Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Summary of Proposed Intrastate Crowdfunding Exemptions July 2014

Caricato da

CrowdfundInsiderCopyright

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Summary of Proposed Intrastate Crowdfunding Exemptions July 2014

Caricato da

CrowdfundInsiderCopyright:

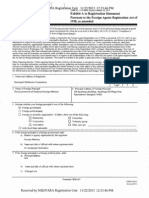

Summary of PROPOSED Intrastate Crowdfunding Exemptions

Any offer or sale of securities that uses the jurisdictional means (the mails, phones, internet) must be registered under the federal Securities Act of 1933 (the Securities Act) or be made in accordance with an exemption from that registration. Such

exemptions apply ONLY to registration of the offering; issuers are still subject to liability under the federal antifraud laws. Similarly, if issuers acquire a specified number of equity holders, they will be required to register under the federal Securities

Exchange Act of 1934. Further, any intermediary used in connection with a securities offering MAY be subject to applicable federal and state broker dealer and/or other registration requirements.

The federal exemption most frequently relied on for intrastate offerings is Section 3(a)(11) of the Securities Act, but Rule 504 of the of the Securities Act is also used. Resale/transfer of securities sold through intrastate offerings will be restricted based

on the underlying federal exemption. If the intrastate offering relies on Section 3(a)(11), the securities will have to come to rest (9 month requirement under SEC Rule 147) in the respective state before they can be transferred. If the intrastate offer

ing relies on Rule 504, the securities will be restricted securities and subject to the restrictions on transfer provide in the Securities Act.

Potential liabilities for issuers and intermediaries in connection with intrastate offerings include, among others, anti fraud liability under 12(a)(2) of the Securities Act and Rule 10b 5 under the Exchange Act, as well as the respective applicable state

securities anti fraud liability statutes (some of which are identified below).

DISCLAIMER: Nothing in this chart is, or is intended to be, legal advice. The information herein is provided for informational purposes ONLY and YOU SHOULD CONSULT WITH YOUR ATTORNEY before using any of this infor

mation. Further, NO REPRESENTATION OR WARRANTY is made as to the accuracy or use of any of information contained in this chart and there shall be NO DUTY, express or implied, on the authors or any other person to

update any of the information herein.

STATE

ALASKA

CALIFORNIA

CONNECTICUT

FLORIDA

ILLINOIS

MISSOURI

HB 308; HB

303

Assembly Bill

2096

HB 5577

HB 1299 (cur

rently dead);

and SB 1596

(currently

dead)

Currently Un

sponsored

(www.illinoiscrowd

fundingnow.com)

HB 1736

Statute citation

Alaska Stat.

45.55.900 (b);

45.55.175

California

Corp. Code.

25112, et seq.,

as amended

by Assembly

Bill 2096

(see Note 4

below)

Fla. Stat.

517.011 et

seq., et seq.,

as amended

by HB 1299/SB

1596

Exemption from

federal registra

tion relied upon

(see Note 1 be

low)

Section

3(a)(11) of the

Securities Act

Rule 504 of

Regulation D

(see Note 4

below)

Companies per

mitted to use the

exemption

Only available

to companies

organized and

doing business

in the state

Silent as to

whether issu

ing company

needs to be

organized in

the state; ex

cludes invest

ment compa

nies, SEC re

porting com

panies, or

(see Note 4

below)

Title

NORTH

CAROLINA

HB 680 (Invest

NC Exemption)

NEW JERSEY

TEXAS

UTAH

VIRGINA

Proposed

Rules (39

TexReg 3652)

HB 142

SB 351; HB

880

815 ILCS

Proposed new

5/1, et seq., as section RSMo

amended by

409.315

proposed bill

Proposed new

section N.C.

Gen. Stat.

78A 19

New act sup

plementing

P.L.1967, c.93

(C.49:3 47 et

seq.)

Proposed new

section S.C.

Code Ann.

35 1 205

Title 7, Part 7,

as amended

by proposed

rules

Utah Code

61 1 14, as

amended by

HB 142

VA Code

13.1 514, as

amended by

SB 351; HB

142

Section

3(a)(11) of the

Securities Act

Section

3(a)(11) of the

Securities Act

Section

3(a)(11) of the

Securities Act

Section

3(a)(11) of the

Securities Act

Section

3(a)(11) of the

Securities Act

Section

3(a)(11) of the

Securities Act

Section

3(a)(11) of the

Securities Act

Section

3(a)(11) of the

Securities Act

Section

3(a)(11) of the

Securities Act

Only available

to companies

organized and

doing business

in the state;

excludes in

vestment

companies,

SEC reporting

companies, or

blank check

Only available

to companies

organized and

doing business

in the state;

excludes in

vestment

companies,

SEC reporting

companies, or

blank check

Only available

to companies

organized and

doing business

in the state;

excludes in

vestment

companies,

SEC reporting

companies, or

blank check

Only available

to companies

organized and

doing business

in the state;

excludes in

vestment

companies,

SEC reporting

companies, or

blank check

Only available

to companies

organized and

doing business

in the state

Only available

to companies

organized and

doing business

in the state;

excludes in

vestment

companies,

SEC reporting

companies, or

blank check

Only available:

to companies:

organized

and doing

business in

the state;

who derived

at least 80%

of their gross

revenues

from opera

Only available

to companies

organized and

doing business

in the state

and who have

at least 80% of

their assets in

the state

Only available

to companies

organized and

doing business

in the state;

excludes in

vestment

companies,

SEC reporting

companies, or

blank check

SB 712

SOUTH

CAROLINA

H. 4799

Prepared as a collaboration by Crowdcheck (www.crowdcheck.com), Anthony J. Zeoli, Esq. (azeoli@ginsbergjacobs.com) of Ginsberg Jacobs LLC, and Georgia P. Quinn, Esq. (gquinn@seyfarth.com) of Seyfarth Shaw LLP.

STATE

ALASKA

CALIFORNIA

CONNECTICUT

blank check

companies

FLORIDA

ILLINOIS

MISSOURI

companies

companies

companies

NORTH

CAROLINA

companies

NEW JERSEY

SOUTH

CAROLINA

companies

TEXAS

UTAH

tions in the

state for the

most recent

fiscal yr. prior

to the offer

ing;

who have at

least 80% of

their assets

in the state

as of the

most recent

semi annual

period prior

to the offer

ing; and

who will use

at least 80%

of the offer

ing proceeds

in the state;

and

whose prin

cipal office is

in the state;

VIRGINA

companies

excludes in

vestment

companies,

SEC reporting

companies, or

blank check

companies

Aggregate annual

sales limit

$1,000,000

$1,000,000

(see Note 4

below)

$1,000,000

Limited to:

$1,000,000

Limited to:

$1,000,000

$5,000,000 if

issu

er provides ind

ependent

ly audited fin.

st atements;

$2,000,000 if

issu

er provides ind

ependent

ly audited fin.

st atements;

NOTE

OR

OR

$3,000,000

if issu

er provides ind

ependent

$1,000,000

Unlimited

$1,000,000

$1,000,000

$2,000,000

(subject to per

offering limits)

Amounts

received by

Accredited

Investors will

not count to

ward calcula

tion of the of

fering

NOTE

Prepared as a collaboration by Crowdcheck (www.crowdcheck.com), Anthony J. Zeoli, Esq. (azeoli@ginsbergjacobs.com) of Ginsberg Jacobs LLC, and Georgia P. Quinn, Esq. (gquinn@seyfarth.com) of Seyfarth Shaw LLP.

