Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Top 9 (Unnecessary and Avoidable) Mistakes in Cash Flow Valuation

Caricato da

Alan RozenbergCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Top 9 (Unnecessary and Avoidable) Mistakes in Cash Flow Valuation

Caricato da

Alan RozenbergCopyright:

Formati disponibili

Top 9 (unnecessary and avoidable) mistakes in cash flow valuation

Joseph Tham

& Ignacio Vlez-Pareja

First version: January 29, 2004

This version: January 29, 2004

Joseph Tham is Visiting Assistant Professor at the Duke Center for International

Development (DCID), Sanford Institute for Public Policy, Duke University and a

Research Associate at the Center for International Health and Development (CIHD) at the

Boston University School of Public Health (BUSPH). Email: ThamJx@duke.edu or

ThamJx@bu.edu.

Ignacio Vlez-Pareja is Finance Professor and Dean of the Industrial Engineering

School at the Politecnico GranColombiano, Bogota, Colombia. Email Address:

ivelez@poligran.edu.co

Our book, titled Principles of Cash Flow Valuation will be published by

Academic Press in January 2004.

TopNineReasons2.doc

J.Tham, 29 January 2004

2

Abstract

In cash flow valuation (CFV), there are two main categories of mistakes:

derivation of the appropriate cash flows and estimation of the cost of capital. A simple-

minded view of the world would suggest that with near perfect capital markets, the

presence of arbitrage would severely punish wrong valuations and eradicate such

mistakes in the derivations of cash flows and estimations of the cost of capital.

Nonetheless, to the dismay of academics, such mistakes continue to exist and thrive. It is

not clear why such mistakes persist in practice.

In this paper we present our list of the top nine mistakes in cash flow valuation.

In the age of the computer these mistakes are both unnecessary and avoidable. In the

usual triumph of hope over experience, we are attempting to persuade analysts that they

would benefit from paying attention to these mistakes. Ultimately, the (un)importance of

the mistakes is an empirical question and depends on the considered judgment of

practitioners.

Word Count: 2,464

Keywords

Cost of capital, WACC, valuation

JEL Classification

D61: Cost-Benefit Analysis G31: Capital Budgeting

H43: Project evaluation

TopNineReasons2.doc

J.Tham, 29 January 2004

3

There is no harm in being sometimes wrong

especially if one is promptly found out.

John Maynard Keynes, 1883-1946

Famous rules of thumb in finance

Whenever in doubt as to what is the right P/E to use,

use 10

If you dont know the RADR, use 10 percent.

The answer to almost any troublesome finance

question should include the word risk.

When in doubt, blame the accountants.

Quoted in Benninga & Sarig Corporate finance,

pg 90.

Why did we show the book balance sheet? Only so

you could draw a big X through it. Do so now.

Brealey & Myers in Principles of Corporate

Finance, Seventh Edition, pg. 525.

Introduction

In cash flow valuation (CFV), there are two main categories of mistakes:

derivation of the appropriate cash flows and estimation of the cost of capital.

1

A simple-

minded view of the world would suggest that with near perfect capital markets, the

presence of arbitrage would severely punish wrong valuations and eradicate such

mistakes in the derivations of cash flows and estimations of the cost of capital.

Nonetheless, to the dismay of academics, such mistakes continue to exist and thrive. It is

not clear why such mistakes persist in practice.

The easiest charitable answer is that these mistakes are really simplifying

assumptions and do not matter very much, except to the academics. In other words, the

1

. For a more extensive list of mistakes, see Fernandez (2003).

TopNineReasons2.doc

J.Tham, 29 January 2004

4

assumptions roughly describe reality.

2

Moreover, in the real world the informational

deficiencies are so severe that refinements in the derivation of the cash flows and

estimations of the cost of capital would make no difference in the final analysis (or

decision) and the rough rules of thumb are sufficient for most practical purposes.

The most obvious (unsatisfactory) answer is the ignorance of the analysts.

3

In this

line of reasoning (which is the secret hope of the academics), if only the analysts realize

and are convinced that they are making mistakes, they would see the errors in their ways

and adjust their practices accordingly. And to the extent that the herd mentality

prevails, there would be a consensus among the analysts.

