Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

GuidelinesGrant of CMS Licence 2014

Caricato da

Harpott Ghanta0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

20 visualizzazioni18 paginelaw

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentolaw

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

20 visualizzazioni18 pagineGuidelinesGrant of CMS Licence 2014

Caricato da

Harpott Ghantalaw

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 18

Monetary Authority of Singapore

SECURITIES AND FUTURES ACT

(CAP. 289)

GUIDELINES ON CRITERIA FOR THE GRANT OF A

CAPITAL MARKETS SERVICES LICENCE OTHER THAN

FOR FUND MANAGEMENT

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 1

Guideline No : SFA 04-G01

Issue Date : 1 October 2002 (Last revised on 6 March 2014)

GUIDELINES ON CRITERIA FOR THE GRANT OF A CAPITAL

MARKETS SERVICES LICENCE

1 PURPOSE

1.1 These Guidelines are issued pursuant to section 321 of the

Securities and Futures Act (Cap. 289) [SFA].

1.2 These Guidelines set out the minimum licensing requirements

under the SFA and the minimum licensing admission criteria for persons

applying for a Capital Markets Services [CMS] licence other than a

CMS licence to carry out the regulated activity of fund management.

Persons applying for a CMS licence to carry out the regulated activity of

fund management should refer to the Guidelines on Licensing,

Registration and Conduct of Business for Licensed or Registered Fund

Management Companies [SFA 04-G05].

[Amended on 22 March 2006]

[Amended on 26 November 2010]

[Amended on 7 August 2012]

1.3 These Guidelines should be read in conjunction with the

provisions of the SFA, the Securities and Futures (Licensing and

Conduct of Business) Regulations (Rg 10) and the Securities and

Futures (Financial and Margin Requirements for Holders of Capital

Markets Services Licences) Regulations (Rg 13).

2 WHO NEEDS TO HOLD A CMS LICENCE

2.1 A corporation that carries on a business in any regulated

activity in Singapore would need to hold a CMS licence under the

SFA. Individuals who are employed by or acting for the corporation

to carry out the regulated activity [other than sub-paragraphs (g)

and (h) below] are required to be an appointed, provisional or

temporary representative under the SFA.

[Amended on 22 March 2006]

[Amended on 26 November 2010]

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 2

2.2 The regulated activities are specified in the Second Schedule to

the SFA as follows:

a) Dealing in securities;

b) Trading in futures contracts;

c) Leveraged foreign exchange trading;

d) Advising on corporate finance;

e) Fund management;

f) Real estate investment trust management;

g) Securities financing;

h) Providing custodial services for securities;

i) Providing credit rating services.

[Amended on 1 August 2008]

[Amended on 17 January 2012]

2.3 The definitions of the regulated activities are provided in the

Second Schedule to the SFA.

3 CRITERIA FOR GRANT OF A CMS LICENCE

General Criteria

3.1 A CMS licence will only be granted to a corporation

1

.

[Amended on 1 August 2008]

3.2 The applicant is a reputable entity that has an established track

record in the proposed activity to be conducted in Singapore or in a

related field, for at least the past 5 years.

3.3 The applicant and its holding company or related corporation,

where applicable, has good ranking in its home country.

[Amended on 1 August 2008]

3.4 Where applicable, the applicant is subject to proper supervision

by its home regulatory authority.

[Amended on 1 August 2008]

3.5 The applicant satisfies the Monetary Authority of Singapore

[MAS] that it will discharge its duties efficiently, honestly and fairly.

1

For applicants that are incorporated in a foreign country, they should satisfy MAS that the branch in

Singapore would be subject to proper management oversight and be able to comply with all laws and

regulations governing its operations.

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 3

3.6 The applicant establishes and operates out of a physical office in

Singapore.

[Amended on 22 March 2006]

3.7 The applicant is primarily engaged in the business of conducting

any one of the regulated activities specified in the Second Schedule to

the SFA.

[Amended on 1 August 2008]

3.8 The applicant, its officers, employees, representatives and

substantial shareholders are fit and proper, in accordance with the

criteria set out in the Guidelines on Fit and Proper Criteria

2

issued by

MAS.

[Amended on 22 March 2006]

[Amended on 26 November 2010]

Criteria in respect of the Board of Directors, Chief Executive Officer and

Representatives of the Applicant

3.9 The board of directors and senior management of the applicant

should uphold good corporate governance standards and practices.

[Amended on 14 May 2010]

3.10 The applicants board of directors should comprise a minimum of

2 members, at least one of whom is resident in Singapore.

[Amended on 1 August 2008]

3.11 The chief executive officer

3

of the applicant is resident in

Singapore.

[Amended on 1 August 2008]

3.12 The applicant should obtain the approval of MAS prior to

appointing a person as its chief executive officer, its director who resides

or is to reside in Singapore, or its director who is directly responsible for

its business in Singapore.

[Amended on 1 August 2008]

2

Guideline No. FSG-G01 issued in September 2007.

3

As defined in section 2(1) of the SFA. The duties of the chief executive officer and directors are spelt

out in regulations 13 and 13A of the Securities and Futures (Licensing and Conduct of Business)

Regulations. [Amended on 6 March 2014]

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 4

3.13 The applicant should notify MAS when any of its directors who

were previously not directly responsible for the business of the applicant

in Singapore (or any part thereof) becomes directly responsible for the

business of the applicant in Singapore (or any part thereof) or otherwise

assuming any form of employment with the applicant or vice versa.

