ontrol

Finance analysis, planning and control are concerned with

/ssessing the finance performance and conciliation of the

firm.

Forecasting and planning the finance future of the firm.

(stimating the financing needs of the firm.

Instituting appropriate systems and control to ensure that the

actions of the firm.

,he modern thin*ing in financial management accords a far greater importance to

management in decision ma*ing and formulation of policy. Financial management

occupies *ey position in top management and plays a dynamic role in solving comple&

management problems. ,hey are now responsible for snapping the fortunes of the

enterprise and are involved in allocation of capital.

2ature of financial management

Financial management is that managerial activity which is concerned with

the planning and controlling of the financial resources. ,hough it was a branch of

economics t i l l 345, as a separate activity or discipline it is of recent origin still, it

has no unique body of *nowledge of its own and draws heavily on economics for its

theoretical concept even today. Financial management is that managerial activity

which is concerned with the planning and controlling of the firms financial

resources.

2 ECE

MBA Programme

6usiness finance may further sub divided into various categories personal

finance, partner ship finance and corporate or company finance as separate activity

it is of recent origin. ,he finance in the modern world is the life of the business economy.

$e can't imagine a business without finance because it is actual point of all business

activities. Finance function has not unique body it is part of economics,

accounting mar*eting, product and quantitative methods.

.anagement 7f ,he Firm's /sset Structure Involves

.anagement of the firm's asset structure involves

. 8etermining the capital budget.

#. .anaging the liquid resources.

%. (stablishing the credit policy.

'. 1ontrolling the level of inventories

.anagement of the firm's financial structure

.anagement ofthe firm's financial structure involves

. (stablishing the debt9equity ratio or financial leverage.

#. 8etermining the divided policy.

%. 1hoosing the specific instruments of financing.

'. 2egotiating and developing relationship with various suppliers of

capital.

3 ECE

MBA Programme

Scope of financial management

,he approach the scope and functions of financial management is vided, for

purpose of e&position into two broad categories

. ,he traditional approach.

#. ,he modern approach.

,he traditional approach

,he traditional approach of the scope of the financial management efers to its

subject matter. ,he scope of the finance function was treated by the traditional approach in the

narrow sense of procurement of funds by corporate enterprise to

meet their financing needs.

. ,he institutional agreement in the form of financial institution

which comprise the organi)ation of the capital mar*et.

#. ,he financial instruments through which funds are raised from the

capital mar*ets and the related aspects of practices and the

procedural aspects of capital.

%. ,he legal and accounting relationships between a firm and its sources of

funds.

,he coverage of corporations, finance was therefore conceived to ascribe the

rapidly evolving comple& of capital mar*ets institutions istruments and practices.

,he first argument against the traditional approach was based on its nphasis on

issues relating to the procedural of iimds by corporate iterprises. ,he second

ground of criticism of the traditional treatment as that the focus was on financing of

corporate enterprises.

,he traditional treatment was found to have a lacuna to the e&tent that the focus

was on term financing. ,he limitation of the traditional approach was more

fundamental it did not consider the important dimension of allocation of capital

4 ECE

MBA Programme

.odern /pproach

,he modern approach views the term financial management in a broad sense

and provides a conceptual analytical frame wor* for financial decision ma*ing.

/ccording to it the finance function covers both acquisitions of fund as well as their

allocation, the main concern of financial management is the efficient and wise

allocation of funds to various as an defined in a broad sense, and it is viewed as

an integral part of overall management.

Financial management in the modern sense of the term can be bro*en down

into three major decisions as function of finance.

. ,he investment decision.

#. ,he financing decision.

%. ,he dividend policy decision.

Investment 8ecision

,he investment decision relates to the selection of quest in which mds will be

invested by a firm. ,he assets are of two types they are

. :ong .term assets and

#. Short term assets ;or< current assets.

,he assets selection decision of a firm is of two types. ,he first itegory of

assets is popularly *nown as +capita= budgeting+ /nd the second category of assets is

*nown as 'wor*ing capital management+

5 ECE

MBA Programme

Capital Budgeting

,he capital budgeting is the oldest and most crucial decision of relates to

allocation of capital and involves the decision to commit funds to long term assets

which would yield benefits in future. ,he measurement of the worth of the

investment proposals is a major element in the capital budgeting decision.

Further benefits are difficult to measure and can't be predicted with

certainty. So the second element of the capital budgeting decision is the

analysis of ris* and uncertaint y. ,he investment proposals should therefore be

evaluated in terms of both e&pected return and ris* associated with the return. ,he

total assets and their composition.

. ,he business rise completion f the firm.

#. 1oncept and measurement of cost of capital

$or*ing capital management

$or*ing capital management is concerned of current assets. ,he financial

manager has a duty to manage the current assets affects firm's profitability liquidity

and ris*. 7ne aspect of wor*ing capital management is the trade of

profitability and ris*. ,here is a conflict between profitability and liquidity. If

firm doesn' t have adequate wor*ing capital it may become liquidity.

If the current assets are too large, the profitability is adversely af fected.

,hus a proper trade off must be achieved between profitability id liquidity in order

to ensure that neither in sufficient unnecessary finds invested in current assets. ,he

financial managers should develop >und techniques of managing current assets. !e

should estimates firm's wor*ing capital needs and ma*e sure that funds would be made

available hen needed.

6 ECE

MBA Programme

Financial decision

,he second important function to be performed by the financial manager. !e must

decide when where and how to acquire funds to meet e firm's needs. ,he financial

manager is concerned with determining e financing mi& can capital structure for his

firm. 7nce the financial manager is able to determine the best combination of debts

and equity he must raise the appropriate amount through best available sources.

8ividend decision

8ividend decision is the third major financial decision the financial manager

must the firm should distribute all profits ;or< retain then ;or< distribute a portion and

retain the balance, the optimum dividend policy s one which ma&imi)es the mar*et

value of the firm's dividends policy, he manager must determined the optimum

dividend payout ratio. Finding the firm's appropriate role in the efforts they solve these

problems demanding on increasing the proportion of these items of financial

manager.

7bjectives of financial management

Financial management is concerned with procurement and use of funds it' s

main aim is to use business funds in such a way that the firm's value earning are

ma&imi)ed. ,here are various alternatives available for sine business funds. (ach

alternative course has valuated in detail. ,he decisions will have to ta*e in to

consideration the commercial strategy of the business. Financial management

provides a frame wor* for selecting a course of action and deciding available

commercial strategy. ,he .ain objective of a business is to ma&imi)e the owner's

economic welfare.

,he objectives can be achieved by

. 0rofit ma&imi)ation.

#. $ealth ma&imi)ation

7 ECE

MBA Programme

0rofit ma&imi)ation

,he main objectives of any business enterprise is ma&imi)ation of profits. (ach

company raises its finance by way of issue shares to public. Investors purchase these

shares in the hoe of getting ma&imum profits from the company as dividend. It is

possible only where the company's goal to earn +profit+ can beyond in two senses

. /s a owner9oriented concept

#. 7perational concept

/s owner9oriented concept it refers to the amount and share of national

income which is paid to the owners of business i.e., those who supply capita?. It

is an operational concept and signifies economic efficiency.

!igher profits are the parameters of its efficiency on all fronts that is

production, sales and management. / few replace the concept of profit

ma&imi)ation to safe9guard the economic interest of persons who directly or

indirectly connected with the company that is share holders, creditors and employees

the all such interested parties must get the ma&imum return for their contributions.

',hat this is possible only when the company earns higher profits or sufficient

profits to discharge its obligations to them. ,herefore, the goal of ma&imi)ation of

profits said to be the best criteria of the decision ma*ing.

,hus the retinal behind ma&imi)ation of profits is simple because profits are

the test of economic efficiency. It is a measuring rod by which the economic

performance of the company can be judged

. 0rofits lead to efficient allocation of resources

#. It ensures ma&imum social welfare

@oal of wealth ma&imi)ation

,his is also *nown as +value ma&imi)ation+ of +2et present worth ma&imi)ation+

wealth ma&imi)ation is universally accepted as an appropriate operational decision

8 ECE

MBA Programme

criteria for financial decision ma*ing. ,he value of an asset should be viewed in

terms of benefits it can produce. ,he worth of a course of action can similarly

be judged in terms of the value of the benefits it produces less the cost of underta*ing

it.

