Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

MOT2008 2011final 1

Caricato da

sudeshjhaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

MOT2008 2011final 1

Caricato da

sudeshjhaCopyright:

Formati disponibili

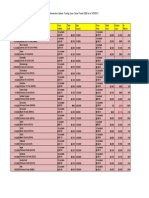

Momentum Options Trading Open Closed Trades 2008 thru 2011 as of 1/25/2012

Date

Opened

Company/

Option Symbol

Price

Added

Total

Cost

Date

Closed

Price

Sold

Total

Cost

$ Gain/

Loss

%

Return

10/13/2010

Chesapeake Energy

January (2011) 25 calls (CHK110122C00025000)

10 contracts

@$1.15

$1,150

1/4/2011

10 contracts

@$1.40

$1,400

$250

22%

10/18/2010

Biodel

March 7.5 calls (BIOD110319C00007500)

10 contracts

@$1.10

expired 3/18/2011

10 contracts

@$0.00

$0

($1,100)

-100%

10/20/2010

American Tower

April 60 (2011) calls (AMT110416C00060000)

10 contracts

@$0.65

$650

expired 4/16/2011

10 contracts

@$0.00

$0

($650)

-100%

11/24/2010

Electronic Arts

March 20 calls (ERTS110319C00020000)

10 contracts

@$0.22

$220

2/16/2011 closed 1/2 @ $0.80,

2/23/2011closed half @ $0.30

10 contracts

@$0.55 avg.

$550

$330

150%

12/8/2010

THQ

June 6 calls (THQI110618C00006000)

10 contracts

@$0.75

$750

1/19/2011

10 contracts

@$0.80

$800

$50

7%

12/14/2010

Jabil Circuit

March 19 calls (JBL110319C00019000)

10 contracts

@$0.70

$700

12/21/2010 closed 1/2 @ $1.70,

1/10/2011 closed half @ $2.25

10 contracts

@$1.975 avg.

$1,975

$1,275

182%

12/27/2010

Seattle Genetics

March 17.50 calls (SGEN110319C00017500)

10 contracts

@$0.70

$700

1/18/2011 closed 1/2 @ $1.20,

1/19/2011 closed half @ $0.75

10 contracts

@$0.975

$975

$275

39%

12/27/2010

JDS Uniphase

March 15 calls (JDSU110319C00015000)

10 contracts

@$0.78

$780

1/7/2011 closed 1/2 @ $1.80,

1/19/11 closed half @ $2.10

10 contracts

@$1.95 avg.

$1,950

$1,170

150%

12/29/2010

Skyworks Solutions

May 32 calls (SWKS110521C00032000)

10 contracts

@$1.70

$1,700

1/18/2011 closed 1/2 @ $3.30,

1/28/2011 closed half @ $2.80

10 contracts

@$3.05 avg.

$3,050

$1,350

79%

12/29/2010

Riverbed Technology

March 40 calls (RVBD110319C00040000)

10 contracts

@$1.70

$1,700

1/7/2011 closed 1/2 @ $3.00,

11/19/2011 closed half @ $2.50

10 contracts

@$2.75 avg.

$2,750

$1,050

62%

1/3/2011

Micron Technology

April 9 calls (MU110416C00009000)

10 contracts

@$0.50

$500

1/18/2011 closed 1/2 @ $1.25,

1/19/11 closed half @ $1.00

10 contracts

@$1.125 avg.

$1,125

$625

125%

1/4/2011

Constellation Brands

February 22.50 calls (STZ110219C00022500)

10 contracts

@$0.35

$350

expired 2/19/2011

10 contracts

@$0.00

$0

($350)

-100%

1/4/2011

Brocade Communications

July 6 calls (BRCD110716C00006000)

10 contracts

@$0.67

$670

2/23/2011 closed 1/2 @ $0.80,

3/7/2011 closed half @ $0.75

10 contracts

@$0.775 avg.

$775

$105

16%

1/5/2011

Louisiana-Pacific

May 11 calls (LPX110521C00011000)

10 contracts

@$0.70

$700

1/20/2011

10 contracts

@$0.50

$500

($200)

-29%

1/7/2011

Apollo Group

February 34 puts (APOL110219P00034000)

10 contracts

@$0.85

$850

1/10/2011 closed 1/2 @ $1.70,

1/31/11 closed half @ $0.10

10 contracts

@$0.90 avg.

$900

$50

6%

1/12/2011

Vivus

June 14 calls (VVUS110618C00014000)

10 contracts

@$1.10

$1,100

expired 6/18/2011

10 contracts

@$0.00

$0

($1,100)

-100%

1/12/2011

JPMorgan Chase

February 46 calls (JPM11021900046000)

10 contracts

@$0.88

$880

2/11/2011 closed 1/2 @ $1.00,

2/15/2011 closed half @ $1.20

10 contracts

@$1.10 avg.

$1,100

$220

25%

1/21/2011

Micron Technology

April 10 calls (MU110416C00010000)

10 contracts

@$0.75

$750

1/28/2011 closed 1/2 @ $1.00,

2/22/2011 closed half @ $1.75

10 contracts

@$1.375 avg.

$1,375

$625

83%

1/21/2011

Spider S&P 500

February 131 calls (SPY110219C00131000)

10 contracts

@$0.95

$950

2/1/2011 closed 1/2 @ $1.35,

2/4/2011closed half @ $1.25

10 contracts

@$1.30 avg.

$1,300

$350

37%

1/21/2011

PowerShares QQQ

March 58 calls (QQQQ110319C00058000)

10 contracts

@$0.75

2/10/2011

10 contracts

@$0.94

$940

$190

25%

1/26/2011

Jabil Circuit

March 21 calls (JBL110319C00021000)

10 contracts

@$0.70

2/10/2011

10 contracts

@$1.00

$1,000

$300

43%

1/28/2011

CurrencyShares Euro Trust

March 134 puts (FXE110319P00134000)

10 contracts

@$1.60

expired 3/18/2011

10 contracts

@$0.00

$0

($1,600)

-100%

1/31/2011

Patriot Coal

March 30 calls (PCX110319C00030000)

10 contracts

@$1.25

expired 3/18/2011

10 contracts

@$0.00

$0

($1,250)

-100%

2/4/2011

Akamai Technologies

March 55 calls (AKAM110319C00055000)

10 contracts

@$0.82

$820

expired 3/18/2011

10 contracts

@$0.00

$0

($820)

-100%

2/4/2011

Pan American Silver

March 37 calls (PAAS110319C00037000)

10 contracts

@$1.35

$1,350

2/23/2011 closed 1/2 @ $3.00,

2/24/2011 closed half @ $2.00

10 contracts

@$2.50 avg.

$2,500

$1,150

85%

2/11/2011

Skyworks Solutions

May 40 calls (SWKS110521C00040000)

10 contracts

@$1.50

expired 5/21/2011

10 contracts

@$0.00

$0

($1,500)

-100%

$1,100

$750

$700

$1,600

$1,250

$1,500

Momentum Options Trading Open Closed Trades 2008 thru 2011 as of 1/25/2012

2/16/2011

eBay

July 40 calls (EBAY110716C00040000)

10 contracts

@$0.78

2/24/2011

RF MicroDevices

August 10 calls (RFMD110820C00010000)

10 contracts

@$0.30

2/25/2011

Dupont

March 55 calls (DD110319C00055000)

10 contracts

@$0.75

2/25/2011

Electronic Arts

April 20 calls (ERTS110416C00020000)

10 contracts

@$0.65

3/3/2011

Comcast

April 26 calls (CMCSA110416C00026000)

10 contracts

@$0.67

3/21/2011

Hershey

April 55 calls (HST110416C00055000)

10 contracts

@$0.83

3/28/2011

Potash

April 60 calls (POT110401C00060000) WEEKLY

10 contracts

@$0.33

3/28/2011

Rovi

May 65 calls (ROVI110521C00065000)

10 contracts

@$0.60

3/30/2011

iShares Russell 2000 Index

April 85 calls (IWM110416C00085000)

10 contracts

@$0.60

3/30/2011

JPMorgan Chase

May 48 calls (JPM110521C00048000)

10 contracts

@$0.80

4/1/2011

Las Vegas Sands

April 45 calls (LVS110408C00045000) WEEKLY

10 contracts

@$0.54

4/13/2011

Cree

May 35 puts (CREE110521P00035000)

10 contracts

@$0.54

4/14/2011

Dendreon

August 50 calls (DNDN110820C00050000)

10 contracts

@$1.85

4/15/2011

McDonald's

May 75 puts (MCD110521P00075000)

10 contracts

@$0.65

4/19/2011

S&P 500 Spiders

May 128 puts (SPY110521P00128000)

10 contracts

@$1.26

4/25/2011

Potash

April 60 calls (POT110429C00060000) WEEKLY

10 contracts

@$0.65

4/25/2011

Illumina

May 75 calls (ILMN110521C00075000)

10 contracts

@$1.15

4/29/2011

Electronic Arts

June 21 calls (ERTS110618C00021000)

10 contracts

@$0.70

5/9/2011

Starbucks

June 38 calls (SBUX110618C00038000)

10 contracts

@$0.60

5/9/2011

Kraft

September 35 calls (KFT110917C00035000)

10 contracts

@$0.70

5/9/2011

Seattle Genetics

September 20 calls (SGEN110917C00020000)

10 contracts

@$1.50

5/10/2011

Research In Motion

June 40 puts (RIMM110618P00040000)

10 contracts

@$1.00

5/12/2011

KLA-Tencor

June 48 calls (KLAC110618C00048000)

10 contracts

@$0.90

5/13/2011

MGM Resorts International

September 17 calls (MGM110917C00017000)

10 contracts

@$0.70

5/13/2011

Alpha Natural Resources

June 44 puts (ANR110618P00044000)

10 contracts

@$0.80

5/20/2011

Vivus

September 10 calls (VVUS110917C00010000)

10 contracts

@$0.65

5/24/2011

S&P 500 Spiders

May 133 calls (SPY110527C00133000) WEEKLY

10 contracts

@$0.60

7/16/2011

10 contracts

@$0.00

$0

($780)

-100%

expired 8/20/2011

10 contracts

@$0.00

$0

($300)

-100%

expired 3/18/2011

10 contracts

@$0.00

$0

($750)

-100%

4/15/2011

10 contracts

@$0.10

$100

($550)

-85%

$670

expired 4/16/2011

10 contracts

@$0.00

$0

($670)

-100%

$830

4/6/2011 closed 1/2 @ $1.15,

4/12/2011 closed half @ $1.45

10 contracts

@$1.30 avg.

