Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ryanair Case

Caricato da

Tatsat Pandey0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

264 visualizzazioni3 pagineAnalysis of dogfight over europe.

Titolo originale

03. Ryanair Case

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoAnalysis of dogfight over europe.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

264 visualizzazioni3 pagineRyanair Case

Caricato da

Tatsat PandeyAnalysis of dogfight over europe.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

MARKETING MANAGEMENT

CASE ANALYSIS DOGFIGHT OVER EUROPE: RYANAIR

Submitted by: PGP H, Group 8

SN Name of Student Roll No.

1 ASHISH TOMAR 2014PGP067

2 PARESH KOTKAR 2014PGP245

3 ISHANI MITTAL 2014PGP137

4 TATSAT PRAKASH PANDEY 2011IPM112

5 PRATIBHA INDORIA 2011IPM072

6 SAHIL AGGARWAL 2014PGP318

7 DHAVAL VAIDYA 2014PGP411

Companys Background: Ryanair was an upstart Irish airline company set up by Cathal and Declan

Ryan in 1985. The airline initially operated only a single scheduled service between Waterford (south

east Ireland) and Gatwick Airport (on the outskirts of London), through a 14-seat turboprop aircraft.

The setting up of the business was greatly enabled by the million Irish pound-contribution of Mr.

Tony Ryan, the father of the Ryan brothers, who had earlier co-founded Guinness Peat Aviation, the

largest aircraft leasing company in the world. In 1986, the company announced that it would soon

commence service on the Dublin-London route.

Industry & competitors profile: The airline sector in the United Kingdom (U.K.) and Ireland

comprised mainly of two major players the British Airways in U.K. (founded in 1930s) and Aer

Lingus in Ireland (founded in 1936). Both these airlines were already operating profitable services

along the Dublin-London route which Ryanair was looking to enter.

Issue: Ryanair is looking to enter a segment in which 2 competitors are already earning well and its

only differentiator in doing so is lower air fares (I98) compared to the average I208 price charged

by them. What should be the marketing strategy of Ryanair to gain a competitive edge? Whether

Ryanair should aim to compete with established players for the existing 0.5 million passengers or

should it aim at attracting the rail and ferry users (new market) to travel through air by offering

lower costs?

Analysis:

Strengths:

The founders (Ryan brothers) have

previous experience in airline industry

Sufficient financial resources available to

offer low-cost services at I98.

Offering first rate services to customers

comparable to big airlines, despite low

priced tickets.

Past record of successfully operating a

scheduled airline between Waterford and

Gatwick Airport

Offers flexibility of timing to customers as

it offers 4 round-trips in a day

Weakness:

Permission to operate only 44 seat

turboprop aircraft.

Opportunities:

Only 0.5 million travellers utilise airways

on this route, while another 0.75million

road/sea travellers still remain to be

tapped to utilise the airways.

Threats:

Consolidated Market as Large established

players such as British Airways and Aer

Lingus were operating profitably on the

new route.

From 1983 to 1985, British Airways

customer base increased at a good rate

of 12.8% (16.3 to 18.4 mn) and tonne-km

capacity also increased, making it a

strong competition for Ryanair.

An analysis of Ryanair reveals that despite cut-throat competition on the London-Dublin route, there

lies huge opportunity for Ryanair to enter into the market. The surplus funds available with the

company is one of the biggest advantages the company holds, as it can focus on adopting a low-cost

strategy to attract customers and establish itself. Further, as mentioned in the case, Ryanair aims to

distinguish itself from the other players in the industry through providing superior customer

satisfaction and charging single fare for a ticket with no restrictions. Such a strategy will further help

Ryanair to establish a consolidated and loyal customer base.

Now even though the existing established players are running at a below par capacity utilisation of

60-70%, Ryanairs value-for-money strategy can directly compete with the existing players for these

customers. Further, the company should also focus on tapping the new market of the 0.75 million

rail and ferry users as it can project substantial value to them by saving 8 hours (9-1) of travel time in

return for just I 43 extra (I 98 - I 55).

As of now, Ryanair has a good opportunity to establish itself on the London-Dublin route. Further, if

Ryanair is able to get permission to fly larger jet aircraft on the route, it can hope to reap benefits of

large scale, which will help it to strengthen its position.

A reverse scenario could also apply, whereby privatization of British Airways (BA) around 1987 along

with its strong financial position could enable BA to reduce air fares in order to increase its

dominance in the market. This could adversely affect the growth of an upstart like Ryanair which is

struggling to find its feet in the industry.

