Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

(Ebook - Finances) Identity Theft

Caricato da

Anonymous 8ooQmMoNs1Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

(Ebook - Finances) Identity Theft

Caricato da

Anonymous 8ooQmMoNs1Copyright:

Formati disponibili

Consumer Alert

Federal Trade Commission I Bureau of Consumer Protection I Office of Consumer and Business Education

Identity Crisis...

What to Do If Your Identity is Stolen

I dont remember charging those items. Ive never even been in that store.

M

aybe you never charged those items, but someone else did...someone who used your name and

personal information to commit fraud. When an imposter co-opts your name, your Social

Security number, your credit card number, or some other piece of your personal information for their

use in short, when someone appropriates your personal information without your knowledge its

a crime, pure and simple.

The biggest problem? You may not know your identitys been stolen until you notice that somethings

amiss: you may get bills for a credit card account you never opened, your credit report may include

debts you never knew you had, a billing cycle may pass without your receiving a statement, or you

may see charges on your bills that you didnt sign for, didnt authorize, and dont know anything

about.

First Things First

If someone has stolen your identity, the Federal Trade Commission recommends that you take three

actions immediately.

First, contact the fraud departments of each of the three major credit bureaus. Tell them to flag

your file with a fraud alert including a statement that creditors should call you for permission before

they open any new accounts in your name.

Report fraud Order credit report Web site

Equifax: (800) 525-6285 (800) 685-1111 www.equifax.com

Experian: (888) EXPERIAN (397-3742) (888) EXPERIAN www.experian.com

Trans Union: (800) 680-7289 (800) 916-8800 www.tuc.com

Its a good idea to order a copy of your credit report from the three credit bureaus every year to check

on their accuracy and whether they include only those debts and loans youve incurred. This could be

very important if youre considering a major purchase, such as a house or a car. A credit bureau may

charge you up to $8 for a copy of your report.

April 1999

Second, contact the creditors for any accounts that have been tampered with or opened

fraudulently. Ask to speak with someone in the security or fraud department, and follow up in

writing. Following up with a letter is one of the procedures spelled out in the Fair Credit Billing Act

for resolving errors on credit billing statements, including charges or electronic fund transfers that you

have not made.

Third, file a police report. Keep a copy in case your creditors need proof of the crime.

Next, Take Control

Although identity thieves can wreak havoc on your personal finances, there are some things you can

do to take control of the situation. Heres how to handle some of the most common forms of identity

theft.

If an identity thief has stolen your mail for access to new credit cards, bank and credit

card statements, pre-approved credit offers and tax information or falsified change-of-

address forms, (s)he has committed a crime. Report it to your local postal inspector.

If you discover that an identity thief has changed the billing address on an existing credit

card account, close the account. When you open a new account, ask that a password be

used before any inquiries or changes can be made on the account. Avoid using easily

available information like your mothers maiden name, your birth date, the last four

digits of your Social Security number or your phone number, or a series of

consecutive numbers. Avoid the same information and numbers when you create a

Personal Identification Number (PIN).

To thwart an identity thief who may pick through your trash to capture your personal information, tear

or shred your charge receipts, copies of credit applications, insurance forms, bank checks and

statements, expired charge cards, and credit offers you get in the mail.

If you have reason to believe that an identity thief has accessed your bank accounts, checking account

or ATM card, close the accounts immediately. When you open new accounts, insist on password-only

access. If your checks have been stolen or misused, stop payment. If your ATM card has been lost,

stolen or otherwise compromised, cancel the card and get another with a new PIN.

If an identity thief established new phone service in your name and is making long-

distance calls, making unauthorized calls that appear to come from and are billed to

your cellular phone, or using your calling card and PIN, contact your service

provider immediately to cancel your account and calling card. Get new accounts

and new PINs.

If it appears that someone is using your Social Security number when applying for a job, get in touch

with the Social Security Administration to verify the accuracy of your reported earnings and that your

name is reported correctly. Call (800) 772-1213 to check your Personal Earnings and Benefit Estimate.