[Amended on 1 August 2008]

3.14 The applicant should inform MAS of any person ceasing to hold

office as its chief executive officer or director.

[Amended on 1 August 2008]

3.15 The applicant employs at least 2 full time individuals

in respect of each regulated activity for which the corporation

is seeking to be licensed to conduct; and

who are appointed representatives

4

for the relevant

regulated activity as required under the SFA.

[Amended on 22 March 2006]

[Amended on 26 November 2010]

Base Capital Requirements

3.16 The applicant should satisfy the base capital requirements [BCR]

for its proposed regulated activities, as set out in the Securities and

Futures (Financial and Margin Requirements for Holders of Capital

Markets Services Licences) Regulations. The BCR for each regulated

activity may also be found in Annex 1.

[Amended on 1 August 2008]

Letter of Responsibility / Letter of Undertaking Requirement

3.17 MAS may, pursuant to section 88 of the SFA, impose a condition

requiring the applicant to procure a Letter of Responsibility

5

or a Letter of

Undertaking

6

(in a form satisfactory to MAS) from its parent company.

4

As defined in section 2(1) of the SFA. Such an appointed representative has to satisfy the following

minimum entry requirements:

(a) be at least 21 years old;

(b) satisfy the minimum academic qualification and examination requirements as prescribed in

the Notice on Minimum Entry and Examination Requirements for Representatives of Holders

of Capital Markets Services Licence and Exempt Financial Institutions under the SFA (Notice

No. SFA 04-N09);

(c) satisfy the fit and proper criteria set out in the Guidelines on Fit and Proper Criteria issued by

the Authority (Guideline No. FSG-G01); and

(d) any other criteria stipulated by MAS.

5

The Letter of Responsibility is a commitment from the applicant's parent company that it will maintain

adequate oversight over the applicant's operations, financial position, compliance with laws,

management and other relevant issues.

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 5

[Amended on 22 March 2006]

Criteria Specific to Certain Regulated Activities

3.18 An applicant which is applying to carry out the regulated activity

of dealing in securities or trading in futures contracts should have

minimum group shareholders funds of S$200 million and S$100 million,

respectively.

[Amended on 6 March 2008]

3.19 [Deleted on 7 August 2012]

3.20 Where an applicant applies to carry out the regulated activity of

advising on corporate finance, MAS may impose a licence condition

requiring the applicant to purchase a Professional Indemnity Insurance

[PII] policy that complies with the requirements set out in Annex 2.

[Amended on 22 March 2006]

[Amended on 7 August 2012]

3.21 An applicant which is applying to carry out the regulated activity of

providing credit rating services will have to provide a description of how it

will observe the Code of Conduct for Credit Rating Agencies. MAS will

also impose a licence condition requiring the applicant to comply with

the Code at all times.

[Amended on 17 January 2012]

Additional Licence Conditions for Applicants which do not satisfy all

Criteria

3.22 MAS may grant a CMS licence to an applicant which does not

satisfy all the requirements set out in paragraphs 3.1 to 3.20 at the time

of application, subject to such additional conditions to be imposed

pursuant to section 88 of the SFA, such as requiring the applicant to

procure a bankers guarantee, PII or Letter of Undertaking.

[Amended on 22 March 2006]

6

The Letter of Undertaking sets out the maximum liability of the applicants parent in support of any

liquidity shortfall or other financial obligations.

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 6

4 [Deleted on 7 August 2012]

5 [Deleted on 7 August 2012]

6 CRITERIA FOR GRANT OF A CMS LICENCE UNDER THE

BOUTIQUE CORPORATE FINANCE ADVISOR SCHEME

6.1 A corporation which does not possess the corporate track record

as required under paragraphs 3.2 to 3.4, but which meets the other

relevant criteria stated in paragraph 3, may apply for a CMS licence to

carry out the regulated activity of advising on corporate finance under

the Boutique Corporate Finance Advisor [BCF] Scheme if it meets the

following requirements:

Requirements

Shareholding Must be ultimately majority-owned by

either Singapore citizens or Singapore

permanent residents. Foreign BCFs will

be considered on a case-by-case basis.

Management Expertise At least 3 corporate finance professionals

with direct and relevant experience, at

least one of whom must be a substantial

shareholder. The substantial shareholder

must have at least a 10-year acceptable

track record in corporate finance advisory

work. In addition, the other 2 corporate

finance professionals must each have at

least 5 years of experience in corporate

finance advisory work.

If the BCF intends to act as issue

manager or sponsor to applicants seeking

a listing on the SGX-ST, the substantial

shareholder must have advised on at least

5 listings in the last 10 years prior to

application, in a managerial or supervisory

capacity. In addition, at least one of the

other 2 corporate finance professionals

must have advised on at least 3 listings in

the last 5 years prior to application.

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 7

The corporate finance professionals must

also have acceptable qualifications such

as a degree or professional qualification.

Permissible Initial Public

Offerings [IPO]

Business for New

Licensees

Permitted to act as issue manager, in the

first instance, for up to 3 IPOs.

To continue to act as an issue manager

after the third IPO, the licensee needs to

demonstrate to MAS that it has put in

place measures to ensure adherence with

the applicable rules and regulations, as

well as industry best practices. This

should be supported by a certification

from an independent party who is

satisfactory to MAS.

Key Officers

7

Must be resident in Singapore, and MAS

prior approval is required for any

replacement of Key Officers.

PII In accordance with the PII requirements

set out in Annex 2.

