Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Income Taxation

Caricato da

Love Lee Hallarsis Fabicon86%(7)Il 86% ha trovato utile questo documento (7 voti)

4K visualizzazioni6 pagineincome taxation

Titolo originale

income taxation

Copyright

© © All Rights Reserved

Formati disponibili

DOC, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoincome taxation

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

86%(7)Il 86% ha trovato utile questo documento (7 voti)

4K visualizzazioni6 pagineIncome Taxation

Caricato da

Love Lee Hallarsis Fabiconincome taxation

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 6

I.

MULTIPLE CHOICE TEST (100x1)

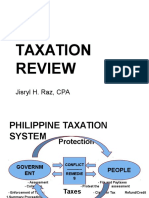

1. It is the governments duty to give taxpayers general advantages and protection in

exchange for the contributions that they have made. Which principle of taxation is described

in this situation?

a. Beneft received principle

b. heoretical !ustice

c."iscal ade#uacy

d. $ife blood theory

%. Which of these is a fee imposed on the right to exercise a professional practice or privilege?

a. oll b. ax c. $icense d. ari&

'. his type of administrative tax remedy is used (hen the government sei)es the personal

property of a delin#uent taxpayer to enforce payment of taxes.

a. $evy b. *istraint c. ax lien d. "orfeiture

+. In this type of administrative tax remedy, the taxpayers property is transferred to another

(ithout compensation or consent of the (rongdoer.

a. $evy b. *istraint c. ax lien d. "orfeiture

-. In a compromise, t(o parties agree to avoid litigation by reciprocal concessions. .ne party

may demand compliance of the other party, (ho (ould then alter their demand to

accommodate the compromise.

a. /tatement 1 and statement % are both correct.

b. /tatement 1 is correct (hile statement % is incorrect.

c. /tatement 1 is incorrect (hile statement % is correct.

d. /tatement 1 and statement % are both incorrect.

0. Which type of a situation allo(s compromise as a tax remedy?

a. 1riminal cases fled in a court

b. he taxpayers fnancial position demonstrates an inability to pay tax

c. axpayer commits tax fraud

d. here is no reasonable doubt as to the validity of the claim against the taxpayer

2. Which of these is 3. a re#uirement for (ithholding tax?

a. here must be an employer4employee relationship

b. here must be (age payment for the services rendered

c. here must be a payroll period

d. Withholding exemption of the employee must be un5no(n

6. his type of (ithholding income is applicable for the compensation and passive incomes.

a. "inal tax

b. *eductible tax

c. 1reditable tax

d. "iscal tax

7. In (ithholding tax, the employer must actually direct the (or5 that the employee does.

Withholding tax is applicable only for the full4time employees.

a. 1riminal cases fled in a court

b. he taxpayers fnancial position demonstrates an inability to pay tax

c.axpayer commits tax fraud

d. here is no reasonable doubt as to the validity of the claim against the taxpayer

18. Which of the follo(ing best describes capital gains?

a. It is the sale or exchange of shares of stoc5

b. It is the interest on savings and time deposits.

c. It is the income gained from a service rendered

d. It is the amount received as (innings.

11. What is the main reason for setting up tax treaties?

a. o enforce tax evasion

b. o obtain business profts

c. o promote international trade

d. o discourage domestic la(s.

1%. Which of the follo(ing is a tax exclusion obtained from the proceeds paid to benefciaries

upon the death of an individual?

a. 9etirement beneft

b. :ri)es and a(ards

c. ax treaties

d. $ife insurance

1'. Which of these is 3. and allo(able deduction t the estate of a citi)en or resident?

a. ;xpenses from business

b. <edical expenses less that : -88.88 incurred in a year prior to the death of the

decedent

c. axes

d. /tandard e#uivalent to :1<

1+. = person is insolvent (hen his properties are not enough to pay his obligators. hese claims

(ill be paid out of the executors property.

a. /tatement 1 and statement % are both correct.

b. /tatement 1 is correct (hile statement % is incorrect.

c. /tatement 1 is incorrect (hile statement % is correct.

d. /tatement 1 and statement % are both incorrect.

