Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Infrastructure Financing in India - Report

Caricato da

Ashwani ShahTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Infrastructure Financing in India - Report

Caricato da

Ashwani ShahCopyright:

Formati disponibili

Infrastructure Project Financing 2013

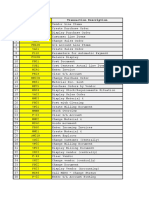

TABLE OF CONTENTS

Acknowledgement!

E"ecuti#e Summar$%

A&out Bank of &aroda'

Introduction(

Features of Infrastructure Finance)

Sources of Infrastructure Financing in India)

*rowt+ Potential,,

*o#ernment Initiati#es,!

-ig+lig+ts of .nion Budget !/,01,%,%

2oad A+ead,%

Issues 3 c+allenges constraining infrastructure funding,'

Infrastructure Financing in Ot+er Countries,)

Infrastructure Financing &$ commercial Banks,)

Ste4s in Infrastructure Finance ,)

2enewa&le Energ$ Project Finance!/

Basic Com4an$ Information0/

Project 5etails0!

Project Cost00

6eans Of Finance00

Credit A44raisal 5etails0%

TE7 Stud$ Anal$sis0(

Securit$ and Banking arrangements08

6ilestones of t+e Project08

Project Im4lementation09

2easons for dela$ in Im4lementation%,

Current Status%!

Swot Anal$sis%0

2ecommendations%%

2eferences%'

Page ,

Infrastructure Project Financing 2013

E:EC.TI7E S.66A2;

T+e fast growt+ of t+e econom$ in recent $ears +as 4laced increasing stress on

a#aila&le infrastructure suc+ as electricit$< railwa$s< roads< 4orts< air4orts< irrigation

and ur&an and rural water su44l$ and sanitation< all of w+ic+ alread$ suffer from a

su&stantial deficit from t+e 4ast in terms of ca4acities as well as efficiencies in t+e

deli#er$ of critical infrastructure ser#ices T+e econom$ can get a &oost t+roug+

im4ro#ed infrastructure T+e im4lementation of infrastructure 4rojects itself 4ro#ides

jo&s and su44orts economic de#elo4ment and it contri&utes to an im4ro#ed =ualit$ of

life for mankind

As t+ese 4rojects re=uire +uge ca4ital in#estments and t+e returns are s4read o#er

longer time +ori>ons< financing t+e e#er growing needs of infrastructure 4rojects

remains an area of t+rust ? concern

T+is re4ort t+rows lig+t on different sources of infrastructure financing a#aila&le in

India and t+eir e"4osure to infrastructure 4rojects T+e growt+ 4otential< go#ernment

initiati#es and issues and c+allenges of infrastructure financing sector are discussed

in &rief Ste4s followed in issuing finance to infrastructure finance 4rojects are

discussed along wit+ different forms of funding a#aila&le from commercial &anks

Bank of Baroda@s financing to renewa&le energ$ 4roject is taken as sam4le 4roject

and +as &een studied in details and major 4arameters w+ic+ are considered for loan

a44ro#al 3 furt+er de&t ser#icing are outlined along wit+ 4roject e"ecution details

Finall$ &ased on findings of t+e stud$ some recommendations are made

Page !

Infrastructure Project Financing 2013

ABO.T BANA OF BA2O5A

Bank of Baroda BBoBC is an Indian state1owned &anking and financial ser#ices

com4an$ +ead=uartered in 7adodara It offers a range of &anking 4roducts and

financial ser#ices to cor4orate and retail customers t+roug+ its &ranc+es and t+roug+

its s4eciali>ed su&sidiaries and affiliates in t+e areas of retail &anking< in#estment

&anking< credit cards and asset management Its total glo&al &usiness was 8</!,

&illion as of 0, 6arc+ !/,0< making it t+e second largest Bank in India after State

Bank of India In addition to its +ead=uarters in its +ome state of *ujarat it +as a

cor4orate +ead=uarter in t+e Bandra Aurla Com4le" in 6um&ai BoB +as total a

network of %!80 &ranc+es Bout of w+ic+ %,)! &ranc+es are in IndiaC and offices< and

o#er !/// AT6s

Banks Mission Statement

To &e a to4 ranking National Bank of International Standards committed to

augmenting stake +oldersD #alue t+roug+ concern< care and com4etence

Brief History:

Bank of Baroda was incor4orated in ,9/8 &$ 6a+araj Sat$ajirao *aekwad III It

launc+ed its first &ranc+ in ,9,/ in A+emada&ad In ,9'0< its first &ranc+es in

Aam4ala and 6om&asa &ecame o4erational Its o#erseas &ranc+ in Nairo&i was

o4ened in ,9'%

Products & Services:

Bank of Baroda 4ro#ides it &anking 4roducts and ser#ices in se#eral categories like

4ersonal< International &usiness< treasur$< cor4orate and rural In 4ersonal &anking

section Bank of Baroda offers 4roducts like de4osits< de&it cards< *en1Ne"t<

4ersonal &anking ser#ices< loans< lockers and credit cards

In &usiness &anking sector< Bank of Baroda offers 4roducts and ser#ices suc+ as

de4osits &usiness &anking ser#ices< loans and ad#ances and lockers In cor4orate

Page 0

Infrastructure Project Financing 2013

&anking section Bank of Baroda offers 4roducts and ser#ices like w+olesale &anking<

loans and ad#ances< de4osits and cor4orate &anking ser#ices

INT2O5.CTION

Infrastructure Financing is t+e long term financing of infrastructure and industrial

4rojects &ased u4on t+e 4rojected cas+ flows of t+e 4roject rat+er t+an t+e &alance

s+eets of t+e 4roject s4onsors .suall$< an Infrastructure 4roject financing structure

in#ol#es a num&er of e=uit$ in#estors< known as s4onsors< as well as

a s$ndicate of &anks or ot+er lending institutions t+at 4ro#ide loans to t+e o4eration

Infrastructure 4rojects differ in some #er$ significant wa$s from manufacturing

4rojects and e"4ansion and moderni>ation 4rojects undertaken &$ com4anies Some

of im4ortant features of Infrastructure Financing are discussed in ne"t section

FEAT.2ES OF INF2AST2.CT.2E FINANCE

1. onger MaturityE Infrastructure finance tends to +a#e maturities &etween ' $ears

to %/ $ears T+is reflects &ot+ t+e lengt+ of t+e construction 4eriod and t+e life of t+e

underl$ing asset t+at is created A +$dro1electric 4ower 4roject for e"am4le ma$ take

as long as ' $ears to construct &ut once constructed could +a#e a life of as long as

,// $ears< or longer

2. arger !mountsE F+ile t+ere could &e se#eral e"ce4tions to t+is rule< a

meaningful si>ed infrastructure 4roject could cost a great deal of mone$ For

e"am4le a kilometre of road or a mega1watt of 4ower could cost as muc+ as .SG ,/

million and conse=uentl$ amounts of .SG !/// to .SG !'/ 6illion B2s9// &illion

to 2s,!// &illionC could &e re=uired 4er 4roject

3. Hig"er #isk: Since large amounts are t$4icall$ in#ested for long 4eriods of time it

is not sur4rising t+at t+e underl$ing risks are also =uite +ig+ T+e risks arise from a

Page %

Infrastructure Project Financing 2013

#ariet$ of factors including demand uncertaint$< en#ironmental sur4rises<

tec+nological o&solescence Bin some industries suc+ as telecommunicationsC and

#er$ im4ortantl$< 4olitical and 4olic$ related uncertainties

$. %i&ed and o' ()ut *ositive+ #ea, #eturnsE *i#en t+e im4ortance of t+ese

in#estments and t+e cascading effect +ig+er 4ricing +ere could +a#e on t+e rest of

t+e econom$< annual returns +ere are often near >ero in real terms -owe#er< once

again as in t+e case of demand< w+ile real returns could &e near >ero t+e$ are

unlikel$

to &e negati#e for e"tended 4eriods of time w+ic+ need not &e t+e case for

manufactured goods 2eturns +ere need to &e measured in real terms &ecause often

t+e re#enue streams of t+e 4roject are a function of t+e underl$ing rate of inflation

SO.2CES OF INF2AST2.CT.2E FINANCIN* IN IN5IA

In first 0 $ears of ele#ent+ 4lan< &udgetar$ su44ort constituted H%' 4er cent of t+e total

infrastructure s4ending T+e de&t from Commercial &anks< NBFCs< Insurance Com4anies

and t+e e"ternal sources constituted H%, 4er cent of t+e funding w+ile t+e &alance ,% 4er

cent was funded t+roug+ E=uit$ and F5I

Sources of %unds for infrastructure -nvestment

Banks:

Page '

Infrastructure Project Financing 2013

T+ere +as &een a ra4id growt+ in &ank credit to infrastructure 4rojects wit+ &anks

contri&uting to t+e tune of !,I of t+e total in#estment during first 0 $ears of ,,t+ fi#e

$ear 4lan, 6ost of t+is funding +as &een 4ro#ided &$ Pu&lic Sector &anks and in

some cases t+e sectoral 4rudential ca4s +a#e almost &een reac+ed Bes4eciall$ for

4ower sectorC t+us constraining an$ furt+er lending to t+ese sectors Banks +a#e

4rudential e"4osure ca4s for infrastructure sector lending as a w+ole as well as for

indi#idual sectors

Banks ,ending to'ards infrastructure investment

.on )anking financia, com*anies (.B%/s+

O#er t+e ele#ent+ 4lan 4eriod< NBFCs lending increased s+ar4l$ 4rimaril$ due to

+ig+er demand from 4ower< telecom and roads sectors

Page (

Infrastructure Project Financing 2013

0ro't" registered )y .B%/s to'ards infrastructure investment and .B%/s

,ending

ife insurance /om*anies

Life insurance com4anies are re=uired to in#est at least ,'I of t+eir Life Fund in

infrastructure and +ousing In#estment &$ insurance com4anies in !/,! +as onl$

&een ,/I of insurance life fund A.6 w+ic+ indicates furt+er 4otential to utili>e

insurance com4anies to fund infrastructure de#elo4ment 6oreo#er insurance

4enetration is estimated to continue to rise< wit+ t+e insurance 4remium e"4ected to

grow from t+e current a44ro"imate %I of *5P to (%I of *5P &$ t+e end of t+e

twelft+ 4lan T+is will generate furt+er 4otential for infrastructure funding +owe#er it

will &e su&ject to management of 4rudential and regulator$ constraints in t+e sector