,he wealth ma&imi)ation objective is consistent with the objectives of

ma&imi)ation of owner's economic welfare that is their welfare the wealth of

owners of company is reflected by the mar*et value of company shares. ,hus

the fundamental principal of the company is to ma&imi)e the value of its share on

the basis of day to day fluctuations of the mar*et price.

In order to li*e the mar*et price of its shares over the short run at the e&pense

or me long run by temporarily diverting source If its funds some other accounts or by

the cutting some of its e&penditure to the cutting at the cost of future profits. ,his does

not reflect the worth of ie share because it will result in the fall of the share price in the

mar*et i the long run. It is therefore the goal of the financial management to ensure its

share holders that the value of their shares will be ma&imi)e in le long run. ,he

performance of the company can be evaluated by the value of its shares.

Importance of financial management

Financial management is of greater importance in the present corporate

would it is a science of money. $hich permits the authorities to go further. ,he

significance of financial management can be summari)ed as

. It assists in the assessment of financial needs of industry large or

small and indicates the internal and e&ternal resources for meeting

them.

#. It assesses the efficient and effectiveness of the financial initiation

in mobili)ing individual or corporate savings. It also prescribes

various means for such mobili)ing of saving into desirable

investment channels.

9 ECE

MBA Programme

%. It assists the management while investing funds in profitable

projects by analy)ing the viability of that project through capital

budgeting techniques.

1ultivation

Successful cultivation of cotton requires a long frost9free period, plenty of

sunshine, and a moderate rainfall, usually from A55 to i#55mm ;#' to '3

inches<. Soils usually need to be fairly heavy, although the level of nutrients does

not need to be e&ceptional. In general, these conditions are met within the seasonally

dry tropics and subtropics in the 2orthern and Southern hemispheres, but a large

proportion of the cotton grown today is cultivated in areas wilh less rainfall that obtain

the water from irrigation.

0roduction of the crop for a given year usually starts soon after harvesting the

preceding autumn. 0lanting time in spring in the 2orthern hemisphere varies from the

beginning of February to the beginning of Bune. ,he area of the Cnited States *nown

as the South 0lains is the largest contiguous cotton9growing region in the world. It is

heavily dependent on irrigation water drawn from the 7gallala /quifer.

1otton is a thirsty crop, and as water resources get tighter around the

world, economies that rely on it face difficulties and conflict, as well as potential

environmental problems. For e&le, cotton has led to desertification in areas of

C)be*istan, where it is a major e&port. In the days of the Soviet Cnion, the /ral

Sea was tapped for agricultural irrigation, largely of cotton, and now salivation is

widespread.

10 ECE

MBA Programme

1apital budgeting

16 is a long term investment made by the organi)ation in different projects and it

helps the firm in evaluating the projects under ta*en by different techniques./ccording to

Weston and Briga! "16 involves the entire process of planning e&penditures whose

returns are e&pected to e&tend beyond one year.

,he 16 decisions include replacement, e&pansion, diversification research and

development and miscellaneous proposals.

Feature 7f 1apital 6udgeting

,he important features, which distinguish capital budgeting decision in other day9

today decision, are 1apital budgeting decision involves the e&change of current funds for

the benefit to be achieved in future. ,he futures benefits are e&pected and are to be

reali)ed over a series of years. ,he funds are invested in non9fle&ible long9term funds.

,hey have a long term and significant effect on the profitability of the concern. ,hey

involve huge funds. ,hey are irreversible decisions. ,hey are strategic decision associated

with high degree of ris*.

Importance of 1apital 6udgeting

,he importance of capital budgeting can be understood from the fact that an

unsound investment decision may prove to be fatal to the very e&istence of the

organi)ation.

,he importance of capital budgeting arises mainly due to the followingD

#. Large in$est!ent%

1apital budgeting decision, generally involves large investment of funds. 6ut the

funds available with the firm are scarce and the demand for funds for e&ceeds resources.

!ence, it is very important for a firm to plan and control its capital e&penditure.

#. Long ter! &o!!it!ent o' 'unds%

1apital e&penditure involves not only large amount of funds but also funds for

long9term or a permanent basis. ,he long9term commitment of funds increases the

financial ris* involved in the investment decision.

11 ECE

MBA Programme

(. Irre$ersi)le nature%

,he capital e&penditure decisions are of irreversible nature. 7nce, the decision for

acquiring a permanent asset is ta*en, it becomes very difficult to impose of these assets

without incurring heavy losses.

*. Long ter! e''e&t on pro'ita)ilit+%

1apital budgeting decision has a long term and significant effect on the profitability of a

concern. 2ot only the present earnings of the firm are affected by the investment in capital assets

but also the future growth and profitability of the firm depends up to the investment decision

ta*en today. 1apital budgeting decision has utmost has importance to avoid over or under

investment in fi&ed assets.

,. Di''eren&e o' in$est!ent de&ision%

,he long9term investment decision are difficult to be ta*en because uncertainties

of future and higher degree of ris*.

-. Notional I!portan&e%

Investment decision though ta*en by individual concern is of national importance

because it determines employment, economic activities and economic growth.

-inds 7f 1apital 6udgeting

(very capital budgeting decision is a specific decision in the situation, for a given

firm and with given parameters and therefore, almost infinite number of types or forms of

capital budgeting decision may occur. Some projects affect other projects of the firm is

considering and analy)ing. ,he project may also be classified as revenue generating or

cost reducing projects can be categori)ed as follows.

#. Fro! te point o' $ie. o' 'ir!/s e0isten&eD

,he capital budgeting decision may be ta*en by a newly incorporated firm or by an

already e&isting firm.

Ne. Fir!D / newly incorporated firm may be required to ta*e different decision such

as selection of a plant to be installed, capacity utili)ation at initial stages, to set up or not

simultaneously the ancillary unity etc.

12 ECE

MBA Programme

E0isting Fir!% / firm which already e&ists may be required to ta*e various decisions

from time to time meet the challenge of competition or changing environment. ,hese

decisions may beD

Repla&e!ents and Moderni1ation De&isionD

,his is a common type of a capital budgeting decision. /ll types of plant and

machineries eventually require replacement. If the e&isting plant is to be replaced because

of the economic life of the plant is over, then the decisions may be *nown as a

replacement decision. !owever, if an e&isting plant is to be replaced because it has

become technologically outdated ;though the economic life may not be over< the decision

any be *nown as a modernization decision. In case of a replacement decision, the

objective is to restore the same or higher capacity, whereas in case of moderni)ation

decision, the objectives are to increase the efficiency andEor cost reduction. In general, the

replacement decision and the moderni)ation decision are also *nown as cost reduction

decisions.

E0pansionD

Sometimes, the firm may be interested in increasing the Installed production capacity so

as to increase the mar*et share. In such a case, the finance manager is required to evaluate

the e&pansion program in terms of marginal costs and marginal benefits.

2i3 Di$ersi'i&ationD

Sometimes, the firm may be interested to diversify into new product lines, new mar*ets;

production of spares parts etc. in such a case, the finance manager is required to evaluate

not only the marginal cost and benefits, but also the effect of diversification on the

e&isting mar*et share and profitability. 6oth the e&pansion and diversification decisions

may be also be *nown as revenue increasing decisions.

,he capital budgeting may also be classified from the point of view of the decision

situation as followsD

Independent pro4e&t De&ision%

,his is a fundamental decision in 1apital 6udgeting. It also called as accept Ereject

criterion. If the project is accepted, the firm invests in it. In general all these proposals,

which yield a rate of return greater than a certain required rate of return on cost of

13 ECE

MBA Programme

capital, are accepted and the rest are rejected. 6y applying this criterion all independent

projects with one in such a way that the acceptance of one precludes the possibility of

acceptance of another. Cnder the accept9reject decision all independent projects that

satisfy the minimum investment criterion should be implemented.