$1,300

$470

57%

3/31/2011

10 contracts

@$0.35

$350

$20

6%

$600

expired 5/21/2011

10 contracts

@$0.00

$0

($600)

-100%

$600

4/1/2011 closed 1/2 @ $1.05,

4/6/2011 closed half @ $1.10

10 contracts

@$1.075 avg.

$1,075

$475

79%

expired 5/21/2011

10 contracts

@$0.00

$0

($800)

-100%

4/7/2011

10 contracts

@$0.60

$600

$60

11%

expired 5/21/2011

10 contracts

@$0.00

$0

($540)

-100%

expired 8/20/2011

10 contracts

@$0.00

$0

($1,850)

-100%

expired 5/21/2011

10 contracts

@$0.00

$0

($650)

-100%

expired 5/21/2011

10 contracts

@$0.00

$0

($1,260)

-100%

$650

expired 4/29/2011

10 contracts

@$0.00

$0

($650)

-100%

$1,150

4/26/2011 closed 1/2 @ $2.00,

5/4/2011 closed half @ $0.50

10 contracts

@$1.25 avg.

$1,250

$100

9%

5/5/2011

10 contracts

@$1.10

$1,100

$400

57%

expired 6/18/2011

10 contracts

@$0.00

$0

($600)

-100%

$700

5/23/2011

10 contracts

@$1.05

$1,050

$350

50%

$1,500

6/1/2011 closed 1/2 @ $2.20,

9/17/2011 half expired @ $0.00

10 contracts

@$1.10 avg.

$1,100

($400)

-27%

$1,000

6/1/2011 closed 1/2 @ $1.75,

6/2/2011 closed half @ $1.45

10 contracts

@$1.60 avg.

$1,600

$600

60%

expired 6/18/2011

10 contracts

@$0.00

$0

($900)

-100%

$700

expired 9/17/2011

10 contracts

@$0.00

$0

($700)

-100%

$800

6/13/2011 closed 1/2 @ $1.50,

6/14/2011 closed half @ $0.40

10 contracts

@$0.95 avg.

$950

$150

19%

expired 9/17/2011

10 contracts

@$0.00

$0

($650)

-100%

5/27/2011

10 contracts

@$0.75

$750

$150

25%

$780

$300

$750

$650

$330

$800

$540

$540

$1,850

$650

$1,260

$700

$600

$900

$650

$600

Momentum Options Trading Open Closed Trades 2008 thru 2011 as of 1/25/2012

5/27/2011

Darling International

July 20 calls (DAR110716C00020000)

10 contracts

@$0.50

5/31/2011

Polycom

July 62.50 calls (PLCM110716C00062500)

10 contracts

@$1.25

6/1/2011

Zagg

July 12 calls (ZAGG110716C00012000)

10 contracts

@$0.35

6/1/2011

Rediff.com India

October 15 calls (REDF111022C00015000)

10 contracts

@$1.25

6/6/2011

Research In Motion

July 32.50 puts (RIMM110618P00032500)

10 contracts

@$0.75

6/9/2011

RealD

July 20 puts (RLD110716P00020000)

10 contracts

@$0.45

6/14/2011

Krispy Kreme

July 10 calls (KKD110716C00010000)

10 contracts

@$0.20

6/16/2011

LinkedIn

July 55 puts (LNKD110716P00055000)

10 contracts

@$1.25

6/20/2011

Rambus

August 17 calls (RMBS110820C00017000)

10 contracts

@$0.60

6/20/2011

Wells Fargo

July 26 puts (WFC110716P00026000)

10 contracts

@$0.50

6/21/2011

Symantec

October 20 calls (SYMC111022C

10 contracts

@$0.93

6/24/2011

LinkedIn

July 55 puts (LNKD110716P00055000)

10 contracts

@$1.20

6/28/2011

Seattle Genetics

August 22.50 calls (SGEN110820C00020000)

10 contracts

@$1.10

7/1/2011

Freeport-McMoRan

August 57 calls (FCX110820C00057000)

10 contracts

@$1.18

7/1/2011

Freeport-McMoRan

July 55 calls (FCX110708C00055000) WEEKLY

10 contracts

@$0.24

7/1/2011

iShares Russell 2000 Index

August 86 calls (IWM110820C00086000)

10 contracts

@$1.10

7/1/2011

TiVo

August 11 calls (TIVO110820C00011000)

10 contracts

@$0.55

7/11/2011

Qualcomm

October 65 calls (QCOM111022C00065000)

10 contracts

@$0.85

7/13/2011

Patriot Coal

August 24 calls (PCX110822C00024000)

10 contracts

@$0.90

7/13/2011

Global Payments

August 55 calls (GPN110820C00055000)

10 contracts

@$0.40

7/20/2011

Broadcom

August 38 calls (BRCM110820C00038000)

10 contracts

@$0.55

7/22/2011

Rambus

September 17 calls (RMBS110917C00017000)

10 contracts

@$0.65

7/26/2011

Mead Johnson Nutrition

November 80 calls (MJN111119C00080000)

10 contracts

@$0.55

7/27/2011

Spider Dow Jones

August 126 calls (DIA110820C00126000)

10 contracts

@$1.05

7/27/2011

Spider S&P 500

August 135 calls (SPY110820C00135000)

10 contracts

@$0.95

7/29/2011

Rambus

August 12.50 puts (RMBS110820P00012500)

50 contracts

@$0.15

8/4/2011

Cigna

September 44 puts (CI110917P00044000)

15 contracts

@$1.20

7/16/2011

10 contracts

@$0.00

$0

($500)

-100%

$1,250

6/8/2011

10 contracts

@$2.00

$2,000

$750

60%

$350

6/15/2011 closed 1/2 @ $1.00,

6/20/2011 closed half @ $0.80

10 contracts

@$0.90 avg.

$900

$550

157%

$1,250

expired 10/22/2011

10 contracts

@$0.00

$0

($1,250)

-100%

$750

6/15/2011 closed 1/2 @ $1.35,

6/21/2011 closed half @ $5.50

10 contracts

@$3.425 avg.

$3,425

$2,675

357%

$450

6/10/2011 closed 1/2 @ $1.60,

6/30/2011 closed half @ $0.50

10 contracts

@$1.05 avg.

$1,050

$600

133%

$200

6/30/2011

10 contracts

@$0.30

$300

$100

50%

$1,250

6/20/2011 closed 1/2 @ $3.50,

6/21/2011 closed half @ $1.75

10 contracts

@$2.625 avg.

$2,625

$1,375

110%

expired 8/20/2011

10 contracts

@$0.10

$100

($500)

-83%

7/16/2011

10 contracts

@$0.00

$0

($500)

-100%

expired 10/22/2011

10 contracts

@$0.00

$0

($930)

-100%

7/16/2011

10 contracts

@$0.00

$0

($1,200)

-100%

expired 8/20/2011

10 contracts

@$0.00

$0

($1,100)

-100%

expired 8/20/2011

10 contracts

@$0.00

$0

($1,180)

-100%

7/7/2011

10 contracts

@$0.95

$950

$710

296%

expired 8/20/2011

10 contracts

@$0.00

$0

($1,100)

-100%

expired 8/20/2011

10 contracts

@$0.00

$0

($550)

-100%

expired 10/22/2011

10 contracts

@$0.00

$0

($850)

-100%

7/21/2011

10 contracts

@$1.60

$1,600

$700

78%

$400

expired 8/20/2011

10 contracts

@$0.00

$0

($400)

-100%

$550

7/26/2011 closed 1/2 @ $1.65,

8/2/2011 closed half @ $0.45

10 contracts

@$1.05 avg.

$1,050

$500

91%

$650

expired 9/17/2011

10 contracts

@$0.00

$0

($650)

-100%

$550

7/28/2011 closed 1/2 @ $1.25,

8/3/2011 closed half @ $0.65

10 contracts

@$0.95 avg.

$950

$400

73%

expired 8/20/2011

10 contracts

@$0.00

$0

($1,050)

-100%

$950

expired 8/20/2011

10 contracts

@$0.00

$0

($950)

-100%

$750

8/5/2011 closed 1/2 @ $1.70,

8/9/2011 closed half @ $2.10

50 contracts

@$1.90 avg.

$9,500

$8,750

1167%

$1,800

8/8/2011 closed 1/2 @ $3.50,

8/9/2011 closed half @ $3.00

15 contracts

@$3.25 avg.

