Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Black Scholes Derivation

Caricato da

Nathan EsauCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Black Scholes Derivation

Caricato da

Nathan EsauCopyright:

Formati disponibili

1 Deriving the Black-Scholes Formula

1.1 Call Option

For a European call option, the potential cash-ows at time t with occur if S

t

> K

1. Receive a stock worth S

t

with probability Pr(S

t

> K)

2. Pay K with probability Pr(S

t

> K)

E(call payo) = Pr(S

t

> K) [E(S

t

| S

t

> K) K]

PV

0

[E(call payo)] = e

t

Pr(S

t

> K) [E(S

t

| S

t

> K) K]

1.2 Put Option

For a European put option, the potential cash-ows at time t with occur if S

t

> K

1. Receive K with probability Pr(S

t

< K)

2. Pay (buy a stock worth) S

t

with probability Pr(S

t

< K)

E(put payo) = Pr(S

t

< K) [K E(S

t

| S

t

< K)]

PV

0

[E(put payo)] = e

t

Pr(S

t

< K) [K E(S

t

| S

t

< K)]

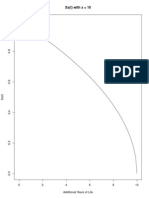

1.3 Lognormal Model

In order to develop the Black-Scholes formula, we need to know the following quantities

1. Pr(S

t

> K)

2. E(S

t

|S

t

> K)

Let A be the normally distributed random variable for the stock return.

S

t

= S

0

e

At

where A N(,

2

).

S

t

/S

0

LN(m = ( 1/2

2

)t, v =

t).

1

These parameters are chosen s.t. E(S

t

/S

0

) = e

()t

where is the capital gains rate.

We can see that this is true since E(S

t

/S

0

) = e

m+1/2v

2

= e

(1/2

2

)t+1/2

2

t

= e

()t

For t = 1 the volatility of the stock return equals to the volatility of ln(S

t

/S

0

)

Otherwise, the volatility of ln(S

t

/S

0

) must be adjusted for time, so v =

t

Pr(S

t

< K) = Pr(S

t

/S

0

< K/S

0

)

= Pr(ln(S

t

/S

0

) < ln(K/S

0

))

Since ln(S

t

/S

0

) Normal(m, v

2

), then (ln(S

t

/S

0

) m)/v = Z N(0, 1) where Z is the

standard normal random variable. Therefore,

Pr(S

t

< K) = Pr(Z <

ln(K/S

0

) m

v

)

= Pr(Z < d

2

)

= N(d

2

)

where d

2

=

ln(S

0

/K)+m

v

=

ln(S

0

/k)+(1/2

2

)

t

Since Pr(S

t

< K) = N(d

2

) then

Pr(S

t

> K) = N(d

2

)

To nd E(S

t

| S

t

< K) we use the following formula

E(S

t

| S

t

< K) = PE(S

t

| S

t

< K)/ Pr(S

t

< K)

where PE is the partial expectation from S

t

= 0 to S

t

= K. Note that

PE(S

t

/S

0

| S

t

/S

0

< K/S

0

) = E(S

t

/S

0

)N((ln(K/S

0

) mv

2

)/v)

We can calculate PE(S

t

| S

t

/S

0

< K/S

0

) = S

0

(PE(S

t

/S

0

| S

t

/S

0

< K/S

0

)). This simplies

as follows

PE(S

t

| S

t

< K) = PE(S

t

| S

t

/S

0

< K/S

0

)

= S

0

(PE(S

t

/S

0

| S

t

/S

0

< K/S

0

))

= S

0

E(S

t

/S

0

)N((ln(K/S

0

) mv

2

)/v)

= S

0

e

m+1/2v

2

N((ln(K/S

0

) ( 1/2

2

)t

2

t)/(

t))

= S

0

e

()t

N((ln(K/S

0

) ( + 1/2

2

)t)/(

t))

= S

0

e

()t

N(d

1

)