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Product Innovation CharterDocumento1 paginaProduct Innovation CharterTatsat PandeyNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Explaining The Issue/opportunity Identified Above?Documento1 paginaExplaining The Issue/opportunity Identified Above?Tatsat PandeyNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- CLR and IR Session 2 of 20Documento11 pagineCLR and IR Session 2 of 20Tatsat PandeyNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- NewsboyDocumento672 pagineNewsboyTatsat PandeyNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Product Innovation Charter MicrofridgeDocumento1 paginaProduct Innovation Charter MicrofridgeTatsat PandeyNessuna valutazione finora

- Session 1: Cost Classification Exercise F&A 377 Example Functional Traceability Behaviour M/S/A/O D/I V/F Part I: Illustrative AnswersDocumento6 pagineSession 1: Cost Classification Exercise F&A 377 Example Functional Traceability Behaviour M/S/A/O D/I V/F Part I: Illustrative AnswersTatsat PandeyNessuna valutazione finora

- ODC Case AnalysisDocumento3 pagineODC Case AnalysisTatsat PandeyNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Correction Mountain Man Brewing Company - Group2 Sec H 2014Documento12 pagineCorrection Mountain Man Brewing Company - Group2 Sec H 2014Tatsat Pandey100% (2)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Anova PDFDocumento25 pagineAnova PDFTatsat PandeyNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Marketing III Strategic Paper 1Documento1 paginaMarketing III Strategic Paper 1Tatsat PandeyNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Group Interviews 9 - 10 Am 10 - 11 Am 11 - 12 AmDocumento3 pagineGroup Interviews 9 - 10 Am 10 - 11 Am 11 - 12 AmTatsat PandeyNessuna valutazione finora

- 8-10000 Brands of Medicines (Varying Compounds) : Discounts Personal Touch Unique MedicinesDocumento1 pagina8-10000 Brands of Medicines (Varying Compounds) : Discounts Personal Touch Unique MedicinesTatsat PandeyNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- LIME 6 Case Study Gionee India NewDocumento33 pagineLIME 6 Case Study Gionee India NewTatsat Pandey100% (2)

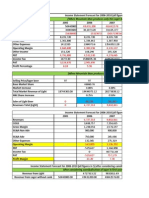

- Income: Particulars March, 31 2012 31-Mar-13Documento6 pagineIncome: Particulars March, 31 2012 31-Mar-13Tatsat PandeyNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Multitech LimitedDocumento2 pagineMultitech LimitedTatsat PandeyNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Classic Knitwear Excel SheetDocumento2 pagineClassic Knitwear Excel SheetTatsat PandeyNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Trait Theories of Leadership: Who Leaders AreDocumento14 pagineTrait Theories of Leadership: Who Leaders AreTatsat PandeyNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Case Study-Donner CompanyDocumento3 pagineCase Study-Donner CompanyTatsat PandeyNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Session 1-4Documento29 pagineSession 1-4Tatsat PandeyNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Align Technology1Documento12 pagineAlign Technology1Tatsat PandeyNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Cisco Systems, Inc.:Implementing ERP: Group 6 Section HDocumento6 pagineCisco Systems, Inc.:Implementing ERP: Group 6 Section HTatsat PandeyNessuna valutazione finora

- Aqualisa QuartzDocumento3 pagineAqualisa QuartzTatsat Pandey100% (1)

- The Nirdosh CaseDocumento2 pagineThe Nirdosh CaseTatsat PandeyNessuna valutazione finora

- Chemalite BDocumento12 pagineChemalite BTatsat Pandey100% (2)

- Ibau-Hamburg 1Documento10 pagineIbau-Hamburg 1belleblackNessuna valutazione finora

- Nueva EcijaDocumento2 pagineNueva Ecijaclaude terizlaNessuna valutazione finora

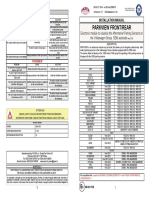

- Parkview FRONT REAR Rev 3 - 13 Da Vers 28 - 85Documento2 pagineParkview FRONT REAR Rev 3 - 13 Da Vers 28 - 85zdenev389Nessuna valutazione finora

- E Ticket Receipt TemplateDocumento1 paginaE Ticket Receipt TemplateJehanzeb KhanNessuna valutazione finora

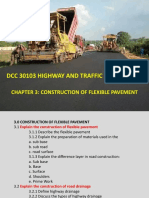

- 3.1 DCC30103 - Chapter 3.1 Construction of Flexible PavementDocumento56 pagine3.1 DCC30103 - Chapter 3.1 Construction of Flexible PavementFATIN NABILA100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Airport PlanningDocumento5 pagineAirport PlanningSaddaqatNessuna valutazione finora

- 2004 Corolla Air Conditioning Wiring DiagramDocumento4 pagine2004 Corolla Air Conditioning Wiring Diagramjldamasceno100% (2)

- Boarding PassDocumento1 paginaBoarding PassMarisol Monsalve Sanchez100% (1)