1&terna, commercia, )orro'ings (1/B2s+

T+e s+are of ECB in total infrastructure in#estments +as &een recording a decline

T+is could &e a reflection of t+e wa$ regulator$ en#ironment is #iewed &$ t+e

international in#estors T+e$ are not keen on making long term in#estments in

en#ironments w+ic+ +a#e regulator$ idios$ncrasies .nder1de#elo4ed financial

markets?4roducts ma$ +a#e also contri&uted to t+is dro4 in ECB funding

Page )

Infrastructure Project Financing 2013

S"are of 1/Bs in tota, infrastructure investment

13uity

A large 4art of e=uit$ in#estments relies on foreign in#estments wit+ domestic

in#estment institutions not s+owing significant interest in taking e=uit$ in

Infrastructure 4rojects T+e e=uit$ in#estment for t+e twelft+ 4lan 4eriod is estimated

to &e 2s %'( lak+ crores

T+ere are t+ree 4rinci4al forms of finance for infrastructure ser#ice deli#er$E

1. Pu),ic %inanceE In industriali>ed countries 4u&lic finance consists of go#ernment

4ro#iding e=uit$ financing Bseed ca4ital< in C+ina@s termsC t+roug+ general &udget

reser#es< earmarked reser#es< self1raised funds Beg licensing fee< and sale< rental

or leasing of go#ernment assetsC< and intergo#ernmental grants and fiscal transfers

5e&t financing in t+e 4u&lic finance s$stem is t+roug+ 4olic$ loans at concessional

rates< su44lier credits< and fi"ed income securities in t+e form of ta"1secured &onds

and re#enue &onds secured &$ 4roject1related re#enue streams In some cases<

4u&lic de&t financing is guaranteed &$ go#ernments eit+er e"4licitl$ or im4licitl$

2. /or*orate financeE Cor4orate finance consists of cor4orations 4ro#iding e=uit$

financing t+roug+ retained earnings and s+are+olders@ e=uit$ 5e&t financing takes

Page 8

Infrastructure Project Financing 2013

t+e form of commercial &ank &orrowing< su&ordinated de&t Bincluding con#erti&le

de&entures and 4referred stocksC< 4ri#atel$14laced &orrowing< and issuance of fi"ed

income securities T+ese securities can &e s+ort1term in t+e form of commercial

4a4er< or of longer durations in t+e form of cor4orate &onds 5e&t is secured t+roug+

collaterali>ation of cor4orate assets and assignments of recei#a&les

3. Pro4ect %inanceE Project finance consists of go#ernment< cor4orations and PPP

financing in#estments solel$ t+roug+ t+e re#enue stream of t+e infrastructure

4rojects wit+out taking recourse to go#ernment guarantees 6ost 4roject finance is

made a#aila&le &$ 4roject1s4ecific com4anies wit+ e=uit$ +eld &$ s4onsors E=uit$

takes t+e form of s4onsor in#estment in s+are ca4ital of t+e 4roject com4an$ 5e&t is

full$ secured t+roug+ t+e re#enue stream of t+e infrastructure 4rojectJ t+is stream is

assigned to lenders t+roug+ securit$ agreements wit+ trustees and does not a44ear

on s4onsor com4anies@ &alance s+eets 5e&t financing usuall$ takes t+e form of a

com&ination of &ank loans Busuall$ s$ndicated for large 4rojectsC< s4onsor loans<

su&ordinated loans< su44liers@ credits< and &onds of t+e 4roject com4an$ Cor4orate

and 4roject finance is clearl$ a44lica&le onl$ to 4ri#ate and clu& goods t$4e of

infrastructure for w+ic+ t+ere is sufficient re#enue stream t+at can &e legall$

collaterali>ed to lenders

*2OFT- POTENTIAL

Planning commission is targeting an in#estment of ', lak+ crores o#er t+e duration

of t+e twelft+ fi#e $ear 4lan w+ic+ is almost dou&le t+e amount 4ro4osed under t+e

ele#ent+ 4lan F+ile t+e s+are of 4u&lic in#estment is 4rojected to decrease from

(!I to a le#el of '0I in t+e twelft+ 4lan< t+e s+are of 4ri#ate in#estment is 4rojected

to increase from 08I Bele#ent+ 4lanC to %)I Btwelft+ 4lanC of t+e total in#estment

In com4arison to ele#ent+ 4lan< a #er$ significant growt+ BK,//IC in in#estments

BBudgetar$ 3 Pri#ateC +as &een 4rojected for Non1Con#entional Energ$< 62TS<

Ports and Storage All t+e ot+er sectors are also 4rojected to +a#e an in#estment

growt+ of K'/I Planning commission is e"4ecting 4ri#ate sector to 4la$ a ke$ role

in twelft+ 4lan wit+ an o#erall in#estment growt+ of ,0,I Pri#ate in#estment is

4rojected to grow in all t+e infrastructure sectors wit+ 2ailwa$s< Fater Su44l$<

Page 9

Infrastructure Project Financing 2013

Storage and Ports 4rojected to grow at K!//I w+ereas in#estment in ot+er sectors

is 4rojected to grow at K,//I O#erall 4ri#ate sector in#estment will &e a ke$ to

success of infrastructure de#elo4ment under twelft+ fi#e $ear 4lan

Pro4ections for investment in infrastructure for t"e t'e,ft" *,an

B2s D/// crore at !/,,1,! 4ricesC

*O7E2N6ENT INITIATI7ES

In order to &roaden t+e &ase< t+e go#ernment 4romoted Industrial Finance

Cor4oration of India BIFCIC to 4ro#ide long term ca4ital to industr$ 2eser#e Bank of

India B2BIC 4romoted Industrial 5e#elo4ment Bank of India BI5BIC for t+e same

4ur4ose Besides< Industrial Credit and In#estment Cor4oration of India BICICIC was

incor4orated in t+e 4ri#ate sector T+ese t+ree institutions were to lend mone$ for

4roject finance< w+ile &anks would su44ort t+e working ca4ital needs of industr$

In t+e ne"t 4+ase of growt+< s4ecialised institutions were created< suc+ as< E"4ort

Credit 3 *uarantee Cor4oration BEC*CC for guaranteeing e"4ort recei#a&les of

Indian industr$< S+i44ing Credit and In#estment Cor4oration of India BSCICIC for

addressing t+e financial needs of s+i44ing industr$ and E"4ort1Im4ort Bank of India

BE:I6C for financing t+e international &usiness of Indian com4anies In order to

address t+e re#i#al needs of industr$< Industrial 2e1construction Bank of India BI2BIC

was created

Page

,/

Infrastructure Project Financing 2013

.nit Trust of India B.TIC was 4romoted< among ot+er reasons< to mo&ilise mone$

from t+e 4u&lic &$ issuing mutual fund units Life Insurance Cor4oration BLICC was

created to co#er t+e li#es of Indians T+ese two institutions +ad access to long term

mone$ collected from Indians< w+ic+ were made a#aila&le for lending to Indian

industr$ T+e$ largel$ in#ested in &onds and de&entures issued &$ com4anies t+at

needed t+e mone$

Com4anies were also 4ermitted mo&ilise mone$ from t+e 4u&lic &$ acce4ting fi"ed

de4osits of u4to 0 $ears A few large com4anies and financial institutions also

managed to issue &onds and de&entures to t+e 4u&lic In t+e mid1,9)/s< w+en

go#ernment 4olic$ forced foreign com4anies to issue s+ares to Indian in#estors at

low 4rices< retail in#estors got interested in t+e e=uit$ market T+us< mone$ was

a#aila&le from &anks< financial institutions and retail in#estors< t+roug+ a mi" of de&t

and e=uit$

.ntil t+e earl$ ,99/s< all interest rates in t+e India econom$ were determined &$ t+e

*o#ernment or 2BI Similarl$< e=uit$ s+ares +ad to &e issued at a 4rice determined

&$ t+e Controller of Ca4ital Issues BCCIC Se#eral &rokers and su&1&rokers were

acti#e in mo&ilising mone$ from retail in#estors Issues of securities to t+e 4u&lic

were +andled &$ 6erc+ant Bankers *raduall$< as 4art of li&eralisation< interest rates

were freed

Currentl$< 2BI onl$ controls a few s+ort term interest rates Besides< wit+ t+e creation

of Securities and E"c+ange Board of India BSEBIC< a regulator$ framework was

created for com4anies to decide t+e 4remium at w+ic+ t+e$ would issue s+ares A

4+ase of consolidation followed< and t+e 4+enomenon of uni#ersal &anking was

introduced Some of t+e institutions mentioned a&o#e c+anged form or were merged

into ot+er institutions .ni#ersal &anks started offering a range of retail and

w+olesale &anking ser#ices< including 4ro#ision of working ca4ital and long term

finance 6erc+ant &anks +a#e mor4+ed into in#estment &anks< t+at are 4re4ared to

in#est in t+e com4anies wit+ w+om t+e$ do &usiness T+ere is a fairl$ acti#e 4rimar$

and secondar$ market in e=uit$ T+e sources of funds for industr$ +a#e grown from

domestic to international O#er t+e last few $ears< Indian com4anies +a#e also

&ecome acti#e in setting u4 4rojects outside t+e countr$ Anot+er de#elo4ment since

Page

,,

Infrastructure Project Financing 2013

t+e turn of t+e centur$ is t+e willingness of *o#ernment to work wit+ t+e 4ri#ate

sector in t+e infrastructure s4ace 6ore and more sectors are &eing t+rown u4 for

Indian 4ri#ate sector to set u4 and o4erate E#en foreign direct in#estment BF5IC u4to

