Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Around The World With Kennedy Wilson

Caricato da

Broyhill Asset ManagementTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Around The World With Kennedy Wilson

Caricato da

Broyhill Asset ManagementCopyright:

Formati disponibili

AROUND

THE

WORLD

WITH KENNEDY WILSON

2

D

I

S

C

L

O

S

U

R

E

S

DISCLAIMER

The analyses and conclusions of Broyhill Asset Management, LLC (BAM") contained in this presentation are based on publicly

available information. BAM recognizes that there may be confidential information in the possession of the companies discussed in

the presentation that could lead these companies to disagree with BAMs conclusions. This presentation and the information

contained herein is not a recommendation or solicitation to buy or sell any securities.

The analyses provided may include certain statements, estimates and projections prepared with respect to, among other things, the

historical and anticipated operating performance of the companies, access to capital markets and the values of assets and liabilities.

Such statements, estimates, and projections reflect various assumptions by BAM concerning anticipated results that are inherently

subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative

purposes. No representations, express or implied, are made as to the accuracy or completeness of such statements, estimates or

projections or with respect to any other materials herein. Actual results may vary materially from the estimates and projected results

contained herein. Accordingly, no party should purchase or sell securities on the basis of the information contained in this

presentation. BAM expressly disclaims liability on account of any partys reliance on the information contained herein with respect to

any such purchases or sales.

Accounts managed by BAM and its affiliates have invested in the equity of Kennedy-Wilson Holdings, Inc (KW). It is possible that

there will be developments in the future that cause BAM to change its position regarding the companies discussed in this

presentation. BAM may buy, sell, cover or otherwise change the form of its investment regarding such companies for any reason.

BAM hereby disclaims any duty to provide any updates or changes to the analyses contained here including, without limitation, the

manner or type of any BAM investment.

3

A

G

E

N

D

A

Forever Blowing Bubbles

Kennedy Wilson Does Europe

Net Asset Value

Introduction

Appendix

INTRO

5

O

U

R

H

I

S

T

O

R

Y

We are a boutique investment firm, established as a

family office and guided by a strict value orientation.

Our family office foundation provides the security of a

stable capital base.

We invest alongside our clients as partners in our

process. As a result, we do not feel the constant pressure

to gather assets, which ultimately results in poor short-

term decisions.

Capital preservation is first and foremost our overriding

priority. We seek to provide consistent returns with a

low probability of loss, through concentrated, long-term

holdings.

We do not follow the crowd, but instead remain

independent in our decision-making. We are willing to

accept short-term underperformance in exchange for

long-term success.

6

S

T

R

I

V

E

F

O

R

B

A

L

A

N

C

E

If I could say one thing to your

investors, it's try to achieve balance.

- Ray Dalio,

Davos World Economic Forum

7

P

E

R

F

O

R

M

A

N

C

E

H

I

S

T

O

R

Y

GROWTH OF $10,000 INVESTED IN BROYHILL HIGH QUALITY COMPOSITE

8

C

A

S

H

I

S

K

I

N

G

Cash is like oxygen. You dont

notice it 99% of the time, but if

its absent its the only thing you

notice.

9

T

H

E

V

A

L

U

E

O

F

E

X

T

E

R

N

A

L

M

A

N

A

G

E

R

S

Our external investments with like-minded, long-term investors complement our internal

capabilities, expand our investable universe, and deepen our understanding of financial

markets. Simply put, External Managers, expand our circle of competence.

BLOWING

BUBBLES

11

F

O

R

E

V

E

R

B

L

O

W

I

N

G

B

U

B

B

L

E

S

CONNECTING THE DOTS BETWEEN THE KING OF COOL & THE MAESTRO

I'm forever blowing bubbles

Pretty bubbles in the air

They fly so high, nearly reach the sky

Then like my dreams they fade and die

Fortune's always hiding

I've looked everywhere

I'm forever blowing bubbles

Pretty bubbles in the air

Source: Im Forever Blowing Bubbles

12

Source: BIS, The Asset Price Bubble in Japan

A

B

R

I

E

F

H

I

S

T

O

R

Y

O

F

C

R

I

S

I

S

FIRST STOP JAPANESE BUBBLE

THIRD STOP IRELANDS BOOM

SECOND STOP US RECOVERY

NEXT STOP SPANISH CASTLES

13

S

W

I

M

M

I

N

G

L

E

S

S

O

N

S

The best swimming in the financial

markets is when panic breaks loose. By

that time, the damage has been done and

those with the courage to dive in head

first will find it extremely rewarding.

The increasing number and magnitude of

crises begs the question of whether central

bank policies are fanning the flames of

destabilizing speculation.