2

where d

1

=

ln(S

0

/k)+(+1/2

2

)

t

. Notice that d

2

= d

1

t

Since E(S

t

) = PE(S

t

| S

t

> K) + PE(S

t

| S

t

< K) then

PE(S

t

| S

t

> K) = E(S

t

) PE(S

t

| S

t

< K)

= S

0

e

()t

S

0

e

()t

N(d

1

)

= S

0

e

()t

(1 N(d

1

))

= S

0

e

()t

N(d

1

)

Which leads to the following formulas

E(S

t

| S

t

< K) = (S

0

e

()t

N(d

1

))/N(d

2

)

E(S

t

| S

t

> K) = (S

0

e

()t

N(d

1

))/N(d

2

)

1.4 The Black-Scholes Formula

Substituting in the formulas derived above, we nd that for a European call option

E(call payo) = Pr(S

t

> K) [E(S

t

| S

t

> K) K]

= N(d

2

)((S

0

e

()t

N(d

1

))/N(d

2

) K)

= S

0

e

()t

N(d

1

) KN(d

2

)

PV

0

[E(call payo)] = e

t

(S

0

e

()t

N(d

1

) KN(d

2

))

= S

0

e

t

N(d

1

) Ke

t

N(d

2

)

So, for a European call option,

C = S

0

e

t

N(d

1

) Ke

t

N(d

2

) (1.1)

Similarly, substituting in the formulas derived above, we nd that, for a European put option

E(put payo) = Pr(S

t

< K) [K E(S

t

| S

t

< K)]

= N(d

2

)(K (S

0

e

()t

N(d

1

))/N(d

2

))

= KN(d

2

) S

0

e

()t

N(d

1

)

PV

0

[E(call payo)] = e

t

(KN(d

2

) S

0

e

()t

N(d

1

))

= Ke

t

N(d

2

) S

0

e

t

N(d

1

)

3

So, for a European put option,

P = Ke

t

N(d

2

) S

0

e

t

N(d

1

) (1.2)

4

Potrebbero piacerti anche

- Real Analysis and Probability: Solutions to ProblemsDa EverandReal Analysis and Probability: Solutions to ProblemsNessuna valutazione finora

- Jump Diffusion Models - PrimerDocumento3 pagineJump Diffusion Models - PrimerycchiranjeeviNessuna valutazione finora

- Mathematical Tables: Tables of in G [z] for Complex ArgumentDa EverandMathematical Tables: Tables of in G [z] for Complex ArgumentNessuna valutazione finora

- 2 Signals and Systems: Part I: Solutions To Recommended ProblemsDocumento9 pagine2 Signals and Systems: Part I: Solutions To Recommended ProblemssamibdzNessuna valutazione finora

- Ten-Decimal Tables of the Logarithms of Complex Numbers and for the Transformation from Cartesian to Polar Coordinates: Volume 33 in Mathematical Tables SeriesDa EverandTen-Decimal Tables of the Logarithms of Complex Numbers and for the Transformation from Cartesian to Polar Coordinates: Volume 33 in Mathematical Tables SeriesNessuna valutazione finora

- Chapter 5: Laplace Transform and Its ApplicationsDocumento23 pagineChapter 5: Laplace Transform and Its ApplicationsEECS7Nessuna valutazione finora

- Analytic Geometry: Graphic Solutions Using Matlab LanguageDa EverandAnalytic Geometry: Graphic Solutions Using Matlab LanguageNessuna valutazione finora

- 5021 Solutions 10Documento7 pagine5021 Solutions 10belenhostNessuna valutazione finora

- Lecture 06 - Optimal Receiver DesignDocumento21 pagineLecture 06 - Optimal Receiver DesignKhoa PhamNessuna valutazione finora

- Solutions Manual To Accompany Arbitrage Theory in Continuous Time 2nd Edition 9780199271269Documento38 pagineSolutions Manual To Accompany Arbitrage Theory in Continuous Time 2nd Edition 9780199271269egglertitularxidp100% (12)