,//I is 4ermitted in some sectors suc+ as 4ower< roads and +ig+wa$s

T+e *o#ernment of India reali>es t+e im4ortance of accelerating t+e in#estments in

infrastructure to &oost t+e countr$@s slowing econom$ T+erefore< it +as set a

massi#e target for dou&ling in#estment in infrastructure from 2s !) lak+ crores

Bele#ent+ 4lan L !/,,?,! 4ricesC to 2s ', lak+ crores during t+e twelft+ 4lan 4eriod<

ie< !/,!L!/,)T+e s+are of infrastructure in#estment in *5P is 4lanned to &e

increased to more t+an ,/I &$ t+e end of t+e twelft+ 4lan T+is in#estment< if it

materiali>es< can 4ro4el India@s economic growt+ to a +ig+er trajector$

-I*-LI*-TS OF .NION B.5*ET !/,01,%

Pro4osed allocation of 2s ', lak+ crores towards infrastructure in#estment

during t+e ,!t+ Plan 4eriod wit+ H%)I e"4ected to come from t+e 4ri#ate

sector

New I5F launc+ed to ta4 t+e o#erseas markets for long term 4ension and

insurance funds< for financing infrastructure 4rojects Four I5Fs +a#e &een

registered wit+ SEBI out of w+ic+ two of t+em were launc+ed in t+e mont+ of

Fe&ruar$< !/,0

2s '/</// crores target for t+e ta" free &onds for financing infrastructure

4rojects in !/,01,%< w+ic+ is less t+an t+e amount B2s (/</// croresC

assigned in t+e 4re#ious $ear

India Infrastructure Finance Cor4oration Ltd BIIFCLC< in 4artners+i4 wit+ t+e

Asian 5e#elo4ment Bank< will offer credit en+ancement to infrastructure

com4anies t+at wis+ to access t+e &ond market to ta4 long term funds

To encourage in#estment< com4anies would &e gi#en in#estment allowance

for 4rojects of 2s ,// crores or a&o#e &etween A4ril ,< !/,% and 6arc+ 0,<

!/,' T+e com4anies would &e allowed to deduct ,'I of t+e in#estment in

addition to t+e normal de4reciation rates

Pro4osal to raise cor4us of 2ural Infrastructure 5e#elo4ment Fund B2I5FC to

2s !/</// crores

Page

,!

Infrastructure Project Financing 2013

Ca&inet Committee on In#estment BCCIC +as &een set u4 to monitor and

re#iew infrastructure 4rojects

2OA5 A-EA5

A coordinated effort is re=uired from t+e go#ernment< 2eser#e Bank of India<

Securities and E"c+ange Board of India and Insurance 2egulator$ and 5e#elo4ment

Aut+orit$ BI25AC to create a #i&rant &ond market Introducing a suita&le mec+anism

for credit en+ancement ena&les cor4orate wit+ lower credit rating to access t+e &ond

market

Infrastructure de#elo4ment continues to &e t+e focus area for t+e go#ernment and in

t+e recent 4ast it +as introduced #arious 4ro4osals to catal$>e in#estments in t+e

infrastructure sector some of w+ic+ will re=uire significant infusion of funding t+roug+

4ri#ate sector In order to mo&ili>e t+e 4ri#ate funding for infrastructure de#elo4ment

a multi14ronged reform 4rocess would need to &e 4ursued In addition to significantl$

im4ro#ed ena&ling en#ironment focused s$stematic c+anges and inter#entions will

&e re=uired to &e im4lemented

ISS.ES 3 C-ALLEN*ES CONST2AININ* INF2AST2.CT.2E F.N5IN*

On t+e de&t side t+e major lenders are commercial &anks *oing forward rel$ing on

commercial &anks as major lenders is 4recarious as &anks are likel$ to &e

constrained in t+eir future lending due to t+e issue of asset lia&ilit$ mismatc+ Also

&anks +a#e not &een a&le to offer #er$ long tenure loans and t+e reset 4eriod on

t+ese loans is #er$ s+ort Finall$ t+e e"4osure norms ma$ 4re#ent &anks from

lending to large de#elo4ers in India t+ere&$ st$mieing t+e growt+ of PPP

infrastructure in India

On t+e e=uit$ side we find t+at 4romoter@s of PPP infrastructure 4rojects +a#e to 4ut

in most of t+e e=uit$ re=uirement of an infrastructure 4roject T+ere is an acute

Page

,0

Infrastructure Project Financing 2013

s+ortage of e=uit$ wit+ 4ri#ate de#elo4ers and if t+e 4resent trend continues t+en

t+e$ will not &e a&le to attract t+e re=uisite amount of de&t for t+e 4rojects .se of

su& de&t +as eased t+e e=uit$ re=uirement somew+at -owe#er< restrictions on

taking out of t+e e=uit$ &$ de#elo4ers remain a cause for concern In#ol#ement of

financial in#estors in &idding for infrastructure 4rojects is also limited at 4resent as is

t+e in#ol#ement of strategic in#estors and international com4anies

T+ere are a lot of ot+er +indrances in ac+ie#ing eas$ financing for infrastructure

4rojects in India w+ic+ are as followsE

1. Savings not c"anne,i5ed 6 Alt+oug+ India@s sa#ing rate ma$ &e as +ig+ as 0)I<

&ut almost one1t+ird of sa#ings are in 4+$sical assets Also financial sa#ings are not

4ro4erl$ c+anneli>ed towards infrastructure due to lack of long term sa#ings in form

of 4ension and insurance

2. #egu,ated 1arnings 6 Earnings from 4rojects like 4ower and toll Bannuit$C ma$

&e regulated leading to limited lucrati#e o4tions for 4ri#ate sector and difficult$ for

lenders Also an$ increase in in4ut cost o#er t+e o4erational life is #er$ difficult to

4ass on to customers due to 4olitical 4ressures

3. !sset7ia)i,ity Mismatc" 6 6ost of t+e &anks face t+is issue due to long term

nature of infrastructure loans and s+ort term nature of de4osits

$. imited Budgetary #esources 6 Fit+ widening fiscal deficit and 4assing of

F2B6 act< go#ernment +as limited resources left to meet t+e ga4 in infra financing

2est of funds +as to &e met &$ e=uit$ ? de&t financing from 4ri#ate 4arties and PS.s

8. 9nderdeve,o*ed :e)t Markets 7 Indian de&t market is largel$ com4rised of

*o#ernment securities< s+ort term and long term &ank 4a4ers and cor4orate &onds

T+e go#ernment securities are t+e largest market and it +as e"4anded to a great

amount since ,99, -owe#er< t+e 4olic$makers face man$ c+allenges in terms of

de#elo4ment of de&t markets likeE

M Effecti#e market mec+anism

M 2o&ust trading 4latform

M Sim4le listing norms of cor4orate &onds

M 5e#elo4ment of market for de&t securiti>ation

Page

,%

Infrastructure Project Financing 2013

;. #isk /oncentration 6 In India< man$ lenders +a#e reac+ed t+eir e"4osure limits

for sector lending and lending to single &orrower B,'I of ca4ital fundsC T+is

mandates need for &etter risk di#ersification and distri&ution

<. #egu,atory /onstraints 6 T+ere are lot of e"4osure norms on 4ension funds<

insurance funds and PF funds w+ile in#esting in infrastructure sector in form of de&t

or e=uit$ T+eir traditional 4reference is to in#est in 4u&lic sector of go#ernment

securities

INF2AST2.CT.2E FINANCIN* IN OT-E2 CO.NT2IES

Fit+ an understanding of w+at is +a44ening in India it is im4ortant to com4are it wit+

+ow infrastructure 4rojects are financed in ot+er countries T+is will +el4 to +ig+lig+t

t+e ga4s faced &$ t+e infrastructure financing market in India and will also 4oint to

w+at can &e done a&out t+em< &ased on t+e e"4eriences in ot+er countries

India is not uni=ue in +a#ing a su&stantial infrastructure creation re=uirement In fact

as earl$ as t+e nint+ fi#e $ear 4lan Bo#er t+e 4eriod ,99(1!///C C+ina +ad 4rojected

an infrastructure re=uirement of nearl$ .S5 0/' &illion< close to t+e infrastructure

financing re=uirement &eing 4rojected in India for t+e ,,t+ fi#e $ear 4lan And like

India commercial &anks +a#e &een t+e major source for financing t+is infrastructure

re=uirement T+e role of ot+er financial institutions and ca4ital markets +as not &een

significant It +as also &een seen t+at C+inese &anks are also resorting to using t+e

cor4orate finance model as o44osed to 4roject finance model for some infrastructure

4rojects to &ring in increased comfort

As far as ot+er Asian countries are concerned t+e infrastructure financing situation is

also not muc+ different from India Before t+e Asian economic crisis t+ere was a

significant flow of foreign currenc$ infrastructure financing< w+ic+ was arranged &$

international &anks International &ank 4artici4ation was +ig+ in a lot of countries as

Page

,'

Infrastructure Project Financing 2013

&anks followed international de#elo4ers w+o 4artici4ated significantl$ in de#elo4ing

infrastructure in t+ese countries T+e long term relations+i4 &etween international

&anks and de#elo4ers +el4ed to gi#e an additional sense of comfort in financing

4rojects Comfort was also got from #arious guarantees gi#en &$ *o#ernments to

reduce t+e risk of t+e lenders -owe#er< t+e e"4erience of t+is first round of

infrastructure de#elo4ment was &itter after t+e East Asian economic crisis +it Some

countries like Indonesia defaulted on t+e guarantees offered to 4roject s4onsors as

t+e$ were +it &$ de#aluation of t+e local currenc$ It was also reali>ed during t+e

crisis t+at man$ 4rojects +ad &een financed on t+e &asis of =uestiona&le #ia&ilit$ and

under 4ressure from t+e economic downturn a lot of t+e 4rojects suffered As

infrastructure 4rojects floundered in t+e wake of t+e crisis t+e increased risk

4erce4tion led to a significant reduction in t+e flow of ca4ital for infrastructure

4rojects in t+ese countries Fit+ international ca4ital flows dr$ing u4 t+ere +as &een

an increased reliance on domestic markets and commercial &anks in man$ countries

to 4ro#ide t+e financing needed for infrastructure 4rojects Infrastructure sector in

countries wit+ +ig+ li=uidit$ in t+e &anking s$stem +a#e &een a&le to tide t+e crisis as

local commercial &anks in t+ese countries +a#e started to take a lead in

infrastructure financing T+e major reason for reliance on t+e &anking s$stem +as

&een t+at ot+er a#enues for financing are not significantl$ de#elo4ed in t+ese

markets

C+ina +as seen t+e conse=uences of e"cessi#e reliance on commercial &anks to

lend to t+e infrastructure sector C+inese &anks are saddled wit+ #er$ +ig+ le#els of