STATE

ALASKA

CALIFORNIA

CONNECTICUT

FLORIDA

ILLINOIS

MISSOURI

NORTH

CAROLINA

Offering cap

amounts will

be increased

every 5 years

for CPI chang

es

NEW JERSEY

SOUTH

CAROLINA

TEXAS

UTAH

VIRGINA

Must file with

commission

before any

general solici

tation:

Notification

of intent to

rely on ex

emption;

Issuer Infor

mation; and

Names of all

persons in

volved with

the offering;

Name of es

crowee insti

tution

Must file with

commission

before any

general solici

tation:

Notification

of intent to

rely on ex

emption;

Issuer Infor

mation; and

Names of all

persons in

volved with

the offering

(including

any Internet

Offering Por

tal);

Name of es

crowee insti

tution

Silent

Must file with

commission

before any

general solici

tation:

Notification

of intent to

rely on ex

emption;

Issuer Infor

mation; and

Names of all

persons in

volved with

the offering;

Name of es

crowee insti

tution; and

Copy of term

sheet pro

vided to in

vestor

Must file with

commission at

least 21 days

before any

offering:

Form 133.17;

Copy of dis

closure

statement

delivered to

investors;

Copy of of

fering sum

mary deliv

ered to in

vestors

Notice re

quired but

rules not final

ized

Must file with

commission

before any

general solici

tation:

Notification

of intent to

rely on ex

emption;

Issuer Infor

mation (in

cluding doc

umentation

evidencing

issuers for

mation with

in the State);

and

Names of all

persons in

volved with

the offering;

ly reviewed fin

. statements;

OTHERWISE

$1,000,000

NOTE

Amounts

received by

Accredited

Investors or

any Experi

enced Inves

tors will not

count toward

calculation of

the offering;

Offering cap

amounts will

be increased

every 5 years

for CPI chang

es

State registration

requirements

Notice re

quired but

rules not final

ized, other

than: (a) inclu

sion of copy of

Escrow

Agreement;

and (b)

if/when using

an Internet

Offering Por

tal, notice

specifying use

of such Inter

net Offering

Portal and the

website ad

dress

Commissioner

may by rule

require the

issuer to file

notice.

NASAA SCOR

disclosure

document on

Form U 7

(see Note 4

below)

Must file with

commission

before earlier

of first sale of

any general

solicitation:

Notification

of intent to

rely on ex

emption;

Issuer Infor

mation (in

cluding doc

umentation

evidencing

issuers for

mation with

in the State);

and

Names of all

persons in

volved with

Must file with

commission

before earlier

of first sale or

any general

solicitation

(other than

the permitted

general an

nounce

ment):

Notification

of intent to

rely on ex

emption;

Issuer Infor

mation (in

cluding doc

umentation

evidencing

issuers for

mation with

Prepared as a collaboration by Crowdcheck (www.crowdcheck.com), Anthony J. Zeoli, Esq. (azeoli@ginsbergjacobs.com) of Ginsberg Jacobs LLC, and Georgia P. Quinn, Esq. (gquinn@seyfarth.com) of Seyfarth Shaw LLP.

STATE

Internet Offering

Portal require

ments or re

strictions

(see Note 2 be

low)

ALASKA

Offering may

be made

through an

Internet Offer

ing Portal

CALIFORNIA

Silent

CONNECTICUT

(see Note 4

below)

Silent as to

required regis

tration of Of

fering Portal

as broker

dealer

Escrowee re

quirements or

restrictions

Funds must be

deposited with

escrowee until

minimum of

fering amount

satisfied (si

lent as to qual

FLORIDA

ILLINOIS

the offering;

Name of es

crowee insti

tution

in the State);

and

Names of all

persons in

volved with

the offering;

Name of es

crowee insti

tution

Offering may

be made

through one

or more Inter

net Offering

Portals

Offering may

be made

through one

or more Inter

net Offering

Portals

Offering Portal

not required

to register as a

broker dealer

if all applicable

conditions met

Funds must be

deposited with

escrowee until

minimum of

fering amount

satisfied (si

lent as to qual

(see Note 4

below)

MISSOURI

NORTH

CAROLINA

NEW JERSEY

SOUTH

CAROLINA

TEXAS

UTAH

VIRGINA

Names of all

principal

owners;

Names of all

managers

(and their

experience);

Identification

of all interme

diaries (incl. all

Internet Offer

ing Portals;

Terms of of

fering includ

ing risk fac

tors;

Current liti

gation or legal

proceedings

involving

company or

management

Copy of es

crow agree

ment

Silent

Offering Portal

not required

to register as a

broker dealer

if all applicable

conditions met

Funds must be Funds must be Funds must be

deposited with deposited with deposited with

escrowee au

escrowee

escrowee au

thorized to do qualified to do thorized to do

business in the business in the business in the

state until

state until

state until

minimum of

minimum of

minimum of

Offering may

be made

through an

Internet Offer

ing Portal

Silent as to

required regis

tration of Of

fering Portal

as broker

dealer

Funds must be

deposited with

escrowee until

minimum of

fering amount

satisfied (si

lent as to qual

Offering is

made exclu

sively through

one or more

Internet Offer

ing Portals

Silent as to

required regis

tration of Of

fering Portal

as broker

dealer

Silent

Offering is

made exclu

sively through

one or more

Internet Offer

ing Portals

Silent

Offering Portal

not required

to register as a

broker dealer

if all applicable

conditions met

Funds must be Funds must be Funds must be

deposited with deposited with deposited with

escrowee until escrowee au

escrowee au

minimum of

thorized to do thorized to do

fering amount business in the business in the

satisfied (si

state until

state until

lent as to qual

minimum of

minimum of

Offering may

be made

through one

or more Inter

net Offering

Portals orga

nized in the

state

Offering Portal

not required

to register as a

broker dealer

if all applicable

conditions met

Silent

Funds must be

deposited with

escrowee lo

cated in the

state until

minimum of

fering amount

Prepared as a collaboration by Crowdcheck (www.crowdcheck.com), Anthony J. Zeoli, Esq. (azeoli@ginsbergjacobs.com) of Ginsberg Jacobs LLC, and Georgia P. Quinn, Esq. (gquinn@seyfarth.com) of Seyfarth Shaw LLP.

