Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CSR and Corporate Governace

Caricato da

Uzzal HaqueTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

CSR and Corporate Governace

Caricato da

Uzzal HaqueCopyright:

Formati disponibili

Corporate Governance and Firm Value:

The Impact of Corporate Social

Responsibility

Hoje Jo

Maretno A. Harjoto

ABSTRACT. This study investigates the effects of

internal and external corporate governance and moni-

toring mechanisms on the choice of corporate social

responsibility (CSR) engagement and the value of firms

engaging in CSR activities. The study finds the CSR

choice is positively associated with the internal and

external corporate governance and monitoring mecha-

nisms, including board leadership, board independence,

institutional ownership, analyst following, and anti-

takeover provisions, after controlling for various firm

characteristics. After correcting for endogeneity and

simultaneity issues, the results show that CSR engage-

ment positively influences firm value measured by

industry-adjusted Tobins q. We find that the impact of

analyst following for firms that engage in CSR on firm

value is strongly positive, while the board leader-

ship, board independence, blockholders ownership, and

institutional ownership play a relatively weaker role in

enhancing firm value. Furthermore, we find that CSR

activities that address internal social enhancement within

the firm, such as employees diversity, firm relationship

with its employees, and product quality, enhance the

value of firm more than other CSR subcategories for

broader external social enhancement such as community

relation and environmental concerns.

KEY WORDS: corporate social responsibility, corpo-

rate governance, analyst following, rm value

JEL CLASSIFICATION: G34, L2, M14

Introduction

Although there has been a noteworthy discussion

among scholars and practitioners over the last two

decades on what constitutes the best corporate

governance practices, corporate governance across

corporate America is more heterogeneous than ever

before. The recent collapse of many rms has not

only proven to be a watershed momentum in U.S.

corporate governance, it also has highlighted the

importance of information transparency. Informa-

tion problems and managerial incentives typically

limit the effectiveness of corporate governance in

public corporations (Jensen, 1993; Miller, 2005). As

a result, there has been a tremendous acceleration of

corporate governance activities, as well as a con-

vergence of certain trends in corporate governance

over the last few years (Hermalin, 2005). While the

literature indicates that effective corporate gover-

nance curtails managerial self-interest and protects

shareholder interests, this study posits that corporate

governance manages the interests of multiple stake-

holders and resolves the conicts of interest between

shareholders and non-investing stakeholders.

Along with the acceleration of corporate gover-

nance issue, one of the most signicant and con-

tentious corporate trends of the last decade is the

growth of Corporate Social Responsibility (CSR).

In essence, CSR is an extension of rms efforts

to foster effective corporate governance, ensuring

rms sustainability via sound business practices that

promote accountability and transparency. However,

there are various denitions of CSR. Friedman

(1970) rst denes CSR as follows: Corporate so-

cial responsibility is to conduct the business in

accordance with shareholders desires, which gen-

erally will be to make as much money as possible

while conforming to the basic rules of society, both

those embodied in law and those embodied in eth-

ical custom. Carroll (1979) and Hill et al. (2007)

dene the hierarchical CSR as economic, legal,

moral, and philanthropic actions of rms that

Journal of Business Ethics (2011) 103:351383 Springer 2011

DOI 10.1007/s10551-011-0869-y

inuence the quality of life of relevant stakeholders.

While the denitions of CSR vary, it generally refers

to serving people, communities, and society in ways

that go above and beyond what is legally required of

a rm. According to Barnea and Rubin (2010),

however, if CSR initiatives do not maximize rm

value, such initiatives are a waste of valuable re-

sources and a potentially value-destroying proposi-

tion. CSR has continued to be a highly topical

subject regarding whether investments in CSR are

value-enhancing, value-destroying, or even value-

irrelevant. The debates about CSR continue to grow

without a clear consensus on its meaning or value.

In this paper, we rst examine the empirical

association between various corporate governance

and monitoring mechanisms and U.S. rms choice

of CSR involvement. We then explore how CSR

engagement and various governance mechanisms

affect rm value after correcting for endogeneity and

simultaneity. Well-designed corporate governance

systems would align managers incentives with those

of stakeholders. Hence, rms with effective corpo-

rate governance should place a greater emphasis on

value maximization. We examine two categories of

governance devices: internal (ownership concentra-

tion and board structure) and external (institutional

ownership and monitoring by security analysts).

Given that the relations among CSR, corporate

governance, and rm value are mixed, and that

previous studies do not control for the simultaneity

bias and endogeneity, this study explores the impact

of various governance mechanisms on rms choice

of CSR engagement and the effect of this engage-

ment on rm value after controlling for both the

simultaneity bias and endogeneity.

1

As one of the essential rationales behind CSR

engagement is to build trust relationships and social

capital, increasing attention is being paid to the effects

that social capital has on economic variables.

2

Several

studies analyze the relation between social capital and

economic growth (Knack and Keefer, 1997); social

capital and trust building (La Porta et al., 1997a, b);

social capital and government performance (La Porta

et al., 1999; Putnam, 1993); and social capital and

nancial development (Guiso, et al., 2004). In spite

of the increasing attention given to social capital,

however, only a few studies in nance examine CSR

engagement. Aggrawal and Nanda (2004) investigate

the relation between board size and social objectives

and nd that the number of social objectives posi-

tively affects rms board size. Fisman et al. (2005)

examine the link between rms CSR engagement

and accounting prot. They nd that the effect of

CSR on protability is stronger for rms in more

competitive industries. Barnea and Rubin (2010)

examine the relation between rms CSR ratings and

their ownership and capital structures and nd that

insiders tend to over-invest in CSR. Goss and

Roberts (2007) analyze the association between CSR

and the cost of bank loans. They nd that rms with

the worst social responsibility scores pay higher loan

costs while rms with good scores do not receive

lower loan costs. Hong and Kacperczyk (2009) nd

sin stocks from publicly traded rms that produce

alcohol, tobacco, and gambling have higher risk and

returns indicating that social norms affect stock prices

and returns. Although these studies enhance our

understanding of the important benets and costs of

CSR engagement, in our view, the previous research

on this issue is still premature to provide any denite

conclusions regarding the impact of CSR engage-

ment on rm value.

3

To correctly examine the relationship between

CSR and rm value, we need to consider potential

simultaneity bias and endogenous treatment effects.

Since better quality rms tend to choose CSR

engagement, the contribution of CSR engagement

to rm value will be overstated (Greene, 1993) if we

do not correct for the simultaneity and endogeneity

problems. In this paper, we conduct our endoge-

neity and simultaneity analyses in two stages. We

examine the factors determining CSR engagement

extensively in the rst stage, and then compare the

rm values of CSR engaging versus CSR non-

engaging rms in the second stage. Based upon a

large sample of 12,527 rm-year (2952 rms)

observations, including both CSR and no-CSR

rms during the 19932004 period, we initially

perform a rst-stage probit regression analysis of

CSR engagement. Consistent with the conict-

resolution hypothesis, the results show that the

likelihood of opting for CSR involvement is sig-

nicantly and positively related to governance

characteristics such as board leadership, board inde-

pendence, institutional ownership, analyst following,

and anti-takeover provisions after controlling for

such rm characteristics as rm size, leverage, prof-

itability, R&D, a rms diversication, and risk.