2ii3 Mutuall+ E0&lusi$e 5ro4e&ts De&ision%

.utually (&clusive project are those, which compete with other projects in such a

way that the acceptance of one will e&clude the acceptance of the other projects. ,he

alternatively are mutually e&clusive and only one may be chosen. Suppose a company is

intending to buy a new machine. ,here are three competing brands, each with a different

initial investment adopting costs. ,he three machines represent mutually e&clusive

alternatives as only one of these can be selected. It may be noted here that the mutually

e&clusive projects decisions are not independent of the accept9reject decisions.

2iii3 Capital Rationing De&ision%

In a situation where the firm has unlimited funds all independent investment

proposals yielding return greater than some pre9determined levels are accepted. !owever

this situation does not prevail in most of the business firms in actual practice. ,hey have a

fi&ed capital budget.

/ large number of investment proposals compete for these limited funds, the firm

must therefore ration them. ,he firm allocates funds to projects in a manner that it

ma&imi)es long run returns; this rationing refers to a situation in which a firm has more

acceptance investment than it can finance. It is concerned with the selection of a group of

investment proposals acceptable.

Cnder the accept9reject decision capital rationing employees ran*ing of the

acceptable investment projects. ,he project can be ran*ed on the basis of a predetermined

criterion such as the rate of return. ,he project is ran*ed in the descending order of the

rate of return.

14 ECE

MBA Programme

0roblems /nd 8ifficulties In 1apital 6udgeting

,he problems in 1apital budgeting decision may be as followsD

Future un&ertaint+%

1apital budgeting decision involves long9term commitments. !owever there is lot

of uncertainty in the long term. Cncertainty may be with reference to cost of the project,

future e&pected returns, future competition, legal provisions, political situation etc.

Ti!e Ele!ent%

,he implication of a 1apital 6udgeting decision are scattered over a long period.

,he cost and benefit of a decision may occur at different points of time. ,he cost of

project is incurred immediately. !owever the investment is recovered over a number of

years. ,he future benefits have to be adjusted to ma*e them comparable with the cost.

:onger the time period involved, greater would be the uncertainty.

Di''i&ult+ in 6uanti'i&ation o' i!pa&t%

,he finance manager may face difficulties in measuring the cost and benefits of

projects in quantitative terms. For e&le, the new products proposed to be launched by

a firm may result in increase or decrease in sales of other products already being sold by

the same firm. It is very difficult to ascertain the e&tent of impact as the sales of other

products may also be influenced by factor other than the launch of the new products.

Assu!ption in &apital )udgeting%

,he capital budgeting decision process is a multi9faceted and analytical process. /

number of assumptions are required to be made. ,hese assumptions constitute a general

set of condition within which the financial aspects of different proposals are to be

evaluated. Some of these assumptions areD

. Certaint+ Wit Respe&t To Cost and Bene'its%

It is very difficult to estimate the cost and benefits of a proposal beyond #9% years

in future. !owever, for a capital budgeting decision, it is assumed that the estimate of cost

and benefits are reasonably accurate and certain.

15 ECE

MBA Programme

#. 5ro'it Moti$eD

/nother assumption is that the capital budgeting decisions are ta*en with a

primary motive of increasing the profit of the firm. 2o other motive or goal influences the

decision of the finance manager.

%. No Capital Rationing%

,he capital 6udgeting decisions in the present chapter assume that there is no

scarcity of capital. It assumes that a proposal will be accepted or rejected in the strength

of its merits alone. ,he proposal will not be considered in combination with other

proposals to the ma&imum utili)ation of available funds.

1apital 6udgeting 0rocess

1apital budgeting is comple& process as it involves decision relating to the

Investment of current funds for the benefit for the benefit to be achieved in Future and the

future are always uncertain. !owever, the following procedure may be adopted in the

process of 1apital 6udgeting.

Identi'i&ation o' in$est!ent proposals%

,he capital budgeting process begins with the identification of investment

0roposals. ,he proposal about potential investment opportunities may originate either

from top management or from any officer of the organi)ation. ,he departmental head

analysis various proposals in the light of the corporate strategies and submits the suitable

proposals to the capital e&penditure planning.

7&reening proposals%

,he e&penditure planning committee screens the various proposals received from

different departments. ,he committee reviews these proposals from various angles to

ensure that these are in accordance with the corporate strategies or selection criterion of

the firm and also do not lead departmental imbalances.

16 ECE

MBA Programme

E$aluation o' 8arious proposals%

,he ne&t step in the capital budgeting process is to various proposals. ,he method,

which may be used for this purpose such as, paybac* period method, rate of return

method, 2.0.F and I.G.G etc.

Fi0ing priorities%

/fter evaluating various proposals, the unprofitable uneconomical proposal may

be rejected and it may not be possible for the firm to invest immediately in all the

acceptable proposals due to limitation of funds. ,herefore, it essential to ran* the

projectEproposals after considering urgency, ris* and profitability involved in there.

17 ECE

MBA Programme

Final approval and preparation of capital e&penditure budget

0roposals meeting the evaluation and other criteria are approved to be included in

the capital e&penditure budget. ,he e&penditure budget lays down the amount of

estimated e&penditure to be incurred on fi&ed assets during the budget period.

I!ple!enting proposals

0reparation of a capital e&penditure budget and incorporation of a particular

0roposal in the budget doesnHt itself authori)e to go ahead with the implementation of the

project. / request for the authority to spend the amount should be made to the capital

(&penditure committee, which reviews the profitability of the project in the changed

circumstances. Gesponsibilities should be assigned while implementing the project in

order to avoid unnecessary delays and cost overruns. 2etwor* technique li*es 0(G, and

10. can be applied to control and monitor the implementation of the projects.

5er'or!an&e Re$ie.

,he last stage in the process of capital budgeting is the evaluation of the

performance of the project. ,he evaluation is made by comparing actual and budget

e&penditures and also by comparing actual anticipated returns. ,he unfavorable variances,

if any should be loo*ed in to and the causes of the same be identified so that corrective

action may be ta*en in future.

18 ECE

MBA Programme

.ethods or techniques of capital budgeting

,here are many methods for the evaluating the profitability of investment

proposals the various commodity used methods are

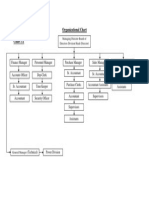

,echniques 7f 1apital 6udgeting

Traditional Metods Ti!e Ad4usted Metods

. 0ay 6ac* 0eriod . 2et 0resent Falue method

#. /ccounting Gate of Geturn #. Internal Gate of Geturn method

%. 0rofitability Inde& method

Traditional !etods%

0aybac* period method ;0.6.0<

/ccounting Gate of Geturn .ethod ;/.G.G<

Ti!e ad4usted or dis&ounted te&ni6ue%

;I< 2et 0resent Falue method ;2.0.F<

;II< Internal Gate of Geturn method ;I.G.G<

;III< 0rofitability Inde& method ;0.I<

0ay 6ac* 0eriod .ethod

,he pay bac* come times called as payout or pay off period method represents the

period in which total investment in permanent assets pay bac* itself. ,his method is based

on the principle that every capital e&penditure pays itself bac* within a certain period out

of the additional earnings generated from the capital assets.

8ecision rule

/ project is accepted if its paybac* period is less than period specific decision

rule. / project is accepted if its paybac* period is less than the period specified by the

management and vice9versa.

19 ECE

MBA Programme

Initial 1ash 7utflow

0ay 6ac* 0eriod I 9999999999999999999999999999

/nnual 1ash Inflows

/dvantagesD

Simple to understand and easy to calculate.

It saves in cost; it requires lesser time and labour as compared to other methods

of capital budgeting.

In this method, as a project with a shorter paybac* period is preferred to the one

having a longer pay bac* period, it reduces the loss through obsolescence.