STATE

Annual Invest

ment/Sale Limi

tations (per Issu

er to an Investor)

per issue annual

investor limits

ALASKA

CALIFORNIA

ifications of

escrowee)

ifications of

escrowee)

Limited to:

Limited to

$5,000 per

investor, un

less investor

qualifies as an

Accredited

investor under

Rule 501 of

Regulation D

the greater

of $2,000 or

5% of the in

vestors in

come or net

worth, IF the

investors in

come or net

worth is less

than

$100,000;

OR

10% of the

investors in

come or net

worth up to

$100,000, IF

the investors

income or net

worth is

greater than

$100,000

NOTE

Commission

er granted au

thor ity to in

crease the in

dividual limit

CONNECTICUT

(see Note 4

below)

FLORIDA

ILLINOIS

MISSOURI

fering amount

satisfied

fering amount

satisfied; Es

crowee must

meet certain

licensing and

registration

requirements

Limited to:

Limited to:

the greater

of $2,000 or

5% of the in

vestors in

come or net

worth, IF the

investors in

come or net

worth is less

than

$100,000;

$5,000 IF the

investors in

come or net

worth is less

than

$100,000;

OR

10% of the

investors in

come or net

worth up to

$100,000, IF

the investors

income or net

worth is

greater than

$100,000

NEW JERSEY

fering amount

satisfied

NORTH

CAROLINA

ifications of

escrowee)

Limited to

$1,000 per

investor, un

less investor

qualifies as an

Accredited

investor under

Rule 501 of

Regulation D

Limited to

$2,000 per

investor, un

less investor

qualifies as an

Accredited

investor under

Rule 501 of

Regulation D

Limited to

$5,000 per

investor, un

less investor

qualifies as an

Accredited

investor under

Rule 501 of

Regulation D

OR

NOTE

10% of the

investors in

come or net

worth up to

$100,000, IF

the investors

income or net

worth is

greater than

$100,000;

unless investor

qualifies as an

Accredited

investor under

Rule 501 of

Regulation D

or an Experi

enced Investor

under Illinois

Compiled Stat.

815 ILCS 5/2

Investment

cap amounts

will be in

creased every

5 years for CPI

changes

ifications of

escrowee)

SOUTH

CAROLINA

fering amount

satisfied

Unlimited

TEXAS

UTAH

fering amount

satisfied

Limited to

$5,000 per

investor, un

less investor

qualifies as an

Accredited

investor under

Rule 501 of

Regulation D

VIRGINA

satisfied

Silent

Limited to:

the greater

of $2,000 or

5% of the in

vestors in

come or net

worth, IF the

investors in

come or net

worth is less

than

$100,000;

OR

10% of the

investors in

come or net

worth up to

$100,000, IF

the investors

income or net

worth is

greater than

$100,000;

unless investor

qualifies as an

Accredited

investor under

Rule 501 of

Regulation D

NOTE

Investment

cap amounts

will be in

creased every

5 years for CPI

Prepared as a collaboration by Crowdcheck (www.crowdcheck.com), Anthony J. Zeoli, Esq. (azeoli@ginsbergjacobs.com) of Ginsberg Jacobs LLC, and Georgia P. Quinn, Esq. (gquinn@seyfarth.com) of Seyfarth Shaw LLP.

STATE

ALASKA

CALIFORNIA

CONNECTICUT

FLORIDA

ILLINOIS

MISSOURI

NORTH

CAROLINA

NEW JERSEY

SOUTH

CAROLINA

TEXAS

UTAH

VIRGINA

changes

Required disclo

sure to investor

(see Note 3 be

low)

Identifying

information

about, and

description of,

the Issuer

Restriction

on transfer

Intended use

of proceeds

Risks to pur

chasers

Restriction

on transfer

Terms of Se

curities

Identifying

information

about, and

description of,

the Issuer

Restriction

on transfer

Intended use

of proceeds

Risks to pur

chasers

Restriction

on transfer

Terms of Se

curities

AND

Any other

information

material to the

offering

Identifying

information

about, and

description of,

the Issuer

Restriction

on transfer

Intended use

of proceeds

Risks to pur

chasers

Restriction

on transfer

Terms of Se

curities

Identifying

information

about, and

description of,

the Issuer

Restriction

on transfer

Intended use

of proceeds

Risks to pur

chasers

Restriction

on transfer

Terms of Se

curities

Identifying

information

about, and

description of,

the Issuer

Restriction

on transfer

Intended use

of proceeds

Risks to pur

chasers

Restriction

on transfer

Terms of Se

curities

Identifying

information

about, and

description of,

the Issuer

Restriction

on transfer

Intended use

of proceeds

Risks to pur

chasers

Restriction

on transfer

Terms of Se

curities

Identifying

information

about, and

description of,

the Issuer

Restriction

on transfer

Intended use

of proceeds

Risks to pur

chasers

Restriction

on transfer

Terms of Se

curities

Identifying

information

about, and

description of,

the Issuer

Restriction

on transfer

Intended use

of proceeds

Risks to pur

chasers

Restriction

on transfer

Terms of Se

curities

Identifying

information

about, and

description of,

the Issuer

Restriction

on transfer

Intended use

of proceeds

Risks to pur

chasers

Restriction

on transfer

Terms of Se

curities

Identifying

information

about, and

description of,

the Issuer

Restriction

on transfer

Intended use

of proceeds

Risks to pur

chasers

Restriction

on transfer

Terms of Se

curities

Identifying

information

about, and

description of,

the Issuer

Restriction

on transfer

Intended use

of proceeds

Risks to pur

chasers

Restriction

on transfer

Terms of Se

curities

AND

AND

AND

AND

AND

AND

AND

AND

AND

AND

NASAA Form

U 7 and all

disclosure re

quired by

same, includ

ing audited (or

reviewed, if

certain qualifi

cations are

met) financial

statements

prepared in

accordance

with GAAP

Any other

information

material to the

offering

Any other

information

material to the

offering

NASAA Form

U 7 and all

disclosure re

quired by

same

NOTE

NASAA Form

U 7 requires

(see Note 4

below)

Identification

Any other

Any other

Required

Copy of Term Financial in

Any other

Any other

of the mini

information

information

disclosure re

Sheet and Pri

formation of

information

information

mum and

material to the material to the garding non

vate Place

Issuer

material to the material to the

maximum

offering

offering

registration of

ment Memo

Current liti

offering

offering

amount of se

securities;

Any other

gation or legal

curities to be

Identity of all

information

proceedings

sold and dead

persons own

material to the

Required

line for closing

ing > 10% of

offering

disclosure

of offering;

any class of

statement

Right of can

securities of

Any other

celation if min

Issuer

information

imum offering

Identity of all

material to the

amount not

officers, direc

offering

met before

tors, etc. of

deadline

Issuer;

Any other

Identification

information

of the mini

material to the

mum and

offering

maximum

amount of se

curities to be

sold and dead

line for closing

of offering;

Identification

of solicitors

and interme

diaries, along

with compen

Prepared as a collaboration by Crowdcheck (www.crowdcheck.com), Anthony J. Zeoli, Esq. (azeoli@ginsbergjacobs.com) of Ginsberg Jacobs LLC, and Georgia P. Quinn, Esq. (gquinn@seyfarth.com) of Seyfarth Shaw LLP.