- Y (S) U (S) K K Τ S Where Ε Is Damping Coefficient M S Thusy (S) = Km S Τ S For Critically Damped, Ε=1, Thus Y (T) =Km T Τ EDocumento4 pagineY (S) U (S) K K Τ S Where Ε Is Damping Coefficient M S Thusy (S) = Km S Τ S For Critically Damped, Ε=1, Thus Y (T) =Km T Τ EirvannsurNessuna valutazione finora

- S - S: I Case: Fraction Expansion of A Given Function P (S) /Q (S) : - PartialDocumento17 pagineS - S: I Case: Fraction Expansion of A Given Function P (S) /Q (S) : - PartialEng M. EissaNessuna valutazione finora

- Time Response AnalysisDocumento151 pagineTime Response AnalysisTushar GuptaNessuna valutazione finora

- Chapter5Documento77 pagineChapter5Aamina87Nessuna valutazione finora

- Formula SheetDocumento15 pagineFormula Sheetsiddhartha-misra-1498Nessuna valutazione finora

- Edu Exam Mfe 0507 SolDocumento14 pagineEdu Exam Mfe 0507 SolguidobambinoNessuna valutazione finora

- Equations Exam 421Documento2 pagineEquations Exam 421hay123ranNessuna valutazione finora

- Merton Jump - Diffusion.modelDocumento7 pagineMerton Jump - Diffusion.modelIoannis MilasNessuna valutazione finora

- MFE FormulasDocumento7 pagineMFE FormulasahpohyNessuna valutazione finora

- 7.2 Estimation of Survival Function: T T T W W W W WDocumento5 pagine7.2 Estimation of Survival Function: T T T W W W W WjuntujuntuNessuna valutazione finora

- 8 Continuous-Time Fourier Transform: Solutions To Recommended ProblemsDocumento13 pagine8 Continuous-Time Fourier Transform: Solutions To Recommended ProblemsRosyiefaAmriNessuna valutazione finora

- SM212 Practice Test 3, Prof Joyner: Sin (T) (The Convolution of TDocumento5 pagineSM212 Practice Test 3, Prof Joyner: Sin (T) (The Convolution of THelbert PaatNessuna valutazione finora

- תקשורת ספרתית- הרצאה 6 - מסננת מתואמת, איפנון בסיסDocumento40 pagineתקשורת ספרתית- הרצאה 6 - מסננת מתואמת, איפנון בסיסRonNessuna valutazione finora

- Calculations of Greeks in The Black and Scholes FormulaDocumento4 pagineCalculations of Greeks in The Black and Scholes FormulaAustin Drukker100% (1)

- Section 9.5: C09S05.001: First Note ThatDocumento13 pagineSection 9.5: C09S05.001: First Note ThatsindynovaNessuna valutazione finora

- MITRES 6 007S11 hw08 SolDocumento13 pagineMITRES 6 007S11 hw08 SolCharles Dave L MartonitoNessuna valutazione finora

- Formula For SOA MFEDocumento4 pagineFormula For SOA MFEferferNessuna valutazione finora

- Fourier TableDocumento4 pagineFourier Tablehomer1_210788Nessuna valutazione finora

- Transformada de Laplace2Documento14 pagineTransformada de Laplace2cisnerosadrianaNessuna valutazione finora

- ECE633 Signals and Systems I, Fall 2009 - Homework 2 SolutionsDocumento13 pagineECE633 Signals and Systems I, Fall 2009 - Homework 2 SolutionsGabrielPopoola13100% (2)

- Definición F (T) F(S) : Formulario de Transformada Z y Transformada de LaplaceDocumento1 paginaDefinición F (T) F(S) : Formulario de Transformada Z y Transformada de LaplaceLuis FernandoNessuna valutazione finora

- Solutions of Assignment #2Documento5 pagineSolutions of Assignment #2Adil AliNessuna valutazione finora

