Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Changes in Remittance Procedures For Payments To Non

Caricato da

rajdeeppawarTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Changes in Remittance Procedures For Payments To Non

Caricato da

rajdeeppawarCopyright:

Formati disponibili

Changes in Remittance Procedures for payments to non-

residents

Changes in Remittance Procedures

for payments to non-residents

Date: 10th October, 2013

As per the Income-tax Act provisions applicable till 30th Septmber 2013, a person

making any payment to a non-resident is required to obtain a Chartered

Accountants (CA) certificate in Form 15CB or a certificate from the tax officer

before making the payment. Further, the remitter is also required to submit

additional information as per Form 15CA. These procedures were required for

each remittance, whether the amount was taxable or not in the hands of the

recipient. In practice, for some payments like imports, some banks were not

insisting on these forms and certificates.

These provisions have been relaxed with effect from 1st October 2013. The new

rules and prescribed forms are annexed with this note. The main changes are:

1. Sums not chargeable to tax:

1.1 The amended provisions no longer require submission of any Forms as

long as the payments are not chargeable to tax in India. Therefore,

payments towards a large number of transactions which have no tax

implications can now be remitted without submission of any forms.

For example, remittance for import of goods; investment in shares; gifts to

relatives[1]; or towards expenses like travel; etc., can now be made without

submission of any forms to the bank.

However, documentary support for each transaction should be maintained

to provide them to the tax officer, if required at a later date. For example,

for travel expenses, tickets can be maintained.

1.2 Further, the rules also include a Specified List of transactions for which

it has been clarified that forms and certificates do not have to be provided.

This list includes transactions in the nature of overseas investments or

loans; remittances towards business & personal travel, transfer of savings

by non-residents; personal gifts & donations; freight insurance; payment of

taxes; and payments towards international bidding.

1.3 Please note that while the new rules provide a significant relaxation, the

tax officer can dispute the claim of the payment not being taxable in India

at a later date. Hence, this relaxation should be used only for those

payments where there is no scope of taxation at source.

Therefore, even where the transaction is included in the specified list

mentioned above, it must be ensured that there is no tax liability.

For example, while remittance of savings from an Indian bank account to a

non-residents own overseas account does not have any tax outgo, it must

be made certain that the remittance is from incomes on which taxes have

already been paid in India. There can be a possibility that the payer while

making the payment has not deducted tax at source. This would not entitle

the non-resident to remit his savings without deduction of tax at source.

Similarly, for gifts made by a resident to an unrelated non-resident, there

can be tax deductible at source.

If there is any doubt regarding the taxability, the procedures should be

complied with and appropriate certificate should be obtained before

making the remittance.

1.4 Further, wherever the income is not chargeable to tax due to a

controversial interpretation of law, it would be better to apply for a

certificate from the CA or the income-tax officer, and fill in the necessary

forms before making the remittance.

For example, where taxability on certain type of income is a matter of

frequent litigation, it would be advisable to take a certificate from a CA or

income-tax officer for correct deduction of tax at source.

1.5 Banks may have their own requirements to allow remittances without

submission of any forms. They may require submission of appropriate

documents or undertaking. Please check with your bank and confirm these

changed requirements beforehand.

2. Sums chargeable to tax, but remittance below the threshold limits:

2.1 The new rules provide that for a payment, where tax is deductible at

source, but the payment does not exceed Rs. 50,000 per transaction (or the

aggregate of such payments does not cross Rs. 2,50,000 during a financial

year), only information required as per Part A of Form 15CA is to be

provided. Part A of Form 15CA requires only limited information

regarding the remitter & remittee, amount remitted, and the amount of tax

deducted at source. A certificate from the CA in Form 15CB or from the tax

officer is not required

.

2.2 There can be an issue when individual remittances are below

Rs. 50,000 but the aggregate of such payments crosses Rs. 2,50,000 at a later

date. In such circumstances, Forms may be required to be filled in f or past

transactions too.

If it is clear as per the contract or agreement that the payments will cross

Rs. 2,50,000 in a financial year, it would be advisable to comply with the

procedures from the first payment onwards.

3. Sums chargeable to tax and remittance above the threshold limits:

Transactions above the threshold limits of Rs. 50,000 each or of Rs. 2,50,000

in aggregate would require providing information as per Part B of Form

15CA along with a certificate from the CA in Form 15CB or a certificate

from the tax officer.

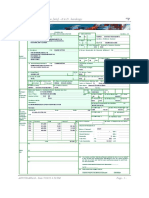

Part B of Form 15CA requires detailed information regarding the remitter,

remittee, the certificate obtained, and the basis for deduction of tax at

source. Further, an undertaking is also required to be provided. The

revised Forms 15CA and 15CB are enclosed with this note.