Source: MarketWatch

14

S

E

T

T

I

N

G

T

H

E

S

T

A

G

E

15

N

P

L

O

P

P

O

R

T

U

N

I

T

Y

EUROPEAN BANKING SNAPSHOT

Source: E&Y

16

F

L

O

C

K

I

N

G

T

O

E

U

R

O

P

E

A RECORD YEAR FOR NON CORE LOANS

Source: PwC

KW

DOES

EUROPE

18

A

T

A

L

E

N

T

E

D

S

W

I

M

M

E

R

Wed like to introduce you to a very

talented swimmer we recently

discovered while surveying the

investment landscape for sharks.

Kennedy Wilson went public in 2009

and remains underfollowed and

misunderstood despite managements

investment success.

Management has a demonstrated nose

for value and a proven track record of

identifying and capitalizing on shark-

infested waters.

Previous investments have

systematically exploited the historical

cycle of boom and bust.

WHO IS KENNEDY WILSON?

19

T

H

I

S

S

H

O

U

L

D

S

O

U

N

D

F

A

M

I

L

I

A

R

INVESTING IN OUR CIRCLE OF COMPETENCE

We generally think that asset management is a terrific business.

Theres a natural growth in global demand for financial assets and while the

barriers to entry are fairly low, the barriers to success are fairly high.

Brand, distribution and long-term performance make a big difference.

That results in established companies for the most part generating high margins,

high returns on capital and excellent free cash flow.

- Mario Gabelli

A SUSTAINABLE COMPETITIVE ADVANTAGE

Truly durable competitive advantages arise from the intersection of supply and

demand, from the linkages of economies of scale with customer captivity.

Competitive advantages based on economies of scale are in a class by themselves.

They tend to be far longer lived than the other types and therefore more valuable.

The best course is to establish dominance in a local market and then expand

outward from it. Economies of scale, especially in local markets, are the key to

creating sustainable competitive advantages.

The appropriate strategy is to identify niche markets, understanding that not all

niches are equally attractive. Ideally, it will also be readily extendable at the

edges. The key is to think local.

- Bruce Greenwald and Judd Kahn, Competition Demystified

STICKY ASSETS GENERATE DURABLE RETURNS

Those who seek to succeed as long-term investors need time, capital, and fortitude.

Time is important because gaps between fundamentals and expectations are not

always closed quickly.

A stable base of investment capital is also crucial because great investment ideas

arent worth anything if you have no money to invest.

Investors with a stable and countercyclical base of capital stand at a huge

advantage to those who work with fleet-footed capital.

Michael Mauboussin

SECULAR TAILWINDS

Alternative assets make up a small portion of global investable assets but are

outgrowing traditional assets for a number of reasons that we believe are likely to

continue for some time. With interest rates at generational lows and public market

volatility near generational highs, investors are diversifying away from conventional

asset classes with subpar returns.

The favorable return attributes of alternative assets are increasingly important as

many liability-matched funds face significant shortfalls. This problem is

exacerbated by high rates of expected returns on pension assets - a hurdle that is

increasingly difficult to reach in todays low return environment.

One way to achieve this return, however, is by committing assets for extended

periods of time to managers with proven track records.

- Me

Source: Broyhill Asset Management, Solid as an Oak

20

B

U

S

I

N

E

S

S

O

V

E

R

V

I

E

W

KENNEDY WILSON SERVICES KENNEDY WILSON INVESTMENTS

21

K

W

S

C

O

M

P

E

T

I

T

I

V

E

A

D

V

A

N

T

A

G

E

A PROVEN MODEL FOR CAPITAL ALLOCATION

Source: Company Filings

22

E

X

C

E

P

T

I

O

N

A

L

R

E

T

U

R

N

S

O

N

C

A

P

I

T

A

L

RECENT EXITS DEMONSTRATE POTENTIAL FOR VALUE CREATION

Date

Acquired

Purchase

Price

($ millions)

Partners

Equity

($ millions)

KW

Equity

($ millions)

Property Name

Sales

Proceeds

KW

Gains

KW

Multiplier

Oct-08 $88.5 $27.8

$3.2

(3)

Saybrook Pointe, 324-unit apartment building,

San Jose, California

$140.8 $2.2 1.7x

Jun-09 $33.5 $5.8

$5.9

(3)

The Mercury, LA condominiums $52.2 $9.4 2.6x

Sep-09 $210.4 $54.7

$17.5

(3)

Four multifamily properties in Western US $243.0 $7.9 1.5x

Dec-09 $218.0 $32.2

$44.3

(3)

6 multifamily properties in Western US $251.7 $19.5 1.4x

Jun-10 $56.0

(1)

9.6

(2)

$6.4

NoHo, 180 unit apartment building; 11,000 sq. ft

retail space; increased NOI from $2.3 to $3.1

million

$74.0 $7.2 2.1x

(3) Assume 1.85x Leverage where inf ormation is unavailable

(1) Calculated using 4.1% cap rate at sale and $2.1 million of NOI bef ore acquisition

(2) Assume 40% participation in partnerships based on company f ilings

Source: Company Filings, Broyhill Asset Management Estimates

Major corrections create new opportunities that, if seized, can transform companies to even greater heights.

