Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Case Solutions For Case Studies in Finance Managing For Corporate Value Creation 6th Edition by Bruner

Caricato da

Gregory WilsonTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Case Solutions For Case Studies in Finance Managing For Corporate Value Creation 6th Edition by Bruner

Caricato da

Gregory WilsonCopyright:

Formati disponibili

3 Case 1 Warren E.

Buffet, 2005

WARREN E. BUFFETT, 2005

Teaching Note

Synopsis and Objectives

Set in May 2005, this case invites the stuent to assess Ber!shire "atha#ay$s %i, through

Mi&'erican Energy "o(ings Co')any, its #ho((y o#ne su%siiary, for the regu(ate energy*

uti(ity +acifiCor). The tas! for the stuent is to )erfor' a si')(e va(uation of +acifiCor) an to

consier the reasona%(eness of Ber!shire$s offer. Stuent ana(ysis reai(y e,tens into the

invest'ent )hi(oso)hy an the re'ar!a%(e recor of Ber!shire$s chair an CE-, Warren E.

Buffett.

The case is an introuction to a finance course or a 'ou(e on ca)ita( 'ar!ets. The

ana(ytica( tas!s are straightfor#ar an intene to )rovie a s)ring%oar into iscussion of the

'ain tenets of 'oern finance. Thus, the case #ou( %e usefu( for.

setting themes at the %eginning of a finance course, inc(uing ris!*an*return, econo'ic

rea(ity /not accounting rea(ity0, the ti'e va(ue of 'oney, an the %enefits of a(ign'ent of

agents an o#ners

linking valuation to the behavior of investors in the ca)ita( 'ar!et

modeling good practice in 'anage'ent an invest'ent using Warren Buffett as an

e,a')(e %y returning to the i'age of Buffett re)eate(y uring a finance course to as!

stuents #hat Buffett #ou( (i!e(y o in a situation

characterizing stock prices as e1ua(ing the )resent va(ue of future e1uity cash f(o#s

exercising simple equity-valuation skills

Whi(e the nu'erica( ca(cu(ations in the case are si')(e, novices #i(( fin it to %e a 'eaty

introuction to a nu'%er of i')ortant conce)ts in finance. 2ea((y, the case cou( %e )ositione

Suggested

complementary case

about investment

managers and superior

performance: 3Bi(( Mi((er

an 4a(ue Trust5

/Case 20.

6 Case 1 Warren E. Buffet, 2005

near the %eginning of a course or 'ou(e, after #hich it can %e reinforce %y other cases an

e,ercises.

5 Case 1 Warren E. Buffet, 2005

Suggested Questions for Advance Assignment

1. What is the )ossi%(e 'eaning of the changes in stoc! )rice for Ber!shire "atha#ay an

Scottish +o#er )(c on the ay of the ac1uisition announce'ent7 S)ecifica((y, #hat oes

the 82.55 %i((ion gain in Ber!shire$s 'ar!et va(ue of e1uity i')(y a%out the intrinsic va(ue

of +acifiCor)7

2. Base on the 'u(ti)(es for co')ara%(e regu(ate uti(ities, #hat is the range of )ossi%(e

va(ues for +acifiCor)7 What 1uestions 'ight you have a%out this range7

3. &ssess the %i for +acifiCor). "o# oes it co')are #ith the fir'$s intrinsic va(ue7 &s an

a(ternative, the instructor cou( suggest that stuents )erfor' a si')(e iscounte cash*

f(o# /9C:0 ana(ysis.

6. "o# #e(( has Ber!shire "atha#ay )erfor'e7 "o# #e(( has it )erfor'e in the

aggregate7 What a%out its invest'ent in Mi&'erican Energy "o(ings7

5. What is your assess'ent of Ber!shire$s invest'ents in Buffett$s Big :our. &'erican

E,)ress, Coca*Co(a, ;i((ette, an We((s :argo7

<. :ro' Warren Buffett$s )ers)ective, #hat is the intrinsic va(ue7 Why is it accore such

i')ortance7 "o# is it esti'ate7 What are the a(ternatives to intrinsic va(ue7 Why oes

Buffett re=ect the'7

>. Critica((y assess Buffett$s invest'ent )hi(oso)hy. Be )re)are to ientify )oints #here you

agree an isagree #ith hi'.

?. Shou( Ber!shire "atha#ay$s shareho(ers enorse the ac1uisition of +acifiCor)7

Suggested Supplemental Readings

&s the case inicates, there is a gro#ing (i%rary of %oo!s an artic(es a%out Buffett an his

invest'ent sty(e. The instructor 'ay choose to assign reaings fro' one or 'ore of the

)u%(ications (iste in Exhibit T!. &(ternative(y, it 'ay %e a))ro)riate si')(y to share the (ist of

%oo!s #ith stuents to i((ustrate the %reath of scho(arshi) an re)ortage a%out the Sage of

-'aha, Warren Buffett.

Suggested Teaching "lan

The fo((o#ing 1uestions cou( %e use to 'otivate a @0*'inute iscussion of the case.

1. What does the stock market seem to be saying about the acquisition of PacifiCorp by

Berkshire Hathaay!

This o)ening offers the o))ortunity to eve(o) the notion that stoc! )rices are the )resent

va(ue of e,)ecte cash f(o#s. Moreover, it ea(s #ith the i''eiate o)ening )ro%(e' of

< Case 1 Warren E. Buffet, 2005

the case. the 'ar!et$s res)onse to the +acifiCor) announce'ent. :ina((y, it shou( he() to

'otivate a iscussion of Buffett$s invest'ent )hi(oso)hy.