8ue to its short9 time approach, this method is particularly suited to a firm which

has shortage of cash or whose liquidity position is not good.

8isadvantagesD

It does not ta*e into account the cash inflows earned after the paybac* period and

hence the true profitability of the project cannot be correctly assessed.

,his method ignores the time value of the money and does not consider the

magnitude and timing of cash inflows.

It does not ta*e into account the cost of capital, which is very important in ma*ing

sound investment decision.

It is difficult to determine the minimum acceptable paybac* period, which is

subjective decision.

It treats each assets individual in isolation with other assets, which is not feasible

in real practice.

A&&ounting Rate O' Return Metod%

,his method ta*es into account the earnings from the investment over the whole

life. It is *nown as average rate of return method because under this method the concept

of accounting profit ;20 after ta& and depreciation< is used rather than cash inflows.

20 ECE

MBA Programme

/ccording to this method, various projects are ran*ed in order of the rate of earnings or

rate of return.

8ecision rule%

,he project with higher rate of return is selected and vice9versa.

,he return on investment method can be in several ways, as

Cnder this method average profit after ta& and depreciation is calculated and then it is

divided by the total capital out lay.

/verage /nnual profits ;after dep.J ta&<

/verage rate of return I 99999999999999999999999999999999999999999 9999 & 55

/verage Investment

/dvantagesD

It is very simple to understand and easy to calculate.

It uses the entire earnings of a project in calculating rate of return and hence gives

a true view of profitability.

/s this method is based upon accounting profit, it can be readily calculated from

the financial data.

8isadvantagesD

It ignores the time value of money.

It does not ta*e in to account the cash flows, which are more important than the

accounting profits.

It ignores the period in which the profit are earned as a #5K rate of return in # L

years is considered to be better than 3Krate of return in # years.

,his method cannot be applied to a situation where investment in project is to be

made in parts.

21 ECE

MBA Programme

2et 0resent Falue .ethodD

,he 20F method is a modern method of evaluating investment proposals. ,his

method ta*es in to consideration the time value of money and attempts to calculate the

return on investments by introducing time element. ,he net present values of all inflows

and outflows of cash during the entire life of the project is determined separately for each

year by discounting these flows with firms cost of capital or predetermined rate. ,he steps

in this method are

< 8etermine an appropriate rate of interest *nown as cut off rate.

#< 1ompute the present value of cash inflows at the above Mdetermined discount rate.

%< 1ompute the present value of cash inflows at the predetermined rate.

'< 1alculate the 20F of the project by subtracting the present value of cash

outflows.

De&ision rule

/ccept the project if the 20F of the projects 5 or positive that is present value of cash

inflows should be equal to or greater than the present value of cash outflows.

Ad$antages%

It recogni)es the time value of money and is suitable to apply in a situation with

uniform cash outflows and uneven cash inflows.

It ta*es in to account the earnings over the entire life of the project and gives the

true view if the profitability of the investment

,a*es in to consideration the objective of ma&imum profitability.

Disad$antages%

.ore difficult to understand and operate.

It may not give good results while comparing projects with unequal investment of

funds.

It is not easy to determine an appropriate discount rate.

22 ECE

MBA Programme

Internal Rate O' Return Metod

,he internal rate of return method is also a modern technique of capital budgeting

that ta*es in to account the time value of money. It is also *nown as time9 adjusted rate of

return or trial and error yield method. Cnder this method the cash flows of a project are

discounted at a suitable rate by hit and trial method, which equates the net present value

so calculated to the amount of the investment. ,he internal rate of return can be defined as

Nthat rate of discount at which the present value of cash inflows is equal to the present

value of cash outflow.

De&ision Rule%

/ccept the proposal having the higher rate of return and vice versa. If

IGG>-, accept project. -Icost of capital. If IGGO-, reject project.

Deter!ination O' Irr

a< $hen annual cash flows are equal over the life of the asset.

Initial 7utlay

F/1,7G I 99999999999999999999999999999999 & 55

/nnual 1ash inflow

b< $hen the annual cash flows are unequal over the life of the assetD

0F of cash inflows at lower rate M 0F of cash out flows

IGG I :GP 999999999999999999999999999999999999999999999999999999999 ;hr9lr<

0F of cash inflows at lower rate 9 0F of cash inflows at higher rate

,he steps are involved here areD

. 0repare the cash flows table using assumed discount rate to discount the net cash

flows to the present value.

#. Find out the 20F, J if the 20F is positive, apply higher rate of discount.

23 ECE

MBA Programme

%. if the higher discount rate still gives a positive 20F increases the discount rate

further. Cntil the 20F becomes )ero.

'. if the 20F is negative, at a higher rate, 20F lies between these two rates.

Ad$antages%

it ta*es into account, the time value of money and can be applied in situation with

even and even cash flows.

It considers the profitability of the projects for its entire economic life.

,he determination of cost of capital is not a pre9requisite for the use of this

method.

It provide for uniform ran*ing of proposals due to the percentage rate of return.

,his method is also compatible with the objective of ma&imum profitability.

Disad$antages%

It is difficult to understand and operate.

,he results of 20F and IGG methods my differ when the projects under

evaluation differ in their si)e, life and timings of cash flows.

,his method is based on the assumption that the earnings are reinvested at the IGG

for the remaining life of the project, which is not a justified assumption.

5ro'ita)ilit+ inde0!etod or )ene'it &ost ratio !etod%

It is also a time9adjusted method of evaluating the investment proposals. 0I also

called benefit cost ratio or desirability factor is the relationship between present value of

cash inflows and the present values of cash outflows. ,hus

0F of cash inflows

0rofitability inde& I 99999999999999999999999999999

0F of cash outflows

24 ECE

MBA Programme

20F

2et profitability inde& I 999999999999999999999999999

Initial 7utlay

/dvantagesD

Cnli*e net present value, the profitability inde& method is used to ran* the

projects even when the costs of the projects differ significantly.

It recogni)es the time value of money and is suitable to applied in a situation with

uniform cash outflow and uneven cash inflows.

It ta*es into account the earnings over the entire life of the project and gives the

true view of the profitability of the investment. ,a*es into consideration the

objectives of ma&imum profitability.

8isadvantagesD

.ore difficult to understand and operate.

It may not give good results while comparing projects with unequal investment

funds.

It is not easy to determine and appropriate discount rate.

25 ECE

MBA Programme

INDU7TR9 5ROFILE

@enetically modified cotton

@enetically modified ;@.< cotton was developed to reduce the heavy

reliance on pesticides. @enetically modified cotton is widely used throughout the world

with claims of requiring up to 35K less pesticide than ordinary cotton as typically

grown commercially. !owever, researchers have recently published the first

documented case of in9field pest resistance to @. cotton. ,he International

Service for the /cquisition of /gri96iotech /pplications ;IS///< said that,

worldwide, @. cotton was planted on an area of AQ,555 *m

#

in #55#. ,his is #5K of

the worldwide total area planted in cotton. ,he C.S. cotton crop was Q%K @. in

#55%.

,he initial introduction of @. cotton proved to be a commercial disaster in

/ustralia 9 the yields were far lower than predicted, and the cotton plants were

cross9pollinated with other varieties of cotton. !owever, the introduction of a

second variety of @. cotton led to RK of /ustralian cotton being @. in #55%.

35K of the crop was genetically modified in #55', when the original @. variety

was banned.

@. cotton acreage in India continues to grow at a rapid rate increasing from

R5,555 hectares in #55# to %.3 million hectares in #55A. ,he total cotton area in

India is about 4.5 million hectares ;the largest in the world or, about #RK of world

cotton area< so @. cotton is now grown on '#K of the cotton area.

,his ma*es India the country with the largest area of @. cotton in the

world, surpassing 1hina ;%.R million hectares in #55A<. ,he major reasons for this

increase is a combination of increased farm income ;S##REha< and a reduction in

pesticide use to control the 1otton 6oll worm.