STATE

ALASKA

Restrictions on

advertising and

communications

Silent

Ongoing report

ing requirements

Silent

CALIFORNIA

audited finan

cial state

ments pre

pared in ac

cordance with

GAAP; the leg

islation only

requires au

dited financial

statements for

offerings be

tween

$500,000 and

$1,000,000

General solici

tation permit

ted

Silent

CONNECTICUT

FLORIDA

ILLINOIS

MISSOURI

NORTH

CAROLINA

NEW JERSEY

SOUTH

CAROLINA

TEXAS

UTAH

VIRGINA

sation

Current liti

gation or legal

proceedings

Any other

information

material to the

offering

(see Note 4

below)

General solici

tation permit

ted after filing

of notice

General solici

tation permit

ted but Issuer

(and any In

ternet Offer

ing Portal

used) must

take commer

cially reasona

ble measures

to limit access

to offer infor

mation to res

idents of the

state (NOTE:

Allows for

general an

nouncement

subject to limi

tations)

General solici

tation permit

ted after filing

of notice

General solici

tation permit

ted after filing

of notice

Silent

General solici

tation permit

ted after filing

with state

General solici

tation permit

ted after filing

with state;

provided all

communica

tion between

Issuer and in

vestors must

be done

through

General solici

tation permit

ted

General solici

tation permit

ted

(see Note 4

below)

Silent

Quarterly (in

ternally pre

pared) reports

to investors

covering busi

ness opera

tions, financial

condition, and

compensation

to directors

and officers;

may satisfy by

posting on its

own website

Silent

Quarterly (in

ternally pre

pared) reports

to investors

covering busi

ness opera

tions, financial

condition, and

compensation

to directors

and officers;

may satisfy by

posting on its

own website

Quarterly (in

ternally pre

pared) reports

to investors

covering busi

ness opera

tions, financial

condition, and

compensation

to directors

and officers;

may satisfy by

posting on its

own website

Silent

Silent

Silent

Quarterly re

ports to inves

tors covering

business oper

ations, finan

cial condition,

and compen

sation to di

rectors and

officers; may

satisfy by post

ing on its own

website or

through a

Prepared as a collaboration by Crowdcheck (www.crowdcheck.com), Anthony J. Zeoli, Esq. (azeoli@ginsbergjacobs.com) of Ginsberg Jacobs LLC, and Georgia P. Quinn, Esq. (gquinn@seyfarth.com) of Seyfarth Shaw LLP.

STATE

ALASKA

CALIFORNIA

CONNECTICUT

FLORIDA

ILLINOIS

MISSOURI

or through a

qualified In

ternet Offer

ing Portal w/in

45 days after

the end of

each fiscal

quarter of Is

suer

NORTH

CAROLINA

or through a

qualified In

ternet Offer

ing Portal w/in

45 days after

the end of

each fiscal

quarter of Is

suer

NEW JERSEY

SOUTH

CAROLINA

TEXAS

UTAH

or through a

qualified In

ternet Offer

ing Portal w/in

45 days after

the end of

each fiscal

quarter of Is

suer

VIRGINA

qualified In

ternet Offer

ing Portal w/in

45 days after

the end of

each fiscal

quarter of Is

suer

Disqualification

from exemption

Bad Actor dis

Bad Actor dis

qualification

qualification

(Same Defn. as (Same Defn. as

Rule 506(d))

Rule 506(d))

(see Note 4

below)

Bad Actor dis

Bad Actor dis

Bad Actor dis

Bad Actor dis

Bad Actor dis

Bad Actor dis

Bad Actor dis

Bad Actor dis

Bad Actor dis

qualification

qualification

qualification

qualification

qualification

qualification

qualification

qualification

qualification

(Same Defn. as (Same Defn. as (Same Defn. as (Same Defn. as (Same Defn. as (Same Defn. as (Same Defn. as (Same Defn. as (Same Defn. as

Rule 506(d))

Rule 506(d))

Rule 506(d))

Rule 506(d))

Rule 506(d))

Rule 506(d))

Rule 506(d))

Rule 506(d))

Rule 506(d))

Applicable state

securities law an

ti fraud liability

Potential lia

bilities include

45.55.925

and

45.55.930 of

the Alaska Se

curities Act

(see Note 4

below)

Potential lia

bilities include

517.241 and

517.302 of

the Florida

Securities Act

Potential lia

bilities include

27200,

27201 and

27202 of the

California Se

curities Act

Potential lia

bilities include

815 ILCS

5/13 and

815 ILCS 5/13

of the Illinois

Securities Act

Potential lia

bilities include

409.5 508

and

409.1006 of

the Missouri

Securities Act

Potential lia

bilities include

78A 56 or

78A 57 of the

North Carolina

Securities Act

Potential lia

bilities include

49:3 70.1

and 49:3 71

of the New

Jersey Securi

ties Act

Potential lia

bilities include

35 1 508

and 35 1

509 of the

South Carolina

Securities Act

Potential lia

bilities include

29 and 33

of the Texas

Securities Act

Potential lia

bilities include

61 1 22 and

61 1 22 of

the Utah Secu

rities Act

Potential lia

bilities include

13.1 520

and 13.1 522

of the Virginia

Securities Act

1. The Section 3(a)(11) exemption from federal registration is generally known as the "intrastate offering exemption." SEC Rule 147 provides a safe harbor from federal regulation for issuers relying on the Section 3(a)(11) intrastate offering exemp

tion. To qualify for this exemption, the company must: (1) be organized in the state where it is offering the securities; (2) carry out a significant amount of its business in that state; and (3) make offers and sales only to residents of that state. For

instance, a corporation organized under the laws of Delaware and does business in Georgia would not qualify for the exemption. Additionally, issuers engaging in general solicitation under the exemptions must take care that they do not make of

fers of securities outside the state.