1-. Which of these is 3. re#uired for casualty losses to be deducible?

a. here must be a loss arising from fre, storms, or robbery

b. he loss must not be compensated by insurance

c. he loss has incurred not later than the last day for the payment of the estate tax

d. he loss has been claimed as a deduction for income tax purposes

10. Which statement (ould best describe the vanishing deduction?

a. It is a deduction for taxes previously claimed.

b. It is a penalty due for a tax fraud

c. It is an exclusion for indebtedness

d. It is a deduction for property previously taxed.

12. Which type of ordinary customs duty is applicable for items that are charged based only on

some standard of measurement?

a. /pecifc

b. =d valorem

c. =lternative

d. 1ompound

16. Imported vehicles are charged (ith -> of their mar5et value price, plus :-88 per metric ton.

Which type of ordinary customs duty is to be paid n this example.

a. /pecifc

b. =d valorem

c. =lternative

d. 1ompound

17. he :hilippine charges taxes on products delivered from 1hina in large #uantities (ith

abnormally lo( prices. What type of special custom duty does 1hina pay?

a. 1ountervailing duty

b. =nti4dumping duty

c. <ar5ing duty

d. *iscriminatory duty

%8. he ma5e4up company $.real failed to properly list all the chemicals in the delivery of

cosmetic products to the :hilippines. Which type of customs duty must $.real pay?

a. 1ountervailing duty

b. =nti4dumping duty

c. <ar5ing duty

d. *iscriminatory duty

%1. Which of these is 3. a characteristic of ?alue =dded ax?

a. It is a uniform tax imposed on every

sale

b. It is a form of sales tax

c. It is an e#ual amount imposed on frms

d. It is an indirect tax.

%%. Which of these business activities may be included under the optional registration?

a. /ale of agricultural food products

b. :ublication of boo5s

c. $ease of properties

d. /ales under international agreements

%'. Which of these statements best describes a ?=4exempt sale?

a. he sale of goods and services (hich are not sub!ect to output tax

b. he sale of goods and services (hich are not sub!ect to input tax

c. he sale of agricultural goods and services

d. he sale of domestic goods and services

%+. If a person sells items that are ?=4exempt, he is re#uired to pay ?= to the BI9. he seller of

the ?=4exempt items may pass on the burden of the tax to the buyers.

a. /tatement 1 and statement % are both correct.

b. /tatement 1 is correct (hile statement % is incorrect.

c. /tatement 1 is incorrect (hile statement % is correct.

d. /tatement 1 and statement % are both incorrect.

%-. Which of these is 3. a violation of ?= la(s?

a. "ailure to issue receipts

b. "ailure to fle ?= returns

c. "ailure to pass ?= to buyers

d. "ailure to register under ?=

%0. What do value added taxes and percentage taxes have in common?

a. Both are taxes for individuals

b. Both must be registered (ith bureau of customs

c. Both are based on annual receipts less than : 1,-88,888

d. Both are business taxes.

%2. :ercentage taxes cannot be passed on to the buyers. @o(ever, it is possible for the business

to pass on value added tax to buyers.

a. /tatement 1 and statement % are both correct

b. /tatement 1 is correct (hile statement % is incorrect.

c. /tatement 1 is incorrect (hile statement % is correct

d. /tatement 1 and statement % are both incorrect

%6. Which of these is 3. an excisable product?

a. =utomobil

es

b. obacco

products

c.Imported goods d. =lcohol

products

%7. his classifcation of excise tax can capture increases in the volume of production.

a. /pecifc

tax

b. =d

valorem tax

c.=lternative tax d. 1ompoun

ded tax

'8. In this classifcation of excise tax, only a shit in a products price can a&ect the excise tax

imposed.

a. /pecifc

tax

b. =d

valorem tax

c.=lternative tax d. 1ompoun

ded tax

'1. Which of these items have compounded excise taxes?