- U&M ARM550 E01Documento165 pagineU&M ARM550 E01Augusto Oliveira100% (2)

- Ship To Ship (STS) Transfer Operations Plan - BP ShippingDocumento68 pagineShip To Ship (STS) Transfer Operations Plan - BP ShippingLingesh100% (1)

- Some Fanfic.Documento342 pagineSome Fanfic.Aiva DanielNessuna valutazione finora

- Bridge Inspections: Dan WalshDocumento25 pagineBridge Inspections: Dan Walshdiarto trisnoyuwonoNessuna valutazione finora

- 2008 Lycoming Service Engine Price ListDocumento14 pagine2008 Lycoming Service Engine Price ListAntoine LE ROUXNessuna valutazione finora

- Technical Submittal For Precast Concrete Low ResDocumento119 pagineTechnical Submittal For Precast Concrete Low ReshmoncktonNessuna valutazione finora

- Manual - V-Drive 2021Documento184 pagineManual - V-Drive 2021AngelNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Bosch K/Ke Fuel InjectionDocumento3 pagineBosch K/Ke Fuel InjectionclcasalNessuna valutazione finora

- Data CollectionDocumento10 pagineData CollectionMadhura BargodeNessuna valutazione finora

- Sop p180 Avanti IIDocumento92 pagineSop p180 Avanti IIcougarfly100% (2)

- I 7 HowlrunnerDocumento1 paginaI 7 HowlrunnerPhilllip MillerNessuna valutazione finora

- Syntegra: The Complete Integration of Traction, Bogie and Braking TechnologyDocumento4 pagineSyntegra: The Complete Integration of Traction, Bogie and Braking TechnologyPTOIR FPTK UPINessuna valutazione finora

- Lifting Handling Instructions For Horizontal TanksDocumento4 pagineLifting Handling Instructions For Horizontal TanksJitendra YadavNessuna valutazione finora

- Bike Routes in GermanyDocumento88 pagineBike Routes in GermanyrorylawtonNessuna valutazione finora

- Crane Design and CalculationDocumento28 pagineCrane Design and Calculationodim7370% (23)

- Curriculum Vitae: Rakesh Kumar GuptaDocumento3 pagineCurriculum Vitae: Rakesh Kumar Guptachitranjan4kumar-8Nessuna valutazione finora

- Fuel System Safety: Presented By: Tony HeatherDocumento40 pagineFuel System Safety: Presented By: Tony HeatherABDELRHMAN ALINessuna valutazione finora

- E Conversation Fact RecountDocumento2 pagineE Conversation Fact RecountMuhammad IlhamNessuna valutazione finora

- Australian Law IndexDocumento34 pagineAustralian Law IndexBashNessuna valutazione finora

- Grievance PRJCT NTPCDocumento138 pagineGrievance PRJCT NTPCRahul Gupta100% (1)

- Monitoring Report of Transport Strategy and Action Plan 2016 2020Documento167 pagineMonitoring Report of Transport Strategy and Action Plan 2016 2020Ilda PoshiNessuna valutazione finora

- Vessel S Guide To Vetting InspectionsDocumento11 pagineVessel S Guide To Vetting Inspectionsmatan55100% (5)

- Job Interview: How to Talk about Weaknesses, Yourself, and Other Questions and AnswersDa EverandJob Interview: How to Talk about Weaknesses, Yourself, and Other Questions and AnswersValutazione: 4.5 su 5 stelle4.5/5 (15)

- How to Be Everything: A Guide for Those Who (Still) Don't Know What They Want to Be When They Grow UpDa EverandHow to Be Everything: A Guide for Those Who (Still) Don't Know What They Want to Be When They Grow UpValutazione: 4 su 5 stelle4/5 (74)

- A Joosr Guide to... What Color is Your Parachute? 2016 by Richard Bolles: A Practical Manual for Job-Hunters and Career-ChangersDa EverandA Joosr Guide to... What Color is Your Parachute? 2016 by Richard Bolles: A Practical Manual for Job-Hunters and Career-ChangersValutazione: 4 su 5 stelle4/5 (1)

- Unbeatable Resumes: America's Top Recruiter Reveals What REALLY Gets You HiredDa EverandUnbeatable Resumes: America's Top Recruiter Reveals What REALLY Gets You HiredValutazione: 5 su 5 stelle5/5 (2)

- Job Interview: The Complete Job Interview Preparation and 70 Tough Job Interview Questions with Winning AnswersDa EverandJob Interview: The Complete Job Interview Preparation and 70 Tough Job Interview Questions with Winning AnswersValutazione: 4 su 5 stelle4/5 (7)

- Get That Job! The Quick and Complete Guide to a Winning InterviewDa EverandGet That Job! The Quick and Complete Guide to a Winning InterviewValutazione: 4.5 su 5 stelle4.5/5 (15)