$4,875

$3,075

171%

$500

$600

$500

$930

$1,200

$1,100

$1,180

$240

$1,100

$550

$850

$900

$1,050

30

Momentum Options Trading Open Closed Trades 2008 thru 2011 as of 1/25/2012

8/8/2011

PowerShares QQQ

September 50 puts (QQQ110917PC00050000)

10 contracts

@$1.55

8/10/2011

Staples

August 12 puts (SPLS110820P00012000)

20 contracts

@$0.50

8/10/2011

United Airlines

September 16 puts (UAL110917P00016000)

10 contracts

@$1.00

8/10/2011

Rambus

September 9 puts (RMBS110917P0000900)

20 contracts

@$0.55

8/11/2011

Pepsi

October 67.50 calls (PEP111022C00067500)

40 contracts

@$0.45

8/11/2011

Potash

September 60 calls (POT110917C00060000)

20 contracts

@$1.00

8/16/2011

SodaStream International

September 55 calls (SODA110917C00055000)

10 contracts

@$1.80

8/22/2011

First Solar

August 80 puts (WEEKLY) (FSLR110826P00080000)

10 contracts

@$0.70

8/22/2011

Sony

September 20 puts (SNE110917P00020000)

20 contracts

@$0.75

8/29/2011

Clean Energy

October 15 calls (CLNE111022C00015000)

10 contracts

@$0.70

8/29/2011

Joy Global

September 87.50 calls (JOYG110917C00087500)

20 contracts

@$1.05

8/30/2011

JDS Uniphase

January 16 calls 2012 (JDSU120121C00016000)

20 contracts

@$1.00

8/30/2011

JDS Uniphase

January 20 calls 2012 (JDSU120121C00020000)

50 contracts

@$0.30

9/6/2011

Research In Motion

October 25 puts (RIMM111022P00025000)

20 contracts

@$1.50

9/9/2011

Spreadtrum Communications

October 22 calls (SPRD111022C00022000)

10 contracts

@$1.10

9/9/2011

Spreadtrum Communications

January 25 calls 2012 (SPRD120121C00025000)

10 contracts

@$1.50

9/13/2011

Lufkin Industries

December 80 calls (LUFK111217C00080000)

10 contracts

@$1.50

9/14/2011

Oracle

October 30 calls (ORCL111022C00030000)

20 contracts

@$0.75

9/20/2011

Ford Motor

November 12 calls (F111119C00012000)

20 contracts

@$0.25

9/20/2011

F5 Networks

October 90 calls (FFIV111022C00090000)

10 contracts

@$1.50

9/26/2011

Rambus

November 16 calls (RMBS111119C00016000)

10 contracts

@$2.40

9/28/2011

Caterpillar

October 70 puts (CAT111022P00070000)

20 contracts

@$1.40

9/28/2011

Goldman Sachs

October 85 puts (GS111022P00085000)

20 contracts

@$1.30

9/29/2011

FedEx

October 65 puts (FDX111022P00065000)

20 contracts

@$1.10

9/29/2011

Goldman Sachs

October 85 puts (GS111022P00085000)

20 contracts

@$1.45

9/29/2011

Occidental Petroleum

October 67.50 puts (OXY111022P00067500)

20 contracts

@$1.35

9/29/2011

Riverbed Technology

October 18 puts (RVBD111022P00018000)

20 contracts

@$0.95

expired 9/17/2011

10 contracts

@$0.00

$0

($1,550)

-100%

expired 8/20/2011

20 contracts

@$0.00

$0

($1,000)

-100%

expired 9/17/2011

10 contracts

@$0.00

$0

($1,000)

-100%

expired 9/17/2011

20 contracts

@$0.00

$0

($1,100)

-100%

8/12/2011

40 contracts

@$0.80

$3,200

$1,400

78%

8/12/2011

20 contracts

@$1.20

$2,400

$400

20%

8/17/2011

10 contracts

@$0.65

$650

($1,150)

-64%

8/25/2011

10 contracts

@$0.15

$150

($550)

-79%

9/6/2011

20 contracts

@$0.90

$1,800

$300

20%

$700

expired 10/22/2011

10 contracts

@$0.00

$0

($700)

-100%

$2,010

8/30/2011 closed 1/2 @ $2.00,

8/31/2011 closed half @ $3.40

20 contracts

@$2.70 avg.

$5,400

$3,390

169%

12/20/2011

20 contracts

@$0.02

$40

($1,960)

-98%

$1,500

12/20/2011

50 contracts

@$0.01

$50

($1,450)

-97%

$3,000

9/16/2011 closed 1/2 @ $3.50,

9/27/2011 closed half @ $3.60

20 contracts

@$3.55 avg.

$7,100

$4,100

137%

$1,100

9/21/2011

10 contracts

@$1.15

$1,150

$50

5%

$1,500

10/27/2011 closed 1/2 @ $2.90,

11/9/2011 closed half @ $4.00

10 contracts

@$3.45 avg.

$3,450

$1,950

130%

expired 12/16/2011

10 contracts

@$0.00

$0

($1,500)

-100%

9/21/2011

20 contracts

@$1.25

$2,500

$1,000

67%

9/29/2011

20 contracts

@$0.15

$300

($200)

-40%

$1,500

9/22/2011

10 contracts

@$0.75

$750

($750)

-50%

$2,400

10/20/2011 closed 1/2 @ $3.05,

11/2/2011 closed half @ $2.75

10 contracts

@$2.90 avg.

$2,900

$500

21%

9/29/2011

20 contracts

@$1.90

$3,800

$1,000

36%

$2,600

9/29/2011

20 contracts

@$1.75

$4,500

$1,900

73%

$2,200

10/4/2011 closed 1/2 @ $3.30,

10/4/2011 closed half @ $2.50

20 contracts

@$2.90

$5,800

$3,600

164%

$2,900

9/30/2011 closed 1/2 @ $2.25,

10/4/2011 closed half @ $6.00

20 contracts

@$4.125 avg.

$8,250

$5,350

184%

9/30/2011

20 contracts

@$2.35

$4,700

$2,000

74%

10/5/2011

20 contracts

@$1.00

$2,000

$100

5%

$1,550

$1,000

$1,000

$1,100

$1,800

$2,000

$1,800

$700

$1,500

$2,000

$1,500

$1,500

$500

$2,800

$2,700

$1,900

Momentum Options Trading Open Closed Trades 2008 thru 2011 as of 1/25/2012

9/30/2011

Cimarex Energy

October 50 puts (XEC111022P00050000)

20 contracts

@$1.30

10/3/2011

iShares Russell 2000 Index

October 59 puts (IWM111022P00059000)

20 contracts

@$1.70

10/5/2011

Broadcomm

October 35 calls (BRCM111022C00035000)

20 contracts

@$0.75

10/5/2011

Microsoft

November 28 calls (MSFT111119C00028000)

20 contracts

@$0.90

10/5/2011

Pepsi

November 65 calls (PEP111119C00065000)

20 contracts

@$0.50

10/5/2011

Seattle Genetics

November 17.50 puts (SGEN111119P00017500)

20 contracts

@$0.60

10/6/2011

Broadcomm

October 36 calls (BRCM111022C00035000)

20 contracts

@$0.80

10/6/2011

Potash

November 52.50 calls (POT111119C00052500)

20 contracts

@$1.00

10/10/2011

O'Reilly Automotive

November 75 calls (ORLY111119C000750000)

20 contracts

@$0.55

10/11/2011

Infosys Technologies

November 60 calls (INFY111119C00060000)

20 contracts

@$0.60

10/12/2011

Intuit

November 55 calls (INTU111119C00055000)

20 contracts

@$0.95

10/13/2011

SanDisk

November 50 calls (SNDK111119C00050000)

20 contracts

@$1.30

10/13/2011

Rockwell Automation

November 70 calls (ROK111119C00070000)

20 contracts

@$1.10

10/13/2011

VMWare

November 105 calls (VMW111119C00105000)

20 contracts

@$0.85

10/18/2011

Potash

November 52.50 calls (POT111119C00052500)

20 contracts

@$1.20

10/18/2011

Qualcomm

November 57.50 calls (QCOM111119C00057500)

20 contracts

@$0.95

10/19/2011

PowerShares QQQ

November 58 calls (QQQ111119C00058000)

10 contracts

@$1.60

10/20/2011

Spreadtrum Communications

November 24 calls (SPRD111119C00024000)

20 contracts

@$1.00

10/24/2011

Cabot Oil & Gas

November 80 calls (COG111119C00065000)

10 contracts

@$1.25

10/24/2011

Pepsico

January 65 calls 2012 (PEP120121C00065000)

20 contracts

@$0.70

10/26/2011

Taiwan Semiconductor Manufacturing

December 12.50 calls (TSM111217C00012500)

30 contracts

@$0.50

10/26/2011

Molex

November 25 calls (MOLX111119C00025000)

20 contracts

@$0.80

10/28/2011

Vivus

March 13 calls 2012 (VVUS120317C00013000)

10 contracts

@$1.55

10/28/2011

Vivus

December 10 calls (VVUS111217C00010000)

20 contracts

@$0.50

10/28/2011

Alcoa

December 13 calls (AA111217C00013000)

50 contracts

@$0.15

10/28/2011

Alcoa

November 12 calls (AA111119C00012000)

50 contracts

@$0.18

10/31/2011

Skyworks Solutions

January 25 calls 2012 (SWKS120121C00025000)

20 contracts

@$0.80

$2,600

10/4/2011 closed 1/2 @ $2.60,

10/4/2011 closed half @ $1.95

20 contracts

@$2.275 avg.

$4,550

$1,950

75%

$3,400

10/4/2011 closed 1/2 @ $2.50,

10/4/2011 closed half @ $2.10

20 contracts

@$2.30 avg.

$4,600

$1,200

35%

$1,500

10/5/2011 closed 1/2 @ $1.25,

10/6/2011 closed half @ $1.00

20 contracts

@$1.125 avg.

$2,250

$750

50%

$1,800

10/13/2011

20 contracts

@$1.40

$2,800

$1,000

56%

$1,000

10/12/2011 closed 1/2 @ $0.85,

10/13/2011 closed half @ $0.55

20 contracts

@$0.70 avg.