a. 1igars b. <ineral

products

c.Wines

d. Ae(elry

'%. Which classifcation of excise tax is used for yachts and other vessels intended for pleasure

or sports?

a. /pecifc tax

b. =d valorem tax

c.=lternative tax d. 1ompounded

tax

''. Which is the main purpose of documentary stamp tax?

a. o allo( parties to form a contract

b. o nullify an existing contract

c.o validate the authenticity of a document

d. o record transaction

'+. he community tax is a form of residence tax used for documentation purposes. he

community tax is also applicable to documents that are going to be used as evidence in

court.

a. /tatement 1 and statement % are both correct

b. /tatement 1 is correct (hile statement % is incorrect

c. /tatement 1 is incorrect (hile statement % is correct.

d. /tatement 1 and statement % are both incorrect.

'-. Which of these is 3. an example of a situation (here community tax must be presented?

a. =n individual liable to tax ac5no(ledges any document before a notary public

b. =nd individual receives a license

c. =n individual ta5es an oath of oBce in government service

d. =n individual sells real property

II. Problem Solving. Show yor !ol"ion!

1. <s. ;lsa *elgado is a resident citi)en of the :hilippines, single, (ith no legal dependents.

/he earned an annual income of : %+-,888 for the year %81+. /he also the sole o(ner of a

business that earned a depreciation expense of : '8,888. What is her income after tax?

%. <r. Brad *icarpio is a resident alien, married (ith t(o dependent 5ids. @e and his (ife

agreed that any income tax deductions (ould be subtracted to his o(n income. What is his

income after tax?

"or the year %81', he earnedC

Income =mount

Income from business :%2-,888

1ompensation for in!uries : 18,888

9etirement and benefts : 18,888

Business expenses : '-,888

"ree legal services : %-,888

3. /tar5 manufacturing is a foreign resident corporation that speciali)es in innovative

technologies. What is the income after tax?

"or the year %81', it earnedC

Income =mount

Income from business :1,1%8,888

Business expenses : %88,888

9esearch and development expense : 08,888

$osses : 1-,888

Bad debts : %-,888

+. <r. 1lar5 Dent, a resident citi)en of the :hilippines passed a(ay and left his estate to his

heirs. =fter valuation, it amounted toC

"or the year %81', it earnedC

Income =mount

Eross estate :+,-88,888

War damage payments : -88,888

ransfers to :hilippine government : -88,888

"air mar5et value of family home : 2-8,888

@o( much is the value of the estate after taxes?

-. Bara5o co&ee shop is a :hilippine corporation that has several locations (ithin <etro <anila.

"or the year %81', their sales and purchases amounted toC

"or the year %81', it earnedC

Income =mount

Eross sales :+,-88,888

:urchases of ra( materials : -88,888

9ent expense to ?=4registered businesses : -88,888

/alaries expense : 2-8,888

@o( much is the ?= payable?