In spite of misgivings about the value of identifying and discussing the common

mistakes in valuation, in this paper we present our list of the top nine mistakes in cash

flow valuation and briefly and informally comment on them. In the age of the computer

these mistakes are both unnecessary and avoidable. In the usual triumph of hope over

experience, we are attempting to persuade analysts that they would benefit from paying

attention to these mistakes. Ultimately, the (un)importance of the mistakes is an empirical

question and depends on the considered judgment of practitioners.

First, we list the top nine mistakes. Second, we briefly comment on the nature of

the mistakes and how they can be easily avoided.

1. Incorrectly using WACC formulas derived from cash flows in perpetuity for finite

cash flows.

2

. Page 259, Benninga and Sarig (1997).

3

. For example, in investment decision making and capital budgeting, practitioners continue to use the

internal rate of return (IRR) and the payback period. In recent years, even the hallowed net present

value (NPV) criterion has come under heavy criticism for not taking into account option value.

TopNineReasons2.doc

J.Tham, 29 January 2004

5

2. Incorrectly constructing cash flows in real terms (or worse, in constant values)

rather than nominal terms.

3. Using book values rather than the (correct) market values to calculate the weights

for debt and equity in the Weighted Average Cost of Capital (WACC).

4. Assuming that the return to levered equity in the WACC is constant even when

the leverage is variable.

5. Specifying the return to levered equity and the return to unlevered equity as

independent parameters.

6. Incorrectly assuming that the tax shields are always realized in the year in which

they occur.

7. Not verifying that the sum of the free cash flow (FCF) and the tax shield (TS)

must equal the sum of the cash flow to debt (CFD) and the cash flow to equity

(CFE).

8. Incorrectly excluding the cash and marketable securities as part of the adjustment

for the change in the New Working Capital (NWC) in the derivation of the free

cash flow (FCF). This leads to an error in the estimation of the cash flow to equity

(CFE).

4

9. Not verifying that the sum of the present value (PV) of free cash flow (FCF) and

the PV of the tax shield (TS) must equal the sum of the PV of the cash flow to

debt (CFD) and the PV of the cash flow to equity (CFE).

4

. For example, see pg 36 in Benninga & Sarig (1997). They state Cash and marketable securities are the

best example of working capital items that we exclude from our definition of NWC, as they are the

firms stock of excess liquidity. (Italics in original)

TopNineReasons2.doc

J.Tham, 29 January 2004

6

1. Incorrectly using WACC formulas derived from cash flows in perpetuity for

finite cash flows.

This assumption is simply false and we do not understand why this error persists

in practical work. With the availability of cheap computing power, the continued

application of formulas derived from cash flows in perpetuity for finite cash flows is

inexplicable.

For example, often, analysts assume that the popular formula for the

relationship between the return to unlevered equity and the return to levered equity for

cash flows in perpetuity also hold true for finite cash flows, and consequently they use

the popular formula to calculate the return to levered equity in the WACC.

Many analysts do not realize that the appropriate discount rate for the tax shield is

implicit in the specification of the formulas for return to levered equity and the WACC.

Thus, it is very important to check for the consistency between the appropriate risk-

adjusted discount rate for the tax shield, the nature of the cash flow (finite or in perpetuity

with and without growth).

2. Incorrectly constructing cash flows in real terms (or worse, in constant

values) rather than nominal terms.

The correct way to construct cash flows is in nominal terms. However, analysts

continue to assume that the final results do not depend on whether the cash flows are

constructed in nominal or real terms.

5

In fact, the authors of many textbooks assert that

the nominal prices and real and constant prices approach give the same results, with one

important caveat on the issue of consistency between the cash flows and the discount

5

. Constructing cash flows in constant values requires the additional heroic assumption that there are no

real changes in the values of the items that constitute the cash flows.

TopNineReasons2.doc

J.Tham, 29 January 2004

7

rates. They say that the methods will give the same results as long as the nominal free

cash flows are discounted with the nominal discount rate, and the real and constant free

cash flows are discounted with the real discount rate. They also say that the cash flows

and discount rates must be consistent; if the free cash flows are nominal, then the

discount rate must be nominal, and if the free cash flows are real, the discount rate must

be real.

