Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Company Profile of Edelweiss

Caricato da

kulvir singCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Company Profile of Edelweiss

Caricato da

kulvir singCopyright:

Formati disponibili

Edelweiss Tokio Life Insurance is the first of a new generation of Insurance companies, creating

its Insurance solutions around a deep understanding of the diverse financial needs of the Indian

consumer.

As a part of its customer centric corporate philosophy, Edelweiss Tokio Life Insurance has

invested in understanding its potential customers; and based on this, developed a unique need-

based selling approach designed to benefit consumers through all their life stages. The company

ensures that whatever the life insurance solution provided to the customer, it is best suited to his

need.

The company is a joint venture between Edelweiss, one of India's leading diversified financial

services companies, and Tokio Marine, one of the fastest growing Life Insurance companies in

Japan. Set up with a start-up capital of INR 550 Crore, Edelweiss Tokio Life Insurance is

dedicated to building a long term sustainable business focused on a consumer centric approach.

Since its inception in 1996, Edelweiss has seamlessly

grown into a large diversified financial services

organization offering businesses ranging from Credit,

Capital Market, Asset management, Housing Finance and

Insurance. Currently, the groups networth is in excess

of INR 2,800 Crores. Over the last decade, Edelweiss

revenue has grown at a CAGR of 63% and net profit has

grown at a CAGR of 76% (till the end of FY 11).

Present across 308 offices in 140 cities, the group, with over 2800 employees, and services

a client base of more than 3,50,000 (Sept 11).

The Groups core brand philosophy, Ideas Create, Values Protect is

translated into an approach that is led by entrepreneurship and creativity,

protected by intellectual rigour, research and analysis. Edelweiss has been

recognized as a Business Super brand in the year 2011 by Super Brands

India, testimony to the reputation enjoyed by the brand.

For more information, visit www.edelweissfin.com

Tokio Marine Holdings Inc, the holding company for Tokio Marine

group is one of the oldest and biggest Insurance companies in Japan;

with interests in Life, Non-Life, and Re-Insurance, it has a presence in

427 cities across 39 countries around the world.

The company has over 130 years of operational history in the Non-Life

sector while it has been in Life Insurance since 1996. It has a presence

in Japan, China, Singapore, Malaysia and Thailand.

The Group has booked revenues of INR 1,77,650 Crore and Net Income of INR 3,884

Crore.

In Life Insurance its Gross Written Premium (GWP) is over INR 31,834 Crore.

A highly respected company around the world, Tokio Marine adheres to Japanese high

standards of quality and a robust corporate governance and risk management framework.

Tokio Marine has a successful track record of building business in developing and

developed markets due to its superior capability of developing products based on research

and consumer understanding.

For more information, visit www.tokiomarinehd.com/en/

Edelweiss Tokio Life Insurance is the first of a new generation of Insurance companies, creating

its Insurance solutions around a deep understanding of the diverse financial needs of the Indian

consumer.

As a part of its customer centric corporate philosophy, Edelweiss Tokio Life Insurance has

invested in understanding its potential customers; and based on this, developed a unique need-

based selling approach designed to benefit consumers through all their life stages. The company

ensures that whatever the life insurance solution provided to the customer, it is best suited to his

need.

The company is a joint venture between Edelweiss, one of India's leading diversified financial

services companies, and Tokio Marine, one of the fastest growing Life Insurance companies in

Japan. Set up with a start-up capital of INR 550 Crore, Edelweiss Tokio Life Insurance is

dedicated to building a long term sustainable business focused on a consumer centric approach.

Since its inception in 1996, Edelweiss has seamlessly

grown into a large diversified financial services

organization offering businesses ranging from Credit,

Capital Market, Asset management, Housing Finance and

Insurance. Currently, the groups networth is in excess

of INR 2,800 Crores. Over the last decade, Edelweiss

revenue has grown at a CAGR of 63% and net profit has

grown at a CAGR of 76% (till the end of FY 11).

Present across 308 offices in 140 cities, the group, with over 2800 employees, and services

a client base of more than 3,50,000 (Sept 11).

The Groups core brand philosophy, Ideas Create, Values Protect is

translated into an approach that is led by entrepreneurship and creativity,

protected by intellectual rigour, research and analysis. Edelweiss has been

recognized as a Business Super brand in the year 2011 by Super Brands

India, testimony to the reputation enjoyed by the brand.