2. Based on your on analysis" hat do you think PacifiCorp as orth on its on before

its acquisition by Berkshire!

This 1uestion e,)ans u)on the o)ening 1uestion an he()s ee)en the 'ystery a%out the

ac1uisitionAthe %i )rice see's to %e a fair(y fu((*)rice offer for +acifiCor).

3. Well" maybe Buffett is overpaying#does he have a record of overpaying in the past!

"ere, the iscussion shou( shift to an ana(ysis of Ber!shire$s genera( recor, its

e,)erience #ith Mi&'erican, an its e,)eriences %uying e1uity )ositions in the Big :our.

The genera( conc(usion #i(( %e that Buffett has one very #e(( as an investor an as the

'anager of Ber!shire.

6. Here are the ma$or elements of Buffett%s philosophy& What do those elements mean! 'o

you agree ith them!

-n a sie%oar, one cou( (ist the 'a=or to)ic heaings given in the case. The ai' here

shou( %e to iscuss the intuition %ehin each )oint. #hy Buffett ho(s those vie#s an

#hat they i')(y for his #or!. 2f the stuents a(reay have %een e,)ose to the 'a=or

uner)innings of 'oern finance, this seg'ent of the iscussion #ou( ta!e the for' of a

1uic! revie#. :or novices, this seg'ent #ou( #arrant s(o#er eve(o)'ent.

5. (et%s return to the basic issue& )s the PacifiCorp acquisition a good or bad deal! Why!

This 1uestion returns the iscussion to the o)ening an ai's to rationa(iBe so'e of the

contraictions that #i(( have e'erge uring c(ass. The 'ain contraiction is the fu(( )rice

an the )ositive 'ar!et reaction to the announce'ent. &s a va(ue investor, Buffett #ou(

)ro%a%(y say that he sees so'ething that others o notAthe )ositive 'ar!et reaction is

=ust the 'ar!et revising its e,)ectations a%out the future )rofita%i(ity of +acifiCor).

<. *ake a vote on hether the shareholders should endorse the acquisition& +or those of you

ho believe that PacifiCorp ill be a good purchase" hat $ustifies your belief! +or

those of you ho voted no" hy did you oppose it!

"earing fro' %oth sies #i(( serve as a su''ary of the 'a=or the'es in the case an #i((

invite a iscussion a%out the sustaina%i(ity of Buffett$s recor.

The instructor cou( c(ose #ith a iscussion of the core tenets of finance an then iscuss

ho# the c(ass #i(( return to those the'es re)eate(y uring the course. The instructor cou( a(so

aug'ent the iscussion of tenets #ith 'ore reaing of 'ateria( a%out Buffett. :ina((y, stuents

cou( %e u)ate on Ber!shire "atha#ay$s )erfor'ance since the ate of the case. See the fir'$s

We% site, htt).CC###.%er!shirehatha#ay.co', for u)ate re)orts as #e(( as a co')i(ation of

Buffett$s (etters to shareho(ers.

> Case 1 Warren E. Buffet, 2005

#ase Analysis

$nvestor reaction to the "acifi#orp announcement

The investor reaction suggests that the ea( #i(( not on(y create va(ue for +acifiCor)$s

ac1uirer, Ber!shire "atha#ay, %ut a(so for the se((er, Scottish +o#er. 2n fact, as a re(ative 'atter,

it #ou( a))ear that the 'ar!et sees 'ore va(ue accruing to Scottish +o#er %ecause of its

ivestiture of +acifiCor) than to Ber!shire, as a resu(t of its ac1uisition of the co')any. Stuents

cou( %e encourage to consier #hy this 'ight %e so /i.e., #hy Scottish +o#er #ou( see' to

gain 'ore %enefit fro' the ea( than Ber!shire "atha#ay0.

The 82.55 %i((ion increase in Ber!shire "atha#ay$s 'ar!et va(ue inicates an e,)ecte

%enefit to Ber!shire fro' the ac1uisition. So'e stuents #i(( 'easure the e,tent of this %enefit as

a gain of 82.55 %i((ion in Ber!shire$s 'ar!et va(ue of e1uity ivie %y +acifiCor)$s 312.1? 'i((ion

shares outstaning or 8<.@5 )er +acifiCor) share more than Buffett is )aying. Ber!shire is offering

85.1 %i((ion in cash for +acifiCor)$s e1uity, for a )er*share )rice of 81<.36D a(together, this #ou(

i')(y a )er*share e,)ecte va(ue for +acifiCor)$s shares of 823.2@. 2s this a fair esti'ate of

+acifiCor)$s intrinsic va(ue7 Stuents 'ust )erfor' their o#n va(uation of +acifiCor) in orer to

arrive at an ine)enent =ug'ent a%out this va(ue.

%aluation of "acifi#orp

Because +acifiCor) is a )rivate(y he( co')any that oes not )ay a

ivien, the case oes not contain enough infor'ation to erive a va(uation for

+acifiCor) using 'ar!et va(ues or the ivien iscount 'oe(. 2t is necessary,

therefore, to re(y on an i')(ie va(uation for the fir' using 'u(ti)(es fro'

co')ara%(e regu(ate uti(ities. Case E,hi%it @ )rovies financia( ata for the co')ara%(e fir's,

an case E,hi%it 10 )resents i')(ie va(uations for +acifiCor) using averages an 'eians of

those fir's$ 'u(ti)(es. Table ! )resents a su''ary of the range of va(uations )rovie in the case.

Ta%(e 1. Su''ary of +acifiCor) va(uation esti'ates.