- MFE NotesDocumento10 pagineMFE NotesRohit SharmaNessuna valutazione finora

- Chapter 2Documento10 pagineChapter 2floriscalcNessuna valutazione finora

- Lecture 04 - Signal Space Approach and Gram Schmidt ProcedureDocumento20 pagineLecture 04 - Signal Space Approach and Gram Schmidt ProcedureKhoa PhamNessuna valutazione finora

- D Com FinalsolDocumento6 pagineD Com FinalsolnidulsinhaNessuna valutazione finora

- LaplaceDocumento133 pagineLaplaceRen MatewNessuna valutazione finora

- Ch7 Laplace TransformDocumento15 pagineCh7 Laplace TransformumerNessuna valutazione finora

- Enae 641Documento17 pagineEnae 641bob3173Nessuna valutazione finora

- On Some Diophantine EquationsDocumento2 pagineOn Some Diophantine EquationsRyanEliasNessuna valutazione finora

- ECE633F09 HW2solutionsDocumento13 pagineECE633F09 HW2solutionsAnonymous xuEZu5KyNessuna valutazione finora

- Step Functions and Laplace Transforms of Piecewise Continuous FunctionsDocumento20 pagineStep Functions and Laplace Transforms of Piecewise Continuous FunctionsLemuel C. FernandezNessuna valutazione finora

- Formulas For The MFE ExamDocumento17 pagineFormulas For The MFE ExamrortianNessuna valutazione finora

- Process Dynamics and Control Seborg 2nd Ch06 PDFDocumento43 pagineProcess Dynamics and Control Seborg 2nd Ch06 PDFRon PascualNessuna valutazione finora

- En1 Periodic Signals Fourier SeriesDocumento3 pagineEn1 Periodic Signals Fourier SeriesAna-Maria Raluca ChiruNessuna valutazione finora

- LE4Documento6 pagineLE4Tim AcostaNessuna valutazione finora

- A General Result On The Smarandache Star FunctionDocumento13 pagineA General Result On The Smarandache Star FunctionDon HassNessuna valutazione finora

- Ch. 1: Review of ProbabilityDocumento19 pagineCh. 1: Review of ProbabilityKyusang ParkNessuna valutazione finora

- Ch-5 Time Res WebpageDocumento48 pagineCh-5 Time Res WebpageTushar GuptaNessuna valutazione finora

- Bjork Algunas SolucionesDocumento45 pagineBjork Algunas SolucionesJuan Camilo RoaNessuna valutazione finora

- Solution To Homework Assignment 4Documento6 pagineSolution To Homework Assignment 4cavanzasNessuna valutazione finora

- Solving TSP by Dynamic ProgrammingDocumento6 pagineSolving TSP by Dynamic ProgrammingSatish JadhaoNessuna valutazione finora

- Practice 11 12Documento27 paginePractice 11 12Marisnelvys CabrejaNessuna valutazione finora

- Retenedor de Orden CeroDocumento21 pagineRetenedor de Orden CeroLuis Miguel BarrenoNessuna valutazione finora

- Ins DC Assign 1-5Documento6 pagineIns DC Assign 1-5murali kakrodaNessuna valutazione finora

- 1 Summary on Θ (n) Sorting Algorithms (Section 7.2) : Lecture SevenDocumento4 pagine1 Summary on Θ (n) Sorting Algorithms (Section 7.2) : Lecture SeventestNessuna valutazione finora

- 1978 An Asymptotic Formula For Reciprocals of Logarithms of Certain Multiplicative FunctionsDocumento5 pagine1978 An Asymptotic Formula For Reciprocals of Logarithms of Certain Multiplicative FunctionskarrasNessuna valutazione finora

- C 2 P 5Documento9 pagineC 2 P 5sundarmeenakshiNessuna valutazione finora

- Q 3Documento1 paginaQ 3Nathan EsauNessuna valutazione finora

- TestDocumento1 paginaTestNathan EsauNessuna valutazione finora

- Short ProgressDocumento1 paginaShort ProgressNathan EsauNessuna valutazione finora