The consistency between the cash flows and the discount rates is NOT sufficient

to obtain identical results. Due to taxes and other issues, the present value of the cash

flows, derived from financial statements that are constructed in nominal terms,

discounted at the nominal discount rate does not equal the present value of the cash

flows, derived from financial statements that are constructed in real terms.

3. Using book values rather than the (correct) market values to calculate the

weights for debt and equity in the Weighted Average Cost of Capital

(WACC).

It is well-known that the weights in the celebrated after-tax WACC applied to the

free cash flow (FCF) are based on market values. However, analysts continue to use book

values even when the book values are not close to the market values. The use of book

values in the estimation of the WACC should be explicitly acknowledged, even if they

are employed as a last resort.

4. Assuming that the return to levered equity in the WACC is constant even

when the leverage is variable.

TopNineReasons2.doc

J.Tham, 29 January 2004

8

The return to levered equity is a positive function of the debt-equity ratio.

Analysts assume that the return to levered equity is constant even when the leverage is

obviously fluctuating widely during the life of the cash flow profile.

5. Specifying the return to levered equity and the return to unlevered equity as

independent parameters.

Some analysts specify the return to levered equity and the return to unlevered

equity as independent parameters even though they cannot be independent.

6. Incorrectly assuming that the tax shields are always realized in the year in

which they occur.

Often, analysts incorrectly assume the tax shields are always realized in the year

in which the tax shields occur, even when they know that this assumption is not true. Tax

shields are only earned when taxes are actually paid.

7. Not verifying that the sum of the free cash flow (FCF) and the tax shield (TS)

must equal the sum of the cash flow to debt (CFD) and the cash flow to

equity (CFE).

The relationship between the FCF, TS, CFD and CFE is fundamental. Yet

analysts do not bother to verify the relationship and this leads to the next mistake.

8. Incorrectly excluding the cash and marketable securities as part of the

adjustment for the change in the Net Working Capital (NWC) in the derivation of

the free cash flow (FCF); this leads to an error in the estimation of the cash flow to

equity (CFE).

Related to this relationship is the treatment of the excess cash in the business,

which is invested in short-term marketable securities. The equity holder does not actually

TopNineReasons2.doc

J.Tham, 29 January 2004

9

receive the cash that is invested in marketable securities and consequently, it must not be

included in the cash flow to equity. The cash flow to equity consists of the actual cash

flows. From the point of view of the business enterprise, the cash and marketable

securities are retained in the business, and thus they should be included as part of the

adjustment for the change in the NWC.

6

9. Not verifying that the sum of the present value (PV) of free cash flow (FCF)

and the PV of the tax shield (TS) must equal the sum of the PV of the cash

flow to debt (CFD) and the PV of the cash flow to equity (CFE).

The relationship between the present values of the FCF, TS, CFD and CFE is

fundamental. Yet analysts do not bother to verify the relationship. Furthermore, all of the

different discounted cash flow (DCF) approaches must match the results from the

Economic Value Added (EVA) approach and the Residual Income Method (RIM). As a

check on the consistency of the valuation exercise, it is important to verify that the results

from DCF methods, the EVA and RIM match.

6

. To document the existence of this error in the derivation of the CFE, we cite references from three

popular books on valuation. Earlier, we had mentioned the book by Benninga and Sarig. Damodaran

(1996) on page 101 provides the following definition for the CFE.

Revenues Operating Expenses Depreciation and Amortization Interest Taxes = Net Income

Net Income + Depreciation and Amortization Preferred Dividends Change in Working Capital

Principal payment + New debt = CFE.

Damodaran (1996) on page 99 writes: Since funds tied up in working capital cannot be used elsewhere

in the firms, changes in working capital affect the cash flows to the firm increases in working capital

are cash outflows and decreases in working capital are inflows. [] The accounting definition of

working capital includes cash in current assets. This is appropriate as long as the cash is necessary for

the day-to-day operations of the firm. Increases in cash beyond this requirement should not be

considered in calculating working capital for the purposes of cashflow calculation, since an increase in

working capital as a consequence of cash accumulating in the firm is not a cash outflow to the firm.