If you suspect that your name or Social Security number is being used by an identity thief to get a

drivers license, contact your Department of Motor Vehicles. If your state uses your Social Security

number as your drivers license number, ask to substitute another number.

If Youre Still Having Identity Problems...

Stay alert to new instances of identity theft. Notify the company or creditor thats involved immediately.

Follow up in writing. You also may want to contact:

The Privacy Rights Clearinghouse, which provides information on how to network

with other identity theft victims. Call (619) 298-3396 or visit www.privacyrights.org.

The US Secret Service, which has jurisdiction over financial fraud cases. Although the

Service generally investigates cases where the dollar loss is substantial, your information

may provide evidence of a larger pattern of fraud requiring their involvement. Contact

your local field office.

The Social Security Administration, which may issue you a new Social Security

number if you still have difficulties even after trying to resolve the problems resulting

from identity theft. Unfortunately, there is no guarantee that a new Social Security

number will resolve your problems.

Complaint Clearinghouse

The Federal Trade Commission is the federal clearinghouse for consumer complaints about identity

theft. The information you provide can help the Commission and other law enforcement agencies track,

investigate and prosecute identity thieves.

To file a complaint about identity theft with the Federal Trade Commission, contact the Consumer

Response Center by phone: 202-FTC-HELP (382-4357); by TDD: 202-326-2502; by mail: Consumer

Response Center, Federal Trade Commission, 600 Pennsylvania Avenue, NW, Washington, DC

20580; or by e-mail: use the complaint form at www.ftc.gov.

The FTC publishes brochures on a variety of topics of interest to consumers. For a complete list, ask

the CRC for a copy of Best Sellers or check it out online at www.ftc.gov.

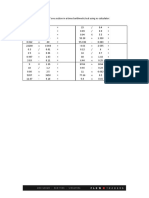

Chart Your Course of Action

Use this form to record the steps youve taken to report the fraudulent use of your identity.

Keep this list in a safe place for future reference.

Credit Bureaus - Report Fraud

Bank and Credit Card Account Issuers (Contact each issuer to protect your rights under the Fair Credit Billing Act)

Law Enforcement Authorities - Report Identity Theft

y c n e g A r e b m u N e n o h P

e t a D

d e t c a t n o C

n o s r e P t c a t n o C r e b m u N t r o p e R s t n e m m o C

u a e r u B r e b m u N e n o h P

e t a D

d e t c a t n o C

n o s r e P t c a t n o C s t n e m m o C

x a f i u q E 5 8 2 6 - 5 2 5 - 0 0 8

n a i r e p x E 2 4 7 3 - 7 9 3 - 8 8 8

n o i n U s n a r T 9 8 2 7 - 0 8 6 - 0 0 8

r e u s s I r e b m u N e n o h P d n a s s e r d d A

e t a D

d e t c a t n o C

n o s r e P t c a t n o C s t n e m m o C

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- L9 - Dynamics of Behaviour in OrganisationsDocumento5 pagineL9 - Dynamics of Behaviour in OrganisationsAnonymous 8ooQmMoNs1Nessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- L7 - Managing DiversityDocumento5 pagineL7 - Managing DiversityAnonymous 8ooQmMoNs1Nessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- L3 - Planning and GoalsDocumento9 pagineL3 - Planning and GoalsAnonymous 8ooQmMoNs1Nessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- L4 - Managerial Decision MakingDocumento9 pagineL4 - Managerial Decision MakingAnonymous 8ooQmMoNs1Nessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- L5 - OrganisingDocumento13 pagineL5 - OrganisingAnonymous 8ooQmMoNs1Nessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- L6 - LeadershipDocumento11 pagineL6 - LeadershipAnonymous 8ooQmMoNs1Nessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- L8 - Human Resource ManagementDocumento6 pagineL8 - Human Resource ManagementAnonymous 8ooQmMoNs1Nessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- L1 - The Changing Paradigm of ManagementDocumento8 pagineL1 - The Changing Paradigm of ManagementAnonymous 8ooQmMoNs1Nessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Bill Niven War MemorialsDocumento7 pagineBill Niven War MemorialsAnonymous 8ooQmMoNs1Nessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Sontag Collective MemoryDocumento7 pagineSontag Collective MemoryAnonymous 8ooQmMoNs1Nessuna valutazione finora