For more information, visit www.edelweissfin.com

Tokio Marine Holdings Inc, the holding company for Tokio Marine

group is one of the oldest and biggest Insurance companies in Japan;

with interests in Life, Non-Life, and Re-Insurance, it has a presence in

427 cities across 39 countries around the world.

The company has over 130 years of operational history in the Non-Life

sector while it has been in Life Insurance since 1996. It has a presence

in Japan, China, Singapore, Malaysia and Thailand.

The Group has booked revenues of INR 1,77,650 Crore and Net Income of INR 3,884

Crore.

In Life Insurance its Gross Written Premium (GWP) is over INR 31,834 Crore.

A highly respected company around the world, Tokio Marine adheres to Japanese high

standards of quality and a robust corporate governance and risk management framework.

Tokio Marine has a successful track record of building business in developing and

developed markets due to its superior capability of developing products based on research

and consumer understanding.

For more information, visit www.tokiomarinehd.com/en/

Potrebbero piacerti anche

- Takaful and Islamic Cooperative Finance for Beginners!Da EverandTakaful and Islamic Cooperative Finance for Beginners!Nessuna valutazione finora

- Tokio Life InsuranceDocumento4 pagineTokio Life InsuranceShobiga VNessuna valutazione finora

- Project On IngDocumento32 pagineProject On IngAnnapurna VinjamuriNessuna valutazione finora

- REITS: How to Build Passive Income from Real Estate Investment TrustDa EverandREITS: How to Build Passive Income from Real Estate Investment TrustValutazione: 3.5 su 5 stelle3.5/5 (2)

- Minor Project FutureDocumento12 pagineMinor Project Futuresourabijoy royNessuna valutazione finora

- Executive Summary: Oriental General Product PortfolioDocumento30 pagineExecutive Summary: Oriental General Product PortfolioRohit J SaraiyaNessuna valutazione finora

- A Project Report On - ULIP (Unit Linked Insurance Plan)Documento45 pagineA Project Report On - ULIP (Unit Linked Insurance Plan)hiralmojidra86% (7)

- Chapter-1: 1.1 Introduction To The CompanyDocumento48 pagineChapter-1: 1.1 Introduction To The Companysanjay198812Nessuna valutazione finora

- Insurance SectorDocumento39 pagineInsurance SectorrrahulrajNessuna valutazione finora

- Company Profile: The Oriental Insurance Company LTDDocumento4 pagineCompany Profile: The Oriental Insurance Company LTDjoshikuminsaNessuna valutazione finora

- FP 601 Financial InstitutionsDocumento10 pagineFP 601 Financial InstitutionsViginesNessuna valutazione finora

- IDBIDocumento10 pagineIDBIArun ElanghoNessuna valutazione finora

- Reliance Nippon Life ProjectDocumento66 pagineReliance Nippon Life ProjectChirag KshirsagarNessuna valutazione finora

- A Project Report On ULIP Unit Linked Insurance Plan PDFDocumento45 pagineA Project Report On ULIP Unit Linked Insurance Plan PDFRima. SapkalNessuna valutazione finora

- AEGON Religare Life Insurance CompanyDocumento4 pagineAEGON Religare Life Insurance CompanycooldudeforyewNessuna valutazione finora

- The Origin of ING Group: ProfileDocumento36 pagineThe Origin of ING Group: ProfilefunnycreationsNessuna valutazione finora

- Topic: Investment Analysis: About Aditya Birla Money LimitedDocumento3 pagineTopic: Investment Analysis: About Aditya Birla Money LimitedRaja ShekerNessuna valutazione finora

- Company Profile - Vision, Mission, ValuesDocumento10 pagineCompany Profile - Vision, Mission, ValuesKamilia Rahma RamadhanNessuna valutazione finora

- Profile of The Company 1.1 Introduction To Insurance SectorDocumento19 pagineProfile of The Company 1.1 Introduction To Insurance SectorRoopesh AggarwalNessuna valutazione finora

- Third Party Products BOCADocumento6 pagineThird Party Products BOCANeelabhNessuna valutazione finora

- About Kotak Life InsuranceDocumento6 pagineAbout Kotak Life InsuranceSundeepKumarReddyNessuna valutazione finora