352 Hoje Jo and Maretno A. Harjoto

In the second-stage analysis, we nd that after

correcting for the endogenous treatment effect and

simultaneity bias, respectively, rm value, measured

by industry-adjusted Tobins q, is positively

related to the CSR choice or the CSR-combined

scores, suggesting that CSR engagement positively

inuences rm value. The results support the

conict-resolution hypothesis, as opposed to the

overinvestment explanation, and remain robust

under various specications, including the OLS, the

Heckman two-stage regressions, and the instru-

mental variables approach. Our results also suggest

that the value enhancement of rms CSR engage-

ment comes from rms internal social enhance-

ment, such as diversity, employee relations, and

product issues more than their CSR involvement in

broader external enhancement, such as activities

related to community and environmental issues. In

addition, after controlling for a potential simultaneity

bias, our inferences concerning the positive associ-

ation between CSR and rm value remain intact.

Furthermore, we maintain that security analysts

are important information intermediaries who

improve the transparency of a rms CSR activities.

Accordingly, the impact of CSR activities are

stronger when analyst following is higher, and the

impact of analyst following on rm value is also

strongly positive in all models. However, the mon-

itoring impact of institutional investors is occasion-

ally positive, but relatively weaker than that of

security analysts, presumably because of their dual

roles of monitors and investors. Overall, our results

suggest that rms engagement in CSR activities,

together with external monitoring by security ana-

lysts, is value enhancing. Furthermore, the positive

impact of CSR activities on rm value implies that

U.S. rms do not over-invest in CSR activities in

the sample period.

This paper contributes to the literature on CSR

and corporate governance in three distinct ways.

First, we conduct a full examination of the deter-

minants of CSR engagement and provide insights

into how corporate governance inuences rms

choice to engage in CSR by using all CSR rms

and no-CSR rms available from the Kinder,

Lydenberg, and Dominis (KLD) Stats database,

RiskMetrics (formerly, the Investor Responsibility

Research Centers (IRRC) governance and direc-

tor) database, and the Institutional Brokers Estima-

tion Services (I/B/E/S) database during the 1993

2004 period. Second, we consider more extensive

governance and monitoring mechanisms to examine

the impact of CSR on rms value and revisit the

over-investment hypothesis and the conict-resolu-

tion explanation in light of CSR. By appropriately

controlling for the endogenous treatment effects and

simultaneity bias, we are able to determine whether

rms over-invest in CSR activities. We postulate

that the role of corporate governance in the choice

of CSR engagement and the impact of that choice

on rm value might be different for each of the

internal and external governance mechanisms. We

believe that this is the rst empirical study to for-

mally address both the simultaneity and endogeneity

issues. Third, we provide further evidence that the

impact of security analyst following on rm value is

one of the most signicant among several considered

governance and monitoring mechanisms in the

presence of CSR engagement.

Hypotheses

Why do rms engage in CSR?

Despite large literature on CSR (Bowen, 1953;

Donham, 1927; and for an overview, see Whetten,

et al., 2002), there is no unied theory behind CSR

engagement, and there are at least two alternative

explanations regarding its existence. First, based on

Jensen and Mecklings (1976) agency theory, Barnea

and Rubin (2010) consider CSR engagement as a

principal-agent relation between managers and

shareholders, and argue that afliated insiders have

an interest in overinvesting in CSR in order to

obtain private benets of building reputation as good

social citizens, possibly at a cost to shareholders.

As reputation improves, top management will

enjoy better outside career opportunities and greater

negotiation power, which will eventually lead them

to have overcondence. Malmendier and Tate

(2005) suggest that there is some evidence of over-

investment by overcondent CEOs. Goel and

Thakors (2008) theoretical model also shows that

overcondent managers sometimes make value-

destroying investments. In a related vein, Bertrand

and Mullainathan (2003) argue that when manag-

ers are not closely monitored and insulated from

353 Corporate Governance and Firm Value

takeovers, active empire building may not be the

norm and managers may prefer to enjoy a quiet life.

If overcondent CEOs tend to over-invest in order

to build their reputations as good social citizens

without monitoring, we expect an inverse associa-

tion between monitoring and CSR choice because

the higher internal and external monitoring through

various governance mechanisms should reduce the

insiders incentive for CSR over-investment.

Second, while it may not be completely possible

to satisfy all related stakeholders, there is a growing

literature on conict resolution based on stakeholder

theory (e,g., Calton and Payne, 2003; Harjoto and

Jo, 2011; Jensen, 2002; Sherere et al., 2006), in

which the role of the corporation is to serve the

interests of other non-investing stakeholders as well.

According to the conict-resolution hypothesis,

to the extent that managers use effective monitor-

ing/governance mechanisms together with CSR

engagement to resolve conicts among stakeholders,

CSR engagement should be positively related to

effective governance mechanisms. Alternatively, if

various governance and monitoring mechanisms

view the rms CSR engagement as an effort of

potential conict resolution among various stake-

holders, then we would expect a positive association

between corporate governance and CSR engage-

ment.

Hypothesis 1: According to the over-investment

hypothesis, we expect that the choice of CSR

engagement is inversely associated with gover-

nance and monitoring mechanisms after control-

ling for confounding factors, while according to

the conict-resolution hypothesis, we expect a

positive association between the choice of CSR

engagement and governance and monitoring

mechanisms.

CSR, corporate governance, and rm value

The impact of CSR engagement on accounting

performance (i.e., return on assets (ROA)), is a long-

standing, but still unresolved question. According to

the management literature summarized by Margolis

and Walsh (2003), over 120 studies between 1971

and 2001 examine the empirical relation between

CSR and nancial performance, and the results are

largely inconclusive. They suggest that previous

studies are subject to various imperfections, such as

measurement problems related to both CSR and

nancial performance, a lack of necessary analyses of

causality and/or endogeneity, omitted variable

problems, a lack of methodological rigor, and a lack

of theory. While it is hard to draw a denite con-

clusion because of the imperfect nature of many

studies, the review of the empirical CSR literature

conducted by Margolis and Walsh (2003) indicates a

generally positive association between investing in

socially responsible activities and nancial perfor-

mance.

The impact of CSR engagement on rm value,

however, is relatively less examined.

4

In particular,

there is less evidence regarding how corporate

governance and the CSR engagement jointly affect

rm value after controlling for both the simultaneity

bias and endogeneity. According to the over-

investment hypothesis, insiders such as the CEO and

the board have a natural motivation to over-invest in

CSR activities if doing so enhances their reputation

building process (Barnea and Rubin, 2010). Then,

rm value will be negatively inuenced by the

CSR engagement. In contrast, the conict-resolu-

tion hypothesis suggests that if managers use effective

governance and monitoring mechanisms in con-

junction with CSR engagement to resolve conicts

among stakeholders, then rm value could be posi-

tively associated with CSR engagement and effective

governance mechanisms through reduced conict-

of-interests among various stakeholders.

Since there is no clear monitoring mechanism to

prevent rms from over-investing in various CSR

activities, we postulate that there should be some

effective monitoring mechanism out of all consid-

ered internal and external governance mechanisms

for the checking and balancing of CSR investments.

Board independence can be important in monitoring

the behavior of top management. Fama and Jensen

(1983) maintain that boards can be effective mech-

anisms to monitor top management on behalf of

dispersed shareholders by effectuating management

appointments, dismissals, suspensions, and rewards.

Other studies, however, point toward a paradoxical,

insignicant, or negative association between gov-

ernance quality, as proxied by the percentage of

outside directors on the board, and rm value.