- Bill Niven War MemorialsDocumento7 pagineBill Niven War MemorialsAnonymous 8ooQmMoNs1Nessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Richard Osborne - MythDocumento3 pagineRichard Osborne - MythAnonymous 8ooQmMoNs1Nessuna valutazione finora

- Portelli Massacre at Fosse ArdeatineDocumento9 paginePortelli Massacre at Fosse ArdeatineAnonymous 8ooQmMoNs1Nessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Ginsborg History of ItalyDocumento8 pagineGinsborg History of ItalyAnonymous 8ooQmMoNs10% (1)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Lectures 1-3 COLOURDocumento45 pagineLectures 1-3 COLOURAnonymous 8ooQmMoNs1Nessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Philip Taylor PropagandaDocumento3 paginePhilip Taylor PropagandaAnonymous 8ooQmMoNs1Nessuna valutazione finora

- Weak & Strong FormsDocumento77 pagineWeak & Strong FormsAnonymous 8ooQmMoNs1Nessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Jock Reynolds J LT RookiesDocumento14 pagineJock Reynolds J LT RookiesAnonymous 8ooQmMoNs1Nessuna valutazione finora

- 08 AnsDocumento13 pagine08 AnsAnonymous 8ooQmMoNs1Nessuna valutazione finora

- Harry HearderDocumento15 pagineHarry HearderAnonymous 8ooQmMoNs1Nessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Fit Interview 071712 PDFDocumento14 pagineFit Interview 071712 PDFAnonymous 9W8HM1nqXBNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Arithmetic Test Example PDFDocumento1 paginaArithmetic Test Example PDFAnonymous 8ooQmMoNs1Nessuna valutazione finora

- 2006 Stanford Consulting Case Interview PreparationDocumento62 pagine2006 Stanford Consulting Case Interview Preparationr_oko100% (3)

- Grammar Guide 2018Documento56 pagineGrammar Guide 2018Tony NguerezaNessuna valutazione finora

- 05 AnsDocumento8 pagine05 AnsAnonymous 8ooQmMoNs1Nessuna valutazione finora

- 02 AnsDocumento10 pagine02 AnsAnonymous 8ooQmMoNs1Nessuna valutazione finora

- 06 AnsDocumento4 pagine06 AnsAnonymous 8ooQmMoNs1Nessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- 07 AnsDocumento5 pagine07 AnsAnonymous 8ooQmMoNs10% (1)

- 04 AnsDocumento20 pagine04 AnsAnonymous 8ooQmMoNs1Nessuna valutazione finora

- Chapter 01 Solutions PalepuDocumento3 pagineChapter 01 Solutions Palepuilhamuh67% (6)

- W01 358 7304Documento29 pagineW01 358 7304MROstop.comNessuna valutazione finora

- ForecastingDocumento16 pagineForecastingSadain Bin MahboobNessuna valutazione finora

- CH03 HKM Law Investigation and EthicsDocumento32 pagineCH03 HKM Law Investigation and Ethicsmilkikoo shiferaNessuna valutazione finora

- Fly The Maddog X User Manual MSFS 2020Documento15 pagineFly The Maddog X User Manual MSFS 2020KING OF NOOBSNessuna valutazione finora

- k90mcc6 PDFDocumento381 paginek90mcc6 PDFTammy JohnsonNessuna valutazione finora

- Creating Website Banners With Photoshop PDFDocumento18 pagineCreating Website Banners With Photoshop PDFLiza ZakhNessuna valutazione finora

- MyLabX8 160000166 V02 LowRes PDFDocumento8 pagineMyLabX8 160000166 V02 LowRes PDFhery_targerNessuna valutazione finora

- Salonga Vs Farrales Digest Ful Case PDF FreeDocumento6 pagineSalonga Vs Farrales Digest Ful Case PDF FreeElyka RamosNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Abstract 2 TonesDocumento8 pagineAbstract 2 TonesFilip FilipovicNessuna valutazione finora

