Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Basic Rules Consolidated Balamce Sheet

Caricato da

brmrodrigues0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

63 visualizzazioni5 pagineHow to consolidate balance sheets

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoHow to consolidate balance sheets

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

63 visualizzazioni5 pagineBasic Rules Consolidated Balamce Sheet

Caricato da

brmrodriguesHow to consolidate balance sheets

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 5

Basic Rules for Preparing a Consolidated balance Sheet.

Rule 1: Cancellation Investment and Share Capital

The Investment in Subsidiary Company by the holding company, appearing on the asset side of the B/S of

the holding company, should cancel out the corresponding Share Capital of the subsidiary Company.

Rule 2: Minority Interest Calculation.

When the holding company acquires more than half but less than all shares of the subsidiary company,

those shareholders who have a minority share are referred to as Minority Shareholders.

Minority interest is the proportion of the subsidiary companys net assets/shareholders fund, which

belongs to the minority shareholders. It should be shown separately in Consolidated B/S.

Minority Interest =Face value of share capital +Share of pre acquisition reserves +Share of pre

acquisition P/L +Share of post acquisition reserves +Share of post acquisition P/L

Rule 3: Goodwill on Consolidation.

Cost of Investment in the books of Holding Company - receipt of dividend from subsidiary company from

pre acquisition profit Share of pre-acquisition Profit of subsidiary company - Share of pre-acquisition

Reserve of subsidiary company Face value of shares of subsidiary company held by holding company

>0, the amount is goodwill which will appear in Consolidated B/S.

Rule 4: Capital Reserve on Consolidation.

Cost of Investment in the books of Holding Company- receipt of dividend from subsidiary company from

pre acquisition profit Share of pre-acquisition Profit of subsidiary company - Share of pre-acquisition

Reserve of subsidiary company Face value of shares of subsidiary company held by holding company <

0, the amount is Capital Reserve which will appear in Consolidated B/S.

Rule 5: Cancellation of Inter Company Debts and Acceptances

If holding and subsidiary companies have business dealings with each other then there may be possibility

of mutually exclusive items called Inter-company items. Say for example H company sales Rs.10000 to its

subsidiary S on credit. Then in H companys book there will be a Debtor amounting Rs.10000 and

simultaneously in Ss book there will be a creditor amounting Rs.10000.

These inter-company items, during consolidation shall be cancelled out in consolidated B/S.

e.g. Debtors canceling creditors and vice versa; O/S Bills Receivable canceling O/S Bills Payable, inter

company Loans and Advances etc.

But if some of the Bills receivables are discounted then corresponding amount of BR will be no longer

O/S even though Bills payable remain. Such types of Bills payable are not inter company cancelable

items.

Another problem under this item may be the mismatch of current accounts maintained by H and S meant

for recording transactions between each other. Suppose H paid Rs.500 to S and recorded in its books as

Current Account with S.Dr Rs.500

To Cash Rs.500

But say S did not receive this Rs.500 till the date of consolidation.

At the time of consolidation Current Account with S will appear in B/S of H and no entry under Ss

books. So consolidated B/S should show an item named Cash in Transit amounting Rs.500.

If say out of Rs.500 S received Rs.200. So S recorded the transaction as

Cash..Dr Rs.200

To Current Account with H Rs.200

At consolidation both the current accounts are required to be cancelled and the difference amount Rs.300

will appear under asset side of the consolidated balance sheet as Cash in transit amounting Rs.300.

Rule 6: Reserves and Surplus under Consolidated B/S.

Reserves and Surplus under Consolidated B/S should contain =Balance of Reserves and surplus of

Holding company + Share of post acquisition reserves of Subsidiary to majority + Share of post

acquisition profit of subsidiary to majority unrealized profit on unsold stock.

Rule 7: Unrealized profit on unsold stock.

H Company sold Stock-costing Rs.10000 to S. The profit charged is @20% on cost. So in S companys

books it will be recoded at Rs(10000+2000) =Rs.12000.

At the time of consolidation the position of H and S is say:

H S

Stock Rs.50000 Stock Rs.30000

Stock amounting Rs.30000 of S includes Rs.12000, purchased from H. In consolidated B/S Stock will be

Rs.50000+Rs.30000 =Rs.80000 Rs.2000 =Rs.78000. Actual journal entry will be

Profit and loss A/C..Dr Rs.2000

To Stock A/C..Rs.2000

So Consolidated Reserves and Surplus (Refer Rule: 6) there is an item of unrealized profit and stock in

CB is simultaneously reduced.