[Amended on 22 March 2006]

7 CRITERIA FOR GRANT OF ADDITIONAL REGULATED

ACTIVITY OF DEALING IN SECURITIES FOR CMS LICENSEES

UNDER BCF SCHEME

7.1 A BCF may apply to add the regulated activity of dealing in

securities to conduct placement and underwriting in relation to IPOs for

which it is acting as issue manager, if it has brought at least 3 IPOs to

the Singapore market and has obtained a certification from an

independent party who is satisfactory to MAS that it has put in place

measures to ensure adherence with the applicable rules and regulations,

as well as industry best practices.

[Amended on 22 March 2006]

7.2 In addition, the BCF will have to satisfy the following financial and

reporting requirements:

a) Maintain a base capital of at least S$5 million;

7

Refers to the corporate finance professionals holding the requisite individual track record under the

"Management Expertise" requirement.

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 8

b) Comply with the requirements under Division 1 of the

Securities and Futures (Financial and Margin Requirements

for Holders of CMS Licences) Regulations (Rg 13); and

c) Extend its PII to cover both dealing in securities and advising

on corporate finance activities.

[Amended on 22 March 2006]

8 CRITERIA FOR GRANT OF CMS LICENCE FOR THE

REGULATED ACTIVITY OF REAL ESTATE INVESTMENT TRUST

MANAGEMENT [REIT]

8.1 Where an applicant does not meet the requirements in

paragraphs 3.2, 3.3 and 3.4, the applicant should:

a) have at least 5 years of experience in managing property

funds

8

;

b) appoint with the approval of the Trustee of the REIT, an

adviser who has at least 5 years of experience in, or 5 years

of advising on, real estate; or

c) employ persons

9

who have at least 5 years of experience in

investing in, or advising on real estate.

[Amended on 1 August 2008]

8.2 The applicant should abide by the Code on Collective Investment

Schemes.

[Amended on 1 August 2008]

8.3 The applicant should conduct the following activities, in relation to

the management of the REIT, in Singapore:

a) accounting;

b) compliance; and

c) investor relations.

[Amended on 1 August 2008]

8.4 The Singapore operations of the applicant should have a

meaningful role in the management of the REIT, relative to any other

related entities or branch offices, as the case may be, which may also

8

As defined in the Code on Collective Investment Schemes issued by MAS.

9

Such persons refer to directors and chief executive officers of the applicant, and may include the

applicants representatives. All directors and chief executive officers of the applicant are expected to

have at least 10 years of relevant experience, including 5 years at management level.

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 9

have responsibility for the management of the REIT. The following

factors are relevant but not exhaustive in MAS assessment of the role of

the Singapore operations in the management of the REIT:

a) the composition and mandates of the applicants board of

directors and management committees; and

b) the extent to which the chief executive officer and directors

who are resident in Singapore participate in the formulation

of investment strategies and financing activities of the

applicant.

[Amended on 1 August 2008]

8.5 The applicant should abide by the Code of Corporate

Governance, where applicable, in respect of listed companies

10

.

[Amended on 14 May 2010]

8.6 Where there are possible situations of conflicts of interest, the

board and senior management of the applicant should ensure that all

necessary steps are taken to avoid conflicts of interest, and should such

conflicts arise, ensure that the conflicts are resolved fairly and equitably.

The following factors are relevant but not exhaustive to MAS

assessment of conflicts of interest:

a) the roles of the chief executive officer and executive directors

in:

i) the applicant; and

ii) entities related to the sponsor of the REIT;

b) the nature of corporate governance arrangements in the

applicant, including the role of board committees and

chairpersons of these committees;

c) the roles and responsibilities of independent directors on the

board of the applicant; and

d) the adequacy of proposed mitigating measures to be

instituted by the applicant, and the disclosures made of

these measures to investors.

10

Issued on 14 July 2005, as from time to time amended, modified or supplemented. In addition,

companies listed on relevant exchanges, for instance, Singapore Exchange Limited, may be required

under the relevant Exchange Listing Rules to disclose their corporate governance practices and give

explanations for deviations in their annual reports. Applicants who manage REITs listed on the

Singapore Exchange Limited are expected to abide by the Code of Corporate Governance.

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 10

The following examples of conflict of interest are relevant but should not

be regarded as exhaustive:

a) an independent director who sits on the board of a sponsor

11

should not sit as an independent director on the board of the

applicant unless the applicant is satisfied that there are no

competing interests between the sponsor and the applicant,

for instance, because they do not invest in assets of a similar

sector or because they are not located in similar jurisdictions.

b) an independent director who sits on the board of the

applicant should not receive any shares or interests in

securities from the -

i) parent of the applicant;

ii) sponsor; or

iii) any related corporation of the applicant or the sponsor,

as part of the independent directors fees or

remuneration.

[Amended on 14 May 2010]

9 CRITERIA FOR GRANT OF CMS LICENCE FOR THE

REGULATED ACTIVITY OF PROVIDING CREDIT RATING SERVICES

9.1 The applicant should abide by the Code of Conduct for Credit

Rating Agencies.

[Amended on 17 January 2012]

9.2 The applicant should provide a description of its business model,

rating methodologies and internal code of conduct.

[Amended on 17 January 2012]

9.3 The applicant should provide a description of how it will observe

the Code of Conduct for Credit Rating Agencies and a confirmation that

it, its employees and its appointed representatives are and will continue

to be in observance of the Code of Conduct for Credit Rating Agencies.