- Mul Ti-Dist Rib Uti On Mo Del: MissionDocumento26 pagineMul Ti-Dist Rib Uti On Mo Del: MissiondeadlydeepanshNessuna valutazione finora

- Insurance Company and History Bajaj Allianz General InsuranceDocumento8 pagineInsurance Company and History Bajaj Allianz General InsurancebibinNessuna valutazione finora

- A Project ReportDocumento11 pagineA Project ReportJeetin KumarNessuna valutazione finora

- A Project ReportDocumento11 pagineA Project ReportJeetin KumarNessuna valutazione finora

- Klaus SMDocumento24 pagineKlaus SMMugilanNessuna valutazione finora

- IciciDocumento18 pagineIcicinikit thakkarNessuna valutazione finora

- ProjectDocumento30 pagineProjectshubhamtayal14Nessuna valutazione finora

- SBI Life InsuranceDocumento17 pagineSBI Life InsuranceAshish PatelNessuna valutazione finora

- Portfolio Management in Idbi Federal Training ReportDocumento49 paginePortfolio Management in Idbi Federal Training ReportAshu Agarwal67% (6)

- Customer Relationship Management in Ing Vysya Life InsuranceDocumento73 pagineCustomer Relationship Management in Ing Vysya Life InsuranceMohit kolliNessuna valutazione finora

- ICICI Prudential Life Insurance CompanyDocumento3 pagineICICI Prudential Life Insurance CompanyAnkur BhardwajNessuna valutazione finora

- Ratio AnalysisDocumento59 pagineRatio AnalysisSridhar RaoNessuna valutazione finora

- Max New York Life Insurance-Saurabh AroraDocumento32 pagineMax New York Life Insurance-Saurabh Arorasaurabh_rou59690% (1)

- Insurance Co. in PakDocumento14 pagineInsurance Co. in Pakhani856Nessuna valutazione finora

- 3C Report ON IDBI FEDDERALDocumento10 pagine3C Report ON IDBI FEDDERALAbhilash SahuNessuna valutazione finora

- Branding Royal Sundaram NationalyDocumento27 pagineBranding Royal Sundaram NationalyAshok LogandaNessuna valutazione finora

- Beant Kaur ID-102261028Documento4 pagineBeant Kaur ID-102261028Courtney BonnerNessuna valutazione finora

- On Private Insurance CompaniesDocumento22 pagineOn Private Insurance CompaniesjeeryNessuna valutazione finora

- To Determine Customer - Thrift Behaviour With ADocumento61 pagineTo Determine Customer - Thrift Behaviour With AlingzenpauliNessuna valutazione finora

- Company ProfileDocumento13 pagineCompany Profiledeepu mathew0% (1)

- Hedge Equities LTDDocumento13 pagineHedge Equities LTDPratheesh BabuNessuna valutazione finora

- Idbi JDDocumento2 pagineIdbi JDLeo PrakashNessuna valutazione finora

- Chapter 3Documento23 pagineChapter 3Soman DiggewadiNessuna valutazione finora

- ProjectDocumento2 pagineProjectAjit SinghNessuna valutazione finora

- History : SBI General Insurance Company Limited Is A Joint Venture Between The State Bank of IndiaDocumento4 pagineHistory : SBI General Insurance Company Limited Is A Joint Venture Between The State Bank of IndiahironenwaniNessuna valutazione finora

- Company Profile: List of CompaniesDocumento18 pagineCompany Profile: List of CompaniesbharatNessuna valutazione finora

- Executive SummaryDocumento2 pagineExecutive SummaryRahul Malhotra0% (1)

- Vishwa CRMDocumento40 pagineVishwa CRMVishwanath PatilNessuna valutazione finora

- Aditya Birla GroupDocumento8 pagineAditya Birla GroupMonica PatelNessuna valutazione finora

- Life Insurance Market Appears VibrantDocumento7 pagineLife Insurance Market Appears VibrantdollyNessuna valutazione finora

- Money Banking and Financial InstitutionDocumento4 pagineMoney Banking and Financial Institutionhussain_naqvi878549Nessuna valutazione finora

- Analysis of Profitibility and Financial Position of Aviva Life InsuranceDocumento62 pagineAnalysis of Profitibility and Financial Position of Aviva Life InsurancerajkishannaiduNessuna valutazione finora