$1,400

$400

40%

11/7/2011

20 contracts

@$0.80

$1,600

$400

33%

10/7/2011

20 contracts

@$1.10

$2,200

$600

38%

10/17/2011

20 contracts

@$1.25

$2,500

$500

25%

$1,100

10/27/2011

20 contracts

@$1.60

$3,200

$2,100

191%

$1,200

10/12/2011 closed 1/2 @ $1.40,

10/12/2011 closed half @ $0.90

20 contracts

@$1.15 avg.

$2,300

$1,100

92%

$1,900

10/17/2011

20 contracts

@$1.15

$2,300

$400

21%

$2,600

10/24/2011 closed 1/2 @ $2.75,

10/25/2011 closed half @ $2.15

20 contracts

@$2.45 avg.

$4,900

$2,300

88%

10/17/2011

20 contracts

@$1.15

$2,300

$100

5%

10/17/2011

20 contracts

@$1.70

$3,400

$1,700

100%

expired 11/18/2011

20 contracts

@$0.00

$0

($2,400)

-100%

expired 11/18/2011

20 contracts

@$0.00

$0

($1,900)

-100%

10/27/2011

10 contracts

@$1.65

$1,650

$50

3%

10/25/2011

20 contracts

@$1.45

$2,900

$900

45%

10/27/2011

10 contracts

@$2.00

$2,000

$750

60%

11/3/2011

20 contracts

@$0.80

$1,600

$200

14%

11/30/2011

30 contracts

@$0.55

$1,650

$150

10%

10/28/2011

20 contracts

@$1.35

$2,700

$1,100

69%

$1,550

11/15/2011

10 contracts

@$2.40

$2,400

$850

55%

$1,000

11/7/2011 closed 1/2 @ $0.90,

11/15/2011 closed half @ $0.80

20 contracts

@$0.85 avg.

$1,700

$700

70%

$750

expired 12/16/2011

50 contracts

@$0.00

$0

($750)

-100%

$900

10/28/2011 closed 1/2 @ $0.32,

11/2/2011 closed half @ $0.08

50 contracts

@$0.20 avg.

$1,000

$100

11%

12/20/2011

20 contracts

@$0.05

$50

($1,550)

-97%

$1,200

$1,600

$2,000

$2,200

$1,700

$2,400

$1,900

$1,600

$2,000

$1,250

$1,400

$1,500

$1,600

$1,600

Momentum Options Trading Open Closed Trades 2008 thru 2011 as of 1/25/2012

11/1/2011

Las Vegas Sands

December 52.50 calls (LVS111217C00052500)

10 contracts

@$1.25

11/1/2011

S&P 500 Spiders

December 128 calls (SPY111217C00128000)

10 contracts

@$2.15

11/1/2011

PowerShares QQQ

November 58 calls (QQQ111119C00058000)

20 contracts

@$0.90

11/2/2011

Rambus

December 20 calls (RMBS111217C00020000)

10 contracts

@$1.70

11/4/2011

Newpark Resources

December 10 calls (NR111217C00010000)

30 contracts

@$0.60

11/7/2011

Spreadtrum Communications

November 31 calls (SPRD111119C00031000)

20 contracts

@$0.80

11/9/2011

Solazyme

March 15 calls 2012 (SZYM120317C00015000)

20 contracts

@$0.80

11/9/2011

Solazyme

December 12.50 calls (SZYM111217C00012500)

30 contracts

@$0.55

11/10/2011

JPMorgan

January 36 calls 2012 (JPM120121C00036000)

10 contracts

@$1.15

11/11/2011

iShares Russell 2000

December 79 calls (IWM111217C00079000)

10 contracts

@$1.10

11/21/2011

Juniper Networks

January 25 calls 2012 (JNPR120121C00025000)

10 contracts

@$0.65

11/21/2011

PowerShares QQQ

December 50 puts (QQQ111217P00050000)

10 contracts

@$0.70

11/25/2011

Tesla Motors

January 35 calls 2012 (TSLA120121C00035000)

20 contracts

@$1.10

11/25/2011

Eaton

January 47.50 calls 2012 (ETN120121C00047500)

30 contracts

@$0.55

11/25/2011

Symantec

January 16 calls 2012 (SYMC120121C00016000)

20 contracts

@$0.70

11/25/2011

Clean Energy

January 12.50 calls (CLNE120121C00012500)

20 contracts

@$0.70

11/29/2011

Spreadtrum Communications

January 29 calls 2012 (SPRD120121C00029000)

20 contracts

@$1.00

12/2/2011

Vivus

January 12.50 calls 2012 (VVUS120121C00012500)

20 contracts

@$0.95

12/2/2011

Autodesk

January 38 calls 2012 (ADSK120121C00038000)

20 contracts

@$0.70

12/7/2011

Transocean

January 52.50 calls (RIG120121C00052500)

20 contracts

@$0.70

11/30/2009

TiVo

February 12.50 calls (TUKBV)

10 contracts

@$0.75

12/4/2009

A123 Systems

January 21 calls (ZKQAU)

10 contracts

@$0.80

12/15/2009

Imax

January 12.50 calls (IMQAV)

10 contracts

@$1.05

12/15/2009

Exxon Mobil

April 75 calls (XOMDO)

10 contracts

@$1.45

12/28/2009

Green Mountain Coffee Roasters

January 85 calls (QGMAQ)

10 contracts

@$0.50

1/4/2010

Green Mountain Coffee Roasters

February 95 calls (QGMBS)

10 contracts

@$1.15

1/5/2010

Las Vegas Sands

February 18 calls (LJJBR)

10 contracts

@$0.95

$1,250

expired 12/16/2011

10 contracts

@$0.00

$0

($1,250)

-100%

$2,150

11/3/2011 closed 1/2 @ $3.00,

11/9/2011 closed half @ $2.50

10 contracts

@$2.75 avg.

$2,750

$600

28%

11/3/2011

20 contracts

@$1.05

$2,100

$300

17%

expired 12/16/2011

10 contracts

@$0.00

$0

($1,700)

-100%

expired 12/16/2011

30 contracts

@$0.00

$0

($1,800)

-100%

expired 11/18/2011

20 contracts

@$0.00

$0

($1,600)

-100%

$1,600

11/30/2011

20 contracts

@$1.05

$2,100

$500

31%

$1,650

11/16/2011 closed 1/2 @ $1.50,

11/17/2011 closed half @ $0.60

30 contracts

@$1.05 avg.

$3,150

$1,500

91%

12/30/2011

10 contracts

@$0.20

$200

($950)

-83%

expired 12/16/2011

10 contracts

@$0.00

$0

($1,100)

-100%

12/30/2011

10 contracts

@$0.10

$150

($500)

-77%

expired 12/16/2011

10 contracts

@$0.00

$0

($700)

-100%

$2,200

12/22/2011

20 contracts

@$0.05

$100

($2,100)

-95%

$1,650

11/30/2011 closed 1/2 @ $1.40,

12/2/2011 closed half @ $1.40

30 contracts

@$1.40 avg.

$4,200

$2,550

155%

$1,400

12/5/2011 closed 1/2 @ $1.20,

12/21/2011 closed half @ $0.25

20 contracts

@$0.725 avg.

$1,500

$100

7%

$1,400

12/1/2011 closed 1/2 @ $1.30,

12/2/2011 closed half @ $1.50

20 contracts

@$1.40 avg.

$2,800

$1,400

100%

$2,000

12/5/2011 closed 1/2 @ $1.40,

12/22/2011 closed half @ $0.10

20 contracts

@$0.75 avg.

$1,500

($500)

-25%

12/22/2011

20 contracts

@$0.10

$200

($1,700)

-89%

12/22/2011

20 contracts

@$0.10

$200

($1,200)

-86%

12/30/2011

20 contracts

@$0.03

$60

($1,340)

-96%

$750

1/12/2010

10 contracts

@$0.85

$850

$100

13%

$800

12/30/2009 closed 1/2 @ $2.00,

1/6/2010 closed 1/2 @ $1.50

10 contracts

@$1.75 avg.

$1,750

$950

119%

1/7/2010

10 contracts

@$2.00

$2,000

$950

90%

$1,450

1/15/2010

10 contracts

@$0.52

$520

($930)

-64%

$500

12/30/2009 closed 1/2 @ $1.50,

1/4/10 closed 1/2 @ $1.00

10 contracts

@$1.25 avg.

$1,250

$750

150%

$1,150

1/11/2010

10 contracts

@$1.15

$1,150

$0

0%

$950

1/13/2010 closed 1/2 @ $1.25,

1/19/10 closed 1/2 @ $1.20

10 contracts

@$1.23 avg.