4. Practical Issues:

4.1 Form 15CA:

The revised Form 15CA is now available online at the income-tax e-filing

portal www.incometaxindiaefiling.gov.in . The payer needs to login to

the portal, and sign with his digital signature for accessing the Form

15CA.

4.2 Bank procedures:

In our knowledge, some banks are asking for issuance of Forms 15CA and

15CB in all transactions which are not covered within the Specified List. In

our view, payment for any transaction which is not taxable in India can be

remitted without submission of any forms.

5. Action to be taken:

The tax department has done away with needless filing of forms for

transactions where there was in any case no tax to be deducted at source.

However, wherever there is any doubt regarding the taxability of

remittances, it would be better to obtain a certificate before making the

remittance.

We have prepared a check-list that can be adopted for each payment to be

made. The same is annexed with this note.

[1] As defined in Explanation (e) to Section 56(2)(vii)

Annexures:

1. Notification for Revised Forms 15CA and 15CB.

2. Revised Form 15CA.

3. Revised Form 15CB.

- See more at: http://www.rashminsanghvi.com/articles/taxation/international-

taxation/Note_on_revised_remittance_procedures.html#sthash.gLyTcB0h.dpuf

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- SCS 2007 04Documento40 pagineSCS 2007 04rajdeeppawarNessuna valutazione finora

- SCS 2006 02Documento40 pagineSCS 2006 02rajdeeppawarNessuna valutazione finora

- SCS 2007 11Documento46 pagineSCS 2007 11rajdeeppawarNessuna valutazione finora

- SCS 2006 02Documento40 pagineSCS 2006 02rajdeeppawarNessuna valutazione finora

- SCS 2007 02Documento29 pagineSCS 2007 02rajdeeppawarNessuna valutazione finora

- SCS 2011 01Documento43 pagineSCS 2011 01rajdeeppawar100% (1)

- SCS 2007 03Documento36 pagineSCS 2007 03Suppy PNessuna valutazione finora

- NOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryDocumento4 pagineNOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryrajdeeppawarNessuna valutazione finora

- Paper 8Documento3 paginePaper 8rajdeeppawarNessuna valutazione finora

- Exam Form Issue CircularDocumento1 paginaExam Form Issue CircularrajdeeppawarNessuna valutazione finora

- Paper 6Documento3 paginePaper 6Suppy PNessuna valutazione finora

- Paper 7Documento4 paginePaper 7Suppy PNessuna valutazione finora

- Paper 5Documento4 paginePaper 5rajdeeppawarNessuna valutazione finora

- Diff Bet USGAAP IGAAP IFRSDocumento7 pagineDiff Bet USGAAP IGAAP IFRSrajdeeppawarNessuna valutazione finora

- Statutory Due Date For F y 15 16Documento1 paginaStatutory Due Date For F y 15 16rajdeeppawarNessuna valutazione finora

- Trade Unions Act 1926Documento15 pagineTrade Unions Act 1926JenniferMujNessuna valutazione finora

- NOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryDocumento3 pagineNOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryrajdeeppawarNessuna valutazione finora

- Roll No : Part - ADocumento5 pagineRoll No : Part - ArajdeeppawarNessuna valutazione finora

- Dtaa UsaDocumento35 pagineDtaa UsarajdeeppawarNessuna valutazione finora

- Paper 2Documento12 paginePaper 2rajdeeppawarNessuna valutazione finora

- Roll No : Part - ADocumento5 pagineRoll No : Part - ArajdeeppawarNessuna valutazione finora

- GrammerDocumento10 pagineGrammerrajdeeppawarNessuna valutazione finora

- NOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryDocumento3 pagineNOTE: Answer SIX Questions Including Question No.1 Which Is CompulsoryrajdeeppawarNessuna valutazione finora

- Exam Centre Node CentreDocumento17 pagineExam Centre Node CentrerajdeeppawarNessuna valutazione finora

- Cost Accounting Standards at A GlanceDocumento10 pagineCost Accounting Standards at A GlancerajdeeppawarNessuna valutazione finora

- Story On DT Case Law Nov.13: Amit JainDocumento3 pagineStory On DT Case Law Nov.13: Amit JainrajdeeppawarNessuna valutazione finora

- Cost Accounting Standards at A GlanceDocumento10 pagineCost Accounting Standards at A GlancerajdeeppawarNessuna valutazione finora

- Tds 195Documento46 pagineTds 195rajdeeppawarNessuna valutazione finora

- MIRO Credit MemoDocumento5 pagineMIRO Credit Memochapx032Nessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Management Letter Mattsenkumar Services PVT LTD 2021-22Documento12 pagineManagement Letter Mattsenkumar Services PVT LTD 2021-22Sudhir Kumar DashNessuna valutazione finora