NPAs and as a conse=uence #er$ low returns on a#erage assets T+e returns on

a#erage assets for C+inese &anks are in t+e &elow /!/ as com4ared to Indian

&anks w+ere t+ese returns range from just &elow , to significantl$ more t+an ,

Banks are sur#i#ing onl$ &ecause of t+e +ig+ le#els of li=uidit$ in t+e market and

&ecause t+e C+inese *o#ernment is strongl$ &acking t+em

Confidence of international lenders +as also slowl$ &een returning -owe#er< in t+eir

second coming international &anks +a#e often &een &eaten &$ +ig+l$ li=uid local

&anks w+ic+ +a#e &een a&le to out 4rice international &anks as well as s+own

willingness to take +ig+er le#els of risk w+ile gi#ing out 4lain #anilla 4roducts

Page

,(

Infrastructure Project Financing 2013

International &anks wit+ +ig+er financing cost as well as currenc$ risks +a#e not

&een a&le to offer t+e kind of 4roducts needed &$ t+e markets in t+ese countries

If we contrast t+e a&o#e wit+ t+e situation 4re#ailing in India it +as &een found t+at

t+ere are man$ similarities Commercial &anks lead infrastructure financing in India

like elsew+ere Also like India most ot+er de#elo4ing countries lack alternati#e

means of financing infrastructure T+ere are some countries like C+ile and 6ala$sia

w+ic+ also +a#e a strong cor4orate &ond market w+ic+ +el4s in raising infrastructure

&onds But e#en in t+ese countries t+e tenure of t+e &onds is not significantl$ more

t+an t+e tenure &eing offered &$ t+e &anks to infrastructure 4rojects in India

As t+e C+inese e"am4le s+ows large in#ol#ement of t+e &anks in financing

infrastructure can lead to deterioration in &ank finances T+us if t+e +ealt+ of t+e

&anking sector +as to &e maintained Bor im4ro#ed u4on in lig+t of Basel II guidelinesC

t+en alternati#es to &ank lending in infrastructure 4rojects will need to &e found

Also< going forward< a large 4ro4ortion of t+e infrastructure financing will &e local

currenc$ &ased e#en t+oug+ ot+er countries +a#e successfull$ im4lemented 4rojects

wit+ e"ternal commercial &orrowing T+is is &ecause in India t+e 2BI fears t+at a

significant rise in li=uidit$ in t+e market will increase t+e inflation rate w+ic+ it wants

to kee4 in c+eck Also 2BI is =uite stringent on e"c+ange risk management

F+ile it is im4erati#e t+at ot+er sources of infrastructure financing will need to &e

ta44ed in India t+ere are #er$ few successful tem4lates t+at e"ist in t+e de#elo4ing

world for de#elo4ing markets for suc+ means of financing As a conse=uence India

will +a#e to largel$ c+art its own course on t+e matter taking cogni>ance of

de#elo4ments elsew+ere T+e aim of t+e reforms will +a#e to &e to ease t+e

constraints t+at are faced in infrastructure financing

Page

,)

Infrastructure Project Financing 2013

INF2AST2.CT.2E FINANCIN* B; CO66E2CIAL BANAS

Banks +a#e traditionall$ funded t+e working ca4ital re=uirements of medium and

large industrial 4rojects -owe#er< wit+ t+e onset of financial sector reforms< &anks

+a#e e"4anded t+eir role from mere 4ro#iders of working ca4ital finance to co#er

ru4ee term loans< guarantees and to a limited e"tent foreign e"c+ange loans for

large 4rojects

As 4art of &anking sector reform< in India 2BI +as rela"ed man$ of t+e restrictions

go#erning &ank 4artici4ation in 4roject financing Since Octo&er ,99%< indi#idual

&anks are 4ermitted to gi#e long1term loans u4 to 2s ! &illion to a single 4roject

wit+out 4rior 2BI a44ro#al w+ile t+e aggregate limit for &ank lending in t+e form of

long1term loans to a single 4roject +as &een raised to 2s ' &illion T+is rela"ation

s+ould result in &anks emerging as an im4ortant source of long1term funds for

medium si>ed infrastructure 4rojects

=y*es of %unding >*tions

=?P1S >% %9.:-.0 >P=->.S !@!-!B1 %># -.%#!S=#9/=9#1 P#>A1/=

%-.!./1

Page

,8

Infrastructure Project Financing 2013

%9.: B!S1: -M-=S:

=erm oan:

As t+e name suggests< t+ese loans are gi#en for fi"ed 4eriod of time wit+ t+e

4ro#ision t+at its re4a$ment s+all also come in regular 4re1fi"ed 4eriodical

instalments w+ic+ ma$ &e e=uated or graduated T+ese loans are generall$

sanctioned for ac=uiring fi"ed assets &$ t+e 4ersons engaged in &usiness and trade

or in manufacturing or ser#icing etc T+is is a source of de&t finance for long term

4ur4ose as 4roject im4lementation takes from , $ear to 0 $ears de4ending on t+e

t$4e of 4roject and t+e loan is re4a$a&le in ' to ,/$ears T+erefore< it is also known

as NTerm Finance@ T+ese loans are generall$ re4a$a&le on t+e &asis of re4a$ment

agreement made according to t+e generation of future cas+ flow

Bank gi#es 2u4ee loans as well as Foreign Currenc$ term loan

a #u*ee currency ,oan L T+ese loans are 4ro#ided for incurring e"4enditure for

land< &uilding< 4lant 3 mac+iner$< tec+nical know1+ow< miscellaneous fi" assets<

4reliminar$ e"4enses 4re1o4erati#e e"4enses and margin mone$ for working

ca4ital

Page

,9

Non-fund Based

Letter of Credit

Bank Guarantees

Deferred Payment Guarantees

Fund Based

Term loan: Rupee Term loan

and Foreign Currency Term

loan

Demand loan

Buyers credit

Working Capital

Infrastructure Project Financing 2013

) %oreign currency ,oan L T+ese loans are 4ro#ided for meeting t+e foreign

currenc$ e"4enditure towards im4ort of 4lant< mac+iner$ and e=ui4ment< and

4a$ment of foreign tec+nical know1+ow fees

T+e 4eriodical lia&ilit$ for interest and 4rinci4al remains in t+e currenc$ of t+e loan

and is translated into ru4ees at t+e 4re#ailing rate of e"c+ange for making 4a$ments

to t+e res4ecti#e Bank?financial institutions T+ese term loans t$4icall$ re4resent

secured &orrowing Assets w+ic+ are financed wit+ t+e 4roceeds of t+e term loan

4ro#ide t+e 4rime securit$ Ot+er assets of t+e firm ma$ ser#e as additional?collateral

securit$ All loans 4ro#ided &$ &anks< along wit+ interest< li=uidated damages<

commitment c+arges< e"4enses< etc< are secured &$ wa$ ofE

a First e=uita&le mortgage of all immo#a&le 4ro4erties of t+e &orrower< &ot+

4resent and future If t+e term loan is e"tended &$ more t+an one &ank< t+en

t+e c+arge on t+e assets to t+e lenders is normall$ on N4ari 4assu@ &asis

& Second c+arge on +$4ot+ecation of all mo#a&le 4ro4erties of t+e &orrower<

&ot+ 4resent and future< su&ject to 4rior c+arges in fa#our of commercial

&anks for o&taining working ca4ital ad#ance in t+e normal course of

&usiness

To t+e general categor$ of &orrowers< &ank c+arges an interest rate t+at is

determined relating to t+e credit risk of t+e 4ro4osal< su&ject usuall$ to a certain floor

rate L generall$ Bank@s Prime Lending 2ate BBPL2C Interest is c+arged on a

mont+l$ &asis and de4ending on t+e terms of t+e 4roject< eit+er ca4itali>ed or

ser#iced during t+e dis&ursement 4eriod

T+e interest &urden decline o#er time on account of re4a$ment of t+e 4rinci4al<

w+ere as 4rinci4al re4a$ment ma$ remain constant if &ased on e=ual installments

Princi4al re4a$ment ma$ #ar$ if t+e re4a$ment is fi"ed on &allooning terms w+ic+

conse=uentl$ de4ends on t+e cas+ flow from t+e 4roject T+us t+e total de&t

ser#icing &urden declines o#er time

:emand oan:

Page

!/

Infrastructure Project Financing 2013

T+is is t+e fund demanded instantaneousl$ &$ &orrower due to uncertain c+anges in

t+e situation Beg economic downturn< inflation< 4rice rise in manufacturing 4roduct

etcC T+is is t+e loan Bsuc+ as an o#erdraftC wit+ or wit+out a fi"ed maturit$ date< &ut

w+ic+ can &e recalled an$time &$ t+e lender and must &e 4aid in full on t+e date of

demand T+is is generall$ not used for 4roject finance &ut its rele#ance wit+ 4roject

finance &ecomes more im4ortant in ad#erse situations if term loan is alread$

financed for t+e 4roject T+ese loans are generall$ re4a$a&le on t+e &asis of

re4a$ment agreement go#erned under negotia&le instruments Beg Promissor$

Notes< Bills of E"c+ange< etcC 5uration of t+ese loans is generall$ ,10 $ears

Buyers /redit:

According to FE6A guidelines on Trade Credits< Bu$er@s Credit refers to loans for

4a$ment of im4orts into India arranged &$ t+e im4orter from a &ank or financial

institution outside India for maturit$ of less t+an t+ree $ears

Bu$er@s credit for im4orts of raw material?non ca4ital goods into India can &e

a#ailed for ma"imum 4eriod of one $ear and Bu$er@s credit for ca4ital goods

can &e a#ailed for ma"imum 4eriod of less t+an t+ree $ears

T+e credit can &e raised irres4ecti#e of w+et+er im4ort takes 4lace under an

arrangement of letter of credit issued &$ a &ank in India or w+et+er t+e su44lier

sends t+e &ills on collection &asis

.nder t+e &u$er@s credit arrangement< t+e e"4orter ie su44lier of t+e goods

recei#es 4a$ment instantl$ in case of sig+t documents and on due date of t+e

drafts?&ills

Bu$er@s Credit is arranged for a maturit$ of less t+an t+ree $ears No roll

o#er?e"tension is 4ermitted &e$ond t+e 4ermissi&le 4eriod Bu$er@s credit for

t+ree $ears and a&o#e comes under t+e 4ur#iew of ECB< w+ic+ are strictl$

go#erned &$ ECB guidelines of 2BI

Page

!,

Infrastructure Project Financing 2013

Borking /a*ita, %inance:

A firmDs working ca4ital is t+e mone$ it +as a#aila&le to meet current o&ligations

Bt+ose due in less t+an a $earC and to ac=uire earning assets Banks offers

cor4orations Forking Ca4ital Finance to meet t+eir o4erating e"4enses< 4urc+asing

in#entor$< and recei#a&les financing

.>. %9.: B!S1: -M-=S:

etter >f /redit:

A letter of credit is a commercial instrument of assured 4a$ment and widel$ used &$

t+e &usiness communit$ for its #arious ad#antages It is an instrument &$ w+ic+ a

&ank undertakes to make 4a$ment to a seller on 4roduction of documents sti4ulated

in t+e credit T+e credit s4ecifies as to w+en t+e documents are 4resented to t+e

4a$ing &ank or at some future date< de4ending u4on t+e terms sti4ulated in t+e

credit

Bank 0uarantee:

*uarantee is a contract to e"ecute t+e 4romise< or disc+arge t+e lia&ilit$ of a t+ird

4erson in case of +is default In t+e ordinar$ course of &usiness< t+e &ank often

issues guarantees on &e+alf of its customers in fa#our of t+ird 4arties F+en t+e

&ank issues suc+ a guarantee< it assumes a res4onsi&ilit$ to 4a$ t+e &eneficiar$< in

t+e e#ent of a default made &$ t+e customer A &ank guarantee ena&les t+e

customer Bde&torC to ac=uire goods< &u$ e=ui4ment< or draw down loans< and

t+ere&$ e"4and &usiness acti#it$

:eferred Payment 0uarantee:

A deferred 4a$ment guarantee is a contract under w+ic+ a &ank 4romises to 4a$ t+e

su44lier t+e 4rice of mac+iner$ su44lied &$ +im on deferred terms< in agreed

installments wit+ sti4ulated interest in t+e res4ecti#e due dates< in case of default in

4a$ment t+ereof &$ t+e &u$er

Page

!!

Infrastructure Project Financing 2013

STEPS IN INF2AST.2.CT.2E FINANCE

Page

!0

u!mission of "pplication !y t#e !orro$er

Preliminary %nformation Collection&

%nformation 'emorandum

Pro(ect "ppraisal

Risk 'easurement and Rating

Preparation of Final proposal

Infrastructure Project Financing 2013

1. Su)mission of !**,ication )y )orro'er:

T+e &orrower a44roac+es t+e &ank wit+ t+e 4ro4osal to finance a 4roject Borrower

+as to gi#e a written a44lication in fa#our of &ranc+ +ead containing t+e &rief

information of a44licant< com4an$< industr$< a&out Project< Project duration and fund

re=uirement from t+at &ank

2. Pre,iminary -nformationC -nformation Memorandum:

T+e &orrower +as to 4ro#ide t+e Bank wit+ t+e 4reliminar$ information T+e &orrower

+as to 4re4are a detailed 4roject re4ort< w+ic+ is su&mitted to t+e &ank and on t+e

&asis of w+ic+ t+e final re4ort is 4re4ared In case of a s$ndication arrangement< t+e

lead arranger 4re4ares an Information 6emorandum in consultation wit+ t+e

&orrowing entit$

3. Pro4ect !**raisa,:

Page

!%

Proposal for$arded to t#e sanctioning

aut#ority

Proposal re(ected anctioned

anction Letter issued

Documentation ) Dis!ursement

Credit monitoring* uper+ision and

Follo$,up

Infrastructure Project Financing 2013

A detailed and critical a44raisal of t+e 4roject is necessar$< &efore taking a final

decision a&out financing an$ 4roject< w+et+er indi#iduall$ or jointl$ T+e a44raisal

met+odolog$ of t+e &anks s+ould kee4 4ace wit+ e#er c+anging economic

en#ironment and also addresses t+e #arious t$4es of risks #i> industr$< &usiness<

financial< management etc

Bank +as to ensure t+at t+e 4eo4le &e+ind t+e 4roject +a#e t+e re=uired knowledge

and e"4ertise in t+e 4ro4osed line of acti#it$< enoug+ owned funds to meet t+e

4romoters contri&ution T+e 4rojections su&mitted &$ t+e 4romoters s+ould &e

realistic and ac+ie#a&le and t+e 4roject must +a#e enoug+ sur4lus generation to

ser#ice de&t in a reasona&le 4eriod of time after meeting t+e normal &usiness

e"4enditures

F+ile doing a44raisal of an$ 4roject< t+e following four fundamentals are carefull$

studied and e"aminedE

BiC Tec+nical A44raisalE

Tec+nical A44raisal of a 4roject is essential to ensure t+at necessar$ 4+$sical

facilities re=uired for 4roduction will &e a#aila&le and t+e &est 4ossi&le

alternati#e is selected to 4rocure t+em

BiiC Commercial A44raisalE

In order to +a#e a 4ro4er a44raisal of t+e demand forecast made &$

&orrowers< t+e term lending institutions would re=uire information regarding

demand< su44l$< distri&ution< 4ricing and e"ternal forces

BiiiC 6anagement A44raisal

Banks gets information a&out t+e com4an$< its &rief +istor$< &usiness

acti#ities< Business model< details of t+e 4romoters< Board of directors<

s+are+olding 4attern< ca4ital structure etc

Bi#C Financial A44raisalE

Page

!'

Infrastructure Project Financing 2013

Financial a44raisal is used to e#aluate t+e #ia&ilit$ of a 4ro4osed 4roject &$

assessing t+e #alue of net cas+ flows t+at result from its im4lementation

Financial a44raisal measures t+e direct effects on t+e cas+ flows of t+e

organi>ation of an in#estment decision

$. #isk Management and /redit #ating:

Credit risk is defined as t+e 4ossi&ilit$ of losses associated wit+ t+e reduction of

credit =ualit$ of &orrowers or counter14arties In a &ank@s 4ortfolio< losses arise from

outrig+t default due to ina&ilit$ or unwillingness of a customer or counter14art$ to

meet commitments in relation to lending< trading settlements< or an$ ot+er financial

transaction Alternati#el$< losses occur due to deterioration in credit =ualit$

Banks are 4ermitted a c+oice &etween ! &road met+odologies for calculating t+eir

ca4ital re=uirements for credit risk One met+od is to measure credit risk in a

standardi>ed manner &ased on e"ternal credit rating T+e ot+er met+od< #i> Internal

2ating Based BI2BC a44roac+< would allow t+e &anks to use t+eir internal rating

s$stem for credit risk T+is will &e su&ject to t+e e"4licit a44ro#al of t+e &ank@s

su4er#isor

A credit rating estimates t+e credit wort+iness of an indi#idual< cor4oration< or e#en a

countr$ Credit ratings are calculated from financial +istor$ and current assets and

lia&ilities T$4icall$< a credit rating tells a lender or in#estor t+e 4ro&a&ilit$ of t+e

su&ject &eing a&le to 4a$ &ack a loan A 4oor credit rating indicates a +ig+ risk of

defaulting on a loan< and t+us leads to +ig+ interest rates or t+e refusal of a loan &$

t+e creditor

8. Pre*aration of %ina, Pro*osa,

Once t+e 4roject is a44raised< t+e final 4ro4osal is 4re4ared &$ t+e credit officer T+e

final 4ro4osal 4re4ared at t+e &ank contains t+e following details regarding t+e

4roject likeJ details a&out t+e &orrower< 5escri4tion a&out t+e management and

names of t+e 4eo4le w+o constitute t+e &oard< t+e 4ur4ose for w+ic+ t+e loan is

taken< securit$ 4ro#ided &$ t+e &orrower< financial indicators< t$4es of risk faced &$

t+e 4roject etc

Page

!(

Infrastructure Project Financing 2013

;. Pro*osa, %or'arded to t"e Sanctioning !ut"ority

Once t+e credit officer 4re4ares t+e final 4ro4osal< it is sent to t+e sanctioning

aut+orit$ It is t+en eit+er a44ro#ed or rejected &$ t+e sanctioning aut+orit$ If

sanctioned it gets a44ro#al wit+ recommended 2ate of Interest B2OIC< concessionar$

fees< securities to mortgage?4ledge< etc After recommendation it is sent &ack to

&ranc+

<. Sanction etter -ssued

As soon as financial assistance is sanctioned< a letter of intent is issued to t+e

a44licant In addition to usual terms and conditions< s4ecial conditions are

incor4orated in t+e letter of intent to co#er weak links< if an$< noticed at t+e a44raisal

stage

D. :ocumentation and :is)ursement:

E"ecution of loan agreement and ot+er necessar$ legal documents is #er$

necessar$ for dis&ursing t+e amount T+e term lending institutions s+ould ensure

t+at t+e amount dis&ursed will &e utili>ed for t+e 4ur4ose for w+ic+ it +as &een

sanctioned

E. Su*ervision and %o,,o'7u*:

Project su4er#ision and Follow1u4 of assisted 4rojects during and after

im4lementation is indeed a crucial e"ercise to &e 4erformed 4eriodicall$ wit+

meticulous care< not onl$ to safeguard t+e interests of t+e term1 lending

institutions &ut also to ensure o4timi>ation of returns on t+e total in#estment in

t+e 4roject

Page

!)

Infrastructure Project Financing 2013

2ENEFABLE ENE2*; P2OOECT FINANCE

BBank of Baroda@s ClientC

T+e com4an$ +ad a44roac+ed Bank of Baroda for 4roject financing re=uirement for

t+eir renewa&le energ$ 4roject &ased in 2ST T+is section outlines all t+e rele#ant

information a&out t+e com4an$ 3 4roject under different +eads

BASIC CO6PAN; INFO26ATION

T+is section contains t+e &asic com4an$ information suc+ as t+e Com4an$ name<

+ead=uarters< etc

Page

!8

1 Name of

the entity

and

Address

M/s. XYZ Pvt. Ltd.

Reg. Off. /Corp. Off. LI*1A<0(E1(< Arera Colon$< B+o4al<

6ad+$a Prades+1%(!/,(

Corporate Off. '/,< Centrium< Plot No!)< Sector1,'< CBO

Bela4ur< Na#i 6um&ai1%//(,%

5ate of Incor4orationE ,'1/'1!//'

! Constit"tion Private Limited Company

# $nd"stry/

Line of

A%tivity/

Nat"re of

&"siness

'eneration of rene(a)*e e*e%tri%ity+ 'as )ased

, 'ro"p/

Promoter

-ire%tors

Promoter M/s A&C Pvt. Ltd.