Enterprise %alue as &ultiple of. &% E'uity as &ultiple of:

Rev( E)$T E)$T*A

et

$ncome E"S )oo+ %alue

<,252 ?,>>5 @,023 >,5@< 6,2>> 5,@06

<,5?6 @,2?@ @,0>< >,553 6,30? 5,<>?

9iscussion

1uestion 1

9iscussion

1uestions 2

an 3

? Case 1 Warren E. Buffet, 2005

Because the case states that it #ou( ta!e 12 to 1? 'onths for the ea( to ac1uire

+acifiCor) to c(ose, the instructor 'ay #ish to so(icit a )resent va(ue for Ber!shire "atha#ay$s

offer for the e1uity )ortion of +acifiCor). &n a))ro)riate iscount rate 'ay %e erive using the

ca)ita( asset )ricing 'oe( /C&+M0. :ootnote 13 in the case e,)(ains that the yie( on the 30*year

E.S. Treasury %on #as 5.><F an that Ber!shire$s %eta #as 0.>5, an the case states that the

(ong*run 'ar!et return #as 10.5F. So Ber!shire$s cost of e1uity 'ay %e esti'ate as @.32F.

Esing this rate to iscount Ber!shire$s 85.1 %i((ion offer over 12 or 1? 'onths, #e get a )resent

va(ue of a%out 86.> %i((ion.

Ber!shire$s offer for +acifiCor) #as, therefore, rough(y in (ine #ith the range of )eer fir'

va(uations. This oes not e,)(ain #hy the 'ar!et reacte so )ositive(y to the ne#s of the

ac1uisition. 2t is )ossi%(e that the investors )erceive )otentia( synergies %et#een +acifiCor) an

Mi&'erican, %ut in the high(y regu(ate an regiona((y focuse e(ectric*uti(ity %usiness, such

synergistic %enefits 'ay %e #ea!. Was there )erha)s so'ething in Buffett$s recor as an investor

that (e to the 'ar!et$s res)onse7

)uffett,s record

The case affors three o))ortunities to ana(yBe Ber!shire "atha#ay$s historica( recor.

Berkshire Hathaay%s historical ealth creation. The case offers a range of evience

a%out shareho(er #ea(th creation at Ber!shire "atha#ay. The case gives a rate of 26F

co')oun annua( gro#th in stoc! )rices fro' 1@<5 to 1@@5. 2n co')arison, #ea(th creation for

(arge fir's average 10.5F )er year over the sa'e )erio. The first chart in the case he()s

stuents visua(iBe the su)ernor'a( )erfor'ance of Ber!shire "atha#ay. Novices to finance shou(

%e encourage to consier ho# ifficu(t it is to %eat the 'ar!et %y such a #ie 'argin.

Berkshire%s experience ith ,id-merican. 9ata in the case an case E,hi%it < give

infor'ation #ith #hich to )erfor' a si')(e ana(ysis of Ber!shire$s return on invest'ent in

Mi&'erican. Beginning in 2000, Ber!shire "atha#ay 'ae an out(ay of 81.<62 %i((ion for an

eventua( ?0.5F econo'ic interest in Mi&'erican. Ber!shire$s econo'ic interest in

Mi&'erican #as co')ose of %oth e1uity an e%t invest'ents such that the cash f(o#s to

Ber!shire inc(ue interest )ay'ents, co''on iviens, an )referre iviens. Therefore,

Ber!shire$s return on invest'ent can %e a))ro,i'ate %y co')uting Ber!shire$s share of

Mi&'erican$s free cash f(o#s, the cash f(o#s avai(a%(e to a(( e%t an e1uity c(ai's. The inco'e

state'ent an %a(ance sheet ata in case E,hi%it < 'ay he() us erive Ber!shire$s share of

Mi&'erican$s free cash f(o#s fro' 2001 to 2006, revea(ing that Ber!shire ha an interna( rate of

return /2GG0 on this invest'ent of >1F. Exhibit T- )resents those ca(cu(ations.

9iscussion

1uestions

6 an 5

@ Case 1 Warren E. Buffet, 2005

Berkshire%s experience ith equity investments. The ata in case E,hi%it 3 give a

founation for a si')(e assess'ent of the 'a=or e1uity invest'ents %y Ber!shire. With a c(ass of

novices, the instructor cou( 'otivate the' to o%serve that a(( those issues have 'ar!et va(ues

consiera%(y higher than their costs. With a c(ass of stuents 'ore e,)erience in finance, it #ou(

%e )ossi%(e to esti'ate a ho(ing*)erio return for Ber!shire$s invest'ents in the Big :our. Esing

the infor'ation in this e,hi%it an its footnote, #e fin that Ber!shire$s invest'ents in &'erican

E,)ress, Coca*Co(a, ;i((ette, an We((s :argo generate a co')oun annua( gro#th rate of

1<.0>F. Stuents cou( %e encourage to co')are this return #ith the (ong*ter' return for a((

(arge stoc!s, 10.5F.

)uffett,s $nvestment "hilosophy

Buffett$s invest'ent )hi(oso)hy reas 'ost(y (i!e a su''ary of the theory of 'oern

finance. &s the su%heaings in the case inicate, the e(e'ents of the )hi(oso)hy are as fo((o#s.

1. Econo'ic rea(ity, not accounting rea(ity

2. &ccount for the cost of the (ost o))ortunity

3. :ocus on the ti'e va(ue of 'oney

6. :ocus on #ea(th creation

5. 2nvest on the %asis of infor'ation an ana(ysis

<. The a(ign'ent of agents an o#ners is %eneficia( to fir' va(ue

Buffett strong(y isagrees, ho#ever, #ith three other e(e'ents of 'oern finance.

