Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Mutual Fund Provided by Cos

Caricato da

rinkidhadwalDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Mutual Fund Provided by Cos

Caricato da

rinkidhadwalCopyright:

Formati disponibili

HOME | PRODUCTS | EasyInvest | EasyCall | DOWNLOADS | MEDIA | ABOUT US | GET IN TOUCH

View Products

Goals

Build wealth no matter what is happening in the economy.

There are obviously no guarantees but you can maximise your chances of making money irrespective of what is happening in the economy by

investing in a diverse range of assets (such as equity, debt and gold). By balancing your investments across multiple asset classes, you tend to

reduce risk of losing money to economic shocks (like the recent global financial crisis).

Here's how.

Empirical studies have shown that between 1995 and 2012, if you had invested equally in stocks, bonds and gold, only once would you have

lost money i.e. in 1995. In all the other 17 years, average returns from an equal mix of these three assets were positive (kindly refer to product

brochure for more details).

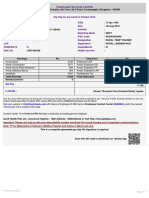

Axis Triple Advantage Fund - Growth through diversification

Axis Triple Advantage Fund helps you take advantage of diversification by investing in a mix of equity, fixed income and gold. This not only

helps avoid monetary surprises but also provides opportunity for wealth growth. With Axis Triple Advantage Fund, if you have planned for

something, chances are you should be able to go and get it.

Key Features

Suitable for an investment horizon of 3 years or more

Provides diversification across three asset classes viz. equity, fixed income and gold thereby leading to reduction in risk

Returns potential not compromised even with reduced risk levels

Returns more stable than pure equity or gold investments over the long term

Offers convenience. Now one single application is sufficient for investment in three asset classes.

20 - 30% of investment in gold. Gold is a good hedge against financial crises.

Download application form

Reach us now

This product is suitable for investors who are seeking *

capital appreciation & generating income over long term

investment in a diversified portfolio of equity and equity related instruments, fixed income instruments & gold Exchange Traded Funds

medium risk (YELLOW)

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them

Note: Risk is represented as:

(BLUE) investors understand that their principal will be at low risk

(YELLOW) investors understand that their principal will be at medium risk

(BROWN) investors understand that their principal will be at high risk

Downloads

Latest NAVs

NAV History

Dividend History

Mutual Fund Taxation

Mailback Service

SEBI Investor Education Programme

View Products

Equity Funds

Axis Equity Fund

Axis Long Term Equity Fund

Axis Midcap Fund

Axis Focused 25 Fund

Fixed Income Funds

Axis Liquid Fund

Axis Treasury Advantage Fund

Axis Short Term Fund

Axis Dynamic Bond Fund

Hybrid Funds

Axis Triple Advantage Fund

Axis Income Saver

Gold Fund

Axis Gold Fund

Axis Gold ET

2.

Potrebbero piacerti anche

- Asset Allocation and Effective Portfolio Management: Part OneDa EverandAsset Allocation and Effective Portfolio Management: Part OneValutazione: 4 su 5 stelle4/5 (3)

- Investing Demystified: A Beginner's Guide to Building Wealth in the Stock MarketDa EverandInvesting Demystified: A Beginner's Guide to Building Wealth in the Stock MarketNessuna valutazione finora

- Iconic Consumer Brands for More Defensive, Lower-risk Investing: Annual Review 2023Da EverandIconic Consumer Brands for More Defensive, Lower-risk Investing: Annual Review 2023Nessuna valutazione finora

- Personal Fin Plan Assi 2Documento7 paginePersonal Fin Plan Assi 2Chandan Kumar SinghNessuna valutazione finora

- The Best Low-Capital Investment Ideas with Good ResultsDa EverandThe Best Low-Capital Investment Ideas with Good ResultsNessuna valutazione finora

- Introduction to Index Funds and ETF's - Passive Investing for BeginnersDa EverandIntroduction to Index Funds and ETF's - Passive Investing for BeginnersValutazione: 4.5 su 5 stelle4.5/5 (7)