-ire%tors Mr. P.R

Shareholding Pattern:

Name of

Shareholder

No. of Shares of

face value of

Rs.10

Value in Rs.

-ire%tor 1 1/.//

M/s. A&C #011111 #011111/.//

Total 37,00,000 3,70,00,000

Infrastructure Project Financing 2013

om!an" #ac$ground:

M/s Ci%on 2nvironment 3e%hno*ogies Ltd 4%ons"*ting %ompany5 (as in%orporated in

&hopa* in the fie*d of 6o*id 7aste Management. 3he said %ompany entered into

agreement (ith R63 M"ni%ipa* Corporation 4R63MC5 on /8 /, !//, for $nsta**ation

of M"ni%ipa* 7aste 9and*ing P*ant in R63 thro"gh an 6P: to )e formed to ena)*e

the Corporation to ta;e %are of hea*th and hygiene of the inha)itants of the %ity. $t

(as on &OO3 4&"i*d< O(n< Operate = 3ransfer5 )asis.

A%%ording*y< an 6P: named M/s XYZ Private *imited (as formed and *ease

agreement (ith R63 M"ni%ipa* Corporation (as entered into on /1 />.!//, for

6o*id 7aste of #?/ 3ons per -ay4@/+ !/A5. M/s. XYZ Pvt Ltd (as in%orporated on

1!./?.!//? in &hopa* 4MP5 to eBe%"te this proCe%t. Present ;ey promoter dire%tor of

6&26 is Mr. P.R.

M/s -2D Pvt *td (as in%orporated on 11 /0 !//8 as a Coint vent"re )et(een a team

of te%hno%rats5 and a gro"p of investors. 3his %ompany is %"rrent*y non+operationa*.

9o(ever< at the time of san%tion of the ear*ier term *oans< %orporate g"arantee (as

stip"*ated.

M/s -2D Pvt Ltd de%ided to spread their a%tivities gro"p (ise and a%%ording*y they

formed a ne( %ompany tit*ed M/s A&C Pvt Ltd on !1./8.!//8. 3he %ompany has

its main o)Ce%t to %arry on the )"siness of promotion and deve*opment of non

%onventiona* energy so"r%es and "*timate*y they too; over M/s XYZ Pvt Ltd and

are the deve*opers of the said proCe%t.

Page

!9

Infrastructure Project Financing 2013

P2OOECT 5ETAILS

T+e details a&out t+e 4roject< its &ackground< and im4lementation details are

s4ecified to gi#e an o#er#iew of t+e 4roject

%NTR&'(T%&N:

3his proCe%t has )een set "p "nder PPP mode* to %onvert m"ni%ipa* so*id (aste

4M675 generated in R63 %ity into energy p*"s %ompost. C"rrent %apa%ity of the p*ant

is p*anned to )e , M7. 3he M67 is provided free of %ost )y R63 M"ni%ipa*

Corporation. Ender Fyoto proto%o*< the proCe%t (i** generate %aro) %redits as the

proCe%t traps methane (hi%h other(ise (o"*d go into atmosphere.

%N'(STR) P*R*PT%&N:

6o*id (aste hand*ing has )een %a"se of %on%ern g*o)a**y. :ario"s methods are

)eing "sed for treatment of so*id (aste.

3here are %onstant efforts made to "se these (aste prod"%ts p"rposef"**y. :ario"s

methods are adopted (hi%h in%*"de %omposting< 'asifi%ation< in%ineration< )io

methanation et%. &io Methanation is the *atest method "nder (hi%h the re%y%*a)*e

so*id (aste is "ti*iGed for generation of e*e%tri%ity and the )y prod"%t is high H"a*ity

ferti*iGer. 6in%e this method has many advantages over the ear*ier methods< it is

)e%oming pop"*ar a** over the (or*d.

$n $ndia a*so the separate ministry has )een set "p as Ministry of Rene(a)*e 2nergy

6o"r%es (hi%h is monitoring the gro(th of this se%tor. 'overnment is giving f"**

s"pport to any s"%h proCe%ts and there are s")sidies and other )enefits avai*a)*e. As

it is an a%tivity invo*ving h"ge %apita* eBpendit"re and te%hni%a* %ompeten%e the

%ompetition is %omparative*y *o(er.

Technolog":

Page

0/

Infrastructure Project Financing 2013

Com4an$ uses Bio1met+anatlon BAnaero&ic digestionC tec+nolog$ in t+e

4roject w+ic+ is ranked as no , tec+nolog$ for treatment of 6SF as 4er

National 6aster Plan issued &$ go#ernment of India

T+e 4roject In#ol#es an e"tensi#e 4re1treatment BsegregationC of 6SF Into

organic and Inorganic waste T+e organic fraction of t+e waste is fed to a

digester w+ic+ 4roduces met+ane in time 4eriod of ,% da$s and is used to

o4erate tur&ines and generate electricit$ 2esidual =ualit$ of t+e waste Bslurr$C

4ost digestion is aero&icall$ treated to 4roduce +ig+ =ualit$ fertili>er T+us t+e

4roject would +a#e dou&le a44lication ie +andling of solid Faste and also to

generate electricit$ and 4roducing fertili>er

P2OOECT COST

T+e 4roject cost is detailed wit+ t+e &reak1u4 for #arious 4ur4oses

Particulars +ctual ,Rs. crore-

&"i*ding = %ivi* (or; 1#.81

P*ant = Ma%hinery #!.1,

Dees for 3e%hni%a* servi%es = other proCe%t

deve*opment eBpenses

1/.#!

ProCe%t finan%e eBpenses = interest d"ring %onstr"%tion 1.?,

T&T+. /0.12

6EANS OF FINANCE

6eans of finance 4ro#ides clarit$ on +ow t+e 4roject is 4ro4osed to &e financed It

also gi#es an indication of t+e s4onsor@s contri&ution to t+e 4roject and grants

recei#ed Bif an$C

Page

0,

Infrastructure Project Financing 2013

Sources of 3und +mount ,Rs. in crores-

6hare Capita* !!.1,

Ense%"red Loans ?.##

3erm Loan+$ form &an; of &aroda 4Origina*5 !!.?

3erm Loan+$$ from &an; of &aroda4for

%apa%ity eBpansion5

8.#/

Dresh term *oan+$$$ for a%hieving -/2 to

>/#/

0.8!

Total /0.12

C2E5IT APP2AISAL 5ETAILS

Periodic credit a44raisal of t+e com4an$ is carried out &ased on following

4arameters Bank of Baroda uses read$ module 4ro#ided &$ C2ISIL

-ndustry #isk

5emand ? Su44l$

*o#ernment Polic$

Com4etiti#e En#ironment

Business #isk

6arket Position

En#ironmental ? Social Im4act

Counter4art$ 2isk

Cost &ase of 4roject

Off take risk

O4erating efficienc$

Page

0!

Infrastructure Project Financing 2013

/om*,etion #isk7 Bui,d P"ase

Funding 2isk

Financial Fle"i&ilit$

Financial Closure

Clearances

*estation Period

1&ecution #isk7 Bui,d P"ase

Tec+nolog$

2e4utation of design consultant

Contractor e"4erience

Contractor@s creditwort+iness

Safeguards in contract

Sta)i,i5ation #isk7 Bui,d P"ase

S4onsor 2isk

Project criticalit$ risk

6anagement =ualit$ risk

%inancia, #isk7 Bui,d P"ase

5egree of e"4osure to interest 2isk

Currenc$ 2isk

2easona&ilit$ of 4roject assum4tions

Internal rate of return1Build 4+ase

Project 5e&t to e=uit$1Build 4+ase

Sensiti#it$ to re#enue1Build 4+ase

Page

00

Infrastructure Project Financing 2013

Sensiti#it$ to cost1Build 4+ase

Based on t+e a&o#e factors t+e 4roject@s current rating is as followsE

S6E 1Non 2egulator$ L O&ligor 2ating L BOB /(

Cas+ Credit

Facilit$ 2atings F2 /!

Com&ined 2atings C2 /'

B>B 0; E In#estment grade moderate safet$

%# 02 : -ig+er Safet$

/# 08 : Ade=uate co#era&le e"4ected loss

Based on t+e com&ined rating t+e interest rate to &e offered is linked to &ase rate

w+ic+ is currentl$ Base #ate F ;.28G. Ie ,/!' P (!' Q ,('I

TE7 ST.5; ANAL;SIS

TE7 stud$ for t+e said 4roject was carried out &$ Project Finance 5e4artment of

Bank of Baroda during 6arc+ !//9 for ca4acit$ of 0// TP5 waste and t+e 4roject

was found to &e tec+no1economicall$ #ia&le It was 4ro4osed t+at com4an$ s+all

com4lete construction of t+e 4roject and commence commercial o4eration -owe#er<

as 4er original TE7 stud$ dated !//0!//9< t+ere was e"4ected to &e a dela$ of

around ( mont+s -owe#er during t+e course of im4lementing t+e 4roject< t+e

com4an$ +as 4ro4osed to en+ance t+e ca4acit$ of 4lant to % 6F estimating

a#aila&ilit$ of around %// TP5 of 6unici4al Solid Faste from 2ST 6unici4al

Cor4oration Fit+ 4ro4osed en+ancement< t+e total cost of 4roject is estimated at

2s'0)% crores as against t+e original estimation of 0// TP5?0 6F 4lant at

2s%/89 crores Fit+ t+e re#ised estimated cost once again TE7 stud$ was carried

out T+e summar$ of anal$sis made during TE7 stud$ is as underE1

Project was assessed in terms of risks< uncertaint$ and sensiti#it$

Page

0%

Infrastructure Project Financing 2013

SFOT anal$sis for t+e 4roject was done

2e4ort +ad &een discussed in detail a&out t+e tec+nical as4ects of t+e 4roject

including t+e 4rocess of manufacturing

7arious re=uirements of resources are taken into account along wit+ t+e

4ro4osed e"4enditure

Ca4acit$ utili>ation is considered at realistic le#els and t+e sales #olume is

calculated in accordance wit+ t+e same

Economic #ia&ilit$ of t+e 4roject +as &een worked out on t+e &asis of different

met+ods

Sensiti#it$ anal$sis for t+e 4roject was carried out

2e#ised estimated 4roject cost of 2s'0)% crores is 4ro4osed to &e funded

wit+ total term loan of 2s0,// crores and 4romoters contri&ution of 2s!!)%

crores BPreference S+are Ca4ital of 2s,9/% crores and e=uit$ s+are ca4ital

of 2s0)/ croresC

In #iew of increased =uantit$ of generation and collection of waste< com4an$

modified its design 4arameters from t+e original 4lan of ! lines of ,'/ TP5

eac+ for 0// TP5 of waste to an installed ca4acit$ of two lines of !// TP5

eac+ for %// TP5 waste T+e c+ange in design 4arameters +as meant t+at

si>ing of all e=ui4ments +as c+anged and some additional

e=ui4ment?au"iliaries are re=uired including one gas engine

T+e re#ised ci#il cost to &e certified &$ &ank@s em4anelled arc+itect Suita&le

condition sti4ulated

T+e com4an$ +as o&tained major a44ro#als for setting u4 t+e 0// TP5?0 6F

4lant -owe#er< t+e same would &e re=uired to &e suita&l$ amended? modified

for t+e en+anced ca4acit$ of %// TP5? % 6F of t+e 4lant

SEC.2IT; AN5 BANAIN* A22AN*E6ENTS

Page

0'