$1,230

$280

29%

$1,800

$1,700

$1,800

$1,600

$1,150

$1,100

$650

$700

$1,900

$1,400

$1,400

$1,050

Momentum Options Trading Open Closed Trades 2008 thru 2011 as of 1/25/2012

1/6/2010

Research In Motion

February 60 puts (RFYNL)

10 contracts

@$1.50

1/7/2010

Vivus

March 10 calls (QJSCB)

10 contracts

@$1.35

1/11/2010

Applied Materials

February 15 calls (ANQBC)

10 contracts

@$0.50

1/11/2010

OSI Systems

February 35 calls (UOJBG)

10 contracts

@$1.40

1/19/2010

EMC

April 19 calls (EMCDS)

10 contracts

@$0.55

1/19/2010

Shuffle Master

May 10 calls (SFQEB)

10 contracts

@$0.85

1/21/2010

Berkshire Hathaway

February 74 calls (BVQBX)

10 contracts

@$1.50

2/1/2010

Berkshire Hathaway

June 100 calls (BPYFT)

10 contracts

@$0.50

2/1/2010

Berkshire Hathaway

September 100 calls (BPYIT)

10 contracts

@$0.95

2/4/2010

Imax

March 12.50 calls (IMQCV)

10 contracts

@$1.25

2/9/2010

Disney

February 30 calls (DIS100220C000300000)

10 contracts

@$0.60

2/16/2010

Deere

March 60 calls (DGV100320C00060000)

10 contracts

@$0.55

2/18/2010

Joy Global

March 55 calls (JQY100320C00055000)

10 contracts

@$1.10

2/22/2010

F5 Networks

April 60 calls (FLK100417C00060000)

10 contracts

@$1.20

2/23/2010

Garmin

March 32 puts (GQR100320P00032000)

10 contracts

@$0.75

2/25/2010

Standard & Poor Depositary Receipt (SPY)

April 113 calls (SPY100417C00113000)

10 contracts

@$1.27

2/26/2010

Cree

April 75 calls (CQR100417C00075000)

10 contracts

@$1.25

3/1/2010

FedEx

April 90 calls (FDX100417C00090000)

10 contracts

@$1.35

3/3/2010

Qualcomm

March 39 call (AAO100320C00039000)

10 contracts

@$0.70

3/4/2010

Barrick Gold

March 42 calls (ABX100320C00042000)

10 contracts

@$0.50

3/4/2010

Barrick Gold

April 43 calls (ABX100417C00043000)

10 contracts

@$1.03

3/5/2010

TiVo

May 20 calls (TUK100522C00020000)

10 contracts

@$0.85

3/8/2010

Akamai Technologies

April 30 calls (UMU100417C00030000)

10 contracts

@$0.92

3/11/2010

SanDisk

April 36 calls (SWF100417C00036000)

10 contracts

@$1.17

3/11/2010

Bucyrus International

April 70 calls (HIK100417C00070000)

10 contracts

@$1.60

3/17/2010

Nike

April 75 calls (NKE100417C00075000)

10 contracts

@$0.50

3/17/2010

Akamai Technologies

April 32 calls (UMU100417C00032000)

10 contracts

@$1.22

2/2/2010

10 contracts

@$0.50

$500

($1,000)

-67%

1/27/2010

10 contracts

@$0.50

$500

($850)

-63%

expired 2/19/2010

10 contracts

@$0.00

$0

($500)

-100%

expired 2/19/2010

10 contracts

@$0.00

$0

($1,400)

-100%

4/13/2010

10 contracts

@$0.15

$150

($400)

-73%

$850

5/13/2010

10 contracts

@$0.25

$250

($600)

-71%

$1,500

1/29/2010 closed 1/2 @ $3.00,

2/2/10 closed 1/2 @ $3.00

10 contracts

@$3.00

$3,000

$1,500

100%

expired 6/18/2010

10 contracts

@$0.00

$0

($500)

-100%

expired 9/17/2010

10 contracts

@$0.00

$0

($950)

-100%

2/8/2010

10 contracts

@$0.60

$600

($650)

-52%

10 contracts

@$0.67

$670

$70

12%

10 contracts

@$1.20 avg.

$1,200

$650

118%

$1,500

$1,350

$500

$1,400

$550

$500

$950

$1,250

$600

$550

2/11/2010

2/17/2010 closed 1/2

@ $1.30, closed

1/2 @ $1.10

$1,100

2/23/2010

10 contracts

@$0.50

$500

($600)

-55%

$1,200

3/2/2010 closed 1/2 @ $2.50,

3/3/2010 closed 1/2 @ $3.60

10 contracts

@$3.05 avg.

$3,050

$1,850

154%

2/24/2010

10 contracts

@$1.20

$1,200

$450

60%

2/26/2010

10 contracts

@$1.53

$1,530

$260

20%

3/3/2010

10 contracts

@$1.60

$1,600

$350

28%

3/8/2010

10 contracts

@$1.65

$1,650

$300

22%

3/18/2010

10 contracts

@$1.00

$1,000

$300

43%

3/10/2010

10 contracts

@$0.10

$100

($400)

-80%

3/10/2010

10 contracts

@$0.50

$500

($530)

-51%

$850

5/12/2010

10 contracts

@$0.35

$350

($500)

-59%

$920

3/2/2010 closed 1/2 @ $2.45,

3/15/2010 closed 1/2 @ $1.90

10 contracts

@$2.175

$2,175

$1,255

136%

$1,170

4/9/2010

10 contracts

@$0.50

$500

($670)

-57%

$1,600

3/23/2010 closed 1/2 @ $2.40,

3/29/2010 closed 1/2 @ $2.40

10 contracts

@$2.40

$2,400

$800

50%

$500

3/18/2010 closed 1/2 @ $1.50,

3/19/2010 closed 1/2 @ $1.40

10 contracts

@$1.45 avg.

$1,450

$950

190%

4/9/2010

10 contracts

@$1.25

$1,250

$30

2%

$750

$1,270

$1,250

$1,350

$700

$500

$1,030

$1,220

Momentum Options Trading Open Closed Trades 2008 thru 2011 as of 1/25/2012

3/18/2010

Best Buy

April 41 calls (BYY100417C00041000)

10 contracts

@$1.10

3/23/2010

General Mills

April 75 calls (GIS100417C00075000)

10 contracts

@$0.60

3/29/2010

American Tower

May 45 calls (AMT100522C00045000)

10 contracts

@$0.60

3/30/2010

Candian Solar

May 26 calls (GQA100522C00026000)

10 contracts

@$1.20

4/5/2010

Diamonds Trust Series

April 110 calls (DIA100417C00110000)

10 contracts

@$0.85

4/5/2010

Garmin

May 32 puts (QGR100522P00032000)

10 contracts

@$1.00

4/12/2010

JDS Uniphase

May 14 calls (UQD10052200014000)

10 contracts

@$0.75

4/12/2010

Corning

August 22 calls (GLW100821C00022000)

10 contracts

@$0.60

4/12/2010

Fastenal

May 55 calls (FQA100522C00055000)

10 contracts

@$0.55

4/14/2010

Bank of America

August 20 calls (BYO100821C00020000)

10 contracts

@$1.00

4/14/2010

Akamai Technologies

May 36 calls (UMU100522C00036000)

10 contracts

@$0.92

4/26/2010

Dendreon

May 55 calls (DNDN100522C00055000)

10 contracts

@$1.50

4/26/2010

DreamWorks Animation

May 45 calls (DWA100522C00045000)

10 contracts

@$0.90

4/28/2010

Qualcomm

June 36 puts (AAO100619P00036000)

10 contracts

@$0.80

4/30/2010

A123 Systems

June 15 calls (AONE100619C00015000)

10 contracts

@$0.40

5/5/2010

SanDisk

June 35 puts (SWF100619P00036000)

10 contracts

@$0.90

5/5/2010

Apollo Group

June 50 puts (APOL100619P00050000)

10 contracts

@$1.25

5/6/2010

Amazon.com

June 105 puts (AMZN100619P00105000)

10 contracts

@$1.18

5/10/2010

eBay

June 21 puts (EBAY100619P00021000)

10 contracts

@$0.48

5/10/2010

SanDisk

July 34 puts (SNDK100717P00034000)

10 contracts

@$1.50

5/12/2010

Moody's

June 20 puts (MCO100619P00020000)

10 contracts

@$0.80

5/14/2010

Expedia

June 20 puts (EXPE100619P00020000)

10 contracts

@$0.45

5/17/2010

Abercrombie & Fitch

June 35 puts (ANF100619P00035000)

10 contracts

@$1.05

5/17/2010

Powershares QQQ

June 45 puts (QQQQ100619P00045000)

10 contracts

@$1.15

5/20/2010

Vale SA

June 22 puts (VALE100619P00022000)

10 contracts

@$1.00

5/25/2010

Wells Fargo

June 25 puts (WFC10061900025000)

10 contracts

@$0.73

6/1/2010

Qualcomm

July 34 puts (QCOM100717P00034000)

10 contracts

@$1.08

3/25/2010 closed 1/2 @ $3.50,

3/26/2010 closed 1/2 @ $2.60

10 contracts

@$3.05 avg.

$3,050

$1,950

177%

expired 4/17/2010

10 contracts

@$0.00

$0

($600)

-100%

expired 5/21/2010

10 contracts

@$0.00

$0

($600)

-100%

expired 5/21/2010

10 contracts

@$0.00

$0

($1,200)

-100%

4/14/2010

10 contracts

@$1.00

$1,000

$150

18%

expired 5/21/2010

10 contracts

@$0.00

$0

($1,000)

-100%

$750

expired 5/21/2010

10 contracts

@$0.00

$0

($750)

-100%

$600

4/27/2010 closed 1/2 @ $1.00,

4/30/2010 closed 1/2 @ $0.55

10 contracts

@$0.775 avg.

$775

$175

29%

$550

4/13/2010 closed 1/2 @ $1.50,

4/13/2010 closed 1/2 @ $1.10

10 contracts

@$1.30 avg.

$1,300

$750

136%

$1,000

4/19/2010

10 contracts

@$0.78

$780

($220)

-22%

$920

4/29/2010 closed 1/2 @ $3.15,

5/3/10 closed 1/2 @ $4.15

10 contracts

@$3.65 avg.

$3,650

$2,730

297%

$1,500

4/30/2010 closed 1/2 @ $4.00,

5/4/10 closed 1/2 @ $1.40

10 contracts

@$2.70 avg.

$2,700

$1,200

80%

$900

4/27/2010

10 contracts

@$1.10

$1,100

$200

22%

$800

5/7/2010 closed 1/2 @ $1.80,

5/25/10 closed 1/2 @ $1.60

10 contracts

@$1.70 avg.

$1,700

$900

113%

$400

expired 6/18/2010

10 contracts

@$0.00

$0

($400)

-100%

$900

5/7/2010 closed 1/2 @ $2.90, 5/10

closed 1/2 @ $1.10

10 contracts

@$2.00 avg.