1. .se of risk-ad$usted discount rates. The 'etho he uses see's rather si'i(ar to the

certainty e1uiva(ent a))roach to va(uation /i.e., iscount certain cash f(o#s at a ris!*free

rate0. &(though it see's ou%tfu( that the cash f(o#s he iscounts are tru(y certain, the

very fact that he 'atches ris!(ess cash f(o#s #ith a ris!*free iscount rate i')(ies an

a))roach consistent #ith the ris!*an*return (ogic of the C&+M.

2. Benefits of portfolio diversification. &(though Buffett isavo#s )ortfo(io iversification,

the %reath of Ber!shire "atha#ay$s ho(ings )ro%a%(y a))roaches efficient

iversification. Case E,hi%it 2 gives a %rea!o#n of Ber!shire$s iverse %usiness seg'ents

/a(so escri%e in the case0D case E,hi%it 3 gives a (isting of Ber!shire$s 10 'a=or

investees. :ro' the (ist, stuents cou( %e as!e #hether the )ortfo(io (oo!s iversifieA

9iscussion

1uestions <

an >

10 Case 1 Warren E. Buffet, 2005

this shou( sti'u(ate a iscussion of #hat iversification 'eans to the' an #hat it 'ight

'ean in finance theory.

The case oes not )rovie the ata #ith #hich to co')(ete an ana(ysis %ase on 'ar!et

va(ues an asset a((ocations, %ut %y =ust (oo!ing, one 'ight ientify )ossi%(e inustry

concentrations in Ber!shire$s ho(ings. Those concentrations o not see' to account for

the %u(! of Ber!shire$s 'ar!et va(ue. The fir'$s )ortfo(io consists of an assort'ent of o

'anufacturing an service %usinesses suggeste in the case, )(us so'e 'a=or e1uity

ho(ings /case E,hi%it 30 that are not easi(y c(assifie in the concentration grou)s. The

'ass of research on )ortfo(io iversification suggests that it oes not re1uire very 'any

ifferent e1uities to achieve the ris!*reuction %enefits of iversification. 9es)ite his )u%(ic

isagree'ent #ith the conce)t of iversification, Buffett see's to )ractice it.

3. Capital-market efficiency. Buffett$s e')hasis on the va(ue of infor'ation asy''etries

see's to confir' so'e a))reciation for efficiency in security )rices. :ro' his )u%(ic

state'ents as re)orte in the case, Buffett$s isagree'ent #ith efficiency focuses on t#o

as)ects.

The conce)t of )assive )ortfo(io 'anage'ent /i.e., ine,ing0

The i')(ication that 1uote )rices e1ua( intrinsic va(ues

The theory of efficiency oes not a%so(ute(y )rec(ue %enefits of active 'anage'ent or the

)ossi%i(ity that )rices 'ay not e1ua( intrinsic va(ues. But it oes suggest that #ithout an

infor'ation avantage or so'e unusua( s!i((, it #ou( %e very ifficu(t to earn su)ernor'a(

returns consistent(y over ti'e. 2t is in this conte,t that Warren Buffett a))ears to %e a

'a=or ano'a(y. The su)ernor'a( returns of Ber!shire "atha#ay suggest that it is )ossi%(e

to %eat the 'ar!et %y a #ie 'argin. Sti((, Buffett$s invest'ent sty(e is consistent #ith

efficiency in so'e i')ortant #ays.

'iscipline and rationality. 2f one is trying to %eat the 'ar!et, it 'a!es no sense to

invest in shares that are fair(y )rice. Buffett$s 1uotations in the case an his

ac1uisition )hi(oso)hy in case E,hi%it ? suggest that he is (oo!ing for the 'ar!et$s

)ricing ano'a(ies. Hoo!ing for the ano'a(ies /the rationa(ity )art0 an #aiting to fin

the' /the isci)(ine )art0 are not inconsistent #ith a 'ar!et that genera((y )rices

securities efficient(y. 2nee, one cou( argue that the activities of investors such as

Buffett he() to create the efficiency that he enies.

)nformation. By virtue of Ber!shire$s (arge stoc!ho(ings in se(ecte fir's, Buffett

ho(s irectorshi)s an en=oys an infor'ationa( avantage unavai(a%(e to outsie

investors. 2nfor'ation avantages are va(ua%(e in a #or( of on(y se'i*strong efficient

'ar!ets.

#onclusion

11 Case 1 Warren E. Buffet, 2005

The fina( issue raise %y the case has to o #ith the sustaina%i(ity of Buffett$s recor. & %i

for +acifiCor) of 8@.6 %i((ion oes not see' unreasona%(e re(ative to current co')ara%(e

va(uations. :or the +acifiCor) ac1uisition to %e a success in the sense of 'atching historica(

returns at Ber!shire, Buffett$s e,)ectations for +acifiCor) 'ust %e raica((y ifferent fro' current,

i')(ie, an e,)ecte va(ues for )eer fir's. With an invest'ent of this siBe, a 'ista!e #i(( have

(asting averse conse1uences for Ber!shire an Buffett. Even if Buffett$s %et on +acifiCor) in May

2005 is correct, the nee to e)(oy (arger a'ounts of 'oney #i(( invite 'ista!esAas Buffet sai,

3& fat #a((et is the ene'y of su)erior invest'ent resu(ts.5 With 'ore than 860 %i((ion in cash an

cash e1uiva(ents, Buffett #ou( have %een 'infu( of this a'onition.