2. The SEC has recently provided guidance on compliance with use of the internet for intrastate offerings. See SEC Securities Act Compliance and Disclosure Interpretations ("CD&Is") questions 141.03, 141.04, 141.05,

http://www.sec.gov/divisions/corpfin/guidance/securitiesactrules interps.htm. Of note, any online solicitation, whether done by the issuer or third party investment platform, must be restricted to intrastate offerees.

3. Some identified disclosures may represent best practice suggestions rather than statutorily required disclosures.

4. Bill only provides for the study of legislation in other states concerning investment exemptions to allow Crowdfunding.

Prepared as a collaboration by Crowdcheck (www.crowdcheck.com), Anthony J. Zeoli, Esq. (azeoli@ginsbergjacobs.com) of Ginsberg Jacobs LLC, and Georgia P. Quinn, Esq. (gquinn@seyfarth.com) of Seyfarth Shaw LLP.

Potrebbero piacerti anche

- Raising Money – Legally: A Practical Guide to Raising CapitalDa EverandRaising Money – Legally: A Practical Guide to Raising CapitalValutazione: 4 su 5 stelle4/5 (1)

- Summary of Intrastate Crowdfunding Exemptions - Enacted - FinalDocumento11 pagineSummary of Intrastate Crowdfunding Exemptions - Enacted - FinalCrowdfundInsiderNessuna valutazione finora

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemDa EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemNessuna valutazione finora

- Sec Form DDocumento5 pagineSec Form DPando DailyNessuna valutazione finora

- Lamprell ProspDocumento165 pagineLamprell ProspdjvhNessuna valutazione finora

- Vallar ProspectusDocumento720 pagineVallar ProspectusdeanmaitNessuna valutazione finora

- Mandatory Notice Fsia & FaraDocumento2 pagineMandatory Notice Fsia & Fararicetech100% (13)

- FATCA Declaration Individual HUFDocumento7 pagineFATCA Declaration Individual HUFprofessionalassociates97Nessuna valutazione finora

- Platform Acquisition ProspectusDocumento128 paginePlatform Acquisition Prospectusathompson14Nessuna valutazione finora

- Prospectus Wise IncomeDocumento203 pagineProspectus Wise IncomesmulyuzNessuna valutazione finora

- Antiboycott Compliance Guide 2010-2011Documento11 pagineAntiboycott Compliance Guide 2010-2011vkrm14Nessuna valutazione finora

- VNR PPMDocumento102 pagineVNR PPMmangijose100% (3)

- Finra Reg Notice - FcpaDocumento6 pagineFinra Reg Notice - FcpaKevin GarveyNessuna valutazione finora

- FcpaDocumento4 pagineFcpaRajarshi DaharwalNessuna valutazione finora

- Cases Under Permissible Delegation and Rule-Making PowerDocumento57 pagineCases Under Permissible Delegation and Rule-Making PowerFaye Cience BoholNessuna valutazione finora

- UP Commercial Law Reviewer 2008Documento691 pagineUP Commercial Law Reviewer 2008seanNessuna valutazione finora

- Goodrich BankruptcyDocumento94 pagineGoodrich BankruptcyBob PriceNessuna valutazione finora

- Understanding The 23 Exemptions From The CTA Reporting Requirements - Wolters KLDocumento15 pagineUnderstanding The 23 Exemptions From The CTA Reporting Requirements - Wolters KLknightttttNessuna valutazione finora

- 2014-07-30 NSD DOJ FARA Registration - Mercury LLC Uganda Anti-LGBT Law (6170-Exhibit-AB-20140730-5)Documento14 pagine2014-07-30 NSD DOJ FARA Registration - Mercury LLC Uganda Anti-LGBT Law (6170-Exhibit-AB-20140730-5)Progress QueensNessuna valutazione finora

- Foriegn Grantor Trusts - 2010 HIRE ActDocumento9 pagineForiegn Grantor Trusts - 2010 HIRE ActGary S. Wolfe100% (2)

- IRS A Private For Profit Foreign Corporation Find Attached IRS Certificate of Incorporation Plus List of Private For Profit Foreign CorporationsDocumento10 pagineIRS A Private For Profit Foreign Corporation Find Attached IRS Certificate of Incorporation Plus List of Private For Profit Foreign Corporationsg100% (1)

- The Introducing Broker (Ib) Agreement: Western Group IncDocumento5 pagineThe Introducing Broker (Ib) Agreement: Western Group Incomidreza tabrizianNessuna valutazione finora

- FCPA-DC de DiosDocumento3 pagineFCPA-DC de DiosC LA RANessuna valutazione finora

- NY FCA Complaint - ProposedDocumento14 pagineNY FCA Complaint - ProposedAvram100% (1)

- Revised Marijuana Bill HB1317Documento73 pagineRevised Marijuana Bill HB1317Greenpoint Insurance ColoradoNessuna valutazione finora

- 20230ab259 99Documento43 pagine20230ab259 99Simon AlvarezNessuna valutazione finora

- Baskin Robbins Franchise AgreementDocumento466 pagineBaskin Robbins Franchise AgreementJuliánVenhuizen50% (2)

- Cms-300-05-Pl-00013 Anti-Corruption Laws and Foreign Corrupt Practices Act (Fcpa)Documento4 pagineCms-300-05-Pl-00013 Anti-Corruption Laws and Foreign Corrupt Practices Act (Fcpa)andruta1978Nessuna valutazione finora

- Platform Acquisition Holdings Final Prospectus 2013-5-17Documento128 paginePlatform Acquisition Holdings Final Prospectus 2013-5-17athompson14Nessuna valutazione finora

- Ra 1405 NotesDocumento11 pagineRa 1405 NotesLisa BautistaNessuna valutazione finora

- United States Means A Federal CorporationDocumento3 pagineUnited States Means A Federal Corporationin1or100% (3)

- Why and Where To Set Up A Foreign Trust For Asset Protectionffjqr PDFDocumento3 pagineWhy and Where To Set Up A Foreign Trust For Asset Protectionffjqr PDFshirticicle02Nessuna valutazione finora

- Athene Asset Holdings - S-1Documento522 pagineAthene Asset Holdings - S-1ExcessCapitalNessuna valutazione finora

- Twitter's S-1Documento420 pagineTwitter's S-1USA TODAYNessuna valutazione finora

- California False Claims Education and TrainingDocumento27 pagineCalifornia False Claims Education and TrainingBeverly TranNessuna valutazione finora

- BSP Circular No. 706Documento8 pagineBSP Circular No. 706Unis BautistaNessuna valutazione finora

- The Sherman Antitrust Act (1890) - Ley - (032860)Documento2 pagineThe Sherman Antitrust Act (1890) - Ley - (032860)Luis Alberto Velasquez AgapitoNessuna valutazione finora