[Amended on 17 January 2012]

11

A sponsor in relation to a REIT means the entity that develops the properties or finances the

acquisition (either directly or indirectly) of the properties for the REIT.

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 11

9.4 Where the applicant also provides other ancillary services, it

should furnish the list of ancillary services provided and an explanation

why such services do not give rise to any conflict of interest with the

applicants credit rating business.

[Amended on 17 January 2012]

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 12

Annex 1 Base Capital Requirements (BCR)

Where more than one BCR is applicable, the amount of BCR required

shall be the highest of the applicable BCRs.

(A) Dealing in Securities

Regulated Activity BCR (S$)

Dealing in securities

(clearing member for securities

12

)

5 million

Dealing in securities

(non-clearing member for securities

13

)

1 million

Dealing in securities

(non-member

14

)

1 million

Dealing in securities

(introducing broker

15

)

500,000

Dealing in securities

(restricted broker

16

)

250,000

12

Refers to a corporation which is a member of an approved clearing house authorised to operate a

clearing facility for securities. [Amended on 6 March 2014]

13

Refers to a corporation (not being an introducing broker or restricted broker) which is a member of

a securities exchange

14

Refers to a corporation (not being an introducing broker or restricted broker) which is a not a

member of a securities exchange

15

For the purposes of dealing in securities, refers to a corporation which deals in securities which

does not carry any customers positions, margins or accounts in its own books; and either (i) carries

on the business only of soliciting or accepting orders for the purchase or sale of any securities from

any customer (not being a restricted broker) or (ii) accepts money or assets from any customer as

settlement of, or a margin for, or to guarantee or secure, any contract for the purchase or sale of

securities by that customer.

16

For the purposes of dealing in securities, refers to a corporation which deals in securities which (i)

does not carry any customers positions, margins or accounts in its own books; (ii) deals in securities

only with accredited investor(s); and (iii) does not accept money or assets from any customer as

settlement of, or a margin for, or to guarantee or secure, any contract for the purchase or sale of

securities by that customer.

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 13

(B) Trading in Futures Contracts

Regulated Activity BCR (S$)

Trading in futures contracts

(clearing member

17

)

5 million

Trading in futures contracts

(non-clearing member

18

)

1 million

Trading in futures contracts

(non-member

19

)

1 million

Trading in futures contracts

(introducing brokers

20

)

500,000

Trading in futures contracts

(restricted broker

21

)

250,000

Trading in futures contracts (clearing member

limited to specified commodity futures

contracts

22

)

1 million

17

Refers to a corporation which is a member of an approved clearing house authorised to operate a

clearing facility for futures contracts, where the corporations membership is not limited to specified

commodity futures contracts. [Amended on 6 March 2014]

18

Refers to a corporation (not being an introducing broker or restricted broker in relation to trading in

futures contracts) which is a member of a futures exchange.

19

Refers to a corporation (not being an introducing broker or restricted broker in relation to trading in

futures contracts) which is not a member of a futures exchange.

20

For the purposes of trading in futures contracts, refers to a corporation which does not carry any

customers positions in futures contracts, margins or accounts in its own books, and either (i) carries

on the business only of soliciting or accepting orders for the purchase or sale of any futures contract

from any customer (not being a restricted broker); or (ii) accepts money or assets from any customer

as settlement of, or a margin for, or to guarantee or secure, any purchase or sale of futures contract

by that customer.

21

In relation to trading in futures contracts, refers to a corporation which (i) does not carry any

customers positions in futures contracts, margins or accounts in its own books; (ii) trades in futures

contracts only with accredited investors; and (iii) does not accept money or assets from any customer

as settlement of, or a margin for, or to guarantee or secure, any purchase or sale of futures contract

by that customer.

22

Refers to a corporation which is a member of an approved clearing house authorised to operate a

clearing facility for futures contracts, where the corporations membership is limited to specified

commodity futures contracts. The applicant engaged in this regulated activity may be required to

maintain and hold its financial resources [as defined in the Securities and Futures (Financial and

Margin Requirements for Holders of Capital Markets Services Licences) Regulations] [SF(FMR)] in

such manner in Singapore as may be specified by MAS. [Amended on 6 March 2014]

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 14

(C) Trading in Commodities Futures Contracts

Regulated Activity BCR (S$)

Trading in specified commodity futures

contracts only (clearing member

23

)

1 million

Trading in specified commodity futures

contracts only (non-clearing member

24

)

500,000

Trading in specified commodity futures

contracts only (non-member

25

)

500,000

Trading in specified commodity futures

contracts only (introducing broker

26

)

250,000

Trading in specified commodity futures

contracts only (restricted broker

27

)

250,000

(D) [Deleted on 7 August 2012]

(E) Other Regulated Activities under the SFA

28

Regulated Activity BCR (S$)

Carrying out real estate investment trust

management

1 million

Carrying out leveraged foreign exchange

trading

1 million

23

Refers to a corporation which is a member of a clearing house authorised to operate a clearing

facility for futures contracts, where the corporations membership is limited to specified commodity

futures contract. The applicant engaged in this regulated activity may be required to maintain and

hold its financial resources [as defined in the SF(FMR)] in such manner in Singapore as may be

specified by MAS. [Amended on 6 March 2014]

24

Refers to a corporation (not being an introducing broker or restricted broker in relation to trading in

futures contracts) which is a member of a futures exchange.

25

Refers to a corporation (not being an introducing broker or restricted broker in relation to trading in

commodity futures contracts) which is not a member of a futures exchange.