Infrastructure Project Financing 2013

Primar" Securit":

-$4ot+ecation of Plant and mac+iner$ created out of &ank financeC

E=uita&le mortgage of land and &uilding leased

B* 6argin

ollateral:

2H"ita)*e mortgage of Offi%e in Andheri

D-Rs

P*edge of 1,<8/</// Redeema)*e Preferen%e shares 4Rs.1//+ per share5

amo"nting to Rs.1.,8 %rores o(ned )y M/s.A&C Pvt *td and #><//</// eH"ity

shares of the %ompany f"**y paid "p amo"nting to Rs.#>/.// *a%s.

M$L263ON26 OD 392 PROI2C3

Concession Agreement was entered in !//% wit+ 2ST 6unici4al

Cor4oration to 4ro#ide 0'/ BP?1 !/IC TP5 of 6unici4al Solid Faste B6SFC

free of cost Concession Agreement 4eriod is !9 $ears and ,, mont+s

Land lease Agreement was entered in !//% and t+e site of t+e 4roject +as

&een allotted &$ 2ST 6unici4al Cor4oration at Tulja4ur 2oad< 2ST of 9 acres

of land Lease 4eriod is !9 $ears and ,, mont+s

2ent 4a$a&le to 2ST6C was 2s ,?1 4er s= mtr as 4er guidelines of

6inistr$ of Non Con#entional Energ$ Sources< *o#ernment of India and as

4er t+e Lease Agreement

First Term Loan of 2s !!'/ crores Bwit+ 4roject costing 2s %, ,) crores 3

5E ratio of B''E%'C for setting u4 t+e 0// TP5 4lant was sanctioned &$ Bank

of Baroda in Oune !//9

T+e com4an$ +as signed Power Purc+ase Agreement dated !%/0!/,, wit+

6a+aras+tra State Electricit$ 5istri&ution Com4an$ B6SE5CC wit+ installed

ca4acit$ of !80 6F and t+e 4urc+aser B6SE5CC will 4a$ to t+e com4an$ for

t+e acti#e energ$ at t+e interconnection 4oint at le#elised tariff of 2s%88 4er

unit as determined &$ 6E2C In case of an$ en+ancement in t+e 4roject

Page

0(

Infrastructure Project Financing 2013

ca4acit$< t+e same terms of t+e Power Purc+ase will &e a44lica&le to

en+anced ca4acit$ as 4er t+e Power Purc+ase Agreement

T+e com4an$ +as taken u4 t+e issue wit+ 6a+aras+tra Electricit$ 2egulator$

Commission B6E2CC for increase in tariff t+roug+ an A44eal to t+e A44ellate

Tri&unal for Electricit$ and an order to &e awarded tariff of u4to 2s(%0 4er

unit +as &een awarded in fa#or of t+e com4an$

5uring t+e im4lementation 4eriod in !/,,< t+e 2ST6C a44roac+ed t+e

5e#elo4ers to en+ance t+e ca4acit$ of t+e 4roject to %// TP5 B% 6FC due to

t+e increased generation in 2ST as 4er t+e terms of t+e Concession

Agreement

T+erefore< an additional term loan of 2s 80/ crores for total 4roject costing

2s '0)% cr Badditional 2s ,!') cr wit+ 5E ratio of ')E %0C was sanctioned

&$ Bank of Baroda in 6arc+ !/,! for t+e 4ro4osed e"4ansion

T+e 4roject +as &een commissioned and 4ower &eing generated is &eing

used for Ca4ti#e consum4tion T+e 4roject is awaiting final grid connecti#it$

a44ro#al to start commercial w+eeling of 4ower and com4an$ is e"4ecting

first 4ower &ill on 0,/0!/,0-owe#er< t+e com4an$ +as started selling

com4ost since 5ecem&er !/,! and it e"4ected to earn re#enue of 2s !'1

0/ lacs In !/,!1,0 from com4ost

P2OOECT I6PLE6ENTATION

Project was initiall$ conce4tuali>ed for t+e de#elo4ment of a Faste1to1energ$

facilit$ for t+e scientific 4rocessing and dis4osal of 0// Tonnes 4er da$ BTP5C

of 6unici4al Solid Faste B6SFC to &e deli#ered &$ t+e 2ST 6unici4al

Cor4oration B2ST6CC

As 4er t+e 4rocess of 6E2C< in order to o&tain t+e order for tariff on w+ic+

&asis t+e PPA waste was to &e entered for esta&lis+ing t+e 4roject #ia&ilit$<

t+e Com4an$ filed a 4etition to t+e 6a+aras+tra Electricit$ 2egulator$

Commission B6E2CC on !,st Octo&er !//9 for determination of Tariff for

su44l$ of electricit$ from 6unici4al Solid Faste Power 4roject for 5istri&ution

licensee in 6a+aras+tra< a44l$ing for a 4ower tariff of 2s ),/ 4er unit as 4er

4re#ailing 4ractices

Page

0)

Infrastructure Project Financing 2013

Su&se=uent to t+e a&o#e< t+e 6E2C released t+e 6A-A2AS-T2A

ELECT2ICIT; 2E*.LATO2; CO66ISSION BTE26S AN5 CON5ITIONS

FO2 5ETE26INATION OF 2E TA2IFFC 2E*.LATIONS< !/,/ on )t+ Oune

!/,/ As 4er t+is guideline guidelines laid down t+e following rules for

determination of tariff wit+ res4ect to 5e&t E=uit$ ratioE

For suo1motu determination of generic tariff< t+e de&t e=uit$ ratio s+all &e

)/E0/

For 4roject s4ecific tariff< t+e following 4ro#isions s+all a44l$E

If t+e e=uit$ actuall$ de4lo$ed is more t+an 0/I of t+e ca4ital cost< e=uit$ in

e"cess of 0/I s+all &e treated as normati#e loan

Pro#ided t+at w+ere e=uit$ actuall$ de4lo$ed is less t+an 0/I of t+e ca4ital

cost< t+e

actual e=uit$ s+all &e considered for determination of tariff

Based on t+e a&o#e< t+e 6E2C in its order dated 0rd Se4tem&er< !/,/

considered a de&tE e=uit$ ratio of )/E0/< e"cluding costs relating to t+e 4re1

treatment section and granted a tariff of 2s %88 4er unit

A44eal to A44ellate Tri&unal for Electricit$E An a44eal was filed against t+e

said 6E2C order in No#em&er !/,/ &$ t+e com4an$ in t+e -onD&le A44ellate

Tri&unal for Electricit$< New 5el+i BAPTELC c+allenging t+e e"clusion of t+e

costs relating to t+e 4re1treatment section and t+e de&t1e=uit$ ratio

Su&se=uentl$< due to t+e increase in waste generation in t+e cit$ of 2ST< t+e

ca4acit$ of t+e 4roject +ad to &e e"4anded during construction 4+ase BOune

!/,,C to %// Tonnes 4er da$ BTP5C in accordance wit+ t+e terms of t+e

Concession Agreement

As 4er T+e -onD&le APTEL@S judgment dated ,(t+ Se4tem&er !/,,< T+e

com4an$ succeed in esta&lis+ing its case t+at t+e Pre1treatment Plant is an

integral 4art of t+e 6SF &ased Power Project and its ca4ital cost s+ould &e

included in t+e ca4ital cost of t+e 4roject considered for determination of

electricit$ tariff

In t+e #iew of t+e a&o#e tariff was increased form 2s %88 4er unit to 2s (%/

4er unit

2EASONS FO2 5ELA; IN I6PLE6ETATION

Page

08

Infrastructure Project Financing 2013

As 4er t+e original sanction< t+e 4roject was sc+eduled to &e commissioned in

Fe&ruar$ !/,/ T+e account was restructured on !),!!/,/ fi"ing re#ised CO5 as

6arc+ !/,, and installments were to commence from Oune !/,, T+e

commissioning of t+e 4roject was dela$ed due to following e"ternal factors? court

cases< &e$ond t+e control of t+e 4romotersE

5ela$ in o&taining 6E2C B6a+aras+tra Electricit$ 2egulator$ CommissionC

Order for tariff fi"ation and su&se=uent signing of Power Purc+ase

Agreement< w+ic+ took almost one and +alf $ear BInstead of sti4ulated 0

mont+s and finall$ signed onl$ in 6arc+ !/,, T+e com4an$ +as filed an

a44eal to -onora&le A44ellate tri&unal for Electricit$ ,n No#em&er !/,/

c+allenging e"clusion of certain cost and 5e&t E=uit$ ratio In t+e 4rocess of

tariff determination T+e -onora&le APTEL 4assed Its judgment on ,(t+

Se4tem&er !/,, and com4an$ +as filed a 4etition against t+e judgment of

APTEL In relation to 5e&t E=uit$ ratio wit+ Su4reme Court of India in

No#em&er !/,, and +as &een admitted in t+e Su4reme Court in Se4tem&er

!/,! and $et to come u4 for furt+er 4roceedings Since de&t dis&ursal was

linked to t+e signing of t+e PPA< com4an$ could not undertake t+e

construction acti#it$ in o4timum s4eed

T+e 4roject is eligi&le for o&taining custom dut$ e"em4tion for t+e Im4ort of

mac+iner$ and its com4onents re=uired for t+e initial setting u4 of a 4roject for