$2,000

$1,100

122%

5/20/2010

10 contracts

@$1.05

$1,050

($200)

-16%

$1,180

5/10/2010

10 contracts

@$1.35

$1,350

$170

14%

$480

5/20/2010 closed 1/2 @ $0.95, 5/21 10 contracts

closed 1/2 @ $0.85

@$0.90 avg.

$1,100

$600

$600

$1,200

$850

$1,000

$1,250

$900

$420

88%

$0

($1,500)

-100%

$1,500

expired 7/16/2010

10 contracts

@$0.00

$800

5/14/2010 closed 1/2 @ $1.60,

5/18 closed 1/2 @ $1.30

10 contracts

@$1.45 avg.

$1,450

$650

81%

$450

5/21/2010 closed 1/2 @ $0.90, 5/27 10 contracts

closed 1/2 @ $0.30

@$0.60 avg.

$600

$150

33%

$1,050

5/20/2010 closed 1/2 @ $1.90, 5/21 10 contracts

closed 1/2 @ $2.00

@$1.95

$1,950

$900

86%

$1,150

5/20/2010 closed 1/2 @ $1.90,

5/25 closed 1/2 @ $1.90

10 contracts

@$1.90

$1,900

$750

65%

expired 6/18/2010

10 contracts

@$0.00

$0

($1,000)

-100%

$730

expired 6/18/2010

10 contracts

@$0.00

$0

($730)

-100%

$1,080

7/1/2010 closed 1/2 @ $2.15,

7/9/2010 closed 1/2 @ $0.50

10 contracts

@$1.325 avg.

$1,325

$245

23%

$1,000

Momentum Options Trading Open Closed Trades 2008 thru 2011 as of 1/25/2012

6/1/2010

Moody's

July 18 puts (MCO100717P00018000)

10 contracts

@$1.10

6/2/2010

Powershares QQQ

July 45 puts (QQQQ100717P00045000)

10 contracts

@$1.50

6/2/2010

F5 Networks

July 60 puts (FFIV100717P00060000)

10 contracts

@$1.85

6/9/2010

Las Vegas Sands

July 22 puts (LVS100717P00022000)

10 contracts

@$1.20

6/21/2010

Green Mountain Coffee Roasters

September 30 calls (GMCR100918C00030000)

10 contracts

@$1.47

6/21/2010

Akamai Technologies

July 48 calls (AKAM100717C00048000)

10 contracts

@$1.18

6/21/2010

Sunoco

July 36 calls (SUN100717C00036000)

10 contracts

@$1.10

6/29/2010

Powershares QQQ

August 41 puts (QQQQ100717P00041000)

10 contracts

@$1.10

6/30/2010

Amazon.com

July 100 puts (AMZN100717P00100000)

10 contracts

@$1.12

7/12/2010

CurrencyShares Euro Trust

August 121 puts (FXE100821P00121000)

10 contracts

@$0.70

7/12/2010

Dendreon

August 40 calls (DNDN100821C00040000)

10 contracts

@$1.10

7/19/2010

Aetna

October 25 puts (AET101016P00025000)

10 contracts

@$0.93

7/30/2010

Semiconductor HOLDRs

September 27 puts (SMH100918P00027000)

10 contracts

@$1.15

8/6/2010

PowerShares QQQ

September 45 puts (QQQQ100918P00045000)

10 contracts

@$0.95

8/10/2010

J.C. Penney

August 21 puts (JCP100821P00021000)

10 contracts

@$0.60

8/11/2010

Qualcomm

September 37 puts (QCOM100918P00037000)

10 contracts

@$0.85

8/12/2010

Research In Motion

September 47.5 puts (RIMM100918P00047500)

10 contracts

@$1.03

8/12/2010

Las Vegas Sands

September 25 puts (LVS100918P00025000)

10 contracts

@$0.75

8/17/2010

TiVo

November 12 calls (TIVO101120C00012000)

10 contracts

@$0.50

8/18/2010

Powershares QQQ

October 43 puts (QQQQ100918P00043000)

10 contracts

@$1.15

8/23/2010

U.S. Steel

September 52.50 calls (X100918C00052500)

10 contracts

@$1.25

8/24/2010

Vornado Realty Trust

September 75 puts (VNO100918P00075000)

10 contracts

@$1.10

9/2/2010

Garmin

October 25 puts (GRMN101016P00025000)

10 contracts

@$0.70

9/2/2010

F5 Networks

October 80 puts (FFIV101016P00080000)

10 contracts

@$1.60

9/2/2010

FedEx

October 75 puts (FDX101016P00075000)

10 contracts

@$1.70

9/13/2010

Research In Motion

October 40 puts (RIMM101016P00040000)

10 contracts

@$1.35

9/13/2010

Research In Motion

October 50 calls (RIMM101016C00050000)

10 contracts

@$1.02

$1,100

expired 7/16/2010

10 contracts

@$0.00

$0

($1,100)

-100%

$1,500

7/1/2010 closed 1/2 @ $2.90, 7/7

closed 1/2 @ $1.50

10 contracts

@$2.20 avg.

$2,200

$700

47%

$1,850

expired 7/16/2010

10 contracts

@$0.00

$0

($1,850)

-100%

$1,200

7/2/2010 closed 1/2 @ $1.65,

1/2 expired 7/16/2010

10 contracts

@$0.825 avg.

$825

($375)

-31%

$1,470

7/29/2010 closed 1/2 @ $2.40,

8/1/10 closed 1/2 @ $2.00

10 contracts

@$2.20 avg.

$2,200

$730

50%

6/24/2010

10 contracts

@$0.65

$650

($530)

-45%

6/29/2010

10 contracts

@$1.15

$1,150

$50

5%

expired 8/20/2010

10 contracts

@$0.00

$0

($1,100)

-100%

expired 7/16/2010

10 contracts

@$0.00

$0

($1,120)

-100%

$700

expired 8/20/2010

10 contracts

@$0.00

$0

($700)

-100%

$1,100

8/4/2010 closed 1/2 @ $1.60,

8/5/10 closed 1/2 @ $1.00

10 contracts

@$1.30 avg.

$1,300

$200

18%

$930

expired 10/15/2010

10 contracts

@$0.00

$0

($930)

-100%

$1,150

9/1/2010 closed 1/2 @ $2.00,

9/3/10 closed half @ $1.30

10 contracts

@$1.65 avg.

$1,650

$500

43%

$950

8/17/2010

10 contracts

@$1.00

$1,000

$50

5%

$600

8/13/2010 closed 1/2 @ $0.93,

8/16/10 closed half @ $1.25

10 contracts

@$1.09 avg.

$1,090

$490

82%

$850

expired 9/17/2010

10 contracts

@$0.00

$0

($850)

-100%

$1,030

8/24/2010 closed 1/2 @ $2.70,

8/26/10 closed half @ $2.25

10 contracts

@$2.475 avg.

$2,475

$1,445

140%

expired 9/17/2010

10 contracts

@$0.00

$0

($750)

-100%

expired 11/19/2010

10 contracts

@$0.00

$0

($500)

-100%

expired 10/15/2010

10 contracts

@$0.00

$0

($1,150)

-100%

9/14/2010

10 contracts

@$0.10

$100

($1,150)

-92%

expired 9/17/2010

10 contracts

@$0.00

$0

($1,100)

-100%

expired 10/15/2010

10 contracts

@$0.00

$0

($700)

-100%

expired 10/15/2010

10 contracts

@$0.00

$0

($1,600)

-100%

expired 10/15/2010

10 contracts

@$0.00

$0

($1,700)

-100%

$1,350

expired 10/15/10

10 contracts

@$0.00

$0

($1,350)

-100%

$1,020

9/16/2010 closed 1/2 @ $1.50,

9/17/10 closed half @ $1.30

10 contracts

@$1.40 avg.

$1,400

$380

37%

$1,180

$1,100

$1,100

$1,120

$750

$500

$1,150

$1,250

$1,100

$700

$1,600

$1,700

Momentum Options Trading Open Closed Trades 2008 thru 2011 as of 1/25/2012

9/13/2010

Best Buy

October 32 puts (BBY101016P00032000)

10 contracts

@$0.99

9/13/2010

Best Buy

October 35 calls (BBY101016C00035000)

10 contracts

@$1.18

9/13/2010

Bank of America

2011 February 15 calls (BAC110219C00015000)

10 contracts

@$0.90

9/20/2010

Adobe Systems

October 32 puts (ADBE101016P00032000)

10 contracts

@$0.92

9/20/2010

Adobe Systems

October 34 calls (ADBE101016C00034000)

10 contracts

@$0.98

9/20/2010

McDonald's

December 80 calls (MCD101218C00080000)

10 contracts

@$0.53

9/23/2010

Deckers Outdoor

October 40 puts (DECK101016P00040000)

10 contracts

@$0.60

9/23/2010

Skechers USA

October 20 puts (SKX101016P00020000)

10 contracts

@$0.70

10/6/2010

Intel

November 18 puts (INTC101120P00018000)

10 contracts

@$0.35

10/6/2010

Intel

November 20 calls (INTC101120C00020000)

10 contracts

@$0.36

10/13/2010

Brocade Communications

April (2011) 6 calls (BRCD110416C00006000)

10 contracts

@$0.60

10/13/2010

Brocade Communications

January (2011) 6 calls (BRCD110122C00006000)

10 contracts

@$0.40

10/13/2010

Juniper Networks

November 33 calls (JNPR101120C00033000)

10 contracts

@$1.19

10/15/2010

Baidu

November 120 calls (BIDU101120C00120000)

10 contracts

@$1.60

10/18/2010

Biodel

November 2.5 puts (BIOD101120P00002500)

10 contracts

@$0.50

10/18/2010

Biodel

November 7.5 calls (BIOD101120C00007500)