- Bill McMorrow, 2009 Letter to Shareholders

23

T

H

E

K

E

N

N

E

D

Y

W

I

L

S

O

N

T

O

U

C

H

VIA VERDE THE ARTISAN

Source: ShowMeTheRent

Source: The Artisan Apt Homes

24

G

O

O

D

C

O

M

P

A

N

Y

FAIRFAX ANNUAL LETTER EXCERPTS

We continued to purchase commercial real estate investments with Bill

McMorrow and his team at Kennedy Wilson. We purchased, 50/50

with Kennedy Wilson, perhaps the finest office building in Dublin,

built in 2009 and 100% leased to State Street Bank for 25 years, for

one-third of its construction cost with an unleveraged yield of

approximately 8.5%. We also own, with Kennedy Wilson, some of

the finest apartment buildings in Dublin with similar return

characteristics. Rest assured we return Bills calls very promptly!

As I mentioned to you last year, one such call from Bill in 2011 led to

our investment (along with W.L. Ross, Fidelity and Capital

Research) in Bank of Ireland the first significant investment in

Ireland by foreign investors since the financial market collapse. Only

one year later, Ireland and its economy have made significant strides

towards recovery. The Bank of Ireland has been one of our most

successful investments

1

We continued to invest with Bill McMorrow from Kennedy Wilson in

2013. We invested in the Clancy Quay apartments and some well-

leased office buildings in Dublin and we also invested in a U.K. loan

pool. We have invested a net cumulative $305 million in real estate

deals with Kennedy Wilson in California, Japan, the U.K. and

Ireland deals at significant discounts to replacement costs and with

excellent unlevered cash on cash returns, in which Kennedy Wilson is

the managing partner and an investor. Also, we continue to own a

fully diluted 10.9% interest in Kennedy Wilson.

2

1

Fairfax 2012 Annual Letter

2

Fairfax 2013 Annual Letter

25

D

E

A

L

S

S

O

U

R

C

E

D

F

R

O

M

A

D

O

Z

E

N

I

N

S

T

I

T

U

T

I

O

N

S

KW HISTORY IN EUROPE

Source: Company Filings

26

W

A

I

T

F

O

R

I

T

27

A

T

T

R

A

C

T

I

V

E

A

S

S

E

T

S

A

C

R

O

S

S

T

H

E

U

K

&

I

R

E

L

A

N

D

KWE ACQUISITIONS SINCE IPO EXCEED 1 BILLION

Source: Company Filings, Broyhill Asset Management Estimates

28

N

A

M

A

ACCELERATING DEBT REDUCTION

NAMA acquired EUR 74 billion of loans as

part of a major Irish asset relief scheme and

subsequent recapitalization program.

The agency has set a debt reduction target of

25% by 2013, 80% by 2017 and 100% by 2019.

Expect activity to heat up between now and

then as illustrated below.

DRIVING INCREASED TRANSACTION ACTIVITY

Source: National Asset Management Agency 2013 Annual Report

29

T

H

E

L

U

C

K

O

F

T

H

E

I

R

I

S

H

DUBLIN PRIME LONG-TERM YIELDS

ANNUAL CHANGE IN PRIME DUBLIN OFFICE RENT

Source: Lisney Research

30

U

P

S

I

D

E

I

N

S

E

C

O

N

D

A

R

Y

M

A

R

K

E

T

S

UK YIELDS & INTEREST RATES

PRIME PROPERTY PERFORMANCE PRIME INVESTMENT YIELDS

Source: Cushman & Wakefield

31

P

O

P

U

L

A

R

G

R

O

W

T

H

I

N

M

A

D

R

I

D

On December 27, 2013, Banco Popular, SA sold the real-estate

management business unit and some of the Banks debt related to the

property sector to a newly incorporated company, with a majority

shareholding by Vrde Partners, Inc. and Kennedy Wilson. The sale

includes the transfer of all resources required to independently carry

out the real-estate management business. This business had been

carried out by the group with the objective of maximizing the sale

price of property assets and maximizing the recovery of debt related

to the real estate sector. This will allow the Bank to benefit from its

partners broad management experience with these types of assets

with the objective of attaining the maximum yield from the

management of this business.

Investments in Europe have been sourced directly through extensive relationships with financial institutions in the

UK and Ireland. Going forward, we expect that KWs team in Madrid will provide a long runway for future

growth. In line with KWs time tested business model, management dusted off the Irish playbook and launched

its operations in Spain in 2012 through the real estate auction business followed by a major strategic acquisition

last year. Heres the summary from Banco Populars Annual Report:

On December 27, 2013, Banco Popular, SA sold the real-estate management business unit and some of the Banks debt related to

the property sector to a newly incorporated company, with a majority shareholding by Vrde Partners, Inc. and Kennedy Wilson. The

sale includes the transfer of all resources required to independently carry out the real-estate management business. This business had

been carried out by the group with the objective of maximizing the sale price of property assets and maximizing the recovery of debt

related to the real estate sector. This will allow the Bank to benefit from its partners broad management experience with these types of

assets with the objective of attaining the maximum yield from the management of this business.