26

In relation to trading in specified commodity futures contracts, refers to a corporation which does not

carry customers positions, margins or accounts in its own books; and either (i) carries on the

business only of soliciting or accepting orders for the purchase or sale of any specified commodity

futures contract from any customer (not being a restricted broker) or (ii) accepts money or assets from

any customer as settlement of, or a margin for, or to guarantee or secure, any purchase or sale of

specified commodity futures contracts that customer.

27

In relation to trading in specified commodity futures contracts, refers to a corporation which (i) does

not carry any customers positions in specified commodity futures contracts, margins or accounts in its

own books; (ii) trades in specified commodity futures contracts only with accredited investors; and (iii)

does not accept money or assets from any customer as settlement of, or a margin for, or to guarantee

or secure, any purchase or sale of specified commodity futures contract by that customer

28

For fund management, please refer to SFA04-G05.

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 15

Carrying out securities financing

1 million

Providing custodial services for securities

1 million

Advising on corporate finance

250,000

Providing credit rating services 250,000

[Amended on 1 August 2008]

[Amended on 17 January 2012]

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 16

Annex 2 Minimum PII Requirements

1 The minimum PII coverage for a standalone non-hybrid PII,

renewable on an annual basis and valid for the licence period, shall be

as follows:

Advising on Corporate Finance (including BCF)

Revenue from advising on

Corporate Finance

31

[REVENUE](S$ million)

Minimum PII Coverage

(S$ million)

< 10 2.5

10 REVENUE < 20 5

20 REVENUE < 30 7.5

30 REVENUE < 40 10

40 REVENUE < 50 12.5

50 REVENUE < 60 15

60 REVENUE < 70 17.5

70 REVENUE < 80 20

80 REVENUE < 100 22.5

100 and above 25

[Amended on 22 March 2006]

2 The amount of PII deductible should not exceed 20% of the

applicants base capital.

[Amended on 22 March 2006]

3 If an applicant carries out both the regulated activities of fund

management and advising on corporate finance, the minimum PII

coverage is cumulative.

[Amended on 22 March 2006]

4 MAS may also consider the following alternative forms of PII, as

long as the applicant has assessed that such a PII does not undermine

the interest of investors, subject to the fulfilment of conditions specified

for each type of PII:

Guidelines on Criteria for the Grant of a Capital Markets Services Licence

Monetary Authority of Singapore 17

Type of PII Conditions to be Satisfied

Group PII Minimum coverage has to be at least 5 times

the required quantum under a standalone

non-hybrid PII.

If the deductible of the Group PII is greater

than 20% of the applicants base capital, an

undertaking from the applicants parent

company to cover the excess in the event of a

claim would be required.

Hybrid PII

29

Sub-limits have to be set for the non-PII

sections of the hybrid PII.

Total coverage under the hybrid PII less the

sub-limits for the non-PII sections has to be at

least equivalent to the required quantum

under a standalone non-hybrid PII.

Group Hybrid

PII

Sub-limits have to be set for the non-PII

sections of the Group hybrid PII.

Total coverage of the Group hybrid PII less

the sub-limits for the non-PII sections has to

be at least 5 times the required quantum

under a standalone non-hybrid PII.

If the deductible of the Group hybrid PII is

greater than 20% of the applicants base

capital, an undertaking from the applicants

parent company to cover the excess in the

event of a claim would be required.

[Amended on 24 August 2010]

5 MAS may consider a Letter of Undertaking, (in a form satisfactory

to MAS) in lieu of a PII and a Letter of Responsibility, to be procured

from the parent company if the parent company is of satisfactory

financial standing.

[Amended on 22 March 2006]

6 The liability under the Letter of Undertaking referred to in

paragraph 4 should be at least that required of the PII as stated in

paragraph 1.

[Amended on 22 March 2006]

29

A hybrid PII is a PII policy which offers coverage on PII as well as other risks, such as crime and

directors and officers liability.

Potrebbero piacerti anche

- Licensing HandbookDocumento75 pagineLicensing HandbookTan YLunNessuna valutazione finora

- Faqssf LCB R7aug2012Documento33 pagineFaqssf LCB R7aug2012Harpott GhantaNessuna valutazione finora

- Licensing HandbookDocumento88 pagineLicensing Handbookalex54321Nessuna valutazione finora

- Eligibility Criteria For A Merchant BankerDocumento2 pagineEligibility Criteria For A Merchant BankerApoorv JainNessuna valutazione finora

- Ramatex CircularDocumento16 pagineRamatex CircularnitbeNessuna valutazione finora

- Companies Act, 2013: An Insight Into Latest AmendmentsDocumento10 pagineCompanies Act, 2013: An Insight Into Latest Amendmentsvipul tutejaNessuna valutazione finora

- Licensing HandbookDocumento88 pagineLicensing HandbookajoiNessuna valutazione finora

- NewGuidelines-Guidelines FB FBR - Oct 12Documento13 pagineNewGuidelines-Guidelines FB FBR - Oct 12Zaffir Zainal AbidinNessuna valutazione finora

- Portfolio Manager CompliancesDocumento3 paginePortfolio Manager CompliancesAvantika ArunNessuna valutazione finora

- 31st Annual General Meeting Notice 10082018Documento12 pagine31st Annual General Meeting Notice 10082018pradeep motapathyNessuna valutazione finora