Copeland, T. et al. (1996) in the second edition give a similar definition to that of Damodaran.

However, Copeland, T. et al (2000) in the third edition provide a different but correct and consistent

definition, in which the sum of the FCF and the TS equals the sum of the CFE and the CFD. Simply

stated, the CFE is the sum of all the actual cashflows received or paid by the equity holder.

TopNineReasons2.doc

J.Tham, 29 January 2004

10

Conclusions

We have briefly described nine common mistakes in cash flow valuation. We

hope that the recognition of these mistakes will improve practical cash flow valuation.

References

Benninga, S. and Sarig, O. (1997) Corporate finance. McGraw Hill

Copeland, T. et al. (1995) Valuation: measuring and managing the value of companies .

Second edition, Wiley.

Copeland, T. et al. (2000) Valuation: measuring and managing the value of companies .

Third edition, Wiley.

Damodaran, A. (1996) Investment Valuation. Wiley.

Fernandez, P. (2003) 75 common and uncommon errors in company valuation. Working

Paper on Social Science Research Network (SSRN).

Tham, J. and Vlez-Pareja, I. (2004) Principles of cash flow valuation. Academic Press.

C:\ThamJx_DP\Papers\Top10Mistakes\TopNineReasons1.doc

Thursday, January 29, 2004

Potrebbero piacerti anche

- McKinsey PSTDocumento16 pagineMcKinsey PSTAlan Rozenberg88% (8)

- McKinsey PST Coaching GuideDocumento0 pagineMcKinsey PST Coaching GuideMiguelGoncalves75% (4)

- Guide To International Arbitration 2014Documento56 pagineGuide To International Arbitration 2014Eduardo Leardini Petter80% (5)

- Valuation of Farstad ShippingDocumento119 pagineValuation of Farstad ShippingAlan RozenbergNessuna valutazione finora

- CF Industries 2012 Annual ReportDocumento223 pagineCF Industries 2012 Annual ReportAlan RozenbergNessuna valutazione finora

- Renewables 2011Documento116 pagineRenewables 2011Alan Rozenberg100% (1)

- Doing Business Hungary 2012Documento26 pagineDoing Business Hungary 2012Alan RozenbergNessuna valutazione finora

- WynnResortsLimited 10K 20040315Documento135 pagineWynnResortsLimited 10K 20040315Alan RozenbergNessuna valutazione finora

- WynnResortsLimited 10K 20030328Documento180 pagineWynnResortsLimited 10K 20030328Alan RozenbergNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Edgar E. Peters - Chaos and Order in The Capital Markets - A New View of Cycles, Prices, and Market VolatilityDocumento126 pagineEdgar E. Peters - Chaos and Order in The Capital Markets - A New View of Cycles, Prices, and Market VolatilityRobertoNessuna valutazione finora

- Sales and Distribution Management Assignment 1: Sales Organisation Structure of Usha International LTDDocumento8 pagineSales and Distribution Management Assignment 1: Sales Organisation Structure of Usha International LTDVenkyBoraNessuna valutazione finora

- Corruption and Underdevelopment in AfricaDocumento14 pagineCorruption and Underdevelopment in AfricaOladayo AwojobiNessuna valutazione finora

- June 2012 Economics Unit 3 MarkschemeDocumento21 pagineJune 2012 Economics Unit 3 MarkschemeEzioAudi77Nessuna valutazione finora

- Ch 5: Risk Return Portfolio Theory Assets PricingDocumento4 pagineCh 5: Risk Return Portfolio Theory Assets PricingMukul KadyanNessuna valutazione finora

- Perpetual License vs. SaaS Revenue ModelDocumento1 paginaPerpetual License vs. SaaS Revenue ModelDeb SahooNessuna valutazione finora

- Expedia Industries Inventory Valuation MethodsDocumento1 paginaExpedia Industries Inventory Valuation MethodsJunzen Ralph YapNessuna valutazione finora

- Group Discussion Topics - Freshers, MBA, CAT, Interview EtcDocumento5 pagineGroup Discussion Topics - Freshers, MBA, CAT, Interview EtcJc Duke M EliyasarNessuna valutazione finora