32

S

A

R

E

B

NET

ASSET

VALUE

34

A

R

A

T

I

O

N

A

L

A

P

P

R

O

A

C

H

MODERN SECURITY ANALYSIS

It seems very hard to try to beat the market consistently

by trying to beat the market. Rather it seems to us a more

rational approach is to be value conscious rather than

outlook conscious.

- Martin J. Whitman, Modern Security Analysis

35

$0

$5

$10

$15

$20

$25

$30

$35

$11

$32

$7

$4

$5

$5

$0

$5

$10

$15

$20

$25

$30

$35

Net LT

Investments

ST

Investments

KW

Services

KWE

Mgmt Fees

Incentive

Fees

Upside

Potential

NET ASSET VALUE & UPSIDE POTENTIAL

Source: Company Filings, Broyhill Asset Management Estimates

Valued at 1.4x-

1.6x Book

Value Net of

Debt and

Non-

controlling

Interests

Cash &

Receivables

14x18x

NOI

14x18x

NOI

Assuming

Fully

Invested

Assets

4x-8x

Incentive

Fee-Related

Earnings

Assuming

1.6x Multiple

Over 3 Year

Holding

Period

W

H

A

T

S

I

T

W

O

R

T

H

?

36

S

U

P

E

R

M

A

R

I

O

KW TOTAL NET INVESTMENT ACCOUNT

Source: Company Filings, Broyhill Asset Management Estimates

APPENDICES

38

U

P

S

I

D

E

I

N

R

E

N

T

G

R

O

W

T

H

&

C

A

P

R

A

T

E

S

KWE SENSITIVITY ANALYSIS

Annual Rent Growth

1.8 0% 2% 4% 6% 8% 10% 12% 14%

9.00% 0.63 0.74 0.87 1.00 1.13 1.28 1.43 1.59

E

x

i

t

C

a

p

R

a

t

e

8.50% 0.72 0.85 0.98 1.11 1.26 1.41 1.57 1.74

8.00% 0.83 0.96 1.10 1.25 1.40 1.56 1.73 1.91

7.50% 0.95 1.09 1.24 1.40 1.56 1.73 1.91 2.10

7.00% 1.09 1.24 1.40 1.57 1.74 1.93 2.12 2.32

6.50% 1.25 1.41 1.58 1.76 1.95 2.15 2.36 2.58

6.00% 1.44 1.61 1.80 2.00 2.20 2.42 2.64 2.88

5.50% 1.66 1.85 2.05 2.27 2.49 2.73 2.97 3.23

5.00% 1.93 2.14 2.36 2.59 2.84 3.10 3.37 3.65

Source: Company Filings, Broyhill Asset Management Estimates

39

T

I

G

E

R

P

O

R

T

F

O

L

I

O

OVERVIEW

40

A

R

T

E

M

I

S

P

O

R

T

F

O

L

I

O

OVERVIEW

41

O

P

E

R

A

P

O

R

T

F

O

L

I

O

OVERVIEW

42

C

E

N

T

R

A

L

P

A

R

K

P

O

R

T

F

O

L

I

O

OVERVIEW

43

P

O

R

T

M

A

R

N

O

C

K

H

O

T

E

L

&

G

O

L

F

L

I

N

K

S

OVERVIEW

44

L

I

F

F

E

Y

T

R

U

S

T

B

U

I

L

D

I

N

G

OVERVIEW

45

F

O

R

D

G

A

T

E

J

U

P

I

T

E

R

OVERVIEW

46

A

V

O

N

L

O

A

N

P

O

R

T

F

O

L

I

O

OVERVIEW

47

D

I

S

C

L

A

I

M

E

R

DISCLAIMER

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

This material has been prepared solely for the purposes of illustration and discussion. Broyhill Asset Management is the marketing name for

the investment management business conducted by Broyhill Asset Management, LLC. and its affiliates. Broyhill Asset Management, LLC is an

SEC Registered Investment Advisor.

Under no circumstances should the information contained herein be used or considered as an offer to sell, or solicitation of an offer to buy any

security. Any security offering is subject to certain investor eligibility criteria as detailed in the applicable offering documents. The information

contained herein is confidential and may not be reproduced or circulated in whole or in part. The information is in summary form for

convenience of presentation, it is not complete and should not be relied upon as such.

Any information, data, statement, opinions, or projections made herein may contain certain forward looking statements, projections, and

information that are based on the beliefs of Broyhill Asset Management as well as assumptions made by, and information currently available to,

Broyhill Asset Management. Such statements reflect the view of Broyhill Asset Management with respect to future events and are subject to

certain risks, uncertainties and assumptions (including, but not limited to, changes in general economic and business conditions, interest rate and

securities market fluctuations, competition from within and without the investment industry, new products and services in the investment

industry, changes in customer profiles, and changes in laws and regulations applicable to Broyhill Asset Management). Should one or more of

these other risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those

described herein.