III. E!!#y

1. ;xplain the method of payment for the excise taxes. F-418 sentencesG

I. MULTIPLE CHOICE (1 $oin" e#%h& # "o"#l o' (0 $oin"!)

1. =

%. 1

'. B

+. *

-. B

0. B

2. *

6. =

7. *

18. =

11. 1

1%. *

1'. =

1+. B

1-. 1

10. *

12. =

16. B

17. B

%8. 1

%1. 1

%%. =

%'. =

%+. *

%-. 1

%0. *

%2. 1

%6. 1

%7. =

'8. B

'1. =

'%. B

''. 1

'+. B

'-. *

II. Problem Solving (() $oin"!)

1. Eross income : %+-,888

$essC allo(able deductionsF itemi)ed or optionalG : '8,888

3et income :%1-, 888

$essC personal and additional exemptions : -8,888

3et taxable income : 10-,888

ax rate : %%,-88 HF %-> of excess over

1+8,888 I : 0, %-8G : %6,2-8

Income after tax : 1'0,%-8

%. Eross income : %2-, 888

$essC allo(able deductions : 28,888

3et income : %8-,888

$essC personal and additional exemptions : 188,888

3et taxable income : 18-, 888

ax rateC : 6,-88 H F%8> in excess of : 28,888G : 1-, -88

Income after tax : 67, -88

'. Income tax for corporation

Eross income : 1,1%8,888

$essC itemi)ed deductions or 18> standard deduction : '88,888

axable income : 6%8,888

<ultiplied byC tax rate F'8>G : %+0,888

Income after tax : -+2,888

+. Item

Eross estate : +, -88, 888

$essC allo(able deductions : 1, %-8, 888

3et estate : ', %-8, 888

$essC exemptions nJa

axable 3et ;state : ', %-8, 888

<ultiplied byC ax 9ate F11> of excess over :%<G : 1'2, -88

;state ax :ayable : %2%, -88

;state after tax F gross estate less estate tax payableG : +, %%2, -88

-. Eross sales : %, 8-8, 888

<ultiplied byC 1%> 8.1%

.utput tax : %+0, 888

:urchase of EoodsJ :ropertiesJ services : -68, 888

<ultiplied byC 1%> .1%

Input tax : 07, 088

.utput tax : %+0, 888

$essC input tax 07, 088

?= :ayable : 120, +88

II. E!!#y () $oin"!)

;xplain the method of payment for excise taxes.

he excise tax on domestic goods shall be paid by the manufacturer or produce before the

products are removed from the place of production. "or imported products, the excise tax

shall be paid by the o(ner, lessee, concessionaire or operator of the frm.

;very person liable to pay excise tax shall fle a separate return for each place of production.

he excise tax return shall include a description and #uantity of the goods to be removed,

the applicable tax base and the tax amount due.

he excise tax return is a document fled by the taxpayer that includes the taxpayers

information and payment details. he excise tax return and its payment may b submitted to

any authori)ed agent ban5 F==BG of the place (here the taxpayer is registered. In places

(here there are no ==Bs, the excise tax return and its payment (ill be submitted directly to

the 9evenue 1ollection .Bcer, or duly authori)ed 1ity or <unicipal reasurer in the o(ners

principal place of business.

he business o(ner may also choose to pay through the electronic fling and payment

system Fe":/G

Potrebbero piacerti anche

- Deductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocumento12 pagineDeductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersMichael Reyes75% (4)

- HQ04 - Final Income TaxationDocumento5 pagineHQ04 - Final Income TaxationJimmyChaoNessuna valutazione finora

- Mcq-Income TaxesDocumento7 pagineMcq-Income TaxesRandy Manzano100% (1)

- MULTIPLE CHOICE QUESTIONS IN TAX REVIEW Jan 5Documento1 paginaMULTIPLE CHOICE QUESTIONS IN TAX REVIEW Jan 5Quasi-Delict89% (18)

- Intro To Income TaxDocumento4 pagineIntro To Income TaxJennifer Arcadio100% (1)

- Income Tax TestbankanssssDocumento17 pagineIncome Tax TestbankanssssAirille Carlos67% (3)

- Taxation of Individuals QuizzerDocumento37 pagineTaxation of Individuals QuizzerCharry Ramos62% (13)

- II Income TaxationDocumento8 pagineII Income TaxationNatasha MilitarNessuna valutazione finora

- Taxation Questions With AnswersDocumento7 pagineTaxation Questions With AnswersYeovil Pansacala100% (2)

- Installment Basis: Page 1 of 7Documento7 pagineInstallment Basis: Page 1 of 7Kenneth Bryan Tegerero Tegio100% (1)

- Transfer and Business Taxation - MIDTERMDocumento14 pagineTransfer and Business Taxation - MIDTERMYvette Pauline JovenNessuna valutazione finora

- Train Law THEORIESDocumento2 pagineTrain Law THEORIESKathleen Maeve Gardoque0% (1)