354 Hoje Jo and Maretno A. Harjoto

Bhagat and Black (2001), Hermalin and Weisbach

(1991), and Morck et al. (1988) nd no signicant

relation between board independence and Tobins q.

Coles et al. (2008) examine the relation between

board structure and rm value, and nd that one

board size or composition does not provide the same

monitoring benets for all rms. Furthermore,

Bhagat and Black (2001), Hermalin and Weisbach

(1991), and Mehran (1995) nd an insignicant

relation between board independence and account-

ing performance. Agrawal and Knoeber (1996) nd

that Tobins q decreases with an increase in the

proportion of outside directors. Thus, the evidence

regarding the merits of independent boards remains

largely inconclusive.

Internal control systems, such as managerial incen-

tives, corporate charters, and boards of directors,

however, may not be a sufciently effective mecha-

nism to ensure corporate transparency and the

self-monitoring of rm behavior (Jensen, 1993).

Consequently, external monitoring by institutional

investors who own blocks of the rm has become

increasingly important. Agency theories argue that

pressures from external investors, such as institutional

investors, are necessary to motivate managers to max-

imize rm value instead of pursuing managerial

objectives (Allenet al., 2001; Jensen, 1986; Shleifer and

Vishny, 1986). Institutional investors are more willing

and able to monitor corporate management than are

smaller and more diffuse investors. Large blockholders

identify that managers are often driven by their self-

interests. Thus, as large shareholders, blockholders

have strong incentive to monitor managers (Demsetz

and Lehn, 1985; Shleifer and Vishny, 1986).

Chung and Jo (1996) indicate that security analysts

play important roles as corporate monitors in

reducing agency costs and motivating managers.

Analysts act as information intermediaries who help

expand the breadth of investors cognizance about

the managerial actions, and therefore, analyst fol-

lowing should have a positive impact on the market

value of rms. Knyazeva (2007) and Yu (2008) also

consider the potential role of analysts as an indirect,

but additional monitoring mechanism and support

the notion that analyst following imposes discipline

on misbehaving managers and helps align managers

with shareholders, thus improving managerial

incentives to undertake more optimal policies. Jo and

Kim (2007, 2008) further indicate that an improved

corporate transparency through frequent voluntary

disclosure will reduce the information asymmetry

between insiders and outsiders, discourage manage-

rial self-dealings, and therefore, enhance rm value.

Thus, to the extent that institutional investors and

security analysts provide effective external monitor-

ing regarding the information transparency of CSR

engagement, the CSR activities will have positive

effects on rm value. Combined together, the

implication that we draw from the above discussion

leads to the second hypothesis.

Hypothesis 2: (a) If the over-investment hypothesis

(the conict-resolution hypothesis) is correct,

then rm value measured by Tobins q is inversely

(positively) associated with the choice of CSR

engagement or investing in CSR activities after

correcting for simultaneity and endogeneity; and

(b) Because security analysts and/or institutional

investors provide external monitoring that im-

proves information transparency, we expect a

positive association between CSR engagement

and rm value to the extent that there exist

external monitoring mechanisms.

If analysts are afliated with investment banks,

then they face their own conicts of interest, raising

questions about their effectiveness. For instance,

Dechow et al. (2000) and Lin and McNichols (1998)

suggest that analysts afliated with investment banks

that underwrite equity issues tend to make higher

growth forecasts than unafliated analysts do, and

subsequently have larger forecast errors. If informa-

tion intermediaries such as nancial analysts are

independent, then their information production is

more likely to increase transparency. As we do not

have an access to the data on analyst afliation, our

results might be biased toward rejecting the analysts

role of enhancing information transparency, and

therefore, the association between CSR engagement

and rm value.

Data, measurement, and methodology

Data

We use CSR measures from the Kinder, Lydenberg,

and Dominis (KLDs) Stats database. KLDs Stats

355 Corporate Governance and Firm Value

database includes over 3000 companies containing

various CSR characteristics. In particular, KLDs

inclusive social rating criteria contain strength ratings

and concern ratings for community, diversity, em-

ployee relations, environment, and product. KLD

also has exclusionary screens, such as alcohol, gam-

bling, military, nuclear power, and tobacco (see

Appendix A). Since KLDs exclusionary screens

differ from the inclusive screens in that only concern

ratings, but no strength ratings, are assigned, we only

use the inclusive screens in our main tests. While

KLD contains data from approximately 650 rms

listed on the S&P 500 or Domini 400 Social Indexes

each year prior to 2001, the KLDs ratings comprise

a summary of strengths and concerns assigned to

approximately 1100 (3100) rms listed on the S&P

500, the Domini 400 Social Indexes, or the Russell

1000 (Russell 3000) Indexes as of December 31st of

each year for 2001 and 2002 (2003 and 2004). In

2002, KLD renamed the other category as corporate

governance.

Since KLDs denition of corporate governance,

which includes compensation, ownership, tax dis-

putes, and other issues, is quite different from that of

conventional corporate governance measures, we

use governance and monitoring measures from

RiskMetrics (formerly, the IRRCs governance and

director) database, CDA/Spectrum 13(f) lings, and

the Institutional Brokers Estimation Services (I/B/

E/S) database instead of KLDs corporate gover-

nance dimension. The corporate governance and

monitoring measures from the above databases

include the proportion of outside independent

directors, the proportion of institutional holdings,

the proportion of blockholdings, and the number of

security analysts following the rm. Specically, (i)

our sample rm must be available from the Risk-

Metrics database; (ii) insider blockholder data must

be available; (iii) the data for outside institutional

holdings must be available from CDA/Spectrum

13(f) lings. These lings contain quarterly infor-

mation on common-stock positions greater than

10,000 shares or $200,000 for each institution with

more than $100 million in securities under man-

agement; and (iv) the number of analysts following a

rm must be available from the I/B/E/S database.

Since we also use various accounting and nancial

information, we require that sufcient COMPU-

STAT and Center for Research in Security Prices

(CRSP) data are available for our tests. This sample

procedure produces a combined sample of 12,527

rm-year (2952 rms) observations from 1993 to

2004. If there are any (no) observations in the KLD

ratings, then we view them as rms with (no) CSR

engagement. We also verify our results based on the

sample containing only positive CSR scores. Actual

samples used in the analyses are slightly different

because the data availability is different for each

regression analysis.

The RiskMetrics does not publish volumes every

year, but publishes volumes in the years of 1993, 1995,

1998, 2000, 2002, and 2004. We ll in the missing

years by assuming that the governance provisions re-

ported in any given year are also in place in the year

preceding the volumes publication, following Beb-

chuk and Cohen (2005) and Gompers et al. (hereafter,

GIM) (2003, 2010). In the case of 2003, for instance,

for which there is no RiskMetrics volume in the

subsequent year, we assume that the governance

provisions are the same as those reported in the

RiskMetrics volume published in 2002. We also

verify whether using a different method based on the

arithmetic average of 2002 and 2004 to assume the

case of 2003 does not change the results. To conduct

the robustness test, we further examine only the

RiskMetricss published years of 1993, 1995, 1998,

2000, 2002, and 2004 in the additional test section.

Measurement

To measure external monitoring by institutional

holders, we use the equity ownership of outside

institutional holders as the sum of the greater-than-

ve percent owners that are unafliated with the

rm (PCTINSTI). We use the number of analysts

who follow the rm to measure external analyst

monitoring by security analysts from the I/B/E/S

database. We measure analyst coverage with the

natural logarithm of one plus the number of ana-

lysts following the rm (LOGANAL) because the

number of analysts is highly skewed to the right

(Bushman, et al., 2005; Lim, 2001).