- Financial Concepts Tutorial: (Page 1 of 9)Documento9 pagineFinancial Concepts Tutorial: (Page 1 of 9)Adithya Shirish PNessuna valutazione finora

- Bricks & Mortar through Stocks & Shares: Property Investing in the Stock MarketsDa EverandBricks & Mortar through Stocks & Shares: Property Investing in the Stock MarketsNessuna valutazione finora

- Beating the Market, 3 Months at a Time (Review and Analysis of the Appels' Book)Da EverandBeating the Market, 3 Months at a Time (Review and Analysis of the Appels' Book)Nessuna valutazione finora

- Investment Banking (Mutual Fund)Documento13 pagineInvestment Banking (Mutual Fund)Mahendra Pratap RathaurNessuna valutazione finora

- Asset AllocationDocumento4 pagineAsset AllocationGarvit JainNessuna valutazione finora

- Suchitra NewDocumento22 pagineSuchitra Newdas.suchitra991Nessuna valutazione finora

- The Asset Allocation Guide to Wealth CreationDa EverandThe Asset Allocation Guide to Wealth CreationValutazione: 4 su 5 stelle4/5 (2)

- Mutual FundsDocumento40 pagineMutual Fundsaditi anandNessuna valutazione finora

- Untitled DocumentDocumento3 pagineUntitled DocumentPhilipNessuna valutazione finora

- Where Can I Invest? Unlocking a World of Opportunities: Get Your Finances In Order, #3Da EverandWhere Can I Invest? Unlocking a World of Opportunities: Get Your Finances In Order, #3Nessuna valutazione finora

- Advantages of Mutual FundsDocumento7 pagineAdvantages of Mutual FundsSiri PadmaNessuna valutazione finora

- What Are The Different Types of InvestmentsDocumento5 pagineWhat Are The Different Types of InvestmentsRoxan PacsayNessuna valutazione finora

- Mutual Fund: IntroductionDocumento5 pagineMutual Fund: IntroductionHarish MalaviyaNessuna valutazione finora

- Fidelity Fav FundsDocumento16 pagineFidelity Fav FundsgirishbhallaNessuna valutazione finora

- Comparative Analysis of Investment Alternatives: Personal Financial PlanningDocumento12 pagineComparative Analysis of Investment Alternatives: Personal Financial Planningwish_coolalok8995Nessuna valutazione finora

- Mutual Funds: Dividends Interest Capital GainDocumento18 pagineMutual Funds: Dividends Interest Capital GainNitish KhuranaNessuna valutazione finora

- Mutual Funds: Different Types of Funds: Printer Friendly Version (PDF Format)Documento3 pagineMutual Funds: Different Types of Funds: Printer Friendly Version (PDF Format)jp4u24Nessuna valutazione finora

- Why You Should Have Multiallocation FundsDocumento5 pagineWhy You Should Have Multiallocation FundsRanjan SharmaNessuna valutazione finora

- Investment: By: Hardeepika Singh AhluwaliaDocumento75 pagineInvestment: By: Hardeepika Singh AhluwaliaMannu SolankiNessuna valutazione finora

- Investment Portfolio Diversification:: Diversify Our Company InvestmentsDocumento4 pagineInvestment Portfolio Diversification:: Diversify Our Company Investmentsfiza akhterNessuna valutazione finora

- Elss ArticleDocumento11 pagineElss ArticlesaravmbaNessuna valutazione finora

- Ipm Report Final TopicsDocumento9 pagineIpm Report Final TopicsJemaicha LimNessuna valutazione finora

- Investing Demystified: Building Wealth for the FutureDa EverandInvesting Demystified: Building Wealth for the FutureNessuna valutazione finora

- 2 The Asset Allocation DecisionDocumento25 pagine2 The Asset Allocation DecisionLea AndreleiNessuna valutazione finora

- Safe Investment??: (A Case Study On Risk of Diversification)Documento26 pagineSafe Investment??: (A Case Study On Risk of Diversification)A Srihari KrishnaNessuna valutazione finora

- Investing - BVC ArticleDocumento3 pagineInvesting - BVC ArticleayraNessuna valutazione finora