- Fsia Coram Non Judice ObjectionDocumento5 pagineFsia Coram Non Judice ObjectionTracy Allen Haynes Sr.80% (10)

- Symfonie Angel Ventures AML 20130715Documento13 pagineSymfonie Angel Ventures AML 20130715Symfonie CapitalNessuna valutazione finora

- Davenport McKesson Corporation Agreed To Provide Lobbying Services For The The Kingdom of Thailand Inside The United States CongressDocumento4 pagineDavenport McKesson Corporation Agreed To Provide Lobbying Services For The The Kingdom of Thailand Inside The United States CongressPugh JuttaNessuna valutazione finora

- FRIA With ConclusionDocumento8 pagineFRIA With ConclusionNrnNessuna valutazione finora

- AMLAWDocumento7 pagineAMLAWLiana AcubaNessuna valutazione finora

- View Supplemental Report 5 PDFDocumento4 pagineView Supplemental Report 5 PDFRecordTrac - City of OaklandNessuna valutazione finora

- Bangko Sentral NG PilipinasDocumento1 paginaBangko Sentral NG PilipinaskwyncleNessuna valutazione finora

- Dealing With Federal Tax Liens Filed IllegallyDocumento10 pagineDealing With Federal Tax Liens Filed IllegallyDonna Eubank Helm100% (1)

- Laws On Other Business Transactions: Philippine Deposit Insurance Corporation (PDIC) LawDocumento15 pagineLaws On Other Business Transactions: Philippine Deposit Insurance Corporation (PDIC) LawAlliahDataNessuna valutazione finora

- SMIETANKA v. FIRST TRUST & SAV BANK - FindLawDocumento4 pagineSMIETANKA v. FIRST TRUST & SAV BANK - FindLawPatricia BenildaNessuna valutazione finora

- The Federal Government Bounty Hunter Rev 1Documento2 pagineThe Federal Government Bounty Hunter Rev 1John Kronnick100% (3)

- 2U, Inc S-1 FilingDocumento272 pagine2U, Inc S-1 Filingannjie123456Nessuna valutazione finora

- Otelco Disclosure StatementDocumento363 pagineOtelco Disclosure StatementChapter 11 DocketsNessuna valutazione finora

- FATCA RBSC Certification Consent Waiver Form 072015Documento4 pagineFATCA RBSC Certification Consent Waiver Form 072015Mary Nespher DelfinNessuna valutazione finora

- Regulation S DisclaimerDocumento2 pagineRegulation S DisclaimerDouglas SlainNessuna valutazione finora

- Affidavit of CreditDocumento2 pagineAffidavit of CreditMill Bey82% (11)

- Updates On TaxDocumento57 pagineUpdates On TaxSamuel CrawfordNessuna valutazione finora

- Letter of Offer PDFDocumento74 pagineLetter of Offer PDFFACTS- WORLDNessuna valutazione finora

- SEC Filing From Article: Granite Resources, LLC Files Form D With The SECDocumento4 pagineSEC Filing From Article: Granite Resources, LLC Files Form D With The SECWilliam HarrisNessuna valutazione finora

- RA 3765 Truth in Lending ActDocumento3 pagineRA 3765 Truth in Lending ActljolivaNessuna valutazione finora

- Credit Helper: The Complete Credit Restoration Guide & Pre-Typed Legal Letter SystemDocumento40 pagineCredit Helper: The Complete Credit Restoration Guide & Pre-Typed Legal Letter SystemTori Grayer100% (2)

- 9 - Shrout Appoint Judge Notice of Appointment A4v and LienDocumento7 pagine9 - Shrout Appoint Judge Notice of Appointment A4v and LienFreeman Lawyer100% (4)

- Cooperation Agreement Asic CSSF 4 OctoberDocumento6 pagineCooperation Agreement Asic CSSF 4 OctoberCrowdfundInsiderNessuna valutazione finora

- 2020 Queens Awards Enterprise Press BookDocumento126 pagine2020 Queens Awards Enterprise Press BookCrowdfundInsiderNessuna valutazione finora

- UK Cryptoassets Taskforce Final Report Final WebDocumento58 pagineUK Cryptoassets Taskforce Final Report Final WebCrowdfundInsiderNessuna valutazione finora

- Monzo Annual Report 2019Documento92 pagineMonzo Annual Report 2019CrowdfundInsider100% (2)

- House of Commons Treasury Committee Crypto AssetsDocumento53 pagineHouse of Commons Treasury Committee Crypto AssetsCrowdfundInsider100% (1)

- 2020 Queens Awards Enterprise Press BookDocumento126 pagine2020 Queens Awards Enterprise Press BookCrowdfundInsiderNessuna valutazione finora

- Bank of Canada Staff Working Paper :document de Travail Du Personnel 2018 - 34 Incentive Compatibility On The Blockchainswp2018-34Documento19 pagineBank of Canada Staff Working Paper :document de Travail Du Personnel 2018 - 34 Incentive Compatibility On The Blockchainswp2018-34CrowdfundInsiderNessuna valutazione finora

- OCC Fintech Charter Manual: Considering-charter-Applications-fintechDocumento20 pagineOCC Fintech Charter Manual: Considering-charter-Applications-fintechCrowdfundInsiderNessuna valutazione finora

- Annual Report and Consolidated Financial Statements For The Year Ended 31 March 2018Documento47 pagineAnnual Report and Consolidated Financial Statements For The Year Ended 31 March 2018CrowdfundInsiderNessuna valutazione finora

- Token Alliance Whitepaper WEB FINALDocumento108 pagineToken Alliance Whitepaper WEB FINALCrowdfundInsiderNessuna valutazione finora

- A Financial System That Creates Economic Opportunities Nonbank Financi...Documento222 pagineA Financial System That Creates Economic Opportunities Nonbank Financi...CrowdfundInsiderNessuna valutazione finora

- Cryptocurrencies and The Economics of Money - Speech by Hyun Song Shin Economic Adviser and Head of Research BISDocumento5 pagineCryptocurrencies and The Economics of Money - Speech by Hyun Song Shin Economic Adviser and Head of Research BISCrowdfundInsiderNessuna valutazione finora

- Annual Report and Consolidated Financial Statements For The Year Ended 31 March 2018Documento47 pagineAnnual Report and Consolidated Financial Statements For The Year Ended 31 March 2018CrowdfundInsiderNessuna valutazione finora

- Crowdcube 2018 Q2 Shareholder Update 2Documento11 pagineCrowdcube 2018 Q2 Shareholder Update 2CrowdfundInsiderNessuna valutazione finora

- EBA Report On Prudential Risks and Opportunities Arising For Institutions From FintechDocumento56 pagineEBA Report On Prudential Risks and Opportunities Arising For Institutions From FintechCrowdfundInsiderNessuna valutazione finora