10 contracts

@$0.60

10/27/2010

PowerShares QQQ

January 53 (2011) calls (QQQQ110122C00053000)

10 contracts

@$1.54

11/2/2010

Aruba Networks

January 25 (2011) calls (ARUN110122C00025000)

10 contracts

@$1.20

11/8/2010

Darden Restaurants

December 49 calls (DRI101218C00049000)

10 contracts

@$1.20

11/8/2010

Juniper Networks

December 35 calls (JNPR101218C00035000)

10 contracts

@$1.05

11/8/2010

CBOE Holdings

December 25 calls (CBOE101218C00025000)

10 contracts

@$0.75

11/17/2010

Riverbed Technology

March 35 calls (RVBD110319C00035000)

10 contracts

@$1.40

11/17/2010

Juniper Networks

January 35 calls (JNPR110122C00035000)

10 contracts

@$1.30

11/19/2010

JDS Uniphase

March 12 calls (JDSU110319C00012000)

10 contracts

@$1.25

11/30/2010

Foster Wheeler

January 30 calls (FWLT110122C00030000)

10 contracts

@$1.00

11/30/2010

FedEx

January 100 calls (FDX110122C00100000)

10 contracts

@$1.25

12/17/2010

Discover Financial Services

January 17.50 puts (DFS110122P00017500)

10 contracts

@$0.45

expired 10/15/10

10 contracts

@$0.00

$0

($990)

-100%

9/14/2010

10 contracts

@$2.40

$2,400

$1,220

103%

$900

10/14/2010

10 contracts

@$0.38

$380

($520)

-58%

$920

9/22/2010 closed 1/2 @ $6.00,

9/22/2010 closed half @ $5.50

10 contracts

@$5.75

$5,750

$4,830

525%

expired 10/15/10

10 contracts

@$0.00

$0

($980)

-100%

10/21/2010

10 contracts

@$1.25

$1,250

$720

136%

expired 10/15/2010

10 contracts

@$0.00

$0

($600)

-100%

expired 10/15/2010

10 contracts

@$0.00

$0

($700)

-100%

expired 11/19/2010

10 contracts

@$0.00

$0

($350)

-100%

10/12/2010

10 contracts

@$0.51

$510

$150

42%

11/8/2010

10 contracts

@$0.70

$700

$100

17%

$400

11/2/2010

10 contracts

@$0.60

$600

$200

50%

$1,190

11/8/2010 closed 1/2 @ $1.65,

11/10/10 closed half @ $1.25

10 contracts

@$1.45 avg.

$1,450

$260

22%

$1,600

10/18/2010 closed 1/2 @ $3.20,

10/22/10 closed half @ $1.50

10 contracts

@$2.35 avg.

$2,350

$750

47%

11/1/2010

10 contracts

@$0.80

$800

$300

60%

$600

11/1/2010

10 contracts

@$0.05

$50

($550)

-92%

$1,540

12/13/2010 closed 1/2 @ $2.15,

12/30/10closed half @ $2.00

10 contracts

@$2.075

$2,075

$535

35%

$1,200

12/29/2010

10 contracts

@$0.10

$100

($1,100)

-92%

$1,200

12/1/2010 closed 1/2 @ $1.80,

12/8/2010 closed half @ $1.30

10 contracts

@$1.55 avg.

$1,550

$350

29%

11/15/2010

10 contracts

@$1.15

$1,150

$100

10%

$750

12/9/2010

10 contracts

@$0.15

$150

($600)

-80%

$1,400

11/23/2010 closed 1/2 @ $3.00,

12/14/10 closed half @ $3.75

10 contracts

@$3.375 avg.

$3,375

$1,975

141%

$1,300

12/2/2010 closed 1/2 @ $1.70,

12/6/10 closed half @ $1.25

10 contracts

@$1.475 avg.

$1,475

$175

13%

$1,250

12/13/2010 closed 1/2 @ $2.70,

12/23/10 closed half @ $2.60

10 contracts

@$2.65 avg.

$2,650

$1,400

112%

$1,000

12/2/2010 closed 1/2 @ $1.90,

12/14/2010 closed half @ $3.50

10 contracts

@$2.70 avg.

$2,700

$1,700

170%

$1,250

12/2/2010 closed 1/2 @ $2.15,

12/7/2010 closed half @ $1.05

10 contracts

@$1.60 avg.

$1,600

$350

28%

12/29/2010

10 contracts

@$0.25

$250

($200)

-44%

$990

$1,180

$980

$530

$600

$700

$350

$360

$600

$500

$1,050

$450

Momentum Options Trading Open Closed Trades 2008 thru 2011 as of 1/25/2012

Las Vegas Sands

11/21/2008 January 2010 10 Call (LNUAB)

10 contracts

@ $2.00

MGM Mirage

11/21/2008 January 2010 10 Call (YDMAX)

5 contracts

@ $4.50

Wynn Resorts

11/21/2008 January 2010 40 Call (YPWAH)

2 contracts

@ $10.00

Alcoa

12/9/2008 January 10 Call (AAAB)

10 contracts

@ $1.20

Caterpillar

12/9/2008 January 40 Call (CXJAN)

5 contracts

@ $4.80

Schlumberger

12/30/2008 Ferruary 45 Call (SLBBI)

10 contracts

@ $2.00

Toll Brothers

1/5/2009 February 20 Call (TEPBD)

10 contracts

@ $3.00

Apple

1/5/2009 January 95 Call (QAAAS)

10 contracts

@ $3.10

AutoZone

1/7/2009 February 115 Puts (AZONC)

10 contracts

@ $3.00

Family Dollar

1/7/2009 February 30 Call (FDOBF)

20 contracts

@ $0.75

Intuitive Surgical

1/9/2009 February 90 puts (AXQNR)

5 contracts

@$4.50

Genentech

1/12/2009 February 95 calls (DWNBS)

10 contracts

@ $0.85

Genentech

1/12/2009 March 95 calls (DWNCS)

10 contracts

@ $1.50

HSBC

1/13/2009 February 45 puts (HBCNI)

10 contracts

@ $2.85

HSBC

1/13/2009 March 45 puts (HBCOI)

5 contracts

@$4.75

HSBC

1/13/2009 March 40 puts (HBCOH)

10 contracts

@ $2.80

HSBC

1/13/2009 March 35 puts (HBCNI)

10 contracts

@ $1.70

Citigroup

1/14/2009 February 5 puts (CNP)

20 contracts

@ $1.10

Apple

1/21/2009 February 90 calls (QAABR)

10 contracts

@ $2.25

Goldcorp

1/21/2009 February 32.50 calls (GGBZ)

50 contracts

@ $0.40

Barrick Gold

1/21/2009 February 40 calls (ABXBH)

30 contracts

@ $0.90

IBM

1/26/2009 February 95 calls (IBMBS)

20 contracts

@ $1.00

Netflix

1/27/2009 March 35 calls (QNQCG)

10 contracts

@ $2.60

Netflix

1/27/2009 March 40 calls (QNQCH)

20 contracts

@ $0.90

Goldman Sachs

1/28/2009 February 85 calls (GSBQ)

5 contracts

@$4.75

JPMorgan

1/28/2009 February 26 calls (JSABI)

10 contracts

@ $2.50

Eletronic Arts

2/2/2009 February 15 puts (EZQNC)

20 contracts

@ $0.90

$2,000 1/7/2009

10 contracts

@ $3.00

$3,000

$1,000

50%

$2,250 1/7/2009

5 contracts

@ $6.25

$3,200

$950

42%

$2,000 1/7/2009

2 contracts

@ $17.00

$3,400

$1,400

70%

$1,200 1/5/2009

10 contracts

@ $2.00

$2,000

$800

67%

$2,400 1/6/2009

5 contracts

@ $6.05

$3,025

$625

26%

$2,000 1/5/2009

10 contracts

@ $6.00

$6,000

$4,000

200%

$3,000 1/7/2009

10 contracts

@ $3.25

$3,250

$250

8%

$3,100 1/5/2009

10 contracts

@ $4.50

$4,500

$1,400

45%

$3,000 1/13/2009

10 contracts

@ $3.30

$3,300

$300

10%

$1,500 1/13/2009

20 contracts

@ $1.05

$2,100

$600

40%

$2,250 1/21/2009

5 contracts

@$6.50

$3,250

$1,000

44%

10 contracts

@ $0.00

$0

($850)

-100%

$1,500 3/9/2009

10 contracts

@ $0.40

$400

($1,100)

-73%

$2,850 1/16/2009

10 contracts

@ $6.50

$6,500

$3,650

128%

$2,400 1/16/2009

5 contracts

@$8.00

$4,000

$1,600

67%

$2,800 1/16/2009

10 contracts

@ $5.00

$5,000

$2,200

79%

$1,700 1/16/2009

10 contracts

@ $3.00

$3,000

$1,300

76%

$2,200 1/14/2009

20 contracts

@ $2.00

$4,000

$1,800

82%

$2,250 1/22/2009

10 contracts

@ $5.10

$5,100

$2,850

127%

$2,000 1/22/2009

50 contracts

@ $0.75

$3,750

$1,750

88%

$2,700 1/22/2009

30 contracts

@ $1.50

$4,500

$1,800

67%

$2,000 1/29/2009

20 contracts

@ $2.25

$4,500

$2,500

125%

$2,600 2/6/2009

10 contracts

@ $3.90

$3,900

$1,300

50%

$1,800 2/6/2009

20 contracts

@ $1.85

$3,700

$1,900

106%

$2,400 1/29/2009

5 contracts

@$6.50

$3,250

$850

35%

$2,500 1/29/2009

10 contracts

@ $2.75

$2,750

$250

10%

$1,800 2/3/2009

20 contracts

@ $1.45

$2,900

$1,100

61%

$850 2/20/2009

Momentum Options Trading Open Closed Trades 2008 thru 2011 as of 1/25/2012

Spider Gold Shares

2/2/2009 March 99 calls (GLDCU)