- Practice Final q15Documento1 paginaPractice Final q15Nathan EsauNessuna valutazione finora

- RCPP Package PDFDocumento8 pagineRCPP Package PDFSoniaGRuizNessuna valutazione finora

- ACMA 320-2014-Asmt 6Documento1 paginaACMA 320-2014-Asmt 6Nathan EsauNessuna valutazione finora

- X or Problem (Algorithm)Documento2 pagineX or Problem (Algorithm)Nathan EsauNessuna valutazione finora

- Mfe Study MaterialDocumento715 pagineMfe Study MaterialWooil ShinNessuna valutazione finora

- Edu 2009 Fall Exam C TableDocumento17 pagineEdu 2009 Fall Exam C TableTrever GrahNessuna valutazione finora

- CerealDocumento2 pagineCerealNathan EsauNessuna valutazione finora

- ReadmeDocumento2 pagineReadmeNathan EsauNessuna valutazione finora

- ACMA 320 Actuarial Mathematics I Assignment 2Documento1 paginaACMA 320 Actuarial Mathematics I Assignment 2Nathan EsauNessuna valutazione finora

- Some R Generated Survival GraphsDocumento2 pagineSome R Generated Survival GraphsNathan EsauNessuna valutazione finora

- Work CitedDocumento1 paginaWork CitedNathan EsauNessuna valutazione finora

- Ebook Eric Johnson Total Electric GuitarDocumento12 pagineEbook Eric Johnson Total Electric GuitarNathan Esau100% (1)

- Alexander The GreatDocumento1 paginaAlexander The GreatNathan EsauNessuna valutazione finora

- Guitar Pro - NonameDocumento1 paginaGuitar Pro - NonameNathan EsauNessuna valutazione finora

- Documents StackDocumento1 paginaDocuments StackDan MNessuna valutazione finora

- Side Job EbookDocumento30 pagineSide Job EbookChristine N. BrousseauNessuna valutazione finora

- Credit Risk Assessment - An Insight (PSG)Documento12 pagineCredit Risk Assessment - An Insight (PSG)ssshantha9974Nessuna valutazione finora

- Participant Handbook (MS7 SM B2C CG) PDFDocumento58 pagineParticipant Handbook (MS7 SM B2C CG) PDFBhavnaNessuna valutazione finora

- Organization and Functioning of Securities MarketsDocumento36 pagineOrganization and Functioning of Securities MarketsabidanazirNessuna valutazione finora

- Description of Span Risk Parameter FileDocumento10 pagineDescription of Span Risk Parameter FileTarun AroraNessuna valutazione finora

- Acct Statement XX3392 29122023Documento5 pagineAcct Statement XX3392 29122023Kanchan SharmaNessuna valutazione finora

- MBGN 4001/FM 4001/in 4001Documento3 pagineMBGN 4001/FM 4001/in 4001ashanNessuna valutazione finora

- Assess Hutchison WhampoaDocumento4 pagineAssess Hutchison WhampoaAyesha KhalidNessuna valutazione finora

- Quiz 1 Answer Key-2Documento3 pagineQuiz 1 Answer Key-2Allison LeNessuna valutazione finora

- SOLUTION1. Exercise 1 PDFDocumento10 pagineSOLUTION1. Exercise 1 PDFVanessa ThuyNessuna valutazione finora

- Dakota Corporation Had The Following Shareholders Equity Account Balances atDocumento1 paginaDakota Corporation Had The Following Shareholders Equity Account Balances atTaimur TechnologistNessuna valutazione finora

- Unit 1 Role of Financial Institutions and MarketsDocumento11 pagineUnit 1 Role of Financial Institutions and MarketsGalijang ShampangNessuna valutazione finora