- Englehart Company Sells Two Types of Pumps One Is Large PDFDocumento1 paginaEnglehart Company Sells Two Types of Pumps One Is Large PDFAnbu jaromiaNessuna valutazione finora

- Decoupling: Natural Resource Use and Environmental Impacts From Economic GrowthDocumento174 pagineDecoupling: Natural Resource Use and Environmental Impacts From Economic GrowthUnited Nations Environment ProgrammeNessuna valutazione finora

- Customer Profitability Analysis: F.M.KapepisoDocumento9 pagineCustomer Profitability Analysis: F.M.Kapepisotobias jNessuna valutazione finora

- Instructional Materials For Microeconomics: Polytechnic University of The PhilippinesDocumento10 pagineInstructional Materials For Microeconomics: Polytechnic University of The PhilippinesIan Jowmariell GonzalesNessuna valutazione finora

- Deloitte Essay Luke Oades First Draft LatestDocumento5 pagineDeloitte Essay Luke Oades First Draft Latestapi-314109709Nessuna valutazione finora

- Stock Market Valuation of Ubid and Creative ComputersDocumento2 pagineStock Market Valuation of Ubid and Creative ComputersdikaNessuna valutazione finora

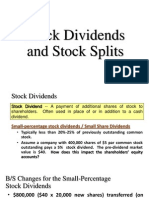

- Stock Dividends and Stock SplitsDocumento18 pagineStock Dividends and Stock SplitsPaul Dexter Go100% (1)

- Applications of Derivatives in Business and EconomicsDocumento6 pagineApplications of Derivatives in Business and EconomicsTed Bryan D. Cabagua100% (1)

- Gross ProfitDocumento3 pagineGross ProfitRafeh2Nessuna valutazione finora

- McDonald's Sustainable Supply ChainDocumento4 pagineMcDonald's Sustainable Supply Chainhimanshu sagarNessuna valutazione finora

- Public Administration EbookDocumento24 paginePublic Administration Ebookapi-371002988% (17)

- ABM 007 Applied EconomicsDocumento10 pagineABM 007 Applied EconomicsMarvin EduarteNessuna valutazione finora

- Cost, Revenue and ProfitDocumento14 pagineCost, Revenue and ProfitAhsan KamranNessuna valutazione finora

- Ial Wec12 01 Oct19Documento32 pagineIal Wec12 01 Oct19non100% (1)

- Importance of Technical and Fundamental Analysis and Other Strategic Factors in The Indian Stock MarketDocumento39 pagineImportance of Technical and Fundamental Analysis and Other Strategic Factors in The Indian Stock MarketArkajeet PaulNessuna valutazione finora

- Bank Exam Question PaperDocumento49 pagineBank Exam Question PaperSelva RajNessuna valutazione finora

- Crop Based Pricing Improves Irrigation EfficiencyDocumento304 pagineCrop Based Pricing Improves Irrigation EfficiencyAdjie Sastra NegaraNessuna valutazione finora

- CASE STUDY 2 - Failure of Venture CapitalistsDocumento8 pagineCASE STUDY 2 - Failure of Venture CapitalistsMahwish Zaheer KhanNessuna valutazione finora

- Classification and Types of Retailers According To Relative Price EmphasisDocumento9 pagineClassification and Types of Retailers According To Relative Price EmphasisKlaus AlmesNessuna valutazione finora

- 2019 Aerospace Manufacturing Attractiveness RankingsDocumento24 pagine2019 Aerospace Manufacturing Attractiveness RankingsNinerMike MysNessuna valutazione finora

- Report On Behavioral FinanceDocumento22 pagineReport On Behavioral Financemuhammad shahid ullahNessuna valutazione finora

- TO HAVE OR NOT TO HAVE, THAT IS THE QUESTION: The Unseen Dimensions of Housing Question in TurkeyDocumento31 pagineTO HAVE OR NOT TO HAVE, THAT IS THE QUESTION: The Unseen Dimensions of Housing Question in TurkeyEmrah AltınokNessuna valutazione finora