12 Case 1 Warren E. Buffet, 2005

&s escri%e here, the case gives the novice a %roa introuction to the va(uation of, an

invest'ent in, e1uities. The e(e'ents of this introuction inc(ue the fo((o#ing.

e, )ost ana(ysis of invest'ent returns /Ber!shire, Mi&'erican, an the Big :our0 an

co')arison of those returns #ith a %ench'ar!, such as the SI+ 500 2ne, or the 2%%otson

tota( return figures

)eer 'u(ti)(es va(uation ana(ysis of +acifiCor)

iscussion of the 'eaning of share*)rice 'ove'ents fo((o#ing the announce'ent of the

+acifiCor) ac1uisition

revie# of the 'a=or tenets of finance in the conte,t of Buffett$s invest'ent )hi(oso)hy

13 Case 1 Warren E. Buffet, 2005

E,hi%it TN1

.ARRE E( )/00ETT1 -223

Bi%(iogra)hy for Warren E. Buffett

Buffett, Mary, an 9avi C(ar!. *he /e Buffettology0 *he Proven *echniques for )nvesting

1uccessfully in Changing ,arkets *hat Have ,ade Warren Buffett the World%s ,ost +amous

)nvestor. /Ne# Jor!. Si'on I Schuster0, 2002.

Cunningha', Ha#rence &. Ho to *hink (ike Ben$amin 2raham and )nvest (ike Warren Buffett.

/Ne# Jor!. Mc;ra#*"i((0, 2002.

AAA. *he 3ssays of Warren Buffett0 (essons for Corporate -merica. 1st rev. e. /Ne# Jor!.

Cunningha' ;rou)0, 2001.

"agstro', Go%ert ;. *he Warren Buffett Way. 2n e. /Ne# Jor!. Kohn Wi(ey I Sons0, 2006.

"e((er, Go%ert. Business ,asterminds0 Warren Buffett. /9or(ing Liners(ey +u%(ishing0, 2000.

Li()atric!, &nre#. 4f Permanent 5alue0 *he 1tory of Warren Buffett. /Ne# Jor!. &ny

Li()atric! +u%(ishing E')ire0, 2006.

AAA. Warren Buffett0 *he 2ood 2uy of Wall 1treet. re)rint e. /Ne# Jor!. +(u'e0, 1@@5.

Ho#e, Kanet. Warren Buffett 1peaks0 Wit and Wisdom from the World%s 2reatest )nvestor. 2n e.

/Ne# Jor!. Kohn Wi(ey I Sons0, 1@@>.

Ho#enstein, Goger. Buffett0 *he ,aking of an -merican Capitalist. /Main Street Boo!s0, 1@@<.

Morio, &yano. Warren Buffett0 -n )llustrated Biography of the World%s ,ost 1uccessful )nvestor.

/Ne# Jor!. Kohn Wi(ey I Sons0, 2006.

-$Hough(in, Ka'es. *he 6eal Warren Buffett0 ,anaging Capital" (eading People. /Honon.

Nicho(as Brea(ey +u%(ishing0, 2003.

Geyno(s, Si'on. *houghts of Chairman Buffett0 *hirty 7ears of .nconventional Wisdom from

the 1age of 4maha. /Ne# Jor!. Co((ins0, 1@@?.

Stee(e, Kay. Warren Buffett0 ,aster of the ,arket. /Ne# Jor!. "ar)er +a)er%ac!s0, 1@@@.

Train, Kohn. *he ,idas *ouch0 *he 1trategies *hat Have ,ade Warren Buffett -merica%s

Preeminent )nvestor. Ge)rint e. /Ne# Jor!. "ar)erCo((ins0, 1@??.

16 Case 1 Warren E. Buffet, 2005

E,hi%it TN2

.ARRE E( )/00ETT1 -223

E,a')(e of Co')(ete 2GG &na(ysis for Ber!shire

"atha#ay$s 2nvest'ent in Mi&'erican

/8 in 'i((ions e,ce)t )er*share figures0

2nitia(

"eriod 2nvest'ent -22! -22- -224 -225

Operating Revenue and Other $ncome 51674(2 8 51624(2 8 91!54(2 8 917-7(2 8

* Cost of sa(es an o)erating e,)enses 3,522.0 8 3,0@2.0 8 3,@13.0 8 6,3@0.0 8

* 9e)reciation an a'ortiBation 53@.0 8 530.0 8 <03.0 8 <3?.0 8

"rofit )efore Tax 6!-(2 8 !1-:!(2 8 !19-7(2 8 !1966(2 8

* Ta,es M ... 60F 3<6.? 8 512.6 8 <50.? 8 <>@.< 8

"rofit After Tax 357(- 8 79:(9 8 679(- 8 !12!6(5 8

N 9e)reciation an a'ortiBation 53@.0 8 530.0 8 <03.0 8 <3?.0 8

* Net change in fi,e assets an #or!ing ca)ita( ?33.0 8 6,3<3.0 8 2?@.0 8 331.0 8

0ree #ash 0lo; from Operations 253.2 8 /3,0<6.60 8 1,2@0.2 8 1,32<.6 8

Ter'ina( va(ue

1

21,<36 8

Total 0ree #ash 0lo; 253.2 8 /3,0<6.60 8 1,2@0.2 8 22,@<0.5 8

)er+shire<s O;nership: :2(3= /1,<620 8 203.? 8 /2,6<<.?0 8 1,03?.< 8 1?,6?3.2 8

&idAmerican $RR 7!(!=

Gis!*free Gate Ber!shire Beta Gis! )re'iu' Gis!*free Gat e

LeO 5.><F 0.>5 10.50F 5.><F 6(4-=

1

Ter'ina( 4a(ue O :ree Cash :(o#/1Ng0C/L

e

*g0D assu'es 3F gro#thD an Le can %e esti'ate using the C&+M, #here the 30*year

Treasury rate #as 5.><F /see case footnote 130, Ber!shirePs Beta is 0.>5 /case footnote 130, an the (ong*ter', E.S. e1uity*'ar!et

ris! )re'iu' is 10.5F /see case footnote 30D so, Le O 5.><F N 0.>5/10.5F*5.><F0 O @.32F.