- Term Report: Submitted By: Dawood Khan (7830)Documento15 pagineTerm Report: Submitted By: Dawood Khan (7830)rao95_kashifNessuna valutazione finora

- SEBI Regulatory Framework For Execution Only PlatformsDocumento13 pagineSEBI Regulatory Framework For Execution Only Platformskarthik kpNessuna valutazione finora

- FAAN13 Exam Notice 30 Dec 2016Documento48 pagineFAAN13 Exam Notice 30 Dec 2016trishitalalaNessuna valutazione finora

- SC Licensing HandbookDocumento75 pagineSC Licensing HandbookYff DickNessuna valutazione finora

- C-Link Squared Limited: Breach of TrustDocumento6 pagineC-Link Squared Limited: Breach of TrustMohjamNessuna valutazione finora

- Single Registration For Depository ParticipantsDocumento2 pagineSingle Registration For Depository ParticipantsShyam SunderNessuna valutazione finora

- Co. Act - 2013: Secretarial AuditDocumento5 pagineCo. Act - 2013: Secretarial AuditofficemvaNessuna valutazione finora

- 1 July 2021 FSGG01 Guidelines On Fit and Proper CriteriaDocumento25 pagine1 July 2021 FSGG01 Guidelines On Fit and Proper CriteriasimsiyangNessuna valutazione finora

- Stock Market ListingDocumento7 pagineStock Market ListingHarsh ShahNessuna valutazione finora

- Enlistment Rules 200519092016Documento71 pagineEnlistment Rules 200519092016sendilkumarpNessuna valutazione finora

- SFA04 G05 Guidelines On FMCLicensing and Registration 7 Aug 2012Documento20 pagineSFA04 G05 Guidelines On FMCLicensing and Registration 7 Aug 2012Harpott GhantaNessuna valutazione finora

- REIT GuidelinesDocumento224 pagineREIT Guidelinesjujuwab100% (1)

- Banks Perspective On Corporate AccountsDocumento38 pagineBanks Perspective On Corporate Accountsnageswara kuchipudiNessuna valutazione finora

- Guidelines On Real Estate Investment Trusts: Issued By: Securities Commission Effective: 21 August 2008Documento162 pagineGuidelines On Real Estate Investment Trusts: Issued By: Securities Commission Effective: 21 August 2008Nik Najwa100% (1)

- RA 9178 BMBE ActDocumento69 pagineRA 9178 BMBE Actinvictusinc100% (1)

- Equity Securities: Qualifications For Listing PreliminaryDocumento15 pagineEquity Securities: Qualifications For Listing PreliminaryJayzie LiNessuna valutazione finora

- STI ETF ProspectusDocumento79 pagineSTI ETF ProspectusKang YaoNessuna valutazione finora

- Requirements For Setting Up A Merchant Bank 1. Formation of The Business OrganisationDocumento5 pagineRequirements For Setting Up A Merchant Bank 1. Formation of The Business OrganisationParul PrasadNessuna valutazione finora

- Prakas On The Registration of Securities Registrar Securities Transfer Agent... EnglishDocumento17 paginePrakas On The Registration of Securities Registrar Securities Transfer Agent... EnglishChou ChantraNessuna valutazione finora

- Mao Caro by Prafful BhaleraoDocumento9 pagineMao Caro by Prafful BhaleraoSonu BhaleraoNessuna valutazione finora

- Mirbriefing Paper PDFDocumento9 pagineMirbriefing Paper PDFPhyoe Wai KhantNessuna valutazione finora

- Online Forex BrokersDocumento7 pagineOnline Forex BrokersKay EMNessuna valutazione finora

- Pre IPO ChecklistDocumento13 paginePre IPO ChecklistNaresh PatroNessuna valutazione finora

- 2020-01 - (masCpResponse - (vcc-Sublegn-Pt2Documento18 pagine2020-01 - (masCpResponse - (vcc-Sublegn-Pt2hypetrusNessuna valutazione finora

- LPS322Dec 895Documento40 pagineLPS322Dec 895John Mel BestudioNessuna valutazione finora

- Hapter Reliminary: Inserted by The SEBI (Self Regulatory Organizations) (Amendment) Regulations, 2013 W.E.F. 07.01.2013Documento24 pagineHapter Reliminary: Inserted by The SEBI (Self Regulatory Organizations) (Amendment) Regulations, 2013 W.E.F. 07.01.2013Pratim MajumderNessuna valutazione finora

- Code-Sebi Insider TradingDocumento58 pagineCode-Sebi Insider Tradingpradeep936Nessuna valutazione finora

- GL Ava 090508Documento65 pagineGL Ava 090508randhisNessuna valutazione finora

- 2023-08-07 Sebi Faq RiaDocumento19 pagine2023-08-07 Sebi Faq Riacawojin576Nessuna valutazione finora

- © The Institute of Chartered Accountants of IndiaDocumento54 pagine© The Institute of Chartered Accountants of IndiasaraswatkomalNessuna valutazione finora

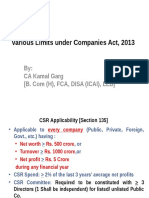

- Various Limits Under Companies Act, 2013 (CA Final)Documento61 pagineVarious Limits Under Companies Act, 2013 (CA Final)Asim JavedNessuna valutazione finora

- Notice & DRDocumento25 pagineNotice & DRvermasanjay69Nessuna valutazione finora

- LLP Settlement Scheme, 2020Documento3 pagineLLP Settlement Scheme, 2020Aseem SahniNessuna valutazione finora