All information, including performance information, has been prepared in good faith; there are no representations or warranty expressed or

implied, as to the accuracy or completeness, of the information, and nothing herein shall be relied upon as a promise or representation as to the

past or future performance. This material may include information that is based, in part or in full, on hypothetical assumptions, models, and/or

other analysis (which may not necessarily be described herein). No representations or warranty are made as to the reasonableness of any such

assumptions, models, or analysis. The information set forth herein was gathered from various sources which are believed, but not guaranteed, to

be reliable. Unless stated otherwise, any opinions expressed herein are current as of the date hereof and are subject to change at any time.

Accordingly, neither Broyhill Asset Management nor its principals or affiliates make any representations as to the timeliness of any information in

this presentation.

Broyhill Asset Management

Christopher R. Pavese, CFA

chris@broyhillasset.com

Potrebbero piacerti anche

- Arlington Value 2006 Annual Shareholder LetterDocumento5 pagineArlington Value 2006 Annual Shareholder LetterSmitty WNessuna valutazione finora

- Stay Rich with a Balanced Portfolio: The Price You Pay for Peace of MindDa EverandStay Rich with a Balanced Portfolio: The Price You Pay for Peace of MindValutazione: 3 su 5 stelle3/5 (1)

- The Future of Common Stocks Benjamin Graham PDFDocumento8 pagineThe Future of Common Stocks Benjamin Graham PDFPrashant AgarwalNessuna valutazione finora

- Understanding the different levels of investing as a gameDocumento11 pagineUnderstanding the different levels of investing as a gamePradeep RaghunathanNessuna valutazione finora

- Anon - Housing Thesis 09 12 2011Documento22 pagineAnon - Housing Thesis 09 12 2011cnm3dNessuna valutazione finora

- Teledyne and Henry Singleton A CS of A Great Capital AllocatorDocumento34 pagineTeledyne and Henry Singleton A CS of A Great Capital Allocatorp_rishi_2000Nessuna valutazione finora

- Klarman WorryingDocumento2 pagineKlarman WorryingSudhanshuNessuna valutazione finora

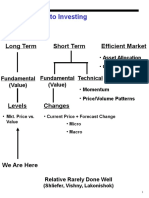

- Approaches To Investing: Long Term Short Term Efficient MarketDocumento71 pagineApproaches To Investing: Long Term Short Term Efficient MarketPeter WarmeNessuna valutazione finora

- Aquamarine - 2013Documento84 pagineAquamarine - 2013sb86Nessuna valutazione finora

- EV The Price of A BusinessDocumento11 pagineEV The Price of A BusinessseadwellerNessuna valutazione finora

- Investing Without PeopleDocumento18 pagineInvesting Without PeopleZerohedgeNessuna valutazione finora

- Tiananmen Square To Wall Street - ArticleDocumento3 pagineTiananmen Square To Wall Street - ArticleGabe FarajollahNessuna valutazione finora

- Buffett On Valuation PDFDocumento7 pagineBuffett On Valuation PDFvinaymathew100% (1)

- BerkshireHandout2012Final 0 PDFDocumento4 pagineBerkshireHandout2012Final 0 PDFHermes TristemegistusNessuna valutazione finora

- Ruane Cunniff Sequoia Fund Annual LetterDocumento29 pagineRuane Cunniff Sequoia Fund Annual Letterrwmortell3580Nessuna valutazione finora

- Spinoff Investing Checklist: - Greggory Miller, Author of Spinoff Investing Simplified Available OnDocumento2 pagineSpinoff Investing Checklist: - Greggory Miller, Author of Spinoff Investing Simplified Available OnmikiNessuna valutazione finora

- Profit Guru Bill NygrenDocumento5 pagineProfit Guru Bill NygrenekramcalNessuna valutazione finora

- The Art of Stock PickingDocumento13 pagineThe Art of Stock PickingRonald MirandaNessuna valutazione finora

- Acumen Phil Fisher 1.0Documento16 pagineAcumen Phil Fisher 1.0Vishwanath PuthranNessuna valutazione finora

- Great CEOs Compilation by @geordiejobDocumento218 pagineGreat CEOs Compilation by @geordiejobndzapakNessuna valutazione finora

- Creighton Value Investing PanelDocumento9 pagineCreighton Value Investing PanelbenclaremonNessuna valutazione finora

- Notes From A Seth Klarman MBA LectureDocumento5 pagineNotes From A Seth Klarman MBA LecturePIYUSH GOPALNessuna valutazione finora

- Sees Candy SchroederDocumento15 pagineSees Candy SchroederAAOI2Nessuna valutazione finora

- Coho Capital Letter Highlights Self-Reinforcing Business Models in TechDocumento13 pagineCoho Capital Letter Highlights Self-Reinforcing Business Models in TechraissakisNessuna valutazione finora