We utilize several structural measures of internal

corporate governance from the RiskMetrics database

(e.g., board characteristics such as independent

outside board proportion, board ownership, and

board leadership, etc.). With these corporate board

356 Hoje Jo and Maretno A. Harjoto

variables, we compare and contrast effective versus

ineffective corporate governance. We rst focus on

effective corporate governance, using an indepen-

dent outside director because the rise of such

directors has been a major trend over the last two

decades (see Harris and Raviv, 2008; Hermalin and

Weisbach, 1998, 2003; Raheja, 2005). We follow

the denition of an independent director from that

of the RiskMetrics, which denes an independent

outside director as a director elected by shareholders

who is not afliated with the company. Based on

Linck et al. (2008), we measure board independence

by the proportion of outside independent directors

(PCTINDEP), and board leadership by a dummy

variable of one if the CEO is the chair of the board

(DUALITY) and another dummy variable if the

CEO is the chair or a member of the nomination

committee (CEONOM).

To measure managerial entrenchment, we use the

governance index (GINDEX) developed by GIM

(2003). The RiskMetrics reports 24 anti-takeover

provisions (ATPs) at the rm level because the basic

ingredients for the GINDEX are ATPs. The GIN-

DEX, therefore, ranges from 0 to 24. A high value

indicates stronger managerial power (less takeover

pressure), and a greater potential for managerial

entrenchment. Bebchuk et al. (2009) create an

entrenchment index (ENTINDEX) based on the

GINDEX, particularly using six provisions four

constitutional provisions that prevent a majority of

shareholders from having their way (e.g., staggered

boards, limits to shareholder bylaw amendments,

supermajority requirements for mergers, and super-

majority requirements for charter amendments), and

two takeover-readiness provisions that boards

establish to be ready for a hostile takeover (i.e.,

poison pills and golden parachutes). Bebchuk et al.

(2009) argue that the ENTINDEX based on these

six ATPs drives the main results of rm valuation.

This ENTINDEX ranges from 0 to 6, with a higher

value indicating stronger managerial entrenchment.

Thus, we also use Bebchuk et al.s (2009) ENT-

INDEX to measure managerial entrenchment. See

the denitions of governance, monitoring, and other

control variables in Appendix B.

We measure rm value with Tobins q, which is a

widely used measure of rm value in accounting,

economics, and nance literature. Tobins q is cal-

culated as: {[Market value of common stock + Book

value of preferred stock + Book value of long-term

debt + Book value of current liabilities -(Book

value of current assets -Book value of Invento-

ries)]/Book value of total assets}. In particular, we

use industry-adjusted Tobins q (the natural log of

rms q divided by the median q in the rms

industry) instead of levels of Tobins q as a measure

of rm value (Campbell, 1996). The advantage of

using industry-adjusted Tobins q (ADJTOBINQ) is

that it neutralizes the effect of specic industries on

Tobins q.

Methodology

We conduct an endogeneity correction for the

treatment effects because rm value could come

from two broad sources of unique features: the

choice of CSR engagement and corporate gover-

nance. The CSR involvements contribution to rm

value could be overstated if we do not control for

the endogeneity problem (Greene, 1993). Speci-

cally, it may be that rms engaging into CSR

activities are simply of higher quality and deliver

better performance, regardless of whether they

choose to become involved in CSR. In this case, the

coefcient on the CSR dummy variable might

reveal a value-add from CSR engagement, when

indeed there is no true effect.

Tobin (1958) rst identied this endogeneity

problem. If this endogeneity problemis not taken into

consideration in the estimation procedure, an ordin-

ary least-square estimation (OLS) will produce biased

parameter estimates. Heckman (1976, 1979) proposed

a two-stage estimation procedure using the inverse

Mills ratio to take account of the endogeneity bias. In

the rst step, a regression for observing a positive

outcome of the dependent variable is modeled with a

probit (or logit) model. The estimated parameters are

used to calculate the inverse Mills ratio, which is then

included as an additional explanatory variable in the

OLS estimation (Greene, 1993). Using Heckmans

two-stage estimation, we correct the specication for

endogeneity and examine whether CSR activities

enhance rm value.

GIM (2010) employ a different approach, i.e., the

instrumental variable to address the endogene-

ity problem. Heckman and Robb (1985) and

Moftt (1999) suggest the instrumental variable (IV)

357 Corporate Governance and Firm Value

method, which focuses on nding a variable (or

variables) that inuences the CSR choice, but does

not inuence Tobins q (and thus is not correlated

with the random error term in the Tobins q

equation). Angrist (2000) asserts that the IV method

works even when the second-stage model is non-

linear, if the researcher focuses on the causal effects.

Moftt (1999) further suggests that each IV, that is

indeed uncorrelated with the random error term

in the Tobins q equation, will yield unbiased

estimates.

5

Our choice of an instrumental variable

is FIRMAGE, which is highly correlated with

CSRDUMMY, but is uncorrelated with industry-

adjusted Tobins q (see Table II). We interpret the

results to suggest that older rms can afford CSR

engagement, but not necessarily lead to higher rm

value.

6

Empirical results

Univariate tests and bivariate correlations

We compare and contrast rm and governance

characteristics in order to test the univariate differ-

ence between CSR rms and no-CSR rms.

Table I presents the means and medians of the

control and governance variables. In Panel A, we

rst examine the differences of the rm character-

istics. In particular, CSR involvement is, on average,

adopted by rms with a lower R&D expenditure

ratio. CSR also is more common among diversied

rms, older rms, larger rms, highly leveraged

rms, more protable rms, rms belong to the S&P

500, rms using a higher advertising expense ratio,

and rms with a higher Tobins q.

The differences of governance characteristics be-

tween CSR rms and no-CSR rms are presented

in Panel B. CSR rms are, on average, associated

with more active board leadership measured by a

higher proportion of CEOs who are also chairs of

the boards (DUALITY) or chairs or members of

nomination committees (CEONOM), and more

anti-takeover provisions (ATPs), respectively. In

addition, CSR engagement is adopted by rms with

higher total block ownership, higher board inde-

pendence, and a higher percentage of institutional

share ownership. They are also covered by more

security analysts. However, they have a lower per-

centage of director ownership and a larger board

size.

Table II presents the bivariate correlation matrix

for the variables of our main interest discussed in the

previous section. Consistent with the positive asso-

ciation between CSR engagement status (CSR) and

board independence (PCTINDEP) or analyst cov-

erage, or institutional share ownership reported

earlier, CSR is positively related to analyst follow-

ing, PCTINDEP, GINDEX, or PCTINSTI. The

correlation coefcients between CSR and the other

variables of interest are relatively high in absolute

numbers, ranging from 0.17 to 0.35. All of the

above correlations are statistically signicant (p val-

ues <0.01). All governance variables (variable

numbers 16 through 25) are signicantly correlated

with the CSR variable as well. Tobins q is positively

related to the CSR variable (0.03, with p val-

ues <0.01).

The determinants of CSR engagement

To understand the differences between rms with

and without CSR involvement, we adopt a probit

analysis of the choice decision, with the following

model:

PrCSR

it

jZ

it

UB

0

Z

it

where CSR

it

is a dummy variable equal to one if

rm i has CSR engagement in year t, and 0 other-

wise. Z

it

is a vector of rm, governance, or moni-

toring characteristics at the time of rm is choice

of CSR engagement. B is a vector of coefcients.