- G G Engineering Limited: (CIN-U28900MH2006PLC159174)Documento25 pagineG G Engineering Limited: (CIN-U28900MH2006PLC159174)Arun GirdharNessuna valutazione finora

- Business Valuation Article May 2014Documento8 pagineBusiness Valuation Article May 2014hozefanatalwala6673Nessuna valutazione finora

- Key Highlights and Analysis: Companies Act, 2013Documento8 pagineKey Highlights and Analysis: Companies Act, 2013Arya BarmaNessuna valutazione finora

- Chapter 10Documento48 pagineChapter 10garimamittalNessuna valutazione finora

- Merchant Banking RegulationsDocumento30 pagineMerchant Banking RegulationsNiyati VaidyaNessuna valutazione finora

- Sebi GuidelinesDocumento20 pagineSebi GuidelinesShalini TripathiNessuna valutazione finora

- AuditorDocumento9 pagineAuditorRamesh RanjanNessuna valutazione finora

- Business RulesDocumento431 pagineBusiness RulesVenkatesh KgNessuna valutazione finora

- SEBI ICDR RegulationDocumento6 pagineSEBI ICDR RegulationVaishnavi ShrivastavaNessuna valutazione finora

- Abu Dhabi Global MarketDocumento4 pagineAbu Dhabi Global MarketMaryam AyomideNessuna valutazione finora

- Notes - Mergers & Acquisitions (M&A)Documento10 pagineNotes - Mergers & Acquisitions (M&A)azrin nazriNessuna valutazione finora

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisDa EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNessuna valutazione finora

- What You Must Know About Incorporate a Company in IndiaDa EverandWhat You Must Know About Incorporate a Company in IndiaNessuna valutazione finora

- Act on Special Measures for the Deregulation of Corporate ActivitiesDa EverandAct on Special Measures for the Deregulation of Corporate ActivitiesNessuna valutazione finora

- Voidable Transactions in The Context of InsolvencyDocumento7 pagineVoidable Transactions in The Context of InsolvencyHarpott GhantaNessuna valutazione finora

- Asset Based Lending in Singapore Jun 2011Documento14 pagineAsset Based Lending in Singapore Jun 2011Harpott GhantaNessuna valutazione finora

- Happy Nails Fa 1Documento14 pagineHappy Nails Fa 1Harpott GhantaNessuna valutazione finora

- ANHD 2016 Economic Opportunity PosterDocumento1 paginaANHD 2016 Economic Opportunity PosterNorman OderNessuna valutazione finora

- Okp 080114Documento4 pagineOkp 080114Harpott GhantaNessuna valutazione finora

- HSBC Institutional Trust (Trustee of Starhill Global REIT) V Toshin Deve...Documento34 pagineHSBC Institutional Trust (Trustee of Starhill Global REIT) V Toshin Deve...Harpott GhantaNessuna valutazione finora

- FileStore - Pdfstore - LectureSpeech - NUSS Professorship Lecture - FromThirdWorldToFirstDocumento26 pagineFileStore - Pdfstore - LectureSpeech - NUSS Professorship Lecture - FromThirdWorldToFirstHarpott GhantaNessuna valutazione finora

- Companies (Application of Bankruptcy Act) RegulationsDocumento3 pagineCompanies (Application of Bankruptcy Act) RegulationsHarpott GhantaNessuna valutazione finora

- Bankruptcy RulesDocumento154 pagineBankruptcy RulesHarpott GhantaNessuna valutazione finora

- Re Wan Soon Construction Pte LTD (2005) 3 SLR 375 (2005) SGHC 102Documento6 pagineRe Wan Soon Construction Pte LTD (2005) 3 SLR 375 (2005) SGHC 102Harpott GhantaNessuna valutazione finora

- Hds Standards and PracticesDocumento29 pagineHds Standards and PracticesHarpott GhantaNessuna valutazione finora

- California Bar ExamDocumento4 pagineCalifornia Bar ExamCarlo Vincent BalicasNessuna valutazione finora

- G2 - List of Videos On AdvocacyDocumento1 paginaG2 - List of Videos On AdvocacyHarpott GhantaNessuna valutazione finora

- Rules of CourtDocumento574 pagineRules of CourtHarpott GhantaNessuna valutazione finora

- SAcL IP Law SummaryDocumento15 pagineSAcL IP Law SummaryHarpott GhantaNessuna valutazione finora

- Aspen Publishers - Drafting Contracts - How and Why Lawyers Do What They Do 2E - Tina LDocumento9 pagineAspen Publishers - Drafting Contracts - How and Why Lawyers Do What They Do 2E - Tina LHarpott Ghanta20% (5)

- Ny All LocationsDocumento1 paginaNy All LocationsHarpott GhantaNessuna valutazione finora

- G2 - List of Videos On AdvocacyDocumento1 paginaG2 - List of Videos On AdvocacyHarpott GhantaNessuna valutazione finora

- Ny All LocationsDocumento1 paginaNy All LocationsHarpott GhantaNessuna valutazione finora

- (TTC) Geis - Business Statistics IIDocumento23 pagine(TTC) Geis - Business Statistics IIminh_neuNessuna valutazione finora

- StateBarRequest - Feb 2015 & July 2015Documento1 paginaStateBarRequest - Feb 2015 & July 2015Harpott GhantaNessuna valutazione finora

- The Ultimate Bar Exam Preparation Resource GuideDocumento18 pagineThe Ultimate Bar Exam Preparation Resource GuidejohnkyleNessuna valutazione finora