- Free Cash Flow Investing 04-18-11Documento6 pagineFree Cash Flow Investing 04-18-11lowbankNessuna valutazione finora

- The Nifty Fifty - Joe Kusnan's BlogDocumento2 pagineThe Nifty Fifty - Joe Kusnan's BlogPradeep RaghunathanNessuna valutazione finora

- Private Debt Investor Special ReportDocumento7 paginePrivate Debt Investor Special ReportB.C. MoonNessuna valutazione finora

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDocumento70 pagineMick McGuire Value Investing Congress Presentation Marcato Capital Managementmarketfolly.comNessuna valutazione finora

- Scion 2006 4q Rmbs Cds Primer and FaqDocumento8 pagineScion 2006 4q Rmbs Cds Primer and FaqsabishiiNessuna valutazione finora

- Distressed Debt InvestingDocumento5 pagineDistressed Debt Investingjt322Nessuna valutazione finora

- Focus InvestorDocumento5 pagineFocus Investora65b66inc7288Nessuna valutazione finora

- VALUEx Vail 2014 - Visa PresentationDocumento19 pagineVALUEx Vail 2014 - Visa PresentationVitaliyKatsenelson100% (1)

- Print Article on Value Investor Seth KlarmanDocumento2 paginePrint Article on Value Investor Seth KlarmanBolsheviceNessuna valutazione finora

- Marcato Capital 4Q14 Letter To InvestorsDocumento38 pagineMarcato Capital 4Q14 Letter To InvestorsValueWalk100% (1)

- Reading List J Montier 2008-06-16Documento12 pagineReading List J Montier 2008-06-16rodmorley100% (2)

- Summary New Venture ManagementDocumento57 pagineSummary New Venture Managementbetter.bambooNessuna valutazione finora

- 9 - Case Shopping MallDocumento11 pagine9 - Case Shopping MallRdx ProNessuna valutazione finora

- Schloss 1995Documento2 pagineSchloss 1995Logic Gate Capital100% (3)

- Charlie Rose Warren Buffett InterviewDocumento20 pagineCharlie Rose Warren Buffett InterviewkayeskowsikNessuna valutazione finora

- RV Capital June 2015 LetterDocumento8 pagineRV Capital June 2015 LetterCanadianValueNessuna valutazione finora

- Value Investing Opportunities in Korea (Presentation by Petra)Documento49 pagineValue Investing Opportunities in Korea (Presentation by Petra)Mike ChangNessuna valutazione finora

- The Beekeepers' Guide to Investing: Focusing on Business Fundamentals Over Emotions in Volatile MarketsDocumento13 pagineThe Beekeepers' Guide to Investing: Focusing on Business Fundamentals Over Emotions in Volatile Marketscrees25Nessuna valutazione finora

- Nick Train The King of Buy and Hold PDFDocumento13 pagineNick Train The King of Buy and Hold PDFJohn Hadriano Mellon FundNessuna valutazione finora

- Words From The Wise Charles Ellis On Confronting Investing ChallengesDocumento23 pagineWords From The Wise Charles Ellis On Confronting Investing ChallengesFrederico DimarzioNessuna valutazione finora

- Interviews Value Investing Guru Roger Montgomery About ValueableDocumento3 pagineInterviews Value Investing Guru Roger Montgomery About Valueableqwerqwer123100% (1)

- East Coast Asset Management (Q4 2009) Investor LetterDocumento10 pagineEast Coast Asset Management (Q4 2009) Investor Lettermarketfolly.comNessuna valutazione finora

- Who Is On The Other Side?: Antti IlmanenDocumento65 pagineWho Is On The Other Side?: Antti IlmanenaptenodyteNessuna valutazione finora

- 1976 Buffett Letter About Geico - FutureBlindDocumento4 pagine1976 Buffett Letter About Geico - FutureBlindPradeep RaghunathanNessuna valutazione finora

- Small CapsDocumento4 pagineSmall CapscdietzrNessuna valutazione finora

- Ruane, Cunniff Investor Day 2016Documento25 pagineRuane, Cunniff Investor Day 2016superinvestorbulletiNessuna valutazione finora

- Notes John Burbank, Passport at University of Texas, UTIMCODocumento2 pagineNotes John Burbank, Passport at University of Texas, UTIMCOHedge Fund ConversationsNessuna valutazione finora

- 10 "The Rediscovered Benjamin Graham"Documento6 pagine10 "The Rediscovered Benjamin Graham"X.r. GeNessuna valutazione finora

- Ben Stein - Leg Up On The MarketDocumento8 pagineBen Stein - Leg Up On The MarketMarc F. DemshockNessuna valutazione finora

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketDa EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketNessuna valutazione finora

- Financial Fine Print: Uncovering a Company's True ValueDa EverandFinancial Fine Print: Uncovering a Company's True ValueValutazione: 3 su 5 stelle3/5 (3)