To understand rm and governance characteris-

tics that lead some rms to choose CSR engage-

ment, we choose several variables to model the

probability of that choice. Based on the previous

literature and our chosen governance metrics, we

include the variables as components of Z and explain

in detail in the following sections.

Governance and monitoring variables

We hypothesize that internal and external moni-

toring and governance mechanisms should be related

to the choice of CSR engagement. Thus, we include

various internal and external governance variables,

including the number of anti-takeover provisions

using the GIM (2003) g index (GINDEX), or

358 Hoje Jo and Maretno A. Harjoto

Bebchuk et al.s (2000) entrenchment index

(ENTINDEX), a dummy variable of 1 if the CEO is

a chairperson of the board (DUALITY), a dummy

variable of 1 if the CEO is a member of the nomi-

nation committee (CEONUM), the percentage of

director shares (PCTDIRSHR), the natural log of

the sum of blockholdings (LOGBLKS), the per-

centage of outside independent directors (PCTIN-

DEP), the percentage of institutional ownership

(PCTINSTI), and the natural logarithm of one

plus the number of analysts following the rm

(LOGANAL).

Firm characteristics

Firm characteristics are used as control variables

including rm size measured by the natural log of

total assets (LOGTA), R&D expenditures divided by

sales revenue (RNDR), total debt divided by total

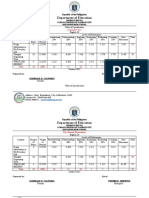

TABLE I

Descriptive statistics and univariate tests

Firms not engaging in CSR Firms engaging in CSR Difference tests

N Mean Median N Mean Median T-stat z-stat

(or Count) (or Count)

Panel A: rm characteristics

FAMFIRM 7750 0.0991 768 5639 0.0890 502 1.964** 1.964**

STATELAW 7742 2.0939 2804 5601 2.2895 2301 -6.795** -5.687***

ROA 6587 1.2559 3158 5575 4.0758 2923 -7.697*** 4.913***

CHGROA 6516 -0.9232 3159 5561 -0.1020 2878 -4.870*** -3.567***

SEGDIV 6659 0.4621 3076 5577 0.6464 3603 -20.750*** -1.550

LOGTA 6588 6.8911 2057 5575 8.4108 4024 -55.566*** -44.994***

DEBTR 6563 0.2399 3158 5557 0.2453 2902 -1.527 -4.484***

RNDR 6516 0.0358 2512 5568 0.0346 2417 0.776 5.397***

CAPXR 6525 0.0739 3152 5567 0.0711 2894 1.489 4.014***

ADVR 6589 0.0076 1416 5576 0.0106 1699 -6.122** -11.285***

FIRMAGE 7743 19.0012 3111 5599 29.8155 3531 -34.271*** -26.075***

SP500 7750 0.0912 707 5639 0.6215 3505 -79.005*** -65.232***

SGROWTH 6546 0.1411 3370 5575 0.1086 2690 4.777*** 3.527***

DIVR 6562 0.0242 2676 5550 0.0512 3380 -4.179*** -22.048***

TOBINQ 6501 1.6229 3099 5557 1.7391 2930 -3.490*** -5.517***

ADJTOBINQ 6501 -0.2556 2984 5557 -0.1422 3045 -10.144*** -9.719***

Panel B: governance characteristics

GINDEX 7750 8.7931 3087 5639 9.7318 3034 -20.269*** -16.006***

ENTINDEX 7750 2.1285 3109 5639 2.3111 2635 -7.615*** -8.011***

DUALITY (1, 0) 7750 0.7503 5815 5639 0.8471 4777 -13.699*** -13.605***

CEONOM (1, 0) 7750 0.2766 2144 5639 0.4325 2439 -19.019*** -18.751***

PCTDIRSHR 7750 0.0950 4545 5639 0.0541 2149 11.281*** 23.447***

BSIZE 7750 9.0988 2852 5639 10.3984 3291 -24.961*** -24.703***

PCTINDEP 7750 0.6011 2874 5639 0.6736 2984 -22.793*** -18.217***

LOGBLKS 7750 13.6855 3105 5639 14.1394 3589 -4.791*** -26.928***

PCTINSTI 7750 57.5194 3455 5639 64.8823 3239 -21.986*** -14.675***

LOGANAL 7750 2.0178 2834 5639 2.5096 3851 -42.821*** -36.232***

This table displays descriptive statistics for the 7750 rm-year (1777 rms) observations of no-CSR rms and 5639 rm-

year (1175 rms) observations of CSR rms from 1993 to 2004. The number of rm-year observations (N), Mean,

Median, Count (i.e., total number of observations for dummy variable) are reported by types of rms. Difference in mean

(t-statistics) and median (non-parametric Wilcoxon) tests are reported. The denitions of variables are provided in

Appendix B. ***, **, *Statistically signicant at the 1%, 5%, and 10% levels, respectively.

359 Corporate Governance and Firm Value

T

A

B

L

E

I

I

B

i

v

a

r

i

a

t

e

c

o

r

r

e

l

a

t

i

o

n

m

a

t

r

i

x

1

2

3

4

5

6

7

8

9

1

0

1

1

1

2

1

3

1

C

S

R

D

U

M

M

Y

1

2

F

A

M

F

I

R

M

-

0

.

0

2

b

1

3

S

T

A

T

E

L

A

W

0

.

0

6

a

0

.

0

4

a

1

4

R

O

A

0

.

0

7

a

0

.

0

3

a

0

.

0

5

a

1

5

C

H

G

R

O

A

0

.

0

4

a

-

0

.

0

0

3

0

.

0

1

0

.

4

8

a

1

6

T

O

B

I

N

Q

0

.

0

3

a

-

0

.

0

4

a

-

0

.

0

8

a

0

.

1

0

a

0

.

0

5

a

1

7

A

D

J

T

O

B

I

N

Q

0

.

0

9

a

-

0

.

0

0

1

-

0

.

0

2

c

0

.

1

9

a

0

.

1

1

b

0

.

6

1

a

1

8

F

I

R

M

A

G

E

0

.

2

8

a

-

0

.

0

2

b

0

.

2

3

a

0

.

0

9

a

0

.

0

3

a

-

0

.

1

1

a

0

.

0

1

1

9

S

P

5

0

0

0

.

5

6

a

-

0

.

0

3

a

0

.

0

4

a

0

.

0

7

a

0

.

0

3

a

0

.

1

1

a

0

.

1

3

a

0

.

3

6

a

1

1

0

R

N

D

R

-

0

.

0

1

-

0

.

0

9

a

-

0

.

1

2

a

-

0

.

2

4

a

-

0

.

0

8

a

0

.

2

9

a

0

.

0

2

a

-

0

.

1

6

a

0

.

0

0

2

1

1

1

C

A

P

X

-

0

.

0

1

-

0

.

0

1

-

0

.

1

0

a

-

0

.

0

7

a

-

0

.

0

4

a

0

.

0

4

a

0

.

0

8

a

-

0

.

0

1

-

0

.

0

2

a

0

.

0

3

a

1

1

2

A

D

V

R

0

.

0

6

a

0

.

0

2

a

-

0

.

0

6

a

-

0

.

0

3

a

-

0

.

0

2

b

0

.

1

2

a

0

.

0

5

a

0

.

0

3

a

0

.