26 ECE

MBA Programme

!istory

1otton plants as imagined and drawn by Bohn .andeville in the fourteenth

century 1otton cultivation in the 7ld $orld began from India, where cotton has been grown

for more than A,555 years, since the pre9!arappan period. 1otton from the !arappan

civili)ation was e&ported to .esopotamia during the %rd millennium 61, and cotton was

soon *nown to the (gyptians as well as becoming a pri)ed trading item from 2ubia and

.e roe. ,he famous @ree* historian !erodotus also wrote about Indian cottonD +,here arc

trees which grow wild there, the fruit of which is a wool e&ceeding in beauty and goodness

that of sheep. ,he Indians ma*e their clothes of this tree wool.+ ;6oo* III. 5A<

/ccording to the 1olumbia (ncyclopedia, Si&th (ditionD

1otton has been spun, woven, and dyed since prehistoric times. It clothed the people

of ancient India, (gypt, and 1hina. !undreds of years before the 1hristian era cotton

te&tiles were woven in India with matchless s*ill, and their use spread to the .editerranean

countries. In the st cent. /rab traders brought fine muslin and calico to Italy and Spain.

,he .oors introduced the cultivation of cotton into Spain in the 4th cent.

Fustians and dimities were woven, there and in the 'th cent, in Fenice and

.ilan, at first with a linen warp. :ittle cotton cloth was imported to (ngland before

the Rth cent., although small amounts were obtained chiefly for candlewic*s.

6y theQth cent. ,he (ast India 1ompany was bringing rare fabrics from India.

2ative /mericans s*illfully spun and wove cotton into fine garments and dyed

27 ECE

MBA Programme

tapestries. 1otton fabrics found in 0eruvian tombs are said to belong to a pre9Inca

culture. In color and te&ture the ancient 0eruvian and .e&ican te&tiles resemble

those found in (gyptian tombs.

In 0eru, cotton was the bac*bone of the development of coastal cultures such

as the .oche and 2a)ca. 1otton was grown upriver, made into nets and traded with

fishing villages along the coast for large supplies of fish. ,he Spanish who came

to .e&ico in the early R55s found the people growing cotton and wearing

clothing made of it.

8uring the late medieval period, cotton became *nown as an imported fiber in

northern (urope, without any *nowledge of how it was derived, other than that it

was a plant noting its similarities to wool, people in the region could only imagine

that cotton must be produced by plant9borne sheep. Bhon .andeville, writing in

%R5, stated as fact the now9preposterous beliefD +,here grew there TIndia? a

wonderful tree which bore tiny lambs on the ends of its branches. ,hese branches

were so pliable that they bent down to allow the lambs to feed when they are

hungrie.+ ;See Fegetable :amb of ,artarE.U ,his aspect is retained in the name for

cotton in many (uropean languages, such as @erman Baumwolle, which translates as

+tree wool+ (Baum means +tree+; Wolle means +wool+<. 6y the end of the Ath

century, cotton was cultivated throughout the warmer regions in /sia and the

/mericas.

28 ECE

MBA Programme

,he Fegetable :amb of ,artarv

India's cotton9processing sector gradually declined during 6ritish

e&pansion in India and the establishment of colonial rule during the late 3t h and early

4th centuries. ,his was largely due to the (ast India 1ompany's de9industriali)ation

of India, which forced the closing of cotton processing and manufacturing wor*shops

in India, to ensure that Indian mar*ets supplied only raw materials and were obliged

to. purchase manufactured te&tiles from 6ritain.

,he advent of the Industrial Gevolution in 6ritain provided a great boost to

cotton manufacture, as te&tiles emerged as 6ritain's leading e&port. In Q%3 :ewis

0aul and Bohn $yatt, of 6irmingham (ngland, patented the Goller Spinning

machine, and the flyer9and9bobbin system for drawing cotton to a more even

thic*ness using two sets of rollers that travelled at different speeds. :ater, the

invention of the spinning jenny in QA' and Gichard /r*wright's spinning frame ;based

on the Goller Spinning .achine< in QA4 enabled 6ritish weavers to produce cotton

yam and cloth at much higher rates. From the late eighteenth century onwards, the

6ritish city of .anchester acquired the nic*name "Cottonopolis" due to the

cotton industry's omnipresence within the city, and .anchester's role as the heart of

the global cotton trade. 0roduction capacity was further improved by the invention of

the cotton gin by (li $hitney in Q4%. Improving technology and increasing control

of world mar*ets allowed 6ritish traders to develop a commercial chain in which raw

cotton fibers were ;at first< purchased from colonial plantations, processed into cotton

cloth in the mills of :ancashire, and then re9e&ported on 6ritish ships to captive

colonial mar*ets in $est /frica, India, and 1hina ;via Shanghai and !ong -ong<.

6y the 3'5s, India was no longer capable of supplying the vast quantities of

cotton fibers needed by mechanised 6ritish, factories, while shipping bul*y, low9price

cotton from India to 6ritain was lime9consuming and e&pensive. ,his, coupled with

the emergence of /merican cotton as a superior type ;due to the longer, stronger

fibers of the two domesticated native /merican species, Gossypium hirsutum and

Gossypium harbadense). encouraged 6ritish traders to purchase cotton from

29 ECE

MBA Programme

plantations in the Cnited States and the 1aribbean. ,his was also much cheaper as it

was produced by unpaid slaves. 6y the mid 4th century, +-ing 1otton+ had become

the bac*bone of the southern /merican economy. In the Cnited States, cultivating

and harvesting cotton became the leading occupation of slaves.

8uring the /merican 1ivil $ar, /merican cotton e&ports slumped due to a

Cnion bloc*ade on Southern ports, also because of a strategic decision by the

1onfederate @overnment to cut e&ports, hoping to force 6ritain to recogni)e the

1onfederacy or enter the war, prompting the main purchasers of cotton, 6ritain and

France, to turn to (gyptian cotton. 6ritish and French traders invested heavily in

cotton plantations and the (gyptian government of Ficeroy Isma'tl too* out

substantial loans from (uropean ban*ers and stoc* e&changes. /fter the /merican

1ivil $ar ended in 3AR, 6ritish and French traders abandoned (gyptian cotton

and returned to cheap /merican e&ports, sending (gypt into a deficit spiral that led to

the country declaring ban*ruptcy in 3QA, a *ey factor behind (gypt's anne&ation by

the 6ritish (mpire in 33#,

0ic*ing cotton in 7*lahoma, CS/, in the 345s

8uring this time cotton cultivation in the 6ritish (mpire, especially India,

greatly increased to replace the lost production of the /merican South. ,hrough tariffs

and other restrictions the 6ritish government discouraged the production of cotton

cloth in India; rather the raw fiber was sent to (ngland for processing. ,he Indian

patriot @andhi described the processD

. (nglish people buy Indian cotton in the field, pic*ed by Indian labor at

seven cents a day, through an optional monopoly.

#. ,hese cotton are shipped on 6ritish bottoms, a three wee*s journey across

the Indian 7cean, down the Ged Sea, across the .editerranean, through

@ibraltar, across the 6ay of 6iscay and the /tlantic 7cean to :ondon. 7ne

hundred per cent profit on this freight is regarded as small.

%. ,he cotton are turned into cloth in :ancashire. Vou pay shilling wages

instead of Indian pennies to your wor*ers. ,he (nglish wor*er not only has

30 ECE

MBA Programme

the advantage of better wages, but the steel companies of (ngland get the

profit of building the factories and machines. $ages; profits; ali these are

spent in (ngland.

'. ,he finished product is sent bac* ,o India at (uropean shipping rales,

onceagain on 6ritish ships, ,he captains, officers, sailors of these ships,

whose wages must be paid, are (nglish. ,he only Indians who profit are a

few lascars who do the dirty wor* on the boats for a few cents a day.

R. ,he cloth is finally sold bac* to the *ings and landlords of India who got

the money to buy this e&pensive cloth out of the poor peasants of India who

wor*ed at seven cents a day. ;Fisher 4%# pp R'9BRA<.