Suppose at the time of consolidation Rs.30000 includes only 80% of the stock purchased from H and

balance 20% was already sold. Then unrealized profit will be 80% of Rs.2000 =Rs.1600.

Similarly unrealized profit on sale of fixed asset between H and S will be treated.

Rule 8: Profit on Revaluation of assets of Subsidiary.

If at the time of acquisition assets of S is revalued the entry in Ss books will be:

a) For revaluation profit-

Assets A/C..Dr

To Profit and Loss A/C

b) For revaluation loss-

Profit and Loss A/C.Dr

To Assets

This revaluation profit or loss will be considered as preaquisition profit or loss and accordingly will be

treated as per rule 2,3 and 4.

Now if the assets are revalued Depreciation also will get changed. Excess or deficit depreciation is to

adjust from the post acquisition Profit and Loss of Subsidiary company.

Rule 8: Issue Bonus Shares

When bonus shares are issued by S journal entry in the books of S will be

Profit and Loss A/C.Dr

To Share capital A/c

Now Profit charged above is say Pre-acquisition profit.

Then effect will be:

Refer Rule 2, 3, and 4- Face value of the shares held will be increased and share of pre acquisition of

profit will be correspondingly reduced. So net effect will be zero.

But if Profit charged above is say Post-acquisition profit.

Then effect will be:

Refer Rule 2- Face value of the shares will increase and share of post acquisition profit will be

correspondingly decreased. Net effect zero.

Refer Rule 3- Face value of the shares will increase and share of post acquisition profit will be

correspondingly decreased. Amount of goodwill will be decreased. Amount of Consolidated reserves and

surplus as per rule 6 will be decreased.

Refer Rule 3- Face value of the shares will increase and share of post acquisition profit will be

correspondingly decreased. Amount of Capital reserve will be increased (as it is negative). Amount of

Consolidated reserves and surplus as per rule 6 will be decreased.

Rule 9: Inter company Dividends paid

If S declares dividend out of pre acquisition profit, on receipt it should be recorded by Hs majority as

Bank A/C..Dr

To Investment in shares of S A/C

Instead if it is recorded as

Bank A/C..Dr

To P/L A/C of H

Then its a wrong and at the time of consolidation a rectifying entry is required as follows:

P/L A/C of H..Dr

To Investment in shares of S A/C and accordingly Rule 3,4 and 6 will be adjusted.

If no mistake is done then no rectification is required.

In case S declares dividend out of post acquisition profit, on receipt it should be recorded by Hs majority

as

Bank A/C..Dr

To P/L A/C of H

Rule 10: Proposed Dividends

When a dividend is proposed by H entry will be

P/L A/C..Dr

To Proposed Dividend A/C

This proposed dividend is to be shown as current liability of C/B. Before consolidation if proposed

dividend already appears then above journal entry is no more required. Only proposed Dividend appearing

in individual B/S will be shown also in C/B.

When a dividend is proposed by S entry will be

P/L A/C..Dr

To Proposed Dividend A/C

This charging of P/L will be Post acquisition. This means if proposed dividend does not appear in the pre-

consolidation B/S of S then post acquisition profit of S will be deducted by the proposed dividend amount.

Share of majority out of this will be added to proposed dividend of H in Hs B/S and the added amount

will appear in C/B as current liability. Minoritys share will be added to minority interest. Rule 2 and rule

6 will be accordingly adjusted because of reduction of post acquisition profit of S due to declaration of

dividend.

If proposed dividend already appears in Ss Book before consolidation then it means post acquisition

profit is already adjusted. So no further adjustment is required and rule 2 and rule 6 also have no effect on

account of this. Proposed dividend quantum will be apportioned between majority and minority only.