- Bar Exams ScheduleDocumento3 pagineBar Exams ScheduleHarpott GhantaNessuna valutazione finora

- Handwritingsample4 6 09Documento1 paginaHandwritingsample4 6 09Harpott GhantaNessuna valutazione finora

- NYS Bar Exam Online Application InstructionsDocumento4 pagineNYS Bar Exam Online Application InstructionsHarpott GhantaNessuna valutazione finora

- Andenas On European Company LawDocumento74 pagineAndenas On European Company LawHarpott GhantaNessuna valutazione finora

- Act of Congress Establishing The Treasury DepartmentDocumento1 paginaAct of Congress Establishing The Treasury DepartmentHarpott GhantaNessuna valutazione finora

- Central Bank CollateralDocumento14 pagineCentral Bank CollateralHarpott GhantaNessuna valutazione finora

- WTO Regulation of Subsidies To State-Owned Enterprises (SOEs) SSRN-id939435Documento47 pagineWTO Regulation of Subsidies To State-Owned Enterprises (SOEs) SSRN-id939435Harpott GhantaNessuna valutazione finora

- International BusinessDocumento9 pagineInternational BusinessNiraj MishraNessuna valutazione finora

- Cason Company Profile Eng 2011Documento11 pagineCason Company Profile Eng 2011Mercedesz TrumNessuna valutazione finora

- The Functional Structure 2. Divisional Structure 3. The Strategic Business Unit (SBU) Structure 4. The Matrix StructureDocumento17 pagineThe Functional Structure 2. Divisional Structure 3. The Strategic Business Unit (SBU) Structure 4. The Matrix StructureYousab KaldasNessuna valutazione finora

- SegmentationDocumento11 pagineSegmentationmridz11Nessuna valutazione finora

- BGV Form - CrisilDocumento3 pagineBGV Form - CrisilAkshaya SwaminathanNessuna valutazione finora

- Unit 7: Rules-Based Availability Check in Global Available-to-Promise (Global ATP)Documento1 paginaUnit 7: Rules-Based Availability Check in Global Available-to-Promise (Global ATP)Tanmoy KarmakarNessuna valutazione finora

- Production SystemDocumento5 pagineProduction SystemPratiksinh VaghelaNessuna valutazione finora

- MilmaDocumento28 pagineMilmaaks16_201467% (3)

- Ouano Vs CADocumento7 pagineOuano Vs CAgraceNessuna valutazione finora

- G.R. No. L-28329Documento6 pagineG.R. No. L-28329JoJONessuna valutazione finora

- Naina Arvind MillsDocumento28 pagineNaina Arvind MillsMini Goel100% (1)

- Confirmation Form: Pillar Regional Conference (NCR)Documento1 paginaConfirmation Form: Pillar Regional Conference (NCR)Llano Multi-Purpose CooperativeNessuna valutazione finora

- Damac Inventorydetail Clone PDFDocumento4 pagineDamac Inventorydetail Clone PDFAnonymous 2rYmgRNessuna valutazione finora

- Interesting Cases HbsDocumento12 pagineInteresting Cases Hbshus2020Nessuna valutazione finora

- Chapt Er: Nature and Scope of Investment DecisionsDocumento21 pagineChapt Er: Nature and Scope of Investment DecisionschitkarashellyNessuna valutazione finora

- How To Become An Entrepreneur Part 1Documento18 pagineHow To Become An Entrepreneur Part 1aries mandy floresNessuna valutazione finora

- Dollar General Case StudyDocumento26 pagineDollar General Case StudyNermin Nerko Ahmić100% (1)

- Donnina C Halley V Printwell (GR 157549)Documento22 pagineDonnina C Halley V Printwell (GR 157549)Caressa PerezNessuna valutazione finora

- Rule 16 (Motion To Dismiss)Documento36 pagineRule 16 (Motion To Dismiss)Eunice SaavedraNessuna valutazione finora

- Profile Options in Oracle Projects: System Administrator's Guide)Documento16 pagineProfile Options in Oracle Projects: System Administrator's Guide)hello1982Nessuna valutazione finora

- TNG Ewallet TransactionsDocumento12 pagineTNG Ewallet Transactionspanjun0821Nessuna valutazione finora

- DepreciationDocumento35 pagineDepreciationAlexie Gonzales60% (5)

- Accbp 100 Second Exam AnswersDocumento5 pagineAccbp 100 Second Exam AnswersAlthea Marie OrtizNessuna valutazione finora

- A Study On Financial PerformanceDocumento73 pagineA Study On Financial PerformanceDr Linda Mary Simon100% (2)

- IC Accounts Payable Ledger 9467Documento2 pagineIC Accounts Payable Ledger 9467Rahul BadaikNessuna valutazione finora

- Subcontracting With Chargeable Components ConfigurationDocumento45 pagineSubcontracting With Chargeable Components ConfigurationSamik Biswas100% (3)

- Banking InformationDocumento14 pagineBanking InformationIshaan KamalNessuna valutazione finora

- Lehman Brothers - The Short-End of The CurveDocumento20 pagineLehman Brothers - The Short-End of The CurveunicycnNessuna valutazione finora

- IP ValuationDocumento4 pagineIP ValuationAbhi RicNessuna valutazione finora

- Types of Risk of An EntrepreneurDocumento15 pagineTypes of Risk of An Entrepreneurvinayhn0783% (24)