Potrebbero piacerti anche

- TN15 Teletech Corporation 2005Documento8 pagineTN15 Teletech Corporation 2005kirkland1234567890100% (2)

- RSM433 Eaton Corporation PDFDocumento3 pagineRSM433 Eaton Corporation PDFRitesh SinghNessuna valutazione finora

- M&M PizzaDocumento3 pagineM&M PizzaAnonymous 2LqTzfUHY0% (3)

- JetBlue SASB Sustainability LeadershipDocumento1 paginaJetBlue SASB Sustainability LeadershipShivani KarkeraNessuna valutazione finora

- This Study Resource Was: Group 9 - M&M Pizza Case StudyDocumento2 pagineThis Study Resource Was: Group 9 - M&M Pizza Case StudyAsma AyedNessuna valutazione finora

- Case Solutions For Case Studies in Finance Managing For Corporate Value Creation 6th Edition by BrunerDocumento12 pagineCase Solutions For Case Studies in Finance Managing For Corporate Value Creation 6th Edition by Brunerbiwithse7en0% (1)

- ALAC International - Working Capital FinancingDocumento8 pagineALAC International - Working Capital FinancingAjith SudhakaranNessuna valutazione finora

- Caso 1 - Warren E Buffett 2005Documento11 pagineCaso 1 - Warren E Buffett 2005Al Aquino40% (5)

- Purinex Case StudyDocumento9 paginePurinex Case Studylucy007Nessuna valutazione finora

- Case 28 UVa Hospital System The Long Term Acute Care Hospital ProjectDocumento6 pagineCase 28 UVa Hospital System The Long Term Acute Care Hospital Projecthnooy50% (2)

- Rocheholdingag 160318174415Documento24 pagineRocheholdingag 160318174415iskandarbasiruddinNessuna valutazione finora

- Assessing Earnings Quality at NuwareDocumento7 pagineAssessing Earnings Quality at Nuwaresatherbd21100% (4)

- KKTiwari - 18214263 - Worldwide Paper Company-2016Documento5 pagineKKTiwari - 18214263 - Worldwide Paper Company-2016KritikaPandeyNessuna valutazione finora

- Case 26 Assignment AnalysisDocumento1 paginaCase 26 Assignment AnalysisNiyanthesh Reddy50% (2)

- Roche S Acquisition of GenentechDocumento34 pagineRoche S Acquisition of GenentechPradipkumar UmdaleNessuna valutazione finora

- Boeing Analysis: Index BusinessDocumento7 pagineBoeing Analysis: Index BusinessPang Chun100% (1)

- Carter LBODocumento1 paginaCarter LBOEddie KruleNessuna valutazione finora

- Boeing's New 7E7 AircraftDocumento10 pagineBoeing's New 7E7 AircraftTommy Suryo100% (1)

- Identify The Industry - Case 5Documento2 pagineIdentify The Industry - Case 5yuki_akitsu0% (1)

- JetBlue Case StudyDocumento4 pagineJetBlue Case StudyXing Liang Huang100% (1)

- DuPont QuestionsDocumento1 paginaDuPont QuestionssandykakaNessuna valutazione finora

- Chestnut FoodsDocumento2 pagineChestnut FoodsNiyanthesh Reddy25% (4)

- Padgett Paper Products Case StudyDocumento7 paginePadgett Paper Products Case StudyDavey FranciscoNessuna valutazione finora

- Eaton Corporation Portfolio Transformation ValuationDocumento1 paginaEaton Corporation Portfolio Transformation ValuationSulaiman AminNessuna valutazione finora

- The WM Wringley JR CompanyDocumento3 pagineThe WM Wringley JR Companyavnish kumarNessuna valutazione finora

- Mars Wrigley Case Study SolutionDocumento8 pagineMars Wrigley Case Study SolutionDivya Khatter100% (1)

- Heinz M&ADocumento25 pagineHeinz M&ASylvain BlanchardNessuna valutazione finora

- Case Study Hertz CorporationDocumento27 pagineCase Study Hertz CorporationprajeshguptaNessuna valutazione finora

- Stone Container Case DiscussionDocumento6 pagineStone Container Case DiscussionAvon Jade RamosNessuna valutazione finora

- Case Write Up-JetBlueDocumento13 pagineCase Write Up-JetBluesreen2r100% (1)

- J&L Railroad Hedging StrategiesDocumento2 pagineJ&L Railroad Hedging StrategiesAde AdeNessuna valutazione finora

- Mergers & AcquisitionsDocumento2 pagineMergers & AcquisitionsRashleen AroraNessuna valutazione finora

- 2 Yeats Valve and Controls Case 1Documento16 pagine2 Yeats Valve and Controls Case 1Yuki JameloNessuna valutazione finora

- UVa Health LTAC Project AnalysisDocumento2 pagineUVa Health LTAC Project AnalysisLana AlghamdiNessuna valutazione finora

- Jetblue Airways Ipo ValuationDocumento9 pagineJetblue Airways Ipo Valuationteddywmt100% (3)

- GR-II-Team 11-2018Documento4 pagineGR-II-Team 11-2018Gautam PatilNessuna valutazione finora

- Financial Analysis Case StudyDocumento14 pagineFinancial Analysis Case StudyPratik Prakash BhosaleNessuna valutazione finora