Potrebbero piacerti anche

- Example Business Plan For MicrofinanceDocumento38 pagineExample Business Plan For MicrofinanceRh2223db83% (12)

- 4 Sem Bcom - Advanced Corporate AccountingDocumento56 pagine4 Sem Bcom - Advanced Corporate AccountingDipak Mahalik57% (7)

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownDa EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNessuna valutazione finora

- BS 1139-6-2005 Metal Scaffolding. Specification For Prefabricated Tower Scaffolds Outside The Scope of BS en 1004, But Utilizing Components From Such SystemsDocumento16 pagineBS 1139-6-2005 Metal Scaffolding. Specification For Prefabricated Tower Scaffolds Outside The Scope of BS en 1004, But Utilizing Components From Such SystemsHiệpBáNessuna valutazione finora

- JEFF Affidavit-of-Loss-PlateDocumento1 paginaJEFF Affidavit-of-Loss-PlateRaysunArellano100% (1)

- SampleDocumento11 pagineSampleYanyan RivalNessuna valutazione finora

- Ca 2Documento16 pagineCa 2Parth SharmaNessuna valutazione finora

- On Holding Co.Documento62 pagineOn Holding Co.Rahul SinhaNessuna valutazione finora

- Share KPTDocumento22 pagineShare KPTAnonymous 3yqNzCxtTzNessuna valutazione finora

- Tybbi Fra TheoryDocumento5 pagineTybbi Fra TheoryNavin Saraf100% (1)

- Holding Company AccountsDocumento8 pagineHolding Company AccountsHasnain MahmoodNessuna valutazione finora

- Nielson & Co V Lepanto Consolidated Mining CoDocumento16 pagineNielson & Co V Lepanto Consolidated Mining Covmanalo16Nessuna valutazione finora

- Accounts Interveiw Question & AnswersDocumento4 pagineAccounts Interveiw Question & Answerslitu84Nessuna valutazione finora

- Chapter 21Documento10 pagineChapter 21soniadhingra1805Nessuna valutazione finora

- Reconstruction InternalDocumento12 pagineReconstruction InternalsviimaNessuna valutazione finora

- Accounting For Investments in SubsidiariesDocumento63 pagineAccounting For Investments in SubsidiariesSoledad Perez100% (2)

- C1 Group Account SDocumento15 pagineC1 Group Account S郑妙卿Nessuna valutazione finora

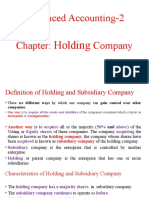

- Advanced Accounting-2 Company: HoldingDocumento20 pagineAdvanced Accounting-2 Company: HoldingTB AhmedNessuna valutazione finora

- Accounting For Treatment For MergerDocumento6 pagineAccounting For Treatment For Mergergoel76vishalNessuna valutazione finora

- Corporate Accounting - NewDocumento11 pagineCorporate Accounting - NewBanday MurtazaNessuna valutazione finora

- Final AccountDocumento14 pagineFinal AccountStiloflexindia Enterprise100% (1)

- Balance Sheet PDFDocumento10 pagineBalance Sheet PDFavinash singhNessuna valutazione finora

- Accounting With AnswerDocumento15 pagineAccounting With Answermary louise maganaNessuna valutazione finora

- Hoyle Chapter 10 Advanced Acct SolutionsDocumento34 pagineHoyle Chapter 10 Advanced Acct SolutionsclevereuphemismNessuna valutazione finora

- Piecemeal RealizationDocumento6 paginePiecemeal RealizationSethwilsonNessuna valutazione finora

- Retirement of A PartnerDocumento6 pagineRetirement of A Partnershrey narulaNessuna valutazione finora

- FormationDocumento31 pagineFormationBYRON DESEMBRANANessuna valutazione finora

- Bonus SharesDocumento3 pagineBonus SharesriddhisanghviNessuna valutazione finora

- AccountsDocumento10 pagineAccountsvaishnaviNessuna valutazione finora

- Term Paper For-Wps OfficeDocumento5 pagineTerm Paper For-Wps OfficeCharity VelezNessuna valutazione finora

- 7 - Consolidated Financial Statements P3 PDFDocumento7 pagine7 - Consolidated Financial Statements P3 PDFDarlene Faye Cabral RosalesNessuna valutazione finora

- Retained EarningsDocumento72 pagineRetained EarningsItronix MohaliNessuna valutazione finora

- Lesson 6 - Statement of Financial Position (Part 2)Documento9 pagineLesson 6 - Statement of Financial Position (Part 2)yana jungNessuna valutazione finora

- Topic 3 SolutionsDocumento13 pagineTopic 3 SolutionsLiang BochengNessuna valutazione finora

- CA IPCC Company Audit IIDocumento50 pagineCA IPCC Company Audit IIanon_672065362Nessuna valutazione finora

- 23 PartnershiptheoryDocumento10 pagine23 PartnershiptheorySanjeev MiglaniNessuna valutazione finora