- Bitcoin Foundation Letter To Congressman Cleaver 5.1.18Documento7 pagineBitcoin Foundation Letter To Congressman Cleaver 5.1.18CrowdfundInsiderNessuna valutazione finora

- Speech by Dr. Veerathai Santiprabhob Governor of The Bank of Thailand July 2018Documento6 pagineSpeech by Dr. Veerathai Santiprabhob Governor of The Bank of Thailand July 2018CrowdfundInsiderNessuna valutazione finora

- AlliedCrowds Cryptocurrency in Emerging Markets DirectoryDocumento20 pagineAlliedCrowds Cryptocurrency in Emerging Markets DirectoryCrowdfundInsiderNessuna valutazione finora

- HR 5877 The Main Street Growth ActDocumento10 pagineHR 5877 The Main Street Growth ActCrowdfundInsiderNessuna valutazione finora

- Mueller Indictment of 12 Russian HackersDocumento29 pagineMueller Indictment of 12 Russian HackersShane Vander HartNessuna valutazione finora

- Virtual Currencies and Central Bans Monetary Policy - Challenges Ahead - European Parliament July 2018Documento33 pagineVirtual Currencies and Central Bans Monetary Policy - Challenges Ahead - European Parliament July 2018CrowdfundInsiderNessuna valutazione finora

- Ontario Securities Commissionn Inv Research 20180628 Taking-Caution-ReportDocumento28 pagineOntario Securities Commissionn Inv Research 20180628 Taking-Caution-ReportCrowdfundInsiderNessuna valutazione finora

- Initial Coin Offerings Report PWC Crypto Valley June 2018Documento11 pagineInitial Coin Offerings Report PWC Crypto Valley June 2018CrowdfundInsiderNessuna valutazione finora

- Let Entrepreneurs Raise Capital Using Finders and Private Placement Brokers by David R. BurtonDocumento6 pagineLet Entrepreneurs Raise Capital Using Finders and Private Placement Brokers by David R. BurtonCrowdfundInsiderNessuna valutazione finora

- FINRA Regulatory-Notice-18-20 Regarding Digital AssetsDocumento4 pagineFINRA Regulatory-Notice-18-20 Regarding Digital AssetsCrowdfundInsiderNessuna valutazione finora

- Funding Circle Oxford Economics Jobs Impact Report 2018Documento68 pagineFunding Circle Oxford Economics Jobs Impact Report 2018CrowdfundInsiderNessuna valutazione finora

- Robert Novy Deputy Assistant Director Office of Investigations United States Secret Service Prepared Testimony Before the United States House of Representatives Committee on Financial Services Subcommittee on Terrorism and Illicit FinanceDocumento7 pagineRobert Novy Deputy Assistant Director Office of Investigations United States Secret Service Prepared Testimony Before the United States House of Representatives Committee on Financial Services Subcommittee on Terrorism and Illicit FinanceCrowdfundInsiderNessuna valutazione finora

- Bill - 115 S 2756Documento7 pagineBill - 115 S 2756CrowdfundInsiderNessuna valutazione finora

- Testimony On "Oversight of The U.S. Securities and Exchange Commission" by Jay Clayton Chairman, U.S. Securities and Exchange Commission Before The Committee On Financial Services June 21 2018Documento25 pagineTestimony On "Oversight of The U.S. Securities and Exchange Commission" by Jay Clayton Chairman, U.S. Securities and Exchange Commission Before The Committee On Financial Services June 21 2018CrowdfundInsiderNessuna valutazione finora

- The OTCQX Advantage - Benefits For International CompaniesDocumento20 pagineThe OTCQX Advantage - Benefits For International CompaniesCrowdfundInsiderNessuna valutazione finora

- Earnings Per ShareDocumento15 pagineEarnings Per ShareMuhammad SajidNessuna valutazione finora

- Review Test Submission - Lecture 6 - Online Assignment - ..Documento6 pagineReview Test Submission - Lecture 6 - Online Assignment - ..RishabhNessuna valutazione finora

- Sbi Mutual Fund: SBI Magnum Children's Benefit Fund - Savings PlanDocumento9 pagineSbi Mutual Fund: SBI Magnum Children's Benefit Fund - Savings PlanvvpvarunNessuna valutazione finora

- American Barrick Resources CorporationDocumento41 pagineAmerican Barrick Resources CorporationMridul SharmaNessuna valutazione finora

- Futures Dec 2013Documento53 pagineFutures Dec 2013anudoraNessuna valutazione finora

- Role of SebiDocumento81 pagineRole of Sebimanwanimuki12Nessuna valutazione finora

- GIOA Conference March 2011 - Las Vegas Callable Debt WorkshopDocumento26 pagineGIOA Conference March 2011 - Las Vegas Callable Debt WorkshopRITENNessuna valutazione finora

- 2010-05-20 - MFR of Interview With Greg Lippmann of DBDocumento13 pagine2010-05-20 - MFR of Interview With Greg Lippmann of DBHcs RichardNessuna valutazione finora

- IpoDocumento71 pagineIpoBhumi GhoriNessuna valutazione finora

- Value Investing: Beat The Market in Five Minutes!Documento5 pagineValue Investing: Beat The Market in Five Minutes!Opet LutunaNessuna valutazione finora

- Shorting Home Equity Mezzanine TranchesDocumento73 pagineShorting Home Equity Mezzanine Tranchesسید ہارون حیدر گیلانیNessuna valutazione finora

- Name of Investors (Bidders) Interest Rate (%) Auction Volume (Billion Dong)Documento2 pagineName of Investors (Bidders) Interest Rate (%) Auction Volume (Billion Dong)Trần Phương AnhNessuna valutazione finora

- Chapter 5 Understanding Capital MarketDocumento4 pagineChapter 5 Understanding Capital MarketSanmay MudbidrikarNessuna valutazione finora

- Sapm Unit 2 Part 1Documento43 pagineSapm Unit 2 Part 1Sushma KumarNessuna valutazione finora

- Abmf 3233Documento17 pagineAbmf 3233Yin HongNessuna valutazione finora

- FNO BasicsDocumento34 pagineFNO Basicsmonty chikNessuna valutazione finora

- Investment & Trading PlannerDocumento4 pagineInvestment & Trading PlannerkarlNessuna valutazione finora

- Traders Mag Aug2010 Dan ZangerDocumento1 paginaTraders Mag Aug2010 Dan Zangergadgetguy2020100% (2)

- A Tale of Two Hedge FundsDocumento17 pagineA Tale of Two Hedge FundsS Sarkar100% (1)

- Testbank - Chapter 19Documento2 pagineTestbank - Chapter 19naztig_017Nessuna valutazione finora

- Sub-Prime CrisisDocumento18 pagineSub-Prime Crisissurajvsakpal100% (2)