- MidlandDocumento4 pagineMidlandsophieNessuna valutazione finora

- Nike, IncDocumento19 pagineNike, IncRavi PrakashNessuna valutazione finora

- Case Discussion PointsDocumento3 pagineCase Discussion PointsMeena100% (1)

- TN16 The Boeing 7E7Documento27 pagineTN16 The Boeing 7E7Stanleylan100% (5)

- XON Parts 2-8Documento88 pagineXON Parts 2-8Anonymous Ht0MIJNessuna valutazione finora

- 3 and 4 Final CrowdfundingDocumento3 pagine3 and 4 Final CrowdfundingPrasant Goel0% (1)

- Genzyme and Relational Investors - Science and Business Collide (SPREADSHEET) F-1660XDocumento35 pagineGenzyme and Relational Investors - Science and Business Collide (SPREADSHEET) F-1660XPaco ColínNessuna valutazione finora

- Pershing Square Kraft PresentationDocumento31 paginePershing Square Kraft Presentationmarketfolly.com100% (3)

- Williams Seeks $900M Financing to Address Liquidity CrisisDocumento4 pagineWilliams Seeks $900M Financing to Address Liquidity CrisisAnirudh SurendranNessuna valutazione finora

- Jetblue Airways Ipo ValuationDocumento6 pagineJetblue Airways Ipo ValuationXing Liang HuangNessuna valutazione finora

- Case Berkshire Hathaway Dividend Policy ParadigmDocumento9 pagineCase Berkshire Hathaway Dividend Policy ParadigmHugoNessuna valutazione finora

- Eastboro Machine Tools CorporationDocumento32 pagineEastboro Machine Tools Corporationrifki100% (2)

- Nike Case AnalysisDocumento11 pagineNike Case AnalysisastrdppNessuna valutazione finora

- Arcadian Business CaseDocumento20 pagineArcadian Business CaseHeniNessuna valutazione finora

- ETHICAL AND PROFESSIONAL STANDARDSDocumento99 pagineETHICAL AND PROFESSIONAL STANDARDSgift108Nessuna valutazione finora

- Reading-Budgeting The Real WorldDocumento10 pagineReading-Budgeting The Real WorldLita Permata SariNessuna valutazione finora

- The Five Rules For Successful Stock InvestingDocumento4 pagineThe Five Rules For Successful Stock Investingkt0% (1)

- Chapter 1 Quiz: Submitted by rjt5008 On 1/22/2007 3:27:17 PMDocumento4 pagineChapter 1 Quiz: Submitted by rjt5008 On 1/22/2007 3:27:17 PMsulabhagarwal1985Nessuna valutazione finora

- CHAPTER 1: Quantitative Methods - Introduction: Series 66: Textbooks, Software & VideosDocumento38 pagineCHAPTER 1: Quantitative Methods - Introduction: Series 66: Textbooks, Software & VideosLeeAnn MarieNessuna valutazione finora

- Chapter 6 Risk and ReturnDocumento6 pagineChapter 6 Risk and Returnsheeraz_255650545Nessuna valutazione finora

- Corporate Financial Reporting: Session-2 IIMC-PGP-2013: Prof. Arpita GhoshDocumento23 pagineCorporate Financial Reporting: Session-2 IIMC-PGP-2013: Prof. Arpita GhoshmilepnNessuna valutazione finora

- Department of Business Administration Technical Education & Research InstituteDocumento72 pagineDepartment of Business Administration Technical Education & Research InstitutePrashant SinghNessuna valutazione finora

- Time Table For Term VDocumento2 pagineTime Table For Term VGregory WilsonNessuna valutazione finora

- Baria Case AlternativesDocumento2 pagineBaria Case AlternativesGregory WilsonNessuna valutazione finora

- HRM SectionA Group3Documento12 pagineHRM SectionA Group3Gregory WilsonNessuna valutazione finora

- 23 Things That They Don't Tell YouDocumento8 pagine23 Things That They Don't Tell YouGregory WilsonNessuna valutazione finora

- KiteRunner MallDocumento14 pagineKiteRunner MallGregory WilsonNessuna valutazione finora

- AmlDocumento6 pagineAmlGregory WilsonNessuna valutazione finora

- Group 3 Section B HRMDocumento5 pagineGroup 3 Section B HRMGregory WilsonNessuna valutazione finora

- Synopsis of GoogleDocumento6 pagineSynopsis of GoogleGregory WilsonNessuna valutazione finora

- How Much LandDocumento25 pagineHow Much LandGregory WilsonNessuna valutazione finora

- M-Paisa in IndiaDocumento7 pagineM-Paisa in IndiaGregory WilsonNessuna valutazione finora

- MonopolyDocumento21 pagineMonopolyDhaval ShahNessuna valutazione finora

- MonopolyDocumento21 pagineMonopolyDhaval ShahNessuna valutazione finora

- Demand ForecastingDocumento66 pagineDemand ForecastingGregory WilsonNessuna valutazione finora

- Session 8 ERP and BPMDocumento41 pagineSession 8 ERP and BPMGregory WilsonNessuna valutazione finora

- Innovating For Shared ValueDocumento16 pagineInnovating For Shared ValueGregory WilsonNessuna valutazione finora

- NikhilDocumento2 pagineNikhilGregory WilsonNessuna valutazione finora

- Kelsey Manufacturing CompanyDocumento7 pagineKelsey Manufacturing CompanyGregory WilsonNessuna valutazione finora

- CB 1Documento2 pagineCB 1Gregory WilsonNessuna valutazione finora

- Marico DistributionDocumento4 pagineMarico DistributionNikita ChristianNessuna valutazione finora