0

7

a

0

.

0

3

a

-

0

.

0

4

a

1

1

3

S

G

R

O

W

T

H

-

0

.

0

4

a

-

0

.

0

1

-

0

.

0

5

a

0

.

0

3

b

0

.

1

2

a

0

.

1

8

a

0

.

1

5

a

-

0

.

0

9

a

-

0

.

0

3

a

0

.

0

7

a

0

.

0

8

a

0

.

0

1

1

1

4

D

I

V

R

0

.

0

4

a

-

0

.

0

1

0

.

0

1

0

.

0

3

a

0

.

0

2

b

0

.

0

2

b

0

.

0

4

a

0

.

0

9

a

0

.

0

5

a

-

0

.

0

3

a

-

0

.

0

1

0

.

0

4

a

-

0

.

0

1

1

5

S

E

G

D

I

V

0

.

1

8

a

-

0

.

0

1

0

.

0

3

a

-

0

.

0

3

a

-

0

.

0

0

2

-

0

.

0

7

a

-

0

.

0

4

a

0

.

0

3

a

0

.

0

4

a

0

.

0

2

b

-

0

.

0

9

a

-

0

.

0

4

a

-

0

.

0

2

a

1

6

G

I

N

D

E

X

0

.

1

7

a

-

0

.

0

7

a

0

.

2

8

a

0

.

0

4

a

0

.

0

3

a

-

0

.

1

3

a

-

0

.

0

4

a

0

.

2

8

a

0

.

1

7

a

-

0

.

1

2

a

-

0

.

0

5

a

-

0

.

0

5

a

-

0

.

0

7

a

1

7

E

N

T

I

N

D

E

X

0

.

0

7

a

-

0

.

1

0

a

0

.

0

6

a

0

.

0

1

0

.

0

1

-

0

.

1

4

a

-

0

.

0

7

a

0

.

0

7

a

0

.

0

3

a

-

0

.

0

8

a

-

0

.

0

2

b

-

0

.

0

7

a

-

0

.

0

6

a

1

8

D

U

A

L

I

T

Y

0

.

1

2

a

-

0

.

0

4

a

0

.

0

6

a

-

0

.

0

0

1

-

0

.

0

2

c

-

0

.

0

4

a

-

0

.

0

3

a

0

.

1

3

a

0

.

1

5

a

-

0

.

0

6

a

-

0

.

0

0

1

0

.

0

2

c

-

0

.

0

1

1

9

C

E

O

N

O

M

0

.

1

6

a

-

0

.

0

4

a

0

.

0

8

a

0

.

0

3

a

0

.

0

2

b

-

0

.

0

5

a

-

0

.

0

3

a

0

.

2

0

a

0

.

1

6

a

-

0

.

0

5

a

-

0

.

0

4

a

0

.

0

1

-

0

.

0

5

a

2

0

B

S

I

Z

E

0

.

2

1

a

0

.

0

6

a

0

.

1

6

a

0

.

0

7

a

0

.

0

4

a

-

0

.

1

8

a

0

.

0

3

a

0

.

3

1

a

0

.

3

3

a

-

0

.

2

4

a

-

0

.

0

8

a

-

0

.

0

0

4

-

0

.

0

3

a

2

1

P

C

T

I

N

D

E

P

0

.

1

9

a

-

0

.

2

7

a

0

.

0

6

a

0

.

0

1

0

.

0

2

b

-

0

.

0

7

a

-

0

.

0

4

a

0

.

2

6

a

0

.

1

8

a

0

.

0

3

a

-

0

.

0

4

a

-

0

.

0

5

a

-

0

.

0

7

a

2

2

P

C

T

D

I

R

S

H

R

-

0

.

1

0

a

0

.

1

4

a

-

0

.

0

3

a

-

0

.

0

2

b

-

0

.

0

1

0

.

0

3

a

0

.

0

1

-

0

.

1

3

a

-

0

.

1

1

a

-

0

.

0

3

a

-

0

.

0

0

5

0

.

0

7

a

0

.

0

2

b

2

3

L

O

G

B

L

K

S

0

.

0

4

a

-

0

.

0

5

a

-

0

.

0

9

a

0

.

0

2

b

0

.

0

0

4

-

0

.

0

0

2

-

0

.

0

6

a

-

0

.

0

9

a

0

.

0

4

a

0

.

0

5

a

-

0

.

0

0

3

-

0

.

0

2

c

0

.

0

1

2

4

L

O

G

A

N

A

L

0

.

3

5

a

-

0

.

0

8

a

-

0

.

0

6

a

0

.

0

3

a

0

.

0

0

3

0

.

1

6

a

0

.

2

3

a

0

.

1

3

a

0

.

5

6

a

0

.

0

5

a

0

.

1

2

a

0

.

0

3

a

0

.

0

8

a

2

5

P

C

T

I

N

S

T

I

0

.

1

9

a

-

0

.

1

0

a

-

0

.

1

0

a

0

.

1

3

a

0

.

0

6

a

0

.

0

8

a

0

.

0

6

a

-

0

.

0

6

a

0

.

1

2

a

0

.

0

3

a

-

0

.

0

1

-

0

.

0

3

a

0

.

0

3

a

1

3

1

4

1

5

1

6

1

7

1

8

1

9

2

0

2

1

2

2

2

3

2

4

2

5

1

3

S

G

R

O

W

T

H

1

1

4

D

I

V

R

-

0

.

0

1

1

1

5

S

E

G

D

I

V

-

0

.

0

2

a

0

.

0

0

3

1

1

6

G

I

N

D

E

X

-

0

.

0

7

a

0

.

0

3

a

0

.

0

7

a

1

1

7

E

N

T

I

N

D

E

X

-

0

.

0

6

a

0

.

0

1

0

.

0

9

a

0

.

7

2

a

1

360 Hoje Jo and Maretno A. Harjoto

assets (DEBTR), and the FamaFrench 48-industry

classication. GIM (2010) suggest using the State

Law as anti-takeover index. Similar to GIM, we

also use the State Law anti-takeover index

(STATELAW), family rms (FAMFIRM), ROA,

the natural log of the change in ROA (CHGROA)

to measure protability, and the diversication

dummy (SEGDIV). We choose family rms instead

of GIMs name variable because the private benets

of control should be more relevant to family

rms, following Anderson and Reeb (2003) and

Villalonga and Amit (2006).

In Table III, we estimate the choice of CSR

engagement using a probit function. We estimate ve

models with different sets of explanatory variables

to compare and contrast the various impacts of con-

trol variables and corporate governance variables.

Throughout Model (1) toModel (5), we replace or add

some of the explanatory variables to investigate the role

of governance and monitoring in the analysis.

7

Consistent with prior literature, we can see that

many of our chosen variables are highly signicant in

explaining the likelihood of choosing CSR engage-

ment for all Models (1) to (5). Model (1) shows that

larger rms, highly leveraged rms, protable rms,

rms with higher R&D, and diversied rms are

more likely to choose CSR engagement while the

coefcient on FAMFIRM is insignicant. Model (2)

shows the same results with the industry adjustment.

Basically, the results are similar, except the signi-

cance of CHGROA disappears. In model (3), we

report the results for the governance variables only.