- Advanced Accounting 1Documento11 pagineAdvanced Accounting 1SheenaGaliciaNew75% (8)

- Module 06business Combination PDF FreeDocumento19 pagineModule 06business Combination PDF FreeCaptain ObviousNessuna valutazione finora

- Accounting and Taxation AspectsDocumento25 pagineAccounting and Taxation Aspectsankit varunNessuna valutazione finora

- Chapter 5 AfspDocumento41 pagineChapter 5 AfspFrances AgustinNessuna valutazione finora

- Admission of A Partner Assignment 3Documento9 pagineAdmission of A Partner Assignment 3Arun KCNessuna valutazione finora

- Consolidated FsDocumento7 pagineConsolidated FsfreyawonderlandNessuna valutazione finora

- Accounting For and Reporting of Preference SharesDocumento19 pagineAccounting For and Reporting of Preference SharesAis Syang DyaNessuna valutazione finora

- Advancedaccounti 00 RittrichDocumento112 pagineAdvancedaccounti 00 RittrichBabar Shahzad Anjum100% (1)

- Financial Accounting & Analysis - N (1A)Documento10 pagineFinancial Accounting & Analysis - N (1A)Tajinder MatharuNessuna valutazione finora

- Consolidation Model - Theory & ExampleDocumento7 pagineConsolidation Model - Theory & Examplesubhash dalviNessuna valutazione finora

- Mediocre Non-Profit OrganizationDocumento12 pagineMediocre Non-Profit OrganizationveenaNessuna valutazione finora

- ACC125 BankingDocumento10 pagineACC125 BankingLenar Dean EdquibanNessuna valutazione finora

- IFRS in Practice CommonErrors Share Based Payment (Print) PDFDocumento20 pagineIFRS in Practice CommonErrors Share Based Payment (Print) PDFnik100% (1)

- UNIT 4: Company Accounts-Share CapitalDocumento13 pagineUNIT 4: Company Accounts-Share CapitalpraveentyagiNessuna valutazione finora

- Business Combinations and Consolidated Financial Statements As Per Accounting Standards (Latest and Simple)Documento9 pagineBusiness Combinations and Consolidated Financial Statements As Per Accounting Standards (Latest and Simple)dsp varmaNessuna valutazione finora

- Capital Maintenance NotesDocumento4 pagineCapital Maintenance NotesFrancis Njihia KaburuNessuna valutazione finora

- Accounting For Groups of CompaniesDocumento9 pagineAccounting For Groups of CompaniesEmmanuel MwapeNessuna valutazione finora

- CHAPTER 14 - Consolidated Statement - Date of AcquisitionDocumento63 pagineCHAPTER 14 - Consolidated Statement - Date of AcquisitionErina KimNessuna valutazione finora

- Acc 702 Assignment 4Documento8 pagineAcc 702 Assignment 4laukkeasNessuna valutazione finora

- Lesson 5 Tax Planning With Reference To Capital StructureDocumento37 pagineLesson 5 Tax Planning With Reference To Capital StructurekelvinNessuna valutazione finora

- Financial Accounting Theory (Sem V) PDFDocumento4 pagineFinancial Accounting Theory (Sem V) PDFHarshal JainNessuna valutazione finora

- Tute 10 PDFDocumento3 pagineTute 10 PDFRony RahmanNessuna valutazione finora

- Accounting For PartnershipDocumento46 pagineAccounting For PartnershipRejean Dela Cruz100% (1)

- Class 12th Accountancy NotesDocumento9 pagineClass 12th Accountancy Notesadarshkumar12040% (1)

- Unit 4 Admission of New PartnerDocumento5 pagineUnit 4 Admission of New PartnerNeelabh KumarNessuna valutazione finora

- Concept of Retirement of A PartnerDocumento3 pagineConcept of Retirement of A PartnerManjeet KaurNessuna valutazione finora

- Resignation From The Post of Vice Chairman and Permanent MemberDocumento1 paginaResignation From The Post of Vice Chairman and Permanent MemberMalik Naseer AhmedNessuna valutazione finora

- Job Description For The Post of Finance & Administration Officer (With Membership Development Support)Documento4 pagineJob Description For The Post of Finance & Administration Officer (With Membership Development Support)Malik Naseer AhmedNessuna valutazione finora

- The Role of Time in International Business NegotiationsDocumento7 pagineThe Role of Time in International Business NegotiationsMalik Naseer AhmedNessuna valutazione finora