- Book BuildingDocumento24 pagineBook Buildingmariam_abbasi5100% (2)

- Biah422 - Risk ManagementDocumento6 pagineBiah422 - Risk ManagementAbigail Ruth NawashaNessuna valutazione finora

- Maf603-Question Test 2 2021 JulyDocumento4 pagineMaf603-Question Test 2 2021 JulyWAN MOHAMAD ANAS WAN MOHAMADNessuna valutazione finora

- PPT On DVRDocumento20 paginePPT On DVRParitosh Rachna GargNessuna valutazione finora

- ThamDocumento48 pagineThamNguyen PhucNessuna valutazione finora

- Problems On Bond YieldDocumento3 pagineProblems On Bond YieldPersonal DocumentsNessuna valutazione finora

- Gitman Chapter 12Documento21 pagineGitman Chapter 12Hannah Jane UmbayNessuna valutazione finora

- Best 5 Mid Cap Stocks To BuyDocumento13 pagineBest 5 Mid Cap Stocks To BuydesikanttNessuna valutazione finora

- Laws Essentials of Financial Management v7Documento186 pagineLaws Essentials of Financial Management v7hshshdhd100% (1)

- Systematic Trading: A unique new method for designing trading and investing systemsDa EverandSystematic Trading: A unique new method for designing trading and investing systemsValutazione: 3.5 su 5 stelle3.5/5 (12)

- Trade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any MarketDa EverandTrade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any MarketValutazione: 5 su 5 stelle5/5 (52)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (8)

- Scalping is Fun! 3: Part 3: How Do I Rate my Trading Results?Da EverandScalping is Fun! 3: Part 3: How Do I Rate my Trading Results?Valutazione: 3.5 su 5 stelle3.5/5 (18)

- A Beginner's Guide To Day Trading Online 2nd EditionDa EverandA Beginner's Guide To Day Trading Online 2nd EditionValutazione: 3.5 su 5 stelle3.5/5 (12)

- The Motley Fool Investment Guide: Third Edition: How the Fools Beat Wall Street's Wise Men and How You Can TooDa EverandThe Motley Fool Investment Guide: Third Edition: How the Fools Beat Wall Street's Wise Men and How You Can TooValutazione: 5 su 5 stelle5/5 (2)

- Forex Trading: Part 1: Time and Price StrategyDa EverandForex Trading: Part 1: Time and Price StrategyValutazione: 4.5 su 5 stelle4.5/5 (6)

- Stock Market 101: From Bull and Bear Markets to Dividends, Shares, and Margins—Your Essential Guide to the Stock MarketDa EverandStock Market 101: From Bull and Bear Markets to Dividends, Shares, and Margins—Your Essential Guide to the Stock MarketValutazione: 4 su 5 stelle4/5 (26)

- Automated Stock Trading Systems: A Systematic Approach for Traders to Make Money in Bull, Bear and SidewaysDa EverandAutomated Stock Trading Systems: A Systematic Approach for Traders to Make Money in Bull, Bear and SidewaysValutazione: 5 su 5 stelle5/5 (1)

- Swing Trading using the 4-hour chart 1: Part 1: Introduction to Swing TradingDa EverandSwing Trading using the 4-hour chart 1: Part 1: Introduction to Swing TradingValutazione: 3.5 su 5 stelle3.5/5 (3)

- How to Trade a Range: Trade the Most Interesting Market in the WorldDa EverandHow to Trade a Range: Trade the Most Interesting Market in the WorldValutazione: 4 su 5 stelle4/5 (5)

- Deep Value Investing: Finding bargain shares with BIG potentialDa EverandDeep Value Investing: Finding bargain shares with BIG potentialValutazione: 4 su 5 stelle4/5 (9)

- Naked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsDa EverandNaked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsNessuna valutazione finora

- Laughing at Wall Street: How I Beat the Pros at Investing (by Reading Tabloids, Shopping at the Mall, and Connecting on Facebook) and How You Can, TooDa EverandLaughing at Wall Street: How I Beat the Pros at Investing (by Reading Tabloids, Shopping at the Mall, and Connecting on Facebook) and How You Can, TooValutazione: 4 su 5 stelle4/5 (14)

- Scalping is Fun! 4: Part 4: Trading Is Flow BusinessDa EverandScalping is Fun! 4: Part 4: Trading Is Flow BusinessValutazione: 4 su 5 stelle4/5 (13)

- The Bogleheads' Guide to the Three-Fund Portfolio: How a Simple Portfolio of Three Total Market Index Funds Outperforms Most Investors with Less RiskDa EverandThe Bogleheads' Guide to the Three-Fund Portfolio: How a Simple Portfolio of Three Total Market Index Funds Outperforms Most Investors with Less RiskValutazione: 5 su 5 stelle5/5 (2)

- Investing 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable PortfolioDa EverandInvesting 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable PortfolioValutazione: 4.5 su 5 stelle4.5/5 (38)

- The FINTECH Book: The Financial Technology Handbook for Investors, Entrepreneurs and VisionariesDa EverandThe FINTECH Book: The Financial Technology Handbook for Investors, Entrepreneurs and VisionariesValutazione: 4.5 su 5 stelle4.5/5 (6)

- Trading Strategy 100: Trade To Win: Stop Gambling In The Market And Master The Art Of Risk Management When Trading And InvestingDa EverandTrading Strategy 100: Trade To Win: Stop Gambling In The Market And Master The Art Of Risk Management When Trading And InvestingValutazione: 3.5 su 5 stelle3.5/5 (17)

- The 10-Minute Millionaire: The One Secret Anyone Can Use to Turn $2,500 into $1 Million or MoreDa EverandThe 10-Minute Millionaire: The One Secret Anyone Can Use to Turn $2,500 into $1 Million or MoreValutazione: 4.5 su 5 stelle4.5/5 (4)

- The Dhandho Investor: The Low-Risk Value Method to High ReturnsDa EverandThe Dhandho Investor: The Low-Risk Value Method to High ReturnsValutazione: 4.5 su 5 stelle4.5/5 (6)

- Market Wizards: Interviews with Top TradersDa EverandMarket Wizards: Interviews with Top TradersValutazione: 4.5 su 5 stelle4.5/5 (140)

- How to Write a Business Plan: Step by Step guideDa EverandHow to Write a Business Plan: Step by Step guideValutazione: 4.5 su 5 stelle4.5/5 (2)

- Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in SchoolDa EverandMillionaire Teacher: The Nine Rules of Wealth You Should Have Learned in SchoolValutazione: 4 su 5 stelle4/5 (51)

- How to Start a Trading Business with $500Da EverandHow to Start a Trading Business with $500Valutazione: 4.5 su 5 stelle4.5/5 (27)