- Cabria Cpa Review Center: Tel. Nos. (043) 980-6659Documento10 pagineCabria Cpa Review Center: Tel. Nos. (043) 980-6659MaeNessuna valutazione finora

- Income Taxation QuizzerDocumento41 pagineIncome Taxation QuizzerMarriz Tan100% (4)

- HQ02 - Taxes, Tax Laws and Tax AdministrationDocumento10 pagineHQ02 - Taxes, Tax Laws and Tax AdministrationJimmyChaoNessuna valutazione finora

- Fringe Benefits Tax: Income Taxation 7Th Edition (By: Valencia & Roxas) Suggested AnswersDocumento8 pagineFringe Benefits Tax: Income Taxation 7Th Edition (By: Valencia & Roxas) Suggested AnswersJuan Frivaldo100% (2)

- DYBSATax213 - Income Taxation (MODULE 1-14)Documento51 pagineDYBSATax213 - Income Taxation (MODULE 1-14)MARK ANGELO PANGILINANNessuna valutazione finora

- Taxation MCQDocumento6 pagineTaxation MCQJade Palma Salingay100% (8)

- Prelim Tax 101Documento16 paginePrelim Tax 101Donna Zandueta-TumalaNessuna valutazione finora

- TAX Assessment October 2020Documento8 pagineTAX Assessment October 2020FuturamaramaNessuna valutazione finora

- Gross Incom TaxationDocumento32 pagineGross Incom TaxationSummer ClaronNessuna valutazione finora

- Taxation Review LectureDocumento600 pagineTaxation Review LectureRaz Jisryl79% (53)

- Ac 3103 Business Tax Mock ExamDocumento14 pagineAc 3103 Business Tax Mock ExamChristine NionesNessuna valutazione finora

- Advance AccountingDocumento12 pagineAdvance AccountingunknownNessuna valutazione finora

- Problems - Income TaxationDocumento4 pagineProblems - Income Taxationpedrosagucio44% (9)

- Income Taxation Sample QuestionsDocumento3 pagineIncome Taxation Sample QuestionsIrdo Kwan33% (3)

- TaxationDocumento10 pagineTaxationMaud Julie May FagyanNessuna valutazione finora

- Tax 2Documento6 pagineTax 2Zerjo CantalejoNessuna valutazione finora

- Quiz Bee Excise TaxDocumento43 pagineQuiz Bee Excise TaxReginald ValenciaNessuna valutazione finora

- Tax CPAR Final Pre Board2Documento5 pagineTax CPAR Final Pre Board2No Longer Existing67% (3)

- Bustax Answer KeyDocumento18 pagineBustax Answer KeyMarchelle CaelNessuna valutazione finora

- Quiz On Fringe Benefit Tax and Dealings in Properties (ACOBA 2TAY2021 BBINCTAX)Documento7 pagineQuiz On Fringe Benefit Tax and Dealings in Properties (ACOBA 2TAY2021 BBINCTAX)Nicole Daphne FigueroaNessuna valutazione finora

- Income Tax Part IIDocumento85 pagineIncome Tax Part IIJon DonNessuna valutazione finora

- Tax Chapter 8 Deduct From Gross IncomeDocumento14 pagineTax Chapter 8 Deduct From Gross Incomemacklyn220% (1)

- Reviewer in Income TaxDocumento97 pagineReviewer in Income TaxBianca Jane KinatadkanNessuna valutazione finora

- Chapter11 PDFDocumento10 pagineChapter11 PDFAmzelle Diego LaspiñasNessuna valutazione finora

- Tax1 1 Basic Principles of Taxation 01.30.11-Long - For Printing - Without AnswersDocumento10 pagineTax1 1 Basic Principles of Taxation 01.30.11-Long - For Printing - Without AnswersCracker Oats83% (6)

- Income-Tax-Assignment No. 3 SolutionDocumento18 pagineIncome-Tax-Assignment No. 3 SolutionAuralin UbaldoNessuna valutazione finora

- Taxation Review Final Simulation ExamDocumento13 pagineTaxation Review Final Simulation ExamARIS100% (1)