- Analysis of Profitibility and Financial Position of Aviva Life InsuranceDocumento62 pagineAnalysis of Profitibility and Financial Position of Aviva Life InsuranceAnonymous NSNpGa3T93Nessuna valutazione finora

- Bharti AxaDocumento18 pagineBharti AxaDIVYA DUBEYNessuna valutazione finora

- History: Religare Enterprises Limited (REL) Is A Diversified Financial Services Group Headquartered in NewDocumento4 pagineHistory: Religare Enterprises Limited (REL) Is A Diversified Financial Services Group Headquartered in NewJayati BhasinNessuna valutazione finora

- HDFC Standard Life Insurance: Final ReportDocumento29 pagineHDFC Standard Life Insurance: Final ReportKunal JalanNessuna valutazione finora

- Company'S ProfileDocumento5 pagineCompany'S ProfileAmar RajputNessuna valutazione finora

- Insurance SectorDocumento40 pagineInsurance SectorRaunak ChaurasiaNessuna valutazione finora

- Journalism of Courage: SINCE 1932Documento16 pagineJournalism of Courage: SINCE 1932kulvir singNessuna valutazione finora

- BT 1000 ManualDocumento52 pagineBT 1000 Manualkulvir singNessuna valutazione finora

- Journalism of Courage: SINCE 1932Documento13 pagineJournalism of Courage: SINCE 1932kulvir singNessuna valutazione finora

- Development Resource GuideDocumento53 pagineDevelopment Resource Guidekulvir singNessuna valutazione finora

- Taapplication FormDocumento29 pagineTaapplication Formchandramouli.peruri6141Nessuna valutazione finora

- 63 PDFDocumento24 pagine63 PDFkulvir singNessuna valutazione finora

- FRM Part1 Practice ExamDocumento130 pagineFRM Part1 Practice ExamSafiek Meeran83% (6)

- TA Comm Advt 050517 - For OnlineDocumento3 pagineTA Comm Advt 050517 - For OnlineSunny SharmaNessuna valutazione finora

- 5stocks EdelwsResrch RegistrDocumento9 pagine5stocks EdelwsResrch RegistrRaghu PrasadNessuna valutazione finora

- Delhi Metro Route MapDocumento1 paginaDelhi Metro Route Mapnakulyadav7Nessuna valutazione finora

- Top Picks Sep 2012Documento15 pagineTop Picks Sep 2012kulvir singNessuna valutazione finora

- BA-Job Description PDFDocumento5 pagineBA-Job Description PDFkulvir singNessuna valutazione finora

- Latest 5 BXDocumento58 pagineLatest 5 BXManeesh GoswamiNessuna valutazione finora

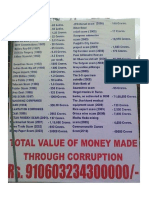

- Scams and Jan LoakayuktaDocumento1 paginaScams and Jan Loakayuktakulvir singNessuna valutazione finora

- FRM Study Guide 2012 PDFDocumento15 pagineFRM Study Guide 2012 PDFDennis LoNessuna valutazione finora

- Rohini Bakshi - Sanskrit Appreciation Hour - NDTV Blog - Don't Tell Me How To Be A Good Hindu. My Way Is FineDocumento7 pagineRohini Bakshi - Sanskrit Appreciation Hour - NDTV Blog - Don't Tell Me How To Be A Good Hindu. My Way Is Finekulvir singNessuna valutazione finora

- Company Profile of EdelweissDocumento3 pagineCompany Profile of Edelweisskulvir singNessuna valutazione finora

- 5bx PlanDocumento18 pagine5bx Planjrpique100% (3)

- Company Profile - Ver 2Documento2 pagineCompany Profile - Ver 2kulvir singNessuna valutazione finora

- CompTIA Europe Software Industry White PaperDocumento43 pagineCompTIA Europe Software Industry White Paperkulvir singNessuna valutazione finora

- President AddressDocumento14 paginePresident AddressNarayan SubramanianNessuna valutazione finora

- Aamar Food Receipt 14-Dec-2016 - AtlantaDocumento1 paginaAamar Food Receipt 14-Dec-2016 - Atlantakulvir singNessuna valutazione finora