- International Business Environment: SyllabusDocumento83 pagineInternational Business Environment: SyllabusMalik Naseer AhmedNessuna valutazione finora

- Maslow'S Needs Heartache Theory: Particular ManagementDocumento2 pagineMaslow'S Needs Heartache Theory: Particular ManagementMalik Naseer AhmedNessuna valutazione finora

- Quasi-Contracts: By: Val F. PiedadDocumento33 pagineQuasi-Contracts: By: Val F. PiedadMingNessuna valutazione finora

- Belgica vs. Ochoa, G.R. No. 208566Documento52 pagineBelgica vs. Ochoa, G.R. No. 208566Daryl CruzNessuna valutazione finora

- G.R. No. 203610, October 10, 2016Documento7 pagineG.R. No. 203610, October 10, 2016Karla KatigbakNessuna valutazione finora

- Topic 1 - Overview: Licensing Exam Paper 1 Topic 1Documento18 pagineTopic 1 - Overview: Licensing Exam Paper 1 Topic 1anonlukeNessuna valutazione finora

- Safety Abbreviation List - Safety AcronymsDocumento17 pagineSafety Abbreviation List - Safety AcronymsSagar GuptaNessuna valutazione finora

- ProjectDocumento70 pagineProjectAshish mathew chackoNessuna valutazione finora

- Institute of Chartered Accountants of India - WikipediaDocumento1 paginaInstitute of Chartered Accountants of India - Wikipediaramthecharm_46098467Nessuna valutazione finora

- Whodunit Case StudyDocumento1 paginaWhodunit Case StudyAnna LiuNessuna valutazione finora

- Penn Exemption Rev-1220Documento2 paginePenn Exemption Rev-1220jpesNessuna valutazione finora

- Isu Assessment Form 04152024Documento1 paginaIsu Assessment Form 04152024yun48814Nessuna valutazione finora

- Chua v. Absolute Management Corp.Documento10 pagineChua v. Absolute Management Corp.Hv EstokNessuna valutazione finora

- 275 The Great Gatsby - Comparatives, Superlatives, Double ComparativesDocumento2 pagine275 The Great Gatsby - Comparatives, Superlatives, Double ComparativesMaria Jose ReisNessuna valutazione finora

- Utilitarianism Is An Ethical TheoryDocumento2 pagineUtilitarianism Is An Ethical TheoryGemma Madrinan PiqueroNessuna valutazione finora

- MOU Barangay CuliananDocumento4 pagineMOU Barangay CuliananAldrinAbdurahimNessuna valutazione finora

- WePay Global Payments LLC V Apple Inc Patent InfringementDocumento5 pagineWePay Global Payments LLC V Apple Inc Patent InfringementJack PurcherNessuna valutazione finora

- Tutorial 3Documento2 pagineTutorial 3YiKai TanNessuna valutazione finora

- CHAPTER 1-8 Noli Me TangereDocumento36 pagineCHAPTER 1-8 Noli Me TangereRianne AguilarNessuna valutazione finora

- Flag of Southeast Asian CountriesDocumento6 pagineFlag of Southeast Asian CountriesbaymaxNessuna valutazione finora

- Common Size/Vertical Analysis: Lecture No. 9Documento4 pagineCommon Size/Vertical Analysis: Lecture No. 9naziaNessuna valutazione finora

- SpColumn ManualDocumento111 pagineSpColumn Manualeid ibrahimNessuna valutazione finora

- Intellectual CapitalDocumento3 pagineIntellectual CapitalMd Mehedi HasanNessuna valutazione finora

- Santos V NLRC, G.R. No. 115795. March 6, 1998Documento3 pagineSantos V NLRC, G.R. No. 115795. March 6, 1998Bernz Velo Tumaru100% (1)

- Asn RNC TicketDocumento1 paginaAsn RNC TicketK_KaruppiahNessuna valutazione finora

- Cost of Capital 2Documento29 pagineCost of Capital 2BSA 1A100% (2)

- Corporate Accounting (BUSN9120) Semester 2, 2020 Assignment 1 Topic Coordinator: Mr. PHILIP RITSONDocumento9 pagineCorporate Accounting (BUSN9120) Semester 2, 2020 Assignment 1 Topic Coordinator: Mr. PHILIP RITSONMANPREETNessuna valutazione finora

- 17025-2017..1Documento109 pagine17025-2017..1حسام رسمي100% (2)