- Taxation Module 3 5Documento57 pagineTaxation Module 3 5Ma VyNessuna valutazione finora

- HQ03 - 6th BATCH - General Principles of Income TaxationDocumento13 pagineHQ03 - 6th BATCH - General Principles of Income TaxationJimmyChaoNessuna valutazione finora

- Review Business and Transfer TaxDocumento201 pagineReview Business and Transfer TaxReginald ValenciaNessuna valutazione finora

- Income TaxationDocumento31 pagineIncome Taxationbenjamintee86% (7)

- Special Topics in Income TaxationDocumento78 pagineSpecial Topics in Income TaxationPantas DiwaNessuna valutazione finora

- Chapter 8 - Deductions From Gross IncomeDocumento36 pagineChapter 8 - Deductions From Gross IncomejohnNessuna valutazione finora

- Taxation MCQDocumento2 pagineTaxation MCQeinsteinspy100% (7)

- Acco 2033 Income TaxationDocumento284 pagineAcco 2033 Income TaxationRita Daniela100% (1)

- Gross IncomeDocumento6 pagineGross IncomeJane TuazonNessuna valutazione finora

- Chapter 4 - Deductions From Gross EstateDocumento6 pagineChapter 4 - Deductions From Gross EstatekaedelarosaNessuna valutazione finora

- Income Taxation DownloadDocumento7 pagineIncome Taxation DownloadKaren May JimenezNessuna valutazione finora

- Allowed Deductions From Gross IncomeDocumento8 pagineAllowed Deductions From Gross Incomealliahbilities currentNessuna valutazione finora

- Income Taxation (Prelims)Documento7 pagineIncome Taxation (Prelims)Lovely Anne Dela CruzNessuna valutazione finora

- Chapter 8 VDocumento28 pagineChapter 8 VAdd AllNessuna valutazione finora

- Spilker Taxation of Business Entities 2013 4e SpilkerDocumento99 pagineSpilker Taxation of Business Entities 2013 4e SpilkerVanessa ThomasNessuna valutazione finora

- CH 09Documento23 pagineCH 09cushin2009100% (1)

- Essentials of Federal Taxation 2018 Edition 9th Edition Spilker Test BankDocumento28 pagineEssentials of Federal Taxation 2018 Edition 9th Edition Spilker Test Bankchompdumetoseei5100% (27)

- Problem Set 1 2Documento7 pagineProblem Set 1 2Ngọc NguyễnNessuna valutazione finora

- Sababan Magic NotesDocumento45 pagineSababan Magic NotesDonna HillNessuna valutazione finora

- Chapter 12 - De-WPS OfficeDocumento6 pagineChapter 12 - De-WPS OfficeKia Mae PALOMARNessuna valutazione finora

- All Tax Law Exit Exam GMANDocumento11 pagineAll Tax Law Exit Exam GMANgetacher2116Nessuna valutazione finora

- Malhabour Vs AttyDocumento2 pagineMalhabour Vs AttyLove Lee Hallarsis FabiconNessuna valutazione finora

- FundraisingDocumento1 paginaFundraisingLove Lee Hallarsis FabiconNessuna valutazione finora

- DisiniDocumento9 pagineDisiniLove Lee Hallarsis FabiconNessuna valutazione finora

- Philippine Rabbit Bus LinesDocumento1 paginaPhilippine Rabbit Bus LinesLove Lee Hallarsis FabiconNessuna valutazione finora

- Affidavit of Loss: AMA Group of Companies Affidavit of Loss of Id Card Rev: 30 March 2002Documento2 pagineAffidavit of Loss: AMA Group of Companies Affidavit of Loss of Id Card Rev: 30 March 2002John Paul M. TubigNessuna valutazione finora

- FAQ For ApplicantsDocumento12 pagineFAQ For ApplicantsLove Lee Hallarsis FabiconNessuna valutazione finora