0risoners farming cotton under trusty system 9 4

In the Cnited States , Southern cotton provided capital for the continuing development

of the 2orth. ,he cotton produced by enslaved /frican /mericans, not only helped the

South, but also enriched northern merchants. .uch of the southern cotton were

transhipped through the northern ports. 0rofits from the cotton shipping provided

some of the funds for the Francis 1abot :owell's :owe ll .ills . In another

e&le, a merchant named /nson 0helps invested his profits from cotton shipping

into iron mines in 0ennsylvania and metal wor*s in 1onnecticut. .uch of the

development of northern industry was made possible by the cotton provided by the

enslaved /frican /mericans of the South. It also fostered the mar*et revolution.

1otton remained a *ey crop in the southern economy after emancipation and

the end of the civil war in 3A R, /cross the South, sharecropping evolved, in which

free blac* farmers wor*ed on white9owned cotton plantations in return for a share of

31 ECE

MBA Programme

the profits. 1otton plantations required vast labor forces to hand9pic* cotton fibers,

and it was not until the 4R5s that reliable harvesting machinery was introduced

into the South ;prior to this, cotton9harvesting machinery had been too clumsy to

pic* cotton without shredding the fibers<. 8uring the early twentieth century .

(mployment in the cotton industry fell as machines began to, replace laborers,

and as the South's rural labor force dwindled during the First and Second $orld

$ars. ,oday, cotton remains a major e&port of the southern Cnited States, and a

majority of the world's annual cotton crop is of the long9staple /merican variety.

0ests and weeds

Main article: List o cotton diseases

,he cotton industry relies heavily on chemicals such as fertili)ers and

insecticides, although a very small number of farmers are moving toward an organic

model of production and organic cotton products are now available for purchase at

limited locations. ,hese are popular for baby clothes and diapers. Cnder most

definitions, organic products do not use genetic engineering.

!oeing a cotton field to remove weeds, @reene 1ounty, @eorgia, CS/, 4'

!istorically, in 2orth /merica, one of the most economically destructive pests

in cotton production has been the boll weevil. 8ue to the CS 8epartment of

/griculture's highly successful 6oll $eevil (radication 0rogram ;6$(0<, this pest

has been eliminated from cotton in most of the Cnited States. ,his program, along

with the introduction of genetically engineered +6t cottonW.

32 ECE

MBA Programme

.echani)ed harvesting

7ffloading freshly harvested cotton into a module builder in ,e&as; previously

built modules can be seen in the bac*ground

.ost cotton in the Cnited States, (urope, and /ustralia is harvested

mechanically, either by a cotton pic*er, a machine that removes the cotton from the

boll without damaging the cotton plant, or by a cotton stripper, which strips the

entire boll off the plant. 1otton strippers are used in regions where it is too windy to

grow pic*er varieties of cotton, and usually after application of a chemical

defoliant or the natural defoliation that occurs after a free)e. 1otton is a perennial

crop in the tropics and without defoliation or free)ing, the plant will continue to grow.

1otton continues to be pic*ed by hand in poor countries such as C)be*istan.

1ompetition from synthetic fibers

,he era of manufactured fibers began with the development of rayon in

France in the 345s. Gayon is derived from a natural cellulose and cannot be

considered synthetic, but is requires e&tensive processing in a manufacturing

process and led the less e&pensive replacement of more naturally derived

materials. Successions of new synthetic fibers were introduced by the

chemicals industry in the following decades. /cetate in fiber form was

developed in 4#'. 2ylon the first fiber synthesi)ed entirely from

petrochemicals was introduced as a sewing thread by 8u0ont in 4%A, followed by

8u0ontHs acrylic in 4''. Some garments were created from fabrics based on these

fibers, such as women's hosiery from nylon, but it was not until the introduction of

33 ECE

MBA Programme

polyester into the fiber mar*etplace in the early 4R5s that the mar*et for cotton

came under threat. ,he rapid upta*e of polyester garments in the 4A5s caused

economic hardship in cotton e&porting economies, especially in 1entral /merican

countries such as 2icaragua where cotton production had boomed tenfold between

4R5 and 4AR with the advent of cheap chemical pesticides. 1otton production

recovered in the 4Q5s, but crashed to pre94A5 levels in the early 445s.

6eginning as a self9help program in the mid94A5s, the 1otton Gesearch J

0romotion 0rogram was organi)ed by C.S. cotton producers in response to cotton's

steady decline in mar*et share. /t that time, producers voted to set up a per9bale

assessment system to fund the program, with built9in safeguards to protect their

investments. $ith the passage of the 1otton Gesearch ! 0romotion /ct of 4AA, the

program joined forces and began battling synthetic competitors and re9establishing

mar*ets for cotton. ,oday, the success of this program has made cotton the best9

selling fiber in the C.S. and one of the best9selling fibers in the world.

/dministered by the 1otton 6oard and conducted by 1otton Incorporated, the

1otton Gesearch J 0romotion 0rogram wor*s to greatly increase the demand

for and profitability of cotton through various research and promotion activities. It is

funded by C.S. cotton producers and importers

Cses

1otton is used to ma*e a number of te&tile products. ,hese include

terry cloth, used to ma*e highly absorbent bath towels and robes; denim, used to ma*e

blue jeans; chambray. 0opularly used in the manufacture of blue wor* shirts ;from

which we get the term +;blue collar<9 and corduroy, seersuc*er, and cotton twill.

Soc*s, underwear, and most ,9shirts are made from cotton. 6ed sheets often are made

from cotton. 1otton also is used to ma*e yarn used in crochet and *nitting. Fabric also

can be made from recycled or recovered cotton that otherwise would be thrown away

34 ECE

MBA Programme

during the spinning, weaving, or cutting process. $hile many fabrics are made

completely of cotton, some materials blend cotton with other fibers, including

rayon and synthetic fibers such as ' polyester.

In addition to the te&tile industry, cotton is used in fishnets, coffee filters,

tents, gunpowder ;see 2itrocellulose<, cotton paper, and in boo*binding. ,he first

1hinese paper was made of cotton fiber. Fire hoses were once made of cotton.

,he cottonseed which remains after the cotton is ginned is used or produce

cottonseed oi l ?, which, after refining, can be consumed by humans l i *e any other

vegetable oi l . ,he cottonseed meal9 that i.s "it generally is fed to livestoc*. 8uring

slavery, cotton root bar* was used as an abortifacient. that is, a fol* remedy to

provo*e abortion.

1otton linters are fine, sil*y fibers which adhere to the seeds of the cotton

plant after ginning. ,hese curly fibers typically are less than E3 in, %mm, long. ,he

term also may apply to the longer te&tile fiber staple lint as well as the shorter

fu))y fibers from some upland species. :inters are traditionally used in the

manufacture of paper and as a raw material in ;he manufacture of cellulose.

7in+ &otton is a processed version of the fiber that can be made into cloth

resembling satin for shirts and suits. !owever, its hydrophobic property of not easily

ta*ing up water ma*es it unfit for the purpose of bath and dish towels ;although

e&les of these made from shiny cotton are seen<.

,he term Eg+ptian &otton refers to the e&tra long staple cotton grown in

(gypt and favored for the lu&ury and up mar*et brands worldwide. 8uring the C.S.

1ivil $ar, with heavy (uropean investments, (gyptian9grown cotton became a

major alternate source for 6ritish te&tile mills. !gyptian cotton is more durable and

softer than /merican 0ima cotton, which is why it is more e&pensive. 0ima

cotton is /merican cotton that is grown in the south western states of the C.S.

In South /sia, cotton is widely used in mattresses, which are the most common type

of mattress used in that region.

35 ECE

MBA Programme

1ottonseed output in #55Q

,he Cnited States, with sales of S'.4 billion, and /frica, with saies of S#.

billion, are the largest e&porters of raw cotton. ,otal international trade is S# billion.