- Shuklam Baradharam VishnumDocumento2 pagineShuklam Baradharam Vishnumkulvir singNessuna valutazione finora

- 5900221Documento39 pagine5900221kulvir singNessuna valutazione finora

- JD AD Lead AdvisoryDocumento2 pagineJD AD Lead Advisorykulvir singNessuna valutazione finora

- Narendra Modi Call FacilityDocumento1 paginaNarendra Modi Call Facilitykulvir singNessuna valutazione finora

- Offensive Defense LinksDocumento1 paginaOffensive Defense Linkskulvir singNessuna valutazione finora

- Art of Living - New ProgramDocumento1 paginaArt of Living - New Programkulvir singNessuna valutazione finora

- JD Assistant Director BMDocumento2 pagineJD Assistant Director BMkulvir singNessuna valutazione finora

- JD AD RestructuringDocumento2 pagineJD AD Restructuringkulvir singNessuna valutazione finora

- Project Report LissstDocumento6 pagineProject Report LissstShivareddyNessuna valutazione finora

- Class 12 Accountancy Practice Paper 02Documento6 pagineClass 12 Accountancy Practice Paper 02Ankit Kumar100% (1)

- Collins Apple PDFDocumento1 paginaCollins Apple PDFGh UnlockersNessuna valutazione finora

- 14TH Annual Report: Year Ended - 3 (. O3.2Oo9Documento19 pagine14TH Annual Report: Year Ended - 3 (. O3.2Oo9ravalmunjNessuna valutazione finora

- Accounts PracticleDocumento75 pagineAccounts PracticleMITESHKADAKIA60% (5)

- Startups - Financial PrudenceDocumento12 pagineStartups - Financial PrudenceNeelajit ChandraNessuna valutazione finora

- Chapter 8Documento19 pagineChapter 8Benny Khor100% (2)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento9 pagineStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLoan LoanNessuna valutazione finora

- Republic Act No. 7279Documento25 pagineRepublic Act No. 7279Sharmen Dizon GalleneroNessuna valutazione finora

- Continuous Futures Data Series For Back Testing and Technical AnalysisDocumento6 pagineContinuous Futures Data Series For Back Testing and Technical AnalysisIshan SaneNessuna valutazione finora

- IFM11 Solution To Ch05 P20 Build A ModelDocumento6 pagineIFM11 Solution To Ch05 P20 Build A ModelDiana SorianoNessuna valutazione finora

- Direst Selling Agent Policy-Retail & Consumer LendingDocumento13 pagineDirest Selling Agent Policy-Retail & Consumer LendingVijay DubeyNessuna valutazione finora

- Business Analysis & ValuationDocumento50 pagineBusiness Analysis & ValuationAimee EemiaNessuna valutazione finora

- Apple Vs SamsungDocumento1 paginaApple Vs SamsungCem KaradumanNessuna valutazione finora

- 4 - Problem SolvingDocumento8 pagine4 - Problem SolvingKlenida DashoNessuna valutazione finora

- CFTC Commitments of Traders Report - CME (Futures Only) 06082013Documento10 pagineCFTC Commitments of Traders Report - CME (Futures Only) 06082013Md YusofNessuna valutazione finora

- Lesson 1 - Overview of Valuation Concepts and MethodsDocumento5 pagineLesson 1 - Overview of Valuation Concepts and MethodsF l o w e rNessuna valutazione finora

- Fac4863 104 - 2020 - 0 - BDocumento93 pagineFac4863 104 - 2020 - 0 - BNISSIBETINessuna valutazione finora

- 1 Point: Failure of Rakham To Collect The Debt Within Three Years From The Date It Becomes DueDocumento17 pagine1 Point: Failure of Rakham To Collect The Debt Within Three Years From The Date It Becomes DueClarince Joyce Lao DoroyNessuna valutazione finora

- Email Id of CEO's Life Insurance - IBAI ORGDocumento3 pagineEmail Id of CEO's Life Insurance - IBAI ORGdheerajdb99Nessuna valutazione finora

- Certificado Inshur SH - 2Documento1 paginaCertificado Inshur SH - 2ukmagicoNessuna valutazione finora