- School Fees: Miscellaneous Fee P1,500 Bar-Ops Fee 500 500Documento2 pagineSchool Fees: Miscellaneous Fee P1,500 Bar-Ops Fee 500 500Love Lee Hallarsis FabiconNessuna valutazione finora

- 15 Eugenia Mendoza VsDocumento3 pagine15 Eugenia Mendoza VsLove Lee Hallarsis FabiconNessuna valutazione finora

- Samala Vs ValenciaDocumento1 paginaSamala Vs ValenciaLove Lee Hallarsis FabiconNessuna valutazione finora

- Adobe Photoshop CC Legal NoticesDocumento25 pagineAdobe Photoshop CC Legal NoticesRichard BirchNessuna valutazione finora

- Photoshop CS5 Read MeDocumento11 paginePhotoshop CS5 Read Meali_mohammed_18Nessuna valutazione finora

- (Art. 287) 3. Pinero v. NLRCDocumento2 pagine(Art. 287) 3. Pinero v. NLRCRoy DaguioNessuna valutazione finora

- Nadayag Vs AttyDocumento2 pagineNadayag Vs AttyLove Lee Hallarsis FabiconNessuna valutazione finora

- Schedule of Enrollment: For School of LawDocumento2 pagineSchedule of Enrollment: For School of LawLove Lee Hallarsis FabiconNessuna valutazione finora

- Consti 2 ADocumento16 pagineConsti 2 ALove Lee Hallarsis FabiconNessuna valutazione finora

- Conflict of LawsDocumento19 pagineConflict of LawsMiGay Tan-Pelaez94% (18)

- Ecumenical Prayer For The CourtsDocumento1 paginaEcumenical Prayer For The CourtsChristel Allena-Geronimo100% (3)

- Pleadings & Motions Flow ChartDocumento9 paginePleadings & Motions Flow ChartAndiAlper100% (19)

- Cir Vs BurroughsDocumento2 pagineCir Vs BurroughsLove Lee Hallarsis FabiconNessuna valutazione finora

- Campos Rueda Vs PacificDocumento1 paginaCampos Rueda Vs PacificLove Lee Hallarsis FabiconNessuna valutazione finora

- Taxation LawDocumento130 pagineTaxation LawJon BandomaNessuna valutazione finora

- Your Wedding emDocumento14 pagineYour Wedding emLove Lee Hallarsis FabiconNessuna valutazione finora

- 6 Mediation Road MapDocumento15 pagine6 Mediation Road MapLove Lee Hallarsis FabiconNessuna valutazione finora

- Ra 9225 (Citizenship Retention and Re Acquisition Act)Documento3 pagineRa 9225 (Citizenship Retention and Re Acquisition Act)rlg2vmmcNessuna valutazione finora

- Pale CasesDocumento1 paginaPale CasesLove Lee Hallarsis FabiconNessuna valutazione finora

- LaborDocumento11 pagineLaborCesNessuna valutazione finora

- GSISDocumento2 pagineGSISLove Lee Hallarsis FabiconNessuna valutazione finora

- LaborDocumento13 pagineLaborLove Lee Hallarsis FabiconNessuna valutazione finora

- LaborDocumento13 pagineLaborLove Lee Hallarsis FabiconNessuna valutazione finora

- Capitol Medical CenterDocumento3 pagineCapitol Medical CenterLove Lee Hallarsis FabiconNessuna valutazione finora

- Nasoya FoodsDocumento2 pagineNasoya Foodsanamta100% (1)

- Options Trading For Beginners Aug15 v1Documento187 pagineOptions Trading For Beginners Aug15 v1Glo BerriNessuna valutazione finora

- Design of Open Channels US Department of Agriculture SCSDocumento293 pagineDesign of Open Channels US Department of Agriculture SCSMiguelGuavitaRojasNessuna valutazione finora

- T R I P T I C K E T: CTRL No: Date: Vehicle/s EquipmentDocumento1 paginaT R I P T I C K E T: CTRL No: Date: Vehicle/s EquipmentJapCon HRNessuna valutazione finora