- AU BankDocumento2 pagineAU BankAayush ManNessuna valutazione finora

- 25 Day Trading Strategies in Nifty & Bank NiftyDocumento170 pagine25 Day Trading Strategies in Nifty & Bank Niftyjemehax13894% (51)

- DTC PARTICIPANTS Listing DRS Direct Resgistration Services Limited ListDocumento2 pagineDTC PARTICIPANTS Listing DRS Direct Resgistration Services Limited Listjacque zidaneNessuna valutazione finora

- Blaine Kitchenware Case Study SolutionDocumento5 pagineBlaine Kitchenware Case Study SolutionMuhammad Shariq Siddiqui100% (3)

- Transfer ReceiptDocumento3 pagineTransfer Receipthaneesh11Nessuna valutazione finora

- Paulson Credit Opportunity 2007 Year EndDocumento16 paginePaulson Credit Opportunity 2007 Year EndjackefellerNessuna valutazione finora

- StudentDocumento49 pagineStudentKevin Che100% (1)

- Portfolio EvaluationDocumento17 paginePortfolio EvaluationLelethu NgwenaNessuna valutazione finora

- Birla Insurance Individual Maximiser Fund December 2023Documento1 paginaBirla Insurance Individual Maximiser Fund December 2023sharmaoriginalNessuna valutazione finora

- Sebi Ankit RajDocumento77 pagineSebi Ankit RajAnkit RajNessuna valutazione finora

- Order Block Institutional Trading Practical Guide by James J KingDocumento59 pagineOrder Block Institutional Trading Practical Guide by James J KingKishor shinde75% (4)

- Model Paper 1: Question No. 1Documento11 pagineModel Paper 1: Question No. 1Ashish SinghNessuna valutazione finora

- MidtermsE 94%Documento17 pagineMidtermsE 94%jrence67% (3)

- Finance Word LibDocumento45 pagineFinance Word LibTor 2Nessuna valutazione finora

- Home Work Ch. 1Documento2 pagineHome Work Ch. 1score08Nessuna valutazione finora

- Importance of Studying Consumer BehaviorDocumento13 pagineImportance of Studying Consumer BehaviorAnjanine Busalpa FernandezNessuna valutazione finora

- Reading 9 The Firm and Market StructuresDocumento61 pagineReading 9 The Firm and Market StructuresNeerajNessuna valutazione finora

- Smart Beta Style Box Mtum en UsDocumento2 pagineSmart Beta Style Box Mtum en Us5ty5Nessuna valutazione finora

- A Beginner's Guide to Constructing the Universe: The Mathematical Archetypes of Nature, Art, and ScienceDa EverandA Beginner's Guide to Constructing the Universe: The Mathematical Archetypes of Nature, Art, and ScienceValutazione: 4 su 5 stelle4/5 (51)

- Knocking on Heaven's Door: How Physics and Scientific Thinking Illuminate the Universe and the Modern WorldDa EverandKnocking on Heaven's Door: How Physics and Scientific Thinking Illuminate the Universe and the Modern WorldValutazione: 3.5 su 5 stelle3.5/5 (64)

- Dark Matter and the Dinosaurs: The Astounding Interconnectedness of the UniverseDa EverandDark Matter and the Dinosaurs: The Astounding Interconnectedness of the UniverseValutazione: 3.5 su 5 stelle3.5/5 (69)

- A Brief History of Time: From the Big Bang to Black HolesDa EverandA Brief History of Time: From the Big Bang to Black HolesValutazione: 4 su 5 stelle4/5 (2193)

- Summary and Interpretation of Reality TransurfingDa EverandSummary and Interpretation of Reality TransurfingValutazione: 5 su 5 stelle5/5 (5)

- Packing for Mars: The Curious Science of Life in the VoidDa EverandPacking for Mars: The Curious Science of Life in the VoidValutazione: 4 su 5 stelle4/5 (1395)

- Quantum Spirituality: Science, Gnostic Mysticism, and Connecting with Source ConsciousnessDa EverandQuantum Spirituality: Science, Gnostic Mysticism, and Connecting with Source ConsciousnessValutazione: 4 su 5 stelle4/5 (6)