- Definition of 'Debt Funds': What Is A Mutual Fund?Documento5 pagineDefinition of 'Debt Funds': What Is A Mutual Fund?Girish SahareNessuna valutazione finora

- Presentation FinDocumento24 paginePresentation FinSagrika SagarNessuna valutazione finora

- Financial Sectors of India: A Presentation By:-Aashima Gelda Parul University, VadodaraDocumento20 pagineFinancial Sectors of India: A Presentation By:-Aashima Gelda Parul University, VadodaraRamachandran SwamiNessuna valutazione finora

- 8 Interesting Ways To Make Your Savings Grow: BanksDocumento4 pagine8 Interesting Ways To Make Your Savings Grow: BanksJems HamalNessuna valutazione finora

- SOURAV'S SIP ON SBI MUTUAL FUND (Introduction)Documento106 pagineSOURAV'S SIP ON SBI MUTUAL FUND (Introduction)sourabha86100% (1)

- Mutual Fund-WPS OfficeDocumento4 pagineMutual Fund-WPS Officesheetalmundada1803Nessuna valutazione finora

- Index Funds: A Beginner's Guide to Build Wealth Through Diversified ETFs and Low-Cost Passive Investments for Long-Term Financial Security with Minimum Time and EffortDa EverandIndex Funds: A Beginner's Guide to Build Wealth Through Diversified ETFs and Low-Cost Passive Investments for Long-Term Financial Security with Minimum Time and EffortValutazione: 5 su 5 stelle5/5 (38)

- Risk ToleranceDocumento8 pagineRisk Toleranceapi-173610472Nessuna valutazione finora

- The WISE Mutual FundDocumento12 pagineThe WISE Mutual FundvineethpjNessuna valutazione finora

- Summary of Taylor Larimore's The Bogleheads' Guide to the Three-Fund PortfolioDa EverandSummary of Taylor Larimore's The Bogleheads' Guide to the Three-Fund PortfolioNessuna valutazione finora

- 6-Investment Planning (Investing Fundamentals)Documento60 pagine6-Investment Planning (Investing Fundamentals)Farahliza RosediNessuna valutazione finora

- Ca1 Financial MarketsDocumento12 pagineCa1 Financial MarketsKartik ChaturvediNessuna valutazione finora

- Mutual FundsDocumento12 pagineMutual FundsMargaret MarieNessuna valutazione finora

- Low Risk InvestmentsDocumento6 pagineLow Risk Investmentsmyschool90Nessuna valutazione finora

- Sr. No. Topic NODocumento64 pagineSr. No. Topic NOniyaazsNessuna valutazione finora

- The Top 100 International Growth Stocks: Your Guide to Creating a Blue Chip International Portfolio for Higher Returns andDa EverandThe Top 100 International Growth Stocks: Your Guide to Creating a Blue Chip International Portfolio for Higher Returns andNessuna valutazione finora

- Mutual Fund Investors, Common Mistakes & Myths: INVESTMENTS, #1Da EverandMutual Fund Investors, Common Mistakes & Myths: INVESTMENTS, #1Valutazione: 4 su 5 stelle4/5 (2)

- Summary of Richard A. Ferri's All About Asset Allocation, Second EditionDa EverandSummary of Richard A. Ferri's All About Asset Allocation, Second EditionNessuna valutazione finora

- Reduction of Portfolio Through DiversificationDocumento28 pagineReduction of Portfolio Through DiversificationDilshaad ShaikhNessuna valutazione finora

- Introduction Investment PlanningDocumento5 pagineIntroduction Investment Planningapi-3770163Nessuna valutazione finora

- Advisorkhoj Mirae Asset Mutual Fund ArticleDocumento6 pagineAdvisorkhoj Mirae Asset Mutual Fund ArticleSowmya GuptaNessuna valutazione finora

- PRF 2Documento2 paginePRF 2zenxtoNessuna valutazione finora

- Financial Concepts: Introduction: Risk-Free Rate of Return Default Index Funds Risk PremiumDocumento114 pagineFinancial Concepts: Introduction: Risk-Free Rate of Return Default Index Funds Risk Premiumarunchary007Nessuna valutazione finora