generation of 4ower using non con#entional materials T+ere was dela$ in

o&taining custom dut$ e"em4tion for t+e im4orted mac+ineries and its

com4onents T+e 4romoter mo#ed Frit Petition in -ig+ Court for Oudicature at

Bom&a$ in No#em&er !/,, wit+ t+e .nion of India< t+roug+ t+e Secretar$<

6inistr$ of Finance< 6inistr$ of New and 2enewa&le Energ$< 6a+aras+tra

Energ$ 5e#elo4ment Agenc$ and 5e4ut$ Commissioner of Customs and t+e

com4an$ o&tained orders In t+eir fa#or for e"em4tion of Custom 5ut$ in

Fe&ruar$ !/,! ot+erwise custom dut$ wit+ 4enalties and demurrage c+arges

would amount to a44ro" 2s '// crores

T+ere was dela$ in grid connecti#it$ w+ic+ was t+e res4onsi&ilit$ of 6SE5CL

Furt+er t+ere were o&jections from local #illagers for erecting of transmission

Page

09

Infrastructure Project Financing 2013

lines t+roug+ t+eir land Finall$ solutions for eac+ of t+e agitators +a#e &een

arri#ed and t+e$ +a#e gi#en t+eir consent for grid connecti#it$ w+ic+ +as &een

com4leted in t+e mont+ of Oanuar$ !/,0

C.22ENT STAT.S

T+e 4roject is now full$ constructed as on date and t+e 4roject +as &een

commissioned Furt+er &iogas generation +as commenced and t+e gas

engines +a#e &een test fired T+e electricit$ 4roduced is &eing used for

ca4ti#e 4ur4oses and e"cess gas is &eing flared since t+e 4roject is awaiting

final connecti#it$ clearance T+e 2ST6C +as &een deli#ering waste at t+e site

currentl$ T+e testing of t+e grid lines is in 4rogress and commercial w+eeling

is e"4ected from 6arc+ !/,0 Com4an$ +as alread$ commenced sale of

com4ost and e"4ected re#enue from sale of com4ost was around 0/ lacs

SFOT ANAL;SIS

SFOT Anal$sis is $et anot+er im4ortant factor w+ic+ gi#es an o#erall #iew of t+e

strengt+s< weakness< o44ortunities and t+reats to t+e 4roject +olisticall$

STR*N4T5S:

T+e 4romoters of t+e com4an$ are =ualified and e"4erienced in t+is work

Tec+nolog$ to &e utili>ed is 4ro#en and su44liers of t+e mac+iner$ are of

international re4ute

Eas$ a#aila&ilit$ of raw material

6ac+iner$?e=ui4ments to &e 4urc+ased are +a#ing customs dut$ e"em4tions

Page

%/

Infrastructure Project Financing 2013

A44arentl$ no com4etition in similar industr$ as su44l$ of 6SF is limited and

is assured to com4an$ &$ 2ST6C

6*+7N*SS:

Ca4acit$ utili>ation is taken at +ig+er le#els since first $ear of o4eration

T+e &orrower is de4endent on foreign counter 4arts for t+e use of tec+nolog$

&PP&RT(N%T%*S:

Suc+ 4rojects are +a#ing +ig+ 4otential as 2enewa&le Energ$ Sector is on

4riorit$ in India and across t+e glo&e

5emand?Su44l$ situation in 4ower sector is in fa#or of t+e &orrower

T+e tie u4 wit+ foreign constituents would ensure t+e success of t+e 4roject

and o44ortunit$ for new 4rojects

Arrangement for 4urc+asing of raw material and selling of energ$ 4roduced is

alread$ in 4lace

T5R*+TS:

Natural 5isasters like eart+=uakes< floods etc

5ela$ in im4lementation of t+e 4roject

-ea#il$ de4endence on t+e su44l$ of 6unici4al Solid Faste &$ 2ST6C

2ECO66EN5ATIONS

To successfull$ ta4 t+e a#aila&le re#enue 4ools< &ank s+ould de#elo4 a

strong understanding of eac+ sector to assess 4roducts needs< timing and

in#estment merit

Bank will also need to &uild dee4 e"4ertise to undertake accurate risk

assessment< for t+is &ank s+ould make different teams to work on 4rojects of

different sectors< t+is will +el4 t+em to s4eciali>e in one sector and also will lead to

&etter understanding of risks and o44ortunities in t+ose sectors

Banks s+ould also +a#e a team focusing entirel$ on t+e stud$ of t+e risks as4ects

of t+e 4rojects

Page

%,

Infrastructure Project Financing 2013

To mo#e u4 t+e #alue c+ain or ac=uire relations+i4s and scale in India< &anks

s+ould consider 4artners+i4s 5omestic incum&ent &anks wit+ a strong funding

&ase and e"isting cor4orate relations+i4s can use glo&al or domestic alliances to

&uild s4ecific sector e"4ertise< go &e$ond 4artici4ating in s$ndications to acti#e

origination and 4artici4ation from t+e e=uit$ side of t+e 4roject ca4ital structure

Page

%!

Infrastructure Project Financing 2013

2EFE2ENCES

Infrastructure Funding 2e=uirements and its Sources o#er t+e

im4lementation 4eriod of t+e Twelft+ Fi#e ;ear Plan B!/,!1 !/,)C

Interim re4ort of t+e -ig+ le#el committee on infrastructure finance1Aug !/,!

Forking su& grou4 on infrastructure< 4lanning commission

Planning Commission B!//)C REle#ent+ Fi#e ;ear PlanR Planning

Commission< *o#ernment of India< New 5el+i

+tt4E??wwwinfrastructurego#in?

Budget !/,0

Bank of Baroda1 5ocumentation of 6?s :;S P#t Ltd

Page

%0

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Belly Dance Orientalism Transnationalism and Harem FantasyDocumento4 pagineBelly Dance Orientalism Transnationalism and Harem FantasyCinaraNessuna valutazione finora

- Under The Crescent Moon: Rebellion in Mindanao By: Marites Danguilan Vitug and Glenda M. GloriaDocumento2 pagineUnder The Crescent Moon: Rebellion in Mindanao By: Marites Danguilan Vitug and Glenda M. Gloriaapperdapper100% (2)

- Govt Influence On Exchange RateDocumento40 pagineGovt Influence On Exchange Rategautisingh100% (3)

- Audit of State and Local GovernmentsDocumento427 pagineAudit of State and Local GovernmentsKendrick PajarinNessuna valutazione finora

- The Diary of John BurchardDocumento560 pagineThe Diary of John BurchardpphuckNessuna valutazione finora

- IRA Green BookDocumento26 pagineIRA Green BookJosafat RodriguezNessuna valutazione finora

- Siswa AheDocumento7 pagineSiswa AheNurMita FitriyaniNessuna valutazione finora

- Great Books JournalDocumento2 pagineGreat Books JournalAnisa GomezNessuna valutazione finora

- Rs-2n Midterm Exam 2nd Semester 2020-2021Documento4 pagineRs-2n Midterm Exam 2nd Semester 2020-2021Norhaina AminNessuna valutazione finora

- 2016-17 Georgia Hunting RegulationsDocumento76 pagine2016-17 Georgia Hunting RegulationsAmmoLand Shooting Sports NewsNessuna valutazione finora

- Blockchain PaperDocumento33 pagineBlockchain PaperAyeshas KhanNessuna valutazione finora

- Nepotism in NigeriaDocumento3 pagineNepotism in NigeriaUgoStan100% (2)

- ECON 121 Seatwork-Assignment No. 2 Answer KeyDocumento1 paginaECON 121 Seatwork-Assignment No. 2 Answer KeyPhilip Edwin De ElloNessuna valutazione finora

- WhittardsDocumento7 pagineWhittardsAaron ShermanNessuna valutazione finora

- Home / Publications / Questions and AnswersDocumento81 pagineHome / Publications / Questions and AnswersMahmoudNessuna valutazione finora

- Mohan ResearchDocumento6 pagineMohan ResearchRamadhan A AkiliNessuna valutazione finora

- Political Law vs. Constitutional LawDocumento3 paginePolitical Law vs. Constitutional LawJamilah DagandanNessuna valutazione finora

- Symantec Endpoint ProtectionDocumento5 pagineSymantec Endpoint ProtectionreanveNessuna valutazione finora

- Ilm-e-Hadees Sikhne Wale Ke Liye Kuch AadaabDocumento5 pagineIlm-e-Hadees Sikhne Wale Ke Liye Kuch AadaabSalman KhanNessuna valutazione finora

- # Transaction Code Transaction DescriptionDocumento6 pagine# Transaction Code Transaction DescriptionVivek Shashikant SonawaneNessuna valutazione finora

- Business PlanDocumento36 pagineBusiness PlanArun NarayananNessuna valutazione finora

- Consejos y Recomendaciones para Viajar A Perú INGLESDocumento3 pagineConsejos y Recomendaciones para Viajar A Perú INGLESvannia23Nessuna valutazione finora

- Social Institutions and OrganisationsDocumento1 paginaSocial Institutions and OrganisationsKristof StuvenNessuna valutazione finora

- C-Profile Text - 2015 PT. Hydroraya Adhi PerkasaDocumento11 pagineC-Profile Text - 2015 PT. Hydroraya Adhi Perkasadaniel_dwi_rahma100% (1)

- Eating According To Our Needs With ChrononutritionDocumento6 pagineEating According To Our Needs With ChrononutritionTatjana VindišNessuna valutazione finora

- Key Area IIIDocumento26 pagineKey Area IIIRobert M. MaluyaNessuna valutazione finora

- Introduction To NstpiiDocumento15 pagineIntroduction To NstpiiSIJINessuna valutazione finora

- 07 DecisionTreeTasksWeek8Documento5 pagine07 DecisionTreeTasksWeek8Nebojša ĐukićNessuna valutazione finora

- Order Confirmation 318155149Documento3 pagineOrder Confirmation 318155149charisse mae rillortaNessuna valutazione finora

- 1 - Blank Financial AppendixDocumento57 pagine1 - Blank Financial AppendixJax TellerNessuna valutazione finora