- Midnight in Chernobyl: The Story of the World's Greatest Nuclear DisasterDa EverandMidnight in Chernobyl: The Story of the World's Greatest Nuclear DisasterValutazione: 4.5 su 5 stelle4.5/5 (410)

- The Simulated Multiverse: An MIT Computer Scientist Explores Parallel Universes, The Simulation Hypothesis, Quantum Computing and the Mandela EffectDa EverandThe Simulated Multiverse: An MIT Computer Scientist Explores Parallel Universes, The Simulation Hypothesis, Quantum Computing and the Mandela EffectValutazione: 4.5 su 5 stelle4.5/5 (20)

- The Magick of Physics: Uncovering the Fantastical Phenomena in Everyday LifeDa EverandThe Magick of Physics: Uncovering the Fantastical Phenomena in Everyday LifeNessuna valutazione finora

- The Beginning of Infinity: Explanations That Transform the WorldDa EverandThe Beginning of Infinity: Explanations That Transform the WorldValutazione: 5 su 5 stelle5/5 (60)

- Too Big for a Single Mind: How the Greatest Generation of Physicists Uncovered the Quantum WorldDa EverandToo Big for a Single Mind: How the Greatest Generation of Physicists Uncovered the Quantum WorldValutazione: 4.5 su 5 stelle4.5/5 (8)

- Quantum Physics: What Everyone Needs to KnowDa EverandQuantum Physics: What Everyone Needs to KnowValutazione: 4.5 su 5 stelle4.5/5 (49)

- The Power of Eight: Harnessing the Miraculous Energies of a Small Group to Heal Others, Your Life, and the WorldDa EverandThe Power of Eight: Harnessing the Miraculous Energies of a Small Group to Heal Others, Your Life, and the WorldValutazione: 4.5 su 5 stelle4.5/5 (54)

- Infinite Powers: How Calculus Reveals the Secrets of the UniverseDa EverandInfinite Powers: How Calculus Reveals the Secrets of the UniverseValutazione: 4.5 su 5 stelle4.5/5 (126)

- Lost in Math: How Beauty Leads Physics AstrayDa EverandLost in Math: How Beauty Leads Physics AstrayValutazione: 4.5 su 5 stelle4.5/5 (125)

- The Holographic Universe: The Revolutionary Theory of RealityDa EverandThe Holographic Universe: The Revolutionary Theory of RealityValutazione: 4.5 su 5 stelle4.5/5 (76)

- Strange Angel: The Otherworldly Life of Rocket Scientist John Whiteside ParsonsDa EverandStrange Angel: The Otherworldly Life of Rocket Scientist John Whiteside ParsonsValutazione: 4 su 5 stelle4/5 (94)

- The Universe: The book of the BBC TV series presented by Professor Brian CoxDa EverandThe Universe: The book of the BBC TV series presented by Professor Brian CoxValutazione: 5 su 5 stelle5/5 (27)

- The Tao of Physics: An Exploration of the Parallels between Modern Physics and Eastern MysticismDa EverandThe Tao of Physics: An Exploration of the Parallels between Modern Physics and Eastern MysticismValutazione: 4 su 5 stelle4/5 (500)

- Chasing Heisenberg: The Race for the Atom BombDa EverandChasing Heisenberg: The Race for the Atom BombValutazione: 4.5 su 5 stelle4.5/5 (8)

- Mastering Logical Fallacies: The Definitive Guide to Flawless Rhetoric and Bulletproof LogicDa EverandMastering Logical Fallacies: The Definitive Guide to Flawless Rhetoric and Bulletproof LogicValutazione: 4 su 5 stelle4/5 (91)

![Mathematical Tables: Tables of in G [z] for Complex Argument](https://imgv2-1-f.scribdassets.com/img/word_document/282615796/149x198/febb728e8d/1699542561?v=1)