- Itrv Sarath 21-22Documento1 paginaItrv Sarath 21-22bindu mathaiNessuna valutazione finora

- Tally ERP 9 Notes + Practical Assignment - Free Download PDFDocumento19 pagineTally ERP 9 Notes + Practical Assignment - Free Download PDFHimanshu Saha50% (2)

- Financial Statement On Sole Trading Ok ProjectDocumento51 pagineFinancial Statement On Sole Trading Ok Projectvenkynaidu57% (14)

- The Jobs and Childcare For Military Families ActDocumento1 paginaThe Jobs and Childcare For Military Families ActU.S. Senator Tim Kaine100% (1)

- A Study On Foreign Exchage and Its Risk ManagementDocumento45 pagineA Study On Foreign Exchage and Its Risk ManagementBhushan100% (1)

- MODULE 1 Variable and Absorption CostingDocumento9 pagineMODULE 1 Variable and Absorption Costingjerico garciaNessuna valutazione finora

- Business Registration and LicensingDocumento30 pagineBusiness Registration and LicensingRheneir MoraNessuna valutazione finora

- AnupamDocumento61 pagineAnupamviralNessuna valutazione finora

- Guesstimate & Case Interview ExamplesDocumento10 pagineGuesstimate & Case Interview ExamplesVishwadeep Mishra100% (2)

- Contract Review ChecklistDocumento3 pagineContract Review ChecklistHaniNessuna valutazione finora

- ECON302 Tutorial1 Answers PDFDocumento5 pagineECON302 Tutorial1 Answers PDFAngel RicardoNessuna valutazione finora

- Lakme: Latest Quarterly/Halfyearly As On (Months)Documento7 pagineLakme: Latest Quarterly/Halfyearly As On (Months)Vikas UpadhyayNessuna valutazione finora

- Retirement Calculator & Planner DemoDocumento39 pagineRetirement Calculator & Planner DemoSumit TodiNessuna valutazione finora

- Fae3e SM ch04 060914Documento23 pagineFae3e SM ch04 060914JarkeeNessuna valutazione finora

- Caf 8 Cma Autumn 2015Documento4 pagineCaf 8 Cma Autumn 2015mary50% (2)

- PTCL ShareDocumento2 paginePTCL SharecontacttoabdulNessuna valutazione finora

- The Effects of Money LaunderingDocumento8 pagineThe Effects of Money Launderingsilvernitrate1953Nessuna valutazione finora

- Finnish TaxationDocumento217 pagineFinnish TaxationTobi MemoryNessuna valutazione finora

- Payslip ModelDocumento1 paginaPayslip ModelKarthikeyan KarthikeyanNessuna valutazione finora

- Capital StructureDocumento8 pagineCapital StructureVarun MudaliarNessuna valutazione finora

- Midterm FarDocumento7 pagineMidterm FarShannen D. CalimagNessuna valutazione finora

- Compensation Managementat ABC TravelsDocumento37 pagineCompensation Managementat ABC TravelsNishala AbeywickramaNessuna valutazione finora

- Financial Analysis Assignment No. 1Documento9 pagineFinancial Analysis Assignment No. 1Shaista BanoNessuna valutazione finora

- Sibongile Mnana TAX2601 Assignment 3Documento7 pagineSibongile Mnana TAX2601 Assignment 3sibongileNessuna valutazione finora

- Roll A'La Pizza Projected Income Statement For Years 1 To 5Documento6 pagineRoll A'La Pizza Projected Income Statement For Years 1 To 5Xyrus PerezNessuna valutazione finora

- Solution Manual For Fundamentals of Taxation 2019 Edition 12th by CruzDocumento31 pagineSolution Manual For Fundamentals of Taxation 2019 Edition 12th by CruzSherryBakerdawz100% (35)

- Food Engineering Design and EconomicsDocumento53 pagineFood Engineering Design and EconomicsMohammad Reza AnghaeiNessuna valutazione finora

- Chapter 1: Introduction To AuditingDocumento3 pagineChapter 1: Introduction To AuditingSaroar HossainNessuna valutazione finora

- Chap 001Documento19 pagineChap 001WilliamNessuna valutazione finora