10 contracts

@ $2.05

Spider Gold Shares

2/2/2009 March 100 calls (GLDCV)

10 contracts

@ $1.90

Google

2/2/2009 February 370 calls (GGDBN)

10 contracts

@ $2.30

Amgen

2/3/2009 March 60 calls (YAACL)

10 contracts

@ $1.20

Visa

2/3/2009 February 55 calls (VBK)

5 contracts

@$0.60

Goldman Sachs

2/6/2009 February 100 calls (GSBT)

10 contracts

@ $3.00

JPMorgan

2/6/2009 February 25 calls (JSABE)

10 contracts

@ $2.45

Bank Of America

2/6/2009 February 6 calls (BYOBF)

30 contracts

@$0.80

Akamai Technologies

2/9/2009 March 17.50 call (UMUCW)

10 contracts

@ $1.25

Bank Of America

2/12/2009 March 6 calls (BYOCF)

20 contracts

@$0.90

Bank Of America

2/12/2009 March 7 calls (BYOCG)

30 contracts

@$0.60

DJIA Index

2/18/2009 March 75 put (DJXOW)

5 contracts

@$3.10

DJIA Index

2/18/2009 March 74 put (DJXOV)

5 contracts

@$2.75

Research in Motion

2/18/2009 March 40 put (RUPOH)

10 contracts

@ $2.15

Research in Motion

2/18/2009 March 35 put (RUPOG)

20 contracts

@$0.85

General Electric

2/23/2009 March 7.50 put (GEWOU)

30 contracts

@$0.55

AutoZone

2/24/2009 March 160 call (AZOCL)

10 contracts

@ $2.30

AutoZone

2/24/2009 March 130 put (AZOOF)

5 contracts

@$3.90

Safeway

2/25/2009 March 20 put (SWYOD)

20 contracts

@$0.65

IBM

2/26/2009 March 95 call (IBMCS)

30 contracts

@$0.70

Freeport-McMoran

2/27/2009 March 35 call (FCXCG)

20 contracts

@$1.00

Amgen

2/27/2009 April 55 calls (YAADK)

20 contracts

@$0.90

Amgen

2/27/2009 March 47.50 puts (AMQOW)

20 contracts

@$1.25

Celgene

3/2/2009 March 40 puts (LQHOH)

20 contracts

@$0.90

Volatility Index

3/2/2009 March 70 calls (VIXCP)

20 contracts

@$0.80

General Electric

3/4/2009 March 7.50 put (GEWOU)

20 contracts

@$1.00

General Electric

3/4/2009 April 5 put (GEWPC)

20 contracts

@$0.80

$2,050 2/20/2009

10 contracts

@ $4.10

$4,100

$2,050

100%

$1,900 2/20/2009

10 contracts

@ $3.80

$3,800

$1,900

100%

$2,300 2/10/2009

10 contracts

@ $15.00

$15,000

$12,700

552%

$1,200 2/10/2009

10 contracts

@ $1.80

$1,800

$600

50%

$300 2/9/2009

5 contracts

@$2.20

$1,100

$800

267%

$3,000 2/9/2009

10 contracts

@ $4.50

$4,500

$1,500

50%

$2,450 2/9/2009

10 contracts

@ $3.50

$3,500

$1,050

43%

$2,400 2/9/2009

30 contracts

@$1.65

$4,950

$2,550

106%

$1,250 2/17/2009

10 contracts

@ $1.10

$1,100

($150)

-12%

$1,800 2/27/2009

20 contracts

@$0.35

$700

($1,100)

-61%

$1,800 2/27/2009

30 contracts

@$0.20

$600

($1,200)

-67%

$1,550 2/24/2009

5 contracts

@$4.50

$2,250

$700

45%

$1,375 2/24/2009

5 contracts

@$4.00

$2,000

$625

45%

$2,150 2/23/2009

10 contracts

@ $4.50

$4,500

$2,350

109%

$1,700 2/23/2009

20 contracts

@$2.10

$4,200

$2,500

147%

$1,650 2/24/2009

30 contracts

@$0.70

$2,100

$450

27%

$2,300 3/3/2009

10 contracts

@ $5.30

$5,300

$3,000

130%

$1,950 3/2/2009

5 contracts

@$4.30

$2,150

$200

10%

$1,300 2/26/2009

20 contracts

@$1.80

$3,600

$2,300

177%

$2,100 2/27/2009

30 contracts

@$2.25

$6,750

$4,650

221%

$2,000 3/2/2009

20 contracts

@$0.70

$1,400

($600)

-30%

$1,800 3/24/2009

20 contracts

@$0.45

$900

($900)

-50%

$2,500 3/6/2009

20 contracts

@$2.50

$5,000

$2,500

100%

$1,800 3/6/2009

20 contracts

@$2.00

$4,000

$2,200

122%

$1,600 3/6/2009

20 contracts

@$0.40

$800

$2,000 3/4/2009

20 contracts

@$1.50

$3,000

$1,000

50%

$1,600 3/4/2009

20 contracts

@$1.15

$2,300

$700

44%

($800)

-50%

Momentum Options Trading Open Closed Trades 2008 thru 2011 as of 1/25/2012

Potash

3/4/2009 April 100 calls (PYPDT)

5 contracts

@$1.70

Exxon Mobile

3/5/2009 April 70 calls (XOMDN)

10 contracts

@$1.25

Apollo Group

3/6/2009 March 55 puts (OAQOK)

20 contracts

@$0.70

Apollo Group

3/6/2009 April 55 puts (OAQOK)

10 contracts

@$2.95

IBM

3/6/2009 April 95 calls (IBMDS)

10 contracts

@$1.20

ConocoPhillips

3/9/2009 March 40 calls (COPCH)

10 contracts

@$0.58

Smith & Wesson

3/9/2009 March 5 calls (UWJCA)

20 contracts

@$0.35

Take-Two Interactive

3/9/2009 June 10 calls (TUOFB)

20 contracts

@$0.25

$850 3/16/2009

5 contracts

@$1.25

$625

($225)

-26%

$1,250 3/11/2009

10 contracts

@$2.40

$2,400

$1,150

92%

$1,400 3/6/2009

20 contracts

@$1.40

$2,800

$1,400

100%

$2,950 3/10/2009

10 contracts

@$2.50

$2,500

$1,200 3/16/2009

10 contracts

@$3.00

$3,000

$1,800

150%

$580 3/11/2009

10 contracts

@$0.80

$800

$220

38%

$700 3/19/2009

20 contracts

@$0.70

$1,400

$700

100%

$500 3/23/2009

20 contracts

@$0.80

$1,600

$1,100

220%

$810 3/13/2009

10 contracts

@$2.10

$2,100

$1,290

159%

$1,500 4/14/2009

20 contracts

@$5.00

$10,000

$8,500

567%

$1,500 4/14/2009

50 contracts

@$1.60

$8,000

$6,500

433%

$1,080 3/18/2009

10 contracts

@$1.00

$1,000

$1,650 3/24/2009

30 contracts

@$1.00

$3,000

$1,350

82%

$1,200 4/14/2009

30 contracts

@$11.00

$33,000

$31,800

2650%

$1,500 4/14/2009

10 contracts

@$13.50

$13,500

$12,000

800%

$1,030 3/24/2009

10 contracts

@$1.30

$1,300

$270

26%

$1,050 3/30/2009

10 contracts

@$2.00

$2,000

$950

90%

$500

($500)

-50%

($450)

-15%

JPMorgan Chase

3/11/2009 April 25 calls (JSADE)

10 contracts

@$0.81

Bank of America

3/11/2009 May 6 calls (BYOEF)

20 contracts

@$0.75

Bank of America

3/11/2009 July 10 calls (JLWGB)

50 contracts

@$0.30

IBM

3/16/2009 April 100 calls (IBMDT)

10 contracts

@$1.08

Intel

3/16/2009 April 15 calls (NQDC)

30 contracts

@$0.55

Dendreon

3/20/2009 April 10 calls (UKODB)

30 contracts

@$0.40

Dendreon

3/20/2009 May 7.50 calls (UKOEU)

10 contracts

@$1.50

DryShips

3/24/2009 April 5 calls (UOCDA)

10 contracts

@$1.03

Family Dollar

3/25/2009 April 32.50 calls (FDODZ)

10 contracts

@$1.05

Blackstone Group

3/25/2009 April 7.50 calls (BXDU)

10 contracts

@$1.00

$1,000 3/30/2009

10 contracts

@$0.50

Blackstone Group

3/25/2009 May 10 calls (BXEB)

20 contracts

@$0.65

$1,300 3/25/2009

20 contracts

@$2.75

$5,500

$4,200

323%

Blackstone Group

3/25/2009 January 10 calls (KLAB)

10 contracts

@$1.75

5/13/2009 closed 1/2 @ $3.15

$1,750 10/15/2009 closed 1/2 @ $7

10 contracts

@ $5.08 avg.

$5,080

$3,330

190%

Best Buy

3/25/2009 April 35 calls (BBYDG)

10 contracts

@$1.25

$1,250 3/26/2009

10 contracts

@$4.00

$4,000

$2,750

220%

Amazon.com

3/27/2009 April 80 calls (ZQNDP)

10 contracts

@$0.90

$900 4/3/2009

10 contracts

@$2.35

$2,350

$1,450

161%

Mosaic

3/27/2009 April 60 calls (MOSDL)

20 contracts

@$0.60

$1,200 3/30/2009

20 contracts

@$0.30

$600

($600)

-50%

Chipotle Mexican Grill

3/27/2009 April 75 calls (CMGDO)

10 contracts