/frica's share of the cotton trade has doubled since 435. 2either area has a significant

domestic te&tile industry, te&tile manufacturing having moved to developing nations in

(astern and South /sia such as India and 1hina. In /frica cotton is grown by numerous

small holders. 8onavan (nterprises, based in .emphis, ,ennessee, is the leading cotton

bro*er in /frica with hundreds of purchasing agents. It operates cotton gins in Cganda,

.o)ambique, and Xambia, In Xambia it often offers loans for seed and e&penses to the

35,555 small farmers who grow cotton for it, as well as advice on farming methods.

1argill also purchases cotton in /frica for e&port.

,he #R,555 cotton growers in the Cnited States are heavily subsidi)ed at the rate

of S# billion per year. ,he future of these subsidies is uncertain and has led to anticipatory

e&pansion of cotton bro*ers' operations in /frica. 8onavan e&panded in /frica by buying

out local operations. ,his is only possible in former 6ritish colonies and

.o)ambique; former French colonies continue to maintain tight monopolies,

inherited from their former colonialist masters, on cotton purchases at low fi&ed

prices.

Fair trade

1otton is an enormously important commodity throughout the world.

!owever, many fanners in developing countries receive a low price for their

produce, or find it difficult to compete with developed countries.

,his has led to an international dispute;

7n #Q September #55# 6ra)il requested consultations with the CS

regarding prohibited and actionable subsidies provided to CS producers, users andEor

e&porters of upland cotton, as well as legislation, regulations, statutory instruments

and amendments thereto providing such subsidies ;including e&port credits<, grants,

and any other assistance to the CS producers, users and e&porters of upland

cotton.

36 ECE

MBA Programme

7n 3 September #55', the 0anel Geport recommended that the Cnited

States +withdraw+ e&port credit guarantees and payments to domestic user and

e&porters, and +ta*e appropriate steps to remove the adverse effects or

withdraw+ the mandatory price9contingent subsidy measures.

In addition to concerns over subsidies, the cotton industries of some

countries are critici)ed for employing child labor and damaging wor*ers' health by

e&posure to pesticides used in production. For e&le, cotton production in

C)be*istan has been described as one of the most e&ploitative industries in the world.

,he international production and trade situation has led to 'fair trade

1otton clothing and footwear, joining a rapidly growing mar*et for organic

clothing, fair fashion or so9called 'ethical fashion'. ,he fair trade system was

initiated in #55R with producers from 1ameroon. .ali and Senegal.

7rganic cotton

7rganic cotton is cotton that is grown without insecticide or pesticide.

$orldwide, cotton is a pesticide9intensive crop, using appro&imately #RK of the

world's insecticides and 5K of the world's pesticides. /ccording to the $orld

!ealth 7rganisation ;$!7<, #5,555 deaths occur each year from pesticide

poisoning in developing countries, manU' of these from cotton farming. 7rganic

agriculture uses methods that are ecological, economical, and socially

sustainable and denies the use of agrochemicals and artificial fertili)ers. Instead,

organic agriculture uses crop rotation, the growing of different crops than cotton in

alternative years. ,he use of insecticides is prohibited; organic agriculture uses

natural enemies to suppress harmful insects. 7rganic cotton is produced in

organic' agricultural systems that produce food and fiber according to clearly

established standards. 7rganic agriculture prohibits the use of to&ic and

persistent chemical pesticides and fertili)ers, as well as genetically modified

organisms. It see*s to build biologically diverse agricultural systems, replenish and

maintain soil fertility, and promote a healthy environment.

37 ECE

MBA Programme

1ritical temperatures

Favorable travel temperature range 9 no lower limitD #R Y1 ;QQ

1

F<

7ptimum travel temperatureD #5 Y1 ;A3 YF<

@low temperatureD #5R Y1 ;'5 YF<

Firepoint D #5o1 ;'5YF<

/uto ignition temperature D '5Q Y1 ;QAR

1

F<

/utoignition temperature ;for oily cotton<D #5 #C ;#'3YF<

1otton dries out, becomes hard and brittle and loses all elasticity at temperatures

above #RY1 ;QQYF<. (&tended e&posure to light causes similar problems.

/ temperature range of #R Y1 ;QQ YF< to %R Y1 ;ZRYF< is the optimal range for maid

development. /t temperatures below 5Y 1 [%# YF<, rotting of wet cotton stops. 8amaged

cotton is sometimes stored at these temperatures to prevent further deterioration.

Britis standard &otton +arn !easures

thread I R' inches ;about %Q cm<

s*ein or rap I 35 threads ;#5 yards or about 54 m<

han* I Q s*eins ;3'5 yards or about QA3 m<

spindle93 han*s ;R,#<

38 ECE

MBA Programme

1ottonseed oil is a vegetable oat e&tracted from the seeds of the cotton plant

after the cotton lint has been removed. It must be refined to remove gossypol, a naturally

occurring to&in that protects the cotton plant from insect damage. Cnrefined

cottonseed oil is therefore sometimes used as a pesticide. In its natural

unhydrogenated state cottonseed oil, li*e all vegetable oils, has no cholesterol. It also

contains no ,rans fatty acids. !owever, it does contain over R5K 7mega9A fatty

acids and oniy trace amounts of 7mega9% fatty acids, and the imbalance is

considered unhealthy if not used in moderation or balanced elsewhere in the diet.

Further, these polyunsaturated fats can potentially go rancid during the e&traction

process.

Some consumers are wary of cottonseed oi l because cotton crops arc one of

the most chemically9intensive crops grown in the C.S. .any chemicals approved

for use on cotton are not approved for use on food9based crops. 1otton field leftovers,

or gin trash, are frequently ed to cattle.

1ottonseed oil is rich in politic acid ;##9#AK<, oleic acid ;R9#5K<,

linoleum acid ;'49R3K< and 5K mi&ture of rachitic add, benefic acid and

lignoceric acid. It also contains about K sterculic acids and galvanic acids in the

crude oil. ,he cyclopropene acids :ire undesirable components, but they are largely

removed during refining, particularly deodori)ation, and also during hydrogen at

ion. ,hey are not considered to present any health ha)ard in cottonseed oil.

Varn is a long continuous length of interloc*ed fibers, suitable for use in the

production of te&tiles, sewing, crocheting;, *nitting, weaving, embroidery and

ropema*ing. ,hread is a type of yam intended for sewing by hand or machine.

.odern manufactured sewing threads may be finished with wa& or other

lubricants to withstand the stresses involved in sewing. (mbroidery threads are yarns

specifically designed for hand or machine embroidery.

39 ECE

MBA Programme

1urrent Status

,he te&tile industry holds significant status in the India. ,e&tile industry provides

one of the most fundamental necessities of the people. It is an independent industry, from

the basic requirement of raw materials to the final products, with huge value9addition at

every stage of processing.

,oday te&tile sector accounts for nearly 'K of the total industrial output. Indian

fabric is in demand with its ethnic, earthly colored and many te&tures. ,he te&tile sector

accounts about %5K in the total e&port. ,his conveys that it holds potential if one is

ready to innovate.

,he te&tile industry is the largest industry in terms of employment economy,

e&pected to generate # million new jobs by #55. It generates massive potential for

employment in the sectors from agricultural to industrial. (mployment opportunities are

created when cotton is cultivated. It does not need any e&clusive @overnment support

even at present to go further. 7nly thing needed is to give some directions to organi)e

people to get enough share of the profit to spearhead development.

40 ECE

MBA Programme

Segments

,e&tile industry is constituted of the following segments

Geadymade @arments

1otton ,e&tiles including !andlooms ;.illmade E 0owerloomE

!andloom<

.an9made ,e&tiles

Sil* ,e&tiles

$oollen ,e&tiles

!andicrafts including 1arpets

1oir

But

,he cottage industry with handlooms, with the cheapest of threads, produces

average dress material, which costs only about #55 I2G featuring fine floral and other

patterns. It is not necessary to add any design to it. ,he women of the house spin the thread,

and weave a piece in about a wee*.

for its contribution to Indian economy as good as A5 It is an established fact that small

and irregular apparel production can be profitable by providing affordable casual wear

and leisure garments varieties.