- Raising the Bar: Integrity and Passion in Life and Business: The Story of Clif Bar Inc.Da EverandRaising the Bar: Integrity and Passion in Life and Business: The Story of Clif Bar Inc.Valutazione: 3.5 su 5 stelle3.5/5 (15)

- Strategic and Tactical Asset Allocation: An Integrated ApproachDa EverandStrategic and Tactical Asset Allocation: An Integrated ApproachNessuna valutazione finora

- Are You Smarter Than A 7th Grader (Notes)Documento37 pagineAre You Smarter Than A 7th Grader (Notes)Broyhill Asset ManagementNessuna valutazione finora

- The Grave Dancer Sam ZellDocumento5 pagineThe Grave Dancer Sam ZellValueWalk100% (2)

- Lumber Liquidators Presentation-Whitney Tilson-11!22!13Documento27 pagineLumber Liquidators Presentation-Whitney Tilson-11!22!13CanadianValueNessuna valutazione finora

- Broyhill Letter (Q2-08)Documento3 pagineBroyhill Letter (Q2-08)Broyhill Asset ManagementNessuna valutazione finora

- Solid As An OAKDocumento32 pagineSolid As An OAKBroyhill Asset ManagementNessuna valutazione finora

- Rational Investing in Irrational MarketsDocumento70 pagineRational Investing in Irrational MarketsBroyhill Asset ManagementNessuna valutazione finora

- HSP Thesis (May-13)Documento17 pagineHSP Thesis (May-13)Broyhill Asset ManagementNessuna valutazione finora

- The Broyhill Letter: Executive SummaryDocumento3 pagineThe Broyhill Letter: Executive SummaryBroyhill Asset ManagementNessuna valutazione finora

- Put Me in Coach!!Documento22 paginePut Me in Coach!!Broyhill Asset ManagementNessuna valutazione finora

- The Broyhill Letter: Executive SummaryDocumento4 pagineThe Broyhill Letter: Executive SummaryBroyhill Asset ManagementNessuna valutazione finora

- CCH Thesis (Dec-12)Documento16 pagineCCH Thesis (Dec-12)Broyhill Asset ManagementNessuna valutazione finora

- Broyhill Letter (Q2-08)Documento3 pagineBroyhill Letter (Q2-08)Broyhill Asset ManagementNessuna valutazione finora

- The Broyhill Letter - Part Duex (Q2-11)Documento5 pagineThe Broyhill Letter - Part Duex (Q2-11)Broyhill Asset ManagementNessuna valutazione finora

- Broyhill Letter (Aug-12)Documento8 pagineBroyhill Letter (Aug-12)Broyhill Asset ManagementNessuna valutazione finora

- A Brief Update On Portfolio Strategy (Nov-12)Documento8 pagineA Brief Update On Portfolio Strategy (Nov-12)Broyhill Asset ManagementNessuna valutazione finora

- The Broyhill Letter (Q4-10)Documento7 pagineThe Broyhill Letter (Q4-10)Broyhill Asset ManagementNessuna valutazione finora

- Broyhill Letter (Oct-12)Documento8 pagineBroyhill Letter (Oct-12)Broyhill Asset ManagementNessuna valutazione finora

- Bienville US Housing (May 2012)Documento23 pagineBienville US Housing (May 2012)Broyhill Asset ManagementNessuna valutazione finora

- Dept of Commerce Preliminary Finding of CVDDocumento9 pagineDept of Commerce Preliminary Finding of CVDBroyhill Asset ManagementNessuna valutazione finora

- Easy Money (Nov-11)Documento37 pagineEasy Money (Nov-11)Broyhill Asset ManagementNessuna valutazione finora

- The Broyhill Letter (Q2-11)Documento6 pagineThe Broyhill Letter (Q2-11)Broyhill Asset ManagementNessuna valutazione finora

- The Broyhill Letter (Q3-11)Documento7 pagineThe Broyhill Letter (Q3-11)Broyhill Asset ManagementNessuna valutazione finora

- Investing Between Crises (Jun-11)Documento53 pagineInvesting Between Crises (Jun-11)Broyhill Asset ManagementNessuna valutazione finora

- Shorting Congress - Commentary & Strategy (January 2011)Documento6 pagineShorting Congress - Commentary & Strategy (January 2011)Broyhill Asset ManagementNessuna valutazione finora

- The Broyhill Letter (Q1-11)Documento7 pagineThe Broyhill Letter (Q1-11)Broyhill Asset ManagementNessuna valutazione finora

- Tis Mir 01.05.10Documento3 pagineTis Mir 01.05.10Broyhill Asset ManagementNessuna valutazione finora

- Broyhill Portfolio Strategy (Apr-11)Documento42 pagineBroyhill Portfolio Strategy (Apr-11)Broyhill Asset ManagementNessuna valutazione finora

- The Great 'Flation Debate (Nov-10)Documento33 pagineThe Great 'Flation Debate (Nov-10)Broyhill Asset ManagementNessuna valutazione finora