- Presentation 1Documento2 paginePresentation 1Gregory WilsonNessuna valutazione finora

- CH 11Documento51 pagineCH 11Gregory WilsonNessuna valutazione finora

- T4 PGPM 2013-15Documento2 pagineT4 PGPM 2013-15Gregory WilsonNessuna valutazione finora

- CBDocumento2 pagineCBGregory WilsonNessuna valutazione finora

- T4 PGPM 2013-15Documento2 pagineT4 PGPM 2013-15Gregory WilsonNessuna valutazione finora

- Tutorial 2 QuestionsDocumento8 pagineTutorial 2 QuestionshrfjbjrfrfNessuna valutazione finora

- Chapter 1 - Fundamental Financial Management Concepts (Student's Copy)Documento23 pagineChapter 1 - Fundamental Financial Management Concepts (Student's Copy)Julie Mae Caling MalitNessuna valutazione finora

- Axis Bank - One PagerDocumento3 pagineAxis Bank - One PagerGokula VaniNessuna valutazione finora

- AF5115 Jul 2014Documento3 pagineAF5115 Jul 2014AwesomeNessuna valutazione finora

- Lahore Business School Accounting 2 Assignment 3 on Statement of Cash FlowsDocumento3 pagineLahore Business School Accounting 2 Assignment 3 on Statement of Cash Flowsmrs adilNessuna valutazione finora

- Power Homes Unlimited Corp V SECDocumento11 paginePower Homes Unlimited Corp V SECarianna0624Nessuna valutazione finora

- Acct ExcerciseDocumento18 pagineAcct ExcerciseJerome MogaNessuna valutazione finora

- Covid Company Statement of Cash FlowsDocumento3 pagineCovid Company Statement of Cash FlowsChristine Joy MoralesNessuna valutazione finora

- SEBI regulations for mutual funds in IndiaDocumento6 pagineSEBI regulations for mutual funds in Indiashobhit_patel19Nessuna valutazione finora

- Impact of Liquidity Management On Bank Pradhan Nepal 2019Documento11 pagineImpact of Liquidity Management On Bank Pradhan Nepal 2019carltondurrantNessuna valutazione finora

- Ge Matrix: Presented By: Sadia Nasir Student Id: 20181-23584Documento18 pagineGe Matrix: Presented By: Sadia Nasir Student Id: 20181-23584Hassan AhmedNessuna valutazione finora

- The Gordon Model Cost of EquityDocumento165 pagineThe Gordon Model Cost of EquitySyed Ameer Ali ShahNessuna valutazione finora

- WRD 27e - IE PPT - Ch01 - ADADocumento64 pagineWRD 27e - IE PPT - Ch01 - ADAYuchen WangNessuna valutazione finora

- MDP - SchwabDocumento5 pagineMDP - SchwabJeff SturgeonNessuna valutazione finora

- Introduction To Business Decision MakingDocumento10 pagineIntroduction To Business Decision MakingscholarsassistNessuna valutazione finora

- Mutual: FundsDocumento20 pagineMutual: FundsNitin GuptaNessuna valutazione finora

- Stock Valuation Case Study of Texas InstrumentsDocumento7 pagineStock Valuation Case Study of Texas Instrumentssaeed ansariNessuna valutazione finora

- Bodie10ce SM Ch03Documento7 pagineBodie10ce SM Ch03beadand1Nessuna valutazione finora

- Key - Stocks & Shares (Equities) VocabularyDocumento1 paginaKey - Stocks & Shares (Equities) VocabularyNguyen HuyenNessuna valutazione finora

- BRANCHES OF ACCOUNTING: Accounting Has Three Main Forms of Branches VizDocumento5 pagineBRANCHES OF ACCOUNTING: Accounting Has Three Main Forms of Branches Vizsohansharma75Nessuna valutazione finora

- Topic 1 - Chapters 5,6, Basics of Risk and ReturnDocumento64 pagineTopic 1 - Chapters 5,6, Basics of Risk and Returnvbgjhktyh9Nessuna valutazione finora

- Problem 16 4Documento9 pagineProblem 16 4one dev onliNessuna valutazione finora

- Mathematics & Decision MakingDocumento9 pagineMathematics & Decision MakingXahed AbdullahNessuna valutazione finora

- Journal of High Technology Management Research: Mohamed Firas Thraya, Jessica Lichy, Amir Louizi, Marouane Rzem 7Documento12 pagineJournal of High Technology Management Research: Mohamed Firas Thraya, Jessica Lichy, Amir Louizi, Marouane Rzem 7Lê Phương UyênNessuna valutazione finora

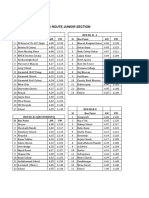

- 19 04 22 Bus Route JNR SCTN 2022Documento2 pagine19 04 22 Bus Route JNR SCTN 2022Jaya SinghNessuna valutazione finora

- CFAS - Statement of Changes in Equity and Notes To FS - Quiz 4 - SY2019 2020Documento19 pagineCFAS - Statement of Changes in Equity and Notes To FS - Quiz 4 - SY2019 2020Ivy RosalesNessuna valutazione finora

- Chapter 2 ValuationDocumento4 pagineChapter 2 ValuationArielle CabritoNessuna valutazione finora

- IPSASB IPSAS 40 Public Sector Combinations at A GlanceDocumento8 pagineIPSASB IPSAS 40 Public Sector Combinations at A GlanceWildan RahmansyahNessuna valutazione finora

- Traditional ApproachDocumento10 pagineTraditional ApproachRevati Shinde100% (1)

- Case 21Documento14 pagineCase 21Gabriela LueiroNessuna valutazione finora