2ow, one may as*, where from the economy and the large profit comes in if the

lowest end of the chain does not get paid with minimum per day labour charge. It is an

irony of course. $hat people at the upper stratum of the chain do is, to apply this fabric

into a design with some imagination and earn in millions. ,he straight A yards simple

saree, drape in with a blouse with embroideries and bead wor*, then it becomes a

designers ensemble. For an average person, it can be a slant cut while giving it a shape,

which can double the profit. .aybe, the %5 K credit that the industry is ta*ing K this

way. ,hough it is an industry, it has to innovate to prosper. It has all the ingredients to go

ahead.

41 ECE

MBA Programme

1urrent Scenario

,e&tile e&ports are targeted to reach SR5 billion by #55. S#R billion of which

will go to the CS. 7ther mar*ets include C/(, C-, @ermany, France, Italy, Gussia,

1anada, 6angladesh and Bapan. ,he name of these countries with their bac*ground can

give thousands of insights to a thin*ing mind. ,he slant cut that will be producing a

readymade garment will sell at a price of A55 Indian rupees, ma*ing the value addition

to be profitable by %55 K.

1urrently, because of the lifting up of The import restrictions of the multi9fibre

arrangement ;.F/< since st Banuary, #55R under the $orld ,rade 7rgani)ation

;$,7< /greement on ,e&tiles and 1lothing, the mar*et has become competitive; on

closer loo* however, it sounds an opportunity because better material will be possible

with the traditional inputs so far available with the Indian mar*et.

/t present, the te&tile industry is undergoing a substantial re9orientation towards

other then clothing segments of te&tile sector, which is commonly called as technical

te&tiles. It is moving vertically with an average growing rate of nearly two times of

te&tiles for clothing applications and now account for more than half of the total te&tile

output. ,he processes in ma*ing technical te&tiles require costly machinery and s*illed

wor*ers.

42 ECE

MBA Programme

,he shape of the te&tile industry in India

! :arge Industry 9 %K of @80, #QK of Fore& earnings, #K of total

employment

Fery large unorganised sector 9 about QAK of total fabrics production

.ar*et is very diverse, does not lend itself to comparative studies in terms of

mar*et share etc.

.ajor players

$elspun India

/sia's largest and world's ' largest terry towel manufacturer

Supply to $a=9mart, !ilfiger

Sales grew by %RK to reach AR5 cr in 5R95A

/lo* India

:argest processing capacity in India

Sales grew by RK to #3R cr 6 /rvind .ills

Q#K share of Indian 8enim mar*et

@o*aldas e&ports

4RKo revenue comes from the e&port mar*et

#5K growth in sales, reached 3A5 cr in 5R95A

7ilier major players li*e Gaymond, Siyaram sil* mills, mahavir spinning mills

etc.

43 ECE

MBA Programme

India te&tile industry

India contributes to about #RK share in the world trade of cotton yarn.

India, the world's third9largest producer of cotton and second9 largest

producer of cotton yarns and te&tiles, is poised to play an increasingly important

role in global cotton and te&tile mar*ets

,he ready made garment sector is the biggest segment in the India's te&tile e&port

bas*et contributing over 'AK of the total te&tile e&ports.

(&ports have grown at an average of 4.'QK p.a over the last decade.

0roblems in the industry

Fragmented industry

(ffect of historical government policies

,echnological obsolescence

Indian companies need to focus on product development

1ompetition in domestic mar*et

2eed to improve the wor*ing conditions of the people.

,ac*le 1hinese aggression over the international mar*et

@rowth opportunities

@rowth opportunities e&ist in following areasD

.edical te&tiles

1onstruction te&tiles

0ac*aging te&tiles

!ome te&tiles ;with fire9retarded fabric<

COM5AN9 5ROFILE

44 ECE

MBA Programme

$e have achieved a great height of success due to the hard wor* of Mr. 9.

7ridar Redd+, the chairman and Mr. 9. 7rini$asulu Redd+, the managing director of

the company. $e have a highly s*illed team of employees, who carries loads of

e&perience in this field. $e have a strong infrastructural base, which is well equipped

with the advanced machineries. $e always endeavor to provide the best and pure fabrics

to our customers and thus always chec* the quality content of the fabric.

$e are engaged in the manufacturing of a wide range of fine cotton fabrics. 7ur

fine cottons fabrics have a remar*able characteristic of providing smoothness and

softness to the body. $e are rec*oned as one of the leading cotton fabrics manufacturers,

based in India. 7ur cotton fabric is used by big companies for production of various types

of garments. $e have also become one of the foremost organic cotton yarn suppliers in

India. 7ur organic cotton is grown without the use of any harmful pesticides J chemicals

and thus this leads to the increase in its quality.

Na!e o' CEO .r. V. Sridhar Geddy

5ri!ar+ Business T+pe .anufacturer

Esta)lis!ent 9ear 444

No. o' E!plo+ees %55

Mar:et Co$er 1hina

Annual 7ale Gs.%5.55 1rores

5rodu&ts .e O''er 1otton Varn J Fabric

45 ECE

MBA Programme

.ission

,o manufacture a high quality yarn thereby withstanding high level of

competitiveness. 8eveloping a long term relationship with our customers and suppliers.

,o use latest technological strategies during production thereby forming an innovative

approach. ,o provide a safe, fulfilling and rewarding wor* environment for our

employees. Servicing and supporting the communities in which we operate.

Fision

,he company has a vision to e&cel in all fields of te&tile industry and agriculture

produce basis. $e will be intensely customer focused and will offer products and services

which provide the best value for our customers.

1orporate office

/ddress @anapavaram ;0ost<, 2adendla

;.andal<, 1hila*aluripet ;Fia<,

@untur 8ist.

1ity 1hila*aluripet

State /ndhra 0radesh

1ountry India

0in 1ode R##A4

0hone P493A'Q9#R'A#A

Fa& P493A'Q9#R%A'4

(mail /ddress ysrmills\gmail.com

/lternate (mail I8 info\ysrmills.com

.obile P4943'3RQ#%5

$eb Site httpDEEwww.ysrmills.comE

46 ECE

MBA Programme

5ro&ess

Spinning 8ivision

V.S.G. Spinning J $eaving .ills 0vt. :td., has installed state of art machines and

has a capacity to produce wide range of cotton yarns. 7ur machinery lines up using the

most equipment sourced from the best vendors. 1urrently the company produces 3.R tons

of 55K cotton yarn per day, with a capacity of #RR' spindles and 5R5 rotors.

$eaving 8ivision

V.S.G. Spinning J $eaving .ills 0vt. :td., has installed 3 nos 0I1/27:

7mniplus /irjet $eaving .achines to produce @rey fabric.

47 ECE

MBA Programme

0roducts

$e also deal with the manufacturing and supplying of organic &otton +arn. $e

provide organic cotton yarn in all shades. $e use environment friendly procedure for

producing our organic cotton yarn. 6elow listed are the two divisions that loo* after our

manufacturing processes.

Spinning 8ivision

7ur major counts range from #'Hs to 35s both carded and combed cotton yarns.

/dding to these counts we have the setup of doubling of yarns in Ging 8oubling yarns.

5rodu&tion Capa&it+

Ging Spun Varns R tons

7pen (nd Spinning # tons

Ging 8oubling .R tons

Wea$ing Di$ision

$e are having /ir jet weaving machines, which we can produce all types of

constructions as per buyer requirements. 0resently we are producing #555 meters of

'5s1]'5Sc9%#]Q#9A%W grey fabric and available this fabric in finished form also

1otton Fabrics

1otton Varn

48 ECE

MBA Programme

1otton Fabrics

$e are happy to acquaint ourselves as one of the salient cotton fabric

manufacturers in India. 7ur cotton fabrics include organic cotton fabrics and white cotton

fabrics. $e use pure and good quality yarn for ma*ing the fabric. 7ur fabric provides

immense comfort to the users. It gives soothing effect to the body and will be the right

choice in the hot and sweaty summers. 7ur cotton fabrics are light in weight in