- LL - Mama Said Knock You OutDocumento17 pagineLL - Mama Said Knock You OutBroyhill Asset ManagementNessuna valutazione finora

- 2020-08-31 - Best Practices For Electrifying Rural Health Facilities - FinalDocumento54 pagine2020-08-31 - Best Practices For Electrifying Rural Health Facilities - FinalAdedimeji FredNessuna valutazione finora

- Statement of Account: Locked Bag 980 Milsons Point NSW 1565Documento9 pagineStatement of Account: Locked Bag 980 Milsons Point NSW 1565Tyler LindsayNessuna valutazione finora

- Track monthly expenses and income in a budget spreadsheetDocumento4 pagineTrack monthly expenses and income in a budget spreadsheetTa Tran100% (1)

- (2013 Pattern) PDFDocumento77 pagine(2013 Pattern) PDFamNessuna valutazione finora

- Proposal of HBLDocumento52 pagineProposal of HBLashuuu143100% (1)

- Revenue Regulations No. 02-40Documento46 pagineRevenue Regulations No. 02-40zelayneNessuna valutazione finora

- PDF - Unpacking LRC and LIC Calculations For PC InsurersDocumento14 paginePDF - Unpacking LRC and LIC Calculations For PC Insurersnod32_1206Nessuna valutazione finora

- Focus4 2E Unit Test Vocabulary Grammar UoE Unit4 GroupA B ANSWERSDocumento1 paginaFocus4 2E Unit Test Vocabulary Grammar UoE Unit4 GroupA B ANSWERSHalil B67% (3)

- Semester 1 of The 2019-2020 Academic Session (September 2019)Documento3 pagineSemester 1 of The 2019-2020 Academic Session (September 2019)Ct HajarNessuna valutazione finora

- Sashaevdakov 5cents On Life1Documento142 pagineSashaevdakov 5cents On Life1abcdNessuna valutazione finora

- Anglais 1Documento3 pagineAnglais 1idilmiNessuna valutazione finora

- Protect Against Rising Rates With CapsDocumento13 pagineProtect Against Rising Rates With Capsz_k_j_vNessuna valutazione finora

- Dividend Discount Model - Commercial Bank Valuation (FIG)Documento2 pagineDividend Discount Model - Commercial Bank Valuation (FIG)Sanjay RathiNessuna valutazione finora

- Meet Your Strawman: Let's Have A Little QuizDocumento50 pagineMeet Your Strawman: Let's Have A Little Quizwereld2all100% (3)

- PBD Cluster 27Documento48 paginePBD Cluster 27Datu Puwa MamalacNessuna valutazione finora

- Costco Connection 201301Documento129 pagineCostco Connection 201301kexxuNessuna valutazione finora

- Ann Reyes General LedgersDocumento4 pagineAnn Reyes General LedgersDianeNessuna valutazione finora

- Ministry of Finance and Financiel Services Joint Communiqué On Mauritius LeaksDocumento4 pagineMinistry of Finance and Financiel Services Joint Communiqué On Mauritius LeaksION NewsNessuna valutazione finora

- Organizational Study at Sunshare InvestmentsDocumento48 pagineOrganizational Study at Sunshare Investmentsguddi kumari0% (1)

- Truth in Lending Act (Ayn Ruth Notes)Documento3 pagineTruth in Lending Act (Ayn Ruth Notes)Ayn Ruth Zambrano TolentinoNessuna valutazione finora

- RMC No. 18-2021Documento2 pagineRMC No. 18-2021Marvin Coming MoldeNessuna valutazione finora

- 1 STND Cost Calculation CK11N and CK24 - PPC1 & ZPC2Documento15 pagine1 STND Cost Calculation CK11N and CK24 - PPC1 & ZPC2Mohammad Aarif100% (1)

- Statement 20140508Documento2 pagineStatement 20140508franraizerNessuna valutazione finora

- Enron Scandal - Wikipedia, The Free EncyclopediaDocumento31 pagineEnron Scandal - Wikipedia, The Free Encyclopediazhyldyz_88Nessuna valutazione finora

- Tugas Pajak InternasionalDocumento3 pagineTugas Pajak Internasionalthapin RfNessuna valutazione finora

- CFO VP Finance Project Controls Engineer in Morristown NJ Resume Matthew GentileDocumento2 pagineCFO VP Finance Project Controls Engineer in Morristown NJ Resume Matthew GentileMatthewGentileNessuna valutazione finora

- Chinese Silver Standard EconomyDocumento24 pagineChinese Silver Standard Economyage0925Nessuna valutazione finora

- AC1025 Mock Exam Comm 2017Documento17 pagineAC1025 Mock Exam Comm 2017Nghia Tuan NghiaNessuna valutazione finora

- Trading Account PDFDocumento9 pagineTrading Account PDFVijayaraj Jeyabalan100% (1)

- Case Studies On HR Best PracticesDocumento50 pagineCase Studies On HR Best PracticesAnkur SharmaNessuna valutazione finora