Model (3) suggests that the coefcients on GINDEX,

DUALITY, CEONOM, PCTINDEP, PCTINSTI,

and LOGANAL are signicantly positive at the 1%

signicance level, implying that rms with a higher

board leadership (DUALITY and CEONOM), a

higher proportion of outside independent directors

(PCTINDEP), a higher proportion of institutional

investors (PCTINSTI), more analysts following the

rm (LOGANAL), or more anti-takeover provisions

(GINDEX) are more likely to choose CSR engage-

ment.

8

We nd that the estimated slope coefcients

on PCTINDEP and LOGANAL have the highest

economic signicance on the rms choice of CSR

engagement. These ndings suggest that internal and

external governance measured by board leader-

ship, independent boards, institutional investors, and

security analysts are positively related to the choice of

T

A

B

L

E

I

I

c

o

n

t

i

n

u

e

d

1

3

1

4

1

5

1

6

1

7

1

8

1

9

2

0

2

1

2

2

2

3

2

4

2

5

1

8

D

U

A

L

I

T

Y

-

0

.

0

1

0

.

0

1

0

.

0

6

a

0

.

1

2

a

0

.

0

8

a

1

1

9

C

E

O

N

O

M

-

0

.

0

5

a

0

.

0

2

c

0

.

1

4

a

0

.

1

7

a

0

.

1

3

a

0

.

2

0

a

1

2

0

B

S

I

Z

E

-

0

.

0

3

a

0

.

0

5

a

0

.

0

6

a

0

.

2

2

a

0

.

1

0

a

0

.

1

2

a

0

.

1

5

a

1

2

1

P

C

T

I

N

D

E

P

-

0

.

0

7

a

0

.

0

3

a

0

.

1

6

a

0

.

2

7

a

0

.

2

6

a

0

.

1

4

a

0

.

2

1

a

0

.

1

1

a

1

2

2

P

C

T

D

I

R

S

H

R

0

.

0

2

b

-

0

.

0

1

0

.

0

1

-

0

.

1

7

a

-

0

.

1

6

a

-

0

.

0

0

4

-

0

.

0

3

a

-

0

.

0

6

a

-

0

.

2

4

a

1

2

3

L

O

G

B

L

K

S

0

.

0

1

-

0

.

0

2

b

0

.

0

3

a

-

0

.

0

0

3

0

.

0

5

a

-

0

.

0

0

1

0

.

0

1

-

0

.

1

6

a

0

.

0

3

a

-

0

.

0

3

a

1

2

4

L

O

G

A

N

A

L

0

.

0

8

a

0

.

0

1

-

0

.

0

3

a

0

.

0

9

a

0

.

0

1

0

.

1

2

a

0

.

0

9

a

0

.

3

1

a

0

.

1

2

a

-

0

.

1

4

a

-

0

.

0

1

1

2

5

P

C

T

I

N

S

T

I

0

.

0

3

a

-

0

.

0

2

c

0

.

1

5

a

0

.

0

6

a

0

.

1

1

a

0

.

0

4

8

a

0

.

0

6

a

-

0

.

1

4

a

0

.

1

8

a

-

0

.

1

5

a

0

.

5

1

a

0

.

1

7

a

1

T

h

i

s

t

a

b

l

e

r

e

p

o

r

t

s

S

p

e

a

r

m

a

n

c

o

r

r

e

l

a

t

i

o

n

c

o

e

f

c

i

e

n

t

s

a

m

o

n

g

v

a

r

i

a

b

l

e

s

f

o

r

t

h

e

7

7

5

0

r

m

-

y

e

a

r

o

b

s

e

r

v

a

t

i

o

n

s

o

f

n

o

-

C

S

R

r

m

s

a

n

d

5

6

3

9

r

m

-

y

e

a

r

o

b

s

e

r

v

a

t

i

o

n

s

o

f

C

S

R

r

m

s

f

r

o

m

1

9

9

3

t

o

2

0

0

4

.

S

e

e

A

p

p

e

n

d

i

x

B

f

o

r

v

a

r

i

a

b

l

e

d

e

n

i

t

i

o

n

s

.

a

,

b

,

c

i

n

d

i

c

a

t

e

t

h

e

1

%

,

5

%

,

a

n

d

1

0

%

l

e

v

e

l

o

f

s

i

g

n

i

c

a

n

c

e

,

r

e

s

p

e

c

t

i

v

e

l

y

.

361 Corporate Governance and Firm Value

TABLE III

Propensity to engage in CSR activities

Model (1) Model (2) Model (3) Model (4) Model (5)

INTERCEPT -3.710

(44.07)***

-4.912

(14.21)***

-3.258

(10.05)***

-5.607

(16.25)***

-5.491

(16.11)***

Governance variables

GINDEX 0.071

(12.29)***

0.049

(7.71)***

ENTINDEX 0.031

(2.87)***

DUALITY 0.121

(3.69)***

0.019

(0.53)

0.030

(0.87)

CEONOM 0.254

(9.35)***

0.102

(3.50)***

0.113

(3.85)***

PCTDIRSHR -0.002

(0.03)

-0.037

(0.54)

-0.065

(0.91)

PCTINDEP 0.708

(8.90)***

0.470

(5.47)***

0.529

(6.16)***

LOGBLKS -0.002

(0.65)

0.002

(0.70)

0.002

(0.58)

PCTINSTI 0.010

(11.42)***

0.008

(8.79)***

0.008

(8.83)***

LOGANAL 0.692

(32.14)***

0.150

(5.31)***

0.149

(5.26)***

Control variables

LOGTA 0.429

(43.09)***

0.583

(47.39)***

0.495

(32.25)***

0.506

(32.89)***

DEBTR -0.296

(3.86)***

-0.724

(7.88)***

-0.793

(8.57)***

-0.776

(8.41)***

RNDR 2.184

(11.48)***

1.485

(6.33)***

1.264

(5.31)***

1.211

(5.13)***

FAMFIRM -0.054

(1.25)

-0.062

(1.37)

0.135

(2.81)***

0.134

(2.79)***

STATELAW 0.025

(3.27)***

0.022

(2.74)***

0.011

(1.26)

0.029

(3.47)***

ROA 0.022

(9.69)***

0.013

(5.45)***

0.009

(3.78)***

0.009

(3.80)***

CHGROA -0.004

(2.06)**

0.004

(0.18)

0.001

(0.67)

0.001

(0.63)

SEGDIV 0.369

(14.58)***

0.450

(16.59)***

0.387

(13.43)***

0.383

(13.31)***

FF 48 industry No Yes Yes Yes Yes

Pseudo R

2

0.1937 0.2571 0.1777 0.2778 0.2746

Observations 11,901 11,901 11,901 11,901 11,901

Number of rms 2493 2493 2493 2493 2493

This table reports the coefcient of estimates from the probit model explaining the determinants of CSR engagement.

The dependent variable is the CSR, which is a dichotomous variable that equals to one if a rm has involved into CSR

activities. Otherwise equals to zero. Model (1) and (2) report only control variables. Model (3), (4), and (5) include

internal and external corporate governance variables. FamaFrench (FF) 48 industry is included all Models except Model

(1). T-statistics are adjusted for robust and clustered (by rm) standard errors and reported in parentheses. Appendix B

provides variable denitions. ***, **, *Statistically signicant at the 1%, 5%, and 10% levels, respectively.

362 Hoje Jo and Maretno A. Harjoto

CSR engagement, supporting the conict-resolution

hypothesis, as stated in hypothesis 1.