- LabVIEW Core 3 2013 - Course ManualDocumento135 pagineLabVIEW Core 3 2013 - Course Manualtalaindio100% (2)

- JPCC PDFDocumento86 pagineJPCC PDFvenkatakrishna1nukalNessuna valutazione finora

- Ngo OrganizationsDocumento2 pagineNgo Organizationsapi-295384272100% (1)

- Communication To Offer-ContractsDocumento20 pagineCommunication To Offer-ContractsAarif Mohammad BilgramiNessuna valutazione finora

- Literature Review On Climate Change in NigeriaDocumento9 pagineLiterature Review On Climate Change in Nigeriac5rn3sbr100% (1)

- Intermediate Course Study Material: TaxationDocumento34 pagineIntermediate Course Study Material: TaxationMd IbrarNessuna valutazione finora

- Case Study 1 - Signal Cable CompanyDocumento5 pagineCase Study 1 - Signal Cable CompanyTengku SuriaNessuna valutazione finora

- Activity 2.1 Test Your Food Safety IQDocumento3 pagineActivity 2.1 Test Your Food Safety IQAustin PriceNessuna valutazione finora

- Scope: Manufacture of High Precision and CloseDocumento1 paginaScope: Manufacture of High Precision and CloseAnuranjanNessuna valutazione finora

- Materi Basic Safety #1Documento32 pagineMateri Basic Safety #1Galih indrahutama100% (1)

- Belimo Fire and Smoke Brochure en UsDocumento8 pagineBelimo Fire and Smoke Brochure en UsAmr AbdelsayedNessuna valutazione finora

- Zeb OSARSInstallDocumento128 pagineZeb OSARSInstallThien TranNessuna valutazione finora

- IS301 P1 Theory June 2021 P1 TheoryDocumento20 pagineIS301 P1 Theory June 2021 P1 Theory50902849Nessuna valutazione finora

- Status of Implementation of Prior Years' Audit RecommendationsDocumento10 pagineStatus of Implementation of Prior Years' Audit RecommendationsJoy AcostaNessuna valutazione finora

- Corporation Law Syllabus With Assignment of CasesDocumento4 pagineCorporation Law Syllabus With Assignment of CasesMarilou AgustinNessuna valutazione finora

- Nomura, SBI Caps, IDFC, Wellington Are in Talks To Buy 10% Stake For Rs 1000 CR in Kerala-Based ManappuramDocumento2 pagineNomura, SBI Caps, IDFC, Wellington Are in Talks To Buy 10% Stake For Rs 1000 CR in Kerala-Based ManappuramRaghu.GNessuna valutazione finora

- Mamba Vs Lara, 608 SCRA 149 (2009) Case DigestsDocumento1 paginaMamba Vs Lara, 608 SCRA 149 (2009) Case DigestsAce Lawrence AntazoNessuna valutazione finora

- Annexure - IV (SLD)Documento6 pagineAnnexure - IV (SLD)Gaurav SinghNessuna valutazione finora

- Appointments & Other Personnel Actions Submission, Approval/Disapproval of AppointmentDocumento7 pagineAppointments & Other Personnel Actions Submission, Approval/Disapproval of AppointmentZiiee BudionganNessuna valutazione finora

- Icd-10 CM Step by Step Guide SheetDocumento12 pagineIcd-10 CM Step by Step Guide SheetEdel DurdallerNessuna valutazione finora

- 13 Ways The Coronavirus Pandemic Could Forever Change The Way We WorkDocumento20 pagine13 Ways The Coronavirus Pandemic Could Forever Change The Way We WorkAbidullahNessuna valutazione finora

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooDa EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooValutazione: 5 su 5 stelle5/5 (2)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorDa EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorValutazione: 4.5 su 5 stelle4.5/5 (63)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementDa EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementValutazione: 4.5 su 5 stelle4.5/5 (20)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseDa EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNessuna valutazione finora

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingDa EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingValutazione: 4.5 su 5 stelle4.5/5 (97)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorDa EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorValutazione: 4.5 su 5 stelle4.5/5 (132)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASDa EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASValutazione: 3 su 5 stelle3/5 (5)