- Omae2008 57495Documento6 pagineOmae2008 57495Vinicius Cantarino CurcinoNessuna valutazione finora

- Bode PlotsDocumento6 pagineBode PlotshasanozdNessuna valutazione finora

- I.V. FluidDocumento4 pagineI.V. FluidOdunlamiNessuna valutazione finora

- Tle 9 Module 1 Final (Genyo)Documento7 pagineTle 9 Module 1 Final (Genyo)MrRightNessuna valutazione finora

- Mutual Fund Insight Nov 2022Documento214 pagineMutual Fund Insight Nov 2022Sonic LabelsNessuna valutazione finora

- Oops in PythonDocumento64 pagineOops in PythonSyed SalmanNessuna valutazione finora

- Manulife Health Flex Cancer Plus Benefit IllustrationDocumento2 pagineManulife Health Flex Cancer Plus Benefit Illustrationroschi dayritNessuna valutazione finora

- Reading TPO 49 Used June 17 To 20 10am To 12pm Small Group Tutoring1Documento27 pagineReading TPO 49 Used June 17 To 20 10am To 12pm Small Group Tutoring1shehla khanNessuna valutazione finora

- Auto Report LogDocumento3 pagineAuto Report LogDaniel LermaNessuna valutazione finora

- Ril Competitive AdvantageDocumento7 pagineRil Competitive AdvantageMohitNessuna valutazione finora

- The Fundamentals of Investing PPT 2.4.4.G1Documento36 pagineThe Fundamentals of Investing PPT 2.4.4.G1Lùh HùñçhòNessuna valutazione finora

- TENDER DOSSIER - Odweyne Water PanDocumento15 pagineTENDER DOSSIER - Odweyne Water PanMukhtar Case2022Nessuna valutazione finora

- Business-Model Casual Cleaning ServiceDocumento1 paginaBusiness-Model Casual Cleaning ServiceRudiny FarabyNessuna valutazione finora

- Unit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARDocumento9 pagineUnit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARAshraf EL WardajiNessuna valutazione finora

- Ting Vs Heirs of Lirio - Case DigestDocumento2 pagineTing Vs Heirs of Lirio - Case DigestJalieca Lumbria GadongNessuna valutazione finora

- Labor Law 1Documento24 pagineLabor Law 1Naomi Cartagena100% (1)

- Troubleshooting For Rb750Glr4: Poe Does Not WorkDocumento7 pagineTroubleshooting For Rb750Glr4: Poe Does Not Workjocimar1000Nessuna valutazione finora

- Land Use Paln in La Trinidad BenguetDocumento19 pagineLand Use Paln in La Trinidad BenguetErin FontanillaNessuna valutazione finora

- TATA Power - DDL:ConfidentialDocumento15 pagineTATA Power - DDL:ConfidentialkarunakaranNessuna valutazione finora

- NCR Minimum WageDocumento2 pagineNCR Minimum WageJohnBataraNessuna valutazione finora

- Usha Unit 1 GuideDocumento2 pagineUsha Unit 1 Guideapi-348847924Nessuna valutazione finora

- To Syed Ubed - For UpdationDocumento1 paginaTo Syed Ubed - For Updationshrikanth5singhNessuna valutazione finora

- CC Anbcc FD 002 Enr0Documento5 pagineCC Anbcc FD 002 Enr0ssierroNessuna valutazione finora

- Modal Case Data Form: GeneralDocumento4 pagineModal Case Data Form: GeneralsovannchhoemNessuna valutazione finora

- Freqinv 3g3fv Ds 01oct2000Documento20 pagineFreqinv 3g3fv Ds 01oct2000Mohd Abu AjajNessuna valutazione finora

- Massive X-16x9 Version 5.0 - 5.3 (Latest New Updates in Here!!!)Documento158 pagineMassive X-16x9 Version 5.0 - 5.3 (Latest New Updates in Here!!!)JF DVNessuna valutazione finora