Other variables are insignicant at the conventional

level. In models (4) and (5), we report the results when

we include both control variables and governance

variables. The results for the governance variables are

qualitatively similar to those of model (3), except the

insignicance of the DUALITY variable. It is

important to note that the internal and external gov-

ernance variables are highly signicant, suggesting

that they are major determinants of CSRengagement.

Table IV reports the coefcient of estimates from

the Tobit model explaining the determinants of

CSR engagement based on the CSR-combined

scores instead of the CSR choice (dummy) variable.

We use the Tobit model because the dependent

variables are left censored at zero rather than

dichotomous variables. The Tobit model is an

econometric model proposed by Tobin (1958)

to describe the relation between a non-negative

dependent variable and an independent variable (or

vector). We compute the arithmetic average of the

combined scores of KLD inclusive strengths and

concerns of community, environment, diversity,

employee relations, and product criteria to get

combined CSR scores. KLD scores report both

strengths and concerns for the above-mentioned

dimensions. The dependent variable is the CSR-

combined scores, including both strengths and

concerns (CSRCOMPOSITE) for models (1) and

(2), combined strength scores (CSRSTR) for models

(3) and (4), and combined concern scores (CSR-

CON) for models (5) and (6), respectively [see the

calculation procedures of the combined strengths

and concerns, combined strength, and combined

concern scores (unreported, but similar to the cal-

culation of strength scores in Appendix C)]. The

results closely mirror those of Table III, in that

the governance and monitoring variables positively

affect the rms decisions about CSR engagement,

supporting the conict-resolution hypothesis. As

expected, the signs of the coefcients on all the

variables based on CSRCON are exactly opposite of

those of the coefcients based on CSRSTR.

Table V shows the results of the 2SLS with the two

dependent variables of CSR and LOGANAL. We

employ the 2SLS estimation method described in

Maddala (1983) for simultaneous equations models in

which one of the endogenous variables is continuous

(LOGANAL) and the other endogenous variable is

dichotomous (CSR). Our results suggest that after

correcting for a potential simultaneity bias, the possi-

bility that rms with a greater analyst following tend to

engage in CSR engagement (with t-values of 23.90

29.13) is much higher than the possibility that rms

choosing CSR tend to have a higher analyst following

(with t-values of 6.036.23). It seems that rms with

greater analyst coverage (i.e., rms with a transparent

information environment) opt for CSR engagement

after incorporating the reverse causality. In addition,

although the top management of CSR rms can

control the number of outside independent directors,

they cannot control the number of analysts following

the rm. Accordingly, security analysts, as third-party

information intermediaries, can provide an external

monitoring mechanism in the top managements

decision-making about CSR engagement.

So far, we use board independence as one of the

measures for the quality of the rms internal gov-

ernance. But for two reasons there may not be a

one-to-one relation between governance quality and

board independence. First, Coles et al. (2008) indi-

cate that board independence reects such things as

rm diversication, rm size, rm age, and insider

ownership. These researchers claim that board

independence reects, and is driven by, other

characteristics of the rm and its line of business.

There is no single board structure that ts all

rms. Rather, board independence is endogenously

determined by rm and managerial characteristics.

This indicates that board independence may or may

not be an indicator of governance quality. Suppose,

for example, that ceteris paribus, board independence

does improve governance. Then, rms with few

independent directors might have more blockhold-

ers, or fewer takeover defenses, or more bond cov-

enants, to offset the effects of having few

independent directors. The result could be that such

rms have better governance, not worse. Thus, we

include such variables, including rm diversication,

rm size, rm age, insider ownership, blockholder

ownership, and GIM index, etc. in the independent

director equation to address the endogeneity issue.

Our unreported results based on two-stage least-

square (2SLS) regressions, in which both CSR

engagement and the percentage of outside indepen-

dent directors are dependent variables, again support

the monitoring role of outside independent directors.

363 Corporate Governance and Firm Value

TABLE IV

Propensity to engage in CSR activities based on the CSR-combined scores

Dependent

variable

Model (1) Model (2) Model (3) Model (4) Model (5) Model (6)

CSRCOMPOSITE CSRCOMPOSITE CSRSTR CSRSTR CSRCON CSRCON

INTERCEPT -1.144

(13.56)***

-1.120

(13.30)***

-0.526

(14.02)***

-0.517

(13.91)***

4.377

(15.05)***

4.305

(14.84)***

GINDEX 0.013

(8.86)***

0.003

(5.99)***

-0.041

(8.16)***

ENTINDEX 0.012

(4.72)***

0.002

(2.10)*

-0.043

(5.00)***

DUALITY 0.002

(0.29)

0.005

(0.66)

-0.001

(0.23)

0.00027

(0.09)

0.008

(0.28)

-0.002

(0.06)

CEONOM 0.018

(2.75)***

0.020

(3.04)***

0.005

(1.96)**

0.005

(2.18)**

-0.053

(2.36)**

-0.058

(2.60)***

PCTDIRSHR 0.012

(0.77)

0.007

(0.46)

0.006

(1.16)

0.005

(0.92)

-0.077

(1.29)

-0.059

(1.01)

PCTINDEP 0.118

(6.00)***

0.129

(6.51)***

0.056

(7.39)***

0.059

(7.85)***

-0.359

(5.24)***

-0.389

(5.65)***

LOGBLKS -0.001

(1.91)*

-0.001

(1.94)*

0.00023

(1.04)

0.00023

(1.02)

0.004

(1.84)

0.004

(1.88)

PCTINSTI 0.004

(17.46)***

0.004

(17.42)***

0.000017

(0.23)

0.000026

(0.33)

-0.013

(17.84)***

-0.013

(17.77)***

LOGANAL 0.049

(7.69)***

0.049

(7.71)***

0.021

(8.27)***

0.021

(8.28)***

-0.169

(7.66)***

-0.169

(7.68)***

LOGTA 0.097

(31.31)***

0.100

(32.25)***

0.045

(37.54)***

0.045

(37.98)***

-0.230

(21.66)***

-0.240

(22.52)***

DEBTR -0.230

(11.16)***

-0.228

(11.05)***

-0.060

(7.46)***

-0.059

(7.31)***

0.700

(9.79)***

0.697

(9.71)***

RNDR 0.207

(4.06)***

0.194

(3.79)***

0.119

(6.16)***

0.115

(5.98)***

-0.559

(3.16)***

-0.518

(2.92)***

FAMFIRM 0.044

(4.09)***

0.044

(4.12)***

0.003

(0.85)

0.003

(0.84)

-0.138

(3.71)***

-0.140

(3.76)***

STATELAW 0.004

(2.30)**

0.009

(4.72)***

0.001

(0.87)

0.002

(2.41)**

-0.012

(1.79)*

-0.026

(4.00)***

ROA 0.003

(5.86)***

0.003

(6.03)***

0.001

(8.14)***

0.001

(8.26)***

-0.010

(6.68)***

-0.011

(6.86)***

SEGDIV 0.144

(22.16)***

0.142

(21.90)***

0.011

(4.51)***

0.01

1(4.43)***

-0.492

(21.60)***

-0.488

(21.36)***

Log likelihood -4740.19 -4770.822 -911.58 -895.31 -11,136.14 -11,160.01

Pseudo R

2

0.347 0.3428 0.5539 0.5440 0.1464 0.1446

Observations 11,901 11,901 11,901 11,901 11,901 11,901

This table reports the coefcient of estimates from the Tobit model explaining the determinants of CSR engagement

based on the CSR-combined scores from the Kinder, Lydenberg, and Dominis (KLD) Socrates database. The dependent