- Financial Analysis Model:: Enter Data in Black Cells Are Computer GeneratedDocumento2 pagineFinancial Analysis Model:: Enter Data in Black Cells Are Computer GeneratedAnkit ChaudharyNessuna valutazione finora

- At January 2008 IssueDocumento68 pagineAt January 2008 IssuejimfiniNessuna valutazione finora

- Curriculum Vitae Anis Abidi: Membership in Professional SocietiesDocumento3 pagineCurriculum Vitae Anis Abidi: Membership in Professional SocietiesJalel SaidiNessuna valutazione finora

- BP2313 Audit With Answers)Documento44 pagineBP2313 Audit With Answers)hodgl1976100% (4)

- Compliances For Small Company - Series - 40Documento11 pagineCompliances For Small Company - Series - 40Divesh GoyalNessuna valutazione finora

- Unilever Annual Report and Accounts 2016 Tcm244 498880 enDocumento192 pagineUnilever Annual Report and Accounts 2016 Tcm244 498880 enromNessuna valutazione finora

- 9 2023 1 06 27 AmDocumento1 pagina9 2023 1 06 27 Amowei prosperNessuna valutazione finora

- PersonalFN Services GuideDocumento4 paginePersonalFN Services GuideafsplNessuna valutazione finora

- Priyanka IntroDocumento8 paginePriyanka IntroSameer KambleNessuna valutazione finora

- Consumer Durable LoansDocumento10 pagineConsumer Durable LoansdevrajkinjalNessuna valutazione finora

- Research Papers On Bank Loans in IndiaDocumento7 pagineResearch Papers On Bank Loans in Indiaofahxdcnd100% (1)

- UNI DRFT - Duty - Apsara - 31.07.2023Documento1 paginaUNI DRFT - Duty - Apsara - 31.07.2023praneeth jayeshaNessuna valutazione finora

- Ali Wahid Mustafa - CopieDocumento1 paginaAli Wahid Mustafa - Copiechrismas info gsmNessuna valutazione finora

- Rajiv Gandhi Equity Savings Scheme (80-CCG)Documento9 pagineRajiv Gandhi Equity Savings Scheme (80-CCG)shaannivasNessuna valutazione finora

- Republic Glass Corporation VS QuaDocumento1 paginaRepublic Glass Corporation VS QuaEarl LarroderNessuna valutazione finora

- Implied Volatility Formula of European Power Option Pricing: ( ) RespectivelyDocumento8 pagineImplied Volatility Formula of European Power Option Pricing: ( ) RespectivelyAdnan KamalNessuna valutazione finora

- Laporan Rekening Koran (Account Statement Report) : Balance Remark Debit Reference No Credit Posting DateDocumento6 pagineLaporan Rekening Koran (Account Statement Report) : Balance Remark Debit Reference No Credit Posting Datedok wahab siddikNessuna valutazione finora

- Ledger - Problems and SolutionsDocumento1 paginaLedger - Problems and SolutionsDjamal SalimNessuna valutazione finora

- NSS Central Audit Report User Manual - 16.032020Documento48 pagineNSS Central Audit Report User Manual - 16.032020Manoj TribhuwanNessuna valutazione finora

- Collection of Sum of Money - Assignment BDocumento5 pagineCollection of Sum of Money - Assignment BMark ValenciaNessuna valutazione finora

- 201120020118700048000000Documento3 pagine201120020118700048000000shubhamNessuna valutazione finora

- BA 323 Study GuideDocumento7 pagineBA 323 Study GuideTj UlianNessuna valutazione finora

- Content Problem Sets 4. Review Test Submission: Problem Set 08Documento8 pagineContent Problem Sets 4. Review Test Submission: Problem Set 08gggNessuna valutazione finora

- International Trading Regulation Hannan Aminatami AlkatiriDocumento11 pagineInternational Trading Regulation Hannan Aminatami AlkatiriAlyssa Khairafani GandamihardjaNessuna valutazione finora

- Decline of Spain SummaryDocumento4 pagineDecline of Spain SummaryNathan RoytersNessuna valutazione finora

- Contingency Planning & Simulation Exercises Practical ApplicationsDocumento11 pagineContingency Planning & Simulation Exercises Practical ApplicationsMustafa Shafiq RazalliNessuna valutazione finora

- Product Costing Material Ledger1Documento31 pagineProduct Costing Material Ledger1Anand NcaNessuna valutazione finora

- Ae1 RFP PDFDocumento117 pagineAe1 RFP PDFAnonymous eKt1FCDNessuna valutazione finora

- 100% Free - Forex MetaTrader IndicatorsDocumento5 pagine100% Free - Forex MetaTrader IndicatorsMuhammad Hannan100% (1)