- Joy 1Documento27 pagineJoy 1rp63337651Nessuna valutazione finora

- How To Start A Picture Framing BusinessDocumento3 pagineHow To Start A Picture Framing BusinessNi NeNessuna valutazione finora

- 26nov2022 - 30jan2023Documento12 pagine26nov2022 - 30jan2023Srishti SharmaNessuna valutazione finora

- MyTW Bill 475525918821 12 12 2022Documento1 paginaMyTW Bill 475525918821 12 12 2022lapenbNessuna valutazione finora

- Schedule of New Fees - RetooledDocumento2 pagineSchedule of New Fees - RetooledRaymund Fernandez CamachoNessuna valutazione finora

- Support Resistance For Day TradingDocumento1.103 pagineSupport Resistance For Day Tradingnbhnbhnnb nhbbnh50% (2)

- Mananquil, Julieta P. - Jeths JefrenDocumento12 pagineMananquil, Julieta P. - Jeths JefrenMarissa Bucad GomezNessuna valutazione finora

- Trent's Mortgage & Finance BrokingDocumento10 pagineTrent's Mortgage & Finance BrokingTrent FetahNessuna valutazione finora

- Accounting Words IDocumento1 paginaAccounting Words IArnold SilvaNessuna valutazione finora

- Scary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldDa EverandScary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldValutazione: 4.5 su 5 stelle4.5/5 (55)

- System Error: Where Big Tech Went Wrong and How We Can RebootDa EverandSystem Error: Where Big Tech Went Wrong and How We Can RebootNessuna valutazione finora

- Generative AI: The Insights You Need from Harvard Business ReviewDa EverandGenerative AI: The Insights You Need from Harvard Business ReviewValutazione: 4.5 su 5 stelle4.5/5 (2)

- AI Superpowers: China, Silicon Valley, and the New World OrderDa EverandAI Superpowers: China, Silicon Valley, and the New World OrderValutazione: 4.5 su 5 stelle4.5/5 (398)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyDa EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyValutazione: 4 su 5 stelle4/5 (51)

- 100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziDa Everand100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziNessuna valutazione finora

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyDa EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNessuna valutazione finora

- The Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldDa EverandThe Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldValutazione: 4.5 su 5 stelle4.5/5 (107)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumDa EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumValutazione: 3 su 5 stelle3/5 (12)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- The AI Advantage: How to Put the Artificial Intelligence Revolution to WorkDa EverandThe AI Advantage: How to Put the Artificial Intelligence Revolution to WorkValutazione: 4 su 5 stelle4/5 (7)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewDa EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewValutazione: 4.5 su 5 stelle4.5/5 (104)

- YouTube Secrets: The Ultimate Guide on How to Start and Grow Your Own YouTube Channel, Learn the Tricks To Make a Successful and Profitable YouTube ChannelDa EverandYouTube Secrets: The Ultimate Guide on How to Start and Grow Your Own YouTube Channel, Learn the Tricks To Make a Successful and Profitable YouTube ChannelValutazione: 4.5 su 5 stelle4.5/5 (48)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andDa EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andValutazione: 4.5 su 5 stelle4.5/5 (709)

- An Ugly Truth: Inside Facebook's Battle for DominationDa EverandAn Ugly Truth: Inside Facebook's Battle for DominationValutazione: 4 su 5 stelle4/5 (33)

- Four Battlegrounds: Power in the Age of Artificial IntelligenceDa EverandFour Battlegrounds: Power in the Age of Artificial IntelligenceValutazione: 5 su 5 stelle5/5 (5)

- The Bitcoin Standard: The Decentralized Alternative to Central BankingDa EverandThe Bitcoin Standard: The Decentralized Alternative to Central BankingValutazione: 4.5 su 5 stelle4.5/5 (41)

- Who's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesDa EverandWho's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesValutazione: 4.5 su 5 stelle4.5/5 (13)

- Artificial Intelligence & Generative AI for Beginners: The Complete GuideDa EverandArtificial Intelligence & Generative AI for Beginners: The Complete GuideValutazione: 5 su 5 stelle5/5 (1)

- How to Do Nothing: Resisting the Attention EconomyDa EverandHow to Do Nothing: Resisting the Attention EconomyValutazione: 4 su 5 stelle4/5 (421)

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseDa EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseValutazione: 3.5 su 5 stelle3.5/5 (12)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)